Research Article: 2021 Vol: 20 Issue: 6S

Employing Augmented Dickey-Fuller Regressions and Vector Autoregressive Model to Affirm Relations of ODA and GDP for the Sustainable Development in Vietnam

Huynh Thi Thu Suong, University of Finance-Marketing

Keywords

Foreign Aids, Economic Growth, ODA, GDP, Vietnam

JEL Classifications

F35, O47, C23

Abstract

The purpose of this study focuses on examining the relationship between foreign aids (focus on ODA) and economic growth (focus on GDP) in an emerging economy such as Vietnam. Previous studies and opinions have been analyzed, synthesized and used as a theoretical basis. Employing mathematics tools to attest the relationship of ODA and GDP, this study uses their panel data for 40 years from 1980 to 2019. Research results show that, in the short term, both ODA and GDP have a negligible impact on each other. However, in the long run, although GDP has a vague effect on ODA, on the contrary, ODA has a significant effect on GDP, at the beginning of the fifth year, the relationship is not clear between ODA and GDP to promote itself increase or decrease. Foreign aid initially negatively affects the growth of nations and, over a period of time, positively contributes to economic growth. Furthermore, the results strongly support the notion that both FDI and ODA are more important determinants of GDP, implying that GDP is less likely to be dependent on ODA. In the long-term, assuming other factors remain constant, if the current ODA attraction increases by 1%, two years later, GDP will increase 0.358%. However, the limited test also shows that under the positive impact of GDP, the ability to attract ODA in the long term will gradually decrease compared to the short-term. Strengthening the legal framework would be essential for Vietnam while the choice of ODA flows can lead to negative effects on overall growth. Importantly, the effective management of foreign aid would ensure the achievement of sustainable development goals

Introduction

Nowadays, the UN and its member states are well aware of this and the newly adopted Sustainable Development Goals include economic growth as one of 17 goals (UN, 2015). Over the past 40 years, Vietnam has attracted, mobilized and used quite effectively the Official Development Assistance (ODA) capital, contributing to promoting economic growth. In particular, there are quite impressive achievements in the whole period. In terms of socio-economy, for the first time in many years, Vietnam has completed and exceeded all 13 planned targets. Regarding economic growth, GDP reached 6.81%, exceeding the set plan, which is a high level compared to other countries in the region and the world. This study will provide evidence and data regarding Vietnam's contribution to economic growth from ODA. Based on the results that Vietnam has achieved and taking advantage of the existing advantages available at home and abroad to be ready to cope with ongoing challenges, specific solutions are required to achieve high efficiency and sustainable development. To achieve a purpose of sustainable development, besides the optimal exploitation of domestic resources, it is extremely important to take advantage of external resources to contribute. Vietnam is a developing country that has received ODA capital, intending to modernize its infrastructure and improve socio-economic issues. However, the attraction of ODA capital is not commensurate with the development needs of the society and economy, significantly, Vietnam's GDP growth rate is 11-12%, while the ODA received about 6.3% of the total investment capital (IMF, 2020) due to slow implementation of policies and projects causing a lot of waste of this source of capital. With its economic characteristics and huge development investment capital required to solve many urgent problems related to many aspects of society such as urban transport, development, environmental pollution, domestic activities, drainage, flooding, traffic jams, social evils, unemployment, medical equipment, hospital sizes, parks, schools, collection-recycling and waste disposal management, clean water sources and incomplete infrastructure works. To solve this problem, Vietnam has been making great efforts together with the Central Government in attracting and improving the transparency mechanism to continue increasing the ODA capital source to solve the mentioned issues. The above is to effectively serve the growth and economic development of the country. In order to identify the current situation of ODA attraction, management and use in Vietnam concerning local economic growth and vice versa, how the use of ODA has such effects by considering local economic growth in both the short term and long term. These results are the basis for proposing recommendations and policy implications for the efficient use of this capital for the country's economic growth goals. Therefore, looking at the overall impact of external factors on Vietnam's growth, this is a period that should be considered.

Literature Review

Sustainable Development

Sustainable development first appeared in the World Conservation Strategy transformed by the International Union for Conservation of Nature (IUCN) in 1980 where economic growth was seen as an enemy of the environment (Stern, 1997). It is noteworthy that the Bruntland Commission's definition of sustainable development is briefly understood as "meeting the needs of the current generation without compromising the ability of future generations to meet the needs of their own" (WCED, 1987). This concept of sustainable development, which focuses on sustaining economic growth and progress, would not have been possible without assimilating technological progress to address the global challenges of job creation, but also enhancing human capital through the promotion of creative skills. As a contributor to better sustainability definition, analysis and realization, Sardar & Munasingheb (2003) proposed the term sustainability to describe "a comprehensive, integrated, transdisciplinary framework, equity, experience and practice to make development more sustainable”. Sustainable development is a process of improving a range of opportunities that allows individuals and communities to achieve their full aspirations and potentials in a sustainable period, while also maintaining the restoration of economic, social and environmental systems. In brief, WCED's concept of sustainable development mainly emphasizes the aspect of efficient use of natural resources and ensuring human living environment in the development process. Sustainable development is a transformational model aimed at optimizing the current economic and social benefits without harming the potential and benefits in the future (Debra, 2014; Hussain & Hassan, 2020). It is about meeting people’s needs today without undermining future generations’ ability (Ehnert, 2015; Hussain, Hassan, Bakhsh & Abdullah, 2020). Sustainable development emphasizes the importance of human capital in each sector by setting concrete targets in the field. Thus, sustainable development is about providing a better life for everyone in ways that would be as feasible in the future as they are at present.

