Original Articles: 2017 Vol: 16 Issue: 1

Empirical Differences between Roe-Growing and Roe Declining Firms in Resource Sourcing, Allocation and Management

TeWhan Hahn, Auburn University at Montgomery

Ravi Chinta, Auburn University at Montgomery

Introduction

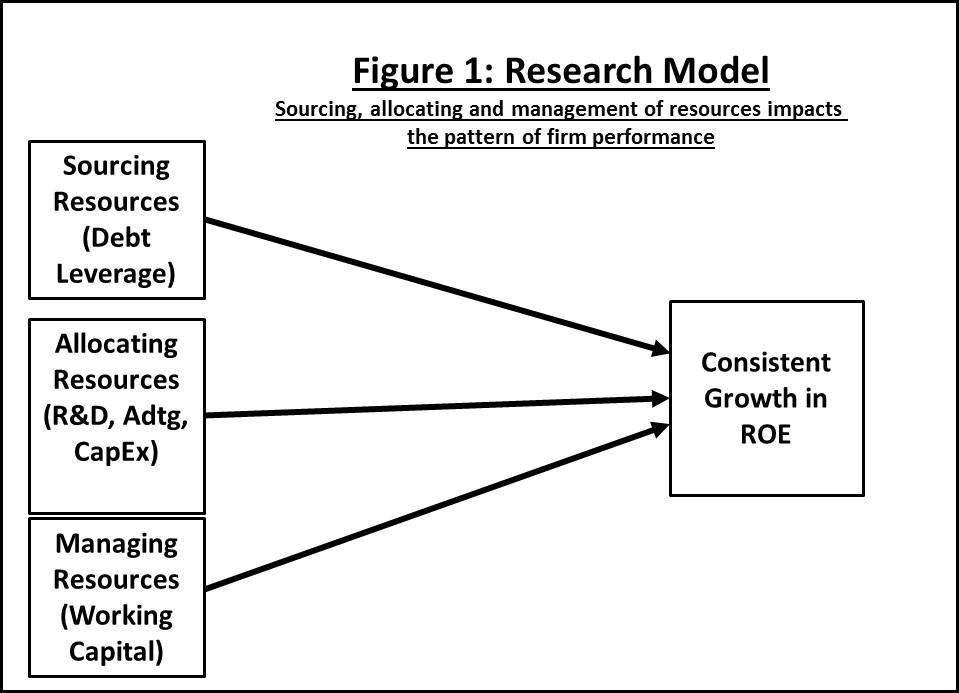

Strategic management of resources at firm level balances the trade-offs required between long-term planning and short-term problem solving. Chandler (1962), Ansoff (1965) and Andrews (1971), after studying the evolutionary patterns of several firms, developed frameworks for strategy formulation that emphasized a goal-oriented approach to how firms source, allocate and manage resources by balancing the trade-offs that the environmental context presents itself to each firm. Thus, longitudinal performance of firms is largely determined by how firms source, allocate and manage resources. However, it is also acknowledged in strategy literature that firm performance is not just a matter of firm level decisions on sourcing, allocating and managing resources. External environmental factors impact firm performance and firms continuously adapt to external forces impinging upon them, making the patterns of resource management highly variable dependent on rate of change in external environment (Mintzberg, 1978, 1987 and 1990; Eisenhardt and Zbaracki, 1992; Whittington, 1996 and 2001). Thus, the continuous alignment with the external environmental forces gives rise to significant variability in firm performance (Slevin and Covin, 1997; Burgelman and Grove, 1996) as firms differ in their capacity to understand the external changes and also in their capabilities to respond appropriately. And yet, we find that some firms consistently grow ROE (Return on Equity which is one measure of firm performance) and some firms consistently decline in ROE. Furthermore, even within consistently growing ROE firms and within consistently declining ROE firms, there is significant variability exhibited. To what extent the behavior of firms in sourcing, allocating and managing resources explains such variance across and within these two patterns of longitudinal performance? That is the crux of our inquiry in our empirical study presented here.

Literature Review

There has been a strong interest among academics in identifying determinants of organizational performance (O’Reilly III and Pfeffer, 2000; Hess and Kazanjian, 2006; Thoenig and Waldman, 2007; Gottfredson and Schaubert, 2008; Simons, 2008; Tappin and Cave, 2008; Spear, 2009). Theories of organizational performance have been rooted in the resource-based view of the firm (Lockett et al., 2009) and dynamic capabilities (Peteraf and Barney, 2003; Easterby- Smith et al., 2009). In the literature on the resource-based view and dynamic capabilities, many different factors are identified as impacting organizational performance (Tallman, 1991; Helfat, 2009). As the external environment changes with the forces of globalization, new technologies, hyper-competition, fast-changing consumer tastes, and generational and cultural differences affecting business, firms cannot afford to rest on their laurels and have to continuously adapt. Adapting to and exploiting change is essentially a creative and entrepreneurial effort and carries with it significant risks of failure (Rosenbusch, et al., 2011). That is, some firms are successful and some are not. In creating new growth platforms, firms need to reallocate and also find new sources of resources (Bogner, et al., 1996; Laurie, et al., 2006). Hence understanding firm behavior related to how they source, allocate and manage resources over time and the consequent pattern of firm performance is worth a deeper empirical study. Our research is such a study.

