Research Article: 2021 Vol: 20 Issue: 3

E-Learning of Auditing Under the Corona Pandemic and Its Compatibility with International Education Standard No 8 (IES8) Related to Auditor Competency Requirements

Jumana Handhal Al-Tamimi, Basrah University

Abstract

The world is witnessing great evolutions via information technology which interfaces with life partitions and since education is one of the most important life actors therefor must exploiting the information technology in education procedures. Accounting is one of the most important sciences taught at universities, E-accounting education has emerged to serve the learning process and achieve its goals. The accounting education has criteria that discipline the educational process and achieve high quality for the educational process as well as preparing a new generation qualified technically and scientifically which complies with the requirements of the accounting and auditing profession. Thus, due to the adoption of e-education at Iraqi universities for the covid -19 pandemic conditions, this research examines how successful e-learning in covering accounting auditing curriculum and determine its compliance with the international educational standard (IES8) related to auditor competency requirements and determining the extent of students’ acceptance to this new educational approach. The research found a great match between accounting audit contents given to students electronically and the requirements of international education standards (IES8). Students prefer e-auditing education because of its flexibility, breaking the routine of the educational process, and breaking the barriers of fear and shyness for some students during the study time intervals.

Keywords

E-accounting Education, E-education, International Educational Standard, Covid -19.

Introduction & Literature Review

Under the Covid -19 pandemic conditions, the Ministry of Education and Scientific Research resorted to relying on e-learning at all universities and educational institutions to reduce the risks of Corona. Since university education is the source of funding for economic units and the work environment from the educated and specialized staff to practice a particular profession, and because accounting and auditing profession is among the most important occupations involved in organizational units that the work environment needs continuously due to the nature of the accounting and auditing profession and its importance and impact on the life of the organizational unit of all kinds, thus, electronic accounting, auditing education, and preparing an efficient accounting and auditing staff has become an essential part of the educational process at the relevant Iraqi universities. Due to the importance of the accountancy and auditing profession, professional organizations such as the International Federation of Accountants (IFAC), which has urged the International Accounting Standards Board for Education to issue a set of International Accounting Education Standards to become a working map of the relevant educational institutes and universities for the production of efficient and scientifically qualified human resources to conduct the accountancy and auditing profession appropriate to the requirements of the working environment. The Board issued the Accounting Education Standards (IAESB) eight standards, the last of which is Standard No. 8 which is related to the professional competence of auditors on the financial statements, to achieve the professional competence at the audit staff that is capable of doing this challenging task at its best. Higher education in Iraq has focused on accountancy education as a unified accounting approach that was established in 2008 to set accounting educational approaches in Iraq, besides, it formed Al-Rai body which included the Minister of Higher Education, the heads of universities, and deans of the Faculties of Administration and Economics to develop the educational process for the accounting curriculum. Therefore, due to the importance and sensitivity of the auditing profession that requires the competent auditor and accounting information experience, this research came to examine the compatibility between the requirements of Education Standard 8 and the e-learning curriculum followed in Iraqi universities as well as the extent of compatibility between the standard and the approach followed for the auditing subject, as well as the students' acceptance of e-learning in the audit studies. The research consists of three sections: The first section of the research includes the methodology, which consists of the importance, problem, objectives, and hypothesis, while the second section is theoretical, which deals with the most important subjects of e-accountancy education and accounting education standards, and also focuses on the clarification of standard 8 in all its details. The third and final section includes discussion and comparison between the standard and the auditing curriculum adopted in Iraqi universities and Basra University in particular, what is the ratio of compatibility between the two as a first part, the second part was based on the questionnaire which was distributed to students of the Accounting Department, University of Basra, who have completed the audit study, to determine their acceptance of this type of education, results, and comments, as well as the most important recommendations.

The Research Importance

The auditing profession represents the safety valve for all organizational units and the backbone of continuation in the work environment, without which the accounting data disclosed in the financial statements of the organizational unit is in doubt and mistrust. Therefore, we need an efficient, scientifically and ethically qualified staff to conduct this difficult and sensitive profession, thus, professional and academic organizations have paid clear attention to the issue of accountancy and auditing education. The accounting education standards have been issued by the International Accounting Standards Board (IAESB) with the aid of the International Federation of Certified Public Accountants (IFAC) to develop a roadmap for accounting and auditing education to provide the informational base that prepares efficient accounting and auditing staff. In Iraq, professional organizations have taken this approach, formed Al-Rai Body, and the accounting committee to develop a standardized accounting and auditing curriculum to produce scientifically qualified staff who have broad information on accounting and audit work, familiar with the international accounting standards and principles, and Iraqi rules that represent international standards, and compatible with the Iraqi environment. Today, the Corona pandemic has imposed a commitment to e-learning in educational institutions. Auditing is an important accounting subject that has been taught within the educational curriculum of the accounting department and it is one of the requirements for graduating from university and obtaining a bachelor’s degree. Therefore, the idea of this research came in determining the compatibility between the requirements of Education Standard No (8) related to the competence of auditors and the auditing curriculum adopted under the approved e-education in Iraqi universities as well as identifying the percentage of congruence between them and the students’ acceptance of e-learning in the auditing subject.

Research Problem

The research problem has emerged due to the need for a scientifically, professionally, and ethically competent staff, and since that education has become electronic, which calls for a modification of the nature of the scientific lecture and the interaction between instructor and student, and the use of means of communication and educational programs that may be new to the receiving student. How can such a factor affect scientifically, professionally, and ethically competent staff in light of the educational standard No. 8 concerning the competence of the audit staff? Hence, the question would be:

Is there congruence between the electronic auditing education used in Iraqi universities and the requirements of standard No. 8 of the auditor's competency requirements who review the financial statements? Do students accept this type of education in the auditing subject or do they prefer traditional education?

