Research Article: 2021 Vol: 20 Issue: 1S

Evaluation Study between the Traditional Financial Accounting and Electronic Financial Accounting and its Impact on Raising the Efficiency of Company's Capital

Hussein Mohammed Alrabba, Yarmouk University

Ashraf Mohammad Salem Alrjoub, Al-Balqa Applied University

Muhannad Akram Ahmad, Al Albayt University

Mohannad AL Shbial, Al Albayt University

Keywords:

Banks, Capital Shareholding Companies, Efficiency, Electronic Financial Accounting, Financial Auditing Companies, Traditional Financial Accounting.

Abstract

The study evaluated the differences between traditional accounting system and Electronic Accounting System (EAS) and their impact on enhancing the public capital efficiency of firms and identified the reasons behind each system’s implementation, as well as each system’s effectiveness in light of work. The study adopted Davis’s TAM to shed insight into the acceptance/rejection of EAS implementation by sample members and the alternative use of traditional accounting system. The study sample comprised of accountants employed in banks, public shareholding firms and financial auditing firms, to which questionnaire copies were administered to, in order to test the study hypotheses. From the findings, majority of the accountants surveyed (96.4%) were using EAS in Jordan, with the top commonly used programs being the e-table/excel (66%) and specialized programs were also being used by some accountants (30.4%). On the other hand, the findings also showed that only few accountants (3.6%) still employed traditional accounting system. As mentioned, Davis’s TAM was used to shed light into the EAS usage among Jordanian accountants and its role in enhancing the public capital efficiency of the firms. The study provided recommendations on how to promote the use of EAS among accountants accordingly.

Introduction

Accounting may be described as a science involved in the systematic process of examining and analyzing economical events information in organizations for its use in management. Such information is invaluable in the process of performance evaluation of the organizations, identification of basic developments in the long-run, and the procedures that can be adopted for the developments across departments. Accounting science is also useful for the determination of tax values that the organization is due to pay.

In addition, accounting science has several branches, with the most popular of which is financial accounting, which is the topic under study when it comes to information in this study. More specifically, two types of financial accounting are examined namely traditional financial accounting (book and paper) and e-financial accounting (electronic tables) in the context of public shareholding firms in Jordan. This decision to focus on Jordan as the study context may be attributed to the fact that Jordan is one of the first Arab nations that have witnessed the advancement of accounting science throughout stages – following its independence up until 1987 and the independence of the Audit Bureau based on the Jordanian constitution. It is also one of the first nations in the Arab world to launch IT and computer in accounting science, with the number of accountants using EAS constituting 96.4% since its introduction in the 1990s. Jordan also focuses on the companies and ethnic groups in the field as exemplified by Talal Abu-Ghazaleh Organization (TAG-Org), among others.

The effective accounting system use, whether it be traditional or electronic, is the top influencing factor of the public capital effectiveness among shareholding firms as evidenced by several studies in literature. However, several authors including, Baxter & Oatley (1991); Torkadeh & Angulo (1992); Sutton & Faulkner (1994); Chau (1996). highlighted the resistance of companies towards using EAS and electronic table software, preferring to use traditional accounting system because of several reasons. The reasons mentioned are financial disclosure process, data loss, piracy or hacking issues, virus issues, and system failure despite the fact that the EAS are generally accurate, timely, and efficient in service delivery, it mitigates errors, enhances profits margins and brings about the increase of capital efficiency among shareholding firms Ahmad (2017).

In the present study, the main objectives include, to examine the factors affecting the acceptance of accounting system implementation (traditional and electronic) and in turn, raise the capital efficiency of shareholding firms in Jordan, to examine the level of accounting system usage (traditional/electronic) among Jordanian accountants and its impact on the capital efficiency of the shareholding firms, to examine the accounting programs (traditional and electronic) that Jordanian accountants commonly make use of and its impact on enhancing the capital efficiency of the shareholding firms in Jordan. The study also aims to explore the functions conducted by accountants via the accounting system (traditional and electronic) at the companies, and to explore the tasks that they conduct using the accounting system (traditional and electronic) among the Jordanian shareholding firms.

The study’s significance is related to its uniqueness in testing the ability of traditional accounting and e-accounting and their impact on enhancing the capital efficiency of Jordanian shareholding firms. The study further examines the benefits arising from the use and ease of use of the systems, identifying which of the systems outperform the other and their impact on the shareholding firms. The study focuses on the acceptance of technology use in the Jordanian accounting realm using TAM to provide information to management’s formation of courses and training initiatives that are aligned with the requirements of the firms. The study also directs academic staff’s attention to the requirements of the market so that they can create suitable accounting curriculum and enhance accountant’s skills and experiences.

