Research Article: 2022 Vol: 21 Issue: 5

Effect of Paid Advance Payments on Performance of Small and Medium Enterprises (SMEs): Evidence from Nigeria

Babatunde Moses Ololade, Elizade University

Citation Information: Ololade, B.M. (2022). Effect of paid advance payments on performance of small and medium enterprises (SMEs): evidence from Nigeria. Academy of Strategic Management Journal, 21(S5), 1-11.

Abstract

The study investigates the effect of paid advance payment on business performance of SMEs and identifies solutions to the effect of SMEs paid advance payments in Nigeria. The study adopts cross-sectional and survey research designs. Structured questionnaires were used to collect primary data from randomly selected SMEs that are appointed distributors of local corporate firms which operate in the foods, beverages, and breweries sectors of the Nigerian economy. The results reveal that paid advance payments of SMEs to their corporate firms’ suppliers for which goods are not supplied timely impact negatively on their business performance: It ties down their working capital which when it is a borrowed fund from financial institutions is at cost. It prevents the SMEs from doing other profitable businesses, reduces the business turnovers, increases the business cash conversion cycles, and invariably reduces the business’s profitability. In view of the financial power at the advantage of the corporate firms, it is recommended that government policies should mandate the corporate firms to publish the stipulated time they would deliver goods for all paid advance payments of the SMEs after taking into consideration the locations of the SMEs and transportation logistics. Thus, non-delivery of the goods within the published stipulated time would earn SMEs interest on their paid advance payment at Central Bank Nigeria (CBN) Monetary Policy Rate (MPR) for number of days the actual time of delivery is more than the published stipulated time. This is to discourage the tying down of the SMEs working capital.

Keywords

Small-and Medium Scale Businesses, Advance Payment, Working Capital Management, Fast Moving Consumer Goods, Cash Conversion Cycle.

JEL Classifications

L25, L66, M41.

Introduction

Local corporate firms producing Fast Moving Consumer Goods (FCMG) in Nigeria enjoy high demands from consumers for their products. These firms distribute their products to the final consumers through their appointed distributors/dealers. The distributors are mainly Small and Medium Scale businesses (SMEs) that are set up with profit motives and to generate employment opportunities for the teeming population of the Nigerian youth (Aremu et al., 2011; Kale, 2019). The revenue of the SMEs so appointed depend greatly on the availability of the products they sell. The SMEs make advance payments to their suppliers in anticipation of supplies of goods to them. How long it takes for the goods to be supplied is not within the purview of the SMEs business owners. Hence, part of the working capital of the SMEs may be tied down with the local corporate firms till when the goods will be finally supplied. This may cause financing difficulties in addition to the SMEs lack of access to finance apart from other business bulwarks confronting SMEs in emerging economies. While few empirical studies (Mateut & Zanchettinb, 2013; Talonpoika, 2012) have been carried out to investigate the effects of advance payments received by listed corporate firms on their working capital management and performance, there is a dearth of empirical findings on the effect of paid advance payments of SMEs on their working capital and performance.

Besides, when SMEs borrow from financial institutions, the borrowings of the SMEs are meant to buoy and support their working capital to do more businesses and earn more revenue. However, the borrowings may be tied down with the local corporate firms in form of paid advance payments for inventories without supply of the intended goods, and without any compensation to the SMEs to offset their interest charges. This can aggravate the SMEs burden of interest charges as cash are not paid timely into their business accounts in the financial institutions from which the loans are borrowed to reduce the interest burdens. Also, the SMEs may suffer default interest rate charges in situation where they fail to pay back their loan as and when due because of the inability of the local corporate firms to timely supply them the products for which they have made paid advance payments.

Even though the local corporate firms will eventually make supplies of the products to their appointed SMEs distributors, yet it may not be at the time the products are most needed to generate immediate sales revenue that would have added value to the SMEs. Unfortunately, there is often no formal agreement between the local corporates and the SMEs on the time products would be supplied for paid advance payments and should in case the time agreed upon is exceeded, the compensation package that should be given to the SMEs that made the advances. Likewise, there are no financial regulations in the country that set fair standard for the treatment of the SMEs paid advance payments so that best business practices among SMEs and their suppliers could be inculcated in their business processes. This is unlike the Late Payment of Commercial Debts (Interest) Act (1998) in United Kingdom, which grants interest to SMEs against large companies and public utilities that failed to settle their obligations to SMEs on stipulated time.

