Research Article: 2020 Vol: 19 Issue: 1

Exploring Adoption of E-Vehicles in India: An Institutional Perspective

Amit Kumar Pandey, Indian Institute of Management (IIM) Raipur

Satyasiba Das, Indian Institute of Management (IIM) Raipur

Abstract

eVehicle technology has been available in India for a decade, yet there has been less than appreciable production and adoption in the market. The possible reason for this is institutional void, which should not occur as there are several institutions to support it. We explore this phenomenon through qualitative study and find that despite the presence of institutions, failure of institutions occurs and are at times hidden due to external circumstances. This research maps the players and factors in the industry to illustrate this failure and define a model to better understand the business strategies adopted by firms in the presence of Institutional Voids. The future scope is suggested.

Keywords

Strategy, Institutional Void, Electric Vehicle, Technology, Judiciary.

Introduction

The adoption of new technology or paradigm in any industry is more a function of the cumulative actions of all players in the industry than that of a single early adopter firm. Industrial Institutions play a significant role in this process by creating agreements and consensus on pivotal issues, access to knowledge and resources, and connecting potential partner firms (Iyer, 2016; Holmes Jr et al., 2013; Luo & Chung, 2013; Powell & DiMaggio, 2012; Mair & Marti, 2009; Williamson, 1991). Inefficient or a lack of institutions, on the other hand, create institutional voids leading to fragmented agreements, lack of coherence in the direction of the industry, and a slow adoption or assimilation of new ideas - in this case - innovative technology.

Investigations of such cases have become essential and sought after for their ability to develop insights and recommendations for such a phenomenon, which has become prevalent in recent years due to the rapid rate of new technology development. However, no such study was found in the area of Electric Vehicles (EVs) in the broader context of the automobile industry. Prior studies suggest EVs adoption to be driven by customer incentives, regulatory incentives, and technology readiness (McKinsey & Company, 2017; Eberhart et al., 2014; Kley et al., 2011; Ostrom, 2009; Jamali & Mirshak, 2007).

In this study, we explore the case of the delayed adoption of Electric Vehicle (EV) technology in the Indian automobile industry. Despite several institutions designed to facilitate the development and adoption of electric vehicles in India, the number of EVs to reach the market and the infrastructure required for them has been less than expected (Vidhi & Shrivastava, 2018; NITI Aayog and Rocky Mountain Institute, 2017; Gupta, 2016; Manikandan & Ramachandran, 2015; Saxena et al., 2014; Bohnsack et al., 2014; Carney, 2008). It provides a unique opportunity to observe the way institutions and automobile firms manage or fail to manage the development and adoption of EV technologies in India (Vidhi & Shrivastava, 2018; Saxena et al., 2014). As part of its commitment to cap the rising carbon emissions, India listed the Intended Nationally Determined Contribution (INDC). INDC enlists electric vehicles as a focus area under transport mitigation actions. Government of India (GoI) adopted the India Faster Adoption and Manufacturing of Hybrid and Electric vehicles (FAME India) as part of the country's National Electric Mobility Mission Plan 2020. GoI has set a target to sell only electric cars by 2030. The above-proposed policy interventions introduce several policy initiatives to promote the development and adoption of EVs in India.

Contrary to the evidence in the literature (Vidhi & Shrivastava, 2018; Dhar et al., 2018; Saxena et al., 2014) review of the industry perspective suggests that the lack of any clear policy is hindering the progress of EV adoption in India. The concerns of the industry executives suggest the presence of institutional void influencing the development and adoption of EVs.

Considering the above gaps/inconsistencies, the objective of this research is to explore the business strategies that firms employ to develop innovative products and take them to market in the presence of institutional voids.

