Research Article: 2021 Vol: 20 Issue: 6S

Female Directors Control Towards Environmental Corporate Disclosure and Firm Performance

Nor Bahiyah Omar, Universiti Teknologi MARA

Norhayati Zamri, Universiti Teknologi MARA

Nor Asyiqin Salleh, Universiti Teknologi MARA

Roshayani Arshad, Universiti Teknologi MARA

Abstract

Purpose: The main objective this research is to examine the relationship between corporate governance component, namely board composition – in particular, board gender diversity (i.e. female vs. male directors), and environmental corporate disclosure, as well as firm performance. Methodology/Methodology/Approach: The sample of this research comprises of the top 150 public listed company, which shares were traded on the Main Board of Bursa Malaysia Berhad in 2017. The secondary data obtained from annual and sustainability reports published by the sample companies from 2014 to 2017 are used for this empirical research. Findings: The results of Structural Equation Modelling – Partial Least Square analysis suggests that there is an existence of a positive significant association between the board gender diversity (presence of female directors in boardroom) and the company’s environmental corporate reporting or disclosure. Significant Contribution: This research creates new knowledge by examining the board gender diversity and the company’s environmental corporate disclosure. It is expected that The board of directors has been regarded as one of the important tools or mechanisms of corporate governance, specifically in monitoring and making decision for the benefit of the organization as a whole. The decision made can be influenced by the demographic characteristics.

Keywords

Board Gender Diversity, Environmental Corporate Supremacy, Climate Change, Corporate Governance, Firm Performance

Introduction

Corporate scandals in the early 2000s, namely WorldCom in 2002 and Enron in 2001, made corporate communities started to notice about how financial performance could be significantly affected if a corporation failed to practice good corporate governance. Those large corporations collapsed due to the abuse or misuse of power by their respective directors. The board of directors has long been considered as one of crucial mechanisms used by corporate world to ensure good corporate governance practices by corporations. In essence, directors are responsible to monitor, set relevant policy, provide adequate resources, as well as improve advisory processes, in order to ensure that the management team is able to carry out its responsibilities and making decisions which beneficial to the shareholders' interests. Hambrick & Mason (1984) stated that the demographic attributes of corporation’s top advisory group and/or administration team such as age, experience foundation, level of education, and tenor of service, effect firm’s execution, and it is unequivocally connected to the Upper Echelon Theory. They argued that dynamics and activities taken by top administration may be influenced by the demographic qualities of the top administration. Demographic attributes are related with numerous psychological bases, qualities and discernments that impact the dynamic. The constructive outcome between these attributes and choice made by top administration will give a positive commitment to firm execution. As indicated by Julizaerma & Zulkarnain (2012), the inclusion of at least two female representatives in boardroom could better improve the firm's dynamics. The various attributes in boardroom enable to firm to screen and assume oversight jobs of the top administration, hence increases shareholders’ wealth. Bear et al. (2010) stated that there is an existence of positive connection between the representation of female board members in the boardroom and corporate notoriety.

Meanwhile, apart from reporting on financial information, organizations nowadays unveil their non-financial data to the stakeholders, for example, information concerning organisation’s activities related to the environmental and Corporate Social Responsibilities (CSR) issues. As such, there are increasing number of studies which highlighted on the CSR (Atan, 2016; Husted & Sousa-Filho, 2019; Liu, 2018; McGuinness et al., 2017; and Gond et al., 2017). According to Williams (1999), CSR reports are documents published by corporations to communicate with their respective stakeholders on the impact of corporate activities to the economic situation, social well-being of society and the environment. CSR is about how corporations make profit rather than what the corporations do with their respective profits (Vilk?a et al., 2014). It provides positive economic impact on many organisational outcomes, including higher firm value (Nekhili et al., 2017), reputation (Axjonow et al., 2018; Bayoud et al., 2012), and consumer loyalty (Deng & Xu, 2017). It can be concluded that CSR positively impact the organization by improving the good image, building an organization brand, thus improve firm performance. Previous study by Bear et al, (2010) concluded that the rating of CSR has a positive impact to the reputation of the corporation, as well as mediates the relationship between the number of female representatives in boardroom and reputation of the corporation. Study done by Gulzar et al. (2019) also indicates organization would have stronger the CSR engagements if there were higher number of female representatives in the boardroom. This finding also in line with the findings of Nekhili et al. (2017) which claims female directorships enhances the credibility of the CSR information to be disclosed. Hence, based on findings of previous literatures, it can be summarised that board diversity could be positively influence the disclosure of corporation’s CSR.