Shorter cash conversion cycles may assist SMEs to generate more sales and revenue. However, the paid advance payments of the SMEs to the corporate firms for which goods are not timely supplied can elongate their cash conversion cycles. Meanwhile, it could constitute credit facilities and support to the local corporate firms’ inventory management (Talonpoika, 2012), whenever consumable products for which they received advance payments are not promptly supplied to the SMEs. According to Mateut & Zanchettinb (2013), a seller might finance the extension of trade credit to financially constraint customers with the advance payments received from other customers. This arrangement or practice, though not usually agreed upon, could result to SMEs being vulnerable to business failure as the meager financial resources at their disposal for ongoing business ventures may be tied down by corporate firms to provide trade credits for their customers to enhance their business performance.

Considering the above, the study attempts to examine the effect of paid advance payments on performance of SMEs in food and beverages sectors of the Nigerian economy by analyzing primary data gathered from 252 SMEs in the sectors. The study is important for many reasons. First, the fact that many of the SMEs cannot easily access the capital market or financial institutions to borrow fund for business growth should make them more ready to discourage any business activities that would tie down part of their working capital. Second, SMEs policy makers would be guided on not only providing financing support for SMEs but also be ready to support them with regulations that will ease bottlenecks in the use of their limited working capital. Third, working capital management routines in respect of the advance payments of SMEs has not been on the forefront of routines frequently undertaken by SMEs operations (Orobia et al., 2016), hence, the study will assist the SMEs operators to not only manage their receivables, cash, and payables only but also the paid advance payments they make to their suppliers.

The study is structured as follows: section one describes advance payments and the preponderance of it in the food and beverage sector of the Nigerian economy. The review of literature is discussed in section two, while section three outlined the research design and methodology employed to achieve the objective of the study. Data collection, analysis and discussions are discussed in section four while conclusion and recommendations for the study are stated in section five.

Literature Review

Okpara (2011) examines the factors constraining the growth and survival of SMEs in Nigeria with a view to measuring the relationship between business performance and constraints impeding the small business development in Nigeria. The study is exploratory and uses survey method to gather primary data from sample of 300 business owners and employees that were randomly selected from a directory of Nigerian business companies. Descriptive data analysis technique, factor analysis, Pearson product moment correlation and multiple regression analysis were used to analyze the primary data. The study finds that financial constraints occasioned by inability to access credit from the financial institutions to support the ongoing business activities of the SMEs is one of the major factors constraining the growth and survival of small business development. Other major constraints identified as impediments to small business development by the study are first, management problems: lack of proper training in management, bookkeeping, accounting, personnel management. Second, corruption arising from payment of bribe to government officials before small business owners could access financial support from government agencies or get businesses from government and third, poor infrastructure in form of poor road network, telecommunication systems and electricity supplies. Results also show that these four major factors are negatively correlated with small business failure. The negative consequences of these factors make small business growth and survival difficult most especially in emerging economy like Nigeria. However, despite these challenges, the effect of paid advance payments of SMEs to their suppliers which are tied down in received advance payments by the local corporate firms has not been examined. This study concentrates on the effect of paid advance payments of the SMEs on their performance because all other components on working capital management: Stock turnover, receivables and payables are within their control while paid advance payments without any formal agreement with their suppliers are outside their control.

Furthermore, Mateut & Zanchettinb (2012) examine whether firms use supplier credit and customer advance payments as complementary or substitute payment terms in France. Using a panel dataset of around 147,000 observations of French firms over a period of 1999-2007, the results show that small sellers of differentiated products and exporters of standardized goods increase their credit sales if they receive advance payments from their customers. This therefore infers that they use credit sales and customers prepayment complementarily as a growth strategy. This might however not be in the interest of the customers if there are no formal agreements as to when the goods for which prepayments are made would be supplied and if the deadline is not met, the compensation that would be given to customers whose working capital or borrowings are held in form of paid advance payments.