Foreign Aids and ODA

This study is based on the theoretical framework of the impact relationship of ODA and GDP. Understanding ODA through the perspectives, followed by growth through GDP (absolute and relative) and finally testing the relationship between ODA and GDP (Moolio & Kong, 2016). The help of ODA, receiving countries creates the first premise, laying the foundation for long-term development through the investment sector, which is to upgrade economic infrastructure (Mekasha & Tarp, 2013). To measure the growth rate of an economy or a locality, this study is mainly based on the GDP target as a basis for calculation, that is, when an increase of 1 ODA capital is attracted, it may be periodic. How much GDP changes in ODA, directly or indirectly, in both the short and long term. ODA is official support from outside, including ODA provision and concessional loans, ODA is understood as a source of capital for developing and least-developed countries implemented by official national agencies. Central and Local Governments or Government Executives are funded by NGOs (Malik, 2008). Foreign capital flow consists of FDI, ODA, and migrant remittances (Driffield & Jones, 2013). ODA is closely related to the economy of developing countries because foreign capital can be absorbed to developing countries through ODA. Related literature has provided a substantial amount of evidence describing the role of ODA in the economic growth of developing countries (Siraj, 2012). In general, the foreign capital inflow through ODA projects promotes the economic growth of a recipient country in instances where the said country has appropriate policies in place (Chung, 2016). Momita, et al., (2019) suggest that before debating on the effectiveness of ODA, researchers should take the heterogeneity of ODA into account because it might be the factor that influences the impact of ODA on economic growth in a recipient country.

Economic Growth and GDP

Economic growth is the term indicating economic changes in a positive direction. It is the scaling up of the output of the economy, the increase in gross national product (GNP) and Gross Domestic Product (GDP) in a given period. In other words, economic growth is an increase in the size of the output of an economy in a given period of time. The growth rate compared to the original time will reflect the growth rate of economic output increasing rapidly or slowly. Currently, in the world, people often calculate the increase in the total value of social wealth by the quantity of Gross National Product (GNP) or Gross Domestic Product (GDP) (Amadeo & Linkedin, 2020; Hussain, Nguyen, Nguyen & Nguyen, 2021). Growth here is seen as a factor that creates an increasing attraction for both domestic and foreign investment. With a guaranteed growth, the accumulation capacity of the economy is likely to increase, and then the scale of domestic capital that can be mobilized will be improved. With the economy growing, higher growth prospects are also a good signal to attract foreign investment capital.