In 2000, Malaysian authority introduced the Malaysian Code on Corporate Governance (MCCG) as one of its responses to the 1997 Asian monetary crisis. In brief, all public listed companies in Bursa Malaysia are required to observe and comply to MCCG starting from July 2001. MCCG provides guidelines on roles and the significance of board and boardroom structure (e.g. board size and composition of independent directors in the boardroom). In 2002, the Bursa Malaysia started to confine the quantity of directorship held in a firm. In 2007 and 2012, the code was further imposed on the feature of the arrangement of the board, and the noteworthiness of the free chiefs to guarantee that the choice made by board is to the wellbeing of investors. MCCG 2012 states that “Should a company chairman is not an independent director; the board has to be dominated by independent directors as people who are entrusted by the shareholders. They are anticipated to reduce managerial opportunism and thus minimizing agency problems”. Meanwhile, Securities Commission in the Corporate Governance Blueprint 2011 highlighted on gender diversity as an important component of board diversity. Julizaerma & Zulkarnain (2012) stated that presence of at least two female in boardroom could better served the firm essential administration, as varying traits in meeting rooms could fulfill the responsibilities to reasonably play checking in order to amplify investors’ wealth.

In line with the above, this research attempts to determine the effect on the roles of female corporate leaders (or as may be referred to as “Girl Power”, i.e. a pop-culture slogan) in the board composition towards the extent or comprehensiveness of the environmental disclosure published by the corporation, as well as the financial performance (i.e. firm performance) of the public listed companies in Malaysia. This examination looks at the determinants of corporate administration by centering into the connection between corporate administration structure, namely board gender assorted variety (female versus male), and the effect on environmental corporate exposures (climate change reporting) by using secondary data sample obtained from 150 top ranking public listed companies which were listed on the Main Board, Bursa Malaysia Berhad. Data gathered are those from annual reports or climate change reports of those companies which are published during the period from 2014 to 2017, and analysed by employing Structural Equation Modeling – Partial Least Square. This research proposes that there is an existence of a significant relationship between board diversity (i.e. gender orientation of the board members, namely female directors) and environmental corporate disclosure of the public listed companies in Malaysia, as well as effect on firm performance. Discoveries from this research are imperative to address the roles of female corporate leaders on the environmental corporate disclosure, as well influence of such factors to the financial performance of the Malaysian Main Board’s public listed companies. At the same time, the findings may also provide better insight to the current literatures, as well as forming basis for future research in the same interest areas.

The remainder of the research paper is organised in the following manners: Section 2 summarises the relevant literatures on the roles of female corporate leaders towards firm’s environmental corporate disclosure, and firm performance. Section 3 elaborates on the research model adopted in the research, type and source of data collected, and statistical tools or techniques employed to analyse the sample data. Section 4 summarises and presents the empirical analysis, as well as providing insight on the overall findings of the research. The final section or Section 5 concludes the findings of the research and highlights its limitations, as well as providing suggestions for future study.

