Research Article: 2020 Vol: 19 Issue: 2

Effect of Corporate Governance and Risk Management against Corporate Sustainability at the Coal Mining Industry in Indonesia

Arief Senjaya, Universitas Padjadjaran

Ernie Tisnawati Sule, Universitas Padjadjaran

Nury Effendi, Universitas Padjadjaran

Martha Fani Cahyandito, Universitas Padjadjaran

Abstract

Mining of natural wealth in Indonesia is still an interesting belle to be discussed, especially coal mining. Coal mining in Indonesia not only has a positive economic impact but also causes various environmental and social problems. Indicators of success of a mining company are not only assessed from economic indicators but also include environmental and social indicators. The principle of sustainability is a key requirement in measuring the success and effectiveness of development in accordance with the agreement set forth in the Brundtland Report, 1987, which has been adopted by the Government of Indonesia in its constitution. This study aims to determine the effect of corporate governance and the use of risk management on business sustainability in the coal mining industry in Indonesia. Some literature has examined this relationship a lot, but until now no one has specifically examined this relationship in coal mining in Indonesia. This research uses the Structural Equation Modeling (SEM) - PLS method in 50 companies. The results showed that: (1) corporate governance has an effect on risk management (2) risk management has an effect on corporate sustainability (3) corporate governance has an effect on corporate sustainability.

Keywords

Corporate Governance, Risk Management, Corporate Sustainability, Coal Mining.

Introduction

Indonesia is a country that is very rich in natural resources, ranging from oil and gas to minerals and other minerals. Realizing this wealth, the Government of Indonesia emphasized in the amendments to the 1945 Constitution of the State of Indonesia, especially in the Preamble and amendments to articles 33 paragraphs (3) and (4) of the 1945 Constitution which stated that such natural resources would be used maximally for the prosperity of the Indonesian people by taking into account national economy that is sustainable and environmentally sound as one of the benchmarks of the success of Indonesia's economic development.

One such source of wealth is coal which, based on data from the Ministry of Energy and Mineral Resources (2015) in 2015-2019, Indonesia has a total coal resource of 120 million tons and reserves that are ready to be produced are 31.35 billion tons. Coal mining becomes an important source for national development, therefore in addition to involving State-Owned Enterprises (SOEs); the Government of Indonesia also encourages the participation of private companies to run the coal mining business. The participation of private companies in the mining world is intended as part of maintaining the sustainability of national development that is efficient, effective and environmentally sustainable.

In managing coal mines, the Government mandates to pay attention to the principles of good mining practice and the principle of sustainability. Sustainability is the performance produced by balancing the three aspects of people, planet, profit, which is known as the Triple Bottom Line (TBL) concept (Elkington, 1998). The sustainability report (sustainability report) is a practice of measurement, disclosure and accountability efforts of sustainability activities that aim to achieve sustainable development (Azapagic, 2004). All stakeholders who consider sustainable development (sustainable development) will be able to increase the overall value, both the government, companies, consumers, company employees, investors, regulators, suppliers and other groups (Fuisz-Kehrbach, 2015).

In the field implementation, the mining industry also has several negative influences, including the loss of biological wealth, forest land grabbing, pollution, environmental pollution, poor reclamation programs, incomplete Environmental Impact Analysis (AMDAL) documents, social jealousy, social environmental problems and society, the emergence of corruption, embezzlement of state revenues through taxes and PNBP, management of mines that are not transparent and accountable.

Some factors that influence the process of sustainability include the existence of corporate governance (Hashim et al., 2015; Janggu et al., 2014; Aras & Crowther, 2008) and good risk management (Kemp et al., 2016; Zhao et al., 2016; Balachandran et al., 2011). While risk management is also influenced by corporate governance (Sae-Lim, 2018; Maruhun et al., 2018; Bastomi et al., 2017; Badriyah et al., 2015; Manab et al., 2010). Some things that become the basis of not implementing good corporate governance include the absence of a structure at the highest level that pays attention to environmental interests so that environmental reporting products are only ordinary or only as a supplementary administration (Cahyandito & Pau, 2017; Rao et al., 2012). The above literature generally does not specifically highlight the relationships and problems in coal mining. Therefore in this discussion we will examine whether this relationship applies in coal mining in Indonesia.

Based on the 2013 Semester II Audit Board of the Republic of Indonesia (BPK RI, 2013), it was found that the level of non-compliance of the company in submitting financial, environmental, and social/community reports was very low. BPK RI (2013) also highlighted the causes of the problem, including the lack of synchronization of policies between the technical ministries and even within the technical ministry itself. Poor mining governance leads to irregularities in state finances including corruption cases and lack of state revenue in the mining sector. Where there is a lack of state revenue of Rp. 54.4 trillion, and there is a potential tax deficit per year of Rp. 6 trillion due to companies not complying with tax rules. This shows that poor management of the mining industry in several countries has a positive correlation between natural resource wealth and the level of corruption (Busse & Gröning, 2013).

