Research Article: 2021 Vol: 24 Issue: 6

Economic Integration in Southern Africa through SADC'S Revised Priorities (2015-2020) for Sustainable Development: A Mirage?

Daniel Chigudu, University of South Africa

Abstract

Economic integration is critical for the Southern African Development Community’s (SADC) agenda for development as it is a driver to guarantee regional inclusive growth. There has been a host of regional and national initiatives directed at addressing challenges militating against stronger regional integration even though intra-regional trade as well as investment have been affected adversely in recent years. This study seeks to explore how SADC can foster regional integration and circumvent challenges before it predicated on the hermeneutic phenomenological approach and content analysis. The study reveals that to establish itself effectively as a sustainable hub for investment, the region should prioritise the harmonisation and coordination of all industrialisation efforts and regulatory frameworks. The level of a continental trend towards improved collaboration could be a possibility for achieving economic integration. But what is questionable is the desired enthusiasm for cooperation among the regional economic members and SADC as an institution alone.

Keywords

Economic Integration, SADC, Priorities, Challenges.

Introduction

Southern African Development Community (SADC), excluding Comoros the newly admitted 16th member in 2017, has undergone an economic downturn in the period 2013 to 2016 (Bronauer & Yoon, 2018). But the International Monetary Fund (IMF) (2018) reveals an increase of 17% in the aggregate nominal gross domestic product (GDP) in 2017 in comparison to the previous year with annual growth projected to 4.7–5.5% up until 2023 (International Monetary Fund, 2018). This outlook provides some optimism although there are hints to a persistent over-reliance on commodities only. The trade map reveals that trade by SADC countries is mostly with global markets, signifying that these persistent factors could deter continental and intra-regional trade (International Trade Centre, 2018). A trade map shows some indicators on international demand, export performance, international demand, competitive markets and alternative markets, directory of exporting and importing companies in the form of maps, tables and graphs. The United Nations Conference on Trade and Development reports that the adverse economic environment prevailing in Southern Africa has dealt a blow on the general investment into the region, whose decline was substantial in 2017. While the recovery of commodity prices could attract capital in the foreseeable future, regulatory discrepancies and cross border challenges to trade among member states have fundamentally prohibited an inflow of foreign direct investment (FDI) which is much needed into the non-extractive industries and regional value chains (RVCs) (Mlambo, 2018).

As opposed to investments stemming from the extraction of natural resources, the creation of RVC coupled with efforts from domestic industrialisation tend to benefit the workforce and local economy hence providing sustainable economic growth (Arndt & Roberts, 2018). Recent industrialisation plans have echoed the same view noting the prioritisation of domestic industries that are viable and the creation of RVCs as building blocks for social and regional economic development (Bronauer & Yoon, 2018). The observation by Chidede (2017) Bronauer and Yoon (2018) is instructive. They note an imbalanced distribution of investment and trade flows regionally showing a significant variation of economic conditions to the extent that some countries stand as established exporters while others remain perpetual importers Biswaro (2012).

Such political and structural challenges have to be overcome if SADC is set to ensure sustainable economic development. According to Bronauer and Yoon (2018), the South African Institute of International Affairs (SAIIA) being supported by the Konrad- Adenauer-Stiftung (KAS) conducted in-depth research on the economic environment in SADC over the previous 5 years. Regional economic integration has been a challenge ever since the SADC regional economic community came into being. This study incorporates these studies among others, into an inquiry seeking to ascertain how regional economic integration can be fostered in Southern Africa informed by the revised SADC priorities under the prevailing challenges. This may complement previous studies (Chingono & Nakana, 2009) while shedding light on impediments to SADC’s economic integration efforts in pursuit of the revised priorities Ayinde (2011).