Literature Review

Board gender diversity and environmental disclosure

The relationship between corporate governance, particularly the firm’s board composition, namely the gender diversity in the boardroom, and environmental corporate disclosure had received much research attention of late (Cullinan et al., 2019; Husted et al., 2019 Maria et al., 2019; Liu, 2018; Fuente et al., 2017; Liao et al., 2015; and Kahreh et al., 2014, Kazemian, et al., 2020). However, previous studies showed differing conclusions on the findings of the associations between these two variables. Some studies concluded that there variables are either positively or negatively correlated, while some reveals that the no such significant relationship exists. Amongst the studies which found that the is an existence of significant positive association between the inclusion of female directors in the boardroom and environmental reporting is one conducted by Maria et al. (2019). According to the study, the inclusion of female representative in the board of directors’ composition improves the environmental corporate disclosure of the firm. Meanwhile, Cullinan et al. (2019) stated that although the inclusion of female representatives in the boardroom is positively correlated with environmental disclosure, it is actually dependent on the status of the directorship of the female directors. Cullinan et al. (2019) further clarified that the inclusion of female independent directors in the boardroom are most firmly connected with environmental disclosure, as compared to having female executive directors to sit in the board. Nekhili et al. (2017), when examining the French listed companies which made out the SBF120 index, concluded that the presence of female representatives as directors in boardroom upgrades the credibility of the CSR disclosure, and subsequently resulting in higher firm worth. The equivalent emphatically critical outcomes were likewise found in China (Gulzar et al., 2019), Vietnam (Hoang, Abeysekera and Ma (2018), Iran (Kazemian, et al., 2020), Australia (Liu, 2018), Spain (Fuente et al., 2017) and United Kingdom (Liao, 2015). Liu (2018), using data of all Standard and Poor's 1500 (S&P1500) ?rms that accessible from the Executive Compensation ("Execucomp") Database in United State, stated that ?rms with more prominent board sexual orientation are frequently sued for natural encroachments.

On contrary, there were studies which reported the existence of negative relationship between board genders assorted variety and environmental corporate disclosure. Husted and Sousa-Filho (2019) concluded that there is an existence of significant negative correlation between the presence of female board members in boardroom and their in?uence towards the Environmental, Social and Governance (ESG) disclosure, when examine 704 ?rms in four Latin American nations, namely Brazil, Mexico, Colombia and Chile. They further clarify that such situation is a direct result of social setting in Latin America, where Collectivist societies favor the in-bunch or in-gathering (family) over the out-gathering. Therefore, the negative outcome may re?ect the protection of the in-gathering (family) and the absence of significance appended to the interests of the out-gathering, as spoke to by the outside partners for whom ESG exposure is especially pertinent.

In addition, there are also studies that indicate indifference between in gender orientation in boardroom and CSR disclosure. Kahreh et al. (2014) found that in spite of relative prevalence of ladies direction over the CSR in Iran, there were no huge and significant contrasts among male and female's direction to the CSR.

Nooraisah et al. (2019) found that there is a significant relationship between board training level and the corporate CSR disclosure, as well as the correlation between board gender diversity and the nature of CSR disclosure in Malaysian public listed company. In their study, they use sample of 200 public listed firms of Bursa Malaysia from 2009 to 2013 and applied OLS and 2SLS instrumental factors (IV) methods to analyse the data. Further analysis on the data using robust regression revealed that there is a positive relationship between gender diversity and CSR disclosure. Alazzani et al. (2019) discovered that the connection between boardroom’s gender variety and CSR exposure is rather moderate when they analysed data of 2009’s corporate reports of 133 companies listed in Bursa Malaysia. Nonetheless, as the data revealed that female directors made up just 8 percent of total directors, they concluded the moderate relationship is most likely due to inadequate number of female directors on the sample selected.

Hence, this research proposes the following hypothesis in order to address the above arguments:

H1. Gender diversity among board members is positively correlated with the environmental corporate disclosure by the firm