Research Objectives

The research aims to the following:

1. Defining International Education Standard No. 8 of the auditor's competency requirements (Finance reviews).

2. Defining electronic accounting and auditing education adopted in the Iraqi universities as well as its advantages and disadvantages.

3. Determine the conformity between the accredited audit curriculum at Iraqi universities and the International Education Standard No. 8 of the auditor's competency requirements (compare the content of Standard No. 8 with the content of the audit curriculum adopted at Iraqi universities).

4. Demonstrate students' acceptance of e-learning in the auditing study.

Research Hypotheses

The research is based on the following hypotheses:

1. There is a match between the requirements of International Education Standard No. 8 and the educational curriculum content in the auditing subject under e-learning.

2. There is a tendency for students to e-learning to clarify the content of the audit curriculum in line with Education Standard No. 8 regarding the requirements for auditors ’competence.

Methodology

Throughout this research, the deductive method was adopted by summarizing the theoretical aspect through what was proposed in the accounting literature regarding accounting education, standards of accounting education, and making a comparison between the two study variables, which are the International Education Standard No. 8 and the educational curriculum for the auditing subject, which is adopted in Iraqi universities to study the first hypothesis and rely upon the inductive approach to examining the second hypothesis by surveying the students in the third stage of the Accounting Department who received audit curriculum electronically (Table 1 & Table 2).

| Table 1 Previous Studies | |||

| Researcher name | Year | Study title | Study objective |

| Al-Jalily & Taha | 2010 | The use of international education standards for professional accountants in the development of accounting curricula for a Bachelor's degree in Iraq" | The study aimed to propose a model for an accounting curriculum for the undergraduate level at the University of Iraq, based on what the International Standards of Education offered to accountants (IESs) and the Global curriculum content for Professional Education for Professional Accountants issued by the United Nations Conference on Trade and Development. The study reached a series of results that revolve around the importance of accounting education curricula as a factor in building professional skills for accounting learners. |

| Jabbar | 2015 | The reality of accounting education in Iraq and its compatibility with international accounting education standards. | The study provided an overall analysis of the accounting education curriculum at Iraqi universities to assess the extent to which the curriculum complies with the requirements of the first four Education Standards (ISE), as well as its reliance on a form distributed to several parties (senior students in accounting education programs, graduates of these programs, faculty members) to learn more about the nature of professional skills developed by graduates of these programs. |

| Al-Barghati | 2018 | The compatibility of the requirements of Libyan university accounting education programs with the requirements of Standard No. 3 of the Accounting Education Standards. | This study aims to find out the reality of accounting education in Libya and its compatibility with an important part of these international standards defined by Standard No. (3), which deals with one of the most important findings of accounting education globally skills to be acquired by the accounting student, whose primary objective was to demonstrate the compatibility of the requirements of the accounting education program at Libyan universities with the requirements of Accounting Education Standard (3), from the point of view of faculty members. The study found that the accounting education program at undergraduate Libyan universities offers the skills of Accounting Education Standard (3) |

| Waad Hadi et al. | 2018 | Accountancy education curricula and their impact on the scientific and practical side of accountants in Iraqi governmental institutions applied research on “a sample of accounting students and graduates working in government institutions. | The objective of the research is to identify what the curricula are related to the three accounting systems((the unified accounting system, the central government accounting system, the decentralized government accounting system). The search also aims to conduct a survey targeting the research sample to determine the strengths and weaknesses of the curricula in terms of developing highly qualified accountants who can manage the activities of their government institutions. |

| Al-Akhdar & Mariah | 2018 | The learning method for accounting and auditing practitioners under the requirements of International Accounting Education Standards. | The study aims to identify possible areas of development by organizing the accounting profession in Algeria concerning the educational requirements for practicing the profession, from the perspective of the requirements of the International Education Standards (IESS), and the practices of certain professional bodies that achieve these standards. |

| Ojeila & Qenea | 2016 | The contribution of e- accounting education to the development of the skills of accounting students. | This study aims to identify the contribution of e- accounting education to the development of the skills and capabilities of accounting students by highlighting the role of ICT in developing the student's intellectual, technical, personal, administrative, and communication skills. |

| Table 2 Foreign Studies | |||

| Researcher name | Year | Study title | Study objective |

| Chen et al. | 2009 | Information technology competencies Expected in Under-graduate Accounting Graduates |

This study aims at identifying the technological skills and competencies expected of accountancy graduates, given the many challenges faced by accounting education, including the impact of information technology on the accountancy profession. |

| Shakun & Churyk | 2013 | Are students ready for their future accounting careers? insights from observed perception GAPS among employers, interns, and Alumni | It aims to examine the practical aspects of the education of the accounting departments, which are curricula, students, and universities, and the compatibility of curricula taught in those universities with the requirements of stakeholders. |

| Patrut | 2010 | Interactive System Education in Accounting Using an | This study aims to develop computer-based accounting education programs, by contributing to access to information, as well as to detonate the energies and talents of students. |

Many studies address accounting curricula and their compatibility with international accounting education standards. However, this study was distinguished from others as it is the first study in the field of teaching the auditing curriculum electronically and the compatibility of this type of education with the requirements of accounting education standard No. 8 related to the auditors’ competency.