Background of the Study

Saurombe (2010) contends that Southern Africa’s regional integration is rooted in the logic of a common destiny carved out by Southern African states wrestling against South Africa’s apartheid. Their determination was premised on the aims of the then Organisation of African Unity (OAU) Liberation Committee. This led to the founding of the Frontline States spearheading the regional battle against dominion by the white minority. When all states attained independence the Frontline States’ focus changed. The Southern African Development Coordination Conference (SADCC) was founded on 1 April 1980 in Lusaka, Zambia, with a strategic statement, “Southern Africa: Towards Economic Liberation” famously known as the Lusaka Declaration (Masemola, 2005).

The states represented which became SADCC 9 member states were Botswana, Lesotho, Angola, Malawi, Zambia, Swaziland, Mozambique, Tanzania and Zimbabwe. Later Namibia became the 10th member. SADCC aimed at decreasing economic dependence on South Africa which at the time was under the apartheid government. In the early 1990s, when it became certain that South Africa’s independence was becoming a reality coupled with severe sub- regional drought, and against the background of changes in the global economy and severe droughts in the sub-region SADCC was transformed into SADC (Masemola,2005). This was on the 17th of August 1992.

The thrust was now on strengthening regional economic integration. In 2003, the transformation birthed the Regional Indicative Strategic Development Plan (RISDP). According to Isaksen (2003) and Makagwe (2013), the aim of the RISDP is couched in the SADC mission statement;

"To promote sustainable and equitable economic growth and socio-economic development through efficient production systems, deeper cooperation and integration, good governance, and durable peace and security, so that the region emerges as a competitive and effective player in international relations and the world economy."

SADC’s current member states are 16 namely; Angola, Botswana, Comoros, Democratic Republic of Congo, Eswatini (Swaziland), Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Tanzania, Zambia and Zimbabwe (Chidede, 2017). The August 1992 Treaty amended several times in 2001, 2007, 2008 and 2009 serves as the constitutive document upon which SADC was established. All other subsidiary instruments are its derivatives (Masemola, 2005).

Extending far beyond the SADC Trade Protocol of achieving free trade area politically are the targets embedded in the Regional Indicative Strategic Development Plan (RISDP) of 2003. This agreement enjoys political legitimacy irrespective of the fact that it is not legally binding (Chidede, 2017). With some of the strategic plan’s targets having been missed since 2003, a revised RISDP (2015-2020) was published in 2017 in which the current SADC regional integration agenda is embodied.

The Study Objective

In pursuit of the economic integration objective, the European Union (EU) and 6 SADC countries namely Lesotho, Botswana, Swaziland, Namibia, Mozambique and South Africa signed an Economic Partnership Agreement (EPA) on the 10th of June 2016. This appears to be the first initiative involving the African region and the EU to achieve economic integration (Muntschick, 2018). The SADC-EU EPA has been provisionally executed since 10 October 2016. To what extent can this be achieved? The thrust of this study is predicated on this question.

Research Analysis

Although the investment promotion and trade continue to be important elements of the agenda for SADC “the revised RISDP (2015–2020) … prioritises industrialisation during the current state of integration in SADC”. The move towards regional industrialisation, together with the development of RVCs is on its own, an acknowledgement that integration stages are not practicable shortly beyond a free trade agreement. It is also noted that the African Continental Free Trade Area (AfCFTA) and the Tripartite Free Trade Area (TFTA) beyond SADC consummated in March 2018 and June 2015 respectively embrace economic integration with a broader approach. Further, it appears AfCFTA’s main challenges include but not limited to its 90% target level trade liberalisation and implementation process, because this hypothetically permits countries to continue levying duty in the region on goods commonly traded (Parshotam, 2018). Therefore, it becomes uncertain if the revised RISDP (2015-2020) will ever see the light of the day in the time left Chen (2011).

Literature Review

The literature review is based on economic performance, intra-regional trade and intra-regional investment in Southern Africa over the past few years.

