Research Article: 2022 Vol: 21 Issue: 2S

Factors Influencing Industry 4.0 Implementation in Oil and Gas Sector: Empirical Study from a Developing Economy

Abdelgnai Benayoune, International Maritime College

Abstract

This study aims to find out the driving factors as well as the main challenges and barriers to Industry 4.0 implementation. Primary data were collected from managers and experts through online questionnaire and interviews. The study explored the views and perceptions of 69 senior managers and expert in the oil and gas industry. The results indicated that cost reductions and the need of efficiency improvement, enhancement of productivity and compliance were found to be the main factors driving Industry 4.0 adoption in Oman. On the other hand, implementation cost, cultural change, and lack of digital skills among the current labor force were the strong barriers and challenges. The study discusses the policy implications of Industry 4.0 and recommends further research in the area

Keywords

Digitalization, Industry 4.0, Oil and Gas, AI, Digital Strategy

Introduction

State of Oil and Gas Industry in Oman

According to the Central Bank of Oman’s Annual Report (CBO, 2020), the oil and gas industry constituted 34.4% of the nominal GDP and 76% of the government revenues in 2019. Oman’s oil and gas industry is expected to grow at a compound rate of 14 per cent during the period from 2020 to 2027 (ONA, 2020). Despite its efforts to diversify its economy away from hydrocarbons, the oil and gas remains at the heart of Oman’s economic growth, and that is expected to continue in the foreseeable future. The overreliance on hydrocarbons exportation means that Oman economy is tied to the volatility of oil and gas prices. In addition, the outbreak of the Covid-19 pandemic inflicted dual shock of lockdown and a collapse in the global oil prices, resulting in a wide spread economic contraction (CBO, 2020).

While oil and gas will continue to be important to the economy and energy mix, the country is aiming to diversify its economy and achieve a sustainable energy through a combination of renewable and existing energy sources enabled by state-of–the art digital technology. This strategy is picking up steam across the O&G value chain. For instance, Petroleum Development Oman (PDO) which delivers the majority of Oman's crude oil production and natural gas supply is developing innovative renewable solutions to create new growth opportunities whilst leveraging new technology and improving the overall energy efficiency. In 2020, Amin Photovoltaic (PV) Power Plant started supplying PDO’s operations at commercially attractive rates. This 100-megawatt PV plant is one of the world's first utility-scale solar projects to have an oil and gas company as the sole buyer of electricity (Renewables Now, 2019). Technology is expected to play a significant role in supporting and accelerating a sustainable energy transition.

The Oil and Gas (here after named O&G) industry can be broadly divided into three main segments: upstream, midstream and downstream as depicted in Table 1. The upstream refers to exploration, development and production of O&G known as E&P, whereas, the midstream refers to the transportation, pipeline, oil tanker or trucks of O&G. While the downstream refers to the refining of petroleum crude oil and the processing and purifying of raw natural gas, storage and sale.

| Table 1 O&G Segments |

||

|---|---|---|

| Upstream | Midstream | Downstream |

| Exploration & Production | Transporation & Trading | Refining & Marketing |

| • Exploration • Development • Production of Oil & Gas • Gas processing • LNG liquefaction |

• Oil & Gas trading • Oil transportation via pipeline and ship • LNG shipping transportation • LNG terminal |

• Refining & petrochemicals • LNG gasification • Gas to market • Marketing and sale |

Oil and Gas 4.0

The term Industry 4.0 has been used since 2011 to describe the widespread integration of information and communication technology in industrial production (Drath & Horch, 2014). Industry 4.0 is not the result of one technology, but the results of development of multiple technologies simultaneously, including big data analytics, Industrial Internet of Things (IIOT), autonomous robot, digital twin, cloud computing, 3D printing, augmented reality, and cybersecurity (Kadir, 2017). The novelty of this concept lies in the combination of available technologies in a new way (Drath & Horch, 2014).

The concept of Oil and Gas 4.0 (hereafter named OG 4.0) was first introduced at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) in 2018. Through OG 4.0, O&G entities expect to unlock the opportunities created by Industry 4.0. The main of objective of OG 4.0 is to permit to the industry remain competitive and resilient regardless of the fluctuation of oil prices (The National, 2018).

The use of industry 4.0 technologies in the O&G sector is expected to increase operational efficiency and reduce maintenance costs through preventive and predictive analytics to maintain a competitive advantage in the face of oil price volatility, energy demand fluctuation, and the pressing need to shift to cleaner energy business models.

O&G firms generate a massive data on a daily basis, but cannot fully make use of it. OG 4.0 utilizes technologies such as 5G, IOT, cloud computing, big data analytics, artificial intelligence and machine learning to collect this massive data and gain real-time visibility over field operations and assets to derive actionable business insights (Report Linker, 2021).

Oil & Gas 4.0 is the utilization of technology to collect data, gain visibility over field operations and assets, derive actionable insights and automate the oil & gas value chain. Some of the technologies being leveraged for Oil & Gas 4.0 are connectivity & 5G, IOT, cloud & edge computing, big data analytics, AI/ML, drones, and robotics (Report Linker, 2021). Some possible applications of O&G 4.0 are summarized in Table 2.

| Table 2 Some Possible Applications Of Og 4.0 In Segments Of O&G Industry |

||

|---|---|---|

| Segment | OG 4.0 Applications | Source |

| Upstream | Seismic collection and data interpretation | (Alfaleh et al., 2015; Roden 2016; Mohammadpoor & Torabi, 2020) |

| Enhance drilling rig efficiency and performance and increase drilling safety | (Duffy et al., 2017; Maidla et al., 2018; Mohammadpoor & Torabi, 2020) | |

| Improve hydraulic fracturing projects | Betz (2015) | |

| Remote smart oil field management | Hussain, et al., (2019a); (2019b) | |

| Midstream | Pipeline inspection and maintenance | (PetroLMI, 2019; Oman Gas Company, 2019) |

| Improve shipping performance | (Anagnostopoulos, 2018) | |

| Energy Efficiency | (Park et al., 2018) | |

| Downstream | Improve asset management: Reduce downtime and maintenance costs. | (Mohammadpoor & Torabi (2020) |

The widespread outbreak of the COVID-19 and the volatility of oil and gas price coupled with environmental issues like climate change and fossil fuel depletion put pressure on the O&G firms to embrace OG 4.0 across O&G value chain, seeking more operational efficiency, lower operating costs, safer operations, and a lower environmental impact (Report Linker, 2021).