Literature Review and Hypotheses Development

Although shareholding companies make for significant studies, organizations as well as other operating business entities have in the Middle East are mostly left out when it comes to examination. Majority of the studies in the field are focused on the Western context, although the Arab countries constitute a large part of the developing nations.

In relation to the topic, Mathieson (1991), highlighted two models that can be useful in examining individual’s intention towards IS usage, and they are Information Technology Model (TAM) and Theory of Planned Behavior Model (TPB). The author conducted a study in the U.S. using both and involving a sample comprising of 262 respondents, who were requested to conduct accounting tasks with the help of electronic tables program after which the questionnaire copies were administered. The findings indicated that TAM outperformed TPB because of the ease of use of the program.

In a similar study, Hendrickson (1996), underpinned their study by the Davis model to examine the use of e-table program in the US, with the variables being contentment by benefit of use, contentment by ease of use and actual use. Their findings showed an indirect moral relationship between contentment by ease of use and intention of use in the face of contentment by benefit of use as well as a direct moral relationship between benefit of use and intention towards actual use. Moreover, the Davis model was also employed in Rose (2003), study, focusing on five Arab nations including Jordan, Egypt, Saudi Arabia, Lebanon and Sudan. The authors explored the use of IT among managerial work, specifically financial and accounting managers at the public and health sectors. Based on the results, the Davis model validity was supported in its use in the Middle East environment. Meanwhile, TAM was adopted by Al-Moghaiwl (2003), study of the use of electronic tables program among Saudi accountants, administering questionnaire copies to 327 accountants in Saudi firms. The author made use of linear regression analysis to analyze the obtained data, after which, it was evidenced that TAM was effective in explaining the behavior of accountants towards using electronic tables program and were contented by the benefit of use, which affected such use. Also, the accountant’s contentment by ease of use of the program had a lower impact on the actual program usage. In the case of virtual university system of the e-learning field, Van Schaik (2005), adopted TAM in Lebanon and found a high level of acceptance among students of the system. Specifically, contentment by benefit of use and by ease of use significantly impacted the intention of students towards system actual usage, with the latter a requirement for achieving high levels of using the system. In Algeria, the Ministry of Finance embarked on a series of reforms in 2006 that encapsulate the financial budgeting, accounting and taxing, directed towards their digitization. This was focused on the level of internal work procedures and the relationship with the public but although efforts were made, in the past 12 years, the landscape remains poor because of barriers and obstacles, with the top being the lack of clear reform strategy and coordination among the general directorates of the Ministry.

Moving on to another related study, Hajj (2018), tackled the e-accounting methods and development as well as the impact that they have had in the accounting systems. The findings showed that e-accounting progress goes hand in hand with the money and business systems development and the identification of ongoing needs. These contribute to the enhancement of performance, high efficiency, accuracy and speed in achieving the objectives and enhanced efficiency of product delivery. Other benefits highlighted were costs reduction and the speed of making decisions.

Theoretical Framework and Study Analysis

The financial and business world dynamic progress and development coupled by the economic developments and tax systems development, among other factors overlapping with IT, all contribute towards the accounting system development among entities. This is manifested in the development of the responsibilities and functions of the accountants and the heightened effectiveness of management in decision-making and in publicizing periodic financial reports to display the financial developments of the firm. In other words, this assists in raising capital efficiency among managers and decision-makers. The IS usage in firms accounting systems have contributed to the ease, speed, accuracy and preparation of reports with little effort, highlighting the need to shift from the traditional accounting system, based on the book system (documents and paper records) and to adopt EAS. This is an attempt to keep abreast of latest developments and the role of the firms, wherein which the financial procedures are processes and followed-up quickly, accurately and continuously, which could ultimately enhance the capital efficiency of the entities. This development is not only confined to cost accounting but to other types of accounting including;

1. Financial Accounting – this specializes in the collection and documentation of the financial statements and preparation of external reports.

2. Managerial Accounting – this is concerned with the collection, compilation and recording of financial information to be used for preparing internal operational documents.

3. Cost Accounting – this is concerned with the collection and documentation of financial information regarding the products and services.

4. Government Accounting – this is concerned with the accounts and financial information that are about the state or government in the form of taxes, imports, exports, general income and budget.

The above developments need accounting system development to keep abreast with the business system and for decision-making, provision of information and data concerning tax return, preparation of payroll reports and customer invoices, determinations of payment of due costs, among others, internal auditing to guarantee that financial procedures are conducted via data processing, measurement of resources changes, provision of information for the long-run, and preparation of reports for the profit or loss over a specific period. These contribute significantly and directly to the capital efficiency of the entity.