Literature Review

Institutional Void

Building on the work of North (1990); Williamson (1991); Khanna & Palepu (1997, 2000), Ardagna & Lusardi (2008); Batjargal et al., (2013); McMillan (2007); Rottig (2016) introduced the concept of institutional voids, defining them as a situation in which weak or absent institutions complicate the establishment of efficient markets. Institutional voids hinder the proper functioning of markets and may lead to their failure (Godfrey, 2011; Khanna & Palepu, 1997 & 2010; Malesky & Taussig, 2009; Hillman & Keim, 1995).

Compared to developed economies, institutional voids in emerging economies gives rise to a host of information asymmetry and agency issues that greatly increase the transaction costs and the costs of doing business (Terjesen et al., 2016; North & Shirley, 2008; Khanna et al., 2005). As noted by international business scholars Peng (2003), institutions in emerging economies play a much more significant role in firm strategic decisions than in developed nations.

The nature of institutional voids in emerging economies has been examined by several empirical studies. Makino et al. (2004) find that in developing countries, the primary sources of variation in firm performance arise from country and industry effects. From the literature reviewed, it becomes quite evident that the institutional ecosystem in emerging economies is different from developed economies and firms embedded in underdeveloped institutional contexts are forced to strategically employ available resources to overcome voids and maximize benefits (Sobel & Coyne, 2011; Pache & Santos, 2010; Persson, 2002). Considering this gap this paper aims to analyses firm’s response in presence of institutional voids and the strategy they employ to overcome institutional voids (Thornton et al., 2012; Romanelli & Schoonhoven, 2001). In this paper the objective is to analyses the firm’s strategy to develop electric vehicles in the presence of institutional voids such as nonexistence of policies and institutions to govern the development and adoption of electric vehicles.

As we summarize the review of literature, it can be concluded that the existence of institutional voids impedes the progress of organizations by creating information asymmetry and increasing the cost of the transaction (Tonoyan et al., 2010). As the review highlights, institutional voids are a significant phenomenon existing in emerging economies. While there are several studies on the way organizations overcome institutional voids in mature industries, there has been little investigation of the phenomena in emerging industries such as the case of this paper EVs. It is necessary to investigate the phenomena of institutional voids in emerging industries as these industries are distinct from the matured industries in terms of well-defined actors and issues. As the review above has highlighted in emerging industry like that of EVs in India there is a lack of existence of clear policies, no convergence on role of regulators and lack of any strong commitment by industry players. However, despite the existence of these institutional voids, certain firms have made significant progress in the development and adoption of BEVs while industry incumbents have refrained from making any commercial move. These abbreviations make it essential to investigate this phenomenon on how actors responded and strategies in institutional voids in emerging industries.

Methodology

To address our research questions, we employ a qualitative method of research using in-depth interviews. Given that there aren’t many studies in the context of barriers to technology adoption due to institutional voids in the emerging economy, we chose an exploratory approach.

Interview Method and Selection

We followed a flexible and emergent method of data collection as suggested by Eberhart et al. (2014) and Gioia et al. (2013). Initially, Judgement sampling was used to locate information-rich respondents. For this purpose, a list of potential respondents was made according to their association with technology assimilation or executive decision bodies, or due to their expertise in the subject matter. They were then approached through connections of the authors, made possible because of the author’s own 15 years association with the industry through professional membership and industry positions. The respondents were revisited for further interviews to gather extra information or for clarification on new findings and developments from other interviews and analysis.

Data Collection

Our primary data collection was covered in a period of 6 months. This included respondent selection, interviews, follow-up interviews, secondary data collection, and transcription. We used multiple data sources for the sake of triangulation.

Data Analysis

Given the exploratory nature of the study, we used inductive analysis to identify categories, themes, and patterns that emerged from the data. Following this, we made possible connections between these themes, cross-checked with follow up interviews and modified and re-modified our understanding of the phenomena surrounding the subject matter.

