Research Article: 2021 Vol: 20 Issue: 2S

Factors Affecting Credit Quality: A Case Study of Commercial Banks in Ho Chi Minh City

Le Dinh Hac, Banking University of Ho Chi Minh City (BUH).

Keywords

Credit, Quality, Commercial, Banks, HCMC, BUH

Abstract

Credit is the primary and most crucial activity in commercial banks' business operations. This activity brings a significant income source for banks but still contains many risks, of which too high credit risk will significantly affect the banking business. Therefore, the article explores factors affecting commercial banks' credit quality in Ho Chi Minh City (HCMC). The author applied a simple random sampling technique, tested Cronbach's Alpha and Confirmatory Factor Analysis (CFA), and model testing with Structural Equation Modeling (SEM). Besides, the study surveyed 800 staffs related to credit activities in 10 commercial banks and answered 28 questions, but 755 samples were processed. The article's findings had six factors affecting commercial banks' credit quality in HCMC with a significance level of 0.01. Based on the mentioned above, the author had recommendations for enhancing the credit quality of commercial banks.

Introduction

Boahene, Dasah & Agyel (2012) studied that the world entered the 4th Industrial Revolution such as virtual reality, Internet of things, big data, artificial intelligence applied to all fields for an area of socio-economic life. Vietnam has been increasingly integrating deeply into the regional and world economy, signing many agreements such as FTA, AEC, joining ASEAN, CPTPP by Siddiqui & Shoaib (2011). In that context, Vietnamese commercial banks are gradually integrating, affirming the growth in all aspects of operation, especially credit activities, to serve the country's economic development effectively.

With its nature as a particular type of business, a commercial bank is considered the most important financial intermediary in the financial market by Burak (2017). Therefore, the credit activities of commercial banks have an exceptional place in banking operations. Along with the world economy's integration trend and the country's development, people's lives improved day by day. People's spending and shopping need increase; businesses increase productivity by Faiçal (2014). Therefore, the demand for using credit services of the bank is expanding. To ensure customers' borrowing needs, bringing significant revenue to the bank while minimizing risks requires banks to control and manage credit quality effectively. From the above analytical issues. Therefore, credit management and improvement play a decisive role in the existence and development that any bank must pay special attention to credit quality in the coming time.

Literature Review

Credit Quality (CQ)

Idris & Nayan (2016) showed that credit quality is a significant profitable activity of the bank in the market economy and contains the most risks. That is why the issue of credit quality is an important and vital issue for all banks. So what is credit quality? Credit quality is a wide range, covering many contents, and currently, there is no official definition of credit quality by Jabnoun & Tamimi (2013). However, people often refer to it from three angles: customers, banks, and the economy regarding credit quality. Each subject has different views on credit quality, such as Kaaya & Pastory (2013) studied that Bank credit quality must pay attention to credit growth target coupled with maximizing profits on a safety basis.

Credit quality is a measure of the completion of credit growth, safety, and profitability goals. Thus, improving credit quality is an urgent requirement for a bank in every development period by Kurawa & Garba (2014). Credit quality is the degree to which a bank achieves its goals of size, safety, and profitability following current domestic laws and regulations and international practices by Ombaba (2013). Besides, credit quality is a general indicator reflecting the credit performance of a commercial bank, demonstrating the capacity to manage credit activities to meet economic development requirements and limit risks, ensuring capital safety and its profitability by Philip (2018).

Credit Strategy and Policy (CSP)

Pasiouras (2018) showed that the credit strategy: the bank needs to define the bank's vision, objectives, and mission to introduce then the "credit risk appetite, which is the acceptable level of risk - to plan appropriate credit management strategy. Credit policy: to implement a credit strategy by Martin (2015). The Board of Management has introduced policies that are the basis for forming a credit process with detailed professional instructions, specific steps in the credit granting process. The credit policy also stipulates loan limits for customers, debt classification, and provisioning by Okoth (2013). The policy should set out to the credit officer the direction of operation and a clear reference framework to consider loan needs.

Suppose the credit policy is correct and appropriate. In that case, it will attract customers, expand the loan scale, ensure profitability based on compliance with the law, and disperse risks by Percy & Wimalasiri (2017). A reasonable credit policy will create conditions for commercial banks to optimize their capital when lending, create favorable conditions for credit expansion, ensuring safety in business is a condition by Skarica (2013). A critical premise to improve the credit quality of commercial banks. Therefore, the author suggested a hypothesis.

H1: Credit Strategy and Policy (CSP) positively affect the credit quality of commercial banks in HCMC

Credit Organization and Administration (COA)

Umar & Sun (2016) showed that the credit organization and administration apparatus is always the most critical tool for the bank leaders to conduct the management and administration according to the planned credit strategy and policy. The general principle to build an effective organizational apparatus is to separate the board of directors' strategic planning function, the board of directors' administrative and executive functions, and the supervision and supervision function of the Board control by Laivi & Kadri (2017).

