Research Article: 2021 Vol: 20 Issue: 2S

Factors Influencing Brand Strength: A Case Study of Commercial Banks in Ho Chi Minh City

Ha Van Son, University of Economics Ho Chi Minh City (UEH)

Nguyen Van Trai, University of Economics Ho Chi Minh City (UEH)

Nguyen Thanh Van, University of Economics Ho Chi Minh City (UEH)

Keywords

Brand, Strength, Commercial, Bank, HCM, and UEH.

Abstract

In the period of the economic opening, the competition between commercial banks is quite fierce. The brand is an essential factor for developing commerce, contributing to enhancing commercial civilization in healthy competition among banks. Besides, the brand identifies the origin of the products or the services, helping customers identify the specific services or distributor responsible for the product traded on the market. When consuming a product, thanks to the use process combined with that product’s marketing over the years, customers know and maintain using the brand. Therefore, this article’s objective is to determine the factors influencing commercial banks’ brand strength in Ho Chi Minh City (HCMC). The paper surveyed 800 staffs working for commercial banks in HCMC, but 785 samples processed and answered 23 items. The data collected from July 2020 to December 2020. The authors tested Cronbach’s Alpha, confirmatory factor analysis (CFA), and structural equation model (SEM) for factors affecting commercial banks’ brand strength with a significance level of 0.01.

Introduction

From 2019 to recent, commercial banks go through an intricate development period by Ahmed (2017). Although domestic banks’ strength lies in traditional services with 70% of interest income on deposits and loans, since 2019 was a crisis period with credit growth. Low, high rate of insolvency loans strongly affected the financial situation and competitiveness of domestic banks. The first problem is that the general economic downturn started in 2019, especially in 2020, with the Covid-19 of many large and small businesses. Second, after the credit growth rate (more than 25% per year) of most banks for short-term profit, banks accept a greater level of risk when they agree to bad loans, Inaccurate assessment, and forecast of the borrower’s future solvency by Atilgan (2015).

Commercial banks face fierce competition from foreign banks, advantageous foreign banks, and the banking industry’s development trend in technology, capital/ energy. Financial strength/ financial status and experience operating in non-traditional and modern banking services by Baumgarth (2019). The production and consumption of banking services take place simultaneously, so bank employees have a significant role. The bank staff’s attitude, behavior, and professional capacity reflect its brand name’s service quality and reputation. With increasingly diverse banking service characteristics, continually innovating, and customers’ knowledge about banking services is still limited, the role of bank staff’s guiding, consulting, and even educating customers becomes more important.

Therefore, the authors chose the topic: Factors affecting the brand strength of commercial banks in Ho Chi Minh City to research with the desire to provide more evidence. Besides, the authors offer more perspectives on brand strength and branding activities in the Vietnamese banking sector. Adding a factual theoretical basis for important governance activities in the current commercial banking sector is “brand management” in the context of competition.

Literature Review

Brand Strength (BS)

According to Becker (2015), the brand is related to exciting brand strength when combining branding approaches and developing a brand value model based on identity, thereby discovering the origin of brand strength from the internal practice Burman, et al., (2009) and externally as well as examining brand strength both from a behavioral and financial perspective. Staffs’ behavior had related to brand understood as communication about the brand. They are acting in every way to convey brand value to other audiences, purchasing products and services. Bergstrom, Blumenthal & Crothers (2012) pointed out the origin of the term brand strength derived from the concept of brand equity.

According to Boone (2016), the points that agree on the brand’s strength are that employees can display the brand on the mental plane and behavior in the audience interested in the corporate brand (customers, employees, partners, investors...). A powerful brand can be differentiated and preferred by its psychologically engaging audiences and brand-related behaviors by Sidyasagar (2017).