Risk management is an integrated activity including risk recognition, assessment, building strategies, and mitigating risks based on organizational resources (Berg, 2010). Risk management is a critical factor that influences the success of a program. The purpose of risk management is to minimize the risk of failure in achieving a goal (Eger & Egerová, 2016). Poor management of risk can have an impact on increasing risk to company management (Wong, 2014). ISO 31000 defines risk management as a process of identifying, assessing, and prioritizing a risk. In the coal mining industry, risk management is needed including risk mapping because coal mining is a risky investment, both systemic and non-systemic risk. This risk map is useful as a management tool for estimating mitigation actions, field preparedness, recovery and rehabilitation in the event of deviations (Mark & Gauna, 2016; Qing-gui et al., 2012; Sari et al., 2009; Grayson et al., 2009; Coleman & Kerkering, 2007).

Based on the description of the above problems, this study will discuss the effect of corporate governance, and risk management, on corporate sustainability in the coal mining industry in Indonesia.

Literature Review

Corporate Governance

Corporate governance is the mechanism of a system that regulates the relationship between shareholders, company management, creditors, government, employees, and other stakeholders. One of the objectives of corporate governance is to create protection, guarantee equality of treatment and create added value for all stakeholders (Baker & Quéré, 2014; Bar-Joseph & Prencipe, 2013; Haat et al., 2008; OECD, 2004; FCGI, 2001). Corporate governance can be measured through the dimensions of commitment to the implementation of corporate governance, the role of capital owners in corporate governance, directors, and information disclosure and transparency (Khan & Benerji, 2016; Veldman & Willmott, 2015; Roy, 2014; Shehata, 2015; Ho & Taylor, 2013; Augustine, 2012; Mitra & Saha, 2012; Todorovic & Todorovic, 2012; Wajeeh & Muneeza, 2012; Stiglbauer et al., 2012; Mulyadi & Anwar, 2011; Kirkbride & Dujuan, 2009). The world of coal mining has also adopted the principles of implementing corporate governance as regulated in the OECD in the hope of providing added value to stakeholders.

Risk Management

Risk management is a systematic effort to maximize the achievement of business objectives through identification, analysis, and control of risk-based activities in order to mitigate and protect vital assets and resources that are used sustainably (Sharma & Swain, 2011; Chatterjee & Bose, 2011; Djohanputro, 2008; Vaughan & Vaughan, 2007). Risk management is measured by the dimensions of understanding of risk and risk management, risk identification, risk assessment and analysis, risk monitoring and control, and communication and consultation (Marcelino-Sádaba et al., 2014; Hoffmann et al., 2013; Xie et al., 2011; Leitch, 2010; Kimbrough & Componation, 2009; Ahmed et al., 2007; Hallikas et al., 2004; Raz & Michael, 2001; Kwak & Stoddard, 2004; Chapman, 2001; Xie et al., 2011). In the mining world also identified several regulations concerning risk management including ESDM Ministerial Regulation (Permen) No. 38 of 2014 concerning the Implementation of a Mineral and Coal Mining Safety Management System (SMKPMB, 2015).

Corporate Sustainability

Corporate sustainability is the company's strategy and practice in achieving the goal of maximizing stakeholder satisfaction in a balanced manner by taking into account environmental, social, and economic factors together and in an integrated manner, as well as maintaining company assets in order to achieve sustainable development and environmentally friendly (Afzal et al., 2017; Elhuni & Ahmad, 2017; Huang & Badurdeen, 2017; Bui et al., 2017; Kulkajonplun et al., 2016; Singh et al., 2016; Koç & Durmaz, 2015; Sari et al., 2015; Godha & Jain, 2015 ; Ghadimi & Heavey, 2014; Erzurumlu & Erzurumlu, 2015 Wolf, 2014; Azapagic, 2004; The World Commission on Environment and Development, 1987). Corporate sustainability is measured by economic, environmental, social dimensions (Schreck & Raithel, 2018; Boiral & Henri, 2015; Bhatia & Tuli, 2015; Montiel & Delgado-Ceballos, 2014; Supriyadi, 2013).

Methodology

The object of research (Blumberg et al., 2014) in research is corporate governance, risk management, and corporate sustainability. The research method used in this research is descriptive research and verification research (causal study) (Sekaran & Bougie, 2016). In this study the operationalization of variables can be done by looking at it from the dimensions of corporate governance, risk management, and corporate sustainability. The target population consists of 82 coal mining companies in Indonesia selected based on economic performance and environmental reporting feasibility in the Ministry of Energy and Mineral Resources and KLHK. Of the 82 companies that met the environmental reporting feasibility, 50 companies were considered economically viable, which at least had a production of 1 million tons/year in 2014-2017. In this study using a sample of 50 coal mining companies selected with 95 respondents coming from supervisor (42%), manager (41%), vice president (8%), and director levels (8%) (Hair et al., 2014). Data collection methods by distributing questionnaires, the instrument used was a questionnaire; the data used in this study were primary and secondary data.