Capability allows a firm to convert resources and opportunities into actual functionings (Lelli, 2008: 311). As ‘guiding metrics’ that describe organizational aspirations, the goals of the firm are often intergenerational and long-term such as longevity of the firm (Brenneman, et al., 2000; De Geus, 2002; Gutwald, et al., 2014). That is, firm growth is a process (Stewart, 2006) and firms strive to achieve consistent patterns of performance over time, and accordingly utilize resources to reach those goals (Stiglitz, 2013). Our interpretation of Stiglitz (2013) work is that longitudinal firm performance stems from the pattern over time of sourcing, allocating and managing resources of the firm. Our study aims to empirically explain differences in the longitudinal performance profiles of firms in terms of the resources utilized by the firms over the same time period. We have chosen to study two distinctly opposite performance profiles, namely,

(i) firms that have consistent growth in ROE over a five year period (2010-2014) and (ii) firms that have consistent decline in ROE over the same period. By empirically examining the resource sourcing, allocation and management patterns of the ROE growth group vis-à-vis the ROE decline group, we will have identified the statistically significant determinants of longitudinal firm performance. Contrasting insights from such comparative analyses will lead to guidelines to better manage the firms that consistently face performance decline.

Stemming from the above research model, this study investigates 1) which strategy variables are important determinants of firm performance and 2) whether the set of important strategy variables for ROE increasing firms and ROE decreasing firms is different. This study, from the Compustat universe of public firms, selects firms with increased ROE each year for the time period of 2010-2014 and firms with decreased ROE each year for the same time period.

To identify the strategy variables important as determinants of firm performance, this study runs both pooled cross section regression of firm performance (ROE) and firm fixed effect regression, with year dummies in both models. To see whether the sets of important strategy variables for ROE increasing firms and ROE decreasing firms are different, this study runs two separate firm fixed effect models, one for ROE increasing group and the other for ROE decreasing group.

Research Model, Questions and Hypothesis

The conceptual model that guides our research is depicted in Figure 1 below

Sample, Variables and Measures

R&D expenditures, advertising expenditures, working capital management, capital investments, debt leverage, equity expansions, were the set of explanatory variables that are readily available in secondary sources of data and will be used to explain the variation in the longitudinal performance profiles of the firms. We used COMPUSTAT database from S&P Capital (www.spcapitaliq.com) for our research. Table 1 below describes the research variables with the abbreviated names used in our data analyses.

| Table 1: Research Variable Names and Descriptions | ||

| Variable | Variable | Variable Description |

|---|---|---|

| Name | Abbreviation | |

| Sales | Sales | is net sales in $million (Compustat item SALE) |

| Shareholder | SEQQ | is shareholder’s equity (Compustat item SEQQ). |

| Receivables | RecPay2Y | is working capital measured as the total receivables (Compustat items RECT) minus |

| minus payablesto sales | total trade payables (Compustat item AP) over net sales (Compustat item SALE). | |

| Investment tosales | I2Y | is capital expenditures (Compustat item CAPX) to net sales (Compustat item SALE) |

| Leverage | Lev | is the ratio of [long term debt (Compustat items DLTT)] plus debt in current liabilities |

| Ad_Intensity | XAD | (Compustat item DLC) to stockholders' equity (Compustat item SEQ)is advertising expenditures (Compustat item XAD) over net sales (Compustat itemSALE). |

| R&D_Intensity | XRD | is research and development expenses (Compustat item XRD) over net sales (Compustatitem SALE). |

Data Analysis and Results

Descriptive Statistics

We report the mean and standard deviation (STD) values of variables in Table 2 below, using 5 year average values of variables. In the table, firms experiencing increasing ROE each year for the 2010-2014 period tend to have lower Sales, slightly lower equity (SEQQ), lower working capital (RecPay2Y), higher capital investment (I2Y), higher debt (Lev), lower advertising expense (Ad_Intensity), higher R&D expense (R&D_Intensity), and lower return on equity (ROE), than firms experiencing decreasing ROE each year for the 2010-2014 period. Among the differences in variables, only Lev and Ad_Intensity show statistical significance, though. This could be due to the fact that we used average values of variables over sample period. A more astounding finding is the variance of variables measured by standard deviation. The variance is significantly higher for ROE increasing group.

|

Table 2: Descriptive Statistics (5 year Average) |

|||||||

| Full Sample | ROE Increasing Group | ROE Decreasing Group | |||||

|---|---|---|---|---|---|---|---|

| Variables | Mean | STD | Mean | STD | Mean | STD | Mean Diff |

| Sales ($mil) | 5645 | 24722 | 4730 | 139367 | 6547 | 32433 | -1800 |

| SEQQ ($mil) | 3451 | 11375 | 3304 | 52711 | 3595 | 14432 | -292 |

| RecPay2Y | -8.28% | 226% | -24.20% | 2740% | 7.40% | 164% | -31.60% |

| I2Y | 9.17% | 135% | 10.20% | 28891% | 8.20% | 93% | 2.00% |

| Lev | 97.82% | 680% | 121.90% | 3934% | 74.10% | 903% | 47.7%** |

| Ad_Intensity | 1.01% | 4.86% | 0.60% | 10.76% | 1.40% | 7% | - |

| R&D_Intensity | 14.40% | 638% | 17.80% | 3339% | 11.00% | 890% | 0.80%*** |

| ROE | 12.55% | 15694% | 8.42% | 33293% | 16.63% | 21879% | 6.80% |

| N | 405 | 201 | 204 | -8.21% | |||

* indicates statistical significance at 10% level. ** indicates statistical significance at 5% level. *** indicates statistical significance at 1% level.