Relations ODA and GDP Supporting for Sustainable Development

Previous studies on the relationship between ODA and economic growth have been carried out by many scholars, especially in developing countries. The results show that ODA has multidimensional impacts on national or local economic growth. Malik (2008) study the relationship between ODA and growth using time series data. They analyze both short and long-term perspectives and conclude that ODA in the short-term has a positive effect, and in the long-term, ODA is a hindrance to growth. Burnside & Dollar (2000) tested on 56 countries using cross-sectional data, and then concluded that ODA had a positive effect on growth and is closely related to recipient country policy. Hansen & Tarp (2001) study the relationship between ODA and GDP per capita using time series data (20 years) also conclude that ODA is an important factor affecting growth. Mohey-ud-din (2005) focuses on researching the impact of ODA on economic growth (GDP) and his findings show that in the least developed countries, foreign capital has a positive effect on economic growth. The study of Feeny (2006) revealed the effectiveness of aids in terms of political economy and country, there is little evidence that aids and its various components have contributed to economic growth. Heidelberg & Chatrna (2010), this study indicated that ODA has had a certain effect on economic growth in developing countries. Whether indirectly or directly, ODA and GDP are interrelated, but until now there are still many views on the dialectical relationship between these three categories (Burnside & Dollar, 2000), including (i) The first point of view, although not always successful, on average, ODA has a positive impact on economic growth and sustainable development. The most obvious economic rationale for ODA is to accelerate growth through new investment financing, especially investments in public goods. ODA is used to build roads, harbors, power plants, schools and other infrastructure to help accelerate capital accumulation, which, if invested effectively, will speed up the growth rate. (ii) The second point of view, ODA has little or no effect on growth and may undermine growth. ODA has no negative impact on growth when most of this capital is wasted. If donors build a cumbersome bureaucracy or spend aid money on highly paid technical experts from their home countries to write achievement reports, then ODA will not help growth. (iii) The third point of view, ODA has a conditional relationship with growth, stimulating growth only in certain situations, such as in countries with good policies or institutions. This point of view begins by accepting the idea that ODA has mixed results, even where research shows a common positive relationship, there is no evidence that ODA has an impact on all countries at all times. This view acknowledges that ODA appears to have stimulated growth in some countries under certain circumstances but failed to do so in others, and focuses on trying to interpret the key traits that can explain this difference. Ji, Woo & Kang (2014) conducted one of the most noted studies in recent years on this topic and concluded that ODA contributes to growth if the country has a good policy climate. An interesting exception was Akramov (2012), who compared different types of foreign aid on target, and concluded that aid for production sectors and infrastructure has positive effects on economic growth. Such a viewpoint is important as it could provide useful policy implications on the role of ODA. Indeed, it is difficult to identify the causal effect of ODA on the GDP growth of recipient countries since there are a large number of confounding factors which affect the GDP growth and ODA inflows. However, based on the assumption that industrial growth is a key component of economic growth, it would be relevant to argue that ODA contributes to economic growth. Developing countries may be able to catch up in terms of productivity primarily in manufacturing industries and, hence, the expansion of their share in a developing country is a critically important condition for overall economic growth. Therefore, this study will elaborate argument that in Vietnam, ODA contributes to real GDP growth by promoting the industrial growth of recipient countries. It is worth noting that Burnside and Dollar (2000) examine how the policies of the recipient governments affect ODA although they did not look into the contents of the ODA. Akramov (2012) is an exception that compares different types of foreign aid in terms of its objectives, although he does not disaggregate it in terms of donors. He concludes that aid for production sectors and infrastructure sectors re has positive effects on economic growth.

Data and Methodology

The qualitative method uses descriptive statistical techniques to collect ODA data by year to assess the impact of ODA on Vietnam's GDP in the period 1980-2019. Simultaneously collect data and analyze the economic growth in this locality. In addition, the study applied deductive methods, going from generalization to specific problems associated with practice, combined with descriptive statistical methods such as analysis, comparison and synthesis. The quantitative method by employing ADF and VAR models to analyze the impact of ODA on GDP. Adopting the ADF model helps to solve the single co-integration problem. Application on small sample size is a useful method, so application is encouraged in local studies because the data is often very limited; all variables can be assumed to be endogenous, consider co-integration by the method of constraint test without the condition that variables must have co-integration of the same order, short term and long term relations are estimated simultaneously in the same equation.

Findings

Research Results

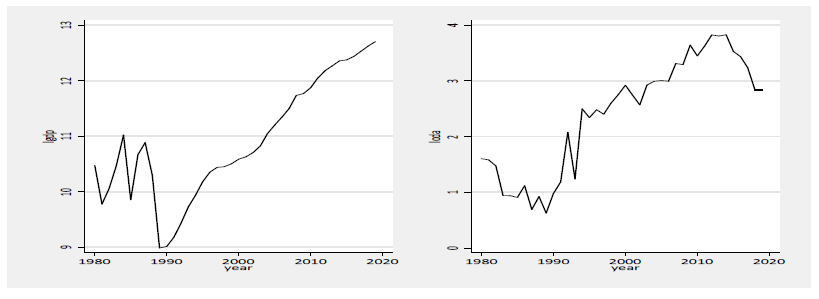

To evaluate the relationship of ODA and GDP in Vietnam, this study uses quantitative methods analyzed on time series data, the research variables are collected by year over a period of time 1980-2019 includes ODA (billion USD) and GDP (billion VND) from the General Statistics Office, the two variables are logarithmic before being analyzed.

The results of the statistics Table 1 in Figure 1 provide descriptive statistical indicators used to generalize the study data set.

| Table 1 Descriptive Analysis |

||

|---|---|---|

| GDP | ODA | |

| Mean | 91,495.63 | 16.81166 |

| Median | 43,786.00 | 14.50296 |

| Maximum | 329,537.0 | 45.96455 |

| Minimum | 7,991.000 | 1.871519 |

| Std. Dev. | 92,774.20 | 13.48473 |

| Coefficient of Variation | 1.014 | 0.802 |

| Skewness | 1.196449 | 0.733050 |

| Kurtosis | 3.114731 | 2.498873 |

| Jarque-Bera | 9.565 | 4.001 |

| Probability | 0.008 | 0.135 |

| Observations | 40 | 40 |

Figure 1: Statistical Results Depicting GDP and ODA

Source: Source: Results obtained from the author’s data process (2021)

During the survey period, the average GDP was about 91,495.63 (billion VND), the average ODA was about 16,811.66 (billion USD). In terms of the variability of the data, the GDP chain has a larger impact than the ODA chain because the coefficient of variation of GDP is 1.014 greater than the coefficient of variation of the variable ODA (0.802). All studied variables have a right skew distribution (because skewness coefficients are positively skewed). The ODA variable has a standard distribution (statistic has a probability value greater than 0.05), in contrast, the distribution of the variable GDP is not normal because the statistic has a probability value less than 0.05.