Accounting Education

Accounting education appeared in England in (1600-1700) when the Elizabeth School appeared, in which accounting lessons were taught to prepare accountants to practice the accounting profession in the Kingdom, it was then spread throughout the Kingdom, such as Scotland, and as a result of the economic development interest in accounting, education has become more widespread, especially after many accountants migrated to South and North America, carrying with them the scientific experiences they received at schools and institutes spread in their countries such as Britain, Ireland, Scotland and Italy. It should be noted that accountancy was engaged anarchically which resulted in many economic crises in America. This led to the emergence of the American Association of Legal Accountants (AAPA), which, in turn, took care of the accountancy profession and standard-setting for the accountancy profession (Al-Jawdah and Al-Tamimi, 2018: 199). Then, the Association of Certified Accountants in England and Wales (ICAEW) has appeared which had a legal capacity and soon many federations appeared, (ACCA), the Association of Certified Accountants and (CIMA) in England. In America, the American Institute of Certified Public Accountants (AICPA) has appeared and grants the certification of a certified public accountant (CPA) who practices the profession of auditing, and then the Authority of Internal Auditors (AII) awarding Certified Internal Auditor (CIA) certification (Altintas & Yilmaz, 2012).

Thus, we note that there is attention to education in the early part of the sixteenth century to regulate the accountancy and auditing profession, which must be in accordance with established international standards, rules, and regulations for efficiency in the profession. In Iraq, accounting education appeared in the 1980s at the University of Basra, which adopted accounting education at the university and then spread at all Iraqi universities, as Iraq is the first source of accounting study in the Arab world. The Department of Accounting Education in Iraq is divided into two types (academic and vocational). Academic education is the predominant type, as it grants a Bachelor's degree, a Master's degree, and a PhD in accounting sciences, and the vocational education grants the diploma degree with two years of accounting study. Moreover, there are academic bodies such as the Arab Institute for Certified Public Accountants, which grant an auditor’s diploma, which is equivalent to a master’s degree, as well as the Higher Institute of Accountancy, which awards a professional certificate in accounting, which is equivalent to a doctorate.

What Is Accounting Education?

Accountancy education was defined as an organized process conducted by the concerned universities through which the learner is provided with the necessary scientific and practical capabilities to practice the profession and it is a continuous process that has its objectives and there must be an evaluation of those returns to ensure that the goals of accounting education have been achieved (Herring & Izard, 1992).

Al-Zamili explained (2014) that the returns accrued by accountancy education are:

1. Cognitive returns are those that express knowledge and problem-solving skills gained by the learner.

2. Behavioral returns, which are interpersonal skills and ethical skills.

3. Impactful returns are the returns of psychological effects that make the learner distinguished, having the ability to think independently.

Accounting education includes all knowledge and skills related to the quality of accounting education to meet the requirements of the labor market. Environmental changes imposed the need for changes in the labor market and a focus on quantity and gender, whose effects have been extended to the range of knowledge, cultures, and skills that require the accountants and auditor (Mami, 2020).

Accounting Education Components

Accounting education as a complete system consisting of the following:

1. Input, it includes students of the Accounting Department.

2. Operational processes are educational processes that can be used to provide students with accounting skills.

3. Outputs: They are graduates of the Accounting Department who are qualified to practice the profession of accounting or auditing to achieve the objectives of the accounting education system in general.

4. Feedback, which is a monitoring process to correct deviations that may occur in the learning process. Good and integrated accounting education is the cornerstone of preparing qualified and competent accountants or auditors (scientifically, professionally, and technically).

The Importance of Accounting Education

1. Good and qualified accounting education helps to prepare and qualify accountants and auditors by providing them with accounting knowledge (IFAC, 2003).

2. Accounting education helps to provide accounting staff working in various economic units with the most important developments in the profession by developing accounting principles and standards as well as training accountants on the new curricula through continuing Education Programs (Korne et al., 2009).

3. Accounting education programs help to meet the requirements and needs of economic and social development and the labor market for accounting and auditing staff (Al-Kilani, 2000).

4. Accounting education contributes to the development of the profession by providing developed scientific curricula to learners in the Accounting Department or accounting and auditing staff working in economic units.

Electronic Accounting Education

Technology has spread widely in different areas of life in the past decades. Since education is one of the most important life-making activities of man, it has also been subject to technology and what is known as e-learning has emerged.

E-learning means that it uses electronic means in the education process through which scientific information can be collected and delivered to the various student groups efficiently and effectively (Agila & Qena 2016)

In Iraq, the concept of e-education has emerged because of the Corona pandemic, although it is a new experience for academic staff and students at various educational institutions in Iraq. Modern electronic programs as (Google Classroom, Zoom, Nebo, Floyd Mas, One Note, Edmodo, and Polar Geojira) are adopted for different school groups. However, at Basra University, the Google Classroom program was adopted as means of communication with university students for educational purposes, delivering lectures, and testing.

Furthermore, accounting is among the sciences taught in Iraqi universities that’s why educational electronic programs have been used to deliver the scheduled educational curriculum to students of the Accounting Department at the University of Basra. The Accounting Department, like the rest of the scientific departments, has adopted the Google Classroom program at different levels of study (undergraduate and postgraduate studies). One benefit of e-learning is to prepare scientifically and technically qualified accounting and auditing staff who can cope with technological changes in the accounting and learning environment, and e-learning meets a requirement of accounting education standards which is providing communication skills for the learner as well as providing intellectual, personal, technical and scientific skills.

Advantages of e-accounting Education

E- Accounting education provides the following skills for the learner:

1. Providing accounting information and breaking the rule of thumb in accounting education by delivering the lecture and communicating with the students in terms of time, place, use of various images, sound, and seminars (Siam, 2012).