SADC Economic Performance

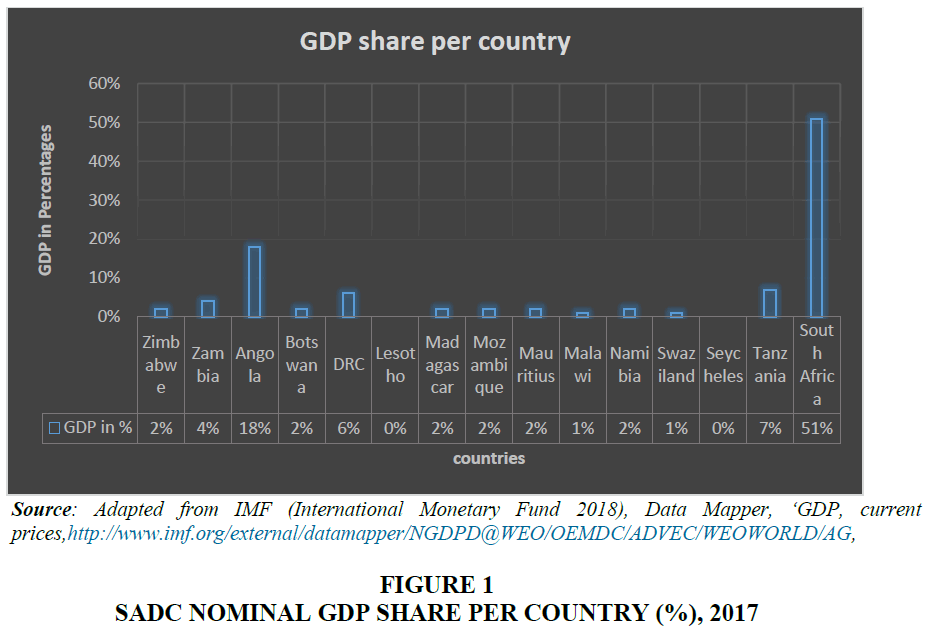

Bronauer and Yoon (2018) argue that the gross domestic product (GDP) levels in SADC in 2017 alone show wide disparities as shown in Figure 1 below.

These disparities hint at noteworthy member states’ structural differences (Bronaeur & Yoon, 2018). Southern Africa’s nominal GDP of approximately US$691 billion in 2017 placed South Africa’s contribution at 51% (International Monetary Fund, 2018). The figure above shows that Angola and Tanzania had 2nd and 3rd highest GDP levels with 18% and 7%, respectively. Even though SADC has continued to grow economically, the actual, inflation-adjusted GDP growth seems to have gone down considerably from 2010 Rosamond (2000). A mere 2, 8 % average real growth was reached in 2017, hitting a 2% mark below the emerging market average (International Monetary Fund, 2018).

SADC Intra-Regional Trade

The SADC intra-regional exports grew annually at an average rate of 9% from 2011 to 2013 while trade went up to nearly US$43 billion (International Trade Centre, 2018). However, as of 2014, the exports dropped at an annual average rate of 8%, peaking US$30.4 billion in 2017, almost close to the global exports of Angola (International Trade Centre, 2018). This trend reversal comes after the sluggish global commodity prices recovery, including a host of outstanding non-trade barriers (NTBs) hampering SADC’s trade and investment. Examples of conspicuous NTBs in Southern Africa include local content requirements, corruption and differences in rules of origin, regulations, local content requirements, arbitrary import restrictions and vehicle certification standards (Bronauer & Yoon, 2018).

In 2017, International Trade Centre (2018) reveals that the largest share of intra-regional trade exports was recorded by South Africa with close to 67% of the total. What followed was only 6% from the Democratic Republic of Congo (DRC). Such a wide gap underscores the economy of South Africa’s ability to attract large industries with its great economic base. It also clearly projects itself distinctly from all regional peers benefitting from the economies of scale to enable exports. A similar disparity is shown by International Trade Centre (2018) concerning the newest intra-SADC trade balance data, where South Africa posted a US$14 billion trade surplus in 2017. This was a lot greater by any stretch of the imagination to other SADC members as well. Bronauer and Yoon (2018) note that out of 15 SADC countries (excluding Comoros) only 5 countries posted an excess in trade over their counterparts in 2017, the other 10 countries were net importers of goods and services.