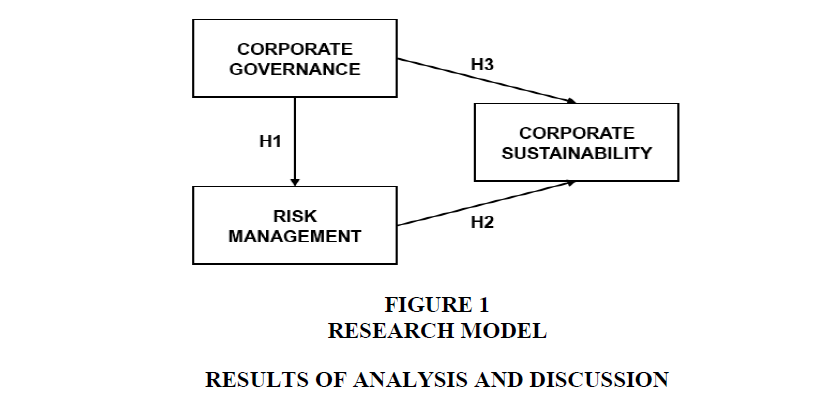

Statistical descriptive analysis is the process of transforming research data into tabulations so that it is easy to understand and interpret. Generally, used to provide information about the characteristics of research variables and demographic data of respondents (Indriyanto & Supomo, 2002). Verification analysis using SEM-PLS structural equation modeling. The path diagram was developed as a method for studying the effect directly and indirectly of the independent variable (independent/exogenous variable) on the dependent variable (dependent/endogenous variable). The theoretical model that has been built is then described in the form of a path diagram, with Hypothesis H1: Corporate governance has a significant effect on risk management, H2: Risk management has a significant effect on corporate sustainability, H3: Corporate governance has a significant effect on corporate sustainability. Flowchart of this research is presented in Figure 1 below.

Results of Aanalysis and Discussion

Profile of Respondents

The number of respondents in this study was as many as 95 people, with the characteristics of respondents as follows:

1. Gender, male respondents are 91 people (96%), and women are 4 people (4%).

2. Age, respondents aged 20-30 years are 5 people (5%), 31-40 years are 43 people (45%), 41-50 years are 29 people (31%), and> 51 years are 18 people (19%).

3. Last education, D3 education respondents numbered 12 people (13%), S1 numbered 66 people (69%), S2 totaled 16 people (17%), and S3 amounted to 1 person (1%).

4. Years of service in the field of coal mining, respondents with tenure of <5 years totaling 11 people (12%), 6-10 years totaling 34 people (36%), and> 11 years totaling 50 people (53%).

5. The level of position in the company, respondents with supervisory positions are 40 people (42%), managers are 39 people (41%), vice president is 8 people (8%), and directors are 8 people (8%).

