Research Article: 2019 Vol: 18 Issue: 1

Ensuring the Efficiency of Integration Processes in the International Corporate Sector on the Basis of Strategic Management

Vyacheslav Makedon, Oles Honchar Dnipro National University

Tetyana Kostyshyna, Poltava University of Economics and Trade

Oksana Tuzhylkina, Poltava University of Economics and Trade

Larysa Stepanova, Poltava University of Economics and Trade

Volodymyr Filippov, Odessa National Polytechnic University

Abstract

The article raises an important scientific point of increasing the efficiency of integration processes of international corporations based on the concepts of strategic management. There were identified main motives for corporate integration, were identified the barriers to synergistic effect, were proposed methodical approach to differentiation of corporate effects strategies in corporate integrations, which increases market and profit effects for merged corporations.

Keywords

International Corporations, Integration Processes, Strategic Management, Strategy Differentiation, Synergistic Effect.

JEL Classifications

M21

Introduction

In the process of development and complication of the structure of international production mergers and acquisitions have become an integral component of corporate policy and a major factor in the development of productive forces. At the same time, it should be noted that the mechanisms of the effects of mergers and acquisitions on the state of corporate finances, as well as the factors that determine the effectiveness of integrations for corporations that are reorganized, have not been fully understood. Specifically, the conventional explanation for the fact that up to 40% of mergers and acquisitions in the world are financially unprofitable (do not give the initiator corporations an increase in cash flow and value) is a wrong estimate of the value of the corporation-target and poor financial structuring of the transaction itself.

Literature Review

Corporate integration issues and the use of mergers and acquisitions are being actively investigated (Gaughan, 2007; De Wit & Meyer, 2005). A number of scientists Gupta (2012); Makedon & Korneyev (2014); Vo et al. (2017) pay considerable attention to the search for the economic effect of mergers and acquisitions, while the issues of primary motivational factors, both external and internal, remain unaddressed (Drobyazko et al., 2019 a & b). The presence of these factors determines the relevance of scientific research in this sector of corporate management.

Methodology

Most researchers believe that the main reasons for the poor financial performance of a large number of mergers and acquisitions are: the wrong choice of the corporation-target, poor quality of transaction development, errors in determining the scale of the synergistic effect. Some experts believe that, in principle, most mergers and acquisitions are effective, but there are doubts about the reliability of the statistics on the low effectiveness of mergers and acquisitions, more precisely, the correctness of the method of assessing the financial impact of mergers and acquisitions. In most cases, a statistical sample was formed by analysts in the nearest periods after mergers and acquisitions (within 1-6 months), and there is evidence that the maximum efficiencies from mergers and acquisitions are reached one and a half years after the transaction, after the stabilization of finances of the merged corporations.

The purpose of the article is to determine the main factors that shape the performance indicators of mergers and acquisitions in the environment of international corporations.

Findings and Discussion

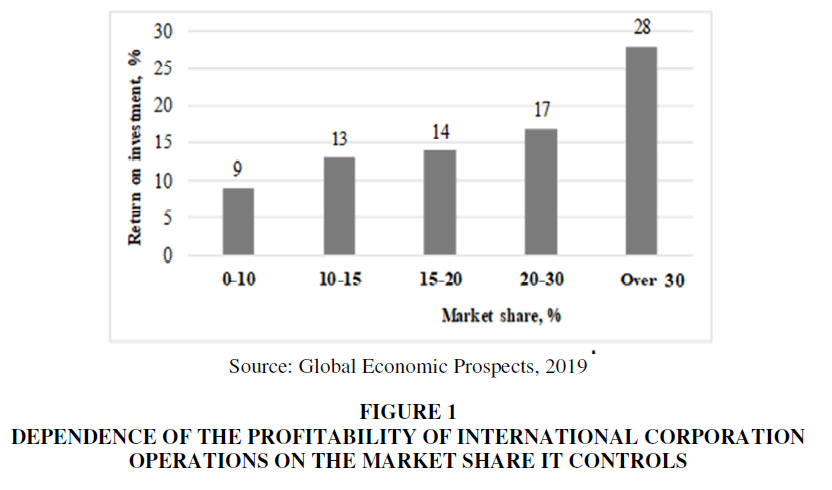

International statistics show that not all mergers and acquisitions lead to a significant improvement in the financial and economic performance of merging corporations. Most mergers and acquisitions are ineffective (not effective) on a formal basis and do not give the merging corporations a high synergistic effect. The real range of initial M&A motives is substantially wider and cannot be limited to efficiency motives. The stabilizing effect of mergers and acquisitions on the finances of corporations and the economy is very multifaceted (Roe, 2004). In particular, such mergers and acquisitions may be motivated by a competitive struggle (Figure 1).