Although there were many studies in the literature related to the drivers and barriers to adoption of Industry 4.0 in various countries, Industry 4.0 adoption challenges in Oman has not been explored. As reported by Maisiri, et al., (2021), Industry 4.0 is not a one-size-fits-all solution. Therefore, a regional and sectorial perspective are necessary when exploring relevant barriers and driving factors to its adoption. In addition, Industry 4.0 challenges and opportunities in the oil and gas sector draw the interest of various stakeholders in Oman including oil and gas firms, technology providers, government, educational and vocational training institutions as well as working professionals in the sector. Hence, through questionnaire and structured interviews, the study attempts to:

•Determine the main driving forces of OG 4.0 implementation in Oman.

•Determining the barriers that O&G firms might face in implementing OG 4.0.

•Identifying types of technologies implemented by O&G firms.

•Discuss policy implications of OG 4.0.

In order to address the research objectives, this paper is structured as follows: Section 2 gives an overview of existing literature. Section 3 provides the research methodology. Questionnaire and interviews results are discussed in Section 4. Policy implications are presented in section 5. Finally, conclusions and recommendation for further research are presented in section 6.

Literature Review

This section presents an overview of the existing literature on the drivers and barriers of OG 4.0. Since literature on OG 4.0 is rather limited, we expanded the review to include Industry 4.0 in other industries with focus on O&G industry. A method of an academic and general search to investigate the existing literature was conducted. The database used in the literature review include, but not limited to Scopus, Google Scholar, IEEE explore, Science Direct, Web of Science. The keywords for searching the database included, but not limited to “big data”, “block chain”, “digital technologies”, “Industry 4.0”, “Internet of Things”, “Oil and Gas 4.0”, “3D printing”. In addition, the lists of references obtained from reviewed papers and industry reports were also included in this study. The relevance of Industry 4.0 to oil and gas industry was selected based on the review of contents of the abstract, introduction and conclusion. Barriers and drivers related to Oil and Gas 4.0 implementation in the O&G industry were identified from the filtered articles. This literature review is a part of a larger study, which addresses several OG 4.0 related issues. In line with the scope of this paper, only the literature that is relevant to the scope of this paper is presented.

Driving Forces of OG 4.0 Adoption

Cost Reduction and Performance Improvement

The adoption of industry 4.0 is motivated by saving cost, reducing risk, and improving performance using operational data to minimize the impact of market volatility (Slusarczyk, 2018; Müller et al., 2017; Erol et al., 2016; Schmidt et al., 2015; Blanchet et al., 2014).

In the O&G sector, Brulé (2015) stated that petroleum engineers and geoscientists spend over half of their time in searching and assembling data. Using big data techniques is being used in the upstream segment to analyse seismic, reservoir simulation resulting in reducing drilling time and increasing drilling safety, optimization of the performance of production pumps, improved asset management and improved occupational safety. Big data can also help in enhancing oil recovery from existing oil wells, improving performance forecasting, optimizing real-time production, increasing safety measures, and preventing risks (Eissa, 2020; Azzedin & Ghaleb, 2019; Mohammadpoor & Torabi, 2018; Johnston & Guichard, 2015).

The upstream industry loses billions of dollars every year due to Non-Productive Time (NPT). IIOT devices could be deployed to reduce NPT by using near-real-time data to monitor equipment, predict breakdowns and schedule preventive maintenance remotely. This will help improve efficiency and transform upkeep from a tender process into a proactive one (Lee, 2019).

In downstream, Cowles (2015) reported that big data techniques help in reducing electricity and fuel consumption of refineries. In the Liquefied Natural Gas, it helps predict maintenance to avoid unplanned shutdowns, improve operations.

In midstream, some O&G companies are starting to invest in big data relevant solutions such as Hadoop to manage transportation fuel cost, monitor pressure efficiently, and forecast supply and demand (Cowles, 2015; Azzedin & Ghaleb, 2019). For instance, Oman Gas Company, a gas transportation provider, used a centralized digital platform to improve reliability performance by 9%. Which is worth substantial savings to the company (Sertin, 2019). MODEC decreased equipment downtime by 65% using advanced analytics and Artificial Intelligence (AI) on data from its fleet units in Brazil (DNVGL, 2020). Using predictive maintenance reduces downtimes of equipment in both upstream production, midstream and downstream refining.

Competitiveness and Creation of New Business Models

Industry 4.0 adoption allows firms to cope with the dynamics in the market. But these changes have an impact on the way companies do business, their competitive position in the market and thus their business model (Lasi et al., 2014; Montanus, 2016; Burmeister et al., 2016; Arnold et al., 2016; Laudien & Daxböck, 2017; Laudien et al., 2018; Ibarra et al., 2018; Slusarczyk, 2018). The business model describes the rationale of how a firm creates, delivers, and captures value (Osterwalder & Pigneur, 2010). It is a framework that companies use to position themselves in the marketplace (Schaefer et al., 2017). The emergence of Industry 4.0 has been associated with the introduction and the widespread application of new business model innovations (Müller et al. 2018). For instance, Big Data and digitization have already begun to challenge the use of traditional business models in manufacturing (Loebbecke & Picot, 2015). It is worth noting that publications on business models in OG 4.0 are very limited. Advanced analytical methods and advanced simulation greatly assist in making timely and accurate O&G field operating decisions. All previous studies focused on the manufacturing industry (Montanus, 2016). However, the establishment of external networks with technology and service providers are becomes increasingly important in the OG 4.0 era. According to a questionnaire conducted across the OGG value chain (DNV GL, 2020), around 80% of respondents believe the industry needs to develop new operating models to achieve further cost efficiencies.

