Research Article: 2019 Vol: 18 Issue: 4

Evolution of a Strategic Business Model of Enterprise in the Sphere of Information and Communication Technologies

Jiafei Guo, Luoyang Normal University

Oksana Portna, V.N. Karazin Kharkiv National University

Volodymyr Rodchenko, V.N. Karazin Kharkiv National University

V.P. Tretyak, V.N. Karazin Kharkiv National University

Jingxu Du, H.S. Skovoroda Kharkiv National Pedagogical University

Abstract

Based on the results of a constructive study of the experience of the activities and development of IT companies, as well as generalization of the accumulated world experience in the management of enterprises in this field, a model for ensuring the effectiveness of companies on the criterion of economic added value is proposed. Authorâs development is represented by a system of deterministic analytical relations, which together allow improving the quality of managerial decisions in the current and perspective conditions.

Keywords

IT Company, Information Products, Added Value, Business Model, Efficiency, Balanced Scorecard.

JEL Classifications

M5, Q2.

Introduction

The growth of competition level in commodity markets and the diversification of trade ties objectively predetermine the spread of new technologies, the domination of innovative approaches to the production and sale of goods in all spheres. Consequently, the basis of the modern approach to the development of companies is innovation, advanced technology and human capital. Under the influence of information and communication technologies the essence of the very concept of “enterprise”, which acquires a number of virtual characteristics, overcomes the spatial and resource constraints of traditional economic activity. The role of intangible characteristics of goods is increasing, accompanied by an increase in the value of information or intellectual components of the formation of its value. At the same time, the globalization of markets, the blurring of sectoral boundaries or market segments leads to the need to synchronize national business practices with world standards of economic activity. Specifically, the above-mentioned specificity is particularly evident in markets where information or intellectual property itself is a commodity. The companies that carry out its activities in the sphere of information and communication technologies are leaders in the speed of innovation, and also have a whole range of unique characteristics. In this regard, the problem of ensuring the effectiveness of its activities has both scientific value and applied value.

Review Of Literature

The study of methods for ensuring the effectiveness of the activities of enterprises in the information and communication sphere, taking into account the specifics of its activities, the speed of innovation changes and the peculiarities of evaluating the value of information products become relevant. The analysis of various aspects and the evaluation of the efficiency of enterprises in this sphere are in the sight of well-known scientists.

Definitely, the creation of added value in the process of using limited economic resources deserves the greatest attention (Agostinho et al., 2016). But in the conditions of the informational-knowledge economy, these aspects of economic relations are significantly transformed in the direction of integration of production and consumption processes point of view of the organization of time-limited and large market transactions of resources, economic benefits from the producer to the consumer, from the owner to the buyer, etc. (Hinkelmann et al., 2016). Information as an economic resource does not have spatial restrictions on its involvement for economic use. At the same time, time factors influence its relevance, and therefore, determine the value of information resources (Lu, 2017; Drobyazko et al., 2019). It should also point to another feature of information products, namely the possibility of its multiple use or consumption without significant loss of its operational (consumptive) properties (Romero & Vernadat, 2016). It should be noted that the consumption process has the character of learning and depends on the ability of the subject to receive certain information services, software, system solutions, etc.

Methodology

The theoretical and methodological basis of the study is a system of general scientific and special approaches containing methods of comparative analysis and synthesis. Econometric modelling based on financial and statistical reporting of companies is used to research the IT sector, in particular to assess trends in market developments and forecast the development of sample companies. Systems of index analysis, estimation of dynamics of time series, formation and statistical verification of representativeness of indicators of IT enterprises are the basis of development of author's model of analysis, namely indicators of economy, speed of service and others.

Results and Discussions

It should be noted that for the company of all spheres of business there is an urgent problem of combining financial and non-financial analytical indicators in the models of applied calculations. It is no exception to the scope of information and communication services, in which the high-tech processes of information processing or transfer from business processes of creation of value to investors, consumers or society as a whole are closely intertwined. It should be acknowledged that most of the application models of analysis and management of company performance (development) are intended to offer a clear and transparent technology combination of technological and financial parameters of organizations, consumer assessments with the economic performance of firms. For example, we can use the very popular model of company management called “Balanced Scorecard”, which in its methodological basis provides four perspectives of analysis: financial, client, process and strategic (training and development).