Figure 1 Dependence of the Profitability of International Corporation Operations on the Market Share it Controls

Dependence of the Profitability of International Corporation Operations on the Market Share it Controls

For small corporations, a very important factor is expanding their niches in the market, strengthening their competitive position and enhancing economic security on this basis. Naturally, in this case, such “classic” motives of mergers and acquisitions as the synergistic effect, the need for a complementary asset structure, and so on, are simply ignored and not calculated by the merging corporations. It is more important for them to eliminate a competitor, to gain an additional part of the market and to provide, thus, a competitive advantage (Boohene & Williams, 2012). As it is obvious that large corporations have significant competitive advantages compared to relatively small and poorly integrated industries.

It is easy for a large corporation to oust from the market a small corporation that produces products of the same type than the other way around, since a large company controls the proportional share of consumer demand for a given product, which significantly increases its financial sustainability. Even if a smaller competitor releases a more competitive product with better consumer properties, in most cases it will not undermine the competitive position of a larger corporation, which controls most of the demand in this commodity market, since a small corporation will not be able to quickly increase production to the required volumes (which is especially important in the low-resilience goods sector, which demand changes little with the change in prices) (Cunliffe, 2008). There are many examples of strategic acquisitions in the world that aim not at increasing efficiency but simply at expanding production, obtaining low-cost (but not always liquid and profitable) assets.

The competitive “monopolistic” factor of mergers and acquisitions is especially important when merging corporations with the same production structure that produce the same mass production (horizontal merger).

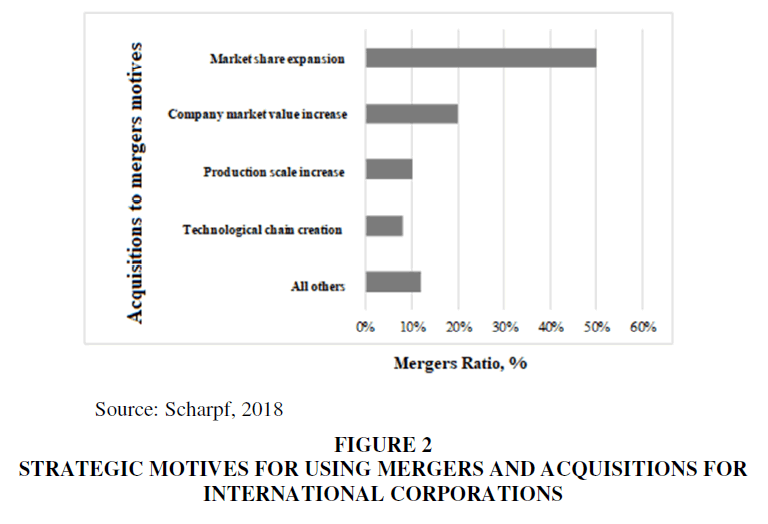

More than 50% of the mergers and acquisitions of corporations taking place in the world are determined by the motives of competition, and only 30% of the transactions are aimed at increasing the market value of the merged corporation, expanding the product range, creating a production chain and concentrating value added at finished product (Chakrabarti & Mitchell, 2004). Figure 2 shows the ratio of mergers and acquisitions to their real motives.

From the above we can draw several conclusions that have some theoretical and practical value. The main motive of most mergers and acquisitions is competition, or the intensity of mergers and acquisitions should depend on the level of competition. Thus, there is a fairly large group of mergers and acquisitions (about 30-35% of their total) that does not formally give corporations a synergistic effect. More precisely, the synergistic effect is also largely present in these cases, in particular, in the form of increasing financial stabilization of the corporate sector, but it is not always calculated by existing methods of assessing the effectiveness of mergers and acquisitions (corporate value increases).