Board gender diversity and firm performance

There are many prior literatures which investigated on the correlation between board of directors’ gender diversity and the firm performance (Suwongrat, et. al, 2019; Ararat et. al, 2019; Rose, 2017; Daniel et al., 2015; Julizaerma and Zulkarnain 2012; Darmadi, 2011; and Bear et al., 2010), and the outcomes acquired are differed. The positive correlation between the board of directors’ gender variety and the performance of the firm suggests that the presence of female representatives in boardroom could offer a superior firm performance. This was apparent in examinations held in Turkey (Ararat et al., 2019), France (Slama et al., 2019), Hong Kong, South Korea, Malaysia and Singapore (Daniel et al., 2015), Study by Ararat et al. (2019), which use a sample of companies in Turkey from 2011 to 2018, found that the presence of female representatives in the boardroom improves the firm’s networth when they have a dynamic position in boardroom composition, and also when they are spoken to in these advisory groups in respectably colossal numbers. This contention was at that point bolstered by Daniel et al. (2015), where it was discovered that expanding quantities of female representatives on the board positively affects firm’s return on equity (ROE) amongst in Asian firms. However, Daniel et al. (2015) posits that the beneficial outcomes of gender diversity decreases in nations with higher women participation in economic sectors, as imposition of gender-related quota in strong cultural resistance nations may adversely affect the performance of the firm. Moreover, positive affiliation is seen as critical just in specific conditions. Two example of such specific conditions are, (i) in a more differentiated board of exceptionally performing firms as opposed to low performing firms (Khalid, Alam, & Said, 2016; Slama et al., 2019), and (ii) during the Great Recession of 2008 when the inclusion of female representatives in the boardroom improved the firm performance. According to Suwongrat et al. (2019), such favorable circumstances have never been seen outside that emergency time frame.

Contrarily, there were findings with adverse outcomes, for example, in France (Slama et al, 2019), America, Europe, Midle East, Africa and Asia (Uribe–Bohorquez et al., 2019) and Indonesia (Darmadi, 2011). Darmadi (2011), when studying 169 firms listed on the Indonesia Stock Exchange, found that the presence of female representatives in the board of directors’ composition has a critical negative association with the companies’ Return on Asset (ROA). Meanwhile, Rose (2017) concluded that there is insignificant association between the presence of female directors and the firm performance as estimated by Tobin's Q when conducting a cross sectional study on Danish’ public listed companies.

Maran & Indraah (2009) analysed a sample of top 100 Malaysian listed companies from the non-financial segment over the period 2000 to 2006 (to mirror the start of the corporate administration improvement in Malaysia as a result of introduction of the Malaysian Code on Corporate Administration in year 2000) and concluded that the board gender diversity did not have any impact on firm performance during those period, except in the year 2005. Data in 2005 revealed that there was an existence of positive correlation between the presence of female representatives in boardroom and company’s ROE. However, they further clarified that the presence of female directors in the boardroom were not felt, and such impact was distinctly for a short run. Ahmad et al. (2019) and Kweh et al. (2019) also found that the inclusion of female representatives in the boardroom does not affect the firm performance.

Julizaerma & Zulkarnain (2012) found that there is an existence of significant association between the board gender diversity and ROA when studying of public listed companies listed in both Main Market and ACE Market of Bursa Malaysia. They further explained that the finding is in line with the Government of Malaysia’s strategy of that targeted participation of female on board to reach 30% by 2016 as prescribed in Securities Commission in Corporate Governance Blueprint in 2011. Julizaerma and Zulkarnain (2012) explained that this approach should be continually maintained and executed by corporates in order to have an ideal situation of having optimal mix of gender in boardroom for the purpose of increasing shareholders’ wealth.

Meanwhile, in order to address the above arguments, this research further proposes the following hypothesis:

H2. Gender diversity among board members is positively correlated with firm financial performance

Methodology

Sample population of this research was taken from public listed companies which were listed on the Main Board of Bursa Malaysia as at year 2017. The sample was chosen because public listed companies in Malaysia are governed by regulatory bodies and they are subject to best compliance practices. The presence of stakeholders’ pressures makes public listed companies to be more proactive when publishing corporate disclosures, particularly when reporting significant or crucial information concerning sustainability issues (Haniffa & Cooke, 2005; da Silva Monteiro & Aibar-Guzman, 2010). As public listed companies are generally large, stakeholder expects them to disclose or report corporate information voluntarily (Gray, Kouhy & Lavers, 1995b).