We consider the relations intuitively understood and statistically proven: the increase in quality, in general, leads to an increase in customer satisfaction; the growth of customer satisfaction is a result of an increase in sales volumes of the company’s products or services, which, in turn, leads to an increase in the market share on other equal terms; an increase in the volume of sales of company’s products or services determines the need to increase the volume of current assets to serve the growing business needs; improvement of the organization of business processes reduces the need of the company in working capital, but this connection is not always clear in various business spheres; the growth of sales volume has a positive impact on the profitability of the activity as a result of reduction of specific expenses and growth of income of the company in other equal conditions; increased profitability of sales leads to an increase in company's capital returns and increases in stock prices; an increase in the company’s shares increases the possibility of attracting additional capital and increases the cost of capital owners.

Examples of such relations can be given a much larger number, but unfortunately, it is not always scientifically proved and measured quantitatively. The problem of establishing causeeffect relations is the object of study for all sciences, but in economics it is most often solved on the basis of the analysis of empirical data.

Despite the modern development of information and analytical technologies, the level of customer satisfaction and the growth of business value remains inadequately grounded in business. Between these two analytical indicators there is an array of direct and indirect economic effects that its direct mathematical comparison may be quite arbitrary, although the link between these indicators is understandable.

An additional problem is the analysis of changes in the analytical indicators of efficiency in the time dimension, that is, the problem of combining time-varying economic, social, financial or environmental indicators in one analysis model.

First of all, let’s give a database that will be used by us to further explore the issues of the effectiveness of IT companies. It should be noted that not all data is used from the initial array of information. Due to the fact that the information in our study is real and formed on the basis of the reporting of real companies, and was not selected according to certain rules of sampling, it is very heterogeneous. In other words, a sample of enterprises needs some degree of unification. In economic studies that focus on the study of socio-economic processes, a certain part of the observation is always deviant. There may be many reasons for this, for example, the inappropriate behaviour of market agents in the market will result in illogical proportions between their capital invested in business and the number of users of their services.

One way or another, we have allocated 15,541 observations on the activities of IT companies in 2010-2016, only two thirds of enterprises that submitted technically correct information in financial and statistical reporting.

This is not about assessing the reliability of data provided by companies, but the fact that they often do not indicate separate lines of its reporting at all, although according to the law, reports are based on further calculations based on missing data. In order not to fill the gaps in the financial statements with our own counting information, we have decided to exclude such technically incorrectly presented data from our analysis.

To the previous financial and economic indicators, we added two operational indicators, which were mentioned above and are part of the model of our analysis. On this basis, we can calculate the amount of economic added value that creates companies per unit of time tEVA (in our study per one working day). Given the high dynamics of this business sphere, it is precisely this indicator to be considered as the most telling one for the analysis of economic processes in the IT sector. The EVA calculation technology is traditional, but in our study, we also need to emphasize the need to bring time-varying economic indicators to a single period of time. At this stage, we leave this question open, but we will decide at the final stage.

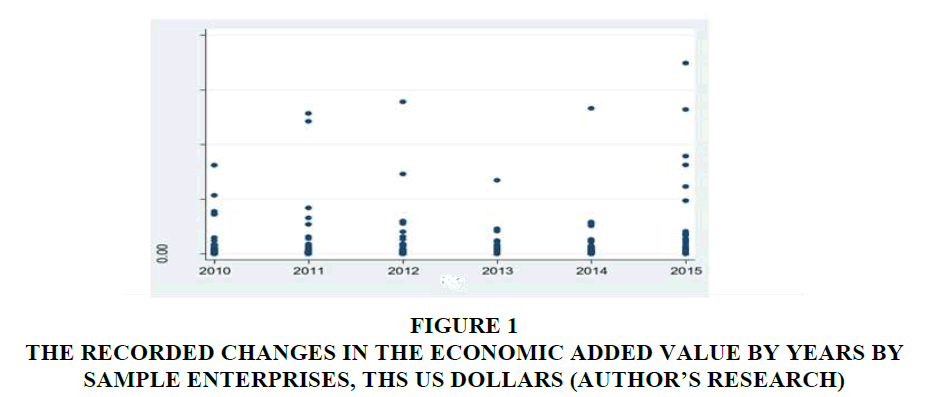

The distribution of economic added value over the analysis periods can be represented graphically.

The Figure 1 shows that most companies in our sample of 10,451 enterprises are concentrated in the lower segment of the graph. Consequently, we can state that most companies are small businesses or individuals with small volumes of their activity. In addition, we note that there has been an increase in the amplitude of fluctuations over the years of analysis; in particular the range of economic added value has increased in 2016.