In modern banks, the organizational apparatus and credit management and administration are implemented in two popular models: centralized credit management model and decentralized credit management model by William & Mark (2017). There is also a combination model between concentration and decentralization, depending on each sector, industry, type of product or service, or customer. Managers can apply the centralized management model at the Head Office or decentralized down to each branch by Messai & Jouini (2013). Thus, the organization and administration of credit affect the credit quality and all operations of the bank. A bank has a scientifically arranged organizational structure, with a specific assignment of work, there is a clear connection between departments, the higher the credit quality by Ruziqa (2013). Therefore, the author suggested a hypothesis.

H2: Credit Organization and Administration (COA) positively affect the credit quality of commercial banks in HCMC

Banking Technology (BT)

Taidenberg (2017) studied that the finance and banking sector is the industry with a high information technology application level. The modern information technology system will meet the accuracy, customers' transaction volume requirements, seek customer information, help banks make decisions, and process loans by Jamil & Abdullah (2014). Modern machinery, technical means, and information technology will facilitate the simplification of procedures. Bank shortens transaction time, faster and more accurate information collection, and cost savings, helping the bank grasp information promptly and market developments. Besides, the bank forecasts socio- economic growth and credit activities to make appropriate decisions with the actual situation and bring about convenience for Olawale (2015). Therefore, the author suggested a hypothesis.

H3: Banking Technology (BT) positively affects the credit quality of commercial banks in HCMC

Credit Information (CI)

Ekanayake & Azees (2015) studied that the credit information required about customers for commercial banks to consider, decide on a loan, and monitor a loan includes. Besides, information about the customer's legal profile, information about the financial situation, credit system of customers, customer credit rating from external rating agencies, and internal credit rating results of commercial banks by Koodhart (2015). The information related to the client's loan application project; information about the business environment related to the borrower's industries and fields of operation, financial information, market, development trends, industry potentials by Grace (2012). Therefore, the author suggested a hypothesis.

H4: Credit Information (CI) positively affects the credit quality of commercial banks in HCMC

Credit Risk Management (CRM)

Ghazouani (2016) studied that credit risk management is a process in which banks plan, implement and supervise all credit-granting activities, to maximize the bank's profit with the Acceptable. Credit risk is the ability that can occur when a customer fails to meet its repayment obligations under agreed terms by Ayanda, Christopher & Mudashiru (2013). Many reasons cause credit risk, but in general, the main reason is implementing a commercial bank's credit management process by Berger & Bourman (2017). Credit risk is closely related to credit quality because it directly affects the credit cycle, business security issues and affects the ability to respond promptly, customer request time by Adeusi (2013). Therefore, the author suggested a hypothesis.

H5: Credit Risk Management (CRM) positively affects the credit quality of commercial banks in HCMC

Internal Control (IC)

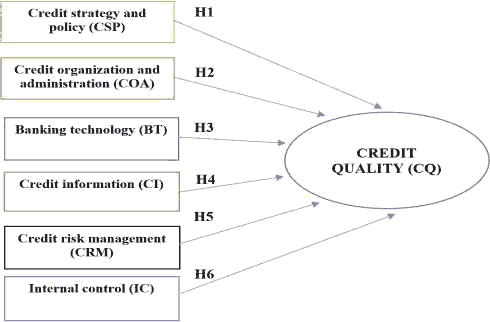

Alexandri & Santoso (2015) studied that internal inspection and control help leaders obtain information about credit officers' lending situations according to their policies, guidelines, and policies. This activity includes checking the operating authority procedures, managing, monitoring loans, techniques, and application for loans to detect wrongdoings by Kristianti (2016) in the lending process, thereby helping management decide to limit credit risk by Allen & Gale (2016). A well-functioning internal control system will create conditions for the bank to improve credit quality by Azam & Siddiqoui (2012). Therefore, the author suggested a hypothesis. (Figure 1)

H6: Internal Control (IC) positively affects the credit quality of commercial banks in HCMC