For this research, 150 public listed companies were selected as a research sample. Company size was used as selection criterion, with market capitalization in year 2017 was used as proxy of company’s size. The data on market capitalization of the companies listed in the Main Board were then ranked, and only the top 150 companies were selected as sample for the research. This particular method was employed due to the following reasons, (i) larger firms are more perceptible to have greater impact on the society (Hackston & Milne, 1996); (ii) shareholders of larger firms normally view issues on sustainability more seriously (Hackston & Milne, 1996); (iii) larger firms typically have adequate resources to address sustainability issues (Cormier & Magnan, 2003); and (iv) many past literatures on sustainability reveals that there is an existence of significant relationship between sustainability disclosure and the size of the corporation (Stanny & Ely, 2008; Prado-Lorenzo et al., 2009).

Source of Data

Increased public awareness climate change issues have caused the stakeholders, particularly investors, to demand the directors and managers of firms to embrace the culture of corporate sustainability. Therefore, it is important for the directors and managers to ensure their firms to report or disclose matters pertaining climate change through credible corporate communication networks, such as corporate website, annual reports, or stand-alone sustainability reports. Through such exercise, firms indirectly show their respective stakeholders that they responding to climate change issues through various communication channels (Adams & Frost, 2006). One of the common communication channels that the firms use to manage their relationships with stakeholders is through voluntary reporting or corporate disclosure (Hopwood, 2009). Adams & Frost (2006) and Amran & Haniffa (2011) stated that it is common for firms to use multiple communication networks like as annual reports, sustainability reports and/or company websites to publicise their corporate sustainability and climate change activities to their stakeholders.

In order to ensure and guarantee the consistency, legitimacy, unwavering quality and trustworthiness of the information, only environmental impact and climate change data disclosed in the annual report and/or sustainability reports were utilized in the research. Meanwhile, any data on environmental impact or climate change on other communication channels such as the firms’ websites were not included in this research.

Measurement of the Variables

Measurement of the variables used is very crucial in this research. For measurement related to corporate governance and firm performance, a straight-forward method was employed, namely, board gander diversity. Meanwhile, as for the measurement on environmental corporate disclosure, content analysis method was employed as the basic design of measurement formula. In brief, two content analysis techniques for estimating the climate change disclosure related issues were applied in this research as the unit of investigation is simply the association between two variables.

The first technique employed was to investigate the presence of the data in climate change disclosure, i.e. whether the firm is making any disclosure or not not making any disclosure on climate change information using value of either "1" or "0". Value "1" was allotted when the climate change disclosure data existed, whilst value "0" was assigned when the climate change information did not exist in the source data. This kind of technique is a common technique applied in the majority of the past study on social and sustainability reporting (Belal et al., 2010; Freedman & Jaggi, 2009; Hague & Deegan, 2010; Amran et al., 2012).

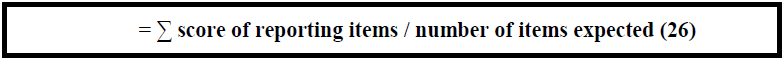

Meanwhile, the type of measurement technique suitable for this research was the utilization of coding system based on categories. The coding system technique encompasses the meaning of each word, sentence or even the paragraph itself. One of the advantages of employing this measurement technique is that it is able to capture the totality of the description and provide a better understanding on the findings (Campbell & Abdul Rahman, 2010). Therefore, by using this type of measurement technique, the climate change reporting could be encapsulated although the firm only reported in few words in their disclosure. This is perhaps a powerful content analysis method in order to give a better description on the meaning for each word, sentences or statement (Campbell & Abdul Rahman, 2010). In this research, the coding was established using classifications proposed by Ooi (2016), i.e. coding sheets dependent on 26 items. In brief, the climate change data was recorded in a coding sheet and assigned with coding value of either "1" or "0", i.e. value “1” assigned when data on climate change disclosure is accessible, or value “0” if otherwise. The aggregate scoring of all 26 items in the coding sheet would then summed up and recorded. The aggregate sum was considered as the estimation of climate change disclosure made by the firm for the year 2016, reflecting the current degree and practice of climate change disclosures of the firm.