Univariate Regression

In Table 3, we report univariate regression results on the dependent variable, ROE. Log Sales, RecPay2Y and Lev are positively correlated with the dependent variable, ROE. Log SEQQ, I2Y, Ad_Intensity, and R&D_Intensity are negatively correlated with the dependent variable, ROE. However, no one variable is significantly correlated with ROE. This result is perhaps due to the extreme values because our sample is ROE increasing or decreasing firms each year for 2010- 2014. Furthermore, combining ROE-increasing firms with ROE-decreasing firms in the sample in table 3 leads to regression to the mean due to nullification.

| Table 3: Univariate Regression based on 5 year average values | ||||

| Independent Variable | Coeff | STD. Err | R-Square | N |

|---|---|---|---|---|

| Log Sales | 3.3250 | 2.8061 | 0.0035 | 405 |

| Log SEQQ | -2.2148 | 3.1152 | 0.0013 | 405 |

| RecPay2Y | 1.2792 | 3.1595 | 0.0004 | 405 |

| I2Y | -4.2256 | 7.3290 | 0.0008 | 405 |

| Lev | 2.2717 | 1.5970 | 0.0050 | 405 |

| Ad_Intensity | -44.4104 | 178.6497 | 0.0002 | 405 |

| R&D_Intensity | -1.2234 | 1.7008 | 0.0013 | 405 |

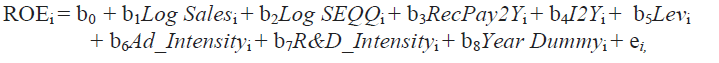

Multivariate Pooled Cross Section Regression

In Table 4, we run a pooled cross section regression with year dummies. To avoid the clutter in the presentation of results, we are not reporting the statistics of year dummies. Log Sales, I2Y, and Lev are positively correlated with ROE and Log Sales and Lev are statistically significant. Log SEQQ, RecPay2Y, Ad_Intensity and R&D_Intensity are negatively correlated with ROE and RecPay2Y, Ad_Intensity and R&D_Intensity are statistically significant. That is, firms with higher sales, higher leverage, lower receivables, lower advertising expense and lower R&D expenditures are experiencing higher ROEs.

| Table 4: Multivariate Pooled Cross Section Regression with Year Dummy Model: ROEi = b0 + b1Log Salesi + b2Log SEQQi + b3RecPay2Yi + b4I2Yi + b5Levi + b6Ad_Intensityi + b7R&D_Intensityi + b8Year Dummyi + ei, where ROEi is firm i’s ROE. Dependent variable: ROE. |

|||

| Variable | Coeff | STD. Err | P-value |

|---|---|---|---|

| Log Sales | 18.8550** | 8.3879 | 0.0250 |

| Log SEQQ | -19.3158 | 12.7859 | 0.1310 |

| RecPay2Y | -1.2399* | 0.6475 | 0.0560 |

| I2Y | 1.6807 | 1.5843 | 0.2890 |

| Lev | 2.2797*** | 0.6277 | 0.0000 |

| Ad_Intensity | -63.6437* | 33.1279 | 0.0550 |

| R&D_Intensity | -0.2374* | 0.1276 | 0.0630 |

| Year Dummy | YES | ||

| Constant | 19.7524 | 29.7607 | 0.5070 |

| Pseudo R-Square | 0.0367 | ||

| N | 2,025 | ||

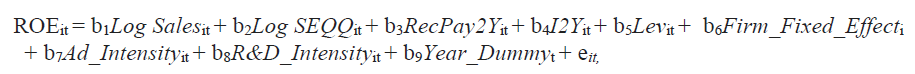

Multivariate Firm Fixed Effect Regression: Full Sample

Why Fixed Effect Regression?: While pooled cross section regression in Table 4 controls year effect by including year dummies, it is most likely exposed to the omitted variable problem since arguably ROE as a firm performance measure may be affected by variables not included in the model in Table 4. To see why not including all the variables affecting firm performance could be problematic, look at the regression model used in Table 4 as follows:

While there could be more than one important variable affecting ROE, let’s consider one such a variable, say, management ability. This variable obviously affects performance (i.e., ROE) but cannot be collected and included in the model. Because this variable is not in the model, its effect on ROE is dumped into the error term, ei. This means that the independent variables in the model and the error term are most likely correlated with each other since they are all affecting ROE, causing biases in the estimated parameters, i.e., omitted variable problem. So the nature of the omitted variable problem is that when we have an important independent variable which is hard to measure and hence excluded from the model, its effect on the dependent variable is captured in the error term and the coefficients of included independent variables present under- estimated or over-estimated effect of the variables on the dependent variable. Econometrics literature suggests the use of fixed effect model as a remedial way to the problem. (Wooldridge (2013) explains this very succinctly.)