An initial reading of the transcripts and field notes revealed that the existing player classification of “Customers”, “Manufacturers”, and “Regulatory bodies” must be further broken into sub-groups as each appeared to have very distinct characteristics, tendencies, and relationships with each other. The “Customers” group could be classified into “Personal Use” and “Professional/Service Use” such as public commutation services both unorganized (e.g. rickshaws) and organized (e.g., mobility service providers). The “Manufacturers” could be classified into large players with research funding and small manufacturers mostly catering to the “Professional/Service Use” customer segment, manufacturing e-rickshaws. The list of both groups is given in the following sections. The “Regulatory bodies” group could be classified into “Executive Government bodies” and “Judiciary”.

In the second stage of the analysis, interviews in each group were analysed to identify dominant models of decision-making metrics, opinions on and demands from other players, and future expectations. The goal was to determine the differentiating characteristics of these players, the forces exerted on them, and create a mapping of their thought process, contributing to a prediction of their future movements and decisions. In the final stage, each of the groups was compared/contrasted with each other, and the connections between them, through coercion, influence, or competition, were investigated. The goal at this stage was to create an understanding of the interactions between these groups.

Results and Discussion

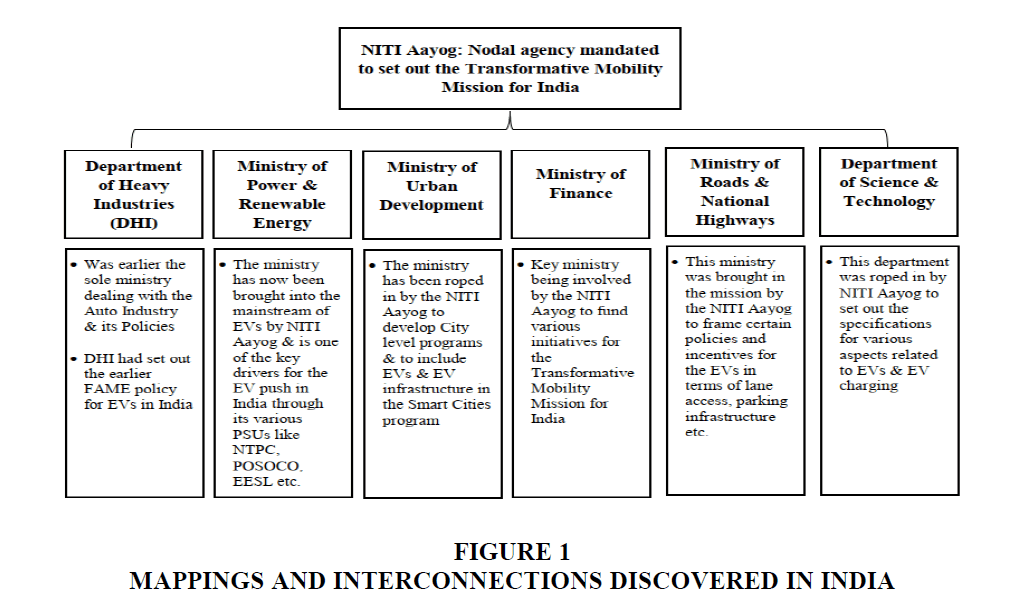

The following section illustrates the mappings and interconnections we discovered (Figure 1).

Institutes responsible for rollout of EVs in India

Large OEMs

These manufacturers act at a national level and have multiple lines of products, including both personal and passenger vehicles. Some examples of these OEMs are Maruti Suzuki, Tata Motors, Hyundai Motors, etc. Some of them, such as Hyundai Motors and Honda, also have international markets. Plying their trade at the national (and at times international) level, employing many thousand workers and connected directly to the individual states and national GDP, entities in this group are scrutinised by media, regulated by many commercial and government associations, and fall in the purview of institutions like the Supreme Court, which acts on the behalf/benefit of people. Owing to their large and visible role and given the ostensible leanings towards eVehicles for their environmental benefits, it is expected that Large OEMs would be the first to adopt and execute eVehicle technology. However, that is not the case.