Structural Model

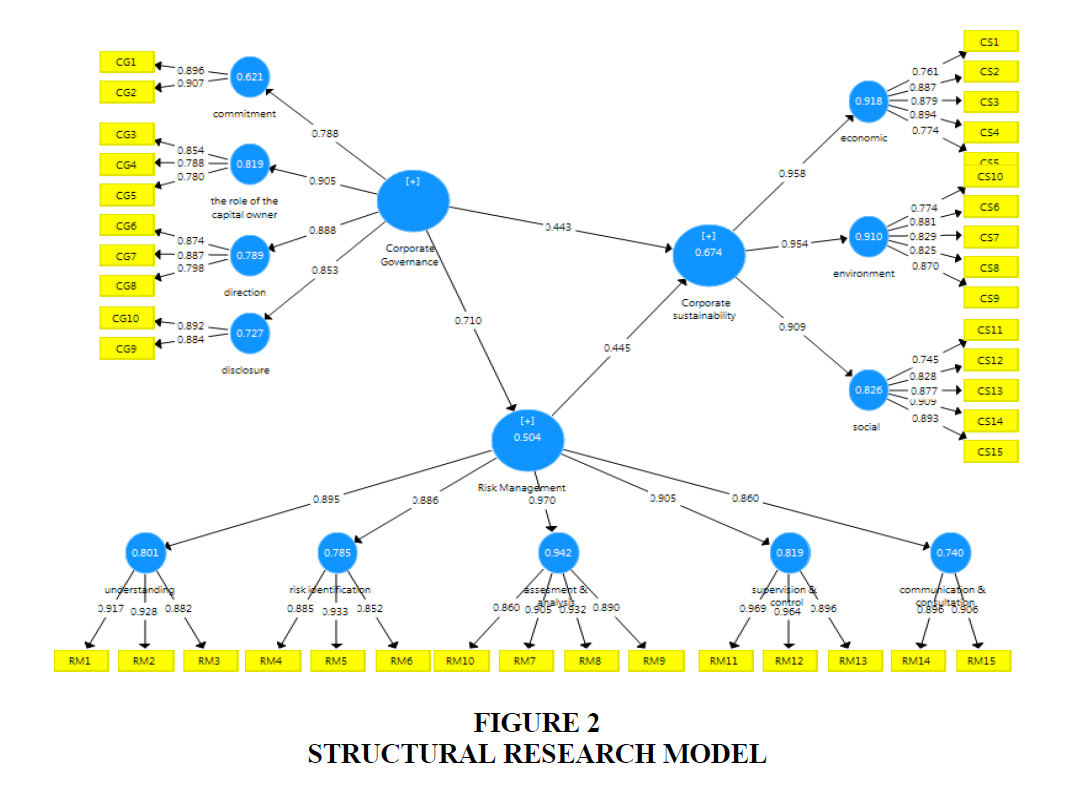

Here is a picture of the structural model in this study:

Structural Research Model

In Figure 2 it can be seen that the construct of corporate governance is measured by 4 dimensions, the risk management construct is measured by 5 dimensions, and the construct of corporate sustainability is measured by 3 dimensions. The direction of the arrow between dimensions and latent constructs is towards the dimension which shows that the study uses reflective indicators that are relatively appropriate to measure perception. The relationship to be examined (hypothesis) is symbolized by arrows between constructs.

Validity and Reliability Testing

Table 1 shows the results of the validity and reliability test. From Table 1 it is found that the value of loading factors for measurement items does not have a value below 0.7 and AVE values in dimensions and variables have values above 0.5 so that it can be stated that all measurement items, dimensions and variables in this study are valid. Cronbach's Alpha value and Composite Reliability above 0.7, the dimensions and variables in this study are reliable.

| Table 1: Validity and Reliability Test Results | ||||||

| Variable | Dimension | Measurement item | Loading Factor | AVE | Cronbach's Alpha | Composite Reliability |

|---|---|---|---|---|---|---|

| Corporate Governance | 0.549 | 0.908 | 0.924 | |||

| Commitment | 0.812 | 0.769 | 0.896 | |||

| CG1 | 0.896 | |||||

| CG2 | 0.907 | |||||

| The role of the capital owner | 0.653 | 0.733 | 0.849 | |||

| CG3 | 0.854 | |||||

| CG4 | 0.788 | |||||

| CG5 | 0.780 | |||||

| Direction | 0.729 | 0.813 | 0.890 | |||

| CG6 | 0.874 | |||||

| CG7 | 0.882 | |||||

| CG8 | 0.798 | |||||

| Disclosure | 0.789 | 0.732 | 0.882 | |||

| CG9 | 0.892 | |||||

| CG10 | 0.884 | |||||

| Risk Management | 0.685 | 0.967 | 0.970 | |||

| Understanding | 0.827 | 0.895 | 0.935 | |||

| RM1 | 0.917 | |||||

| RM2 | 0.928 | |||||

| RM3 | 0.882 | |||||

| Risk Identification | 0.794 | 0.869 | 0.920 | |||

| RM4 | 0.885 | |||||

| RM5 | 0.933 | |||||

| RM6 | 0.852 | |||||

| Assessment & Analysis | 0.804 | 0.919 | 0.943 | |||

| RM7 | 0.905 | |||||

| RM8 | 0.932 | |||||

| RM9 | 0.890 | |||||

| RM10 | 0.860 | |||||

| Supervision & control | 0.890 | 0.938 | 0.961 | |||

| RM11 | 0.969 | |||||

| RM12 | 0.964 | |||||

| RM13 | 0.896 | |||||

| Communication & conclusion | 0.812 | 0.769 | 0.896 | |||

| RM14 | 0.896 | |||||

| RM15 | 0.906 | |||||

| Corporate Sustainability | 0.627 | 0.957 | 0.962 | |||

| Economic | 0.707 | 0.895 | 0.923 | |||

| CS1 | 0.761 | |||||

| CS2 | 0.887 | |||||

| CS3 | 0.879 | |||||

| CS4 | 0.894 | |||||

| CS5 | 0.774 | |||||

| Environment | 0.700 | 0.892 | 0.921 | |||

| CS6 | 0.774 | |||||

| CS7 | 0.881 | |||||

| CS8 | 0.829 | |||||

| CS9 | 0.825 | |||||

| CS10 | 0.870 | |||||

| Social | 0.727 | 0.904 | 0.930 | |||

| CS11 | 0.745 | |||||

| CS12 | 0.828 | |||||

| CS13 | 0.877 | |||||

| CS14 | 0.909 | |||||

| CS15 | 0.893 | |||||

Inner Model

The following is the inner model:

In Table 2 it can be seen that the R-Square value for the risk management construct gives a result of 0.504. This means that the construct of risk management can be explained by the construct of corporate governance by 50.4%, while the rest (49.6%) is explained by other variables not examined in this study. The R-Square value of the corporate sustainability construct is 0.674. This means that the construct of corporate sustainability is explained by the construct of corporate governance and risk management by 67.4% while the rest (32.6%) is explained by other variables not examined in this study.