Two types of advance payments are identified in empirical literature. They are received advance payment and paid advance payment. The received advance payments are from customers to suppliers. The customers made the payment to their suppliers beforehand to receive goods or services later. Since two parties are involved in advance payment, then, to the party that received the payment, it is received advance payment while to the party that paid, it is paid advance payment. Talonpoika (2012) examines the role of received advance payment in working capital management of 108 companies listed on the Helsinki Stock Exchange in Finland and the relationship between advance payments and profitability of the listed 108 companies. The results show that 68% of the sampled companies are receiving advance payments with 13 days average cycle time for received advance payments. The cash operating cycles of these companies were reduced by 13 days when the received advance payments were used to calculate their working capital cycles rather than using only inventories, receivables, and payables. Besides, results show negative correlation between received advance payment and profitability of the studied companies because of the period of financial crisis in which the study was carried out contrary to previous empirical studies (Dong & Su, 2010; Mojtahedzadeh et al., 2011) that show positive relationship between received advance payments and profitability. However, the study fails to investigate the effect of paid advance payments on the business performance of the customers that made the advance payment.

Besides, Orobia et al. (2016) examine working capital management routines that are most frequently performed by small-scale business in Uganda and explain the activity rates of the working management routines. Using the cross-sectional research design, the study finds that safeguarding cash, safeguarding inventory, assessment of credit risk, and communication of credit terms to their customers are the most frequently performed working capital management routines undertaken by Ugandan small-scale business while payable management is the least performed routine. Besides, results show that business size, perceived usefulness of working capital management routines and owners-managers’ positive attitude to benefits associated with management of working capital are the reasons some small-scale businesses in Uganda undertake working capital management routines more frequently than others. Again, the study fails to consider paid advance payments among the working capital management routines that ought to be frequently managed by SMEs despite its being a critical working capital management component.

Though many scholars have identified financial constraints as a major impediment to the growth and survival of the SMEs in both the developing and developed economies (Manigart & Sapienza, 2017; De Prijcker et al., 2019; Cummings et al., 2020; Rao et al., 2021), yet empirical studies have not been carried out to investigate the effect of paid advance payments on performance of the small business development in Nigeria. Hence, the need for this study to show the effect of SMEs paid advance payments on their performance and to aid policy formulation and implementation on treatment of paid payment advances of the SMEs in the emerging economies for mutual benefit of both the SMEs entrepreneurs and their suppliers.

Theoretical Framework and Hypotheses Development

This paper is anchored on Modified Cash Conversion Cycle (MCCC). The Cash Conversion Cycle (CCC) as developed by Richards & Laughlin (1980) excluded the consideration of advance payments in the computation of the working capital cash conversion cycles of firms. This however does not give an accurate picture of the level of working capital of firms because evidence exists in literature that many firms have significant amount of received and paid advance payments in their statement of financial position. Modified Cash Conversion Cycle therefore accommodates the advance payments of firms to reflect their actual working capital and aids finance manager to effectively manage the working capital of firms with less dependence on external sources of finance.

The SMEs that paid advance payments to their local corporate suppliers may experience a longer cash conversion cycle because advance payments are made prior to supplies of goods to them. On the other hand, the receipt of cash advance payments by the local corporate firms can shorten their cash conversion cycle because payment for goods yet to be supplied to their customers (SMEs) are received by them. Hence, the needed amount of finance required to support the working capital of the SMEs would be much and sometimes they may resort to borrowings from friends, family members, financial institutions and unstructured sources with high interest charges and transaction costs to meet up with the level of finance needed to keep their businesses running.

Hence, the following hypotheses could be inferred from the theoretical undertone as follows:

H0: Untimely receipt of goods by SMEs after making paid advance payment to their suppliers does not affect their business performance.

H1: Untimely receipt of goods by SMEs after making paid advance payment to their suppliers affects their business performance. Modified Cash Conversion Cycle.

The Modified Cash Conversion Cycle (MCCC) for paid advance payment of SMEs is calculated by adding together days of inventory outstanding plus days of account receivable outstanding plus days of advance payment outstanding and subtracting from them days of account payable outstanding.

