Research Article: 2021 Vol: 20 Issue: 3

Factors Influencing the Adoption of E-Banking in Kuwait

Abdullah AL-Mutairi, Gulf University for Science and Technology

Kamal Naser, Kuwait Fund

Mshael A. Salem, Gulf University for Science and Technology

Abstract

The purpose of this study is to identify factors impact customers’ decision to adopt e-banking services in Kuwait. The study used a questionnaire survey to identify the factors affect customers’ decision to adopt e-banking. Various factors employed in literature were used together with some demographic factors and the participants were asked to express their level if agreement with each of them on 5 points Likert scale. 500 questionnaires were distributed and 320 returned completed, resulting in 64% a usable response rate. The collected data were analysed by employing a stepwise regression analysis. The outcome of the analysis pointed to relative advantage that excludes cost and profit together with trialability and the participant’s level of education as being positively and significantly associated with customer’s decision to adopt e-banking in Kuwait.

Keywords

Adoption, e-banking, Relative Advantage, Computability, Complexity, Observability, Safety and Security, Kuwait.

Introduction

Consumers attitude toward e-banking have been the subject of growing theoretical and empirical investigations in the banking literature. The central issue in this literature is whether e-banking is fulfilling customers banking needs through providing them the most convenient channel to monitor their accounts, lower bill-paying and time saving in managing their finances. Empirical studies on the factors that impact the adoption of e-banking have produced conflicting results with respect to their relative importance. For example, while some studies found security interests is one of the major factors that affects e-banking adoption, others found it to be only marginally significant. Moreover, research demonstrated the importance of demographic factors such as age and education level in the use of e-banking. However, the findings in different countries are not automatically applicable to the banking sector in Kuwait due to environmental and institutional differences.

The aim of the study is to ascertain the factors that affect Kuwaitis' use of e-banking services. The importance of the study lies in the fact that it covers an oil-exporting country with high per capita income. Covering the cost of technology in a country like Kuwait does not constitute a problem for either commercial banks or their clients. In addition, the banking sector is of interest because of its importance to the domestic economy and the huge amounts of money invested in adopting new technologies by these banks. Furthermore, Kuwait enjoys a relatively advanced technological infrastructure. Hence, it is expected that the factors affecting Kuwaitis' use of e-banking to be different from what many previous studies have concluded and the outcome would add a new dimension to the literature by contributing to the limited body of empirical studies about Innovation Diffusion of the banking sector in the Gulf Co-operation Council (GCC) region.

The current study would also be appreciated by both policy-makers and customers. For the former, it would provide useful information that assist bank management in formulating e-banking marketing strategies to attract more consumers to their internet offerings. For the later, it would provide empirically supported data that assist in understanding consumer perceptions, interests and opinions regarding to Innovation Diffusion in banking sector in Kuwait. In addition, the findings of this study are expected to promote the adoption of internet-based services that helps in reducing pressure on the roads and parking lots and save customers time to go to the bank and wait for a long time. It would also help in limiting gatherings, especially in the event of a pandemic, such as the Corona virus.

The rest of the study is organized as follows: a brief review of related literature is offered in the following section. Data collection and study methodology are explained in section three. While the findings are discussed in section four, the conclusion is presented in the last section.

Literature Review

Melo et al. (2020) referred to Tranfield et al. (2003) who described the purpose of the literature review as to map, consolidate and evaluate the theoretical dimension of a domain area and, subsequently, identify the knowledge gaps to be filled in future research. Zhu & Wang (2018) showed that in the literature review, bibliometric analysis method is used to effectively summarize a significant amounts of data rooted in solid and well-defined theories.

The diffusion theory of innovation proposed five characteristics that influence the adoption of any innovation namely, relative advantage, complexity, compatibility, trialability and observability (Rogers, 1962). Rogers (1995) highlighted all benefits and obstacles that affect in the adoption of five attributes of innovation perceived by individuals or organizations. The attributes of innovation have major impact on achieving competitive advantage and reducing cost (Bradley & Stewart, 2003). Moreover, there is an agreement that they explain acceptance behaviour and represent important determinants of consumers' adoption decisions (Black et al., 2001). Additional factors are used to explain variation in the adoption of e-banking including: customer’ demography factors and security and safety.