Testing of Stationary Properties

Nelson & Plosser (1982) argue that most time series are non-stationary at the order I(0), so before analysis it is necessary to test whether the time series is stationary or not. The stopping time of the time series is significant in determining the efficiency of the estimation method used. If the time series does not stop then the assumption of the OLS (Ordinary Least Square) method is not satisfied. Accordingly, the t-tests or F-tests are not valid (Brooks, 2008). The results in the below Table 2 present the stationary test results according to two methods ADF and PP, considering the original series (original series), the remaining chains are non-stop. For the 1-difference sequence, all chains stop at a significance level of 1%, where the ADF-exported chain stops at a 5% significance level.

| Table 2 Stability Test According To ADF and PP |

||||

|---|---|---|---|---|

| Variable | Original String | Sequence of Degree 1 Difference | ||

| ADF | PP | ADF | PP | |

| lgdp | -2.582 | -2.53 | -6.654*** | -6.766*** |

| loda | -2.117 | -2.116 | -9.518*** | -5.467*** |

The results in the above Table show that, considering the original series (original series), the variables do not stop in the case of a trend. In contrast, for a sequence of 1 difference, sequences stop in both cases without bias and trending. So the sequence GDP and loda both stop at the first difference or the difference of I(1).

VAR Estimation

In time-series data analysis, it is particularly important to determine the appropriate delay order. If the delay order is too long, the estimates will be ineffective, otherwise too short, the residual of the estimate does not satisfy the white noise, which falsifies the analytical results. To choose the optimal delay order, one usually bases on criteria: AIC (Akaike Information Criterion), SBIC (Schwart Bayesian Information Criterion) and HQIC (Hannan Quinn information criterion). According to AIC, the optimal delay order SBIC and HQIC are selected as the hysteresis order with the smallest index. (Table 3)

| Table 3 Estimation of the Optimal Hysteresis Order |

||||||||

|---|---|---|---|---|---|---|---|---|

| lag | LL | LR | df | p | FPE | AIC | HQIC | SBIC |

| 0 | -89.3124 | 0.54727 | 5.07291 | 5.10362 | 5.16089 | |||

| 1 | -22.8485 | 132.93 | 4 | 0 | 0.017038 | 1.6027 | 1.69481 | 1.86662 |

| 2 | -13.4413 | 18.815* | 4 | 0.001 | 0.012653* | 1.30229* | 1.45582* | 1.74216* |

| 3 | -12.428 | 2.0267 | 4 | 0.731 | 0.015033 | 1.46822 | 1.68315 | 2.08403 |

| 4 | -10.0097 | 4.8366 | 4 | 0.304 | 0.016606 | 1.55609 | 1.83244 | 2.34785 |

The statistical results show that according to AIC, SBIC and HQIC standards, the most suitable hysteresis order results used in the analysis are the second order.

Table 4 presents the results of the VAR model, in equation (1) the variable has 5% statistical significance. This means that if the current ODA attraction increases by 1%, 2 years later, GDP will increase by an average of 0. 358% (assuming other factors are unchanged). Similarly, equation (2) shows that ODA capital is affected by itself in different directions. Specifically, the variable coefficient with the negative sign has a statistical significance of 10%, on the contrary, the variable coefficient with a positive sign. This explains that ODA has had a positive effect on itself since year 2.

| Table 4 Estimation Results Of Var Model |

||

|---|---|---|

| (1) | (2) | |

| Variables | Δlgdpt | Δlodat |

| Δlgdpt-1 | -0.057 | -0.112 |

| (0.153) | (0.138) | |

| Δlgdpt-2 | -0.204 | 0.081 |

| (0.145) | (0.131) | |

| Δlodat-1 | 0.166 | -0.295* |

| (0.175) | (0.158) | |

| Δlodat-2 | 0.358** | 0.276* |

| (0.178) | (0.160) | |

| Constant | 0.039 | 0.053 |

| Observations | 40 | 40 |

Source: Results obtained from the author’s data process (2021)