Thus, employees can understand that branding within the enterprise is the organization’s branding efforts, helping the business create cooperation between customers inside and outside the organization by Brick, Jeffs & Carless (2014). The brand included communicating the brand effectively to employees, convince them of brand value, and make it essential in every job they do to convey the brand’s essence to customers by Burman & Zeplin (2015). A bank has brand power among employees, which is reflected in that employees have the spiritual motivation to perform well in their jobs, not badge their bank brand, and convey the bank’s brand value goods yourself to others by Raker (2016).

Commitment to the Bank Brand (CB)

Commitment to the bank brand understood as the employee’s firm belief, pride, concern, and acceptance of the bank’s brand goals and values, and an attitude of willingness to contribute to the brand by Cable & De-Rue (2012) become more popular and become part of their lives.

CB1: Employees take pride in telling others that the employee is part of the bank’s brand that the employee is working with managers.

CB2: Employees are willing to put in great effort to make a bank brand become a success by Chatman (2018).

CB3: Employees are pleased to work for their bank brand, not other banking brands by Cook & Wall (2017).

Act Towards the Bank Brand (AB)

Actions towards the bank’s brand name are understood as all employee’s behaviors and activities that are consistent with the bank’s brand value, positively affecting the brand value, reinforcing, and increasing importance. Brand and promote the bank’s brand value to all related parties by De-Chernatony & Segal (2011).

AB1: Employees are responsible for work outside of their duties by Drake & Roberts (2015).

AB2: Employees often recommend their bank brand to others.

AB3: Employees impart their bank branding knowledge to new employees.

AB4: Employees love to learn more about their bank’s brand by Gerbing & Anderson (2015).

Relationship Oriented in the Bank (RO)

According to Ghose (2019), with the concept of relationship orientation in the bank, respondents emphasized the relationships mentioned in the idea that need to be further specified between employees who directly contact customers, indirect employees in the working group, with other departments directly involved in handling customers’ work by Hulland (2018). The ability, the degree to which a bank establishes the environment and conditions for the development of good relationships within the bank, the degree to which it appreciates positive employee behavior such as cooperation, continuing well, honestly, encouraging working towards common goals by Indu (2013).

RO1: Managers and staff members work well together.

RO2: Communication in the bank provides good support for the development of relationships within the organization.

RO3: All bank employees are united to join forces to realize the bank’s goals and values.

RO4: The bank members respect each other and are people who appreciate life values by Kapferer (2014).

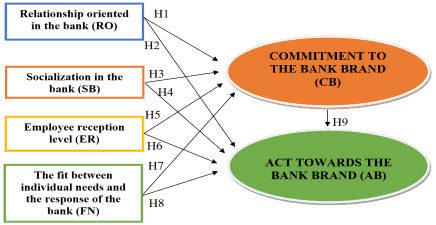

With those as mentioned above, the researchers have hypothesis following:

H1: Relationship Oriented in the bank (RO) has a positive relationship with the Commitment to the Bank Brand (CB)

H2: Relationship Oriented in the bank (RO) has a positive relationship with the Act Towards the Bank Brand (AB)

Socialization in the Bank (SB)

According to Kettinger & Choong (2015) studied, the bank needs to organize a mechanism to effectively support the transmission of the service and brand value to customers, or the staff to sell the service be well supported by the department behind the procedure. To keep the “trust” and keep the “trust” of the individual staff with the customer. The ability and extent are to the bank that helps its employees learn and determine the bank’s value. Its brand value, beliefs, expectations, information, and knowledge related to work effectively supporting employees to take action towards the bank brand by Kim & An (2013).

SB1: The bank has done good training.

SB2: The bank’s training activities help me do my job well.

SB3: Colleagues support each other well at work.

SB4: The working environment helps me understand how to act in the bank by Kimpakon & Tocquer (2016).

For the things mentioned earlier, the researchers have hypothesis following:

H3: Socialization in the Bank (SB) has a positive relationship with the Commitment to the Bank Brand (CB)

H4: Socialization in the Bank (SB) has a positive relationship with the Act Towards the Bank Brand (AB)

Employee Reception Level (ER)

According to King & Grace (2012) employee adoption is the degree to which a bank’s efforts are receptive to developing mutually beneficial relationships.

