Research Article: 2022 Vol: 21 Issue: 4S

Enhancing Customers Deminer and Criteria towards Selecting Islamic Banks

Mohammad Kamal Kamel Afaneh, Imam Mohammad Ibn Saud Islamic University (IMSIU)

Citation Information: Afaneh, M.K.K. (2022). Enhancing customers’ deminer and criteria towards selecting Islamic banks. Academy of Strategic Management Journal, 21(S4), 1-11.

Abstract

This study aims to determine customer's attitude and deminer illustrative elements for the selection of Islamic banks in Saudi Arabia. Basically, distinguish factors shape client's attitude toward Islamic Banks that are considered in clients' decision choices identified with various behavioral theories. Information were arbitrarily gathered from Islamic banks clients in Saudi Arabia. A poll was created, circulated, and examined through the model of t-test on 138 clients. The outcomes show that clients consider a few factors in their decision that were assigned among religious and non-religious. Basically, religious factors are standards, nonappearance of interest, religious sanction or avocation, profit sharing, and Islamic value premise of banking services. The non-religious related factors were adequate branches, caring and agreeable, appearance and inward embellishment design, quick services, reaction to the requirements of their clients, adequate number of staff, giving clients the first concerns, clients' necessities to incorporate unveiling data as a piece of accounting framework ampleness. Sufficient regard for each client, competitive service costs, and the impact of friends and family. It is beyond the realm of possibilities to expect to say that religious factors are sufficient, yet the interest free banking significantly addresses the non-religious or the economic variables, and the profit-sharing guideline is significant; Policymakers should consider this to develop an positive perspective toward Islamic banks. This present review's discoveries suggest that religious and non-religious values fundamentally impact clients' expectations and decisions. It proposes that religious decree is the main variable, and the accessibility of data frameworks revealing clients' requirements.

This study guarantees that Islamic banks are needing drawing in and retain clients. To do as such, they would need to utilize related techniques intended to address such issues. Non-religious as the sole inspiration for picking Islamic banks has been expanded by fixing many related theories that are relied upon to widen Islamic banks' degree in creating methodologies toward clients' attitude development.

Introduction

Banks' comparability of services and the developing competitiveness in the banking industry have turned into a central issue of banks today. Consequently, banks should recognize separating factors that decide clients' preferred premise among suppliers of financial services. Banks would need to pay a lot of attention regarding their different clients' demographics, for example, their religious convictions to improve clients' confidence in the financial firm and support giving assorted choices. Building up certain client’s attitudes towards Islamic banks is the essential worry of this examination paper. Clients are the main partners in any association; in this manner, a lot of interest ought to be centered around client retention and upgrading profits (N'Goala, 2007; Pappas & Perotti, 2021). Customers have various Behaviors or responses toward business signals (Hoffman & Bateson, 2016). Because of finance behavior theory, Islamic banks might have experienced an oppressive relationship or an irrational one that arrived at a state of disappointment particularly when they gave a good advice and their clients would not acknowledge. Simultaneously clients might respond distinctively toward banks business gestures (Hoffman & Bateson, 2016). As a rule, banks are trusted to protect clients' money; clients' requirements in front of the banks' goals, straightforwardness of expenses and veritable aim to give relevant advice. This present paper's fundamental goal is to comprehend the clients' rationale or attitudinal behavior on how they see Islamic banking. The analysts profited from many related theories that arrangement with the clients' essential assumptions and relationships.

Literature Review

Islamic Banks Concept

Islamic banks are viewed as financial intermediation organizations whose rules, statutes, and procedures unequivocally express their obligation to explicit standards in prohibiting to manage interest. Simultaneously, they are not holier than thou; clients have other inclination factors, for example, family impact, quality, staff, notoriety, straightforwardness, and returns. All the last option referenced are persuasive on the clients' attitudes. Various theories, like intellectual discord, recommend that clients can be roused to change their attitudes, convictions, and behaviors (Harmon-Jones & Mills, 2019). Simultaneously, clients with better understanding how Islamic banks work is a proposed strategy emerging through sending banks messages (Gong & Yi, 2018).

In building trust, banks plan explicit persuading communications that the services and items being sold will cover clients' remarkable financial and non-financial prerequisites (Pappas & Perotti, 2021). Likewise, a few analysts recommended that banks would produce undeniable level of retention and profits on the expenses related with their signals as they communicate with clients or prospects (Alanazi & Lone, 2016; Howard-Grenville & Rerup, 2016). Moreover, Thakur & Workman (2016) has taken on a particular technique to comprehend clients' attitudes by estimating their risk level. In finance and accounting, it was feasible to score clients' hazard return relationship dependent on portfolio theory concepts (Niromandfam et al., 2020).