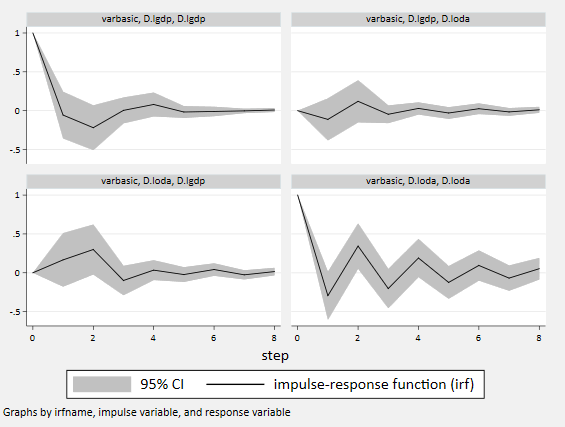

Analysis of Impulse Response Function

Figure 2 shows the correcting trend of the studied variable after it receives shocks from other variables. As for the GDP variable when affected by shocks itself, this indicator fluctuates strongly in the first 2 years, then stabilizes from the second year onwards. In addition, when GDP receives shocks from ODA variables, GDP tends to decrease slightly in the first year, and through the second year, GDP tends to increase and stabilize since the second year. On the other hand, the variable ODA fluctuates quite strongly when it receives shocks from itself and tends to stabilize after the fifth year. However, shocks from GDP cause a strong increase in the first two years, decreased slightly in 3rd year and stabilized from AU 3rd year.

Figure 2: Results of Impulse Response

Source: Results obtained from the author’s data process (2021)

The purpose of variance decomposition tells us which variable the shock in each variable is affected by other variances. Table 5 shows that fluctuations of economic growth of 1 year earlier explained 100% of its fluctuations at present. Similarly, fluctuations of the 3rd year economic growth explain 91.6739% of the current economic growth volatility, the rest is analyzed from other variables, of which 8.3261% is from ODA. Similarly, 1st year ODA volatility explains 99.7597 of its current volatility, the rest is explained from other variables, of which 0.2403% GDP.

| Table 5 Results of Decomposition of Variance |

||

|---|---|---|

| Δlgdp | ||

| Latency | Δlgdp | Δloda |

| 1 | 1 | 0 |

| 2 | 0.978236 | 0.021764 |

| 3 | 0.916739 | 0.083261 |

| 4 | 0.910372 | 0.089628 |

| 5 | 0.91015 | 0.08985 |

| 6 | 0.909844 | 0.090156 |

| 7 | 0.908736 | 0.091264 |

| 8 | 0.908295 | 0.091705 |

| Δloda | ||

| 1 | 0.002403 | 0.997597 |

| 2 | 0.019714 | 0.980286 |

| 3 | 0.035657 | 0.964343 |

| 4 | 0.037345 | 0.962655 |

| 5 | 0.037562 | 0.962438 |

| 6 | 0.038241 | 0.961759 |

| 7 | 0.038742 | 0.961258 |

| 8 | 0.038921 | 0.961079 |

Discussion

The estimation results of the ADF model show that the regression coefficient component in the short-term is statistically significant at the level of 5% at 1 (year) delay. The coefficient of the positive variable is statistically significant at 5%, meaning that there is statistical evidence to confirm GDP has a positive effect on ODA flows and assumes other factors remain unchanged if present. At GDP of 1%, an average year after, ODA attraction increases about 4.04533%. However, the constraint test also shows that under the positive influence of GDP, the long-term ODA attraction will gradually decrease compared with the short-term. In the long run, if GDP increases 1%, ODA attraction increases by an average of 2.06045% (assuming other factors remain constant). The quantitative research results show that although there is no clear evidence of the direct impact of ODA on GDP, however, by the tests using the VAR model above, it implies that ODA and GDP are related. Besides, the direction of the impact of ODA on growth is unclear, this is completely consistent with the three perspectives on ODA and GDP presented above. Research results indicate that in the long-term, ODA is a positive factor to promote GDP. In the short-term, ODA flows have a positive impact on GDP growth but it is delayed by 2 years. To further promote the effectiveness of this aid, implied policies should consider concluding, (i) Agencies at all levels need to agree on the view that ODA inflows are an important part of the state budget, so it is necessary to manage and use them effectively, if not effective, it will create a burden for the nation even for future generations. Therefore, the information about the use of this fund needs to be transparent and closely monitored by the competent authorities. (ii) The Government needs to have a strategy to attract this capital in the long term following the socioeconomic development conditions. Further efforts to improve policies and mechanisms are to ensure adequate and timely reciprocal capital for ODA programs and projects to achieve the highest, fastest, and most effective disbursement rate. Moreover, it is necessary to prioritize investment in high-efficiency projects accompanied by clear assignment and assignment to promote efficiency and minimize the negative potential in projects. Thirdly, the ministries and agencies must have plans to train and improve the capacity of officials in the field of management and use of aid sources in a professional manner, meeting the development needs in the new era.