Relative Advantage

Relative advantage does not mean that the value of an innovation only includes profit, but it extends to cover other factors such as the ease of use and storage (Olatokun & Igbinedion, 2009). Relative advantages in economic terms are expressed in time saving, money and convenience (Zolait et al., 2008). Innovation adoption provides a benefit to the users to manage their finances properly in a more convenient manner (Ndubisi & Sinti, 2006). It is well known that the perceived benefit is a key reason for innovation adoption; this might include lower administrative cost or increased internal efficiency (Rogers, 1962). The rate of adoption of a new innovation is seemed to be linked to relative advantage. In other words, the faster of adoption the innovation depends upon its relative advantage (Rogers, 1995). Hence, it is fair to say that the perceived benefit is one of the main factors that influence customers’ adoption of e-banking.

Wang et al. (2003) noticed that the perceived usefulness and credibility are important factors that affect the adoption of e-banking. Al-Sabbagh & Molla (2004) examined factors behind affecting the adoption of e-banking and found the relative advantage to be one of the most important factors. Kolodinsky et al. (2004) examined the factors that affect the adoption or intention to adopt three e-banking technologies and changes in these factors over time. They found that the relative advantage is associated with adoption. They also found that the adoption changed over time, but the impact of the factors on adoption has not changed. Al-Samani (2005) identified the relative advantage as the main factor behind adopting electronic banking. Lichtenstein & Williamson (2006) conducted a study to identify the key influences in consumer adoption of e-banking and convenience particularly in terms of time savings is the main motivator for consumer adoption of e-banking. The researchers argue that there is a need to change habits in order to persuade consumers to move to internet delivery.

Almazari & Siam (2008) examined e-finance practices in commercial banks and found that there is a positive statistical relation between: e-services and reduction of cost and efforts. They also found that the customers do not look for an emotional relationship with the banks but sees the price, quality and performance as important factors when choosing banks. They concluded that bankers need to educate their customers more about using e-finance and the risks involved in it. Zolait et al. (2008) examined the main dimensions of e-banking and noticed that the respondents do not distinguish the variation among Rogers’ (1995) two dimensions of relative advantage and compatibility. They also found that e-banking adoption is influenced by the relative advantage combined with compatibility. Azam (2007) found that relative advantage has a significant relation with the adoption of e-banking.

Similarly, Al-Hajri (2008) stated that the relative advantage as a significant determinant of e-banking. Daghfous & Toufaily (2007) reported a positive relationship between relative advantage and the level of the adoption of e-banking. Hashim & Chaker (2009) found that the e-banking services is not doing the purpose it was originally made for, which is to provide customer convenience and reduce customer visits to the banks. They concluded that a significant number of customers do not trust the e-banking as a channel to conduct their banking transactions. Omar et al. (2011) found that mostly customers prefer e-banking services over branch banking due to reliability, convenience, speed, user-friendly and error free system. The researchers also observed that cost effectiveness as an important factor in customer’s preference of e-banking services over branch banking. El-Qirem (2013) found that the successful adoption of e-banking seems to be cost and convenience beneficial for all stakeholders in the financial sector. Fonchamnyo (2013) identified the cost of service as one of the drivers to the customer’s perception of e-banking adoption. Anouze & Alamro (2019) tested factors influencing the use of e-banking and observed that the perceived usefulness is one of the main barriers to the intention to use e-banking. It is, therefore, hypothesized that:

H1 The use of the e-banking is affected by its relative advantage.

Complexity

Complexity is the degree to which an innovation is difficult to learn and use or the degree to which an innovation is perceived as difficult to understand and use (Zolait et al., 2008). According to Al-Sabbagh & Molla (2004), complexity is the customer's perception of difficulty of doing e-banking. It might refer to the degree to which an innovation is perceived relatively difficult to understand and use (Azam, 2007). Al-Hajri (2008) explained complexity in terms of three major issues related to perceived ease of use: easy to navigate, easy to learn and easy to manage. It is not surprising to see customers hesitating in adopting innovation they found it difficult to use. Complexity might represent customers’ reluctance to change (Sathye, 1999). Better access to the services or convenience motivates customers to use e-banking. Hence, the adoption of the e-banking would increase when customers consider it easy. Wang et al. (2003) indicated that the acceptance of e-banking is affected by the perceived ease of use. In other words, the customers are less likely to adopt a new technology if it demands high level of technical skills. Kolodinsky et al. (2004) observed significant association between the complexity/simplicity factor and the adoption of e-banking. They further observed that the adoption changed over time with no change on the effect of complexity/simplicity factor.