ER1: Employees actively seek information about how their banks are operating.

ER2: Employees find it interesting to get so much different stories about their bank by Kristof & Colbert (2012).

ER3: The employee’s job becomes more interesting when I am informed about my bank’s matters, not just information related to my work.

ER4: Staff is happy to give all feedback on work issues to the boss.

The researchers have hypothesis following:

H5: Employee Reception Level (ER) has a positive relationship with the Commitment to the Bank Brand (CB)

H6: Employee Reception Level (ER) has a positive relationship with the Act Towards the Bank Brand (AB)

The fit between individual needs and the response of the bank (FN)

According to Loshnjaku & Muca (2017), Employee perceptions of the match between individual needs and desires at work and the degree to which these unique needs are met through compensation, benefits, bonuses, and public recognition. Work, favorable working conditions that the bank offers, consider fairness among the bank members.

FN1: Employees appreciate the rewards employees receive for doing well at their jobs by Meh (2016).

FN2: The Bank provides good support to employees when employees make efforts to perform their jobs effectively.

FN3: Employees believe that employees are rewarded for their contribution to their work by Moxall (2017).

FN4: Staff believes that the level of giving - receive between employees and the bank they are working- is acceptable Raker (2016).

The mentioned above, the researchers have hypothesis following:

H7: The fit between individual needs and the response of the bank (FN) has a positive relationship with the Commitment to the Bank brand (CB)

H8: The fit between individual needs and the response of the bank (FN) has a positive relationship with the Act towards the Bank Brand (AB)

H9: The commitment to the Bank brand (CB) has a positive relationship with the Act towards the Bank Brand (AB)

A research model for the factors influencing brand strength of commercial banks in Ho Chi Minh City following:

(Source: Researchers proposed)

Figure 1: A Research Model for Factors Influencing Brand Strength of Commercial Banks in HO Chi Minh City

Methods of Research

The research process is done through two stages:

Stage 1: The authors carried out qualitative research to examine the applicability of the proposed research model in the commercial banking sector to explore the factors affecting commercial banks’ brand strength in HCMC. Besides, qualitative research also assessed commercial banks’ brand strength based on the bank’s staff, demonstrating the level of employee commitment and employee’s actions towards the bank brand. It considers the impact of the internal brand strength on the bank’s business operations, especially on the bank-customer relationship by Hair, Anderson, Tatham & Black (1998).

Besides, the in-depth individual interview method focuses on clarifying the nature of the proposed research model elements and newly discovered factors in focus group interviews, assessing the extent and nature of images. Relationship-oriented factors, socialization in the bank, employee adoption, and critical factors found in the interviewed individual focus group interview and their bank work assess the influence of two groups of working environment factors and individual employees on the brand strength. Doing this is to meet personally with each interviewee, about 11 subjects working in different commercial banks. The interview was conducted in about 4.0 hours, according to an in-depth personal interview guide.

Stage 2: Quantitative research is designed to realize the following research objectives:

1. Assess the proposed research model’s appropriateness in commercial banks.

2. Testing the reliability of the variables’ scale in the proposed research model, including a commitment to employee’s banking brand, action towards employee’s banking brand, orientation banking relations, banking socialization, employee reception, the suitability of individual needs - bank response.

The method of implementation is the survey by questionnaires with two forms of face-to-face and email-based approaches. With the first method, the investigator directly meets the surveyed subjects at banks, the bank branch where the respondent works, explains the study’s purpose and objectives, briefly describes the research content, and distributes the questionnaire to the respondents to fill out and answer the questions and answers. Questions related to the research content and questionnaire by Hair, Anderson, Tatham & Black (1998).

The survey questionnaire was then collected and checked for the completeness of the content. If the missing contents are detected, the surveyed person is requested to supplement information. With the second method, the investigator sends surveys and documents fully explaining the content related to the email lists of research subjects working at banks due to personal relationships have been. After a month, do the repeating and collect the final votes.

