Research Article: 2019 Vol: 18 Issue: 6

Efficiency of the Investment Project Solution for Diversification in the Oil and Gas Industry

Aliya A. Razakova, Korkyt Ata Kyzylorda State University

Urpash Zh. Shalbolova, L. N. Gumilyov Eurasian National University

Madina A. Yelpanova, Korkyt Ata Kyzylorda State University

Abstract

Keywords

Oil and Gas, Hydrocarbon Resources, Oil and Gas Companies, Diversification, Investment Project, Economic Efficiency, Feasibility Study.

Introduction

The economy of any country rich in hydrocarbon raw materials, including Kazakhstan, is based on the development of oil and gas production. The need to develop the production infrastructure of oil companies, increase competitiveness, and take a permanent place in world energy markets results in the implementation of diversification programs. Today, Kazakhstan is implementing a number of investment projects on the Norwegian option for diversifying the country's oil and gas industry. The State Program of Industrial and Innovative Development of the Republic of Kazakhstan for 2015-2019 identified priority areas for the diversification of the oil industry (Kazakhstan’s oil refining industry, 2015). The development of the oil and gas complex of the Republic of Kazakhstan, the improvement of the efficiency of integrated use and proportional development of the regions developing new large reserves of hydrocarbon resources, the formation of a cluster in the oil industry and priority areas for oil refining and petrochemistry (Suerbaev et al., 2007; Appazov et al., 2017) are the main directions for the diversification of the country's oil industry (Egorov & Chigarkina, 2015).

Literature Review

The issue of the rational usage of natural resources is becoming more acute every year due to a deeper scarcity of resources. Hence, the problem of the diversification of natural resources is relevant for every country all over the world, especially one that is at the stage of intensive development. The current study takes into account the most significant researches within the niche, such as the works of Jumadilova (2012), Cohen et al. (2011); Steen & Weaver (2017), Teka (2012).

Scottish Enterprise (2018) information and research free resource presents a study in the form of a guide designed for Scottish oil and gas companies with an interest in new markets and new opportunities. The study considers Sectors, Oil & Gas Segmentation and Diversification Model Options.

Teka (2012) discusses the current state and future prospects of backward production linkages to the manufacturing sector in the Angolan oil and gas industry. There is an idea about realistic and strategic potential for local manufacturing linkages to expand in the oilfield services sector of the industry;

Steen & Weaver (2017) analyzes data from a first-of-its-kind survey of 133 incumbent firms in Norway's two main energy sectors, namely oil/gas and hydropower. Providing inter-temporal dimensions, their data covers incumbents’ diversification activities beyond their primary sector in the past (cancelled activities), present (ongoing activity in secondary sectors) and future (ambitions of diversification);

Cohen et al. (2011) present evidence on one facet of energy security in OECD economies-the extent of diversification in sources of oil and natural gas supplies. There has not been much change in diversification in oil supplies over the last decade, but diversification in sources of natural gas supplies has increased steadily;

Jumadilova’s survey (2012) is of special interest for the current study as it is based exactly on the ground of Kazakhstan’s economy. Jumadilova (2012) defines the status of the oil and gas industry in the economy of Kazakhstan, emphasizes mainly the growing role of the oil and gas sector, as well as discusses current problems in the industry and provides strategic recommendations for further improvement of the oil and gas sector of Kazakhstan.

Material and Methods

A wide range of research methods have been used, while conducting the current study:

1. Modern literature study in order to explore the state of research ability of the problem of natural resources diversification;

2. Study of the national support programs and state legal basis that may fit to help build and implement a national diversification strategy;

3. Study and generalization of statistical information on diversification programs;

4. Analysis of oil and gas market entry requirements;

5. Research of market/supply chain positioning;

6. Analysis of the diversification capabilities of Kazakhstan’s national economy within oil and gas sectors and development of a prospective forecast of how these can be used in other sectors.