To begin-Production and sale of eVehicles by Large OEMs is minuscule compared to their production and sale of Internal Combustion Engine (ICE) vehicles in the years post the industries vehement public posturing that eVehicles were the top priority. Some examples of such posturing are in 2017 against a total of 700000 EVs larger OEMs produced 3.79 million ICE based vehicles. As we considered our data, we explored a common mismatch between the declarations and posturing of such large OEMs versus their actual actions (such as production).

Further, informants representing large OEMs or having worked closely with them suggested that the predominant understanding of the industry was that eVehicle technology would take 10 years (from 2019, when the study was being conducted) to establish itself in the market. As one informant explained, “We still don’t have that kind of technology for commercial production and it may take 5- 6 years or even 10 years to reach there” [Informant code - 03]. Some of the reasons for these beliefs were: (1) uncertainty with eVehicle technology, as the technology for personal vehicles was still being tested on Indian conditions, (2) non-readiness of charging infrastructure, much needed for a eVehicle heavy traffic, and (3) a lack of customer purchase intention, as much of the customer base still considered purchase cost as a larger motivator than environment and long term (or life-time) running costs of the vehicle. As one informant explained, “Unfortunately, there is no proper infrastructure where these people can charge their vehicle. Now what they are doing is currently they are either charging from home supply or there are some illegal charging stations”.

Technology availability is not an issue preventing the production and sale of eVehicles. As explained by one informant, “China has progressed very much more than the developed markets to show electrification can be done. Of the approx. 1.1 million electrical vehicles sold globally last year about 70,000 were sold in China. So, incentivize to apply the disruptions in the market to bring in capabilities to capture faster than those more developed market”. From the facts of the case, we surmised that market conditions, a factor common among all large OEMs both domestic and international, might have something to do with the unwillingness of both groups of manufacturers (domestic and international large OEMs) from offering eVehicles in the Indian market.

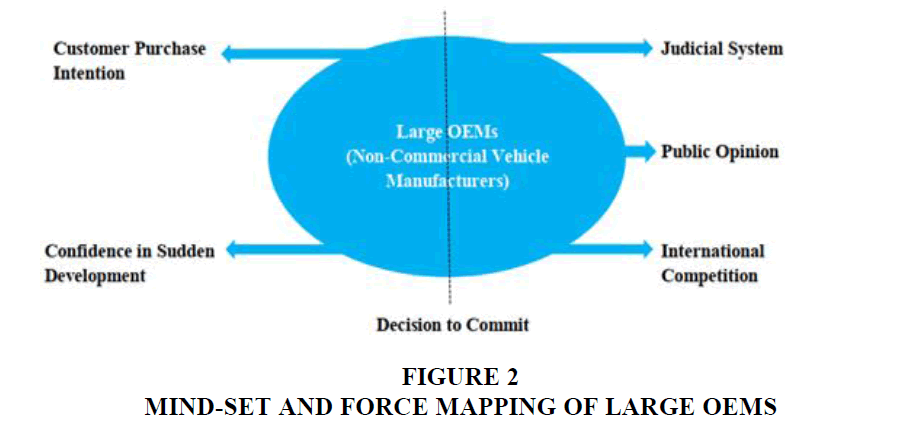

Another reason for the delayed actions of the large OEMs was the confidence in their research and ability to develop and deliver a product in a short amount of time when the market was ready. It appeared that the larger OEMs believed in delivering the best product at the right time to the market versus delivering incrementally better products over a larger period of time. As suggested by one informant, “When given a chance, we will deliver the products to the market. But the market must mature first. Making offerings to the market in trying to mature the market is expensive and not strategically sound”. These statements were reinforced by the fact most of the large OEMs had huge R&D expenditures and can deliver a completely tested model in a year's time at least. Figure 2 shows the mind-set and force mapping of large OEMs on the decision to commit to eVehicles.