The following is the fixed effect model used in Table 5:

| Table 5: Multivariate Firm Fixed Effect Regression with Year Dummy: Full Sample Model: ROEit = b1Log Salesit + b2Log SEQQit + b3RecPay2Yit + b4I2Yit + b5Levit + b6Firm_Fixed_Effecti + b7Ad_Intensityit + b8R&D_Intensityit + b9Year_Dummyt + eit, Note the coefficient of Firm_Fixed_Effect is not reported because technically there are (n-1) terms of different intercept terms are there, where n is the number of sample firms. Dependent variable: ROE |

|||

| Variable | Coeff | STD. Err | P-value |

|---|---|---|---|

| Log Sales | 8.6293 | 7.7452 | 0.2650 |

| Log SEQQ | 61.0331*** | 6.4002 | 0.0000 |

| RecPay2Y | -1.1718 | 2.8740 | 0.6840 |

| I2Y | 1.4788 | 2.3344 | 0.5270 |

| Lev | 4.1823*** | 0.3615 | 0.0000 |

| Ad_Intensity | -1.0666 | 61.1594 | 0.9860 |

| R&D_Intensity | -0.7918* | 0.4728 | 0.0940 |

| Year Dummy | YES | ||

| R-Square | 0.1263 | ||

| N | 405 | ||

| *indicates statistical significance at 10% level. ** indicates statistical significance at 5% level. *** indicates statistical significance at 1% level. | |||

The idea here is to run a regression that allows a different intercept for each firm which will capture each individual firm’s effect on ROE including management ability’s effect on ROE. Note as a result, b0, the common intercept term in pooled cross section is not there and is replaced by heterogeneous intercept term for each firm, Firm_Fixed_Effecti. As a result, the variation in ROE due to the cross-sectional heterogeneity of firms such as effect of management ability on ROE is captured by a different intercept for each firm (i.e., firm fixed effect) and the estimation of the model will be dependent on net effect of the variation of present dependent variables over time. So the interpretation of results should be different between pooled cross-section regression versus firm fixed effect regression. For example, if the result says a positive and significant coefficient of Log Sales, in pooled cross-section regression, it should be interpreted as “Firms with higher sales experience higher ROE.” But in firm fixed effect regression, it should be interpreted as “Firms that increase sales over time experience higher ROE.”

Comparison of Results between Pooled Cross Section and Firm Fixed Effect Models: In Table 5, we run firm fixed effect regression of ROE with year dummies. Among Log SEQQ, Lev, and R&D_Intensity which are statistically significant, Log SEQQ and Lev are positively correlated with ROE and R&D_In tensity is negatively correlated with ROE. In other words, as equity (SEQQ) and leverage (Lev) increase over time, ROE increases as well; and as R&D increases over time, ROE decreases. The results here are quite different from those in Table 4 (pooled cross section), suggesting that firms increasing equity, leverage and lowering R&D expenditures over time experience higher ROE. Higher equity and higher leverage may indicate more available financial resources (and possibly leading to more net income) and debt financing over time and lower R&D expenditures may mean slash in R&D expenditures.

While Lev and R&D_Intensity are significant in both pooled cross-section regression and firm fixed effect regression, Log SEQQ is significant only in Table 5 (firm fixed effect) and Log Sales, RecPay2Y, and Ad_Intensity are significant only in Table 4 (pooled cross section). Much of this difference is possibly due to the omitted variable absorbed in the error term in pooled cross section model but captured in fixed effect term in firm fixed effect model.

Multivariate Firm Fixed Effect Regression: ROE Decreasing Firms

Table 5 analyzes the full sample and does not render the intuition on whether the same strategic variables are correlated with higher ROE for both ROE decreasing firms and ROE increasing firms or not. In fact, ROE decreasing firms and ROE increasing firms may have different strategies to achieve higher ROE and hence the results of Table 5 may mask the difference in the set of important strategic variables between ROE decreasing and ROE increasing firms.

In Table 6, we report firm fixed effect regression results for ROE decreasing firms. Log SEQQ, Lev, and R&D_Intensity are statistically significant in explaining ROE of ROE decreasing firms. That is, as equity (SEQQ) and leverage (Lev) increase over time, higher ROE results; and as R&D increases over time, lower ROE ensues. The results may mean that more financing is helpful in slowing down the decline of ROE but more R&D expense will worsen the ROE. This is consistent with the results for the full sample in the previous table, indicating that the results for the full sample reported in Table 5 are pertinent to ROE decreasing firms.