Labor Market Changes

The volatility of oil price and uncertain business environment have significantly impacted O&G firms, leading to spending cuts, mass layoffs and a migration of workers to other industries. Mass layoffs continue to challenge the industry’s reputation as a reliable employer. According to a recent questionnaire conducted by the University of Houston (Kever, 2020), more than half (53%) of O&G workers cited job security as a concern. Due to retirement of experienced workers, the industry is also at high risk of losing institutional knowledge gained through decades of experience. As oil prices rises and demand recovers, employment will pick up. As a result, attracting new talent and filling the skills gap while addressing the concern of an aging workforce will be a challenge for the industry. Therefore, the industry will face skills deficiency in the foreseeable future. Automated O&G production and operation ensure and maintain consistent operations and productivity in the case of shortage of workforce (Lu et al., 2019). Production facilities depends heavily on a human presence, however, the recent pandemic forced O&G firms to accelerate the adoption of digital solutions that allow workers to work remotely.

Customer Requirements

In the era of OG 4.0, supply chain management will progress into an integrated value chain of mutually beneficial relationships where suppliers and customers work together to create efficiencies by combining systems and processes. For instance, block chain technology can be used to secure data, increase transaction transparency, and provide tracking services for goods or equipment. In addition, smart services use a variety of intelligent integration technologies to automatically identify the user’s explicit and implicit needs, thus actively and efficiently meet customer needs (Lu et al., 2019). Whereas big data can be used for describing customer portraits (Zhifeng et al., 2019).

Regulations and Compliance

As regulations and legislations tighten and environmental awareness rises, O&G firms are under pressure from investors, governments and consumers to accelerate the transition to a decarbonized energy future. O&G firms must produce store and ship products with minimal energy consumption and in a safer manner.

In upstream business, IIOT sensors allow O&G operators to monitor environmental conditions remotely and monitor compliance metrics, such as oil leaks and gas emissions (Lee, 2019).

In midstream segment, Oman Gas Company (2019) has adopted aerial inspections across its natural gas pipeline infrastructure in order to inspect its pipeline infrastructure faster and safely detect and fix potential technical issues. Using drone-based aerial inspection is helping the company reduce CO2 emissions of vehicles used during periodic inspections of pipelines and driven at an estimated distance of 260,000 km/year.

Identification of Challenges and Barriers of OG 4.0

Although OG 4.0 technologies are gaining interest, there are still some key challenges and barriers which are required to be addressed. For the adoption of new technologies, O&G firms face two main challenges, namely limited budget, and limited expertise. For instance, changes in operating models require the replacement of a large number of equipment and systems and require a substantial capital investment (Lu et al., 2019). With the unpredictable fluctuations in O&G prices, it becomes a big challenge to invest in a new technology. Another important factor is that rapid technological change and technology improvement have a significant influence on firms’ investment decisions (Tung et al., 2020). Below are the main challenges and barriers found in the literature?

High Investment Cost and Limited Budget

The cost of digital deployment was cited as a significant challenge to the adoption of digital technologies (Lu et al., 2019; Mogos et al., 2019; Tung et al., 2020). OG 4.0 implementation requires the replacement of a large number of equipment and systems, which require a significant capital expenditure (Lu et al., 2019). Add to this, there is a limited budget coupled with an unknown economics benefits of in implementing OG 4.0 (Benayoune et al., 2020). For example, one of the main challenges of Big Data's application is the cost associated with managing the data recording, storage, and analysis (Mohammadpoor & Torabi, 2020).

Lack of Adequate Skills

Lack of digital talent and knowledge gap were found to be amongst the main barriers of adopting and implementing OG 4.0 technologies (Zhifeng et al., 2019; Lu et al., 2019; Mogos et al., 2019; Tung et al., 2020; Benayoune et al., 2020). A lack of technological knowledge and expertise to conduct OG 4.0 related projects is equally challenging (Tung et al., 2020). The little knowledge about implementation risks and consequences of OG 4.0 was also identified as barrier (Mogos et al., 2019). The increasing adoption of technology is also changing the skills level required in the O&G industry, and will have a profound impact on the employment landscape over the coming years (Benayoune et al., 2020). For instance, as more and more equipment becomes connected, more data scientists will be needed to produce systems to interpret this. Data security concerns will also increase, creating demand for digital security specialists to protect data and processes. According to Petrol MI (2018), there will be an increased need for software engineers, data management and analytics specialists and instrumentation technologists to measure operations in real-time.

Cyber Security

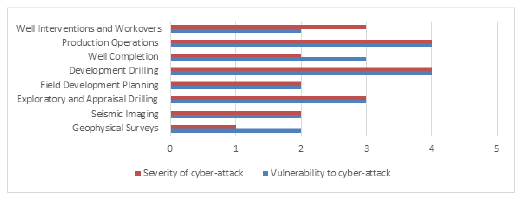

The combination of information technology and operational technology has brought new challenges for the O&G industry. Based on our review of key OG 0.4 technologies data security was cited as one of the key concerns (Lu et al., 2019; Mogos et al., 2019; DNV GL, 2020; Nguyen et al., 2020; Tung et al., 2020; Report Linker, 2021). This is a legitimate and genuine concern as O&G industry networks are by far the most targeted by industrial hackers (Dalton, 2016). A report by Ponemon Institute 2017 showed that nearly 68% of O&G companies in the US were hit by at least one cyber incident. In 2021, an American fuel pipeline operator shut down its entire network after a cyber-attack (Bing & Kelly, 2021). Cyber security vulnerabilities have become a key challenge for the industry. However, many cyber security solutions have been developed and implemented to mitigate this risk against cyber-attacks. Severity of cyber-attack evaluation for upstream O&G are shown in Figure 1.