Arab countries, as mentioned, constitute a major proportion of developing nations and are characterized as late introducers and users of technology into the business system. In this regard, Jordan is one of the pioneering Arab countries to use EAS in the public firms, since 1990s, where the Jordanian accountants began using e-tables (working papers that include tables with rows and columns) to record financial statements and calculate numbers flexibly and easily. In later years, several technological firms began designing specialized accounting systems based on the required processes by the accountants in order to achieve higher efficiency and effectiveness and to save time for accessing reports for the purpose of decision-making. This significantly impacted the capital and revenues of the company and upped its processing speed and performance of auditing. The systems have assisted in accounting areas including cost accounting, financial accounting, auditing, financial analysis, among others. The findings indicated that some accountants were inclined towards traditional accounting system use over their EAS counterpart as some delay has been noted in using accounting-related technical information technology system, because of lack of user’s acceptance of it Davis (1993).

TAM expounds on the behavior towards IT in different areas including contentment by benefit and contentment by ease of use, and notably, several studies have supported the effectiveness of TAM implementation in different work contexts. The model is developed on a reasonable and logical theory consisting of three pats, contentment by benefit of use and contentment by ease of use constitute the first part, and the assessment of such contentment to use a specific IT type constitutes the second part. The third part consists of the intention to use via the inclination of the individual towards using specific type of the two systems (traditional and electronic).

Study Model

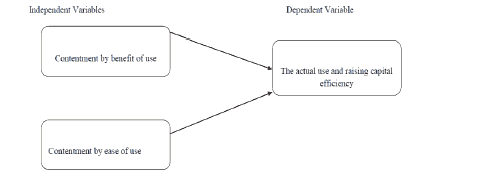

The present study’s underpinning model is Davis (1989) model and the study uses it to shed light on the behavior of Jordanian accountants’ use of e-accounting (specifically the electronic table program) or the traditional accounting. The study examines the direct impact of contentment by benefit of use and contentment by ease of use in the actual use of the programs as suggested by Davis (1993) as shows in Figure 1.

Study Hypotheses

Based on the reviewed literature, the following hypotheses are developed to be tested.

• There is a significant relationship between contentment by benefit of using traditional accounting system, actual use of such system among accountants and raising of capital efficiency of shareholding firms in Jordan.

• There is a significant relationship between contentment by benefit of using electronic accounting system (electronic table program), the actual use of the system among accountants, and raising of capital efficiency of shareholding firms in Jordan.

• There is a significant relationship between contentment by ease of using traditional accounting system, the actual use of the system among accountants, and the raising of the capital efficiency of shareholding companies in Jordan.

• There is a significant relationship between contentment by ease of using electronic accounting system (electronic table program), the actual use of the system among accountants and the raising of the capital efficiency of shareholding companies in Jordan.

Research Method

The sample study comprises of accountants in Jordan’s public sharing firms but owing to the large population, a sample was chosen from banks, financial and accounting auditing public shareholding firms. The sample was chosen based on the organizations use of traditional and current accounting methods and their implementation of IT. Two hundred and fifty (250) questionnaire copies were distributed to accountants and financial managers based on the statistical sample at the significance level of (α ≤ 0.05). The division of distribution was as follows, 60 questionnaire copies were distributed to the banking sector employees, 70 to the auditing companies’ employees, and 120 to the public shareholding firms’ employees. From the total distributed questionnaire copies, 212 were retrieved, indicating a rate of response of 84.8%, but from this number, 18 copies were dropped because of their lack of analysis validity, and thus, the number of questionnaires exposed to statistical analysis was 194. Based on the variable’s nature, the unit of analysis was reflected by the number of employees in the accounting field, whose sample was obtained through a random sampling method. The questionnaire was designed to gather additional data of the sample including their demographic characteristics.

Data Analysis

The study tool was distributed to obtain data, whose analysis findings were used to test the hypotheses formulated. The process of analysis was carried out using the Statistical Package for Social Sciences (SPSS) program, following the descriptive analytical approach and implementing the following tests;

• Frequencies and percentages – this test identifies and analyzes the adopted measurement indicators and scales in the instrument.

• Arithmetic means – this determines the level of response of the study sample in terms of the study variables and the comparison process to be conducted.

• Standard deviation – this measures the dispersion level of the members of the study sample in light of their responses and their arithmetic means.

• Category Length Formula – this test obtains the importance level of the variables, calculated using the equation.

• Implementation degree (level of importance) – Higher degree – Lower degree/Number of importance level (5-1/3=1.33).

• Cronbach’s Alpha Coefficient – this measures the questionnaire’s reliability and consistency and internal consistency, and it determines the validity of the responses of the items in the questionnaire.

• Variance Inflation Factor (VIF) and Tolerance Test – this test ensures that the independent variables are not highly correlated with each other.

• Factor Analysis – this test is used to establish the level of belonging to the dimensions of the items. Table 1 tabulates the reliability and validity analysis.