We place the Large OEMs “on the fence” with the decision to commit. Despite pressures from the Judicial system, international competition in eVehicles (where these companies also have vested interests), and a small but vocal public opinion, Large OEMs are dragging their feet when it comes to the production and offering of eVehicles to the personal vehicle customer segment. Our findings suggest that the reasons for this delay are the previously mentioned lackluster purchase intention of the customer base and the confidence that when the market matures and becomes viable, these large OEMs will be able to deliver a viable product in a few years’ time. Some functions that the large OEMs are expected to perform but are not performing are: (1) lobby the government and industry for rapid deployment of charging infrastructure (2) educate the customer segment to accept and even demand eVehicles (3) demonstrate the efficiency of the prototype vehicles that are being designed in their labs. The reason for this nonperformance is that there is less early reward for the same. For these reasons, the Large OEMs remain on the fence.

Smaller OEMs

These manufacturers act at a regional level and have single lines of products, mostly of passenger vehicles. Some examples of these OEMs are REVA, Electrotherm, Tunwal E-vehicles, UM Lohia Two Wheelers Pvt. Ltd., Ather Energy, Okinawa Autotech Pvt. Ltd etc. Some of them, such as REVA and Electrotherm, also have international markets but have small distributions and low market shares. An approx. 11000 electric three-wheelers hit the Indian roads every month as in 2019. Plying their trade at the state or regional level, employing a few hundred workers each, they are hardly scrutinized by media or state and national ministries. They are of small consequence to national or state GDP thus can cut corners and find workarounds with lower-level state officials. Owing to their small and rarely noticeable role, it is expected that Small OEMs would be the last to adopt and execute a new and uncertain technology such as eVehicle. However, that is also not the case.

To begin-the Production and sale of eVehicles by Small OEMs is the only proven and continuous production of eVehicles in India. They are entirely in the passenger vehicle division, with eRickshaws replacing Cycle Rickshaws. As one informant explains, “In three-wheeler segment, large company Mahindra is there, Mahindra is manufacturing in this, then Kinetic they are doing this, Sizou also is there, then Lohia motors are there. But they are not in our market. We will not be fighting with them”.

There is hardly any posturing involved when it comes to small OEMs as their business is not dependent and does not get affected by it. The production and technology conditions too are different for them. They believe in incremental development and production i.e. they produce and sell vehicles based on current technology, at the same time investing in the further development of technology. Most of the small OEMs do not have large R&D funds or infrastructure and take help from external consultants. Some are even planning to hire these consultants full time. As one informant explains, “Actually I did almost 3-4 months research right! I went to Défense manufacturers, 8-10 manufacturers I visited the factories, talked to them then I hired the consultant as well.” Some of the concerns they have are (1) lack of government funding, (2) lack of private venture funding and (3) lack of charging infrastructure.

Interestingly, the Small OEMs are not concerned about the large OEMs moving into their business. They reinforced our understanding of the stand taken by large OEMs. In this case, they agreed that the large OEMs will not begin serious production in eVehicles soon. As one informant explains, “Interestingly larger OEMs are not very aggressive in this segment, except Mahindra is very aggressive now. However, they are not trying to replace the auto market typical E-Rickshaws with 4 passengers”.