Resistance to Change

R Resistance to change caused by OG 4.0 implementation was found to be an important barrier (DNV GL, 2020; Tung et al., 2020). The reason for workers’ resistance is uncertainty and fear of the unknown. They perceive digital disruption as a threat to their job security (Tung et al., 2020). According to Lu, et al., (2019), the resistance to change in OG firms is due to a lack of government guidance. OG 4.0 is not just about technology; it is about a change of culture.

Lack of Standardization

A lack of standards of interoperability between various digital platforms, which cause discrepancies among OG 4.0 implementation projects, represent a challenge that needs to be addressed (Lu et al., 2019; Mogos et al., 2019; Nguyen et al., 2020; Tung et al., 2020). For example, the complex nature Industrial Internet of Things (IIOT) systems has brought together many technical challenges such as interoperability, security and privacy, scalability, heterogeneity, reliability and resource management (Khan, 2019).

Other Challenges and Barriers

In addition to the five challenges described in sections 3.2.1-3.2.5, there are other barriers found in the literature such as laws and regulations support related to identification, authentication, data accuracy, data ownership issues, privacy, and confidentiality, data ownership and privacy (Cameron 2018; Nguyen et al., 2020), a lack of business support and awareness (Mohammadpoor & Torabi, 2018), data quality standards (Zhifeng et al., 2019). Lack of implementation strategy and digitalization strategy in which firms fail to connect digital strategy to their business goals (Tung et al., 2020) or implement digital solutions in functional silos or on ad hoc basis not aligned across business units.

OG 4.0 deployment also raises many concerns such as data sovereignty & data residency. Sovereign data is subject to the laws of the country in which it is collected or processed. Many countries, to varying degrees, have formulated their own cross-border data flow laws based on the need to safeguard the privacy and cybersecurity. O&G companies are facing growing challenges to meet local data sovereignty and regulatory requirements (Benayoune et al., 2020).

Methods

The research method adopted is considered as an exploratory in nature using qualitative and

quantitative approaches. The aim of this study is to explore and understand the perceptions, and the experience of experts from O&G industry about the driving factors as well challenges and barriers related to the implementation OG 4.0 in Oman. For collecting primary data, a questionnaire and structured interview were used. They questionnaire was prepared in Microsoft Forms and a link was sent to each respondent by e-mail. The questionnaire was directed to managers and technology experts who should have sufficient expertise and knowledge about digital strategy in their firms.

Sampling Method

Questionnaire

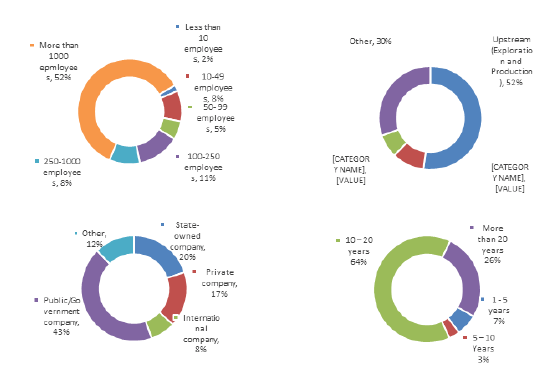

To effectively collect data without any bias, employing a probability or random sampling was selected for this study. Random sampling is considered the easiest way of sampling technique. It gives every respondent an opportunity to be selected. The questionnaire was sent to 400 O&G companies’ members of Oman Society for Petroleum Services (OPAL). The response rate was 17.25%. About 52% of participating companies were upstream (exploration and Production), 10% midstream (transportation, pipeline, oil tanker or trucks). 7% of companies were from Downstream segment as shown in Figure 2. The data collected have been analyzed using frequency analysis techniques using Microsoft Excel Data Analysis.

Interviews

The questionnaire was followed by eight structured interviews involving senior managers and technology experts from O&G firms. The structured interview consists of open-ended questions to gather more detailed information and obtain a range of views and opinions from the respondents. Purposeful sampling was employed in this study. The selection criteria of participants include participant’s position, experience (more than 10 years in the oil and gas sector in Oman) and knowledge about digital technologies.

It is worth noting that that the questionnaire and interviews are a part of a larger study, which addresses several OG 4.0 related issues. In line with the scope of this paper, only those questions that are relevant to the scope of this paper are addressed.

Findings

This section presents and discusses the results of the questionnaire results considering earlier research literature together with interview results.

Key Factors Affecting O&G Firms in Oman

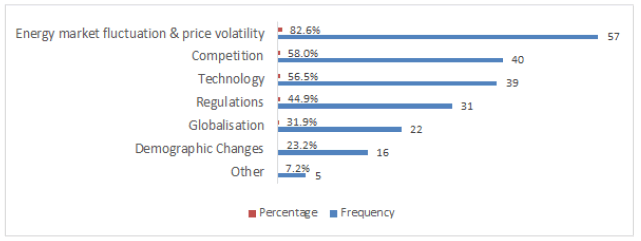

Energy market fluctuations (82.6%), competition (58%), and technology (56.5%), were found to be the strong factors affecting the O&G firms in Oman as depicted in Figure 3. On the other hand, regulations and compliance (44.9%) was ranked fourth.

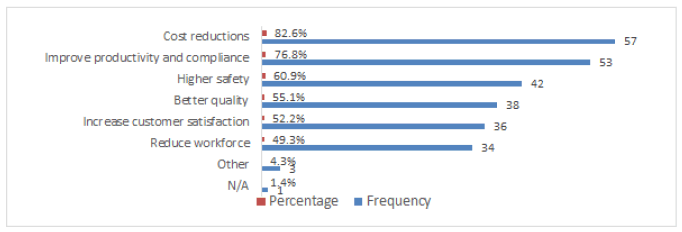

As expected, cost reductions and the need of efficiency improvement (82.2%), improve productivity and compliance (76.8%), and higher safety (60.9%) are key benefits of technology adoption as shown in Figure 4. The interview answers related to OG 4.0 drivers, confirmed the results of this questionnaire. The implementation of enhanced oil recovery (EOR) remains a major strategic option for Oman upstream firms to boost their oil production. However, this option has increased the cost of oil production. Hence, adopting of OG 4.0 is expected to lead to more operation efficiency and cost reductions. Interview answers also indicated that cost reduction, compliance with regulations and customer demand are main drivers for technology adoption. The adoption of OG 4.0 helps in the production of cost-effective energy and reduction of equipment failure while at the same time addressing safety and environmental concerns.