Figure 1.The Recorded Changes Inn The Economic Added Value By Years By Sample Enterprises, Ths Us Dollars (Author?s Research.

Based on the presented figure, we can state that the value created by the company does not depend on the number of clients of the company. We believe that to a greater extent in this area it matters what the company’s business model adheres to, or how its business is built. We can see that in the figure there are companies with a high level of added value per unit time for a small number of users. Probably, in these cases, companies create some unique information solutions, for which users are willing to pay much more. Therefore, in some cases, companies do not make sense to build a customer base.

The results of our study are confirmed by the following studies. Companies and organizations of IT spheres do not have a strong attachment to a particular region, to the material and technical base that determines its exceptional mobility and independence from the above macroeconomic aspects of business (Hilorme et al., 2018). It can be noted that the subjects of the management of the information and communication spheres often carry out its activities outside the normative and legislative regulation of the national level, use financial mechanisms of a transnational nature, combine the personnel of different regions of the world on the basis of the use of remote technologies. This feature during development should be taken into account when developing macroeconomic policies and conducting market analyses in various sectors of the national economy (Tetiana et al., 2018). Ability to duplicate (distribute) information with minimal expense, high speed of its distribution, small storage costs, and inexhaustibility during use determine the impossibility of applying traditional approaches to the formation of the value of goods and services.

Conclusion

Considering the information factors of the functioning of economic systems from the standpoint of the resource, the way of using resources as a system-forming element of social production, as a result of economic transactions, it was possible to substantiate the system of evaluation of economic results, as well as to synthesize the quadratic function of its estimation and forecasting. Formalized role of information components of enterprises activity in providing of technological efficiency of its functioning, timeliness of realization of economic competences and expediency of obtaining economic effects is determined.

The proposed econometric model of enterprise performance evaluation, implemented with the help of a specialized mathematical apparatus, is brought to the level of specific indicators using the added value criterion. By defending the consumer-oriented approach to the analysis of the efficiency of enterprises, the mechanisms of the transfer of added value created by the producer to the consumer of products are analysed.

Recommendations

In order to improve the system for ensuring the effectiveness of the activities and development of IT companies, we recommend developing a system for classifying costs that accompany commercial transactions in the markets of information products, which allowed to correctly formulating a conceptual model for its analysis. In order to adequately assess and manage the effectiveness of IT companies, current, promising and indirect (side) economic effects need to be taken into account. The use of only financial indicators of analysis should be supplemented by a number of operational indicators.

References

- Agostinho, C., Ducq, Y., Zacharewicz, G., Sarraipa, J., Lampathaki, F., Poler, R., & Jardim-Goncalves, R. (2016). Towards a sustainable interoperability in networked enterprise information systems: Trends of knowledge and model-driven technology. Computers in Industry, 79, 64-76.

- Drobyazko, S., Hryhoruk, I., Pavlova, H., Volchanska, L., & Sergiychuk, S. (2019). Entrepreneurship innovation model for telecommunications enterprises. Journal of Entrepreneurship Education, 22(2).

- Hilorme, T., Nazarenko, I., Okulicz-Kozaryn, W., Getman, O., & Drobyazko, S. (2018). Innovative model of economic behavior of agents in the sphere of energy conservation. Academy of Entrepreneurship Journal, 24(3).

- Hinkelmann, K., Gerber, A., Karagiannis, D., Thoenssen, B., Van der Merwe, A., & Woitsch, R. (2016). A new paradigm for the continuous alignment of business and IT: Combining enterprise architecture modelling and enterprise ontology. Computers in Industry, 79, 77-86.

- Lu, Y. (2017). Industry 4.0: A survey on technologies, applications and open research issues. Journal of Industrial Information Integration, 6, 1-10.

- Romero, D., & Vernadat, F. (2016). Enterprise information systems state of the art: Past, present and future trends. Computers in Industry, 79, 3-13.

- Sun, Z., Strang, K., & Firmin, S. (2017). Business analytics-based enterprise information systems. Journal of Computer Information Systems, 57(2), 169-178.

- Tetiana, H., Chorna, M., Karpenko, L., Milyavskiy, M., & Drobyazko, S. (2018). Innovative model of enterprises personnel incentives evaluation. Academy of Strategic Management Journal, 17(3).