The authors conducted official quantitative research in HCMC with a total number of 800 votes, collected 785 votes, of which 15 were unsatisfactory (inadequate votes, unclear questionnaires) of respondents; the questionnaire has the same answer in most questions). The actual sample size used for analysis is 785, which meets the minimum sample requirement. The results describing the official quantitative research sample are presented below.

The research model is built based on SEM network model theory and uses SPSS and Amos 20 software in data analysis and processing. The initial data is cleaned, encrypted, and inputted into SPSS software. According to the working department’s criteria, the author performs sample description statistics, bank and bank group, location - job, and seniority at work. Cronbach alpha analysis was performed to check the reliability of the variables’ scale in the model by Hair, Anderson, Tatham & Black (1998).

EFA analysis then conducted to explore and determine how the scope and degree of relationship between the observed variables and the underlying factors serve as the basis for a set of measurements to reduce. Or reduce the number of observed variables that are uploaded to the baseline. Explore Factor Analysis (EFA) is beneficial in the initial experimental step or test extension. CFA is the next step of the EFA to test whether a pre-existing theoretical model underpins a set of observations. Next, the SEM linear structure analysis method is used to test the suitability of theoretical models and research hypotheses.

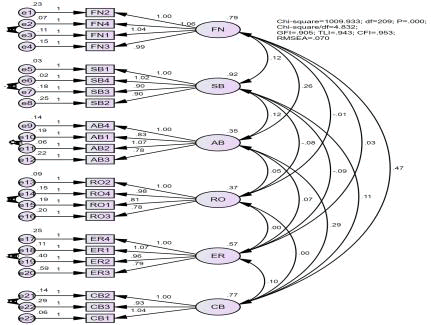

Finally, the authors had the purpose of Confirmatory Factor Analysis (CFA) to clarify. Authors tested Chi-square testing is P-value > 5%; CMIN/df ≤ 2.0, some cases CMIN/df maybe ≤ 3.0 or < 5.0; GFI, TLI, CFI ≥ 0.9. GFI is still acceptable when it is greater than 0.8; RMSEA ≤ 0.08. The results presented in detail in the following content by Hair, Anderson, Tatham & Black (1998).

Research Results

Testing Cronbach’s alpha for factors influencing brand strength of commercial banks in Ho Chi Minh City following:

| Table 1 Cronbach’s Alpha for Factors Influencing Brand Strength Of Commercial Banks in Ho Chi Minh City |

||

|---|---|---|

| No. | Components | Cronbach’s Alpha |

| 1 | Commitment to the bank brand (CB): CB1, CB2, CB3 | 0.948 |

| 2 | Act towards the bank brand (AB): AB1, AB2, AB3, AB4 | 0.877 |

| 3 | Relationship oriented in the bank (RO): RO1, RO2, RO3, RO4 | 0.88 |

| 4 | Socialization in the bank (SB): SB1, SB2, SB3, SB4 | 0.965 |

| 5 | Employee reception level (ER): ER1, ER2, ER3, ER4 | 0.855 |

| 6 | The fit between individual needs and the response of the bank (FN): FN1, FN2, FN3, FN4 | 0.96 |

(Source: Researchers proposed by SPSS 20.0)

Table 1 showed that all of Cronbach’s Alpha is greater than 0.7. Besides, the research results are very consistent with the data set and eligible for the next steps.

(Source: Researchers proposed)