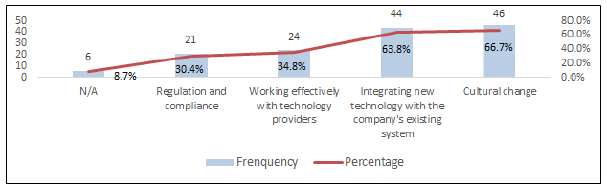

When asked about adopting up-to-date technologies, 62% of respondents indicated that their companies are ‘keeping up with technology”, ‘ahead of the curve’ (23%), and ‘lagging behind’ (15%). When the respondents were asked about the operational changes they faced when they adopted new technology in the past 5 years, 66.6% of respondents ranked high ‘cultural change’, (68%) ‘Integrating new technology with the company's existing system’ (34.8%), and ‘regulation and compliance’ (30.4%) as depicted in Figure 5. The answers to this question obtained from interviews confirmed the results of the questionnaire.

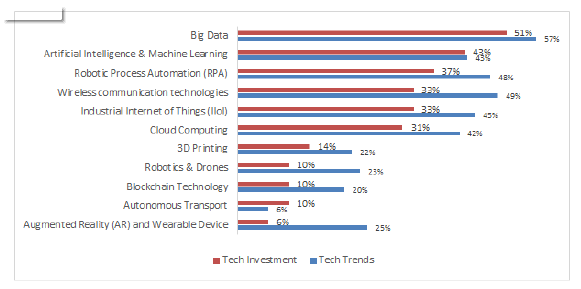

Top OG 4.0 trends in Oman and where OG firms are focusing their investment over the next ten years, according to respondents are shown in Figure 6. O&G firms are focusing their investment on “big data” (35.2%), “artificial intelligence & machine learning” (27.8%), “robotic process automation (RPA)” (21.6%), “wireless communication technologies)” (21.6%). “industrial internet of things (IIoI)” (17.6%), and cloud computing (31%). These were regarded as top technology trends in O&G industry according to respondents.

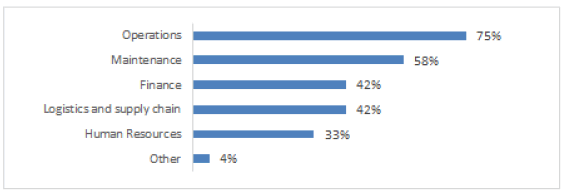

According to questionnaire data, O&G firms are mainly investing in digital solutions in Operations (75%), Maintenance (58%), Finance (42%), Logistics and supply chain (42%) and human resource management (33%) as shown in Figure 5. Interview answers to this question confirmed that O&G firms are investing more in operation and maintenance, exploration, finance and asset integrity as illustrated in Figure 6 and 7.

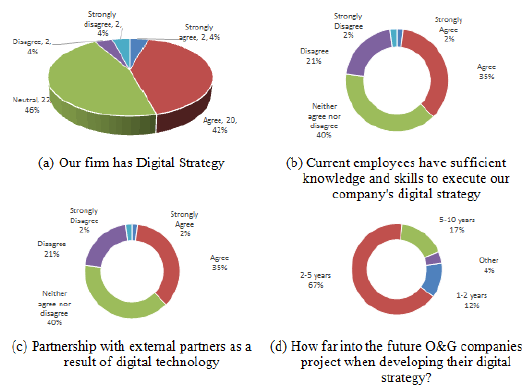

O&G Digital Strategy

About 24% of respondents agreed that their firms have a digital strategy and only 6% of them disagree. However, the majority of respondents (46%) were “Neutral” as shown in Figure 8a. 37% of respondents agreed that their current employees have sufficient knowledge and skills to execute their firm's digital strategy and 23% of them disagree. The majority (40%) were neutral as illustrated in Figure 8b. About 48% of firms have a digital strategy that looks 2–5 years ahead, while 35% of respondents stated that their firms have 5 to 10-year digital strategy. This means the majority of O&G firms in Oman do not have a clear digital strategy as shown in Figure 8c. The interview answers confirmed the questionnaire data. 4 out of 8 interviewees stated that their firms don't have a clear digital strategy but they are aware of the importance of digitalization and have already invested in digital solutions. The rest (50%) agreed that they have a digital strategy, but capacity, pace and scale of applications are well below opportunity set. All strategies look 2–5 years ahead. This shows there is a poor commitment for OG 4.0 implementation from top management. This is due to the fact that they management does not see the opportunities OG 4.0 presents.

When asked about forging a strategic partnership as a result of digital technology, 35% of respondent’s state that their firms have established strong relationships with external partners (Figure 8c).

Successful digital strategy focuses on using digital solutions to cut cost, increase efficiency, enhance safety and predict maintenance needs. To be successful, a digital strategy must be a strategic priority, have dedicated investment, backed by top management and workforce that has the right skills to drive the required changes in processes, infrastructure and systems. However, only one third of O&G firms have a digital strategy that fulfill the above description.