Results and Discussion

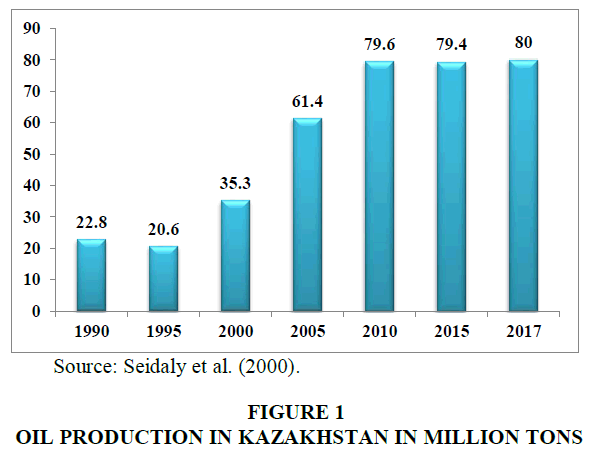

An important role in world energy markets is played by the Organization of the Petroleum Exporting Countries (OPEC). OPEC has 12 member countries, which control in total 75% of the world's oil reserves (Dynamics of the main socio-economic indicators, 2017). The extraction and export of crude oil and gas condensate in the Republic of Kazakhstan is also the main source of replenishment of the country’s national fund. Figure 1 shows the dynamics of oil and gas condensate production during the years of independence.

Kazakhstan has large hydrocarbon reserves (3% of the world's total). 62% of the country's territory is occupied by oil and gas deposits, namely 172 oil deposits, and 80 are in the process of development. In the world rating, Kazakhstan ranks 17th in oil production.

The extraction of hydrocarbon raw materials is carried out in six Kazakhstan’s regions: Aktyubinsk, West Kazakhstan, Atyrau, Karaganda, Mangistau, and Kyzylorda. There are 55 oil fields in the country. In recent years, much work has been done on geological exploration. Exploration of the shelf of the Caspian and Aral Seas has great prospects. Seismic work is also conducted in the Northern, Southern and Central regions of Kazakhstan. The share of oil and gas in the national production of Kazakhstan can be traced in terms of the volume index for 2017.

The analysis shows that oil production occupies 31.8% in Kazakhstan’s total oil and gas production, gas condensate - 6.4%, and natural gas - 0.9%. The complex use of oil resources in Kazakhstan is one of the main priority directions of developing the country’s industrial and innovative potential and increasing the competitiveness of the national economy. Currently, in all Kazakhstan’s oil regions, extensive work is carried out to diversify production in the oil and gas industry. Important social programs within the regions and the country as a whole are associated with the active work of the oil and gas complex (Service projects, 2017).

Kazakhstan’s oil sector during the last decades has been the most developing area and attracted the main foreign investments. Each oil-producing enterprise of the country is obliged to carry out a social program, which helps to improve the social and economic infrastructure. In addition, the oil sector contributes to the development of the accompanying and servicing industries, and is the main city-forming factor, providing jobs to the able-bodied population.

The accompanying enterprises of Kazakhstan’s oil and gas industry constantly conduct work on the diversification of their activities. The diversification of production, as a rule, is introduced for sustainability in the industry market, in order to optimally address the most problematic production issues. The diversification of any production should be accompanied by the implementation of an investment project aimed at improving the technological process or expanding the range of marketable products.

The solution of problematic issues in the enterprise influences the restructuring of its production. In this regard, for the continuity of the production process and the maximum utilization of capacities, various investment project solutions are considered, aimed at diversifying the functioning of the enterprise.