Validity and Reliability Result

Table 1 shows the reliability analysis measured through Cronbach Alpha which should be <0.50 is reliable, 0.70 is decent, 0.80 is very good and 0.90 is excellent. Table (1) describes Cronbach Alpha from the current study between 0.75 and 0.81, and the results indicated that all variables have a reliable degree and have achieved and fulfill the rule. However, the factor load should be (≥0.5) and the high factor load reflects the high convergence (Adams, 1992; Sl Shbail, 2018; Al-Shbiel, 2018; Obeid, 2017; Ahmad, 2017; Ahmad, 2019; Ahmad, 2019; Obeid, 2019). Table 1 shows the loading factors for the Contentment by benefit of use, Contentment by ease of use, and The Actual use and raising of capital efficiency components greater than 0.5 thresholds, and KMO for the study constructs were between 0.62 and 0.84. The results indicated that all formulations check for close compatibility.

| Table 1 Validity and Reliability Results |

||||

|---|---|---|---|---|

| Variable | Factor loading | KMO | C. | |

| Alpha | ||||

| Contentment by benefit of use | Traditional Accounting | 0.83 | 0.84 | 0.79 |

| 0.66 | ||||

| 0.67 | ||||

| 0.8 | ||||

| Electronic Accounting | 0.66 | 0.75 | ||

| 0.72 | ||||

| 0.77 | ||||

| 0.64 | ||||

| Contentment by ease of use | Traditional Accounting | 0.61 | 0.74 | 0.8 |

| 0.77 | ||||

| 0.69 | ||||

| 0.87 | ||||

| 0.85 | ||||

| Electronic | 0.82 | 0.78 | ||

| Accounting | 0.66 | |||

| 0.66 | ||||

| 0.7 | ||||

| 0.86 | ||||

| The Actual use and raising of capital efficiency | 0.7 | 0.62 | 0.81 | |

| 0.72 | ||||

| 0.89 | ||||

| 0.7 | ||||

| 0.78 | ||||

Sample Members Characteristics

Table 2 shows that majority of the respondents held bachelor’s degrees (38.7%), providing study credibility as this is evidence of the sample’s proper academic education. Majority of the members were also employees of public shareholding firms (58.8%), followed by financial auditing firms (22.7%).

| Table 2 Demographic Characteristics Analysis |

||||

|---|---|---|---|---|

| Orders | Questions | Responses Alternatives | Frequencies | Percentages |

| 1 | Scientific or professional qualification | Community college diploma/ accounting |

29 | 14.90% |

| 2 | Professional certificate in accounting |

36 | 18.60% | |

| 3 | Bachelor/ accounting |

75 | 38.70% | |

| 4 | Master/ Accounting | 36 | 18.60% | |

| 5 | PHD/ Accounting | 18 | 9.30% | |

| 6 | Total | 194 | 100% | |

| 7 | The accountant's organization type | Bank | 36 | 18.60% |

| 8 | Auditing company | 44 | 22.70% | |

| 9 | Shareholding company |

114 | 58.80% | |

| 10 | Total | 194 | 100% | |

| 11 | Number of accounting work experience years | Less than 5 yrs | 56 | 28.90% |

| 12 | 5 yrs-less than 10 yrs |

79 | 40.70% | |

| 13 | 10 yrs-less than 15 | 36 | 18.60% | |

| yrs | ||||

| 14 | 15 yrs-less than 20 yrs |

17 | 8.80% | |

| 15 | 20 yrs or more | 6 | 3.10% | |

| 16 | Total | 194 | 100% | |

| 17 | Number of experience years in e-accounting system (use of e- tables) | Less than 5 yrs | 65 | 33.50% |

| 18 | 5 yrs-less than 10 yrs |

77 | 39.70% | |

| 19 | 10 yrs-less than 15 yrs |

23 | 11.90% | |

| 20 | 15 yrs-less than 20 yrs |

12 | 6.40% | |

| 21 | 20 yrs or more | 4 | 2.10% | |

| 22 | Didn’t use | 12 | 6.40% | |

| 23 | Total | 194 | 100% | |

Table 3 tabulates that almost all the respondents (96.4%) use electronic accounting system, with only a few (3.6%) that still used the traditional by the book accounting system.

| Table 3 Frequencies and Percentages of Sample Members' Responses/The Type of Accounting System Used |

||||

|---|---|---|---|---|

| Order | Type of accounting systems used | Question | Frequencies | Percentage |

| 1 | Traditional Accounting | Book | 7 | 3.6% |

| Electronic Accounting | Electronic Tables | 128 | 66.0% | |

| Specialized accounting system for the nature of company's work | 47 | 24.2% | ||

| External accounting auditing company | 12 | 6.2% | ||

| Total | 194 | 100% | ||

Table 4 presents the responses of the sample members, reflecting their low assessment rate of book tasks, obtaining an overall arithmetic mean of 2.32, with standard deviations of the like, while also indicating that most of them use electronic accounting system, obtaining an overall arithmetic mean of 4.41, with corresponding standard deviation value. The respondents preferred electronic accounting over the traditional book accounting system to complete their tasks.