Research Method

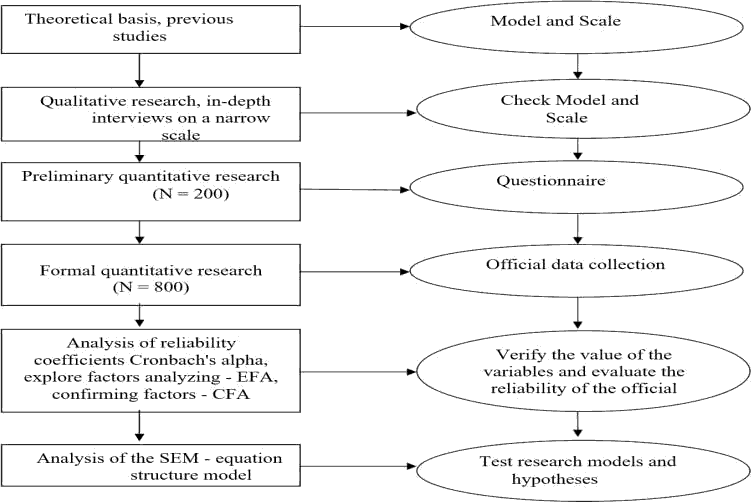

The research process is done through the following steps (Figure 2):

The building models, testing models and scales, collecting preliminary data to preliminarily check the scale's reliability, collecting official data, factor analysis, test the reliability of the scale, test models and research hypotheses.

Step 1: The author collected statistics and collects primary and secondary data related to credit quality at commercial banks over time series from internal reports of commercial banks, reports of State management agencies, and directly observed at the Exchange, some branches to collect information and data for research.

Step 2: During the research process, the author has participated in seminars on credit, approached Vietnam Joint Stock Commercial Banks to collect data. The author also consulted with leading experts in finance - banking to give scientific suggestions for the research. This process is the basis for the author to build a theoretical framework and complete the proposal by Hair, Anderson, Tatham & Black (2010).

Step 3: Within the research scope, qualitative research methods are carried out by the author by interviewing managers, experts, bank staff, bank credit officers. The author has also studied and synthesized materials from the textbooks; related studies have been published to help the author gather the factors and observed variables, thereby building a preliminary research model for the trial investigation process with experts. The author makes the most of the opportunity to interview industry experts to refine the research model and build primary data collection tools during the formal investigation by Hair, Anderson, Tatham & Black (2010).

Step 4: After qualitative research, the author gave a preliminary questionnaire and conducted a pilot survey to know the difficulties and problems of managers and credit officers when filling out the questionnaire to adjust, modify and form the official questionnaire. After designing the complete questionnaire and selecting a sample to conduct the survey, the credit officers formally interviewed the investigation subject to get information to fill in the questionnaire by Hair, Anderson, Tatham & Black (2010).

Step 5: The author has sent a "consultation form for credit managers and credit officers" by email to meet in person and post to 800 managers from the department's deputy head. And the specialist at the head office of commercial banks; directors and deputy directors, heads and deputy heads of transaction offices, officers of credit bureaus of joint-stock commercial banks. As a result, 755 valid responses were obtained. The answer results are synthesized to prove objectively, supplementing the research's reviews.

Step 6: SEM can give a complex model suitable for longitudinal survey datasets, positive factor analysis (CFA), non-normalized models, and databases with Correlated error structure, data with non-standard variables (Non-Normality), or missing data. Survey results were screened by the author and Confirmed Factor Analysis (CFA) to test the scale's appropriateness, general reliability, quote variance; unidirectionality; Convergence and differentiation, and SEM test by Hair, Anderson, Tatham & Black (2010).

Analysis of SEM: Chi-square adjusted for degrees of freedom (CMIN)/df), GFI (Goodness-of-Fit Index), CFI (Comparative Fit Index), TLI (Tucker and Lewis Index), and RMSEA (Root Mean Square Error Approximation) index. A model is said to be consistent (compatible) with market data when: Chi-square test has p>0.5, Chi-square/df ≤ 2.0 by Hair et al., (2010), in some cases, CMIN/df can be ≤ 3.0 by Hair et al., (2010). Finally, the author had conclusions and policy implications by Hair, Anderson, Tatham & Black (2010).

Research Results

Testing of Cronbach's Alpha

Table 1 showed that Cronbach's alpha for Credit Quality (CQ) meets this technique's requirements. Specifically, Cronbach's Alpha values of the Credit Quality (CQ) is 0.951, and Cronbach's Alpha if Item Deleted (>0.6).

| Table 1 Testing of Cronbach's Alpha for Credit Quality (CQ) |

||

|---|---|---|

| Code | Credit Quality (CQ) | Cronbach's Alpha if Item Deleted |

| CQ1 | Credit growth has a high safety | 0.942 |

| CQ2 | The bank's bad debts are not complicated | 0.893 |

| CQ3 | The bank's credit operations can be well controlled | 0.948 |

| Cronbach's alpha: 0.951 | ||

Table 2 showed that Cronbach's alpha for the Credit Strategy and Policy (CSP) meets this technique's requirements. Specifically, Cronbach's Alpha values of the credit strategy and policy (CSP) is 0.880, and Cronbach's Alpha if Item Deleted (>0.6).