Conclusion and Policy Recommendations

Test the relationship between ODA and GDP in Vietnam, the empirical model results have shown that ODA has a causal relationship with GDP, although the results indicate that the impact of ODA on GDP is not strong, and it is also unclear. In another meaning, it is not direct, significantly, it must be confirmed that ODA is an additional source of capital for investment in socio-economic infrastructure development and a catalyst for other investment sources such as FDI and investment capital private sector. However, ODA capital only promotes its effects in a good management mechanism, stable political environment, and open policy. On the contrary, it does not promote positive effects but leaves the burden of debt. Thus, the entire content in this study presented in the above sections has proven that, in the past time, ODA has had a direct impact on economic development but not direct impact on GDP. In turns, GDP also has an opposite effect continue this capital. In fact, ODA is very important for underdeveloped and developing countries in the early time for establishing. Numerous previous studies on ODA have all confirmed the important role of ODA for sustainable development through GDP. However, the studies focus mainly on the macro aspect of ODA without the research on assessing the factors affecting the efficiency of ODA use in an experimental aspect. Therefore, this thesis focuses on analyzing and evaluating the effectiveness of ODA use in the aspect of project implementation in Vietnam. However, the impact of ODA on GDP in this locality is not clear due to many reasons, both subjective and objective. Although Vietnam is a country with socio-economic development indicators, its infrastructure is still inadequate, so it is necessary to invest heavily in infrastructure projects, which require large capital. The capital recovery time is slowly, affecting GDP has a certain delay. With a huge investment demand in the coming period but limited state resources, Vietnam needs to have reasonable mechanisms and policies for all economic sectors to participate in infrastructure investment and business together appropriate form to contribute to promoting socio-economic development in accordance with the direction of its development strategy. As ODA is expected to promote the economic development and sustainable of developing countries. However, the question of whether ODA really has promoted the economic development of developing countries remains unclear. Especially, there have been many studies to examine the relationship between ODA and economic growth by introducing different instrumental variables. In this study, the author only conduct examining two variances of ODA and GDP. Combining the research results and the real context of Vietnam, some implied policies that Vietnam needs to strengthen its productive assets, with priority given as following (i) Create more dynamic firms, that require encouraging competition and easing firm entry and exit ensures the flow of resources to the most innovative and productive firms. This can only happen in a supportive business environment that ensures access to finance, transparent regulations and legal protections. (ii) Build more efficient infrastructure, it requires Vietnam has built up a large stock of infrastructure. It now needs to improve the efficiency and sustainability of infrastructure services, including financing, and operations and maintenance. (iii) Improve more skilled workers and opportunities for all, the scores of this country well on basic education, but it will need to promote university and vocational-technical skills that are becoming even more important for a productivity- led growth model. Those facing barriers entering the labor market, including ethnic minorities, should be provided with greater opportunities—to boost both social equity and economic growth as the population ages and the labor force shrinks. (iv) Oriented to green economy, means that sustainable development requires more effective management of renewable natural resources such as land, forest and water; stricter pollution controls, including in major urban centers; and mitigation of and adaptation to the inevitable growing impacts of climate change.

Recommendations on Policy Implications

Being one of the countries with many efforts and achievements on the road to sustainable development, Vietnam has enacted a national program for sustainable development, and established a National Council for Sustainable Development and Competitiveness Enhancement. Vietnam ranked 69/190 in terms of business environment (World Bank assessment in 2018); ranked 77/140 in terms of competitiveness (assessed by the World Economic Forum-WEF), ranked 54/162 countries in the top 3 of countries leading in sustainable development (behind Thailand in ASEAN). Therefore, the awareness issue must be taken into account from a macro perspective, the mobilization and use of ODA must take into account the national debt strategy. ODA capital with preferential loan conditions will gradually decrease with GDP growth, so it should be used most effectively. Do not take out ODA loans to implement projects that can be done on their own, or if loan conditions cancel out or significantly reduce the concession of interest rates. Based on this strategy, ministries, branches and localities need to formulate plans on the use of ODA in the sector and local development strategies. There is a need for coordination between authored agencies in making a list of projects managed by ministries, sectors and localities, based on the planning of each locality and economic region, in which the issue is clearly stated and reciprocal capital issue. Therefore, borrower, loan terms, deadline and repayment schedule for each project. This list is communicated to each ministry, branch and locality so that the ODA beneficiaries and relevant specialized management agencies are responsible for making plans for the repayment of ODA loan and interest. The planning of ministries, branches and local planning must be harmonized and integrated and must show the direction of investment to develop regions and territories. The planning on using ODA for capital construction investment must be in the master plan for spatial development, stable and sustainable land use and management. Specifically: (i) Well maintaining macro-environmental conditions, including exchange rates, interest rates, and inflation in order to maintain macroeconomic stability, and strengthen the banking and financial system is an important condition for can mobilize diversified capital sources, including ODA capital for development, in order to strongly enhance local economic potentials. (ii) Gradually decreasing and shifting to lower concessional sources (including less concessional loans such as ADB OCR loans, WB's IBRDs, and Japan's loans. It is necessary to have specific calculations with mid-term and long-term to coordinate the use of funds in the most appropriate way. (iii) Promote the disbursement of committed ODA, associated with the flexible use of new ODA sources, including ODA as bait. It is necessary to perform well the disbursement of committed ODA sources, especially the ground conditions, to ensure the reciprocal capital in the revised Budget Law (or prioritize the allocation of annual budget capital for the projects. ODA project) and improving the quality of ODA management. From mastering the process of using ODA capital to more flexible use of foreign loans with fewer concessions, but can be added as a primer for projects, including infrastructure projects. Welcome all large-scale partners of the private sector when the public sector divests, to make the country's investment strategy more flexible. This suggests that Vietnam can catch up in terms of productivity primarily in manufacturing industries, therefore, a developing country, regardless of its geographical location, may be able to promote economic growth from the development of the manufacturing industry. As seen above, industrialization is crucial for economic growth. The shift from agriculture to industry does not require high technology or a large accumulation of capital right from the beginning. Many researchers suggest that a country should start by imitating technologies from developed countries in order to improve productivity rapidly (Islama & Munasingheb, 2003; Moheyuddin, 2005; Rajan & Subramanian, 2008; Szirmai & Verspagen, 2015). Based on the assumption that industrialization promotes economic growth, ODA can contribute to economic growth by giving a push to industrialization. Standard economic theory suggests a positive relationship between foreign aid and economic growth. Development aid, in this line of thinking, adds to the recipient country capital and enhances economic growth, contributing significantly to the productive capacity of the recipient economy (Minoiu & Reddy, 2010). This view suggests a positive causal relation between foreign aid and economic growth per capita. There are, however, other theoretical explanations that refute this view, claiming that foreign aid is negatively related to economic growth. In this line of thinking, development aid is ineffective, and might even be harmful to recipient countries as aid crowds out domestic savings by accelerating consumption expenditures, distorts relative prices, and reduces productivity and international competitiveness. The effectiveness of foreign aid in sustaining economic growth and development has long been a major research topic in applied economics. Empirical evidence on this issue, however, remains mixed. Several studies provided empirical evidence in support of aid effectiveness, at least in certain macroeconomic environments and under certain conditions (Burnside & Dollar, 2000; Minoiu & Reddy, 2010). However, failed to find a significant relationship between development aid and economic growth (see Boone, 1994; Easterly, Levine & Roodman, 2004, among others). Studies such as Bobba & Powell (2007); Dreher & Langlotz (2015) on the other hand, suggest that foreign aid might have a negative impact on economic growth.