In our view, this is precisely why the main motive and result of mergers and acquisitions is considered to be an increase in the production efficiency of the merged corporation. The logic behind the existing approach, perhaps, is as follows: since the most important performance indicator of mergers and acquisitions is the increase in the value of the merged corporation (which is correct in itself) and the increase in value is determined by the appearance of additional cash flow the absence of that flow (insufficient improvement in financial performance) is treated as insufficient effectiveness of mergers and acquisitions themselves. Table 1 presents the original approach to differentiation of mergers and acquisitions in terms of their outcome-increasing economic effectiveness or improving the financial stability of merging corporations.

| Table 1 Differentiation of Corporate Effects Strategies in Corporate Integration | |||||

| Main strategies aimed at corporate effects | Share of the type of strategy in their general volume | Type of mergers and acquisitions | Economic sectors | The main effect of mergers and acquisitions | |

| Improving the financial efficiency of the corporation | Improving financial stability in the economy | ||||

| Scaling up production | 30% | usually horizontal | Production of the same products/services | – | + |

| Expanding market share, strengthening positions in it, other motives for competition | 25% | any | any | – | + |

| Variable external conditions of production (change in demand for products, innovations of scientific and technological progress) | 10% | any | any | – | + |

| Improving production efficiency | 20% | any | any | + | + |

| Increasing the level of integration, vertical integration of production | 15% | Vertical | Technology-, knowledge-intensive sectors | + | + |

The Table 1 shows that up to 35% of mergers and acquisitions may, even theoretically, not be accompanied by improvements in corporate performance (which is interpreted as maximizing the economic effect per unit cost). This is the main reason for the large number of formally ineffective mergers and acquisitions in the global economy.

The statistics of the impact of mergers and acquisitions on production efficiency are dramatically exacerbated by those operations which do not have the immediate purpose of obtaining a synergistic effect (and, conversely, those operations which, initially, aim at improving efficiency are in most cases successful). This also explains the significant differences in the assessment of the effectiveness of mergers and acquisitions by different researchers reaching 35-40% (which can hardly be explained only by differences in methodologies and approaches).

Recommendations

The recommendation is that markets themselves should be an indispensable institutional element in the process of corporate sector structural reorganization, both in terms of fair, comprehensive evaluation of corporations, and in terms of the source of investment resources required by corporations for mergers and acquisitions (in particular, at the cost of additional equity issues by corporations). It is particularly important to emphasize that the market evaluation of the merged corporations and the market evaluation of the effectiveness of mergers and acquisitions (i.e. the evaluation of the merged corporation) also include those cost factors that are not analytically calculated.

Conclusion

Thus, it can be stated that not only the expected synergistic effect is the main motivating factor for integration operations. Too often, corporations try to increase the level of competitiveness of their products, increase market capitalization, or create an effective mechanism of production activity. It is proved that the accelerated growth of equity of a merged corporation in a merger is a further proof that the market value indicators are the most representative and accurate, at least, most accurately reflect all the variety and complexity of financial and economic processes of modern production.

References

- Boohene, R., & Williams, A.A. (2012). Resistance to organisational change: A case study of Oti Yeboah Complex Limited. International Business and Management, 4(1), 135-145.

- Chakrabarti, A., & Mitchell, W. (2004). A corporate level perspective on acquisitions and integration. In Advances in mergers and acquisitions. Emerald Group Publishing Limited.

- Cunliffe, A.L. (2008). Organization theory. Sage.

- De Wit, B., & Meyer, R. (2010). Strategy synthesis: Resolving strategy paradoxes to create competitive advantage. Cengage Learning EMEA.

- Drobyazko, S., Barwi?ska-Ma?ajowicz, A., ?lusarczyk, B., Zavidna, L., & Danylovych-Kropyvnytska, M. (2019a). Innovative entrepreneurship models in the management system of enterprise competitiveness. Journal of Entrepreneurship Education.

- Drobyazko, S., Okulich-Kazarin, V., Rogovyi, A., & Marova, S. (2019b). Factors of influence on the sustainable development in the strategy management of corporations. Academy of Strategic Management Journal.

- Gaughan, P.A. (2010). Mergers, Acquisitions, and Corporate Restructurings. John Wiley & Sons.

- Global Economic Prospects (2019). Retrieved from https://www.worldbank.org/en/publication/global-economic-prospects

- Gupta, P.K. (2012). Mergers and acquisitions (M&A): The strategic concepts for the nuptials of corporate sector. Innovative Journal of Business and Management, 1(04).

- Makedon, V., & Korneyev, M. (2014). Improving methodology of estimating value of financial sector entities dealing in mergers and acquisitions. Investment Management and Financial Innovations, 11(1), 44-55.

- Roe, M.J. (2005). The institutions of corporate governance. In Handbook of new institutional economics. Springer, Boston, MA.

- Scharpf, F.W. (2018). Games real actors play: Actor-centered institutionalism in policy research. Routledge.

- Vo, L., Van, Le, H.T., Le, D.V., Phung, M.T., Wang, Y.H., & Yang, F.J. (2017). Customer satisfaction and corporate investment policies. Journal of Business Economics and Management, 18(2), 202-223.