| Table 2 Testing of Cronbach's Alpha for Credit Strategy and Policy (CSP) |

||

|---|---|---|

| Code | Credit Strategy and Policy (CSP) | Cronbach's Alpha if Item Deleted |

| CSP1 | Credit policy for each customer group is clearly and precisely defined | 0.860 |

| CSP2 | Credit strategy is competitive enough with other banks | 0.821 |

| CSP3 | Appropriate strategy with credit policy | 0.865 |

| CSP4 | The credit policy is built in compliance with the laws of the State | 0.837 |

| Cronbach's alpha: 0.880 | ||

Table 3 showed that Cronbach's alpha for the Credit Organization and Administration (COA) meets this technique's requirements. Specifically, Cronbach's Alpha values of Credit organization and Administration (COA) is 0.917, and Cronbach's Alpha if Item Deleted (>0.6).

| Table 3 Testing Of Cronbach's Alpha For Credit Organization And Administration (COA) |

||

|---|---|---|

| Code | Credit Organization and Administration (COA) | Cronbach's Alpha if Item Deleted |

| COA1 | Bank appropriate arrangement of the quantity and quality of human resources at the working positions |

0.915 |

| COA2 | The functions of departments are separated, clearly, and tightly regulated | 0.895 |

| COA3 | Management personnel, leaders have high professional qualifications, many experiences in management and operation |

0.917 |

| COA4 | There is a division of scientific work between departments, specialization in the creation of each department | 0.880 |

| COA5 | A model of credit management suitable for the bank | 0.880 |

| Cronbach's alpha: 0.917 | ||

Table 4 showed that Cronbach's alpha for the Banking Technology (BT) meets this technique's requirements. Specifically, Cronbach's Alpha values of the Banking Technology (BT) is 0.962, and Cronbach's Alpha if Item Deleted (>0.6).

| Table 4 Testing Of Cronbach's Alpha For Banking Technology (Bt) |

||

|---|---|---|

| Code | Banking Technology (BT) | Cronbach's Alpha if Item Deleted |

| BT1 | Accelerate the digitization of credit activities in the era of technology 4.0 | 0.939 |

| BT2 | Credit management and rating software operating reliably and safely | 0.962 |

| BT3 | The current bank's internal management system is modern | 0.958 |

| BT4 | Modern equipment, computers, servers, information technology, ensure continuity and continuity 24/24 |

0.942 |

| Cronbach's alpha: 0.962 | ||

Table 5 showed that Cronbach's alpha for the Credit Information (CI) meets this technique's requirements. Specifically, Cronbach's Alpha values of the Credit Information (CI) is 0.857, and Cronbach's Alpha if Item Deleted (>0.6).

| Table 5 Testing Of Cronbach's Alpha For Credit Information (CI) |

||

|---|---|---|

| Code | Credit Information (CI) | Cronbach's Alpha if Item Deleted |

| CI1 | Customer credit information are managed, stored scientifically, detailed, and promptly updated |

0.806 |

| CI2 | Information source for complete credit processing | 0.816 |

| CI3 | Credit officers can easily access and exploit customers' credit information | 0.846 |

| CI4 | The source of customers' credit information accurately and reliably | 0.803 |

| Cronbach's alpha: 0.857 | ||

Table 6 showed that Cronbach's alpha for the Credit Risk Management (CRM) meets this technique's requirements. Specifically, Cronbach's Alpha values of the Credit Risk Management (CRM) is 0.960, and Cronbach's Alpha if Item Deleted (>0.6).

| Table 6 Testing Of Cronbach's Alpha For Credit Risk Management (CRM) |

||

|---|---|---|

| Code | Credit Risk Management (CRM) | Cronbach's Alpha if Item Deleted |

| CRM1 | Credit risks identified through signs arising from customers and banks | 0.942 |

| CRM2 | The bank develops a policy of debt classification and timely provisioning for risks |

0.960 |

| CRM3 | Credit officers analyze and evaluate customers from contact, during the lending process, and after lending | 0.952 |

| CRM4 | Managing customer information by categories and creating reports is very effective |

0.938 |

| Cronbach's alpha: 0.960 | ||

Table 7 showed that Cronbach's alpha for the Internal Control (IC) meets this technique's requirements. Specifically, Cronbach's Alpha values of the Internal Control (IC) is 0.953, and Cronbach's Alpha if Item Deleted (>0.6).