Ndubisi & Sinti (2005) found complexity to be significantly and negatively associated with the adoption of e-banking. Azam (2007) noticed that complexity is the strongest factor that negatively affects the adoption of e-banking. Al-Sabbagh & Molla (2004) disclosed that the ease of use is one of the most important factors affects the adoption of e-banking. Al-Hajri (2008) observed that the perceived ease of use provided a broader understanding of e-banking adoption. Alhassany & Faisal (2018) studied factors influencing e-banking adoption decision and showed that clear and easy-to-use website as the most important factor. Gunaratnam et al. (2018) looked into the influencing factors of e-banking practices and noticed that content and website layout, speed of delivery, and accessibility are the critical factors. Anouze & Alamro (2019) explored factors impact the use of e-banking and observed that perceived ease as a significant one. It is, therefore, hypothesized that:

H2 The use of the e-banking is affected by its complexity.

Compatibility

Compatibility is the degree to which an innovation fits in with the customer's existing purchases and lifestyle. It demonstrates the situation at which an innovation fits with an individual's working and lifestyle, values and needs (Zolait et al., 2008). It is obvious that the lack of compatibility is the main factor of hindering the adoption of e-banking (Polatoglu & Ekin, 2001). The smoother the innovation fits into the culture, the sooner the rate of adoption. Black et al. (2001) argues that the past experiences and the values of consumers are seemed to play significant impact on their willingness to adopt e-banking. Kolodinsky et al. (2004) studied the effect of the compatibility factor on the adoption of e-banking and found it to be significant. Ndubisi & Sinti (2006) found compatibility is significantly and positively associated with the adoption. Azam (2007) reported a strong association between compatibility and the adoption of e-banking. Zolait et al. (2008) found the e-banking adoption is influenced by compatibility. Al-Somali et al. (2009) investigated the factors that encourage customers to adopt e-banking and found compatibility as one of the most important ones. Olatokun & Igbinedion (2009) found compatibility impacts users’ attitude towards the adoption of e-banking. Fonchamnyo (2013) demonstrated that usefulness and accessibility influence customer’s attitudes towards the adoption of e-banking. It is, therefore, hypothesized that:

H3 The use of the e-banking is affected by its compatibility.

Trialability

Trialability is the degree to which the innovation can be tried before purchase (Lichtenstein & Williamson, 2006). It is important to allow the customer to use the innovation in order to remove certain perception on the complexity and identify how easy it is over the traditional methods (Zolait et al., 2008). E-banking innovation presents two attitudes for trail enabling, while the first one gives the chance for the customer to perform a trail by himself or herself, the second one emphasizes on enabling customer to note the success of e-banking by others (Al-Sabbagh & Molla, 2004). According to Rogers (1995) trialability means users would like an opportunity to trial with the innovation prior to committing to its use. This reflects the consumer's ability to furnish the innovation an attempt before deciding to adopt it or not (Brown et al., 2004). Logically, the successful trial will lead to an increase of the rate of adoption. Therefore, it is fair to state that the greater the trialability connected to employ e-banking, the more possible that it will be adopted. Alhassany & Faisal (2018) noticed that the usefulness of e-banking service is significantly influenced by the surrounding people’s views and prior experience. Zolait et al. (2008) detected insignificant association between the adoption of e-banking and trialability. It is, therefore, hypothesized that:

H4 The use of the e-banking is affected by its trialability.