SADC intra-regional investment

UNCTAD reports that SADC was hit hard particularly by the decrease in global investment flows recently with a 66% incoming investment decline. Following the 2013 global commodity prices’ sudden drop, several investors continued to be fearful of a possible recurrent crisis. As a result, there has been an investment reluctance, particularly in commodity extraction. This is an investment with a propensity to build large stocks of capital for a comparatively long period (Bronauer & Yoon, 2018). Due to this reluctance, most countries in SADC are unable to easily attract FDI through these predominant extractive sectors. This decline in investment has had a profound economic impact.

South Africa’s outgoing and incoming investment disparity streams are a reflection of a shrinking role for the country as a regional investment hub. This has seen the advent elsewhere of investment opportunities in the region as observed by Bronauer and Yoon (2018). Also, the International Monetary Fund (2017) confirms the same when it reports South Africa’s global direct investment statistics. The report shows positive net capital flows for Botswana and Zambia and a net capital outflow of US$40 billion compared to a US$48 billion net FDI inflow for Mauritius (International Monetary Fund, 2017).

Political Stability

Political stability also has an impact on economic performance and investment. On political stability, Mauritius rates high. It was rated 1st out of 54 African states by the 2017 Ibrahim Index of African Governance rating sustainable economic opportunity, the rule of law and safety, participation, human rights and human development. The country boasts of a fairly diversified economic base, which includes tourism and financial services All these are factors that provide insights into critical domestic sectors that require enhancement in other SADC countries to drive investment (Bronauer &Yoon, 2018). It also should be noted that the economic performance of Mauritius is very closely related to its function as a tax haven, thus it has a large amount of foreign financial investment. This is not a role model for other countries in SADC to follow.

Methodology

To understand economic integration in Southern Africa, this study employs the hermeneutic phenomenological approach as described by Kafle (2011); Cohen (2001). According to Kafle (2011), hermeneutic phenomenology is predicated on the subjective experiences of individuals or groups. “It attempts to unveil the world as experienced by the subjects through their lifeworld stories.” This study attempts to unveil the economic integration pattern in Southern Africa as experienced by SADC member states informed by the revised 2015-2020 RIDSP’s priorities. Hermeneutic phenomenology believes that “interpretations are all we have and description itself is an interpretive process” (Kafle, 2011). Therefore, from SADC’s experiences in economic integration, the researcher’s responsibility is to make interpretations and describe if economic integration is ever going to be achieved. Cohen (2001) asserts that hermeneutic phenomenology is premised on understanding textual facts. This means creating an in-depth account of what is studied with sensitivity while concentrating on unveiling and not using prior knowledge. In creating an in-depth account this study employs a content analysis based on secondary data. The limitations identified with hermeneutic phenomenology include the quest to stay immersed and sustained in a study for a long time while considering some stories which have meanings that are ontological. Such an experience would require that researchers have to be open and be available for opportunities that enable one to understand a phenomenon. Researchers who employ hermeneutic phenomenological need to have necessary skills Ogbeide.

Results and Discussion

The study reveals that, from the time when the SADC free trade agreement (FTA) was created in 2001, attention has been drawn to a myriad of regional trade and investment barriers. These include political and economic challenges, NTBs and infrastructure constraints; all undermining the FTA rewards (Bronauer & Yoon, 2018). These are discussed below. This is exacerbated by the paucity of regional economic improvements and the dearth of initiatives directed at reducing these barriers. As a result, the regional outlook is negative. On the positive side, the SADC’s revised RISDP is set to stimulate momentum to develop business linkages through regional industries and set to increase economic intra-regional cooperation Gilpin (2001).