Modified cash conversion cycle ? DIODSO?DAO– DPO

Where, DIO=Days of inventory outstanding

DSO=Days of Account receivable outstanding

DPO=Days of Account payable outstanding

DAO=Days of advance payments outstanding

The period between when cash advance payments were received by the Local Suppliers and Days Advance Payment Outstanding (DAO) signifies the waiting time for the SMEs Operators before goods/products finally reach them for sales. The longer this period, the longer the cash conversion cycles of the SMEs and the lower their sales turnover which will eventually lead to low revenue.

Methodology

The cross-sectional and survey research designs were adopted for the study. The population of the study are the appointed distributors of listed corporate firms that manufacture and sell confectionaries, foods & beverages including soft drinks, and breweries. The sample size consists of 550 SMEs in Nigeria that were selected randomly from the list of SMEs listed in the Nigerian yellow page. Those that were subsequently selected for the study were 252 after taking out those that were not dealers, distributors, or partners to the firms in the fast-moving consumable goods sector in Nigeria. Structured questionnaires were administered to selected sample in Lagos, Akure, Abeokuta, Osogbo, Ibadan and Ado-Ekiti. These cities were selected because of the concentration of these SMEs in them in Southwest, Nigeria. Six research assistants distributed the questionnaires and went back the following week to collect the filled questionnaires from the respondents.

The validity of the research instrument was conducted by the review of two Professors of Economic and Accounting & Finance respectively. The suggestions of these experts in SMEs financing were accommodated in modification of the research instrument. A pilot test of the survey questionnaire was conducted among five appointed distributors in Ilesha, Osun State, Nigeria, to determine the reliability of the research instrument. The research instrument was confirmed to be reliable through a Cronbach Alpha of 0.8.

The analysis of the primary data obtained from the respondents was done through descriptive statistics, Pearson correlation and multiple regression analysis.

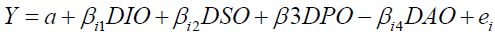

Model Specification

Where: Y=Annual Turnover

a=constant

DIO=Days of inventory outstanding

DSO=Days of Account receivable outstanding

DPO=Days of Account payable outstanding

DAO=Days of advance payments outstanding, proxy for advance payment.

Data Analysis and Discussion of Results

Table 1 shows the background of the respondents. Female entrepreneurs are 67% of the respondents while the male is 33%. The SMEs entrepreneurs in Southwest Nigeria, the area where the study was conducted, are predominantly female. The respondents are mainly adults, within the age range of forty-four (44) years and sixty-five (65) years. They are well educated to carry out SME business activities because 54% of them have both first- and second-degree levels of education while 46% are with either secondary school or diploma levels of education. This coupled with their age and business experience should add value to their businesses through frequent audit of their working capital activities.

| Table 1 Background Information of The Respondents | |||

| Background Characteristics | Number | % | |

| Gender | Male | 25 | 33 |

| Female | 52 | 67 | |

| Age group | 40 - 49 | 22 | 29 |

| 50- 55 | 31 | 40 | |

| 56- 65 | 20 | 26 | |

| 66- 75 | 4 | 5 | |

| Educational qualifications | SSCE/WAEC | 14 | 18 |

| OND/NCE | 22 | 28 | |

| First Degree | 29 | 38 | |

| Second Degree | 12 | 16 | |

| Advance Payments | Yes | 71 | 92 |

| No | 6 | 8 | |

| Sources of funds | Owners’ Cash | 14 | 18 |

| For advance payments | Financial Institutions | 4 | 5 |

| Family and Friends | 1 | 1 | |

| All the above | 58 | 76 | |

| Total | 77 | 100 | |

Majority of the respondents, 92%, indicated that they paid cash advances to their suppliers before they supplied them the goods. The supply priority of fast-moving consumable goods by corporate firms is to SMEs that made payment in advance while those that couldn’t pay for goods in advance will not be in the priority list of supply. This account for why most SMEs in fast-moving consumable goods industry make advance payment before the receipt of goods. The cash they made for advance payment are part of the working capital which comprises owners’ equity, borrowings from financial institutions, relatives, and friends.