| Table 4 Responses of Sample Members About the Tasks Performed by the Accountant Through the Implemented Accounting System |

|||||

|---|---|---|---|---|---|

| Number | Type of implemented accounting system | Item | Arithmetic mean | STDEV | Response assessment |

| 1 | Traditional Accounting (book) | The book used for daily journal keeping processes | 1.95 | 0.86 | Low |

| 2 | The book used for wages calculation purposes | 2.33 | 0.67 | Moderate | |

| 3 | The book used for calculation of taxes, operational cost, and net profit account purposes | 2.26 | 0.89 | Low | |

| 4 | The book used for ownership calculation purposes | 2.48 | 0.60 | Moderate | |

| 5 | The book used for financial accounts purposes | 2.31 | 0.74 | Low | |

| 6 | The book used to obtain a report that helps with capital budget | 2.22 | 0.69 | Low | |

| 7 | The book used to obtain management reports | 2.73 | 0.78 | Moderate | |

| The arithmetic mean as a whole | 2.32 | Low | |||

| 8 | Electronic Accounting System | Use the electronic tables in book keeping process | 4.23 | 0.80 | High |

| 9 | Use the electronic tables to calculate wages | 4.64 | 0.67 | High | |

| 10 | Use the electronic tables to calculate taxes, operating costs, and net profit | 4.39 | 0.78 | High | |

| 11 | Use the electronic tables to calculate ownership | 4.23 | 0.63 | High | |

| 12 | Use the electronic tables for financial analysis and regression | 4.39 | 0.68 | High | |

| 13 | Use electronic tables to prepare the capital budget | 4.60 | 0.68 | High | |

| 14 | Use the electronic tables to process all types of reports | 4.42 | 0.68 | High | |

| The arithmetic mean as a whole | 4.41 | High | |||

In the above table (Table 5), the responses of the sample members indicate contentment by benefit of using electronic accounting system, which in turn, enhanced the general arithmetic mean of the responses (4.51). This indicates that the respondents had high assessment and evaluation of the benefit of using electronic accounting as supported by the standard deviation value. However, a few of the sample members also indicated contentment in the traditional accounting system, enhanced by the arithmetic mean value of 2.49 (moderate), supported by the corresponding standard deviation value presented in the table.

| Table 5 Descriptive Statistics of the Sample Members' Answers about the Contentment by Benefit of using the Accounting System |

|||||

|---|---|---|---|---|---|

| Number | Type of implemented accounting system | Item | Arithmetic mean | STDEV | Response assessment |

| 15 | Traditional accounting (book) | Using the book helps saving data directly in order to posted later in the book and maintains the capital | 2.65 | 0.73 | Moderate |

| 16 | Using the book helps completing the accounting tasks and contributes to improving the performance | 2.65 | 0.80 | Moderate | |

| 17 | Using the book contributes to enhance effectiveness and increase production | 2.24 | 0.71 | Low | |

| 18 | Using the book enables me to perform the needed equations to reach the required calculation process | 2.43 | 0.88 | Moderate | |

| The arithmetic mean as a whole | 2.49 | Moderate | |||

| 19 | Electronic accounting system | Using electronic tables helps in keeping the financial statements processes and transfer it directly to the daily record | 4.54 | 0.60 | High |

| 20 | Using electronic tables is quick and helps to improve the performance | 4.52 | 0.57 | High | |

| 21 | Using electronic tables is highly effective which reflect on the production increase and its follow-up | 4.45 | 0.68 | High | |

| 22 | Electronic tables program helps me to perform the mathematical calculations and equations in a big way without the need to repeat it. | 4.51 | 0.60 | High | |

| The arithmetic mean as a whole | 4.51 | High | |||

In Table 6, the responses to contentment by ease of use of the respondents to the study in using electronic accounting system is positive in that they agree that it facilitates accounting process via a speedy process of accessing files and high interactivity that provides tables, inputs, and outputs organization, as displayed by the general arithmetic mean of the responses (4.54), with corresponding standard deviation values. Moreover, some of the respondents also indicated contentment in the ease of using traditional accounting system in that it is moderately easy to use when conducting accounting processes in light of files accessing, dealing with inputs and outputs, organizing tables as well as other processes, writing notes, and drawing tables as required, as displayed by the arithmetical mean of the responses (2.80), indicating moderate assessment, with corresponding standard deviation values.