Consider the cost-effectiveness of such an investment project. The proposed example considers the existing large oil company, which implements an investment project to ensure the production of its own electricity (Vilenskii, 2008). The company has several subsidiaries. The delivery of electricity for production activities is carried out by public energy networks. However, frequent emergency power outages occur, mainly due to the deterioration of capacity and the lack of standby power supplies. As a result, oil fields have along downtime, which hinders the timely implementation of planned technological work to maintain and increase the level of oil production. Emergency power outages are the main reasons for the loss of oil production. All this leads subsequently to an increase in the cost of production (Table 1).

| Table 1 The Impact of Emergency Power Outages in Public Networks on the Volume of Work Performed By The oil Company | ||

| Year | Emergency power outages | |

| Multiplicity of outages | Oil losses (thousand tons) | |

| 2011 | 12 | 14 509 |

| 2012 | 13 | 4 890 |

| 2013 | 6 | 1 803 |

| 2014 | 18 | 3 519 |

| 2015 | 13 | 15 762 |

| 2016 | 26 | 1 522 |

| Total | 88 | 42 005 |

Systematic oil losses are mainly related to the limitation of power consumption, due to the shortage of generated electric power of the public station. It should also be noted that an annual increase in the tariff for electricity supply by 6-7% leads to an increase in the cost of production-crude oil. At the same time, the share of electricity in the lifting costs of the parent oil company, i.e. in the cost of oil production, is about 10%. In addition, electricity tariffs are increasing every year. The main reason is the implementation of investment programs for the modernization and reconstruction of public facilities for electricity supply. However, the increase in tariffs for the electricity received is not always equivalent to the actual investment of the oil company's funds.

In order to address the issue of ensuring energy security and reducing electricity costs, the oil company plans to build its own gas-turbine power plant, which will be one of the priority options for uninterrupted power supply to cover the needs of its subsidiaries. The strategic goal of the investment project is that the construction of a modern power-generating unit could provide its own power supply for the needs of several oil and gas fields.

The design of a new plant at the field is justified by the concept of capacity expansion in the future when there is an operational need, for example, in the case of a subsequent transfer of the oil company (or its subsidiaries) to the use of electric motors for drilling. This option will make it possible to quickly enter new additional production capacities (Table 2).

| Table 2 Characteristics of the Main Indicators of the Investment Project for The Construction of a Gas-Turbine Power Plant | ||

| No | Indicators | Primary information |

| 1 | The purpose of the investment project | - To provide uninterrupted power supply to oilfield facilities of the subsidiaries of the company “A” - To reduce oil production costs and expenditures by reducing the cost per 1 kWh of electricity |

| 2 | The volume of electricity consumption | - 20 MW - substation “I” - 20 MW - substation “II” (Stage 1) |

| 3 | The installation site of the power plant | Deposits of Western Kazakhstan |

| 4 | Raw materials used | Dry gas from natural gas suppliers |

| 5 | The main technological equipment of the investment project | - Power-generating station, including water heating boilers - Synchronizer |

| 6 | The construction period of the power plant | - 24 months from the date of signing the contract - 2017-2018 – the design period (1 year) - 2019-2021 – the construction period (3 years) |

| 7 | The implementation period of the investment project and contract duration | 2017 to 2035 (taking into account the point of the break-even project, the payback period of the project and profit) |

| 8 | Financing sources of the investment project | The oil company “A” own funds, borrowed capital |

The total amount of capital expenditures is approximately 100 million USD without VAT. The investment project will be implemented in stages in accordance with the schedule of staged financing (Table 3). Calculations of determining the economic efficiency of investment project solutions were made according to existing models and by formulas recommended in the economic literature (Vilensky ey al, 2008; Kuzmin & Molodykh 2012; Mazurina & Pavlovskaya 2016).

| Table 3 Distribution of Financial Resources by Years of Implementation of the Investment Project | ||||||||

| Year | 2017-2023 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Cash flows by year, million USD | 100.9 | 20.2 | 10.1 | 20.2 | 10.1 | 15.1 | 15.1 | 10.1 |

| % of realization of cash flows | 100% | 20% | 10% | 20% | 10% | 15% | 15% | 10% |

The cost of the preliminary project will be determined based on the results of the feasibility study. Also, based on the results of the feasibility study, one of the following two concepts for the construction of a power plant will be selected:

1. Investment project solution for the construction of a gas-turbine power plant;

2. Investment project solution for the construction of a gas-engine power plant.

The construction of the power plant (project implementation) will be carried out in stages, taking into account the elaboration of design estimates.