Since Islamic banks are set up on the sharing standard, all investors clients hope to get the most noteworthy expected returns rate from their underlying investments and ought to consistently be well-prepared against conceivable hazard. Hamza (2016) presumed that the deposit management and profit and loss statement assets are sorted by an ethical threat behavior and inappropriate risk taking. The gauge disclosed that capital rate and interest rate influence straightforwardly the deposit return (Hamza, 2016). Profit and loss sharing includes Islamic banks and clients' relationship. One suitable investment is fixed income; in any case, Minhat & Dzolkarnaini (2016) expressed that functional risks open Islamic banks to potential investment deposits withdrawals, income loss, and agreement cancelling. All the last option referenced may influence Islamic banks' image and reputation, which might restrict their future chances and opportunities (Minhat & Dzolkarnaini, 2016).

Subsequently, each Islamic bank should finish a risk evaluation to decide general classes of assets or investments, which can be considered fitting for a given customer. Risk limit and risk tolerance are limitations on potential investment returns. Since financial foundations are hoping to get acknowledgment by all clients, their goals basically augment clients' value and inclinations in risk tolerance (Chung & Au, 2020).

Various theories introduced in this paper will show a superior comprehension of clients' rationale or attitudinal behavior about the Islamic banks' sharing concept. The uniqueness parts of Islamic banks are quite few; as per Komijani & Taghizadeh-Hesary (2018), the first is by creating a gain through the guideline of equity, which restricts foreordained payments and outlandish vulnerability. Second is the guideline of participation, which requires a borrower to give the bank an offer in their profits rather than paying interest. The guideline of ownership precludes selling something one does not completely possess (Hussain et al., 2015).

Notwithstanding, Muslim and Christian clients the same acknowledge that poor people, the vagrants, and the penniless have an endorsed or honest conviction to partake in the income of assets. The last option referenced may give a better and more secure society where the wealthy clients are leaned to share the risk that is expected in the helpless' life. Nonetheless, borrowers and depositors’ cutthroat determination are not important to make the most noteworthy conceivable return, and not to be balanced against potential risk (Chowdhury, Saba & Habib, 2019). In addition, to be balanced, the Islamic banks' strategy for leading business should be perceived.

Related Theories

Gawronski & Brannon (2019) reasoned that clients act as indicated by determined feelings or convictions are known as attitudes. Islamic banks might allude to various theories to all the more likely adjust clients to their inclinations. As indicated by Gawronski & Brannon (2019), the main theory is called cognitive dissonance, which reveals a peculiarity where a client encounters distress because of clashing considerations, convictions, or sentiments between elaborate parties. Such irregularity (dissonance) can be disposed of by making explicit strides (Gawronski & Brannon, 2019). Predominantly, cognitive dissonance theory accepts a reconsidering attitude is practically identical to what in particular has been really followed. In this way, one way of beating dissonance is by expanding the picked elective alternative quality (Harmon-Jones & Harmon-Jones, 2019). Given the way that dissonance is the feelings of clients, banks need to rethink it. Regardless of the distinctions in what to flag, Islamic banks can deal with their signs by depending on what makes clients' positive reactions.

Bahrini (2017); Thaker, et al., (2016) both accepted the chance of developing a typical conviction among clients is imperative to upgrade a condition for progress. The religious factor is a significant intention that can impact dissonance; in such manner, clients might retain just data that insists a previous belief. In some cases, new signals can be overlooked on the off chance that they go against religious beliefs (Ziky & Daouah, 2019). Wallston & Wallston (2020) thought about perceived benefits as another compelling factor. Additionally, Aladekomo (2020) characterized perceived benefits as the level of anticipated delights or outcomes. One stride ahead is to accept that Islamic banks' management might limit dissonance by signaling one of its hidden most desirable characteristics. Power (2017); Bananuka, Katamba, et al., (2020) both considered at least one related signaling issues that might be chosen from high corporate administration, straightforwardness, trust, and responsibility. Every one of the last options referenced is a basic focal point of signaling theory (Lujja et al., 2018; Soma, Primiana, Wiryono & Febrian, 2017). Nonetheless, it is quite important that a religious client is one recommended commendable signal.