The Solution to Promote Growth is to Facilitate Continued Prestige to Attract ODA Capital

Thanks to the private sector’s access to and use of ODA and concessional loans from foreign donors, Vietnamese government should have a priority for businesses operating in 3 priority areas. First, the field that supports economic growth through improved infrastructure. The second is to support the poor. The third is climate change. In order to get an ODA loan, a private enterprise must be in one of the three above areas. Therefore: (i) To flexibly, proactively and synchronize Vietnam's socio-economic development by continuing to accelerate the implementation of the program to support economic restructuring and growth model transformation, local economy; continue to improve the business environment, enhance the competitiveness of businesses; continue to develop several major service sectors with potentials and strengths of Vietnam. At the same time, it is necessary to focus on strengthening the review of the job loss and underemployment situation; expanding job transaction activities to each district and strengthening job transaction sessions. (ii) Economic growth and development must ensure sustainability, sustainable economic development needs to be clearly defined, an investment must serve integration. Slow reform administrative procedures are strongly hindering the State apparatus as a leading breakthrough and must be drastic, the next step is to put an end to the planning and construction of infrastructure, small-scale industrial clusters to attract or even invite businesses to relocate. Need a great reform in organizational direction, assignment, and close inspection of the implementation process. Because Vietnam's comparative advantage has decreased gradually, it is forced to recalculate the product structure, it is not advisable to invest too many common sectors, to switch to high-value and high-gray matter issues as supporting high quality human resources, improving regimes and policies through technical cooperation, advertising high technology of agriculture, developing urban and transport network construction, building modern infrastructure for international business.

References

- Kamiljon, A.T. (2012). Foreign aid allocation, governance, and economic growth. International Food Policy Research Institute, 7(2), 4-12.

- Addison, T., & Tarp, F. (2015). Aid policy and the macroeconomic management of aid. Journal of World Development, 69, 1-5.

- Amadeo, K., & Linkedin, F. (2020). Economic growth, its measurements, causes, and effects, how it's measured and what are the causes, world economy review. Investopedia Pub., US.

- Boone, P. (1994). The impact of aid on savings and growth. Centre for Economic Performance Working Paper, No. 677. London School of Economics.

- Bobba, M., & Powell, A. (2007). Aid and growth: Politics matters. Inter-American Development Bank Working Paper, No. 601, Washington, DC.

- Brooks, C. (2008). Introductory econometrics for finance. Cambridge University Press, UK.

- Burnside, C., & Dollar, D. (2000). Aid, policies, and growth. American Economic Review, 90(4), 847-868.

- Chung, T.Y. (2016). Effectiveness of Korean official development assistance. International Journal of Business Review, 20(4), 211–229.

- Huy, D.T.N., Loan, B.T.T., & Anh, P.T. (2020). Impact of selected factors on stock price: A case study of Vietcombank in Vietnam. Entrepreneurship and Sustainability Issues, 7(4).