| Table 7 Testing Of Cronbach's Alpha For Internal Control (IC) |

||

|---|---|---|

| Code | Internal Control (IC) | Cronbach's Alpha if Item Deleted |

| IC1 | The credit management apparatus should avoid the overlap in functions and conflicts of interest between the control departments | 0.933 |

| IC2 | Internal inspection and control activities implemented regularly and effectively | 0.946 |

| IC3 | Evaluation, inspection, and control criteria are clearly defined, consistent with professional reality | 0.943 |

| IC4 | Management personnel are always interested in improving credit quality | 0.931 |

| Cronbach's alpha: 0.953 | ||

Table 8 showed that the Kaiser-Meyer-Olkin Measure of Sampling Adequacy (KMO) is 0.798 (>0.5). This result is consistent with the actual data investigated by 800 staffs related to credit activities at ten commercial banks in Ho Chi Minh City.

| Table 8 Kmo And Bartlett's Test For Factors Affecting Credit Quality (CQ) |

||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy | 0.798 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 22142.636 |

| df | 378 | |

| Sig. | 0.000 | |

| Extraction Sums of Squared Loadings: Cumulative is 82.481 % | ||

Testing Coefficients for Factors Affecting the Credit Quality (CQ) at Commercial Banks in HCMC

Table 9 showed six factors affecting the Credit Quality (CQ) at commercial banks in HCMC with a significance level of 0.01. These results are critical information for managerial implications to enhance the Credit Quality (CQ) at commercial banks in HCMC. Besides, the results showed that the research model is consistent with market data.

| Table 9 Testing Coefficients For Factors Affecting The Credit Quality (CQ) At Commercial Banks In Hcmc |

||||||||

|---|---|---|---|---|---|---|---|---|

| Relationships | Unstandardized Estimate | Standardized Estimate | S.E. | C.R. | P | Results | ||

| CQ | <--- | CSP | 0.174 | 0.073 | 0.052 | 3.358 | *** | Accepted |

| CQ | <--- | COA | 0.172 | 0.102 | 0.049 | 3.473 | *** | Accepted |

| CQ | <--- | BT | 0.092 | 0.110 | 0.023 | 3.982 | *** | Accepted |

| CQ | <--- | CI | 0.165 | 0.161 | 0.033 | 4.932 | *** | Accepted |

| CQ | <--- | CRM | 0.502 | 0.541 | 0.030 | 16.892 | *** | Accepted |

| CQ | <--- | IC | 0.071 | 0.065 | 0.026 | 2.758 | 0.006 | Accepted |

Table 10 showed that the bootstrap test results are very good with a sample of 30.000 credit staffs related to 10 commercial banks in Ho Chi Minh City. These results indicated six factors affecting the Credit Quality (CQ) at ten commercial banks in HCMC with a significance level of 0.01.

| Table 10 Testing Bootstrap With 30.000 Samples For Factors Affecting The Credit Quality (CQ) At Commercial Banks In Hcmc |

|||||||

|---|---|---|---|---|---|---|---|

| Parameter | SE | SE-SE | Mean | Bias | SE-Bias | ||

| CQ | <--- | CSP | 0.049 | 0.002 | 0.166 | -0.007 | 0.003 |

| CQ | <--- | COA | 0.046 | 0.002 | 0.168 | -0.004 | 0.003 |

| CQ | <--- | BT | 0.021 | 0.001 | 0.086 | -0.005 | 0.001 |

| CQ | <--- | CI | 0.033 | 0.002 | 0.163 | -0.002 | 0.002 |

| CQ | <--- | CRM | 0.044 | 0.002 | 0.507 | 0.005 | 0.003 |

| CQ | <--- | IC | 0.022 | 0.001 | 0.069 | -0.002 | 0.002 |

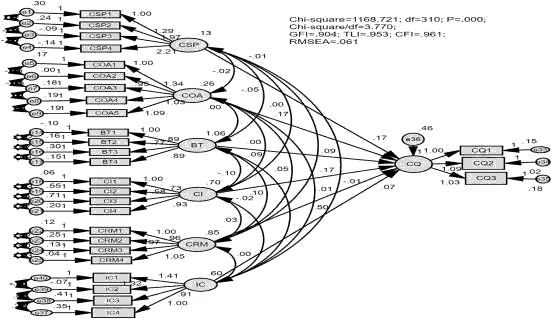

Figure 3 showed that the SEM assessment had six factors affecting the Credit Quality (CQ) at ten commercial banks in HCMC with a significance level of 0.01. Figure 2 showed that the assessment of the scale of the Credit Quality (CQ) at commercial banks in HCMC including: CMIN/DF=3.770 (<5.0), GFI=0.904 (>0.8), TLI=0.953 (>0.9), CFI=0.961 (>0.9) and RMSE=0.061 (<0.08). All model indicators showed that they are perfect and consistent with both theory and practice in Vietnam. This result is significant proof for bank managers to refer and recommend.