Another theory that is worth focusing on is the transaction cost theory. It raises two restricting contentions about the effects of social contrasts on bank choice. The main contention expresses that social distance is an element of contrasts in values established in personal feelings toward the costs and advantages. The subsequent contention expresses that clients' trouble to get exact data (Knoll et al., 2016). As per the transaction cost theory, each group of clients has their own risk or cost-benefits; getting and forfeiting something of roughly equivalent value will impact future connections and emotions (Ltifi et al., 2016). Clients need to utilize one bank for a wide scope of requirements, and they need to do it such that accommodates their every day schedule. A new report proposed that bank clients actually pick their banks principally dependent on the least expenses, close areas, and in view of family or companions’ suggestions, separately. In any case, other helpful elements might incorporate bank reputation, interest rates, and existing associations with the bank (Iqbal, Nisha & Rashid, 2018). Clients value is the view of what an item or service is worth to a client versus the potential other options. The last option implies that clients feel the received advantages and services over what was paid. Microsoft Financial Services has illustrated five top esteemed characteristics of banks on the client's rundown, including easy banking, decisions for how they bank, responsive customer service, and a superior worth of financial items and services (Microsoft, 2017). Disregarding the last option referenced top qualities may contrarily influence all banks, including Islamic banks, in keeping up with clients.

Behavioral Finance Theory

Analysts distributed a few studies that might challenge thoughts regarding human instinct took on by ordinary economics. Those researchers showed that decisions are not generally ideal, and human tendency to face challenges is leaned by how choices are introduced (Wilkinson & Klaes, 2017). Such end additionally applies in accounting and finance, which accepted that clients who deposit or borrow money are not generally levelheaded and have restricted restraint and decisions. Likewise, Jackson & Vaughn (2018) reasoned that clients' capacity to manage once feelings and contemplations are dependent upon their thought processes and inclinations. In such manner, Markowitz set up a deterministic model for ideal asset allocation. The last option referenced model was under an exceptionally unreasonable set of behavioral assumptions dependent on client's attitudes, convictions, and experience (Hoffmann & Post, 2017). The deterministic model expected that clients regularly overlook behavioral finance standards in their decision-making, and inefficiant allocation of assets might affect clients' decision or choice (Fama, 2021). Some emotional articulations are made out of dread, confidence, outrage, kinship, tranquility, hostility, disgrace, pity, graciousness, envy, anger, imitating, and scorn (Karjaluoto et al., 2002).

Nonetheless, it is to say that clients are bound to act productively in allocating their investments or choosing their bank over the long-haul dependent on a trade-off between expected increases versus misfortunes. They like to face extra challenges to accomplish adequate kinds of gains that kill the misfortunes. It is crucial to realize that clients' decisions are not satisfied productively and not liberated from encompassed failure parts. (Korteling, Brouwer & Toet, 2018) characterized the last option referenced as a piece of cognitive predispositions or a methodical example of deviation from rationality in judgment. Due to clients' powerlessness to solve an issue because of their accessible data deciphering and restricted insight, it can frequently be amended through a banker's direction.

Signaling Theory

Signaling theory upholds and depicts the behavior of banks as data senders. The sender picks how for sure to signal, and the beneficiary claims his way of interpreting what has been shipped off direct clienteles' decision (Rahi, 2016). Banks should have less motivation to signal a few things to other people. For instance, Chen & Komal (2018) reasoned that situations where banks were less enthused to signal others, such cases as shareholders turnover is high, and a straightforwardly close management observing with insider admittance to corporate data and low organization costs. Levie, et al., (2008) demonstrated that inadequate revelation or signals lead to wrong choices and difficult to moderate low performance. It is to say that banks wonder whether or not to consider sufficient and helpful signal for using wise judgment is not acceptable. Signaling theory plays its own part in adjusting the beneficiary's behavior nearer to the sender's advantage. Signs might be straightforward, conveying data, helpfully in expanding the decency of the receiver. Simultaneously, a sender needs to try not to give a deceptive signal. It turns out to be notable that both the sender and the receiver are presented to the risk of sabotaging the signaling framework. True versus false data is the thing that the framework should be based on.

Furthermore, Kocak, Carsrud & Oflazoglu (2017) referenced that since banks are risk gatherers, they appear to be covered up risks situated. Banks' profits can be noticed while hazard can't. Clients should be more astute by not facing more challenges and paying similar returns. It is taking into account to play a game or conclude a decision signaling in showing themselves facing higher challenges and conveying a similar return. Hence, Clients should be more astute in understanding risk-return coefficient changes from illusive signals. Clients' response relies upon how their experience is, and their encounters rely upon how they see banks approaching data.