2. Ability to solve problems and good student thinking.

3. Ability to communicate.

4. The ability to sustain education.

5. The learner overcomes difficult conditions by developing self-skills in the learner (Al-Shujairi, 2006).

6. Provide a flexible educational base for communication between the learner and the teacher.

7. Achieving human resources development through the creation of an advanced technical generation.

8. Providing a flexible environment for education as (Koohang, 2004) pointed out that the students who are shy in classrooms are more active in the e-classroom.

We note that the electronic accounting education process is in line with the requirements of accounting and auditing education standards emphasized by the International Federation of Accountants.

Disadvantages of E-Accounting Education

Every system has advantages and disadvantages, as with e-learning that has the following disadvantages:

1. The students' technological skills and some teaching staff necessary for e-learning are weak (Agila & Qena, 2016).

2. Weak information network infrastructure (weak Internet) may hinder the educational process and cause miscommunication between student and teacher.

3. The poor financial condition of some students may prevent them from owning a personal computer, which may constitute an obstacle in the educational process.

4. Weak social relations between students on the one hand and between the professor and the student on the other hand, due to the social distancing between the leaders of the educational process.

Despite these flaws, e-education advantages outweigh their flaws and prepare an educated and technically advanced generation to meet the requirements of accounting education standards in line with the requirements of the work environment.

Accounting Education Standards

Accounting Education Standards is a model that provides general guidance that leads to directing and rationalizing the educational processes with accounting education. That is, it is a roadmap that guides any education institution that seeks to build a good educational accounting program as it covers the aspects of successful accounting education worldwide.

These standards have been established by the International Accounting Education Standards Board (IAESB) in the last decade of the millennium. These are not binding standards, rather they are considered as a guide to accounting education, which has generated a difference in educational foundations and methodologies followed in universities and institutes in different countries of the International Federation of Accountants. The failure to apply the standards has adversely affected the quality of the output of the accounting system; also, following these standards contributes to the preparation of professional accounting and auditing staff according to IFAC standards (Al-Faki, 2014)

Accounting education standards according to the recent version of 2015 included the following eight standards (Table 3):

| Table 3 Accounting Education Standards According to the Recent Version Of 2015 | |

| Standard | Standard nature |

| IES1 | Entry Requirements To Professional Accounting Education Programs |

| IES2 | Initial Professional Development- Technical Competence |

| IES3 | Initial Professional Development- Professional Skills |

| IES4 | Initial Professional Development- Professional Values, Ethics, And Attitudes. |

| IES5 | Initial Professional Development- Practical Experience |

| IES6 | Initial Professional Development- Assessment Of Professional Competence |

| IES7 | Continuing Professional Development |

| IES8 | Professional Competence For Engagement Partners Responsible For Audits Of Financial Statements |

Accounting Education Standard No. (8) Professional competency requirements for auditors:

Due to the importance of the auditing profession and its sensitivity in companies, it requests attention to the quality of auditors who perform the auditing profession in terms of high professional competence. Accounting education is considered the first nucleus for creating qualified auditors through the knowledge and skills they acquire in universities. This knowledge must also be developed, and accordingly, the International Federation of Accountants (IAESB) has developed a standard that ensures the achievement of the auditor's professionalism, which is the educational standard, No (8) which aims to the following: (International Accounting Education Standards Board, 2014)

1. Determine the requirements for professional competence in the field of auditing.

2. Create a special system for experts in auditing and not just for obtaining the Professional competence of auditors but also for other parties (such as the public) for their dependence on audited financial statements.

3. Qualify accountants with high professional qualifications to practice the auditing profession.

The standard indicates the meaning of competence, it is the ability to perform the profession according to the standards of auditing, and there are a variety of means for assessing efficiency, which is performed in the working environment, simulation in the working environment, written and oral tests and self-evaluation. Capabilities are the personal qualities that enable an individual to perform the task.

The International Federation of Accountants (IFAC) has generally identified professional skills as:

1. Intellectual skills: Skills that help the accountant and auditor to think, to operate mental abilities and reasoning to help make decisions, i.e. skills that help predict, identify, and solve problems (Stark & Lauther, 1998), these skills come from the auditor's acquired education during his years of study and (IFAC) has identified intellectual skills as follows:

a) The ability to obtain and classify information.

b) The ability to investigate, logical thinking, and analysis.

c) The ability to identify and solve problems.

d) The ability to make decisions and to judge appropriately promptly.

e) The ability to predict and draw conclusions.

2. Technical and practical skills: These are the skills that help the accountant and auditor perform their work according to what is required under accounting principles and auditing standards (Al-Futtaimi, 2009). IFAC has identified technical skills as follows:

a) The ability to measure the accounting and non-accounting information.

b) Ability to prepare financial reports.

c) The ability to use mathematical and statistical applications.

d) The ability to master information technology.

e) Ability to analyze risks.

3. Interpersonal skills: they are the skills that are related to the accountant's personality or auditor's professional behavior. The improvement and development of these skills improve the personality of the accountant and auditor (Al-Hubaity, 2003). IFAC has identified interpersonal skills as follows:

a) Learner’s self-development ability.

b) The ability to manage and respect time.

c) The ability to adapt to environmental changes.

d) Consider ethical values when making decisions.

e) Professional skepticism.

4. Communication skills: the standard defined it as the ability to work with others for the benefit of the organization and the ability to receive and send information that contributes to decision-making. IFAC has identified communication skills as follows:

a) Communicate with others and solve problems.

b) Ability to work in different environments.

c) Capacity for cultural and intellectual diversity.

d) Ability to present, discuss, and report in writing or orally.