Observability

Observability is the degree to which the results of an innovation can be seen by others. It reflects the degree to which the results of an innovation are noticeable to others (Rogers, 1995). What is noticeable by others means what can be communicated, and this depends on the outcome of what has been observed. Observability is the scope to which an innovation is visible by other customers in a social life (Black et al., 2001). The more easily consumers can observe the positive impacts of adoption, the better its chances of success (Polatoglu & Ekin, 2001). Zolait et al. (2008) argues that the greater using e-banking being observable, the more probable that it will be adopted. Kolodinsky et al. (2004) noticed that the adoption of the e-banking is strongly related to observability. They further noticed that while the adoption changed over time, the observability not changed. Azam (2007) considered observability as explanatory variable of the e-banking adoption. Zolait et al. (2008) noticed a insignificant association between e-banking and trialability. Olatokun & Igbinedion (2009) observed that observability impacts the customer’s attitude to use e-banking. It is, therefore, hypothesized that:

H5 The use of the e-banking is affected by observability.

Demographic Factors

Wu (2005) examined the attitudes of retail banking customers in South Africa, towards the adoption of e-banking. He observed that demographic factors including age, income, education level and occupation affect the adoption of e-banking. However, psychological factors including perceived relative advantage, perceived compatibility, perceived complexity, perceived risk, and perceived cost were found to influence the adoption of e-banking. He concluded that social influences including opinions of friends, parents and colleagues were not found to be significant factors to influence the adoption of e-banking. Fonchamnyo (2013) showed that customer characteristics such as age, education and marital status have significant influence on their attitude toward the adoption of e-banking. Moreover, Kim et al. (2005) examined the determinants of e-banking adoption based on an individual’s benefits and costs of adopting e-banking. They found that demographic factors, age, income, education, occupation to be significant factors. They noticed that younger and well-educated consumers are more likely to adopt e-banking. They concluded that computer education might be more important than simple promotion or advertising for e-banking use. It is, therefore, hypothesized that:

H6 The use of the e-banking is affected by consumer’s demography.

Safety and Security

Sathye (1999) used individual residents and business firms as a sample to examine the factors affecting the adoption of e-banking and found that security concerns and lack of awareness about e-banking are the main obstacles. Internet security is a major factor inhibiting wider adoption. Wang et al. (2003) found that the “perceived credibility” reflects the user's security and privacy concerns in the acceptance of e-banking. Al-Sabbagh & Molla (2004) provided evidence that security interest is one of the major factors that affect the adoption of e-banking. Kolodinsky et al. (2004) reported significant association between the adoption of the e-banking and the security factor. They also found that the adoption changed over time, but the impacts of other factors on adoption have not changed.

Samphanwattanachai (2007) used Delphi study to examine the experts’ opinion about e-banking adoption and detected that the number of Internet users, trust, and security are the main factors that affect E-banking adoption by the customers. Al-Smadi (2012) attempted to identify and understand factors that affect bank customers' use of e-banking services and established that uncertainty avoidance has a positive and significant impact on perceived ease of use and perceived usefulness. He also observed that perceived risk has the stronger impact on customers' attitude, which in turn influences customers' intention to use electronic banking services. Omar et al. (2011) noticed that customers prefer e-banking services over branch banking due safety and security among other factors. Fonchamnyo (2013) found that the perceived security and trust have significant influenced on customer’s attitudes and the adoption of e-banking. Gunaratnam et al. (2018) explored the influencing factors of e-banking practices and noticed that privacy and convenience is one of them. Anouze & Alamro (2019) considered factors affecting the adoption of e-banking and identified security as a significant one. Lin et al. (2020) proposed a research model to explore the key factors affecting consumers’ willingness to use e-banking. They witnessed differences in the factors that companies and consumers adopted. The primary factor valued by both companies and consumers is trust. Alhassany & Faisal (2018) observed that risk has weak negative impact on the adoption of e-banking. It is, therefore, hypothesized that:

H7 The use of the e-banking is affected by safe and security.