Table 2 shows the descriptive statistics and reveals that the average monthly advance payments of the surveyed SMEs are ?110.36 million ($265,288) while the average monthly turnover is ?141.40 Million ($339,904). Besides, its takes average of 15 days before the goods paid for in advance by the SMEs entrepreneurs get supplied to them. The days it takes to sell the goods supplied to them are 6 days, while if the SMEs have any credit from their suppliers, they are required to pay back on average of 4 days. The customers that buy from the SMEs on credit make payment to them on average of 3 days. The paid advance payments of ?110.36 million for which goods are supplied in 15 days are with the local corporate firms in form of received advance payments. It could serve as support to their working capital and reduce their cash conversion cycle.

| Table 2 Descriptive Statistics | ||||||

| Adv. Payment | Turnover | DIO | DPO | DSO | DAO | |

| Valid | 77 | 77 | 77 | 77 | 77 | |

| Missing | 0 | 0 | 0 | 0 | 0 | |

| Mean | 110.36 | 141.40 | 0.8571 | 0.5416 | 0.4351 | 2.2013 |

| Std. Error of Mean | 0.892 | 1.784 | 0.16711 | 0.11470 | 0.20111 | 0.13211 |

| Median | 80.00 | 105.00 | 0.900 | 0.500 | 0.500 | 1.5000 |

| Mode | 8 | 51a | 1.50 | 1.50 | 1.50 | 1.50 |

| Std. Deviation | 7.829 | 15.656 | 1.46642 | 1.00647 | 1.76470 | 1.15923 |

| Variance | 61.287 | 245.112 | 2.150 | 1.013 | 3.114 | 1.344 |

| Skewness | 1.487 | -0.483 | 2.002 | 2.907 | 2.697 | 1.861 |

| Std. Error of Skewness | 0.274 | 0.274 | 0.274 | 0.274 | 0.274 | 0.274 |

| Kurtosis | 1.659 | -.751 | 4.133 | 11.302 | 8.207 | 4.622 |

| Std. Error of Kurtosis | 0.541 | 0.541 | 0.541 | 0.541 | 0.541 | 0.541 |

The model summary (Table 3) reveals that the explanatory variables can influence the outcome of SMEs performance in terms of turnover by 53% (R=0.781, R2=0.531, P<0.05). The result is therefore fit for the evaluation of the effect of paid advance payments of SMEs on their performance.

| Table 3 Model Summary | |||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | |||

| 1 | .781a | 0.531 | 0.188 | 14.105 | |||

| a. Predictors: (Constant), DAO, DSO, DPO, DIO | |||||||

| ANOVAa | |||||||

| Model | Sum of Squares | Df | Mean Square | F | Sig. | ||

| Regression | 4304.624 | 4 | 1076.156 | 5.409 | 0.001b | ||

| Residual | 14323.895 | 72 | 198.943 | ||||

| Total | 18628.519 | 76 | |||||

| a. Dependent Variable: Annual Business Turnover (Y) | |||||||

| b. Predictors: (Constant), DAO, DSO, DPO, DIO | |||||||

The regression results in Table 4 shows a negative and insignificant relationship between days of inventory outstanding (DIO), days of accounts payables outstanding (DPO) and turnover. However, there is significant negative relationship at 10% level between days of account receivables outstanding (DSO), days of advance payment outstanding and turnover. This implies that the longer it takes for account receivables to pay the SMEs and the longer it takes for the suppliers of SMEs to supply them the goods they make advance payment for, the lower their business turnover and hence business performance in terms of profitability.

| Table 4 Regression Results | |||||

| Model | Unstandardized Coefficient |

Unstandardized Coefficient |

t | Sig. | |

| B | Std. Error | Beta | |||

| Dependent Variable: Annual Business Turnover (Y) | |||||

| (Constant) | 57.717 | 4.601 | 12.544 | 0.000 | |

| DIO | -1.872 | 1.675 | -0.175 | -1.117 | 0.268 |

| DSO | -2.373 | 1.338 | -0.268 | -1.774 | 0.080 |

| DPO | -2.322 | 1.758 | -0.149 | -1.321 | 0.191 |

| DAO | -0.733 | 1.452 | -0.54 | -0.505 | 0.061 |

From the regression results, the null hypothesis which states that untimely supply of goods to SMEs after making paid advance payments for goods does not affect their business performance should therefore be rejected while the alternate be accepted as there is significant negative relationship between days of advance payment outstanding and turnover.