Multivariate Firm Fixed Effect Regression: ROE Increasing Firms

In Table 7, we report firm fixed effect regression results for ROE increasing firms. Log Sales, Log SEQQ, Ad_Intensity, and R&D_Intensity are statistically significant explaining ROE of ROE-increasing firms. That is, as Sales and R&D increase over time, ROE increases as well; and as equity (SEQQ) and Ad_Intensity increase over time, ROE decreases. The results may mean that creating more sales and more R&D expense are helpful in increasing ROE but getting more equity financing or increase in advertising expense are dragging down the ROE.

| Table 6: Multivariate Firm Fixed Effect Regression with Year Dummy: ROE Decreasing Firms Model: ROEi = b1Log Salesit + b2Log SEQQit + b3RecPay2Yit + b4I2Yit + b5Levit + b6Firm_Fixed_Effectib7Ad_Intensityit + b8R&D_Intensityit + b9Year_Dummyt + eit |

|||

| Variable | Coeff | STD. Err | P-value |

|---|---|---|---|

| Log Sales | -8.8258 | 13.7459 | 0.5210 |

| Log SEQQ | 98.7569*** | 10.2491 | 0.0000 |

| RecPay2Y | -3.0155 | 5.2873 | 0.5690 |

| I2Y | 20.0018 | 17.2717 | 0.2470 |

| Lev | 4.5425*** | 0.4836 | 0.0000 |

| Ad_Intensity | 38.4990 | 82.1192 | 0.6390 |

| R&D_Intensity | -3.1747* | 1.8983 | 0.0950 |

| Year Dummy | YES | ||

| R-Square | 0.2141 | ||

| N | 1,020 | ||

*indicates statistical significance at 10% level. ** indicates statistical significance at 5% level. *** indicates statistical significance at 1% level.

The results in Table 7 are in stark contrast to those in Table 5 (full sample) and Table 6 (ROE decreasing firms), confirming that strategies useful for ROE decreasing firms are different from those useful for ROE increasing firms. Overall, results indicate that ROE decreasing firms should focus on getting more financing and hold the R&D expenses to stop the bleeding while ROE increasing firms should focus on increasing sales and R&D activities and avoid equity financing or increase in advertising expense to accelerate the trend of ROE increase. Such contrasting insights that are empirically (statistically) significant allow for pragmatic guidance.

| Table 7: Multivariate Firm Fixed Effect Regression with Year Dummy: ROE Increasing Firms Model: ROEi = b1Log Salesit + b2Log SEQQit + b3RecPay2Yit + b4I2Yit + b5Levit + b6Firm_Fixed_Effecti b7Ad_Intensityit + b8R&D_Intensityit + b9Year_Dummyt + eit, Dependent variable: ROE |

|||

| Variable | Coeff | STD. Err | P-value |

|---|---|---|---|

| Log Sales | 7.8047** | 3.2631 | 0.0170 |

| Log SEQQ | -11.2748*** | 3.4527 | 0.0010 |

| RecPay2Y | 0.4305 | 1.0717 | 0.6880 |

| I2Y | 0.7298 | 0.6636 | 0.2720 |

| Lev | -0.2518 | 0.7099 | 0.7230 |

| Ad_Intensity | -1034.1740*** | 308.3345 | 0.0010 |

| R&D_Intensity | 4.0693*** | 0.7924 | 0.0000 |

| Year Dummy | YES | ||

| R-Square | 0.2380 | ||

| N | 1,005 | ||

Limitations and Implications

Like in any performance attribution studies, there are several limitations in generalizing the findings of this study. First, this study used just one five year time period of 2010-2014. Apparently this time period can be viewed as an economic recovery period and hence it is not clear whether the similar findings can be obtained for different time periods, especially for economic downturn periods. Second, this study used only the firms which experienced increasing or decreasing ROEs every year over the five year sample period. So findings here may not applicable for the entire universe of firms. Third, this study used return on equity as a performance measure since it is arguably one of the most frequently used measure of firm performance. However, one can argue it may not be the best performance measure available out there. Fourth, the use of 5-year averages for our research variables has the potential to miss out lagged effects of investments on firm performance. Lastly, the five year time horizon that frames this study misses out the performance outcomes of long term investments such as R&D (Rosenbusch, et al., 2011).

The implications of our research findings are significant for senior managers seeking sustained performance increases for their firms. Our results show that sourcing, allocating and managing resources would be different for sustained ROE-increasing firms and for sustained ROE- decreasing firms, and suggest guidelines for firm-level longitudinal performance management. For future researchers, investigating the leading and lagging effects of some variables (e.g., R&D expenditures) is an area for further study. Context-specific knowledge for management of R&D expenditures for better results is still a largely empirically unexplored area. Wall Street analysts, who focus narrowly on quarterly performance setting the expectations for firm-level performance, have much to learn from longitudinal studies such as our current study. CEOs stressing longevity of the firm rather than annual or quarterly financial performance would find needed justification for their long-term orientation from studies such as our research.

Areas for Future Research and Noted Gaps in the Extant Literature

Given that firm performance is influenced and impacted by a large number of variables many of which are not directly measurable, a full explanation of variance in firm performance is an elusive task. However, we notice several possible directions future research can pursue to fill the gaps in the extant literature.

First, while majority studies in resource based view used cross sectional analysis, our research shows significantly different empirical results between “cross-sectional analysis” and “fixed effects analysis” in terms of signs and/or magnitudes of regression coefficients of the explanatory variables of firm performance. We believe that the explanatory variables whose coefficients change signs or magnitudes significantly between “cross-sectional analysis” and “fixed effects analysis” may be the venues managers should focus on to affect firm performance. For example, in our cross section analysis, equity (log SEQQ) had a coefficient of -19.3158 in Table 4, where pooled cross section analysis is presented, while it had a coefficient of 61.03 in Table 5, where firm fixed effect analysis is presented. Potentially this difference may be due to the firm fixed effect. In our model, we hypothesized management’s ability as one of the unobserved (latent) determinants that affect firm performance and it would have a fixed effect on firm performance each period. Under this scenario, when management’s ability is not controlled as in the pooled cross section analysis, increase in equity (log SEQQ) is shown to have a negative effect on firm performance. But when management’s ability is controlled as in the fixed effect analysis, increase in equity (log SEQQ) is shown to have a positive effect on firm performance. This may indicate that equity is an important venue through which managers affect firm performance. While this type of analysis does not reveal exactly how managers use equity to affect firm performance, at least it begs for more attention on the way managers use equity to affect firm performance. So studies comparing results between cross section analysis and fixed effect analysis using different set of explanatory variables of firm performance can guide us to the areas we should focus on more.