Figure 3: Testing Sem For Factors Affecting The Credit Quality (CQ) At Commercial Banks In Hcmc

(Source: Data processed by SPSS 20.0 and Amos)

Conclusion & Policy Implications

Conclusion

Credit is the primary and most crucial activity in commercial banks' business activities in Vietnam. This article is an activity that brings a great source of income for banks but still contains many risks. Therefore, banks need to pay due attention to credit capital's safety, loan effectiveness, and the bank's sustainable development. The bank's credit quality plays a vital role in the growth of a bank. The higher the credit quality, the lower the risk level in banking operations and commercial banks' higher competitiveness. Therefore, researching to find measures and ways to improve credit quality in the context of international economic integration, technology 4.0 is an urgent requirement and has important implications for commercial banks. Finally, the research result had six factors affecting the Credit Quality (CQ) at ten commercial banks in HCMC with a significance level of 0.0. Based on the research results, the author proposed the following policy implications.

Policy Implications

(1) Credit Risk Management (CRM): To limit credit risk, commercial banks need to build and implement a risk management system. The bank's credit risk appetite is clearly and prudently built, targeting less risky segments such as customers with high income and repayment capacity. Besides, CRM is less risky products, mortgages, short-term loans, and less risk-focused components the shift from large corporate loans to SME and retail loans. Commercial banks also need to develop an internal credit risk assessment system applicable to all bank branches and allow the bank to control customers' credit quality. Simultaneously, banks also build credit quality assessment processes and early warning systems to identify possible customer solvency changes early. For loans with unfavorable developments in debt quality, in addition to carrying out debt collection procedures through a specialized department, the bank must proactively make complete and timely provisions following the regulations. Besides, commercial banks should build a comprehensive and reliable credit information database. And finding sources of information outside the industry is to get more information on customer credit ratings and ratings, apply information technology, train many experts, and improve credit rating quality reputation. Finally, the bank's credit rating results must be objective and independent for enterprises to understand their operating capacity, thereby giving them a more effective business direction. Commercial banks need to focus on exploiting and using credit rating results and general information on credit ratings.

(2) Credit Information (CI): Prioritize the development of a digital banking strategy comprehensively on all aspects of business operations, processes, products, and distribution channels in line with the trend of industrial revolution 4.0. Commercial banks should focus on operating the Digital Banking Center associated with specific financial mechanisms, human resources concentrating resources to accelerate fundamental technology projects as a basis for development. They are developing digital banking, ensuring the safety and confidentiality of information. On the other hand, information technology systems' administration and operation, especially information security and safety at banks, should be paid attention to, focused on, and closely monitored 24/24 according to the system of processes and regulations issued and periodically reviewed and updated. The bank should develop risk prevention plans and scenarios in information technology incidents. And regularly conduct and promptly react to security events, confidentiality, and safety of information from the outside, ensuring the preventive factor for continuous operation and helping the information technology system operate stably safely.

(3) Banking Technology (BT): Banks need to build a database system containing rich and helpful information to facilitate access to all credit officers to serve the assigned work best. The credit information system must be organized into a unified network from the central to grassroots centralization. All credit information of traditional customers and potential customers, whether or not having a relationship with any transaction center or branch, is gathered and stored at each bank's credit information center. Banks need to have a specialized department in charge of collecting and analyzing information, updating daily details on customers relating to the bank, economic news, market, law, instruction, and instruction documents from the relevant superiors to serve the credit work directly. These officers should collect information from many sources: news provided by the credit officer, data from the credit information center of the bank, data from customers, or managed by the official from the radio. The press, from various organizations, is one of the tools for the bank to transmit information to investors interested in understanding the bank's operations. Commercial banks need to build credit risk management systems that ensuring accurate and regularly updated news and databases on credit operations to help bank leaders manage adequate credit and limit losses. Therefore, the risk management information system includes two types of information: (1) Macro information including economic environment, state economic policies, legal documents; (2) Information serving the management of a bank's credit activities including credit status report, credit growth trend forecast, credit activity summary report.

(4) Credit Organization and Administration (COA): A credit officer is directly involved in analysis, appraisal, and lending to customers. A wrong loan decision dramatically affects the credit quality of the loan. A loan decision's accuracy depends on the credit officer's professional qualifications, skills, experience, and ethics. Therefore, improving the quality of personnel performing credit operations will help the bank enhance credit quality. Commercial banks need to apply recruitment software and information technology to critical recruitment processes, demonstrating openness, transparency, and consistency throughout the system, ensuring quality. Candidates are recruited according to the requirements of each locality. Thereby, the bank attracts a team of high-quality candidates from all parts of the country, creating a good impression on society in general and candidates, contributing to promoting and enhancing the brand—bank image on the market. The stage of recruitment of credit officers must be strict and ensure the quality of credit officers. Regularly guide the organization of training and refresher courses in training programs on knowledge, management skills, and working skills for leaders at all levels and staff in the entire banking system step by step. According to international standards, improve the quality of human resources to meet the requirements of providing the best products and services to customers.