5. Organizational and administrative skills: Skills for planning, work management, human resources organization and leadership in the issuance of professional judgments (Deppe et al., 1991) IFAC has identified organizational and managerial skills as follows:

a) Strategic planning and human resource management.

b) The ability to regulate and delegate authority, on the one hand, and to motivate and develop individuals on the other.

c) Ability to issue professional judgments

The Education Standard (8) defined the requirements for the professional competence of auditors as follows:

1. Auditors should be qualified as professional accountants.

2. They must have a bachelor's degree or its equivalent.

3. Meet all professional requirements from behavioral, cognitive, and ethical skills.

Educational Standard No (8) emphasizes that the auditor must have access to a Bachelor's degree through a university study in which knowledge, professional and ethical skills are required.

The cognitive skills of the auditors:

1. Knowledge of auditing historical financial information.

2. Knowledge of how financial information is disclosed and reported.

3. Knowledge of information technology.

The professional skills of the auditors are:

1. Professional skills in identifying and solving problems.

2. Conducting appropriate technical research.

3. Work within an effective audit team.

4. Evidence collection and evaluation.

Submit, discuss, and actively defended views of other parties. Professional, ethical and consistent values, the standard emphasized that it must have professional ethical values and the ability to address situations when engaging in auditing work.

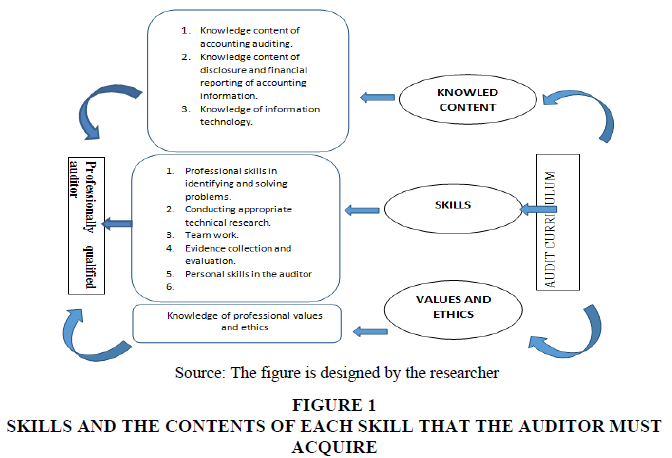

These skills should be gained by the auditor from his university studies as the curriculum for these accounting and auditing studies should cover the overall skills to prepare a future professional auditor. After Iraqi universities went through e-learning due to the Covid 19 pandemic, to what extent was the electronic audit education able to meet the requirements of Standard No. (8) to prepare a professionally qualified accounting and auditing generation and the answer to this question will be in the second part of the research, which is the discussion and results. The following Figure 1 shows the skills and the contents of each skill that the auditor must acquire from his university studies as indicated by the standard.

Results and Discussion

In the theoretical aspect, we have addressed e-learning, its nature, advantages, and disadvantages as well as learn about the auditing learning standard developed by the International Federation of Accountants (IFAC) related to competency requirements in financial auditors. In this aspect of the study, we try to determine how electronic audit education is in line with standard (8) by relying on the deductive approach and conducting a comparison between the two study variables to determine the congruence between the auditing curriculum given electronically to students and the requirements of Standard No (8) of cognitive content, technical skills, and ethical values to test the first hypothesis of the research. As for the second hypothesis, the inductive approach employed the questionnaire to determine how well the e-learning served the audit education process to achieve the requirements of Standard No. (8) and the extent of student’s acceptance to this type of education.

Testing the First Hypothesis

Due to Covid 19 pandemic conditions, electronic education has been adopted in Iraqi universities, including Basra University/College of Administration and Economics, Accounting Department, besides, many programs were used to in this concern including Google Classroom as an educational platform to deliver educational lectures on accounting in various forms (written lectures, video lectures, and interactive lectures) to clarify the curriculum content of the accounting and auditing studies, which is taught in the third stage, three hours per week, which is one of the requirements for graduation from the Accounting Department. As a result of the educational flexibility of e-education, students have reacted more positively to this type of education. The objective of teaching auditing is to introduce the student to the knowledge content of the auditing subject, how to audit the financial statements, and to express his opinion regarding the fairness of financial statements in light of the application of auditing standards in a way that prepares scientifically qualified auditors to engage in the field of auditing. To achieve this educational objective, it is essential to rely on the International Standard on Auditing (8). Accordingly, there must be compatibility between e-learning of the auditing subject and the requirements of international standard No (8). Thus, the following comparison will be made (Table 4):

| Table 4 Compatibility Between E-Learning of the Auditing Subject and the Requirements of International Standard No (8) | |||

| Basis of comparison | Standard requirements | Audit methodology | Comparison result |

| Knowledge content | The knowledge content of the accounting treatments. | Intellectual identification of the content of the auditing profession and how to audit financial statements In the light of generally accepted accounting principles and examination of accounting treatments, whether in traditional education or e-learning. | Matching |

| The knowledge content of how to disclose and report these accounting treatments. | Introduce the student to how the auditor's opinion on the balance sheet is expressed in the auditor's report, what types of reports are, and how they vary from case to case, whether in traditional or e-learning. | Matching | |

| Technological knowledge of information. | In the conditions of e-learning, the curriculum covers auditing basically, the e-learning experience is still modern in Iraq In traditional education, and however, in traditional education e-auditing was addressed simply. | Matching to some extent. | |