Main Challenges and Barriers to Adopting OG 4.0

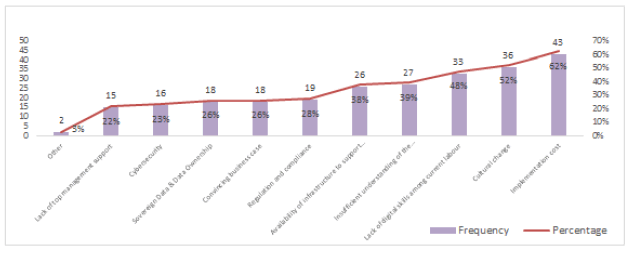

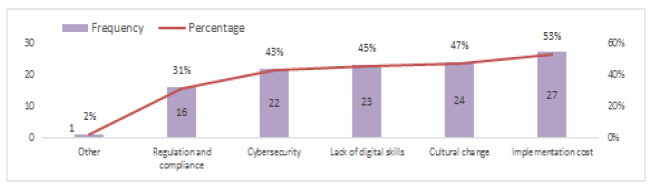

As expected, many O&G firms hesitate to make high upfront OG 4.0 investments. The vast majority of respondents (62%) regarded ‘implementation cost’ as a strong barrier for their firms. While 52% and 48% respondents see ‘cultural change’ and ‘the lack of digital skills of their current workforce’ respectively as strong barriers as well. On the other hand, respondents ranked as barriers ‘insufficient understanding of the opportunities the technology presents’ (39%) and ‘availability of infrastructure to support OG 4.0’ (38%) as shown in Figure 9. The cost of implementation, cultural change including resistance to change and the lack of adequate skills have been already highlighted as major barriers to OG 4.0 in the literature. Opposite to our expectation, ‘cybersecurity’ (23%) was relatively considered less significant barrier compared to ‘convincing business case’ (26%) or ‘regulations and compliance’ (28%) according to respondents. However, as depicted in Figure 10, ‘cybersecurity’ was considered one of the major risks in adopting OG 4.0. Again ‘implementation cost’ (53%), ‘cultural change’ (47%), ‘digital skills’ (45%) and ‘regulations and compliance’ (31%) were regarded strong barriers as well as potential risks in implementing OG 4.0.

In comparison, interview answers confirmed that the cost of implementation, reluctance and resistance to change, and a lack of adequate skills were strong barriers. In addition, a lack of support for technology, change in existing system, a lack of ICT readiness, complexity of industrialization, scale and breadth of opportunities associated resourcing intensity were viewed as main barriers for their firms. When it comes to risks, interview answers indicated that with lower oil prices, OG 4.0 may get de-prioritized. Some stated that their firms are risk averse and there is insufficient leveraging of global experimentation and best practice in O&G industry in Oman. O&G firms should strive to create a culture of experimentation, one senior manager suggested. It was also mentioned that OG 4.0 technologies are still in developing stage. As a result, there is still a great deal of uncertainties about which technologies to adopt. Table 3 and 4 provides a summary of drivers and barriers of OG 4.0 implementation in O&G sector in Oman compared to the literature review findings.

| Table 3 Drivers Based On The Literature Review Vs Drivers Identified By O&G Firms In Oman (All Segments) |

|

|---|---|

| Drivers identified in the literature review | Drivers identified by O&G firms in Oman |

| Cost reduction and performance improvement | ü |

| Competitiveness and creation of new business models | ü |

| Labor market changes | |

| Customer requirements | ü |

| Regulations and compliance | ü |

| Table 4 Barriers Based On The Literature Review Vs Barriers Identified By O&G Firms In Oman (All Segments) |

|

|---|---|

| Barriers based on the literature review | Barriers identified by O&G firms in Oman |

| High investment cost and limited budget | ü |

| Lack of adequate skills | ü |

| Cyber security | ü |

| Resistance to change | ü |

| Lack of standardization | ü |

| Laws and regulations support related to identification, authentication, data accuracy, data ownership issues, privacy, and confidentiality, data ownership and privacy | ü |

| A lack of business support and awareness | ü |

|

Data quality standards |

ü |

|

Data sovereignty & data residency. |

ü |

Policy Implications at the National Level

OG 4.0 is expected to reduce cost, improve efficiency, and boosts productivity and compliance and allows new business models. However, the implementation of OG 4.0 is not without its challenges. High capital investments, inadequate ICT infrastructure and overcoming resistance to change are key challenges. As expected and in line with other research works found in the literature, the workforce challenges were identified as a strong barrier of O&G implementation. Although this challenge is found in both developed and developing economies, Oman does not suffer from aging populations like developed countries. On the contrary, there are many young job seekers, but new technology jobs continue to be filled by foreign migrants. According to participants, this is due to the lack of the necessary skills. 54% of them indicated that educational institutions and vocational training providers do not produce graduates with the right skills to fill their current and future roles. As demand for emerging technologies increases, the gap between talent demand and supply increases. Educational institutions should focus on the development of interdisciplinary talents such as petroleum engineering, information engineering, computer science, and engineering management (Lu et al., 2019). Interview answers emphasized that the education system needs to change and adapt to meet the industry needs.

A shortage of Industry 4.0 skill requirements is not unique to Oman, but it a global challenge as discussed in the literature, therefore, O&G sector must invest in skills development to bridge current and future skills gap.

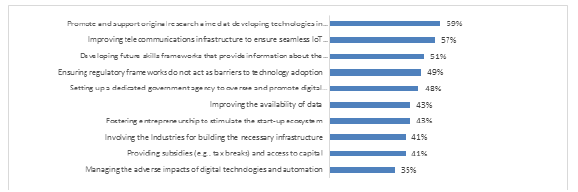

When asked about the role of government to support the transition towards OG 4.0, the majority of respondents ranked high “promoting and supporting research aimed at developing technologies in emerging areas’ (59%), ‘improving telecommunications infrastructure’ (57%), ‘developing future skills frameworks that provide information about industry related occupations and skills needed with the relevant training programs’ (51%), and ‘ensuring regulatory frameworks do not act as barriers to technology adoption (49%) as shown in Figure 11.

The interview data confirmed the questionnaire results. In addition, the interview responses suggested that the government should act as a regulator and an enabler supporting collaboration between key stakeholders (industry-academia-government) while enhancing cybersecurity, allowing cross-border data sharing and improving ICT infrastructure, and providing financial incentives for OG 4.0 initiatives.

Conclusions

This study evaluated and assessed the views and perceptions of senior managers and experts in oil and gas firms in Oman on the implementation of OG 4.0 to better understand the factors influencing the adoption and implementation of these technologies in the O&G sector.