Methodology

To test the above hypotheses, 500 questionnaires were distributed to banks customers. 320 questionnaires collected resulting in 64% usable response rate. The questionnaires contained two sections. This first section seeks information about the participants’ demographic features including their nationality, gender, age, marital status, level of education, income and the sector where the participant works (public or private sector). The second section of the questionnaire contained various factors employed in the literature to explain the adoption of e-banking or otherwise. Each factor was comprised of a set of statements and the participants were asked express their perception on a five Likert scale ranging between strongly disagree (1) to strongly agree (5). A summary of the factors and the statements is presented in Table 1.

| Table 1 Factors Affect the Adoption of E-Banking | |

| Factor | Statement |

| Relative advantage (1) | IB accomplishes tasks quickly. IB improves work’s quality. IB enhances job’s effectiveness. IB makes my life easier. IB allows me to manage my finances better IB saves my time. IB makes me more comfortable |

| Relative advantage (2) | Internet banking is cost-effective The Internet installation cost is expensive The telecommunication cost is expensive. Internet banking service fee is expensive. |

| Compatibility | IB suits my life style. IB fits my work style. IB makes my lifestyle more convenient. Internet banking programme facilitates my finances. |

| Complexity | Using internet banking is too complicated IB makes it easy to communicate with the bank. |

| Risk | I prefer to go to the bank to do my banking business for security reason. Internet banking is safe/ secure. I am not afraid of disclosing my credit card and my account details on the Internet. I am not afraid of disclosing personal information on the Internet. |

| Observability | I will use IB when it is used by many. I will use IB when I have seen others using it. I will use IB if this service becomes popular. I will wait and see. |

| Trialability | IB service is easy for me I find my interaction with the use of the IB services clear and understandable It is easy for me to become skillful at the use of the IB services |

To assess the internal consistency of the collected data and its reliability, Cronbach's Alpha was undertaken for factors appeared in the questionnaire. The result is summarized in Table 2.

| Table 2 Results of the Reliability Test | |

| Factor | Cronbach's Alpha |

| Relative advantage (1) | 0.773 |

| Relative advantage (2) | 0.949 |

| Compatibility | 0.859 |

| Complexity | 0.922 |

| Risk | 0.718 |

| Observability | 0.924 |

| Trialability | 0.993 |

It is obvious from the table that none of resulted Cronbach's Alpha is less than 0.70 as an acceptable level of reliability.

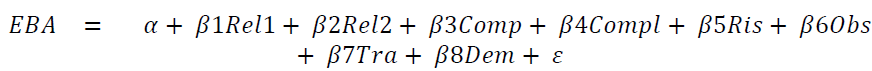

To identify factors affecting the adoption of e-banking in Kuwait, the following a stepwise will be undertaken to estimate the following model. Stepwise regression is a fitting regression models in which the choice of the independent variables is undertaken in steps. In each step, an independent variable is considered for addition to or subtraction from the set of independent variables on the basis of its significance. Insignificant independent variables are removed, resulting in the best fit model with only significant independent variables that explain variations in the dependent variable.

Where :α : Constant

Rel1 : Relative advantage (1)

Rel2 : Relative advantage (2)

Comp : Compatibility

Compl : Complexity

Ris : Risk

Obs : Observability

Tra : Trialability

Dem : Demographic factors

β1- β7 : The parameters of the model

ε : Standard Error

Results

Participants Background

Participant’s background information is summarized in Table 3.