| Table 2: Inner Model | |

| Dependent variable | R Square |

|---|---|

| Risk management | 0.504 |

| Corporate sustainability | 0.674 |

Hypothesis test

The following are the results of testing the hypothesis:

The results of testing the hypotheses in Table 3 and Table 4 can be explained as follows:

| Table 3: Research Hypotheses and Verification Results | ||||

| Hypothesis Pathway | Hypothesis relationship | Pathway value | t-statistics | Result |

|---|---|---|---|---|

| Corporate governance → risk management | Positive | 0.710*** | 10.030 | Supported |

| Risk management → corporate sustainability | Positive | 0.445*** | 4.498 | Supported |

| Corporate governance → corporate sustainability | Positive | 0.443*** | 5.037 | Supported |

Note: *** p-value < 0.001

| Table 4: Effects between Latent variables in overall samples | |||

| Hypothesis pathway | Direct effect | Indirect effect | Total effect |

|---|---|---|---|

| Corporate governance → risk management | 0.710 | 0.710 | |

| Risk management → corporate sustainability | 0.445 | 0.445 | |

| Corporate governance → corporate sustainability | 0.443 | 0.136 | 0.759 |

H1 Accepted. Corporate governance has a positive and significant effect on risk management. This is based on; it is based on, the value of t-count (t-statistics) of 10,030, and is greater than the value of t-table (1.96).

H2 Accepted. Risk management has a positive and significant effect on corporate sustainability. This is based on, the value of t-count (t-statistics) of 4.498, and greater than the value of t-table (1.96).

H3 Accepted. Corporate governance has a positive and significant effect on corporate sustainability. This is based on, the value of t-count (t-statistics) of 5037, and greater than the value of t-table (1.96).

Based on the test results above, it can be concluded that good governance is influenced by commitment and openness of management in every decision making. These commitments include measurement and implementation that is consistent in the implementation of corporate governance. In measuring the significance of risk management it is influenced by factors of understanding and identifying risks and controlling risks that affect management in managing mine risk. The world of Indonesian mining is very dependent on the rules issued by the government. Social conditions are strongly influenced by employee satisfaction and maintaining good relations with the communities around the mining area. This is in line with the principle of good mine management where the interests of employees and the community are always the company's concern to minimize conflicts.

This study valuates how the risk assessment process occurs in the company and how to mitigate those risks. The results show that respondents' perceptions assess that (1) the company has identified all risks comprehensively and systematically, (2) the company has conducted an analysis of all potential risks, (3) the company already has inspection procedures for work implementation, and (4) the company has prepared procedures to respond to the risks that will occur. However, several things according to the perception that need to be improved are (1) in terms of communication, the company does not socialize risk to stakeholders and does not routinely inform the risk management report to the competent authority, (2) the company does not have a detailed strength and weakness map of each risk, and (3) in terms of monitoring, the company lacks monitoring of the effectiveness of risk management, and the company has less established risk management documentation procedures.

For the implementation of corporate governance, the company has already adequate corporate governance guidelines. Although some assessments of supporting elements of governance based on respondents' perceptions still need to be improved including in terms of (1) the absence of guidelines/regulations regarding the process of appointment and dismissal of directors and commissioners by capital owners, (2) capital owners do not apply regulations that limit duplicate positions for directors and commissioners, (3) lack of approval of annual reports and financial reports from capital owners. In general, respondents rated good implementation of corporate governance, especially in terms of (1) the Board of Directors has made policies in accordance with existing business processes within the company, (2) the Board of Directors has set targets for company performance and has been stepped down gradually to the levels below, and (3) The Board of Directors has built a good relationship with all stakeholders, which causes the company to have added value.

Other results show that the principles of good governance affect risk management in Indonesian coal mines and the condition is in line with the results of previous studies. Likewise, the influence of risk management that affects business continuity is in line with the results of previous studies. Both of these components can help the company simultaneously in preventing greater losses and can mitigate risks appropriately in accordance with its objectives to maintain business continuity.

Conclusion and Suggestions

The conclusions in this study indicate that: (1) Corporate governance influences risk management, (2) Risk management influences corporate sustainability, (3) Corporate governance influences corporate sustainability.

From the results of the analysis above it is known that the role of good governance can mitigate the risk of coal mining companies. The governance is expected to prevent the occurrence of business risks through a mining management system in accordance with established regulations. As a business that is always related to risk, coal mining in Indonesia needs to manage its risks better. Risk management, especially compliance risk and investment risk has always been a major factor in the Indonesian coal mining business.