Customer's Choice

A few informative articles decide the most featured variables in the study including perceived quality of service, consistence with Islamic law, and trust in regards to the customer's choice. PY Lai & Samers (2017) analyzed the determination criteria for Islamic banking. The observational outcomes showed an overall accord among Muslims and non-Muslims clients as far as different criteria. A critical contrast among Muslims and non-Muslims is being paid higher interest, which was far more grounded with non-Muslims. In a similar respect, In North Cyprus, it was found that the fundamental factors that decide bank clients are efficiency level, service quality, parkings, image, emotional state, show location, and financial viewpoints that might influence client assessment (Oh & Kim, 2017). In a similar setting, Sheikh & Qureshi (2017) guarantee that chiefs consider service quality a competitive advantage for financial organizations. A few associations focus on uncovering to their client that they present preferred and more effective services over their rivals. Notwithstanding, Jham (2018) proposed that quality can be utilized to inspect the contrasts between perceived service and clients' expectations.

Moreover, the service quality and financial reputation are viewed as the fundamental determinants of picking Islamic banks in Malaysia (Nomran, Haron & Hassan, 2018). Nonetheless, client selection factors can fluctuate across nations. Kashif, et al., (2015) contended that there is an inconsequential connection between reliability aspect and customers satisfaction with Malaysian Islamic banks. Al-Salim (2018) claims that bank representatives' set of principles is the vitally recognized perspective that influences customer satisfaction in the Saudi financial sector. Indeed, there may be an absence of certainty between the bank and clients except if there is a high chance of dividing benefits among the bank and the client (Poppo, Zhou & Li, 2016). Trust depends on the perceived degree of risk. Nasser, et al., (1999) brought up that trust is the primary component that might influence an Islamic bank's choice in KSA. Different studies suggested that trust and reputation are important to clients. Altaf, Iqbal, Mokhtar & Sial (2017) found that trust and brand reputation are key factors for picking a bank. Notwithstanding, trust influences client's future behavior (Poppo, Zhou & Li, 2016). In a similar respect, Pérez & del Bosque (2017) observed that bank size, number of branches, and reputation considered the key factors that influence banks' selection in Nigeria.

Banking Service Excellence

In more detail, offering extraordinary service or assistance means to blow away what clients hope to cause them to feel that the bank understands what they are going through. Giving workers the instruments, they need to successfully go about their role, consequently offering liberal self-service support and giving reliably exact data across channels. Saleh, Quazi, Keating & Gaur (2017) presumed that excellent services to accomplish high certainty are needed to retain clients. Excellency in this matter can't be accomplished in the present moment since it is a journey, not a destination; it is persistently increasing present expectations to further develop the bank's present service performance. The last option is a responsibility and a genuine challenge in trying to take a pursue at service excellence.

The normal return level, which ought to be sufficiently high to counterbalance the expenses of equity, is an absolute necessity to attain clients; any other way, no clients will deposit their cash at a zero-return rate in a risky financial organization (Tan, Floros & Anchor, 2017). Islamic banks finance their assets at expanding anticipated that profitability should balance the expense of equity does not involve choice. Signaling theory accepts that bank management signals private data about a positive connection between Islamic banks' possibilities to build equity return.

Alshurideh, et al., (2017) indicated that after a bunch of service quality aspects, the two analysts inferred that substance, reliability, sympathy, affirmation, and responsiveness fundamentally sway choice. Moreover, clients communicated significant degrees of loyalty towards all service quality aspects to all the more likely understand each service fundamental antecedents and outcomes (Alshurideh et al., 2017). Moreover, the recently referenced study inferred that set up strategies for working on such quality to apply better consideration for loyal clients between them are the most profitable to them.

Methodology

The review is led using a formerly utilized study of 150 and was sent to example Islamic bank clients haphazardly chose across Islamic banks in Saudi Arabia. Be that as it may, just 138 were returned finished up. The inner consistency and reliability of the survey tool were evaluated utilizing Cronbach's Alpha. Likewise, for information analysis, distinct apparatuses and t-test were directed. The study respondents indicated their degree of agreement on five levels Likert scale, as displayed beneath. The degrees of agreements were delegated the accompanying:

- Low level of agreement (1 to 2.33).

- The medium level of agreement (2.34 to 3.67).

- A high level of agreement (3.68 to 5).

Hypotheses

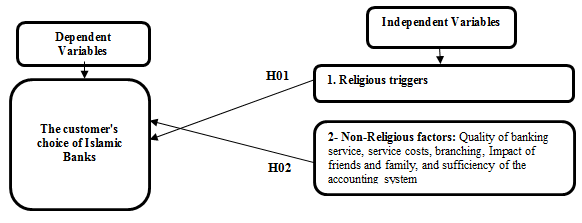

Hypothesis H1: The religious factors signaled by an Islamic bank have a statistically noticeable impact on the customers’ choice decision.

Hypothesis H2: The non-religious factors signaled by an Islamic bank significantly impact the customers’ choice decision.