| Skills in identifying and solving problems. | Under e-learning there are homework which are practical cases of some accounting treatments in a company from which the student works on analyzing and extracting an audit opinion more than it is in traditional education, it is because e-learning has flexibility in learning time, so the practical cases are numerous and diverse. | Matching | |

| Conducting the necessary technical research. | Under e-learning, each student must submit a report related to the subject study out of 15 scores as part of the final exam scores (50), this was not adopted in traditional education. | Matching | |

| Working with a competent team. | E-learning achieves teamwork among the student community by communicating in discussing the homework. Besides, the vocational training that a student must conduct on the summer vacation after the end of the third stage of university education also achieves this skill, but at present, because of the Corona pandemic, it has become difficult to conduct vocational training for students. | ||

| Evidence collecting and evaluation. | The e-Learning Auditing approach addresses the topic of audit evidence and how to obtain audit standards (500). The paragraph is addressed in the curriculum under both traditional and electronic education. | Matching | |

| Auditor’s skills. | The curriculum covers the personal characteristics of the auditor as emphasized by Standard (200) of the International Auditing Standards which are independence, honesty (integrity), objectivity, professional competence, confidentiality, and professional behavior. These are dealt with in both traditional and electronic education. | Matching | |

| Professional values and ethics | The standard emphasizes the need to introduce the ethics of the audit profession to prepare a professionally and ethically qualified auditor. | Based on the methodology adopted, the auditor's responsibilities are explained If there is a defect in his or her work, including criminal and disciplinary responsibilities and liability towards third parties, referring to the civility and personal qualities that the auditor should have necessary to avoid those responsibilities, and this is both in electronic and traditional education. | Matching |

From the comparison Table 4 below we note that the audit curriculum is in line with the requirements of Education Standard No (8) related to the requirements of auditors' competence. However, with e-learning, it is broader and more evolved from traditional education due to the flexibility of the educational environment in terms of time, location, and communication between a teacher and a student. The first hypothesis is thus accepted that (there is a match between the requirements of International Education Standard 8 and the auditing educational curriculum under e-learning).

Testing the Second Hypothesis

To test the second hypothesis that states (there is a tendency for students to e-learning as it clarifies the auditing curriculum content that is consistent with the Education Standard No. 8 for the requirements of the auditors' competence). The researcher relied on the (15) electronic questionnaire questions related to what e-learning achieves in the auditing curriculum. The answer is according to Likert's five-point scale (completely agree, agree, neutral, disagree, and completely disagree), and the value of the answer is divided (5, 4, 3, 2, 1). The research community consisted of 170 students from the third stage in the Accounting Department (who successfully passed the auditing course within the last academic course). (156) questionnaires were collected from students to analyze the students ’answers in the Spss statistical program to calculate the arithmetic mean and find out the direction of the students, if the arithmetic mean is greater than the hypothesis mean, which is here (3), then the arithmetic mean is positive and consistent with the hypothesis. If the opposite, then the arithmetic mean is negative and inconsistent with the hypothesis. The standard deviation was also calculated to determine the disinformation of the study sample in answering the questions of the hypothesis test, which must be less than (1) at a statistically significant level of 5%. Moreover, to determine whether or not the hypothesis is accepted, the t-test one sample was used and according to the decision rule, which states ((If the calculated t is greater than the tabular t, then the null hypothesis is rejected and the hypothesis accepts the stability. If the calculated t is the lowest, then the hypothesis rejects the stability and the null hypothesis is accepted)).

To test the validity of the questionnaire assigned to testing the second hypothesis, the validity of the questionnaire questions was calculated by calculating the correlation coefficients (R) between the paragraphs of the questionnaire and the total score of the questions at the degree of freedom (number of questions -2) i.e. (15-2=13) and the significance level of (0.05) according to the table for the correlation coefficients, the tabular value of the correlation here will be (0.514) and the decision rule here (If the tabular R is smaller than the calculated R we accept the question, and when the calculated value is smaller than the tabular value, the question is rejected). The results are as follows (Table 5):

| Table 5 The Correlation Coefficients | ||

| The questions | R coefficient | SIG |

| Does e-learning achieve quality in the educational process? | 0.726 | 0.00 |

| Does the electronic audit education adapt the student to the changes that occur in the work environment continuously? | 0.499 | 0.00 |

| Does electronic auditing education break students' fear, confusion, and shyness, which increases student-teacher interaction and communication? | 0.533 | 0.00 |

| Does electronic audit education break the routine rule in education, which creates a student's love of learning? | 0.623 | 0.00 |

| Does the electronic audit achieve human development for the student by participating in electronic and interactive lectures and taking electronic tests? | 0.583 | 0.00 |

| Does electronic audit education develop research methods and prepare scientific studies by submitting reports on auditing at the end of the semester? | 0.587 | 0.00 |

| Does electronic audit education provide students with homework that develops the ability to define the problem and solve it? | 0.690 | 0.00 |

| Does electronic audit education develop the technical and technological skills of the student? | 0.714 | 0.00 |

| Does electronic audit education provide students with knowledge content on financial disclosure? | 0.621 | 0.00 |

| Does electronic audit education provide students with the knowledge content to accurately review financial statements? | 0.531 | 0.00 |

| Does auditing electronic education provide the student with the skill of adapting to the means of communication? | 0.723 | 0.00 |

| Does e-learning provide the opportunity for a student to learn more about audit sources? | 0.516 | 0.00 |

| Does electronic audit education develop research methods and prepare scientific studies by submitting reports on auditing at the end of the semester? | 0.601 | 0.00 |

| Does e-learning cover the content of the auditing curriculum more comprehensively than usual education? | 0.673 | 0.00 |

| Does electronic audit education develop teamwork skills among students? | 0.598 | 0.00 |

| Does e-learning develop professional ethics and commitment to professional behavior through and commitment to the electronic lecture? | 0.743 | 0.00 |

It is noted from the Table 5 above that all values of the R coefficient were greater than the tabular R-value and the level of significance for the questions was less than (0.05). Accordingly, there is internal consistency and validity of the questionnaire questions to test the hypothesis for which they were designed. Also, Cronbach's alpha coefficient for the stability of the questionnaire questions was (0.852) which is higher than (0.7), i.e. the alpha coefficient was relatively greater.