The study results indicate that the energy market fluctuations, competition, technology together with regulations and compliance are strong factors affecting O&G firms in Oman.

The study shows that cost reductions and the need of efficiency improvement, productivity enhancement and compliance, and customer demand were found to be strong drivers for technology adoption. The majority of respondents agree that the adoption of OG 4.0 helps in the production of cost-effective energy and reduction of downtime while at the same time addressing safety and environmental concerns.

Strong barriers to adopting OG 4.0 technologies identified by respondents include implementation cost, cultural change, the lack of digital skills. To a lesser extent, respondents regarded factors such as insufficient understanding of the opportunities the technology presents, availability of infrastructure to support OG 4.0, regulations and compliance, convincing business case and cyber security as barriers to OG 4.0 implementation.

The results also showed that cyber security was considered one of the major risks in adopting OG 4.0 in the next 10 years together with implementation cost, cultural change and insufficient skills together with regulations and compliance.

According to questionnaire and interview-results, O&G firms in Oman are focusing their investment on Big Data, Artificial Intelligence & Machine Learning, Robotic Process Automation (RPA), Wireless Communication Technologies, Industrial Internet of Things (IIoI), and Cloud Computing. They focus their investment in operation and maintenance, finance and logistics and supply chain.

The policy implication of this study is that the government should promote and support research aimed at developing technologies in emerging areas, improve ICT infrastructure, develop future skills frameworks that provide information about O&G industry related occupations and future skills needed while ensure regulatory frameworks do not act as barriers to OG 4.0 adoption and implementation. O&G firms suggested that the government should act as a regulator and an enabler supporting collaboration between key stakeholders, enhancing cyber security, and providing financial incentives for OG 4.0 projects. Similar outcome was found in the literature in other countries.

The paper presents additional and novel data to fill a gap in this research field that still lacks empirical data. It contributes to the current knowledge base of factors influencing the adoption and implementation of OG 4.0 in the O&G industry. The author believes that the results of this study are also applicable to other industries in Oman and elsewhere in the GCC countries. Nevertheless, the data of this study was based on answers form a single or two respondents from each O&G firms. The respondents may not have knowledge about all the research themes. This can be considered as a limitation. The second limitation is the sample size. Therefore, future researchers can draw data from larger size from multiple respondents from the same firm to further investigate this topic and strengthen the results. Further research into specific barriers and drivers to Industry 4.0 implementation in other industrial sectors in Oman and other developing economies in the region is recommended.

Acknowledgements

The author gratefully appreciates the financial support from Occidental of Oman Inc. and OQ to undertake the project “The Future of Labor Market in the Energy Sector: Challenges and Opportunities”. This study is a part of this project. The author also acknowledges Oman Society for Petroleum Services (OPAL) for its support in designing the questionnaire questions, sending out the questionnaire and following up with participants. Likewise, the author is grateful to the questionnaire and interview respondents. Without their insights, this study would not have been possible

Conflicts of Interest

The author declares no conflict of interest.

References

Alfaleh, A., Wang, Y., Yan, B., Killough, J., Song, H., & Wei, C. (2015). Topological data analysis to solve big data problem in reservoir engineering: Application to inverted 4D seismic data. SPE Annual Technical Conference and Exhibition.

Anagnostopoulos, A. (2018). Big data techniques for ship performance study, 887-893.

Arnold, C., Kiel, D., & Voigt, K.I. (2016). How the industrial internet of things changes business models in different manufacturing industries. International Journal of Innovation Management, 20, 1640015.

Azzedin, F., & Ghaleb, M. (2019). Towards architecture for handling big data in oil and gas industries: Service-oriented approach. International Journal of Advanced Computer Science and Applications, 10(2).

Benayoune. (2020). The future of labor market in the energy sector: Challenges and opportunities. OPAL-IMCO Report.

Betz, J. (2015). Low oil prices increase value of big data in fracturing. Journal of petroleum technology, 67, 60-61.

Bing, C., & Kelly, S. (2021). Cyber-attack shuts down U.S. fuel pipeline.

Blanchet, M., Rinn, T.T., Thaden, G., & Thieulloy, G. (2014). Think act: Industry 4.0, Ronald berger strategy consultants, Munich, Germany.

Brulé, R. (2015). The data reservoir: How big data technologies advance data management and analytics in E & P Introduction General data reservoir concepts data”. Group IBMS, Reservoir for E & P.

Burmeister, C., Lüttgens, D., & Piller, F.T. (2016). Business model innovation for Industry 4.0: Why the “Industrial Internet” mandates a new perspective on innovation. Die Unternehm. 70: 124–152

Cameron, D., Waaler, A., & Komulainen, T., (2018). Oil and gas digital twins after twenty years. How can they be made sustainable, maintainable and useful? Proceedings of the 59th Conference on Simulation and Modelling (SIMS 59), 26-28.

Cowles, D. (2015). Oil, gas, and data.

Drath, R., & Horch, A. (2014). Industrie 4.0: Hit or Hype? (Industry Forum). Industrial electronics magazine.

Dalton, M. (2016). Wireless technology for asset utilisation and operator profitability.

DNV, G.L. (2020). New direction, complex choices: The outlook for the oil and gas industry in 2020.

Duffy, W., Rigg, J., & Maidla, E. (2017). Efficiency improvement in the bakken realized through drilling data processing automation and the recognition and standardization of best safe practices. SPE/IADC Drilling conference and exhibition, The Hague, The Netherlands.

Eissa, H. (2020). Unleashing industry 4.0 opportunities: Big data analytics in the midstream oil & amp; Gas Sector. International Petroleum Technology Conference. 3-15.

Erol, S., Jager, A., Hold, P., Ott, K., & Sihn, W. (2016). Tangible industry 4.0: A scenario-based approach to learning for the future of production. Procedia CIRP, 54, 13–18.

Gómez, C., & Green, D.R. (2017). Small unmanned airborne systems to support oil and gas pipeline monitoring and mapping. Arabian journal of geosciences. 10, 202.