Figure 2 : Testing Factors Influencing Brand Strength of Commercial Banks in Hcmc

| Table 2 Factors Influencing Brand Strength of Commercial Banks in HCMC |

|||||||

|---|---|---|---|---|---|---|---|

| Relationships | Coe. | Standardized Coefficient | S.E. | C.R. | P | ||

| CB | <--- | RO | 0.147 | 0.076 | 0.056 | 2.601 | 0.009 |

| CB | <--- | SB | 0.086 | 0.1 | 0.026 | 3.368 | *** |

| CB | <--- | ER | 0.158 | 0.156 | 0.033 | 4.728 | *** |

| CB | <--- | FN | 0.519 | 0.554 | 0.03 | 17.235 | *** |

| AB | <--- | RO | 0.122 | 0.115 | 0.032 | 3.784 | *** |

| AB | <--- | SB | 0.073 | 0.156 | 0.015 | 4.952 | *** |

| AB | <--- | ER | 0.069 | 0.125 | 0.019 | 3.713 | *** |

| AB | <--- | FN | 0.145 | 0.285 | 0.02 | 7.26 | *** |

| AB | <--- | CB | 0.186 | 0.34 | 0.022 | 8.266 | *** |

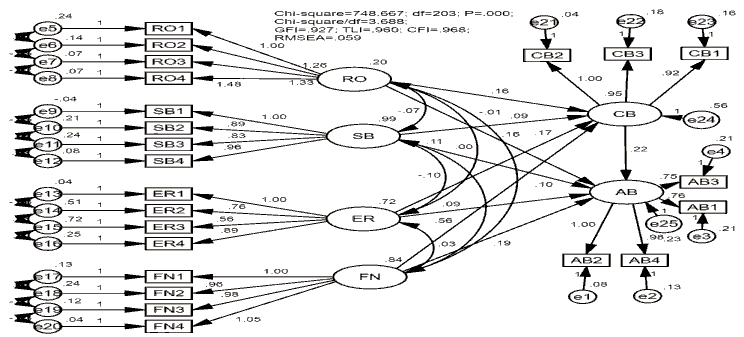

Table 2 showed that column “P” < 0.01 with significance level 0.01. Table 3 indicated that four factors affected commercial banks’ brand strength in Ho Chi Minh City with a significance level of 0.01.

(Source: Researchers proposed)

Figure 3 : Testing Factors Influencing Brand Strength of Commercial Banks in Hcmc

| Table 3 The Results of Bootstrap for 5.000 Samples |

|||||||

|---|---|---|---|---|---|---|---|

| Parameter | SE | SE-SE | Mean | Bias | SE-Bias | ||

| CB | <--- | RO | 0.078 | 0.001 | 0.124 | -0.022 | 0.001 |

| CB | <--- | SB | 0.024 | 0 | 0.082 | -0.004 | 0 |

| CB | <--- | ER | 0.035 | 0 | 0.156 | -0.001 | 0 |

| CB | <--- | FN | 0.041 | 0 | 0.518 | -0.001 | 0.001 |

| AB | <--- | RO | 0.058 | 0.001 | 0.108 | -0.013 | 0.001 |

| AB | <--- | SB | 0.017 | 0 | 0.071 | -0.003 | 0 |

| AB | <--- | ER | 0.018 | 0 | 0.067 | -0.002 | 0 |

| AB | <--- | FN | 0.022 | 0 | 0.143 | -0.003 | 0 |

Table 3 indicated that column “Bias” is tiny with a significance level of 0.01.

Conclusion and Policy Implications

Conclusions

Research results showed that the essential premise for creating a positive attitude and behavior towards a bank’s brand is each employee’s characteristics in the bank and the working environment and the working environment. Every bank creates a substantial impact on its employees. Therefore, according to the authors, employee attitudes and behaviors towards the brand are relatively dependent on how the bank can create a work environment for the employees, not just on what employee gives to the bank. Besides, the research is carried out in HCMC only considers the impact of some factors of the working environment and individuals on commercial banks’ brand strength in HCMC. Consider the application level of measuring these factors in circumstances in the commercial banking sector in HCMC and is implemented to a limited extent. The study surveyed 800 staffs related to commercial banks, but 785 samples processed and answered 23 items. Commercial banks should pay attention to factors in the following:

1. Relationship Oriented in the bank (RO),

2. Socialization in the Bank (SB),

3. Employee Reception level (ER), and the fit between individual needs and the response of the bank (FN).

Policy Implications

Based on the results mentioned above, commercial banks should enhance the brand strength following.