Trade Diversification Paucity

It appears SADC has two-pronged challenges in its quest to achieve regional economic stable growth for its RVC and domestic industries. First, it has to decrease the over-reliance on primary commodities and second, diversify export networks. For instance, in 2017 62 % of SADC’s total exports were oils and mineral fuels, ores and precious metals, and vehicles (International Trade Centre, 2018). The US, EU and China being the main destinations (International Trade Centre, 2018). Predominantly relying on these primary commodities traded with only key few partners exposes SADC to the dictates of global commodity prices thereby increasing global market turbulence risks and uncertainties (Bronauer & Yoon, 2018).

Diversification of Commodities

It is envisaged that SADC’s challenge of disabling its excessive dependence on primary commodities is likely to persist for a while. This is revealed by a correlation analysis of SADC export volume and world commodity prices, 2010–2016. The analysis suggests that the investments’ influx into Africa through Mauritius as the popular investment hub largely depends on the primary commodity prices irrespective of economic fundamentals in a particular country. This implies that SADC countries cannot individually diversify exports for their domestic economies to become resilient. SADC will have to collectively depart from the commodity dependence syndrome Gehring (2008).

United Nation has shown through “SADC commodity share of global exports (%), 2017 or latest” that when exports for SADC states are disaggregated into some commodity groupings, for more than half of their global exports some four countries depend on one similar type of commodity. Angola presents the least diversification degree exporting 97% mineral fuels together with some related products while only Zimbabwe, Mozambique and South Africa are the most diversified economies. For these last three countries, it is reported that a single type of commodity constitutes not more than one-third of global exports.

Because of this high level of commodity dependence, SADC must develop a diversification investment framework (Bronauer & Yoon, 2018). Examples can be borrowed from South-East and East Asia. South Africa appears to have taken that route through its Industrialisation Draft Action Plan, but what is important is the need for SADC states to develop regional complementarities and sustain RVCs. This will reduce regional competition from one another although there are inherently social, economic and political challenges to this approach.

Diversification of Trade Partnership (Non-SADC and Intra-SADC Trade)

According to International Trade Centre (2018), there are six countries in the SADC region relying on over 30% of their exports in one foreign market. Zimbabwe being the highest exporter (79.5% to South Africa), Swaziland (66% to South Africa), Zambia (44.5% to Switzerland) and the DRC (40.4% to China) (International Trade Centre, 2018). Bronauer and Yoon (2018) contend that too many export shares directed to a single trading partner aggravate the external market volatility effect on the domestic economy. They cite the prevailing uncertain trade environment in respect to the slowing Chinese economic growth and the protectionist US economy as particularly problematic Ogbonna et al. (2013).

Bronauer and Yoon (2018) further argue that African states should desist from being choosy and picky when it comes to trade partnerships. Some good examples refer to the EU Economic Partnership Agreements (EPAs) and the African Growth and Opportunity Act (AGOA) (Prinsloo & Ncube, 2016; EC, 2016). These are global initiatives meant to bolster economic development based on specific conditions of trade to which some of the SADC member states have signed up to expand their exports to the EU and the US, in particular agriculture-related products. AGOA is a programme led by the United States of America giving preferred US markets to African countries (Prinsloo & Ncube, 2016). Whereas the EU-EPAs is a programme giving preferred access to EU markets to Pacific, Caribbean and African countries (EC, 2016). However, it appears very little is known in the region about business conditions available although there are investment promotion agencies Ogbeide (2010).

Absence of Effective Intra-SADC Trade Policy Harmonisation

Although intra-African national programmes to increase trade and reduce regional tariffs through SADC seem to have improved connectivity in the last 10 years, the proliferation of NTBs protecting domestic industries has been noted (Bronauer & Yoon, 2018). This is in sharp contrast to SADC’s provisions in Article 6 of SADC’s Protocol on Trade effected in 2000 compelling all states to obliterate NTBs and desist from creating new ones. Member states prefer to habitually invoke provisions of Article 21 to provisionally set aside some of this Protocol’s obligations to deal with local poverty and soaring unemployment rates. It remains problematic for trade and investment in SADC especially with the reluctance of members to sign the Multilateral Cross-Border Road Transport and Vehicle Load Management Agreements Jiboku (2015).