Discoveries and Discussions

Information Presentation

The review covered three participant banks working in KSA while keeping their names unknown, the polls were disseminated inside the city of Riyadh branches, and eye to eye surveys were led. The survey was partitioned into two primary parts; segment one contained demographic data—segment two indicated clients' attitudes toward banking issues. In the subsequent part, members were mentioned to rate the overall significance of banks choice criteria on a five-point Likert scale going from significant to not significant. The tool for the review was taken on from previous literature (Al-Ajmi et al., 2009).

Demographic Data

In the initial segment, the study included demographic data showing participants’ engaging components like occupations, age, academic degree, and monthly salary. In more detail, Table 1 shows that (11.3%) of the clients are working in the private sector and (88.7%) in the public sector. (60.15%) are under 30 years old and (39.85%) over that. Just (36.24%) of them are not holding a university degree, and (63.76%) have a bachelor's certification or above. The normal monthly salary is generally beneath 5280 SAR, comparable to $ 1,400 US Dollars each month.

| Table 1 Demographic information |

|||

|---|---|---|---|

| Demographic factors | Frequency | Percent | |

| Occupation | Private sector | 16 | 11.3 |

| Public Sector | 122 | 88.7 | |

| Total | 138 | 100.0 | |

| Age | Age below 30 years | 83 | 60.15 |

| 30 years and above | 55 | 39.85 | |

| Total | 138 | 100.0 | |

| Academic Degree | Less than Bachelor Degree | 50 | 36.24 |

| Undergraduate and Graduate | 88 | 63.76 | |

| Total | 138 | 100.0 | |

| Monthly Salary | Less than 5280 SAR | 118 | 85.51 |

| 5280 SAR and above | 20 | 14.49 | |

| Total | 138 | 100.0 | |

Religion-Related Factors

Table 2 shows proclamations satisfying the first segment of this paper second part, the religion factor thought process on customer's choice. Graphic statistics of the gathered information show the agreement arithmetic implies ran between (2.50 to 3.04) and the grand mean of 2.87. The most elevated arithmetic mean was (3.04), with a standard deviation of (0.81) was on articulation 5; this moderately low standard deviation mirrors a typical agreement between respondents. It was regarding how 138 respondents put stock in the requirement for a religious proclamation to legitimize Islamic banks' service. Nonetheless, the edict term of proclamation number 5 is to guarantee religious freedom in ensuring people’s rights to live, talk, and act as indicated by their convictions. It is the assertion evaluated by the degree of high mean. The most noticeable components in different articulations are Islam's alignment standards by the clients at the medium level. The medium level number juggling mean was portrayed by eight articulations in Table 2 (1, 2, 3, 4, 5, 6, 7, 8). All are guaranteeing that participants are supportive of Islamic banks because of the substance of such statements. The grand mean of this segment is at the medium level of 2.83 out of 5.

| Table 2 Religious motives for the customer’s choice |

|||||

|---|---|---|---|---|---|

| No. | Statement | Arithmetic mean | Standard deviation | t- test | Status |

| 1 | The services I got from Islamic banks are in line with my religious principles. | 2.5 | 0.85 | 4.05 | Medium |

| 2 | What encourages me to deal with Islamic banks is the absence of interest. | 2.87 | 0.98 | 4.66 | Medium |

| 3 | I see that the Islamic banking system is in line with the principles of Islam. | 2.94 | 0.92 | 4.72 | Medium |

| 4 | I would like to compare between religious standards and what is offered by Islamic banks. | 2.99 | 1.22 | 4.82 | Medium |

| 5 | A religious edict is to justify any service provided by the Islamic banks | 0.81 | 0.81 | 4.92 | Medium |

| 6 | Non-Muslims discover substantial benefits through their agreements with Islamic banks. | 0.83 | 0.83 | 4.1 | Medium |

| 7 | The principle of profit-sharing is the best alternative, in replacing the principle of interest rates. | 0.8 | 0.8 | 4.7 | Medium |

| 8 | I admit religion principle when dealing with Islamic banks. | 0.88 | 0.88 | 4.62 | Medium |

| 9 | Suitable and Islamic cost basis of banking services. | 0.86 | 0.86 | 4.58 | High |

| Grand Mean | 0.91 | 0.91 | 4.58 | Medium | |

The 9 statements of table 2 are covering convictions on the interest rate and other disallowed banking financial issues not adequate by respondents. Each acknowledged assertion depended on the Islamic slogan, for example, activities of every kind taken by Islamic banks ought to be liberated from exorbitant vulnerability and different types of conceded policies. Certainly, such statements incorporate the bank not investing in organizations engaged with alcoholic beverages, betting, non-Islamic financial services, porn, and tobacco or weapons. As an internal control system, Islamic financial foundations work under an administrative board made out of chief management and Islamic researchers whose job is to guarantee that their financial exercises are attempted by Islamic standards. Respondents level out of Likert high score, not exactly number five appears to take into consideration a room of conflict in all table 2 statements. The last option implies that clients are expecting something different, enhancements to religious issues.