1. Commercial banks should organize training courses on employees’ knowledge and skills, helping them understand products/services, thereby deploying banking services and brands well. This implication is a way to reduce the occupational risk that helps employees turn brand commitment into brand action. Therefore, banks should continue to focus on training to support their expertise and skills in high-risk jobs such as banking. Focusing on direct contact with customers and the department directly helps these employees in terms of procedures, focusing on training activities on the bank’s position and professional characteristics in the banking industry, especially with the following departments. Contact with each type of customer, so there should be training activities about the customer’s field’s professional characteristics. Commercial banks need to train a team of experts in branding, good in business, knowledgeable about banking services, able to grasp and forecast the development trend of banking services in the future and attach importance to the intellectual property’s knowledge. Along with product quality, policy and customer care service are also an effective and fast branding strategy for businesses. Some standard policies of companies are pricing policies, promotions, discounts and customer gratitude events. Besides, these policies also include customer care, shipping policy, warranty, maintenance. If these customer policies are implemented well and satisfy every customer, its reputation can spread quickly. The brand is a sign that helps identify brands, affirms prestige, and creates trust. That is why companies need to build a long-term and effective brand development strategy.

2. Commercial banks should improve the remuneration regime should focus on building a remuneration mechanism associated with the assessment and determination of the employee’s desired needs at work and in the correlation of individual contributions, correlation with other individuals in the working group, correlating with similar work positions at other branches, other banks, and other businesses. This remuneration regime should be supported by a healthy financial situation and transparent operations to create long-term employees’ confidence. Besides, commercial banks should select adequate human resources for functional level leaders and train them to build a working environment. Banks support the relationship between employees - direct leadership, employees - customers, employees - colleagues in the same department, and other departments involved in the customer service process.

3. Commercial banks should need to develop internal communication activities about brand value through highly appreciated and practical channels such as internal forums to exchange ideas among employees and contests of initiatives daily work change. The bank’s communication should be compared with other banks in the same group and industry to understand the brand value. The foundation for employees’ trust and action towards the brand. Besides, commercial banks should have communication activities that should not be one-way but should ensure staff responsiveness and participation in the communication process. The best audience to perform internal communication activities is the functional leaders who directly manage their staff. In commercial banks, there should be a department specializing in branding to help leaders deploy and supervise the brand building and development activities so that each bank employee becomes an ambassador for your brand. To do this, each bank’s leaders must know how to implement many sharing vision sessions for employees; organize brand training for everyone in the bank.

4. Commercial banks should focus on brand-oriented leadership on building the working environment and leadership style of functional, departmental management teams. Leadership activities should link to the specific cultural factors of each bank. Therefore, it is necessary to integrate banking culture with brand value and leadership and communication activities to feel the brand value sustainably. Besides leadership towards the brand, senior leaders focus on building brand value, brand vision. Communication to employees should be the job of functional leaders who directly manage employees while enhancing employee engagement and empowerment in the bank’s work and brand operations. Finally, commercial banks should find and build a team of staff with substantial expertise and dedication to customers is still a challenging problem for domestic, commercial banks. Therefore, commercial banks need to have the correct awareness of the brand in the entire staff and employees through propaganda and education throughout the system to create a permanent sense of everyone’s image, especially its services.

References

- Ahmed, P.M. (2017). The role of internal marketing in the implementation of marketing strategies. Journal of Marketing Practice, 1(2), 32-51.

- Atilgan, E.S. (2015). Determinants of the brand equity: A verification approach in the beverage industry in Turkey. Marketing Intelligence & Planning, 2(3), 37-48.

- Baumgarth, C.K. (2019). The brand orientation of museums: Model and empirical results. International Journal of Arts Management, 11(3), 3-15.

- Becker, M.S. (2015). Notes on the concept of commitment. American Journal of Sociology, 6(6), 32-42.

- Bergstrom, A., Blumenthal, D., & Crothers, S. (2012). Why internal branding matters: The case of Saab. Corporate Reputation Review, 5(3), 13-22.