(5) Credit Strategy and Policy (CSP): Commercial banks actively quantify credit plans and responsibilities for credit activities. To implement the plan targets set by the general meeting of shareholders, the Board of Directors shall orient the operational strategy. The Board of Management implements actions according to the Board of Directors' strategies. All credit staff members act for credit targets that have been set. The planned marks for credit activities developed by the general meeting of shareholders are outstanding loans, bad debts, and pre-tax profit. From these intended targets, each credit officer is allocated according to each specific plan target. This recommendation is the criterion to evaluate the responsibility and fulfillment level of each staff member. Credit policy, first of all, commercial banks must ensure the strict observance of the regulations relating to the direction of credit operations of the State Bank based on each commercial bank system's specific characteristics for explicit content. Credit policy is considered a guideline for the entire implementation system, so it needs to be detailed to ease the implementation process and concretize regulations on the target customers' needs. Credit, the target of limited and non-credit customers, the structure of credit granting by terms, by industry, by region must also be specific. Commercial bank managers must build commercial banks the credit policy according to the provisions of law, the State Bank's regulations on credit activities, the bank's long-term strategic orientation, and business motto to ensure safety, efficiency, and sustainable development.

(6) Internal Control (IC): Commercial banks need to complete documents, procedures, regulations to guide the control and management of loans. These documents should specify the following order, purpose, content, and control of customers, including individual customers and corporate customers. The attached forms should be clear, detailed, scientific, and easy to apply for each bank. Commercial banks need to promote the inspection and supervision of business units' post-control activities (Branches, Transaction Offices, and Business Centers) by the credit quality review division implemented by the Head Office. The object of review is the entire portfolio of bad debts on the balance sheet and off-balance sheet of each bank's system based on each item's actual situation. However, this is the work done after credit granting. Hence, it is necessary to step up the assessment and review of loans showing signs of credit deterioration to prevent and reduce risks. Commercial banks need to enhance the independent role of internal control in checking and monitoring compliance. Internal control is the unit that controls the observation of the bank's business processes, and managers should do regular checking, periodically, and on a large scale to detect violations and zero points. It is suitable for each bank's lending process and regulations, thereby giving out innovations and improvements to ensure efficient and safe business operations. Commercial banks need to be flexible in the combination of types of loan control and management. Loan control and management should be flexibly applied, suitable for each customer and each specific business sector. It is possible to combine physical inspection with documentary inspection, between periodic inspection and unscheduled inspection, between detailed inspection and general inspection to enhance inspection effectiveness loan supervision.

Finally, this paper's limitations had data collected within the framework of 10 commercial banks in HCMC. Besides, the research model only tested with data of 800 credit staffs in 10 commercial banks. Therefore, the results had not reflected the appropriateness of the research model. Thus, it is necessary to further try other banks with many big cities such as Can Tho City, Da Nang, Hai Phong, and Ha Noi City to increase data reliability.

References

- Adeusi, H. (2013). Risk management and financial performance of banks in Nigeria. Journal of Business and Management, 14(6), 52-55.

- Ahmed, SF., & Malik, Q.A. (2015). Factors affecting credit quality: An empirical study of the Jordanian commercial banks. International Journal of Economics and Financial, 5(2), 574-579.

- Alexandri, A., & Santoso, S. (2015). Non-performing loan: Impact of internal and external factor evidence in Indonesia. International Journal of Humanities and Social Science Invention, 4(1), 2319-7722.

- Allen, H., & Gale, F. (2016). A welfare comparison of intermediaries and financial markets in Germany and the U.S. European economic review, 39(2), 179-209.

- Ayanda, A.M., & Christopher, E.I., & Mudashiru M.A. (2013). Determinants of banks' profitability in developing economy: Evidence from the nigerian banking industry. Interdisciplinary Journal of contemporary research in business, 4(1), 55-181.

- Azam, M., & Siddiqoui, S. (2012). Domestic and foreign banks' profitability: Differences and their determinants. International Journal of Economics and Financial, 2(1), 33-40.

- Berger, A., & Bourman, C. (2017). Bank liquidity creation, monetary policy, and financial crisis. Journal of Financial Stability, 30(1), 139-155.

- Boahene, S.H., Dasah, J., & Agyel, S.K. (2012). Credit risk and profitability of selected banks in ghana. Research Journal of Finance and Accounting, 3(7), 6-14.