For the integration initiative, these two agreements are the primary enabling legal instruments without which implementation to full throttle would be less likely. In sum, it is this disconnect of intra-SADC trade policy stemming from fragmented regulations that make the regional economic integration an illusion or a mirage. It is encouraging that removal of these discrepancies continues to be part of the African Continental Free Trade Area (AfCFTA) and Tripartite Free Trade Area (TFTA) negotiations agenda Koukoudakis (2012).

Constraints in Domestic Infrastructure

In exploring the ease of doing business the World Bank’s (World Bank, 2018) Doing Business Report, focuses on 190 countries to measure the number of procedures, money and time needed for certain business tasks to be accomplished. In this report, SADC countries ranked at an average of 117th. Mauritius was the best in SADC and Africa ranking globally at 25th. In the SADC region, Mauritius was followed by Botswana taking up the 81st global position, with South Africa sitting at the 82nd position. In that survey, SADC’s worst economies were DRC at 182nd despite being well endowed with resources while Angola sat at the 175th global position Manboah (2000).

Concerning cross-border which relates closely to regional trade, the thrust of this current study, on average SADC ranked 118th which is not a good performance indicator. Bronauer and Yoon (2018) observe that the World Bank’s quantitative findings are corroborated with more qualitative findings from the 2012 survey conducted by Makokera et al. (2012). In their study as sponsored by SAIIA, Makokera et al. (2012) focus on the 10 uppermost investment and development constraints in SADC revealing urgent challenges including among others; customs regulations and corruption; access to finance, access to skilled labour in local markets, regulatory transparency and oversight Gibb (2009).

The World Economic Forum 2017-2018 Global Competitive Index shows SADC members’ average rank of infrastructure out of 137 countries as 101. For electricity and telephone infrastructure this translates to 102 and for transport infrastructure sitting at 95 Laffan (1992).

Transport and Energy Infrastructure

According to Wentworth et al. (2018) the African Development Bank estimates that US$140-170 billion is needed for Africa’s infrastructure yearly but there is a financial annual gap of US$67.6 to 107.5 billion. In 2012, SADC’s efforts to address its share of this gap resulted in the launching of the Project Preparation and Development Facility (PPDF) to which the Development Bank of Southern Africa (DBSA) stands as the agent for implementation.

The PPDF facilitates the Regional Infrastructure Development Master Plan (RIDMP) implementation by providing technical assistance among others. The Regional Development Fund (RDF) approved by SADC in August 2017 is anticipated to integrate the PPDF with the largest initial capitalisation fund coming from member states (Wentworth et al., 2018). As expected, there could be fiscal difficulties ahead owing to the inability by some member states to meet their financial obligation share of the initial seed money totalling US$120 million (Wentworth et al., 2018). Bronauer and Yoon (2018) observe that one priority of the RIDMP relating to road transport through the creation of a one-stop border post (OSBP) is yet to be achieved citing the upgrading of the Beit bridge border into an OSBP. This project was meant to be completed in 2014. While the necessary infrastructure appeared to have been in place long back, the delay has been attributed to a lack of political will (Bronauer & Yoon, 2018).

Constraints Due to Politics and Economies

Bronauer and Yoon (2018) argue that 90% of funding to SADC is through donors and the institution only depends on members for offers to host negotiations. The paucity of offers when negotiations are needed most puts at risk the conclusion of the desired agreements. National politics determine when to provide offers or not including the country’s economic status Niemann & Schmitter (2009).