Therefore, to support the creation of business sustainability, mining risk management is expected to be adequately managed and understood by the company. Continuous supervision and control activities in mine risk management are prioritized. In addition, good corporate governance also ensures the realization of the sustainability of the mining business not only through economic indicators but comprehensively covers environmental and social indicators. This condition is reflected in several mining business requirements that must be met either through central government regulations, relevant ministries or local government regulations. Governance is important in realizing business sustainability in the current era of globalization.

Noting the test results and taking into account several important points, it is recommended that special emphasis be placed on mining company management to be more transparent, including in the process of licensing and disclosure of public information. In addition in its implementation the company is given space to be more active and given incentives or facilities to invest. The management of mine risk management and management is also more focused on improving the process of disclosure in establishing business risks. In addition to complying with established regulations, it is hoped that the company will always pay attention to the three aspects of sustainability including economic, environmental and social indicators as part of the company's sustainability.

The suggestion to the Government, government should propose to form a separate Risk Management Committee under the technical ministry to minimize company risk and integrated all regulations to provide ease of business.

References

- Afzal, F., Lim, B., & Prasad, D. (2017). An investigation of corporate approaches to sustainability in the construction industry. Procedia engineering, 180, 202-210.

- Ahmed, A., Kayis, B., & Amornsawadwatana, S. (2007). A review of techniques for risk management in projects. Benchmarking: An International Journal, 14 (1), 22-36.

- Aras, G., & Crowther, D. (2008). Governance and sustainability. Management Decision.

- Augustine, D. (2012). Good practice in corporate governance: Transparency, trust, and performance in the microfinance industry. Business & Society, 51(4), 659-676.

- Azapagic, A. (2004). Developing a framework for sustainable development indicators for the mining and minerals industry. Journal of Cleaner Production, 12(6), 639-662.

- Badriyah, N., Sari, R.N., & Basri, Y.M. (2015). The effect of corporate governance and firm characteristics on firm performance and risk management as an intervening variable. Procedia Economics and Finance, 31, 868-875.

- Baker, C.R., & Quéré, B.P. (2014). The role of the state in corporate governance. Accounting History, 19(3), 291-307.

- Balachandran, K., Taticchi, P., Hogan, J., & Lodhia, S. (2011). Sustainability reporting and reputation risk management: an Australian case study. International Journal of Accounting & Information Management.

- Bar-Yosef, S., & Prencipe, A. (2013). The impact of corporate governance and earnings management on stock market liquidity in a highly concentrated ownership capital market. Journal of Accounting, Auditing & Finance, 28(3), 292-316.

- Bastomi, M., Salim, U., & Aisjah, S. (2017). The role of corporate governance and risk management on banking financial performance in Indonesia. Jurnal Keuangan dan Perbankan, 21(4), 670-680.

- Berg, H.P. (2010). Risk management: procedures, methods and experiences. Reliability: Theory & Applications, 5(2 (17)).

- Bhatia, A., & Tuli, S. (2015). Sustainability disclosure practices: a study of selected Chinese companies. Management and Labour Studies, 40(3-4), 268-283.

- Blumberg, B., Cooper, D.R., & Schindler, P.S. (2014). The Research process and proposal. Business Research Methods, 1(1), 55-105.

- Boiral, O., & Henri, J.F. (2017). Is sustainability performance comparable? A study of GRI reports of mining organizations. Business & Society, 56(2), 283-317.

- Bui, N.T., Kawamura, A., Kim, K.W., Prathumratana, L., Kim, T.H., Yoon, S.H., Jang, M., Amaguchi, H., Du Bui, D., & Truong, N.T. (2017). Proposal of an indicator-based sustainability assessment framework for the mining sector of APEC economies. Resources Policy, 52, 405-417.

- Busse, M., & Gröning, S. (2013). The resource curse revisited: governance and natural resources. Public Choice, 154(1-2), 1-20.

- Cahyandito, M.F., & Pau, O.N. (2017). The Importance of Considering GCG and CSR While Pursuing Corporate Share Value. Jurnal Bisnis dan Manajemen, 18(1), 21-33.

- Chapman, R.J. (2001). The controlling influences on effective risk identification and assessment for construction design management. International Journal of Project Management, 19(3), 147-160.

- Coleman, P.J., & Kerkering, J.C. (2007). Measuring mining safety with injury statistics: Lost workdays as indicators of risk. Journal of Safety Research, 38(5), 523-533.

- Djohanputro, B. (2008). Corporate Risks Management. Jakarta: PPM Publisher.

- Eger, L., & Egerová, D. (2016). Project risk management in educational organizations: A case from the Czech Republic. Educational Management Administration & Leadership, 44(4), 578-598.

- Elhuni, R.M., & Ahmad, M.M. (2017). Key performance indicators for sustainable production evaluation in oil and gas sector. Procedia Manufacturing, 11, 718-724.

- Elkington, J. (1998). Partnerships from cannibals with forks: The triple bottom line of 21st century business. Environmental quality management, 8(1), 37-51.