| Table 6 Descriptive Statistics of the Sample Members' Answers about the Contentment by Ease of Using the Accounting System |

|||||

|---|---|---|---|---|---|

| Number | Type of implemented accounting system | Item | Arithmetic mean | STDEV | Response assessment |

| 23 | Traditional accounting (book) | It is easy to use books and paper records | 3.46 | 0.73 | High |

| 24 | It is easy to organize work using paper records and book, and acquire the accounting skills | 2.64 | 0.80 | Moderate | |

| 25 | It's easy to organize charts and tables using the paper records | 2.40 | 0.74 | Moderate | |

| 26 | It's easy to deal with notes and remarks, understand it,and writeit on paper | 2.71 | 0.97 | Moderate | |

| 27 | I am able to access the required file or report through the process of organizing records in a classifier and arranging it | 2.78 | 0.97 | Moderate | |

| The arithmetic mean as a whole | 2.80 | Moderate | |||

| 28 | Electronic accounting system | It's easy to use electronic tables program | 4.63 | 0.59 | High |

| 29 | The electronic table program helps me in the organizing records process and helps me acquire the skills | 4.58 | 0.56 | High | |

| 30 | It's easy to organize charts and tables and make it interactive using the electronic table program | 4.39 | 0.59 | High | |

| 31 | It's easy to write notes and make it interactive by hyperlink or through the notes that appear when cursor is placed on the cell without its direct appearance | 4.34 | 0.75 | High | |

| 32 | I am able to access the required file very quickly by typing a name or word related to the file in the search box | 4.78 | 0.53 | High | |

| The arithmetic mean as a whole | 4.54 | High | |||

Table 7 tabulates the measurement items of actual use of accounting system and from the table, it is evident that majority of the respondents use electronic accounting system for its speed in tasks completion, mitigated time use, and accurate mathematical processes, increase in production and minimal staff for performance of internal audit processes. The system is also related to great interactivity feature, contributing to raising the efficiency of the public capital of the firm, as displayed by the general arithmetical mean of the responses (4.47). On the other hand, for the actual use of traditional accounting system, the respondents considered it to be slow, taking time to conduct processes, prone to errors, requires immediate tasks and less interactive, which leads to delayed issuance of reports, negatively reflecting the efficiency of the public shareholding company’s capital. This is evidenced by the arithmetic mean value of the items at 1.94, with corresponding standard deviation values.

| Table 7 Descriptive Statistics of the Sample Members' Answers Related to the Actual use of Accounting System |

|||||||

|---|---|---|---|---|---|---|---|

| Rank | Item | Traditional Accounting System (book) | Electronic Accounting System | ||||

| Mean | STD EV | Degr ee | Me an | STD EV | Degree | ||

| 33 | Using the accounting system helps me shorten the time and speed that increases capital efficiency | 1.95 | 0.73 | Low | 4.48 | 0.68 | High |

| 34 | Using the accounting system gives more accuracy and therefore reflects on raising capital efficiency | 1.92 | 0.72 | Low | 4.45 | 0.65 | High |

| 35 | Using the accounting system increases production and therefore helps to raise capital efficiency | 1.95 | 0.73 | Low | 4.50 | 0.64 | High |

| 36 | Using the accounting system helps me do more than one accounting job and therefore reduce the number of auditors to increase capital efficiency | 1.93 | 0.72 | Low | 4.45 | 0.65 | High |

| 37 | Using the accounting system helps to increase profits and reduce waste and therefore increase the capital efficiency | 1.94 | 0.73 | Low | 4.49 | 0.61 | High |

| 1.94 Low |

4.47 High | ||||||

Statistical Values of the First Regression Model

The relationship between contentment by ease of use and contentment by benefit of use (independent variables) of the traditional accounting system and the actual use of traditional accounting system (dependent variable) and capital efficiency was regressed and the obtained statistical values are displayed in Table 8.

| Table 8 Impact Factors for Independent Variables on the Dependent Variable |

||

|---|---|---|

| Variable Statistical Value | The contentment by benefit of using the traditional accounting system | The contentment by ease of using the traditional accounting system |

| ß-value | 0.273 | 0.136 |

| Calculated T-value | 2.559 | 1.636 |

| Sig | 0.11 | 0.104 |

| Calculated F-value | 3.551 | |

| Sig | 0.031b | |

| R2 | 0.036 | |

In Table 8, the contentment by ease of using and benefit of using traditional accounting system and their impact on the actual use of the system and on raising the efficiency of public capital obtained a weak coefficient value (R2) of 0.036, indicating that the two variables explained 3.69% of the differences in the accountants’ behavior towards the actual use of the traditional accounting system and towards raising the efficiency of the public capital of the shareholding firms in Jordan. Based on the results, contentment by benefit of using traditional accounting system and its impact on actual use of the system had a regression value of 0.273, while contentment by ease of using traditional accounting system and its impact on actual use and raising capital efficiency had a regression value of 0.136. Moreover, the calculated F value was 3.551, a tabular value, with t value of contentment by benefit of use being 1.636 (insignificant), and of contentment by ease of use being 0.031 (insignificant).