- Boone, M.T. (2016). The importance of internal branding. Sales and marketing management, 9(2), 6-18.

- Brick, M., Jeffs, D., & Carless, S.A. (2014). A global self-report measure of person-job fit. European Journal of Psycological Assessment, 1(8), 43-51.

- Burman, C. & Zeplin, S.T. (2015). Building brand commitment: A behavioral approach to internal brand commitment. Journal of Brand Management, 12(3), 79-93.

- Cable, D.M. & DeRue, D.K. (2012). The convergent and discriminant validity of subjective fit perceptions. Journal of Applied Psychology, 8(7), 75-84.

- Chatman, J.M. (2018). Matching people and organizations: Selection and socialization in public accounting firms. Administrative Science Quarterly, 3(6), 59-74.

- Cook, J.M. & Wall, T.J. (2017). New work attitude measures of trust, organizational commitment, and personal need nonfulfillment. Journal of Occupational Psychology, 5(3), 9-18.

- De Chernatony, L.G., & Segal, S.H. (2011). Building on services characteristics to develop successful services brands. Journal of Marketing Management, 1(7), 45-61.

- Drake, S.M., & Roberts, S.I. (2015). The brand inside: The factors of failure and success in internal branding. Irish Marketing Review, 1(9), 5-16.

- Gerbing, M., & Anderson, T. (2015). An updated paradigm for scale development incorporating unidimensionality and its assessment. Journal of Marketing Research, 2(5), 18-26.

- Ghose, K.D. (2019). Internal brand equity defines the customer experience. Direct Marketing: An International Journal, 1(5), 77-85.

- Hair, J., Anderson, R., Tatham, R.L., & Black, W.C. (1998). Multivariate data analysis, (5th edition). Prentice Hall, NJ: Upper Saddle River.

- Hulland, J.Y. (2018). Use a Partial Least Squares (PLS) in strategic management research: A review of four recent studies. Strategic management journal, 20(3), 195-204. Indu, N.K. (2013). Turn employees into brand ambassadors. ABA Bank Marketing, 3(5), 22-26.

- Kapferer, J.N. (2014). The new strategic brand management: Creating and sustaining brand equity long term. Journal of Marketing Research, 2(3), 5-14.

- Kettinger, W.J., & Choong, C.L. (2015). Perceived service quality and user satisfaction with the information services function. Decision Science, 2(5), 37-46.

- Kim, H.B., & An, J.T. (2013). The effect of consumer-based brand equity on firms’ financial performance. The Journal of Consumer Marketing, 2(3), 35-41.

- Kimpakon, N.J., & Tocquer, G.M. (2016). Service brand equity and employee brand commitment. Journal of Services Marketing, 2(4), 78-88.

- King, C.T., & Grace, D.R. (2012). Examining the antecedents of positive brand-related attitudes and behaviors. European Journal of Marketing, 4(6), 1-10.

- Kristof, B., & Colbert, A.Y. (2012). A policy-capturing study of the simultaneous effects of fit with jobs, groups, and organization. Journal of Applied Psychology, 8(7), 15-23.

- Loshnjaku, A.T. & Muca, E.N. (2017). Brand awareness and consumer profile for milk: Case of the Tirana market, Thailand. Annals of Marketing Management & Economics, 13(12), 13-19.

- Meh, F.Y. (2016). Dimensions of customer-based brand equity: A study on Singapore brands. Journal of Marketing Research and Case Studies, 3(5), 12-22.

- Moxall, G.R. (2017). What consumers maximize: Brand choice as a function of utilitarian and informational reinforcement. Managerial and Decision Economics, 3(7), 36-47.

- Raker, D.K. (2016). Measuring brand equity across products and markets. California Management Review, 3(8), 10-21.

- Sidyasagar, A.F. (2017). Success crowns banking services: Brand and culture analysis. International Journal of Applied Business and Economic Research, 15(2), 77-89.