Non-Religion Related Factors

Table 3 shows the arithmetic for statements identified with non-religious intentions. Clients' answers were gone between (2.32-2.85), at medium level. Statement number 8 was on the accounting information system unveiling the client's requirements. It has the most elevated number juggling mean of (2.85) out of five and (0.84) standard deviation. The least mean was (2.32) on statement 3 of appealing branches' appearance, and all assertions are at a medium acknowledgment level.

| Table 3 Non-religious motive |

|||||

|---|---|---|---|---|---|

| No. | Statement | Arithmetic mean | Standard deviation | t-test | Status |

| 1 | Selecting Islamic banks is due to their sufficient branches. | 2.44 | 0.77 | 4.01 | Medium |

| 2 | Selecting Islamic banks is due to caring and comfortable. | 2.57 | 0.76 | 4.06 | Medium |

| 3 | Selecting Islamic banks is because of their appealing and internal decoration design | 2.32 | 0.72 | 3.9 | Medium |

| 4 | Selecting Islamic banks is due to their rapid services to clients. | 2.64 | 0.83 | 4.34 | Medium |

| 5 | Selecting Islamic banks is because of their instant interaction to the requirements of their clients. | 2.5 | 0.79 | 4.39 | Medium |

| 6 | Selecting Islamic banks is because of the sufficient number of employees. | 2.42 | 0.82 | 4.14 | Medium |

| 7 | Selecting banks is due to giving clients the top priorities. | 2.64 | 0.74 | 4.71 | Medium |

In any case, table 3 shows levels of standing out for clients on 11 articulations or statements. The banks can recognize, screen, and distinguish clients' requirements as a fundamental assignment. Every statement centers around non-religious factors like individual consideration, Branching, services costs, accounting system, clients' attention, and quick interaction to the client's requirements. As a rule, banks these days are working on their services and updating their qualities by distinguishing the clients' preferences and assumptions. Banks' endeavors are to expand deals over the long haul due to drawing in clients and retaining them. An effective and productive bank is that one fixes its needs and sets its priorities right. Client' requirements ought to consistently be the main goal and a definitive objective for expanding deals. Good client's service is straightforwardly relative to the quantity of clients, which at last adds to higher deals. The past 11 statements are critical ways of accomplishing service excellence, increment great customer care, and produce benefit by expanding deals. They draw client consideration and encourage them to return for additional services to expand the relationship.

Hypotheses Testing

Hypothesis H1: The one-sample t-test at the classified worth of 2.33 with importance at the 0.01 level has been applied to acknowledge or dismiss the 11 statements of theory one included in table 2. The determined t was 4.58, which makes it conceivable to acknowledge the invalid hypothesis, which expresses that the Religious factors signaled by an Islamic bank affect the clients' selection decision. Therefore, it shows the presence of a positive connection between religious factors and Islamic banks customers' choice. It is likewise affirmed that every statement in the table mirrors a sub of hypothesis one, which demonstrated a positive and huge relationship on customer' choice.

Hypothesis H2: The one-sample t-test at the organized worth of 2.33 with importance at the 0.01 level has been applied to acknowledge or dismiss the nine statements of theory two included in table 3. The worth of t was 4.34 makes it conceivable to acknowledge the invalid hypothesis, which expresses that the non-religious factors signaled by an Islamic bank fundamentally impact the clients' selection decision. Therefore, it demonstrates that there is a positive connection between non-religious factors and Islamic banks customers' choice. It is additionally affirmed that every statement in the table mirrors a sub of hypothesis two, which exhibited a positive and critical relationship on customers' choice.

Conclusion

This review presumed that the attitude development of clients' determination criteria shows that the non-religious item and service highlights are exceptionally regarded. It likewise proposes that clients' religious-related issues are exceptionally assumed, yet it isn't the sole motivation to choose an Islamic bank. The management of Islamic banks needs to consider item features and service quality as similarly critical to Islamic standards in planning the procedure of Islamic banking choice criteria. Both religious and non-religious factors are comparably significant in signaling the clients and developing their assumptions and attitudes.

It is preposterous to expect to say that religious factors are sufficient to decide the elements of picking banks. In any case, the non-religious or the economic factors are comprehensively addressed by the interest-free banking and profit-sharing standards are so essential to develop a positive perspective towards Islamic banks. The study discoveries demonstrate that both religious and non-religious values can altogether affect clients' intentions and decisions. It recommends that religious declaration is a fundamental factor. Among non-religious is the accessibility of an information system disclosing clients' requirements.