Hussain, F., Salehi, A., Kovalenko, A., Feng, Y., & Semiari, O. (2019a). ‘‘Federated edge computing for disaster management in remote smart oil fields,’’ in Proc. IEEE 21st Int. Conf. High Perform.

Hussain, F., Salehi, A., & Semiari, O. (2019b). Serverless edge computing for green oil and gas industry. In Proc. IEEE Green Technol. Conf. (GreenTech).

Ibarra, D., Ganzarain, J., & Igartua, J.I. (2018). Business model innovation through Industry 4.0: A review. Procedia Manuf. 22, 4–10.

Johnston, J., & Guichard, A. (2015). New findings in drilling and wells using Big data analytics Offshore Technol. Conf, SPE, Houston.

Kadir, B.A., 2017. The nine pillars of industry 4.0.

Kever, J. (2020). Energy workforce survey. University of Houston.

Khan, W., Rehman, Z.M., Zangoti, H.M., & Afzal, M. (2019). Industrial internet of things: Recent advances, enabling technologies, and open challenges.” Computers & Electrical.

Lasi, H., Fettke, P., Kemper, H.G., Feld, T., & Hoffmann, M. (2014). Industry 4.0. Business & information systems engineering, 6, 239–242.

Laudien, S.M., & Daxböck, B. (2017). Business model innovation processes of average market players: A qualitative empirical analysis. R D Manag. 47, 420–430.

Laudien, S.M., Bouncken, R., & Pesch, R. (2018). Understanding the acceptance of digitalization-based business models: A qualitative-empirical analysis.

Lee, S. (2019). IOT Applications in the Oil and Gas Industry.

Loebbecke, C., & Picot, A. (2015). Reflections on societal and business model transformation arising from digitization and big data analytics. Journal of Strategic Information Systems. 1(24), 149–157.

Lu, H., Guo, L., Azimi, M., & Huang, K. (2019). Oil and Gas 4.0 era: A systematic review and outlook. Computers in Industry.

Maisiri, W., Dyk, L.V., & Coeztee, R. (2021). Factors that inhibit sustainable adoption of industry 4.0 in the South African manufacturing industry. Sustainability. 13, 1013.

Maidla, E. Maidla, W., Rigg, J., Crumrine, M., & Wolf-zoellner, P. (2018). Drilling analysis using Big data has been misused and abused.

Mohammadpoor, M., & Torabi, F. (2020). Big Data analytics in oil and gas industry: An emerging trend, Petroleum, 6(4). 321-328,

Mohammedpoor, M., & Torabi, F., (2018). Big Data analytics in oil and gas industry: An emerging trend.

Mogos, M. Eleftheriadis, R., & Myklebust, O. (2019). Enablers and inhibitors of Industry 4.0: Results from a survey of industrial companies in Norway. Procedia CIRP. 81. 624-629.

Montanus. M., (2016). Business models for industry 4.0 developing a framework to determine and assess impacts on business models in the Dutch oil and gas industry. Master of science thesis. Delft University of technology.

Mittal, A., Slaughter, A., & Zonneveld, P., (2017). Protecting the connected barrels-cyber security for upstream oil and gas.

Müller, J.M., Buliga, O., & Voigt, K.I. (2018). Fortune favors the prepared: How SMEs approach business model innovations in Industry 4.0. Technological Forecasting and Social Change, 132(1), 2-17.

Nguyen, T., Gosine, R., & Warrian, P. (2020). A systematic review of big data analytics for oil and gas industry 4.0.

Oman Gas Company, 7 August 2019. OGC uses drone technology for gas pipeline inspections.

ONA. (2020). Research foundation projects growth of oman's oil, Gas Sector by 14pc.

Osterwalder, A., & Pigneur, Y. (2010). Business model generation: A handbook for visionaries, game changers, and challengers. Wiley, New Jersey.

Park, W., Roh, I., Oh, J., Kim, H., Lee, J., Kim, I., & Kim, Y. (2018). Estimation model of energy efficiency operational indicator using public data based on big data technology.’’ In Proc. 28th International ocean and polar engineering conference. 894–897.

Petro LMI. (2019). Oil and gas labor market update.

Petro LMI. (2018). A workforce in transition: Oil and gas skills of the future.”

Ponemon Institute. (2017). The state of cyber security in the oil & gas industry: United States.”

Renewables Now, (2021).

ReportLinker (2021). Oil and Gas 4.0. Underlying technologies, Use cases and TELCO positioning strategies.

Roden, R. (2016). Seismic interpretation in the age of big data. SEG International Exposition and Annual Meeting, Dallas, Texas, 16 - 21 October 2016.

The National. (2018). Oil and Gas 4.0 explained.

Schmidt, R., Möhring, M., Härting, R.C., Reichstein, C., Neumaier, P., & Jozinovi´c, P. (2015). Industry 4.0 potentials for creating smart products: Empirical research results. In proceedings of the international conference on business information systems, Poznan, Poland, 24–26 June 2015.

Schaefer, D., Walker, J., & Flynn, J. (2017). A data-driven business model framework for value capture in industry 4.0.

Sertin, C. (2019). Case study: Oman Gas Company digitalises its reliability and integrity programme.

Slusarczyk, B. (2018). Industry 4.0: Are we ready? ´ Pol. J. Manag. Stud. 17, 232–248.

Tung, T., Ngoc, T., Ngo, Hai, H., & Thanh, T. (2020). Digital transformation in oil and gas companies: A case study of Bien Dong POC. 2020. 68-81.

Zhifeng, Y., Fei, H., Xuehui, F., Zhen, C., & Yidan, Z. (2019). Cloud computing and big data for oil and gas industry application in China. Journal of Computers. 269-282.

Received: 15-Nov-2021, Manuscript No. asmj-21-8787; Editor assigned: 17-Nov-2021; PreQC No. asmj-21-8787(PQ); Reviewed: 02-Dec-2021, QC No. asmj-21-8787; Revised: 09-Dec-2021, Manuscript No. asmj-21-8787(R); Published: 15-Dec-2021