- Burak, G.L. (2017). Bank lending opportunities and credit standards. Journal of Financial Stability, 4(2), 62-87. Ekanayake, E.M.N.N., & Azees, A.A. (2015). Determinants of non-performing loans in licensed commercial banks:

- Evidence from SriLanka. Asian Economic and Financial Review, 5(6), 868-882.

- Faiçal, B.H. (2014). Loan quality determinants: Evaluating the contribution of bank-specific variables, macroeconomic factors, and firm-level information. Graduate Institute of International and Development Studies, 5(1),14-25.

- Ghazouani, I. (2016). Explanatory factors of credit risk: Empirical evidence from tunisian banks. International Journal of Economics, Finance, and Management, 4(5), 21-29.

- Grace, N. (2012). The effect of credit risk management on the financial performance of commercial banks in Kenya, England. International Research Journal of Finance and Economics, 69(11), 124-135.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (2010). Multivariate data analysis with readings. U.S: Prentice- Hall: Upper Saddle River, NJ, USA.

- Idris, I.T., & Nayan, S. (2016). The moderating role of loan monitoring on the relationship between macroeconomic variables and non-performing loans in ASEAN countries. International Journal of Economics and Financial, 6(2), 402-408.

- Jabnoun, G . , & Tamimi, F. (2013). Measuring perceived service quality at UAE commercial banks. International Journal of Quality and Reliability Management, 1(2), 185-199.

- Jamil, J., & Abdullah, A. (2014). Impact of external and internal factors on commercial bank profitability in Jordan. International Journal of Business and Management, 5(7), 22-30.

- Kaaya, I., & Pastory, D. (2013). Credit risk and commercial banks performance in tanzania: A panel data analysis. Research Journal of Finance and Accounting, 4(16), 55-62.

- Koodhart, C.A. (2015). Financial regulation, credit risk, and financial stability. National Institute Economic Review, 29(1), 118-127.

- Kristianti, R. (2016). Factors affecting bank performance: Cases of top 10 biggest government and private banks in Indonesia in 2004-2013. Review of integrative business & economics, 2(3), 371-378.

- Kurawa, J.M., & Garba, S. (2014). An evaluation of the effect of Credit Risk Management (CRM) on the profitability of Nigerian banks. Journal of Modern Accounting and Auditing, 10(1), 104-115.

- Laivi, L., & Kadri, M. (2017). Do credit commitments compromise credit quality? Research in International Business and Finance, 41(3), 303-317.

- Martin, G.K. (2015). Systemic aspects of risk management in banking and finance. Journal of Economics and Statistics, 131(1), 723-737.

- Messai, A., & Jouini, F. (2013). Micro and macro determinants of non – performing loans. International Journal of Economics and Financial, 3(4), 852-860.

- Musyoki, D. (2011). The impact of credit risk management on the financial performance of banks in kenya. Journal of Business and Public Management, 2(2), 72-80.

- Okoth, G.B. (2013). Determinants of financial performance of commercial banks in kenya. International Journal of Economics and Financial, 11(2), 237-252.

- Olawale, S. (2015). The effect of credit risk on the performance of commercial banks in nigeria. Journal of Business and Economics, 5(6), 60-79.

- Ombaba, M.K.B. (2013). Assessing the factors contributing to non–performance loans in kenyan banks. European Journal of Business and Management, 5(32), 155-162.

- Pasiouras, F.R. (2018). Estimating greek commercial banks' technical and scale efficiency: The impact of credit risk, off-balance-sheet activities, and international operations. International Business and Finance, 22(3), 301-318.

- Percy, W., & Wimalasiri, P.D. (2017). Impact of risk management on the performance of commercial banks in sri lanka. International Journal of Advanced Research, 5(11), 1441-1449.

- Philip, E.S. (2018). Risk management, capital structure, and lending at banks. Journal of Banking & Finance, 28(3), 19-43.

- Ruziqa, A. (2013). The impact of credit and liquidity risk on bank financial performance: The case of indonesian conventional bank with total asset above 10 trillion rupiah. International Journal of Economic Policy in Emerging Economies, 6(2), 93-106.

- Siddiqui, M.A., & Shoaib, A. (2011). Measuring performance through capital structure: Evidence from banking sector of pakistan. African Journal of Business Management, 5(1), 1871-1879.

- Skarica, B. (2013). Determinants of non-performing loans in central and eastern european countries. Financial Theory and Practice, 38(1), 37-59.

- Taidenberg, M.R. (2017). Evaluating credit risk models. Journal of Banking & Finance, 2(4), 151-165.

- Umar, M., & Sun, G. (2016). Determinants of different types of bank liquidity: Evidence from BRICS countries. China Finance Review International, 6(4), 380-403.

- William, F.K., and Mark, C. (2017). Credit risk rating systems at large U.S banks. Journal of Banking & Finance, 24(1), 167-201.