This paper upholds the fact that Islamic banks are needing drawing in and retaining clients. To retain clients, Islamic banks would need to foster important strategies intended to meet such prerequisites. Non-religious factors as the sole motivation for picking Islamic banks have been broadened by contracting many related theories. The last option is relied upon to widen Islamic banks' extension in creating strategies toward clients' attitude formation.

References

Aladekomo, A. (2020). Islamic banking licensing controversy, legality question and recent reforms in Nigeria.Legality Question and Recent Reforms in Nigeria (June 30, 2020).

Alanazi, E., & Lone, F.A. (2016). Social satisfaction towards Islamic banking in Saudi Arabia: A survey.Asian Social Science, 12(1).

Al-Salim, M.A. (2018, July 3). A closer look at the relationship of entry-level bank employees? leadership attributes and customer satisfaction.Journal of Financial Services Marketing, 23(5), 91-103.

Alshurideh, M.T., Al-Hawary, S.I., Mohammad, A.M., Mohammad, A.A., & Al Kurdi, B.H. (2017). The impact of Islamic banks? service quality perception on Jordanian customers loyalty.Journal of Management Research, 9(2), 139-159.

Altaf, M., Iqbal, N., Mokhtar, S.S.M., & Sial, M.H. (2017). Managing consumer-based brand equity through brand experience in Islamic banking.Journal of Islamic Marketing.

Bahrini, R. (2017). Efficiency analysis of Islamic banks in the Middle East and North Africa region: A bootstrap DEA approach.International Journal of Financial Studies, 5(1), 7.

Bananuka, J., Katamba, D., Nalukenge, I., Kabuye, F., & Sendawula, K. (2020). Adoption of Islamic banking in a non-Islamic country: Evidence from Uganda. Journal of Islamic Accounting and Business Research.

Chen, S., & Komal, B. (2018). Audit committee financial expertise and earnings quality: A meta-analysis.Journal of Business Research, 84, 253-270.

Chowdhury, Y., Saba, N., & Habib, M. (2019). Factors affecting the choice of Islamic banking by the customers: A case study.Frontiers in Management Research, 3(1), 1-5.

Chung, W.K., & Au, W.T. (2020). Risk tolerance profiling measure: Testing its reliability and validities.Journal of Financial Counseling and Planning.

Fama, E.F. (2021). Market efficiency, long-term returns, and behavioral finance (174-200). University of Chicago Press.

Gawronski, B., & Brannon, S.M. (2019). What is cognitive consistency, and why does it matter?

Gong, T., & Yi, Y. (2018). The effect of service quality on customer satisfaction, loyalty, and happiness in five Asian countries. Psychology & Marketing, 35(6), 427-442. Crossref, Google scholar

Hamza, H. (2016). Does investment deposit return in Islamic banks reflect PLS principle?BorsaIstanbul Review, 16(1), 32-42.

Harmon-Jones, E., & Harmon-Jones, C. (2019). Understanding the motivation underlying dissonance effects: The action-based model.

Harmon-Jones, E., & Mills, J. (2019). An introduction to cognitive dissonance theory and an overview of current perspectives on the theory.

Hoffman, K.D., & Bateson, J.E. (2016). Services marketing: Concepts, strategies, & cases. Cengage learning.

Hoffmann, A.O., & Post, T. (2017). How return and risk experiences shape investor beliefs and preferences.Accounting & Finance, 57(3), 759-788.

Howard-Grenville, J., & Rerup, C. (2016). A process perspective on organizational routines. The SAGE handbook of organization process studies, 323-337.

Crossref, Google scholar

Iqbal, M., Nisha, N., & Rashid, M. (2018). Bank selection criteria and satisfaction of retail customers of Islamic banks in Bangladesh.International Journal of Bank Marketing.

Jaara, O., Kadomi, A., Ayoub, M., Senan, N., & Jaara, B. (2021). Attitude formation towards Islamic banks.Accounting, 7(2), 479-486.

Jackson, D.B., & Vaughn, M.G. (2018). A multi-informant study of the role of household disorder in low self-control.Criminal Justice and Behavior, 45(12), 1977-1996.

Jham, V. (2018). Customer satisfaction, service quality, consumer demographics and word of mouth communication perspectives: Evidence from the retail banking in United Arab Emirates.Academy of Marketing Studies Journal, 22(3), 1-17.