Conclusion and Recommendations

It can be concluded that only the effective execution of current SADC initiatives could influence the achievement of the revised 2015-2020 (RISDP), particularly the objective for profound economic integration. For this to be achieved there is a need for political will among member states to comply with these measures. The host of different institutions and programmes addressing impediments to investment and trade need buy-in from member states lest regional integration may remain a pipe-dream. Then other challenges revealed in this study like intra-SADC trade policy harmonisation, diversification of trade partnership, paucity of trade and commodity diversity will easily fall in place. The study further revealed that the struggle to realising a regional steady economic growth is located in most of the countries’ reliance on primary commodities for their biggest export share.

Whereas intra-regional trade and investment may remain closely tied to global commodity exports and prices for some time, SADC member states should focus more on developing sustainable domestic sectors. This implies genuinely evaluating the critical national economic fundamentals and identifying sustainable sectors which have regional comparative advantage prospects. National industrial policies promoting only one industry like mining across the region may not be effective. Intra-regional synchronisation is imperative to complement funding of SADC’s regional infrastructure to enhance regional economic development. Mechanisms to hold members accountable for not upholding economic integration agreements should be put in place and made legally binding. However, a glimmer of hope for a broader regional integration is evident in the impetus portrayed by both the AfCFTA and the TFTA. Further, similar studies should be done in other RECs for comparative analysis.

References

- Arndt, C., & Roberts, S. (2018). Key issues in regional growth and integration in South Africa. Development Southern Africa, 35(3), 297–314.

- Ayinde, A. (2011). Technical cooperation and regional integration in Africa: A study of nigeria’s technical aid corps. Journal of Sustainable Development in Africa, 13(8), 182-186.

- Biswaro, J. (2012). The quest for regional integration in the twenty-first century: Rhetoric versus reality: A comparative study. Dar es Salaam: NkukinaNyota Publishers Ltd.

- Bronauer, J., & Yoon, J. (2018). Regional economic development in SADC: Taking stock and looking ahead. Retrieved February 25, 2019, from http//www.africaportal.org/.../18832/saia_report-25 Bronnauer-Yoon_20181102pdf

- Chen, Z. (2011). The development of cross-strait relationship in a neo-functionalism framework. Chinese Academy of Social Sciences, 5(3), 1-2.

- Chidede, T. (2017). Intra?SADC trade remains limited: How can it be boosted? Retrieved March 2, 2019, from https://www.tralac.org/discussions/article/11962?intra?sadc?trade?remains?limited?how?can?it?be?boosted.html

- Chingono, M., & Nakana, S. (2009). The challenges of regional integration in Southern Africa. African Journal of Political Science and International Relations, 3(10), 396–408.

- Cohen, A. (2001). Review of literature: Responses to Empirical and hermeneutic approaches to phenomenologicalresearch in psychology, a comparison. Gestalt, 5(2), 1-11.

- Gehring, T. (2008). Integrating integration theories: Neo-functionalism and international regimes. Retrieved March 05, 2019, from https://doi.org/10.1080/13600829608443111

- Gibb, R. (2009). Regional integration and africa’s development trajectory: Meta-theories expectations and reality. Third World Quarterly, 30(4), 701-721.

- Gilpin, R. (2001). Global political economy: Understanding the international economic order. Princeton: Princeton University Press.

- International Monetary Fund. (2017). Coordinated direct investment survey. Retrieved March 13, 2019, from http://data.imf.org/?sk=40313609-F037-48C1-84B1-E1F1CE54D6D5&sId=1482331048410

- International Monetary Fund. (2018). IMF datamapper: World economic outlook. Retrieved March 3, 2019, from https://www.imf.org/external/datamapper/NGDPD@WEO/OEMDC/ADVEC/WEOWORLD/AG

- International Trade Centre. (2018). Trade map. Retrieved March 04, 2019, from https://www.trademap.org/Index.aspx

- Isaksen, J. (2003). Restructuring and progress in Regional Integration. Gaborane: SADC.