| Table 3 Participants Background | |||||

| Nationality | Freq. | Percent | Gender | Freq. | Percent |

| Kuwaiti | 281 | 87.8 | Male | 209 | 65.3 |

| Non-Kuwaiti | 39 | 12.2 | Female | 111 | 34.7 |

| Total | 320 | 100.0 | Total | 320 | 100.0 |

| Age (Years) | Academic qualification | ||||

| Less than 25 | 34 | 10.6 | Diploma | 41 | 12.8 |

| 26-35 | 44 | 13.8 | Bachelor | 119 | 37.2 |

| 36-50 | 204 | 63.7 | Masters | 37 | 11.6 |

| More than 50 | 38 | 11.9 | PhD | 123 | 38.4 |

| Total | 320 | 100.0 | Total | 320 | 100.0 |

| Marital Status | Sector | ||||

| Not-married | 180 | 56.3 | Public | 209 | 65.3 |

| Married | 140 | 43.8 | Private | 111 | 34.7 |

| Total | 320 | 100.0 | Total | 320 | 100.0 |

| Frequent use of e-banking | Monthly earnings (KD) | ||||

| Once a week | 313 | 97.8 | Less than 1,000, | 69 | 21.6 |

| Once a month | 6 | 1.9 | 1,000-1,999 | 195 | 60.9 |

| Once in 3 months | 1 | .3 | 2,000-3,000 | 52 | 16.3 |

| Total | 320 | 100.0 | More than 3,000 | 4 | 1.3 |

| Total | 320 | 100.0 | |||

It is evident from the table that almost 88% of the participants are Kuwaitis and 65% of them are males. The table also reveals that 64% of the participants ages are between 36- 50 years old and more than 50% of the participants possess either Masters or PhDs. The table further revealed that 56% of the participants are not married. In addition, the table disclosed that 65% of the participants work for the public sector. Moreover, the table showed that the vast majority of the participants’ monthly salary ranges between KD 1,000- KD 1,999 (Between USD 3,300- 6,600). What attracts attention in Table 3 is that almost 98% of the participants use e-banking once a week. It is evident from the table that the participants in the questionnaire survey have different characteristics and this will give a strong ground for the findings and ensure their credibility.

Descriptive Statistics

To determine with which of the factors appeared in the literature the participants agree, descriptive statistics have been carried out and reported in Table 4. It is evident from the table that the ease and complexity, compatibility, relative advantage (1) and trialability were the main variables that received the highest level of agreements, as reflected by the resulted means and medians. The relatively low standards deviations associated with the factors’ complexity, compatibility and the relative advantage indicate high level of consistency in the participants’ answers.

| Table 4 Participants Level of Agreement with Factors Affecting the Adoption of E-Banking | |||||

| Mean | Median | Std. Deviation | Minimum | Maximum | |

| Relative Advantage (1) | 4.951 | 5.00 | 0.14 | 3.43 | 5.00 |

| Compatibility | 4.978 | 5.00 | 0.16 | 3.25 | 5.00 |

| Complexity | 4.980 | 5.00 | 0.17 | 3.00 | 5.00 |

| Relative Advantage (2) | 2.143 | 2.00 | 0.78 | 1.00 | 4.00 |

| Risk | 2.884 | 3.00 | 0.55 | 1.00 | 4.00 |

| Observability | 1.762 | 1.00 | 0.98 | 1.00 | 4.00 |

| Trialability | 4.809 | 5.00 | 0.76 | 1.00 | 5.00 |

Stepwise Regression

Stepwise regression is undertaken and the outcome is reported in Table 5. It is clear from the table that the relative advantage 1, trialablity and academic qualifications are the most important factors significantly and positively associated with the adoption e-banking in Kuwait. The outcome of the study is in line with Olatokun & Igbinedion (2009) who emphasized that the relative advantage other than profits and costs would affect the adoption of e-banking. It is also consistent with empirical results reported by researchers such as Ndubisi & Sinti (2005); Wang et al. (2003); Al-Sabbagh & Molla (2004); Al-Samani (2005); Lichtenstein & Williamson (2006); Almazari & Siam (2008); Azam (2007); Daghfous & Toufaily (2007); Al-Hajri (2008); Zolait et al. (2008); Omar et al. (2011); El-Qirem (2013) and Anouze & Alamro (2019).

| Table 5 Stepwise Regression | |||

| Variable | Beta | t | Sig. |

| Constant | 1.807 | 0.072 | |

| Relative Advantage 1 | 0.355 | 6.811 | 0.000 |

| Trialability | 0.156 | 2.980 | 0.003 |

| Academic qualification | 0.122 | 2.312 | 0.021 |

| F= 20.956 | Sig.= 0.000 | Adj. R2 = 0.158 | |

Positive and significant relationship between the trialability factor and the adoption of e-banking appeared in this study is consistent with results reached by researchers such as: Al-Sabbagh & Molla (2004); Brown et al. (2004); Zolait et al. (2008) and Alhassany & Faisal (2018).

Positive and significant association between the participants’ academic qualification and the adoption of e-banking resulted in this study is similar to that reported by researchers such as Kim et al. (2005); Wu (2005) and Fonchamnyo (2013).