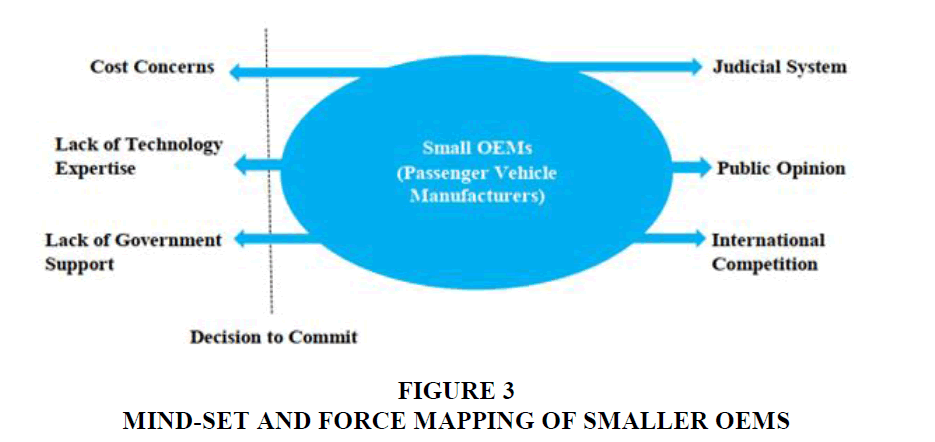

Small OEMs further mentioned several factors that affected their business. First, the customers (passenger vehicle drivers or eRickshaw drivers) did not receive adequate financial support from banks. As one informant explains, “So an E Rickshaw buyer can have maximum up to subsidy is Rs. 30000/- on the vehicle. [Which is not enough as his original investment is more]”. Second, several Small OEMs received licenses but were not plying their trade. Possible reasons were that they were waiting for foreign players to connect with them and use them as entry points into the Indian Passenger eVehicle market. Our informants suggested interests have been shown from firms in Japan and China (possibly because of their advancements in eVehicle battery technology). Figure 3 shows the mindset and force mapping of small OEMs on the decision to commit to eVehicles.

Small OEMs are on the positive side of the decision to commit. The most pressing reason for their willingness to commit is the purchase intention of the customer base willing to use eVehicles as passenger vehicles. They are pressed for support in terms of technology, which they borrow from consultants and companies in developed economies like Japan and China. They also lament the lack of tax relief for their customers who they consider are getting a bad deal when it comes to GST norms. However, despite these issues they continue to produce, sell, and further improve eVehicles. They remain confident that Large OEMs will not enter into their markets soon. This notion was common among almost all our respondents.

Customer Purchase Intentions

We defined this label as indications that customers were willing to purchase eVehicles. We determined this willingness from the inferences drawn by the informants who were part of the market research or eVehicle departments of the Large and Small OEMs.

The customer segment, as it appeared, was divided in its opinion of eVehicles. When it came to purchasing personal vehicles, most believed they were the future and were good both for the environment and for the customer (due to lower running and maintenance costs). However, as the informants repeatedly and consistently suggested, most customers were unsure about the Charging infrastructure required for such cars or if adequate technology and if testing was ready for such cars to be successful. As one informant explains, “So If I work in Nissan office, there is a surety that I will get charging Park there. I know that I will go to the office and I will get charging station there. But tell me how many other offices have it?” Customer purchase intention for passenger vehicles i.e. Individuals wanting to purchase eRickshaws to replace cycle rickshaws for the use of providing passenger services, customers were more willing and readier to purchase. Charging for such vehicles was still not hassle-free but the advantages of a battery-run Rickshaw versus the cycle run Rickshaw appears to have overshadowed the disadvantages of charging the eVehicle.

Customer Patronage Intentions

Customers were also willing to use these eRickshaws. There were no indications of fear of failure or accident. Customers considered the eRickshaws safe and more convenient (because of higher speeds) than the cycle driven Rickshaw. These notions were reinforced by secondary research, which found approximately 11,000 eRickshaws plying in NCR every month at the time when this report was being written (2019).

Customer Environmental Concerns

This factor was considered the most powerful driving force behind the adoption and demand of eVehicles. With the customers asking for a less polluting vehicle, most OEMs were supposed to have pushed for eVehicle technology and delivered market offerings adequate to the demand. However, our investigations found this force to be “in name only” i.e. customers were still price focused and not demanding a non-polluting car as much. An informant suggests, “I want environmental change. But given the prices, I will wait for the right car with the right price before shifting to Electric”.

Conclusion

Once we identified the requirements of institutions in the broader framework of eVehicle technology adoption, we began reanalyzing our data to identify common explanations for lack of institutional efficacy. We were able to make the following conclusions:

1. Institutions to promote eVehicle technology do exist and have been functioning to an extent for both the large and small OEMs.