- Erzurumlu, S.S., & Erzurumlu, Y.O. (2015). Sustainable mining development with community using design thinking and multi-criteria decision analysis. Resources Policy, 46, 6-14.

- Forum for Corporate Governance in Indonesia: FCGI. (2001). Corporate Governance. Jakarta.

- Fuisz-Kehrbach, S.K. (2015). A three-dimensional framework to explore corporate sustainability activities in the mining industry: Current status and challenges ahead. Resources Policy, 46, 101-115.

- Ghadimi, P., & Heavey, C. (2014). Sustainable supplier selection in medical device industry: toward sustainable manufacturing. Procedia Cirp, 15, 165-170.

- Godha, A., & Jain, P. (2015). Sustainability reporting trend in Indian companies as per GRI framework: A comparative study. South Asian Journal of Business and Management Cases, 4(1), 62-73.

- Grayson, R.L., Kinilakodi, H., & Kecojevic, V. (2009). Pilot sample risk analysis for underground coal mine fires and explosions using MSHA citation data. Safety Science, 47(10), 1371-1378.

- Haat, M.H.C., Rahman, R.A., & Mahenthiran, S. (2008). Corporate governance, transparency and performance of Malaysian companies. Managerial Auditing Journal.

- Hair Jr, J.F., Hult, G.T.M., Ringle, C., & Sarstedt, M. (2014). A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications.

- Hallikas, J., Karvonen, I., Pulkkinen, U., Virolainen, V.M., & Tuominen, M. (2004). Risk management processes in supplier networks. International Journal of Production Economics, 90(1), 47-58.

- Hashim, F., Mahadi, N.D., & Amran, A. (2015). Corporate governance and sustainability practices in islamic financial institutions: The role of country of origin. Procedia Economics and Finance, 31(15), 36-43.

- Ho, P.L., & Taylor, G. (2013). Corporate governance and different types of voluntary disclosure. Pacific Accounting Review.

- Hoffmann, P., Schiele, H., & Krabbendam, K. (2013). Uncertainty, supply risk management and their impact on performance. Journal of purchasing and supply management, 19(3), 199-211.

- Huang, A., & Badurdeen, F. (2017). Sustainable manufacturing performance evaluation: Integrating product and process metrics for systems level assessment. Procedia Manufacturing, 8, 563-570.

- Indriyanto, N., & Supomo, B. (2002). Business Research Methodology. Penerbit BFEE UGM.

- Janggu, T., Darus, F., Zain, M.M., & Sawani, Y. (2014). Does good corporate governance lead to better sustainability reporting? An analysis using structural equation modeling. Procedia-Social and Behavioral Sciences, 145, 138-145.

- Kemp, D., Worden, S., & Owen, J.R. (2016). Differentiated social risk: Rebound dynamics and sustainability performance in mining. Resources Policy, 50, 19-26.

- Khan, M.I., & Banerji, A. (2016). Corporate governance and foreign investment in India. Indian Journal of Corporate Governance, 9(1), 19-43.

- Kimbrough, RL., & Componation, P.J. (2009). The relationship between organizational culture and enterprise risk management. Engineering Management Journal, 21(2), 18-26.

- Kirkbride, J., & Dujuan, Y. (2009). Inefficient American corporate governance under the financial crisis and China's reflections. International Journal of Law and Management.

- Koç, S., & Durmaz, V. (2015). Airport corporate sustainability: An analysis of indicators reported in the sustainability practices. Procedia-Social and Behavioral Sciences, 181, 158-170.

- Kulkajonplun, K., Angkasith, V., & Rithmanee, D. (2016). The development of a sustainable resort and indicators. Procedia CIRP, 40, 191-196.

- Kwak, Y.H., & Stoddard, J. (2004). Project risk management: lessons learned from software development environment. Technovation, 24(11), 915-920.

- Leitch, M. (2010). ISO 31000: 2009-The new international standard on risk management. Risk Analysis: An International Journal, 30(6), 887-892.

- Manab, N.A., Kassim, I., & Hussin, M.R. (2010). Enterprise-wide risk management (EWRM) practices: Between corporate governance compliance and value. International Review of Business Research Papers, 6(2), 239-252.

- Marcelino-Sádaba, S., Pérez-Ezcurdia, A., Lazcano, A.M.E., & Villanueva, P. (2014). Project risk management methodology for small firms. International journal of project management, 32(2), 327-340.

- Mark, C., & Gauna, M. (2016). Evaluating the risk of coal bursts in underground coal mines. International Journal of Mining Science and Technology, 26(1), 47-52.

- Maruhun, E.N.S., Abdullah, W.R.W., Atan, R., & Yusuf, S.N S. (2018). The effects of corporate governance on enterprise risk management: evidence from malaysian shariah-compliant firms. International Journal of Academic Research in Business and Social Sciences, 8(1), 865-877.

- Mitra, G., & Saha, S.S. (2009). Corporate Governance Disclosure Practices: Do We Proceed Towards Global Convergence. Indian Journal of Corporate Governance, 2(2), 139-158.