Economic calculations show that the implementation of the project has positive effects on aggregate indicators at the discount rate (R) considered for power supply in the value of 11.0%. This effect is conditioned by the expected reduction in costs for the purchase of electricity, given that the unit cost of 1 kWh is reduced approximately twofold (for IRR 11.0%). As a result, the first option will be chosen-the construction of a gas-turbine power plant.

It should also be taken into account that as a result of the transition to autonomous power supply sources, there can be indirect positive effects, such as an increase in oil production due to the elimination of downtime in oil fields that currently exists in connection with emergency outages of public power supply systems.

The main financial indicators for the project are presented in Table 4.

| Table 4 Economic Indicators of the Efficiency of the Investment Project for the Construction of a Gas-Turbine Power Plant | |

| Effect on power supply indicators | |

| Discount rate (r) | 11.0% |

| Current tariff of public power supply organizations | 0.6$/kWh |

| Expected tariff of own electricity, tenge/kWh | 0.3$/kWh |

| Free cash flow, million USD | 112.7 |

| Net present value (NPV), million USD | 69.71 |

| Cash shortage, million USD | 63.2 |

| Effect on the performance indicators of the subsidiary company-1 | |

| Cost saving, million USD | 496.5 |

| Present value (PV) of cost saving, million USD | 167.8 |

| Effect on the performance indicators of the subsidiary company-2 | |

| Lost revenue, million USD | 146.3 |

| Present value (PV) of lost revenue, million USD | 51.4 |

| Overall effect on the performance indicators of the parent company “A” | |

| Cost saving, million USD | 462.9 |

| Present value (PV), million USD | 116.5 |

The substantiation of any investment project solution requires that the main economic risks be identified (Badalova & Panteleev, 2015). It is also desirable to determine the economic security of the project implementation and the direction of eliminating the perceived risks (Table 5).

| Table 5 Analysis of the Risks of the Investment Project for the Construction of a Gas-Turbine Power Plant | |

| Possible risks | Influence of the tariff of fuel commodity (dry) gas on the state of the population |

| Possible increase in costs associated with the modernization of the power supply infrastructure, the selection of equipment, and the diversification of the technological process | |

| Security assurance | As part of the feasibility study, a proposal is considered for hiring a consulting company to subcontract for possible (future) invisible (uncertain) risks at the moments of decision making and design |

The implementation of an investment project for the construction of a power plant by an oil company within the framework of diversification can result in indirect positive effects not included in this analysis, in particular, the production effects from eliminating oil production losses that currently occur as a result of power outages from suppliers. The expected performance criteria, as a rule, should be defined in more detail at the subsequent stages of project development during the feasibility study of the investment project. The implementation of the proposed investment project solution will produce the following effects:

1. Provision of uninterrupted power supply and realization of planned oil production volumes;

2. Provision of oil fields with high-quality electricity;

3. Autonomous (independent) own power supply;

4. Execution of production activities for electricity generation along with the public power supply network;

5. Guaranteed provision of emergency power supply reservation;

6. Reduction of electricity costs as part of the cost of market products;

7. Reduction of direct losses of energy resources and increase of capacity of public electric networks;

8. Creation of new workplaces and increase of employment level of the able-bodied local population.

The diversification of production of the parent oil company is aimed at minimizing the losses of crude oil. The construction of a gas-turbine power plant will be a solution to the problems, since the implementation of the investment project will ensure the uninterrupted supply of electricity to the oil-producing industries.

Conclusion

The development of service production in the oil and gas industry allows the oil company to be independent in making operational decisions. Currently, Kazakhstan has a well-formed oil-producing complex, which has made the country one of the leading exporters of hydrocarbon raw materials. As a supplier of oil and gas resources and products of their processing in world oil markets, Kazakhstan positions itself as a reliable partner.