The more there are delays in the supply of the goods for which advance payment had been made by the SMEs; the lower will be there business turnover. The lower the business turnover of the SMEs in the Fast-Moving Consumable Goods (FCMG), the lower will be their profitability and liquidity.

The analysis of the responses of the sample SMEs on the effect of the advance payment on their business performance in Table 5 reveals that part of the working capital of the SMEs, which is from their equity contribution, borrowings from financial institutions, and from friends and relatives are in received advance payments of their local corporate suppliers as 85% of the respondents agreed with this proposition with mean value of 1.84. Thus, almost all the respondents agreed that advance payment for which goods are not supplied timely denies the SMEs entrepreneurs the advantages of doing alternatives business and profit, reduces the SMEs business turnover, increase their cash conversion cycle, and reduces their profitability.

| Table 5 Effect of Advance Payment on Sme’s Performance | |||||

| S/N | Statements | Agree | Disagree | Mean | SD |

| 1 | Advance payments tie down our working capital | 65 84% (n=77) |

12 16% (n=77) |

1.84 | 0.37 |

| 2 | Advance payments deny us the opportunities of alternative businesses and profit | 57 74% (n=77) |

20 26% (n=77) |

1.74 | 0.44 |

| 3 | Advance payments reduce our annual business turnover. | 52 67% (n=77) |

25 33% (n=77) |

1.68 | 0.47 |

| 4 | Advance payments increase our cash conversion cycle | 57 74% (n=77) |

20 26% (n=77) |

1.74 | 0.44 |

| 5 | Advance payments reduce our profitability. | 53 69% (n=77) |

24 31% (n=77) |

1.69 | 0.47 |

Table 6 shows the analysis of the responses of the selected sample of SMEs entrepreneurs on their proffered solutions to the late delivery of goods for which advance payment had been made. Two phases of solution were proffered by the SMEs. The first phase involves government intervention in form of legislations on disclosure of stipulated time to supply goods for all paid advance payments made by SMEs. Also, statutory sanctions in form of payment of interest on the paid advance payments of the SMEs for which goods could not be suppled within the stipulated period by the corporate firms to the SMEs at monetary policy rate of central bank. Training of the SMEs entrepreneurs by the agency of government on the financial implications of making advance payments on their business is also considered a proffered solution under the first phase according to 74% of the respondents. The second phase proffered solution involves direct negotiation of terms of supplies of goods between the SMEs and their corporate firms’ suppliers before making advance payment. However, 59% of the respondents with mean value of 0.84 disagreed that this as a solution. This could be because of the financial power at the disposal of the corporate firms to hire or fire any distributors not ready to comply with their terms of business.

| Table 6 Suggested Solution To Late Supplies of Goods For Which Advance Payment Had Been Made | |||||

| S/N | Statements | Agree | Disagree | Mean | SD |

| 1 | Statutory penalties inform of payment of interest on paid advance payment of SMEs for which goods could not be supplied within the stipulated time. | 60 78% (n=77) |

17 22% (n=77) |

1.78 | 0.41 |

| 2 | Government intervention is necessary to curb late supplies through legislation of payment and supply terms in FMCG sectors because Suppliers wield superior power over their customers in credit negotiations. | 64 83% (n=77) |

13 17% (n=77) |

1.83 | 0.38 |

| 3 | Suppliers and their customers should be free to negotiate payment terms and supply periods. | 32 41% (n=77) |

45 59% (n=77) |

0.84 | 0.94 |

| 4 | Compulsory disclosures of the supply’s terms of the local corporate firms in the annual reports. | 58 75% (n=77) |

19 25% (n=77) |

1.75 | 0.43 |

| 5 | Training of SMEs owners on the financial implications of making advance cash payments by agency of Government. | 57 74% (n=77) |

20 26% (n=77) |

1.74 | 0.44 |

Conclusion

The study concludes that paid advance payments of SMEs to their corporate firms’ suppliers for which goods are not supplied timely impact negatively on their business performance. It ties down their working capital which when it is borrowed fund from financial institutions is at cost. It prevents the SMEs from doing other profitable businesses, reduces the business turnovers, increases the business cash conversion cycles, and invariably reduces the business’s profitability.