- Montiel, I., & Delgado-Ceballos, J. (2014). Defining and measuring corporate sustainability: Are we there yet?. Organization & Environment, 27(2), 113-139.

- Mulyadi, M.S., & Anwar, Y. (2011). Investor's perception on corporate responsibility of Indonesian listed companies. African Journal of Business Management, 5(9), 3630.

- Organization for Economic Cooperation and Development: OECD. (2004). Principles of Corporate Governance. The OECD Paris.

- Qing-gui, C., Kai, L., Ye-jiao, L., Qi-hua, S., & Jian, Z. (2012). Risk management and workers’ safety behavior control in coal mine. Safety science, 50(4), 909-913.

- Rao, K.K., Tilt, C.A., & Lester, L.H. (2012). Corporate governance and environmental reporting: an Australian study. Corporate Governance: The international journal of business in society.

- Raz, T., & Michael, E. (2001). Use and benefits of tools for project risk management. International journal of project management, 19(1), 9-17.

- Roy, A. (2014). Corporate governance and firm performance: An exploratory analysis of Indian listed companies. Jindal Journal of Business Research 3 (1&2), 93-120.

- Sae-Lim, P. (2018). Structural model of opportunity management (OM) towards corporate governance (CG) and enterprise risk management (ERM).

- Sari, M., Selcuk, A.S., Karpuz, C., & Duzgun, H.S.B. (2009). Stochastic modeling of accident risks associated with an underground coal mine in Turkey. Safety Science, 47(1), 78-87.

- Schreck, P., & Raithel, S. (2018). Corporate social performance, firm size, and organizational visibility: Distinct and joint effects on voluntary sustainability reporting. Business & Society, 57(4), 742-778.

- Sekaran, U., & Bougie, R. (2016). Research methods for business: A skill building approach. John Wiley & Sons.

- Sharma, S.K., & Swain, N. (2011). Risk management in construction projects. Asia Pacific Business Review, 7(3), 107-120.

- Shehata, N.F. (2015). Development of corporate governance codes in the GCC: An overview. Corporate Governance.

- Singh, S., Olugu, E.U., & Musa, S.N. (2016). Development of sustainable manufacturing performance evaluation expert system for small and medium enterprises. Procedia CIRP, 40, 608-613.

- SMKPMB. (2015). ESDM ministerial regulation no. 38 of 2014 concerning the implementation of a mineral and coal mining safety management system (SMKPMB). Retrieved from http://satudata.semarangkota.go.id/adm/file/20171003092617PERMENKEMENESDMNomor38Tahun2014kemenesdmno38th2014.pdf

- Stiglbauer, M., Fischer, T.M., & Velte, P. (2012). Financial crisis and corporate governance in the financial sector: Regulatory changes and financial assistance in Germany and Europe. International Journal of Disclosure and Governance, 9(4), 331-347.

- Supriyadi. (2013). The concept and model of corporate sustainability measurement: A literature review.

- The Audit Board of the Republic of Indonesia: BPK RI. (2013). Summary of examination results, semester II 2013. Retrieved from https://www.bpk.go.id/ihps/2013/II#

- The Ministry of Energy and Mineral Resources of the Republic of Indonesia. (2015). Strategic plan of the ministry of energy and mineral resources of the republic of Indonesia 2015-2019. Retrieved from https://www.esdm.go.id/id/publikasi/rencana-strategis

- The World Commission on Environment and Development. (1987). Our Common Future. Retrieved from https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf

- Todorovic, Z., & Todorovic, I. (2012). Compliance with modern legislations of corporate governance and its implementation in companies. Montenegrin Journal of Economics, 8(2), 309.

- Vaughan, E.J., & Vaughan, T. (2007). Fundamentals of risk and insurance. John Wiley & Sons.

- Veldman, J., & Willmott, H. (2016). The cultural grammar of governance: The UK Code of Corporate Governance, reflexivity, and the limits of ‘soft’regulation. Human Relations, 69(3), 581-603.

- Wajeeh, I.A., & Muneeza, A. (2012). Strategic corporate governance for sustainable mutual development. International Journal of Law and Management.

- Wolf, J. (2014). The relationship between sustainable supply chain management, stakeholder pressure and corporate sustainability performance. Journal of Business Ethics, 119(3), 317-328.

- Wong, A. (2014). Corporate sustainability through non-financial risk management. Corporate Governance: International Journal of Business in Society, 14(4), 575-586.

- Xie, C., Anumba, C.J., Lee, T.R., Tummala, R., & Schoenherr, T. (2011). Assessing and managing risks using the supply chain risk management process (SCRMP). Supply Chain Management: An International Journal.

- Zhao, C., Song, H., & Chen, W. (2016). Can social responsibility reduce operational risk: Empirical analysis of Chinese listed companies. Technological Forecasting and Social Change, 112, 145-154.