References

- Appazov, N.O., Seitzhanov, S.S., Zhunissov, A.T., & Narmanova, R.A. (2017). Synthesis of cyclohexyl isovalerate by carbonylation of isobutylene with carbon monoxide and cyclohexanol in the presence of Pd (PPh 3) 4-PPh 3-TsOH and its antimicrobial activity. Russian Journal of Organic Chemistry, 53(10), 1596-1597.

- Badalova, A.G., & Panteleev, A.V. (2015). Enterprise risk management. Moscow: Vuzovskaya Kniga.

- Cohen, G., Joutz, F., & Loungani, P. (2011). Measuring energy security: Trends in the diversification of oil and natural gas supplies. Energy policy, 39(9), 4860-4869.

- Dynamics of the main socio-economic indicators (2017). The official website of the committee on statistics of the ministry of national economy of the republic of Kazakhstan. Retrieved June 20, 2019, from http://www.stat.gov.kz

- Egorov, O.I., & Chigarkina, O.A. (2013). Priorities for improving the competitiveness of the petrochemical complex in Kazakhstan. Exposition Oil Gas , 5 (30).

- Jumadilova, S. (2012). The Role of Oil and Gas Sector For The Economy of Kazakhstan. International Journal of Economic Perspectives, 6(3).

- Kazakhstan’s oil refining industry (2015). Retrieved from https://en.wikipedia.org/wiki/Energy_in_Kazakhstan#Oil

- Kuzmin, T.G., & Molodykh, P.V. (2012). Economy of the investment project in the oil and gas industry. Tomsk: Tomsk Polytechnic University.

- Mazurina, E.V., & Pavlovskaya, A.V. (2016). Economic evaluation of projects on improving energy efficiency in oil and gas industry companies. Ukhta: USTU.

- Reports and tariff estimates (2017). The official website of MAEK-Kazatomprom LLP. Retrieved June 20, 2019, from http://maek.kz/

- Scottish Enterprise (2018). Oil & Gas Diversification Opportunities. Retrieved June 20, 2019, from https://www.scottish-enterprise.com/learning-zone/research-and-publications/components-folder/research-and-publications-listings/scotlands-energy-facts

- Seidaly A.S., Lazareva E.A. & I.A. Semiletova (2000). Current state of the coal, mining and metallurgy industry of Kazakhstan: Analytical review. Almaty: KazgosINTIN.

- Service projects (2017). The official website of KazMunaiGas JSC. Retrieved June 20, 2019, from http://www.kmg.kz

- Steen, M., & Weaver, T. (2017). Incumbents’ diversification and cross-sectorial energy industry dynamics. Research Policy, 46(6), 1071-1086.

- Suerbaev, H. A., Chepajkin, E. G., Dzhiembaev, B. Z., Appazov, I. O., & Abyzbekova, G. M. (2007). Catalytic hydroxycarbonylation of isobutylene with carbon monoxide and polyhydric alcohols in the presence of the Pd (acac) 2-PPh 3-TsOH system. Petroleum Chemistry, 47(5), 345-347.

- Sustainable development (2017). The official website of EmbaMunaiGas JSC. Retrieved June 20, 2019, from http://emba.kz/

- Teka, Z. (2012). Linkages to manufacturing in the resource sector: The case of the Angolan oil and gas industry. Resources Policy, 37(4), 461-467.

- The State Program of Industrial and Innovative Development of the Republic of Kazakhstan for 2015-2019 (2015). Retrieved June 20, 2019, from https://www.baiterek.gov.kz/en/state-program-innovative-and-industrial-development

- Vilenskii, P.L., Livshits, V.N., & Smolyak, S.A. (2008). Evaluation of the efficiency of investment projects: Theory and practice. Delo, Moscow.