Crossref, GoogleScholar

Knoll, M., Lord, R.G., Petersen, L.E., & Weigelt, O. (2016). Examining the moral grey zone: The role of moral disengagement, authenticity, and situational strength in predicting unethical managerial behavior.Journal of Applied Social Psychology, 46(1), 65-78.

Kocak, A., Carsrud, A., & Oflazoglu, S. (2017). Market, entrepreneurial, and technology orientations: Impact on innovation and firm performance.Management Decision. Crossref, GoogleScholar

Komijani, A., & Taghizadeh-Hesary, F. (2018). An overview of Islamic banking and finance in Asia.

Korteling, J.E., Brouwer, A.M., & Toet, A. (2018). A neural network framework for cognitive bias.Frontiers in psychology, 9, 1561.

Lujja, S., Mohammed, M.O., & Hassan, R. (2018). Islamic banking: An exploratory study of public perception in Uganda.Journal of Islamic Accounting and Business Research.

(2017). The top five things a customer needs from their bank.

Crossref, Google scholar

Minhat, M., & Dzolkarnaini, N. (2016). Islamic corporate financing: Does it promote profit and loss sharing?Business Ethics: A European Review, 25(4), 482-497.

Niromandfam, A., Yazdankhah, A.S., & Kazemzadeh, R. (2020). Designing risk hedging mechanism based on the utility function to help customers manage electricity price risks.Electric Power Systems Research, 185, 106365.

Nomran, N.M., Haron, R., & Hassan, R. (2018). Shari?ah supervisory board characteristics effects on Islamic banks? performance: Evidence from Malaysia.International Journal of Bank Marketing.

Oh, H., & Kim, K. (2017). Customer satisfaction, service quality, and customer value: Years 2000-2015.International Journal of Contemporary Hospitality Management.

Pappas, V., & Perotti, P. (2021). Quality comes cheap: Evidence from auditing in Islamic banks.

Perez, A., & del Bosque, I. R. (2017). Personal traits and customer responses to CSR perceptions in the banking sector.International Journal of Bank Marketing.

Poppo, L., Zhou, K.Z., & Li, J.J. (2016). When can you trust ?trust?? Calculative trust, relational trust, and supplier performance.Strategic management journal, 37(4), 724-741.

Power, E.A. (2017). Discerning devotion: Testing the signaling theory of religion.Evolution and Human Behavior, 38(1), 82-91.

PY Lai, K., & Samers, M. (2017). Conceptualizing Islamic banking and finance: a comparison of its development and governance in Malaysia and Singapore.The Pacific Review, 30(3), 405-424.

Rahi, S. (2016). Impact of customer value, public relations perception and brand image on customer loyalty in services sector of Pakistan.Arabian Journal Business Management, 2(2).

Saleh, M.A., Quazi, A., Keating, B., & Gaur, S.S. (2017). Quality and image of banking services: A comparative study of conventional and Islamic banks.International Journal of Bank Marketing.

Sheikh, N.A., & Qureshi, M.A. (2017). Determinants of capital structure of Islamic and conventional commercial banks: Evidence from Pakistan.International Journal of Islamic and Middle Eastern Finance and Management.

Soma, A.M., Primiana, I., Wiryono, S.K., & Febrian, E. (2017). Religiosity and Islamic banking product decision: Survey on employees of Pt Telekomunikasi Indonesia. Ethics, 16(1), 194867.

Tan, Y., Floros, C., & Anchor, J. (2017). The profitability of Chinese banks: impacts of risk, competition and efficiency.Review of Accounting and Finance.

Thaker, H.M.T., Khaliq, A., & Thaker, M.A.M.T. (2016). Evaluating the service quality of Malaysian Islamic Banks: An importance-performance analysis approach.International Journal of Business & Information, 11(3).

Thakur, R., & Workman, L. (2016). Customer Portfolio Management (CPM) for improved customer relationship management (CRM): Are your customers platinum, gold, silver, or bronze?Journal of Business Research, 69(10), 4095-4102.

Wallston, B.S., & Wallston, K.A. (2020). Social psychological models of health behavior: An examination and integration. In Handbook of Psychology and Health, 4, 23-53. Routledge.

Wilkinson, N., & Klaes, M. (2017). An introduction to behavioral economics. Macmillan International Higher Education.

Ziky, M., & Daouah, R. (2019). Exploring Small and Medium Enterprises

Received: 08-Jan-2021, Manuscript No. ASMJ-22-10806; Editor assigned: 10- Jan -2021, PreQC No. ASMJ-22- 10806 (PQ); Reviewed: 23- Jan -2021, QC No. ASMJ-22-10806; Revised: 29-Jan-2021, Manuscript No. ASMJ-22-10806 (R); Published: 08-Feb-2022.