Statistical Values of the Second Regression Model

The relationship between contentment by ease of use and contentment by benefit of use (independent variables) of the electronic accounting system, and the actual use of the system, and the raising of the company’s capital efficiency was regressed and the results showed the following

In Table 9, the impact of the two variables (contentment by ease of use and benefit of use of electronic accounting system) on the dependent variable (actual use of electronic accounting system) and on raising the public capital efficiency was regressed and the result supported a strong impact, with (R2) value of 0.740, indicating that the variables explained 74.0% of the differences that occurred in the accountants’ behavior towards the actual electronic accounting system use, their contentment towards using it and on raising the public capital efficiency. Moreover, from the results it indicates that the benefit of using electronic accounting system had a stronger impact with regression value amounting to 0.811 over contentment by ease of using the system amounting to 0.785. Furthermore, the calculated F value was 34.591, a tabular value, with t value for contentment by benefit of use being 8.058, significant at 0.000, and for contentment by ease of use being 8.099, significant at 0.000.

| Table 9 Impact Factors for Independent Variables on the Dependent Variable |

||

|---|---|---|

| Variable Statistical Value | The contentment by benefit of using the electronic accounting system | The contentment by ease of using the electronic accounting system |

| ß-value | 0.811 | 0.785 |

| Calculated T- value | 8.058 | 8.099 |

| Sig | 0 | 0 |

| Calculated F- value | 34.951 | |

| Sig | 0.000b | |

| R2 | 0.74 | |

Discussion and Conclusion

On the basis of the results of the analysis of data obtained from the questionnaire responses, the hypotheses were tested and the results can be summarized as follows; Almost all of the Jordanian accountants working in public shareholding companies (96.4%) use electronic accounting system to complete their accounting tasks. In addition, majority of the Jordanian accountants (66%) use electronic tables program and specialized accounting programs due to the nature of their jobs (30.4%), as a result of which the proportion of those using the former program is decreased by around 15.1%. A related study by Noor & Zweilf (2009) reported a percentage of 82.9%.

There appears to be a trend among accountants in Jordanian companies in using electronic accounting systems because of the benefits they can reap from it in the form of speed, decreased number of processes, decreased time, interactivity, rapid access and production of timely reports, speedy decision-making, high accuracy and less errors that can adversely impact the reports. This also contributes to saving staff and resources and positively raises the public capital efficiency of public shareholding firms in Jordan.

Majority of the Jordanian accountants also have a tendency to carry out bookkeeping processes, wages and depreciation calculations, financial report drafts, capital balance and administrative reports using electronic accounting system because of its superiority to traditional accounting system as confirmed by the weighted general arithmetic mean of the responses concerning the performance of accounting tasks while using electronic accounting system (4.39) against that of using traditional accounting system (2.32), as supported by the values of standard deviation.

From the findings, there is low-medium contentment among the respondents concerning the usefulness or benefit of using traditional accounting system, as the arithmetic mean was 2.49. Contrastingly, the respondents showed high arithmetic mean of contentment by benefit of using electronic accounting system, as the arithmetic mean was revealed to be 4.51.

For the ease of using traditional accounting system, it had a weighted general arithmetic mean of 2.80, indicating medium contentment, against the weighted arithmetic mean of ease of using electronic accounting system, which was at 4.54, indicating high contentment.

More importantly, the accountants make use of electronic accounting system with the actual frequencies of the system being 4.47, as opposed to 1.94 for the traditional accounting system (used rarely). This is aligned with the development experienced in financial and business fields, the introduction of current technology and accelerated development and their significant effect on the public capital efficiency of public shareholding firms in Jordan.

According to the results obtained from the multiple regression analysis, contentment by ease of use and contentment by benefit of using traditional accounting system had low significant impact on the behavior towards using the actual traditional accounting system, and on raising the public capital of the shareholding firms as evidenced by their values (0.273 and 0.163 respectively). Based on language of interpretation ratio, the two variables had apparent difference in the use of traditional accounting system of 3.6%.

Comparatively, in the case of the electronic accounting system, contentment by ease of using the system and by benefit of using electronic accounting system had high significant impact on the behavior towards using the actual system, and on raising the public capital of the shareholding firms as evidenced by their values (0.811 and 0.785 respectively). Based on language interpretation ratio, the two variables had a difference of 74% in using the electronic accounting system. Lastly, the model was evidenced to be valid in examining IT in accounting work system environment as supported by the results in the context of Jordanian accountants. Two regression points described the relationship between the two independent variables on the dependent one.

Study Implications

The following recommendations are developed based on the study findings.