2. They have been active in facilitating technology dissemination and distribution of licensing.

3. Their efficiency has been found lacking when it comes to ensuring if the distributed licenses are being used properly. As evidenced by (a) a large number of licenses in small OEMs being left unused, and (b) no pressure from the institutes on large OEMs to begin production and distribution of eVehicles in the large OEMs major market segments.

4. The partial execution of the institution’s mandate i.e. The adoption of eVehicle technology and offering to the public, has been made possible in the case of passenger vehicles (produced and sold by small OEMs) due to the customer segments willingness to purchase (for use as passenger vehicles) and the customer segment’s willingness to patronise eVehicles as passenger vehicles.

5. The public opinion or the customer bases' opinion of eVehicles remains circumspect because of (a) a lack of proper understanding of the benefits of eVehicles (and the harm of normal ICE vehicles), (b) a suspicion over future expectation of charging facilities required to support large numbers of personal eVehicle, and (c) a lack of a successful precedent when it comes to new concept cars (Nano and Reva are considered lukewarm successes or failures).

As we conducted a further round of interviews to confirm our conclusions, we received positive reinforcement from our informants. We found strong relationships between customer purchase intention and the OEMs’ willingness to commit to the production of eVehicles. In conclusion, the institutions set to look over the adoption and execution of eVehicle technology and have been successful in the first half of their mandate. One can assume that they will soon move over to the second half of said mandate soon.

References

- Ardagna, S., & Lusardi, A. (2008). Explaining international differences in entrepreneurship: The role of individual characteristics and regulatory constraints. National Bureau of Economic Research.

- Batjargal, B., Hitt, M.A., Tsui, A.S., Arregle, J.L., Webb, J.W., & Miller, T.L. (2013). Institutional polycentrism, entrepreneurs' social networks, and new venture growth. Academy of Management Journal, 56(4), 1024-1049.

- Bohnsack, R., Pinkse, J., & Kolk, A. (2014). Business models for sustainable technologies: Exploring business model evolution in the case of electric vehicles. Research Policy, 43(2), 284-300.

- Carney, M. (2008). The many futures of Asian business groups. Asia Pacific Journal of Management, 25(4), 595-613.

- Powell, W.W., & DiMaggio, P.J. (2012). The new institutionalism in organizational analysis. University of Chicago press.

- Dhar, S., Pathak, M., & Shukla, P.R. (2018). Transformation of India's transport sector under global warming of 2 C and 1.5 C scenario. Journal of Cleaner Production, 172, 417-427.

- Eberhart, R.N., Eesley, C., & Eisenhardt, K. (2014). Compensating Conformity: Resolving the tension between economic incentives and organizational legitimacy in entrepreneurship.

- Gioia, D.A., Corley, K.G., & Hamilton, A. L. (2013). Seeking qualitative rigor in inductive research: Notes on the Gioia methodology. Organizational Research Methods, 16(1), 15-31.

- Godfrey, P.C. (2011). Toward a theory of the informal economy. The Academy of Management Annals, 5(1), 231-277.

- Gupta, J. (2016). The Paris climate change agreement: China and India. Climate Law, 6(1-2), 171-181.

- Hillman, A., & Keim, G. (1995). International variation in the business-government interface: Institutional and organizational considerations. Academy of Management Review, 20(1), 193-214.

- Holmes Jr, R.M., Miller, T., Hitt, M.A., & Salmador, M.P. (2013). The interrelationships among informal institutions, formal institutions, and inward foreign direct investment. Journal of Management, 39(2), 531-566.

- Iyer, L. (2016). Institutions, institutional change and economic performance in emerging markets. World Scientific Books.

- Jamali, D., & Mirshak, R. (2007). Corporate social responsibility (CSR): Theory and practice in a developing country context. Journal of Business Ethics, 72(3), 243-262.