Conclusion

The objective of this study is to identify factors affect the adoption of e-banking Kuwait. To achieve this objective, 500 administered questionnaires were distributed to various bank customers and 320 collected; resulting in 64% usable response rate. The participants in the questionnaire survey are coming from different backgrounds. Most of them were Kuwaiti nationals and some non-Kuwaitis with different marital status. They also represent different ages, both genders, with different monthly income and academic qualifications. Variations in the participants’ background characteristics give credibility to the results of the study. Although the participants expressed high level of agreements with factors such as the ease and complexity, compatibility, relative advantage (1) and trialability as being the most important factors affect the adoption of e-banking, the outcome of the stepwise regression pointed to positive and statistically significant level of association between relative advantage (1), participant level of education and trialability showed positive and the adoption of e-banking.

The results of the questionnaire analysis are not surprising. As Kuwait is an oil producing and exporting country with a high per capita income, the cost of the internet and the cost of using it are not considered an important factor that affect their adoption to e-banking. What is important to the Kuwaitis is the availability of e-banking services that attain their relative advantage regardless of the cost. Needless to say, the development of the information systems infrastructure in Kuwait plays a major role in the widespread use of e-banking. Therefore, the strong positive relationship between the adoption of e-banking services and the level of academic education is predictable since most university graduates are qualified to deal with e-banking services. Availability of advanced information technology infrastructure r in Kuwait and the development of the school education system that includes some courses in the field of technology will help banks in developing their strategies to offer most of their services and products on line. Therefore, it may be useful for the banks and the Ministry of Education to cooperate in supporting courses in information technology that help in delivering their services to the largest number of clients at different ages and different levels of education.

Although the study reached important results that would add a new dimension to the published literature in this area of research, it is not, however, without limitations. Two different banking systems are operating in Kuwait, conventional commercial banking and Islamic banking. Despite the similarity in several services and products that they offer to their customers, they differ in the principles on which they operate. While receiving and paying interest is the core of the conventional commercial banks, Islamic banks prohibit the use of any type interest. Hence, the reasons that motivate Kuwaitis to use e-banking in Islamic banks would be different from those reasons that encourage the customers of conventional commercial banks. Not making distinction between Islamic banks and conventional commercial banks customers is among the weaknesses of this study.

References

- Al-Hajri, S. (2008). The adoption of e-banking: The case of omani banks. International Review of Business Research Papers, 4(5), 120-128.

- Alhassany, H., & Faisal, F. (2018). Factors influencing the internet banking adoption decision in North Cyprus: An evidence from the partial least square approach of the structural equation modeling. Financial Innovation, 4(1), 1-21.

- Almazari, A.A.K., & Siam, A.Z. (2008). E-Banking: An empirical study on the Jordanian commercial banks. Economics and Administration, 22(2), 3-26.

- Al-Sabbagh, I., & Molla, A. (1970). Adoption and use of internet banking in the Sultanate of Oman: an exploratory study. The Journal of Internet Banking and Commerce, 9(2), 1-7.

- Al-Samani, G. (2005). Using of e-banking service by individual clients in state of Qatar: An exportable study. Banking and Financial Studies, 9, 63-78.

- Al-Smadi, M.O. (2012). Factors affecting adoption of electronic banking: An analysis of the perspectives of banks' customers. International Journal of Business and Social Science, 3(17), 294-309

- Al-Somali, S.A., Gholami, R., & Clegg, B. (2009). An investigation into the acceptance of online banking in Saudi Arabia. Technovation, 29(2), 130-141.

- Anouze, A.L.M., & Alamro, A.S. (2019). Factors affecting intention to use e-banking in Jordan. International Journal of Bank Marketing, 38 (1), 86-112.

- Azam, S. (2007). Internet adoption and usage in Bangladesh. Japanese Journal of Administrative Science, 20(1), 43-54.

- Black, N.J., Lockett, A., Winklhofer, H., & Ennew, C. (2001). The adoption of Internet financial services: a qualitative study. International Journal of Retail & Distribution Management, 29 (8), 390-398.

- Bradley, L., & Stewart, K. (2003). The diffusion of online banking. Journal of Marketing Management, 19(9-10), 1087-1109.

- Daghfous, N., & Toufaily, E. (2007). The adoption of “E-banking by Lebanese banks: Success and critical factors.

- El-Qirem, I.A. (2013). Critical factors influencing E-Banking service adoption in Jordanian commercial banks: a proposed model. International Business Research, 6(3), 229-236

- El-Sherbini, A.M., Roas, C.P., Mohamed, M., & Wugayan, A. (2007). Bank customer behavior perspectives towards internet banking services in Kuwait. Advances in Global Business Research, 4(1), 28-35.