- Dreher, A., & Langlotz, S. (2015). Aid and growth. New evidence using an excludable instrument. CEPR Discussion, 108-111.

- Debra, L. (2014). Vietnam’s sustainable development policies: Vision vs. implementation. World Scientific Book, 2014.

- Driffield, N., & Jones, C. (2013). Impact of FDI, ODA and migrant remittances on economic growth in developing countries: A systems approach. European Journal of Development Review, 25(2), 173–196.

- Easterly, W., Levine, R., & Roodman, D. (2004). Aid, policies, and growth: Comment. American Economic Review, 94(3), 774-780.

- Ehnert, I. (2015). Reporting on sustainability and HRM: A comparative study of sustainability reporting practices by the world’s largest companies. The International Journal of Management, 88-108.

- Feeny, S. (2006). Policy preferences in fiscal response studies. Journal of International Development, 18(8), 1167–1175.

- Feeny, S. (2007). “Impacts of Foreign Aid to Melanesia.” Journal of the Asia Pacific Economy, 12(1), 34–60.

- IMF. (2020). Statistical data of Vietnam. Available at: https://www.imf.org/en/Countries/VNM#countrydata

- Kang, H.J., & Kim, K.K. (2019). The impact of S&T ODA on economic growth of the recipient countries. Journal of Science Technology Policy, 2(1), 31–57

- Hussain, S., Hassan, A.A.G., Bakhsh, A., & Abdullah, M. (2020). The impact of cash holding, and exchange rate volatility on the firm’s financial performance of all manufacturing sector in Pakistan.

- Hussain, S., & Hassan, A.A.G. (2020). The reflection of exchange rate exposure and working capital management on manufacturing firms of Pakistan. Talent Development & Excellence, 12(2).

- Hussain, S., Nguyen, Q.M., Nguyen, H.T., & Nguyen, T.T. (2021). Macroeconomic factors, working capital management, and firm performance—A static and dynamic panel analysis. Humanities and Social Sciences Communications, 8(1), 1-14.

- Hansen, H., & Tarp, H. (2001), Aid and growth regressions. Journal of Development Economics, 64(2), 547-570.

- Heidelberg, E., & Chatrna, D. (2010).The effect of foreign aid on economic growth in developing countries. Journal of International Business and Cultural Studies, 3, 1-13.

- Hanh, H.T., Huy, D.T.N., Phuong, N.T.T., & Nga, L.T.V. (2020). Impact of macro-economic factors and financial development on energy projects - Case in ASEAN Countries, Management, 24(2). DOI:10.2478/manment-2019-0051

- Ji, H.R., Woo, M.J., & Kang, M.G. (2014). A study on the effect of ODA’s aids and urbanization on developing countries’economic growth through panel analysis. Journal of Korea Plan Association, 49(4), 179–194.

- Moheyuddin, G. (2005). Gender, economic development and poverty reduction. World Bank Institute, Washington DC. USA.

- Minoiu, C., & Reddy, S. (2010). Development aid and economic growth: A positive long-run relation. The Quarterly Review of Economics and Finance, 5(1), 27-39.

- Moolio, P., & Kong. S, (2016). Foreign aid and economic growth: Panel Cointegration Analysis for Cambodia, Lao PDR, Myanmar, and Vietnam”. Journal of Business and Economics, 2(4), 417-128.

- Mekasha, T.J., & Tarp, F. (2013). Aid and growth: What Meta-analysis Reveals. Journal of Development Studies, 49(4), 564–583.

- Mallik, G. (2008). “Foreign aid and economic growth: a cointegration analysis of the six poorest African countries.” Economic Analysis and Policy, 38(2), 251–260.

- MOPI. (2021). Statistical handbook of Vietnam. Available at: http://ncif.gov.vn/en/Pages/default.aspx

- Niyonkuru, F. (2016). Failure of foreign aid in developing countries: A quest for alternatives. Business and Economics Journal, 7, 1-9.

- Nelson, C., & Plosser, C. (1982). Trends and random walks in Macroeconmic time series. Journal of Monetary Economics, 10(i982), 139-162.

- Rajan, R., & Subramanian, A. (2008). Aid and growth: What does the cross-country evidence really show? The Review of Economics and Statistics, 90(4), 643-665.

- Islama, S., & Munasingheb, M. (2003). Making long-term economic growth more sustainable: Evaluating the costs and benefits. Ecological Economics, 47, 149 – 166.

- Stern, E.K. (1997). Crisis and learning: A conceptual balance sheet. Journal of Contingencies and Crisis Management, 5(2), 69–86.

- Szirmai, A., & Verspagen, B. (2015). Manufacturing and economic growth in developing countries, 1950-2005. Structural Change and Economic Dynamics Journal, 34, 46-59.

- United Nations. (2015). General assembly resolution 70/1, Transforming our world: The 2030 Agenda for Sustainable Development., US.