• It is important to strengthen and support the teaching curriculum with materials focused on electronic accounting systems as it has key role in enhancing the skills of accountants as well as their abilities to be useful to the labor market.

• Public shareholding companies should provide training courses to their accountants to supplement their abilities to tackle and leverage electronic accounting system, particularly when it comes to the work nature, as this study showed that the level of ease and usefulness of the system in the perception of accountants can raise the capital efficiency of the whole firm.

• This study also recommends that professional bodies invite small shareholding firms to seminars to stress on the importance of electronic accounting system, highlighting its usefulness and ease of use to benefit the company, and to ultimately raise its capital efficiency.

• Similar studies can be conducted in the future to follow-up on the progress of using electronic accounting system and to determine the level of risks/issues faced by the accountants in Jordanian firms. This would lead to the provision of required training courses to overcome the barriers and significantly affect their career progression, while raising the public capital efficiency of the Jordanian shareholding firms.

References

- Baxter, I., & Oatley, K. (1991). Measuring the learn ability of spreadsheets in inexperience. Behavior and Information technology, 10, 475-490.

- Torkadeh, G., & Angulo, I. The concept and correlates of computer anxiety. Behavior and Information Technology, 11, 99-108.

- Sutton, D., & Faulkner, L. (1994). The use of spreadsheets in management decision making: A linear programming case study. Leicester Business School Occasional Paper, 19.

- Chau, P. (1996). An empirical assessment of a modifief technology acceptance model. Journal of Management Information System, 3(2), 185-204.

- Ahmad, M., & Alrabba, H. (2017). Examining the impact of capital structure on earnings quality in food and beverage companies listed on the jordanian stock exchange. International Journal of Economic Research, 14(15).

- Mathieson, K. (1991). Predicting user intentions: Comparing the technology acceptance model with the theory of planned behavior. Information Systems Research, 2(3), 173-191.

- Hendrickson, A., & Collins, M. (1996). An assessment of structure and causation of is usage. The DATABASE for Advances in Information Systems, 27(2), 61-67.

- Rose, G., & Straub, D. (1998). Predicting general it use: Applying TAM to the arabic world. Journal of Global Information Management, 6(3), 39-45.

- Al-Moghaiwl, H. (2003). An empirical evidence on accountants’ user of spreadsheets in saudi Arabia. Journal of King Saud University: Administrative Sciences, 15(2), 95-122.

- Van Schaik, P., Barker, P., & Moukadem, I. (2005). Using a digital campus support electronic learning in Lebanon. Innovation in Education and Teaching International, 42(2), 157-166.

- Jab Allah Amal, H. (2018). Application of electronic management in the ministry of finance: an analytical and critical study of the modernization of the information system within the framework of financial and budgetary reforms. International conference on the legal system of the electronic public facility.

- Davis, F. (1993). User acceptance of information technology, System characteristics, User perceptions and behavioral impacts. Int. Journal of Man Machine Studies, 38, 475-487.

- Adams, D., Nelson, R., & Todd, P. (1992). Perceived usefulness, ease of use and usage of information technology: A replication. MIS Quarterly, 30(2), 361-391.

- Sl Shbail, M., Salleh, Z., Nor, M., & Nazli, N. (2018). Antecedents of burnout and its relationship to internal audit quality. Business Economic Horizons, 14, 789-817.

- Al-Shbiel, S.O., Ahmad, M.A., Al-Shbail, A.M., Al-Mawali, H., & Al-Shbail, M.O. (2018). The mediating role of work engagement in the relationship between organizational justice and junior accountants turnover intentions. Academy of Accounting Financial Studies Journal.

- Obeid, M., Salleh, Z., & Nor, M.N.M. (2017). The mediating effect of job satisfaction on the relationship between personality traits and premature sign-off. Academy of Accounting Financial Studies Journal.

- Ahmad, M., & Alrabba, H. (2017). The role of external auditing in activating the governance for controlling banking risk. Corporate Ownership & Control, 14(3), 100.

- Ahmad, M.A. (2019). The effect of ethical leadership on management accountants’ performance: The mediating role of psychological well-being. Problems and Perspectives in Management, 17(2), 228.

- Ahmad, M.A., & Seif, O.A. (2019). Factors related to organizational commitment of jordanian auditors: A structural model. The Journal of Social Sciences Research, 5(5), 1020-1034.

- Ahmad, M.A., & Seif, O.A. The effect of accounting information system on organizational performance in jordanian industrial SMEs: The mediating role of knowledge management. International Journal of Business and Social Science, 10(3).

- Al Shbail, M.O., Zalailah, S., & Mohd N.M.N. (2018). The effect of ethical tension and time pressure on job burnout and premature sign-off. Journal of Business and Retail Management Research, 12(4).

- Davis, F.D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS quarterly, 319-340.