To test the second hypothesis, the arithmetic mean was extracted to find out the extent of consistency of the targeted sample answers with the hypothesis of the study, as well as the calculation of the standard deviation through the use of the Spss program. The results are as follows:

It is noted from the above Table 6 that the arithmetic mean of the targeted sample was (3.225), which is higher than the hypothesis mean (3), and that the standard deviation of the targeted sample was (0.389) indicating the consistency of the study sample’s opinion with the second hypothesis and that the dispersion in the answer is very little less than (1). Besides, we note that question (12) has taken the highest hypothesis mean (4.25). That is, the students agree that the electronic learning of the auditing study subject developed the students’ research methods. Also, students agreed on the question (13) that electronic education has covered most of the curriculum content, as this question has taken the arithmetic mean of (4.01), which is the same arithmetic mean achieved by question (4), it is indicated in question (4) that electronic education breaks the routine rule in education, thus attracting students to the educational process. Furthermore, to determine the statistical significance between the second hypothesis and the questions addressed to the respondents from the statistical sample, the t-test one sample was adopted as well as determining whether or not the second stability hypothesis is accepted. The results were as follows:

| Table 6 Arithmetic Mean | |||

| The questions | Arithmetic mean | Standard deviation | |

| Does e-learning achieve quality in the educational process? | 3.54 | 0.18 | |

| Does the electronic audit education adapt the student to the changes that occur in the work environment continuously? | 3.18 | 0.74 | |

| Does electronic auditing education break students' fear, confusion, and shyness, which increases student-teacher interaction and communication? | 3.87 | 0.31 | |

| Does electronic audit education break the routine rule in education, which creates a student's love of learning? | 4.01 | 0.82 | |

| Does the electronic audit achieve human development for the student by participating in electronic and interactive lectures and taking electronic tests? | 3.41 | 0.15 | |

| Does electronic audit education provide students with homework that develops the ability to define the problem and solve it? | 3.27 | 0.16 | |

| Does electronic audit education develop the technical and technological skills of the student? | 3.03 | 0.64 | |

| Does electronic audit education provide students with knowledge content on financial disclosure? | 3.49 | 0.15 | |

| Does electronic audit education provide students with the knowledge content to accurately review financial statements? | 3.11 | 0.18 | |

| Does auditing electronic education provide the student with the skill of adapting to the means of communication? | 3.39 | 0.21 | |

| Does e-learning provide the opportunity for a student to learn more about audit sources? | 3.07 | 0.90 | |

| Does electronic audit education develop research methods and prepare scientific studies by submitting reports on auditing at the end of the semester? | 4.25 | 0.16 | |

| Does e-learning cover the content of the auditing curriculum more comprehensively than the usual education? | 4.01 | 0.71 | |

| Does electronic audit education develop teamwork skills among students? | 3.81 | 0.15 | |

| Does e-learning develop professional ethics and commitment to professional behavior through and commitment to the electronic lecture? | 3.19 | 0.38 | |

| Total | 3.225 | 0.389 | |

It is noted from the Table 7 above that all the values of the probability (sig) were less than the level of significance (0.05) and the degree of freedom (156-1=155), and therefore the arithmetic averages are statistically significant and the calculated (T) values are greater than the tabular value of (T). Consequently, the second consistency hypothesis must be accepted, which is (there is a tendency for students to e-learning in explaining the auditing curriculum content in accordance with Education Standard 8 regarding the requirements for auditors competency).

| Table 7 Hypothesis | ||||

| Hypothesis | Tabular T | Calculated T | SIG | Df |

| There is a tendency for students to e-learning in explaining the auditing curriculum content in accordance with Education Standard 8 regarding the requirements for auditors ’competency. | 1.98 | 8.63 | 0.00 | |

Conclusions

1. E-education is the best alternative to traditional education in the Corona pandemic, as it achieves the goal of the educational process efficiently and effectively.

2. To achieve quality in accounting education, it is necessary to adhere to the international accounting education standards issued by the International Federation of Accountants (IFAC) in covering the content of accounting materials, including auditing.

3. Electronic accounting and auditing education achieve development in the mental capabilities of the student and the professor, thus achieving human development in society.

4. E-learning covers the auditing curriculum concerning the cognitive content stipulated in the International Auditing Education Standard No. (8) better than it is in traditional education.

5. Adopting e-learning to cover the audit curriculum achieves the professional skills required in the electronic auditing education standard No (8) to achieve professional competence among auditors more comprehensively and accurate than traditional education.

6. Adopting e-learning to cover the auditing curriculum achieves the personal skills required in auditing education standard No (8) as it makes the student work within the team and develops his ability to research, solve problems and prepare audit reports, which is one of the requirements of e-learning for students.

7. Students of the Accounting Department at Basra University are inclined towards electronic accounting education in general and to electronic education in auditing in particular because of its flexibility and break the routine. The student can overcome his fears and shyness in the lecture hall.