- Khanna, T., & Palepu, K.G. (2010). Winning in emerging markets: A road map for strategy and execution. Harvard Business Press.

- Khanna, T., & Palepu, K. (1997). Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75, 41-54.

- Khanna, T., Palepu, K.G., & Sinha, J. (2005). Strategies that fit emerging markets. Harvard Business Review, 83(6), 4-19.

- Kley, F., Lerch, C., & Dallinger, D. (2011). New business models for electric cars-A holistic approach. Energy Policy, 39(6), 3392-3403.

- Luo, X.R., & Chung, C.N. (2013). Filling or abusing the institutional void? Ownership and management control of public family businesses in an emerging market. Organization Science, 24(2), 591-613.

- Mair, J., & Marti, I. (2009). Entrepreneurship in and around institutional voids: A case study from Bangladesh. Journal of Business Venturing, 24(5), 419-435.

- Makino, S., Isobe, T., & Chan, C.M. (2004). Does country matter? Strategic Management Journal, 25(10), 1027-1043.

- Malesky, E.J., & Taussig, M. (2009). Where is credit due? Legal institutions, connections, and the efficiency of bank lending in Vietnam. The Journal of Law, Economics, & Organization, 25(2), 535-578.

- Manikandan, K.S., & Ramachandran, J. (2015). Beyond institutional voids: Business groups, incomplete markets, and organizational form. Strategic Management Journal, 36(4), 598-617.

- McMillan, J. (2007). Market institutions. The new Palgrave dictionary of economics.

- McKinsey & Company. (2017). The future of mobility in India: Challenges & opportunities for the auto component industry.

- North, D., & Shirley, M. (2008). Conclusion: Economics, Political Institutions, and Financial Markets. Haber et al., Political Institutions; thereafter: North and Shirley,?Conclusions.

- North, D.C. (1990). Institutions, institutional change and economic performance. Cambridge university press.

- Ostrom, E. (2009). Understanding institutional diversity. Princeton university press.

- Pache, A.C., & Santos, F. (2010). When worlds collide: The internal dynamics of organizational responses to conflicting institutional demands. Academy of Management Review, 35(3), 455-476.

- Peng, M.W. (2003). Institutional transitions and strategic choices. Academy of Management Review, 28(2), 275-296.

- Persson, T. (2002). Do political institutions shape economic policy? Econometrica, 70(3), 883-905.

- Romanelli, E., & Schoonhoven, C.B. (2001). The Entrepreneurship Dynamic: Origins of Entrepreneurship and the Evolution of Industries.

- Rottig, D. (2016). Institutions and emerging markets: effects and implications for multinational corporations. International Journal of Emerging Markets.

- Saxena, T., Rumyantsev, S.L., Dutta, P.S., & Shur, M. (2014). CdS based novel photo-impedance light sensor. Semiconductor Science and Technology, 29(2), 025002.

- Sobel, R.S., & Coyne, C.J. (2011). Cointegrating institutions: the time-series properties of country institutional measures. The Journal of Law and Economics, 54(1), 111-134.

- Terjesen, S., Hessels, J., & Li, D. (2016). Comparative international entrepreneurship: A review and research agenda. Journal of Management, 42(1), 299-344.

- Thornton, P.H., Ocasio, W., & Lounsbury, M. (2012). The institutional logics perspective: Foundations, research, and theoretical elaboration. Oxford University Press.

- Tonoyan, V., Strohmeyer, R., Habib, M., & Perlitz, M. (2010). Corruption and entrepreneurship: How formal and informal institutions shape small firm behavior in transition and mature market economies. Entrepreneurship Theory and Practice, 34(5), 803-832.

- Vidhi, R., & Shrivastava, P. (2018). A review of electric vehicle lifecycle emissions and policy recommendations to increase EV penetration in India. Energies, 11(3), 483.

- Williamson, O.E. (1991). Comparative economic organization: The analysis of discrete structural alternatives. Administrative Science Quarterly, 269-296.