The study recommends intervention of government in formulating policies that would require all corporate firms operating in Fast Moving Consumable Goods (FMCG) sectors to publish the maximum stipulated time that all SMEs with paid advance payments for goods will get delivery of their goods. This they should do on either monthly or quarterly basis taking into considerations the locations of the SMEs and transportation logistics. Also, government policies should require the corporate firms to pay interest on the paid advance payment of SMEs for which goods could not be supplied within the published stipulated time. Finally, Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), should be involved in training the SMEs on the management of working capital and financial implications of making paid advance payments for goods that were not supplied on time. The agency of government should be able to do this to prevent the tying down of government grants given to the SMEs to address unemployment and reduce poverty with the corporate firms.

Limitation of the Study

The study focuses on the effect of the paid advance payments on the performance of the SMEs. The study does not consider internal and external macro-economic variables that could cause the untimely supply of goods to the SMEs. This could be a subject of further research.

References

Aremu, M.A., & Adeyemi, S.L. (2011). Small and medium scale enterprises as a survival strategy for employment generation in Nigeria. Journal of Sustainable Development, 4(1), 200-206.

Cummings, M.E., Rawhouser, H., Vismara, S., & Hamilton, E.L. (2020). An equity crowdfunding research agenda: evidence from stakeholder participation in the rulemaking process. Small Business Economics, 54(4), 907-932.

Indexed at, Google Scholar, Crossref

De Prijcker, S., Manigart, S., Collewaert, V., & Vanacker, T. (2019). Relocation to get venture capital: A resource dependence perspective. Entrepreneurship Theory and Practice, 43(4), 697-724.

Indexed at, Google Scholar, Crossref

Dong, H.P., & Su, J.T. (2010). The relationship between working capital management and profitability: A Vietnam case. International Research Journal of Finance and Economics, 49(1), 59-67.

Kale, Y. (2019). Micro, Small and Medium Enterprises (MSME). National Survey 2017 report, National Bureau of Statistics.

Late Payment of Commercial Debts (Interest) Act (1998)

Manigart, S., & Sapienza, H. (2017). Venture capital and growth. The Blackwell Handbook of Entrepreneurship, 240-258.

Mateut, S., & Zanchettin, P. (2013). Credit sales and advance payments: Substitutes or complements?. Economics Letters, 118(1), 173-176.

Indexed at, Google Scholar, Crossref

Mojtahedzadeh, V., Tabari, S., & Mosayebi, R. (2011). The relationship between working capital management and profitability of the companies (Case study: Listed companies on TSE). International Research Journal of Finance and Economics, 76(1), 158-166.

Okpara, J.O. (2011). Factors constraining the growth and survival of SMEs in Nigeria. Management Research Review, 34(2), 156-171.

Indexed at, Google Scholar, Crossref

Orobia, L.A., Padachi, K., & Munene, J.C. (2016). Why some small businesses ignore austere working capital management routines. Journal of Accounting in Emerging Economies, 6(2), 94-110.

Indexed at, Google Scholar, Crossref

Rao, P., Kumar, S., Chavan, M., & Lim, W.M. (2021). A systematic literature review on SME financing: Trends and future directions. Journal of Small Business Management, 1-31.

Indexed at, Google Scholar, Crossref

Richards, V.D., & Laughlin, E.J. (1980). A cash conversion cycle approach to liquidity analysis. Financial Management, 32-38.

Talonpoika, A.M. (2012). The role of advance payments in working capital management and profitability.

Received: 01-Mar-2022, Manuscript No. ASMJ-22-11420; Editor assigned: 03-Mar-2022, PreQC No. ASMJ-22-11420 (PQ); Reviewed: 14-Mar-2022, QC No. ASMJ-22-11420; Revised: 23-Mar-2022, Manuscript No. ASMJ-22-11420 (R); Published: 28-Mar-2022