Recommendations

1. E-learning should be used to teach accounting and auditing due to its compatibility with international accounting education standards for quality in the learning process.

2. Focus on international accounting education standards in covering the content of the accounting curriculum in general and auditing in particular under e-learning.

3. Providing the infrastructure and all that is required for the success of e-learning in Iraqi universities to achieve human resources development for both the student and the professor.

4. E-learning needs to be developed more seriously and effectively by relying on more efficient e-learning programs and accurate educational platforms.

5. E-workshops should be conducted for the teaching staff regarding accounting education and electronic auditing, and the most important recent developments in how interactive e-lectures and video lectures work with students.

References

- Agila, M., & Qena, A. (2016). Contribution of e-learning to developing the skills of students of accounting departments. Algerian Journal of Accounting and Financial Studies, 3.

- Al-Akhdar, A., & Mariah, A.S. (2018). The learning method for accounting and auditing practitioners under the requirements of international accounting education standards.

- Al-Barghati, I.A.F. (2018). The extent to which the requirements included in accounting education programs in Libyan universities are consistent with the requirements of Standard No. 3 of the Accounting Education Standards. Libyan International Journal, 1.

- Al-Faki, A.A.A. (2014). A proposed depiction of the application of accounting education standards and their role in controlling the quality of accounting curricula in Saudi universities. The Arab Journal for Quality Assurance of University Education, 7(16).

- Al-Futtaim, M.F. (2009). The role of accounting education in refining graduates with accounting skills needed for the labor market. Research presented to the Arab Conference on Higher Education and the Labor Market, The Open University, Libya.

- Al-Hubaity, Q.M. (2003). Labor market requirements for graduates of the College of Administration and Commerce in the public and private sectors. Research presented to the Arab Forum for the Development of the Performance of Colleges of Administration and Commerce in Arab Universities, Aleppo, Syria, 2003.

- Al-Jalily, M., & Taha, A.A. (2010). The use of international education standards for professional accountants in developing the accounting curriculum for bachelor stage in Iraq a model of suggested accounting curriculum for bachelor stage in Iraq. Tanmiyat Al-Rafidain, 32(99), 234-256.

- Al-Kilani, A.K. (2000). Accounting education and its relationship to economic development. Journal of Economic Research, Economic Research Center, 11(1).

- Al-Shujairi, M. (2006). Accounting education in Iraq, an analytical study in the light of the entrance of radical change. Journal of Accounting and Financial Studies, 1(32).

- Altintas, N., & Yilmaz, F. (2012). The accounting profession: A descriptive study of the common and code law countries. Journal of Modern Accounting and Auditing, 8(7), 932.

- Al-Zamili, A.A.H.H. (2014). Accounting education and its role in developing the professional skills of graduates of the Accounting Department/a survey of the opinions of a sample of faculty members and graduates of the Accounting Department, Qadisiyah University. Journal of Administration and Economics, 3(12).

- Chen, J., Damtew, D., Banatte, J.M., & Mapp, J. (2009). Information technology competencies expected in undergraduate accounting graduates. Research in Higher Education Journal, 3, 1.

- Deppe, L.A., Sonderegger, E.O., Stice, J. D., Clark, D.C., & Streuling, G.F. (1991). Emerging competencies for the practice of accountancy. Journal of Accounting Education, 9(2), 257-290.

- Herring, H.C., & Izard, C.D. (1992). Outcomes assessment of accounting majors. Issues Accounting Education.

- International Accounting Education Standards Board. (2014). Retrieved from http://www.ifrs.org.ua/wp-content/uploads/2014/11/Handbook-of-International-Education-Pronouncements-2014.pdf

- International Federation of Accounting (IFAC). (2003). Report of accounting education and professional skills. Education Committee, New York.

- Jabbar, N.S. (2015). The reality of accounting education in Iraq and its compatibility with international accounting education standards - an applied study of a sample of Iraqi universities. Al-Muthanna Journal of Administrative and Economic Sciences, 5(1).

- Koohang, A. (2004). Students’ perceptions toward the use of the digital library in weekly web based distance learning assignments portion of a hybrid programmer. British Journal of Educational Technology, 35(5).

- Korne, D., Custers, F., Thomas, S., Ethar, V., Klazing, & Neik, S. (2009). Development of accounting education. International Journal of Education Quality, 33(4).

- Mami, A. (2020). The extent to which the accounting formation in Algeria is compatible with the requirements of the International Standards for Accounting Education (IES) - a comparative study. Journal of Economic Studies, 18(1).

- Ojeila, M., & Qenea, A. (2016). The contribution of e- accounting education to the development of the skills of accounting students.

- Patrut, B. (2010). Education in Accounting Using an Interactive System.

- Shakun, Y.C, & Churyk, N. (2013). Are students ready for their future accounting careers? Insights from observed perception GAPS among employers, interns, and Alumni. Global Perspectives on Accounting Education.

- Siam, W.Z. (2012). The extent of the contribution of electronic education in ensuring the quality of higher education, a case study of accounting education in Jordanian universities. The Second Arab International Conference for Quality Assurance of Higher Education.

- Stark, M. & Lauther, B. (1998). Reforming accounting education. Journal of Accounting Education, 24 (2).

- Waad Hadi, A.H, Haider, A.A., Aqeel, D.K. (2018). Curricula of accounting education and its impact on the scientific and practical side of accountants in Iraqi government institutions, applied research on “a sample of students and graduates of accounting working in government institutions. Dinanir Journal/Iraqi University, 1(13).