- Jiboku, P. (2015). Africa’s public service delivery & performance review. The challenge of regional economic integration in Africa: Theory and Reality, 3(4), 5-28.

- Kafle, N. (2011). Hermeneutic phenomenological research method simplified. Bodhi: An Interdisciplinary Journal, 5(1), 181-200.

- Koukoudakis, G. (2012). European integration and the reconceptualisation of state sovereignty. Spectrum: Journal of Global Studies, 4(1), 91-101.

- Laffan, B. (1992). Integration and cooperation in Europe. London and New York: Routledge/The University Association for Contemporary European Studies.

- Makagwe, J. (2013). The activities of the Southern African development in relation to its purpose statement. Masters Dissertation, University of South Africa. Pretoria: Unpublished.

- Makokera, C., Chapman, G., & Wentworth, L. (2012). Top 10 business constraints in SADC’: SADC business case studies. Retrieved March 16, 2019, from https://saiia.org.za/wp-content/uploads/2015/05/Top_10_Business_constraints_in_SADC.pdf

- Manboah, J. (2000). Regionalism and integration in Sub-Saharan Africa: A review of problems, issues and realities at the close of the twentieth century. Retrieved March 11, 2019, from https://www.ucalgary.ca/innovations/files/innovations/inv2000-5.pdf

- Masemola, H. (2005). An analysis and appraisal of restructuring in SADCC/SADC since 1990. Masters Dissertation. University of South Africa. Pretoria: Unpublished.

- Mlambo, D. (2018). Unearthing the challenges and prospects of regional integration in Southern Africa. Retrieved January 21, 2019, from https://www.researchgate.net/publication/329416283

- Muntschick, J. (2018). The Southern African development community (SADC) and the European Union (EU): regionalism and external influence. Geneva: Palgrave Macmillan.

- Niemann, A., & Schmitter, P. (2009). Neo-functionalism. In A. Wiener, & T. Diez, (Eds.), Theories of European Integration. Oxford: Oxford University Press.

- Ogbeide, M. (2010). Comparative integration: A brief analysis of the European Union (EU) and the economic community of West African States (ECOWAS). The Journal of International Social Research, 3(10), 478-486.

- Ogbonna, C., Aluko, B., & Awuah, K. (2013). The ECOWAS platform and persisting challenges of integrating the West African region: A Discourse. Journal of Economics and Sustainable Development, 4(1), 104-113.

- Parshotam, A. (2018). Can the African continental free trade area offer a new beginning for trade in Africa?’, SAIIA (South African Institute of International Affairs). Retrieved March 3, 2019, from http://www.saiia.org.za/occasional-papers/can-the-african-continental-free-trade-area-offer-a new -beginning- in- Africa

- Prinsloo, C., & Ncube, C. (2016). Deepening trade and investment relations post-AGOA: Three options for South Africa’, SAIIA Policy Insights, 36. Retrieved February 27, 2019, from http://www.saiiaorg.za/policy-insights/deepening-trade-and-investment-relations-post-agoa-three-options- for-South Africa

- Rosamond, B. (2000). Theories of European integration. New York: Palgrave.

- Saurombe, A. (2010). The role of South Africa in SADC regional integration: The making or braking of the organization. Journal of International Commercial Law and Technology, 5(3), 124-131.

- Wentworth, L., Markowitz, C., Ngidi, Z., Makwati, T., & Grobbelaar, N. (2018). SADC regional development fund: operationalisation imminent? Retrieved March 16, 2019, from http://www.gegafrica.org/item/718-sadc-regional-development-fund-operationalisation-imminent

- World Bank. (2018). Doing business report 2018: Reforming to create jobs. Retrieved March 16, 2019, from http://www.doingbusiness.org/reports/global-reports/~/media/WBG/DoingBusiness/Documents/Annual-Reports/English/DB18-print-report.pdf