Second, our study used a firm performance variable based on 5 year period performance for ROE-decreasing firms and ROE-increasing firms for the entire 5 year period. Firms in each group may share a similar resources and which set of explanatory variables will explain variance in firm performance will reveal a different set of resource combinations managers use when faced with different situations. By running separate analyses between ROE-decreasing firms and ROE- increasing firms, this study reveals contrasting insights and provides guidance for ROE-decreasing firms to focus on getting more financing and hold down the R&D expenses to stop the bleeding while ROE increasing firms should focus on increasing sales and R&D activities and avoid equity financing or increase in advertising expense to accelerate the trend of ROE increase. However, more future studies are warranted to empirically support and affirm this guidance. One of the points here is that while several studies such as Klepper and Simons (2000) and Greenstein (2000) used industry specific samples to have a homogeneous sample to start off, firms which experience sustained excellent (or poor) performance also may have a similar set of resources and use the certain set of available resources to boost the profits (or to minimize the losses). Future studies may use an expanded set of observable variables to identify different resources managers use to change firm performance when faced with different situations.

Third, Resource Based View (RBV) of the firm is based on competences and capabilities that a firm possesses, and directs the measurement of these in-house competences by the resource allocation patterns of the firm. For example, R&D expenditure is a proxy measure for the innovativeness of the firm, advertising expenditure is a proxy measure for the brand equity of the firm, inventory turns is a proxy measure for efficient operations and so on. However, we realized after our study is done that the notion of competences should be broadened to include external competences that a firm can harness through alliances, partnerships, outsourcing relationships, joint ventures, etc. Considerable research has highlighted the value of firms working with partners who bring complementary skills and resources (Chinta & Culpan, 2014; Lee et al., 2011; Rothaermel & Boeker, 2008; Stuart et al., 1999). The collaborative scope of a firm’s activities is a direct measure of the extent to which a given firm is able to leverage the notion of “complementarity” in its efforts to create sustainable value in the marketplace. Future research using this expanded view of competences will challenge the RBV paradigm that has dominated strategic management field in the last two decades. For example, born-global firms in international entrepreneurship literature show the power of sustainable value creation using dynamic capabilities (Eisenhardt & Martin,2000; Helfat et al., 2007) of firms (i.e., internal and external competences via transient partnerships) even in the incipient stages of birth of a firm (Knight & Cavusgil, 2005; Freeman et al., 2006; Sullivan & Weerawardena, 2006). A given firm need not and should not rely on building only on its existing in-house set of competences.

Fourth, while our dataset from COMPUSTAT offers many advantages, there are limitations. Cooper, et al., (2009) suggest that extending the applicability of any research study is limited by the sample, time period and construct measurement issues. First, we only study variables available in the COMPUSTAT database as proxy measures (e.g., R&D expense as a proxy measure for innovativeness and advertising expense as a proxy measure for brand equity) and such proxies significantly limit the validity of measures used in our study. Second, we focus on ROE-increasing and ROE-decreasing firms in our sample for our study which leaves out many other firm performance profiles. Moving from easy-to-measure proxies to a relatively more difficult territory of hard-to-measure constructs (Eisenhardt, 2016: p. 1117) may prove crucial in establishing the generalizability and limits of our present study. There is an opportunity to test our research framework using more valid measures of resource sourcing, resource allocation and resource management. It would be especially intriguing to explore the extent to which such measurement inaccuracies are present in other settings - possibly even including information-rich contexts (e.g., how cognition affects behaviors in firms) to uncover the underlying patterns of influence and impact on firm performance. Hempel (2015) writes about Microsoft CEO Satya Nadella, who became known for his ability to reorganize assets “across once-siloed divisions” in an effort to reinvent Microsoft’s innovation capabilities and increase firm performance. Also, empirical studies in non-US contexts have enriched strategic management literature with respect to understanding determinants of firms’ performance (Crook, et al., 2011).

Fifth, an interesting direction for future research would be to examine potential boundary conditions - such as the external environment of the firm which exerts some influence on firm behavior and firm performance. Future research can utilize event study methodology, which is popular in Finance literature, to investigate the relative impact of intra-firm (internal) forces and extra-firm (external) forces that impact firm behavior and firm performance. The primary purpose of strategic management at firm level is adaptation, i.e., to fit the firm more particularly for sustained survival under the conditions of its changing environment to achieve longevity over the long term (Chakravarthy, 1982). While our research focused on internal factors, future research should take a holistic view to include both internal and external determinants of firm performance in order to provide more pragmatic guidance for action.