- Fonchamnyo, D.C. (2013). Customers’ perception of e-banking adoption in Cameroon: an empirical assessment of an extended TAM. International Journal of Economics and Finance, 5(1), 166-176.

- Gunaratnam, A., Kajenthiran, K., Ratnam, U., & Sivapalan, A. (2018). Factors influencing on e-Banking practices: Evidence from Sri Lanka. Journal of Sociological Research, 9(1), 1-14.

- Hashim, A.A.R., & Chaker, M.N. (2009). Customers' perception of online banking in Qatar. Journal for Global Business Advancement, 2(3), 252-263.

- Kim, B.M., Widdows, R., & Yilmazer, T. (2005). The determinants of consumers’ adoption of Internet banking. In Proceedings of the Consumer Behavior and Payment Choice 2005 Conference, Boston, MA (pp. 1-34).

- Kolodinsky, J.M., Hogarth, J.M., & Hilgert, M.A. (2004). The adoption of electronic banking technologies by US consumers. International Journal of Bank Marketing, 22(4), 238-259.

- Lichtenstein, Sh., & Williamson, K. (2006). Understanding consumer adoption of e-banking: an interpretive study in the Australian banking context. Journal of Electronic Commerce Research, 7(2), 50-66

- Lin, W.R., Wang, Y.H., & Hung, Y.M. (2020). Analyzing the factors influencing adoption intention of internet banking: Applying DEMATEL-ANP-SEM approach. Plos One, 15(2), e0227852.

- Melo, P.N., Martins, A., & Pereira, M. (2020). The relationship between Leadership and Accountability: A review and synthesis of the research.

- Ndubisi, N.O., & Sinti, Q. (2005). ‘Internet banking adoption intention in Malaysia: the roles of personal and system characteristics. In International Conference in Economics and Finance, Labuan, May (pp. 26-27).

- Ndubisi, N.O., & Sinti, Q. (2006). Consumer attitudes, system's characteristics and internet banking adoption in Malaysia. Management Research News, 29 (½):16-27.

- Olatokun, W.M., & Igbinedion, L.J. (2009). The adoption of automatic teller machines in Nigeria: An application of the theory of diffusion of innovation. Issues in Informing Science & Information Technology, 6, 372-392

- Omar, A., Sultan, N., Zaman, K., Bibi, N., Wajid, A., & Khan, K. (2011). Customer perception towards online banking services: Empirical evidence from Pakistan. Journal of Internet Banking and Commerce, 16(2), 1-24

- Polatoglu, V.N., & Ekin, S. (2001). An empirical investigation of the Turkish consumers’ acceptance of Internet banking services. International Journal of Bank Marketing, 19(4), 156-165.

- Rogers, E. (1962). Diffusion of innovations. New York, Macmillan.

- Rogers, E. (1995). Diffusion of innovations (4th ed). New York, Free Press.

- Samphanwattanachai, B. (2007). Internet banking adoption in Thailand: A Delphi study. In Proceedings of the 24th South East Asia Regional Computer Conference (pp. 18-19).

- Sathye, M. (1999). Adoption of Internet banking by Australian consumers: an empirical investigation. International Journal of Bank Marketing, 17 (7), 324-334.

- Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence?informed management knowledge by means of systematic review. British Journal of Management, 14(3), 207-222.

- Wang, Y.S., Wang, Y.M., Lin, H.H., & Tang, T.I. (2003). Determinants of user acceptance of Internet banking: an empirical study. International Journal of Service Industry Management, 14 (5), 501-519.

- Wu, J. (2005). Factors that influence the adoption of internet banking by South Africans in the Ethekweni metropolitan region.

- Zhu, W., & Wang, Z. (2018). The collaborative networks and thematic trends of research on purchasing and supply management for environmental sustainability: A bibliometric review. Sustainability, 10(5), 1510.

- Zolait, A.H.S., Sulaiman, A., & Alwi, S.F.S. (2008). Prospective and challenges of internet banking in Yemen: an analysis of bank websites. International Journal of Business Excellence, 1(3), 353-374.