Sixth, in their study of nonprofit firms, Arik, et al. (2016) found empirically that resource dependency is a significant factor that impacts firm behavior and the resultant firm performance. Our study did not include resource dependency as an independent variable, but used other resource sourcing, allocation and management variables to explain the variance in firm performance. Antecedent conditions can significantly impact the temporal vectors of firm behavior. Future studies should add resource dependency and other antecedent conditions to our research frame to develop more fine-grained nuances in firm performance. Resource dependency theory has a long lineage in strategic management literature (Pfeffer & Leong, 1977; Pfeffer & Salancik, 1978; Ulrich & Barney, 1984; Healy, et al., 2015) and suggests that firms depend on external resources, and antecedent conditions matter in shaping firm behaviors.

Conclusion

Our study investigated 1) which strategy variables are significant determinants of firm performance and 2) whether the sets of significant strategy variables for ROE increasing firms and ROE decreasing firms are different. Regarding the first issue investigated, the results suggest that the significant determinants of firm performance could be different depending on the model used: while leverage (Lev) and R&D expenditure intensity (R&D_Intensity) are significant in both pooled cross-section regression and firm fixed effect regression, size of equity (Log SEQQ) is significant only in firm fixed effect model and Sales amount (Log Sales), working capital management (RecPay2Y), and advertising expense intensity (Ad_Intensity) are significant only in pooled cross section model. Much of this difference is possibly due to the omitted variables absorbed in the error term in pooled cross section model but captured in fixed effect term in firm fixed effect model. Regarding the second issue investigated, the results suggest that the set of important strategy variables is indeed different between ROE decreasing and ROE increasing groups: ROE decreasing firms should focus on getting more financing and hold the R&D expenses to stop the bleeding while ROE increasing firms should focus on increasing sales and R&D activities and avoid equity financing or increase in advertising expense to accelerate the trend of ROE increase.

We believe that our study provides an empirically-based rationale for appropriately sourcing, allocating and managing resources for sustainable performance increases at firm-level over a five year time period. We hope that our study will encourage more research on longitudinal performance at firm-level.

References

- Andrews, K.R. (1971). New horizons in corporate strategy. McKinsey Quarterly, 7, 34-43.

- Ansoff, H. (1965). Corporate Strategy: An Analytic Approach to Business Policy for Growth and Expansion. New York-San Francisco-Toronto.

- Arik, M., Clark, L.A. & Raffo, D.M. (2016). Strategic responses of non-profit organizations to the economic crisis: Examining through the lenses of resource dependency and resource based view theories. Academy of Strategic Management Journal, 15(1), 48-70.

- Bogner, W., Thomas, H. & McGee, J. (1996). A longitudinal study of the competitive positions and entry paths of European firms in the pharmaceutical market. Strategic Management Journal, 17(2), 85–107.

- Brenneman, W.E., Keys, J.B. & Fulmer, R.M. (2000). Learning across a living company: The Shell companies’ experiences. The Knowledge Management Yearbook 2000–2001.

- Burgelman, R.A. & Grove, A. (1996). Strategic dissonance. California Management Review, 38, 35-54

- Chakravarthy, B. (1982). Adaptation: A promising metaphor for strategic management. Academy of ManagementReview, 7, 35-44.

- Chandler, A.D. (1962). Strategy and structure: Chapters in the history of the American enterprise. Massachusetts Institute of Technology Cambridge.

- Chinta, R. & Culpan, R. (2014). The role of open innovation in business-university R&D collaborations. In R. Culpan (ed), Open Innovation through Strategic Alliances (pp. 145-165). New York: Palgrave MacMillan.

- Cooper, H., Hedges, L.V. & Valentine, J.C. (2009). The handbook of research synthesis and meta-analysis. Russell Sage Foundation.

- Crook, T.R., Todd, S.Y., Combs, J.G., Woehr, D.J. & Ketchen, D.J. (2011). Does human capital matter? A meta-analysis of the relationship between human capital and firm performance. Journal of applied psychology, 96(3), 443.

- De Geus, A. (2002). The living company: Habits for survival in a turbulent business.Easterby Smith, M., Lyles, M.A. & Peteraf, M.A. (2009). Dynamic capabilities: Current debates and future directions. British Journal of Management, 20, S1-S8.

- Eisenhardt, K.M. & Zbaracki, M.J. (1992). Strategic decision making. Strategic Management Journal, 13, 17-37.

- Eisenhardt, K.M., Graebner, M.E. & Sonenshein, S. (2016) Academy of Management Journal, 59(4), 1113-1123.

- Freeman, S., Edwards, R. & Schroder, B. (2006). How smaller born-global firms use networks and alliances to overcome constraints to rapid internationalization. Journal of international Marketing, 14(3), 33-63.

- Gottfredson, M. & Schaubert, S. (2008). The breakthrough imperative, how the best managers get outstanding results. HarperCollins, New York

- Greenstein, S. (2000). Building and delivering the virtual world: Commercializing services for internet access. Journal of Industrial Economics, 48, 391-412.

- Gutwald, R., Lessmann, O., Masson, T. & Rauschmayer, F. (2014). A Capability Approach to Intergenerational Justice? Examining the Potential of Amartya Sen's Ethics with Regard to Intergenerational Issues. Journal of Human Development and Capabilities, 15(4), 355-368.

- Eisenhardt, K.M. & Martin, J.A. (2000). Dynamic capabilities: What are they?. Strategic Management Journal, 21,1105–1121.

- Healy, W., Knaus, E., Matthews, W., Mir, R. & Betts, S. (2015). Strategy in an era of economic uncertainty: Integrating external and internal antecedents of firm performance. Academy of Strategic Management Journal, 14(1), 92-108

- Helfat, C.E. & Winter, S.G. (2011). Untangling dynamic and operational capability: Strategy for the (n)ever-changing world. Strategic Management Journal, 32, 1243–1250.

- Helfat, C.E., Finkelstein, S., Mitchell, W., Peteraf, M., Singh, H., Teece, D. & Winter, S.G. (2009). Dynamic capabilities: Understanding strategic change in organizations. John Wiley & Sons.

- Hempel, J. (2015). Restart: Microsoft in the age of Satya Nadella. Wired. Hess, E.D. & Kazanjian, R.K. (eds.) (2006). The search for organic growth. Cambridge University Press

- Klepper, S. and Simons, K.L. (2000). Dominance by birth right: Entry of prior radio producers and competitive ramifications in the U.S. television receiver industry. Strategic Management Journal, 21, 997–1016.

- Knight, G.A. & Cavusgil, S.T. (2005). A taxonomy of born-global firms. MIR: Management International Review,15-35.

- Laurie, D.L., Doz, Y.L. & Sheer, C.P. (2006). Creating new growth platforms. Harvard Business Review, 84(5),80-90.

- Lee, P.M., Pollock, T.G., & Jin, K. (2011). The contingent value of venture capitalist reputation. Strategic Organization, 9, 33–69.

- Lelli, S. (2008). Operationalizing Sen's capability approach: The influence of the selected technique. The Capability approach: Concepts, Measures and Application, 310-361.

- Lockett, A., Thompson, S. & Morgenstern, U. (2009). The development of the resource-based view of the firm: A critical appraisal. International Journal of Management Reviews, 11(1), 9-28.

- Mintzberg, H. (1978). Patterns in strategy formation. Management Science, 24, 934-948.

- Mintzberg, H. (1987). Crafting strategy. Harvard Business Review, 65(4), 66-75.

- Mintzberg, H. (1990). Strategy formation: Schools of thought. Perspectives on strategic management,105-235.

- O’Reilly III, C.A. & Pfeffer, J. (2000). Hidden value. How great companies achieve extraordinary results with ordinary people. Harvard Business School Press, Boston

- Peteraf, M.A. & Barney, J.B. (2003). Unravelling the resource-based tangle. Managerial and Decision Economics, 24, 309-323.

- Pfeffer, J. & Salancik, G.R. (1978). The external control of organizations: A resource dependence perspective.The Stanford University Press.Pfeffer, J. & Leong, A. (1977). Resource allocations in United Funds: Examination of Power and Dependence. Social Forces, 55(3), 775-790.

- Rosenbusch, N., Brinckmann, J. & Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing, 26(4), 441-457.

- Rothaermel, F.T. & Boeker, W. (2008). Old technology meets new technology: Complementarities, similarities, and alliance formation. Strategic Management Journal, 29, 47– 77.

- Simons, T. (2008). The integrity dividend, leading by the power of your word. Jossey-Bass, San Francisco.

- Slevin, D.P. & Covin, J.G. (1997). Strategy formation patterns, performance, and the significance of context. Journal of Management, 23, 189-209.

- Spear, S.J. (2009). Chasing the rabbit, how market leaders outdistance the competition and how great companies can catch up and win. McGraw-Hill, London

- Stuart, T.E., Hoang, H. & Hybels, R.C. (1999). Interorganizational endorsements and the performance of entrepreneurial ventures. Administrative Science Quarterly, 44, 315–349.

- Stewart, T.A. (2006). Growth as a process. Harvard Business Review, 84(6), 60–70.

- Stiglitz, J.E. (2013). Selected Works of Joseph E. Stiglitz: Information and Economic Analysis: Applications to Capital, Labor, and Product Markets. Oxford university press.

- Sullivan Mort, G. & Weerawardena, J. (2006). Networking capability and international entrepreneurship: How networks function in Australian born global firms. International Marketing Review, 23(5), 549-572.

- Tallman, S. (1991). Strategic management models and resource-based strategies among MNE are in a host market. Strategic Management Journal, 12(3), 69–82.

- Tappin, S. & Cave, A. (2008). The secrets of CEOs. Nicholas Brealey Publishing, London

- Thoenig, J.C. & Waldman, C. (2007). The marking enterprise, business success and societal embedding. Insead Business Press/Palgrave MacMillan, Basingstoke

- Ulrich, D. & Barney, J.B. (1984). Perspectives in organizations: Resource dependence, efficiency and population. The Academy of Management Review, 9(3), 471-81.

- Whittington, R. (1996). Strategy as practice. Long Range Planning, 29, 731-735.

- Whittington, R. (2001). What is strategy, and does it matter?. Cengage Learning EMEA.

- Wooldridge, Jeffrey M. (2013). "Fixed Effects Estimation". Introductory Econometrics: A Modern Approach. Mason, OH: South-Western.