Equation 3.1: Climate Change Reporting Index

In term of measurement on firm performance, simulation of three (3) variables were used as proxy to firm performance. The three (3) variables, which are all financial in nature, are as follows:

(i) ROA (profit/total assets);

(ii) Sales (total sales for the year); and

(iii) Profitability (profit margin, i.e. profit/sales).

Findings and Discussion

The research findings revealed that the average company board of directors’ size is eight (8) members, i.e. minimum number of directors is four (4), while the maximum is fifteen (15) directors. In terms of the board composition, particularly in regards to the participation of female director in the company, the findings showed that on average, 19.69% of the company’s boardroom comprise of female representatives. At maximum, female directors represent 75% of the boardroom, whilst at minimum, there is no female representation sits on the board.

The research also revealed (Table 4.1) that out of 150 companies, 139 companies or 92.7% reported or disclosed information related to company’s activities impacted the climate change, and only 11 public listed companies did not reveal any climate change issues that affecting their business operations in either the yearly report or in any sustainability reporting disclosure. Meanwhile, although more than 90% of the public listed companies published some form of report concerning climate change, less than 40% of the companies registered score index of 50% and above. On average, public listed companies only disclosed less than 50% of the crucial information on company’s activities that impacted climate change in their climate change disclosure or reporting.

| Table 1 Descriptive Statistics (Extent of Reporting) |

||

|---|---|---|

| Extent of Climate Change Reporting Score Index (%) | Sample Companies | |

| Number | Percentage (%) | |

| 0 | 11 | 7.33 |

| 7.69 | 13 | 8.67 |

| 11.5 | 3 | 2 |

| 15.4 | 13 | 8.67 |

| 19.23 | 14 | 9.33 |

| 23.1 | 6 | 4 |

| 26.9 | 7 | 4.67 |

| 30.8 | 9 | 6 |

| 34.62 | 3 | 2 |

| 38.5 | 6 | 4 |

| 42.3 | 4 | 2.67 |

| 46.2 | 3 | 2 |

| 50 | 2 | 1.33 |

| 53.8 | 4 | 2.67 |

| 57.7 | 8 | 5.33 |

| 61.5 | 10 | 6.67 |

| 73.1 | 8 | 5.33 |

| 76.92 | 8 | 5.33 |

| 80.77 | 14 | 9.33 |

| 84.62 | 4 | 2.67 |

| Total | 150 | 100 |

The high standard deviation value of 25.21 (Table 4.2) shows that the degree of disclosures varies significantly amongst the public listed companies, which essentially demonstrates that the degree of climate change reporting disclosure by public listed companies in Malaysia is still rather insignificant or low.

| Table 2 Extent of Reporting |

|||||

|---|---|---|---|---|---|

| N | Minimum | Maximum | Mean | Std. Deviation | |

| CCR | 150 | 0 | 88.46 | 45.77 | 25.21 |

The findings also indicate that topic which most frequently disclosed the climate change report is "Future Viewpoint and Outside Issue", i.e. 79.33% of the companies disclosed such topic in their reporting. Information disclosed on this topic typically centered on the additional efforts that the company took to advance their sustainable-culture through education, for instance, providing training. Another popular climate change topic reported by the companies is "Key Analysis". Amongst the subjects reported in the company’s disclosure was information concerning the company's efforts to lessen the discharge of ozone depleting substance discharges and carbon foot-print impression in order to limit the risks of administrative law and/or physical dangers (59.33% of the companies). This topic also saw disclosure on how the companies using innovation in their respective business processes as one of strategies to upgrade the effectiveness of dealing with climate change matters (58.67%).

It was also found that under the disclosures classified "Administration", the number of companies that reported such matter is generally low. Under this topic, about one-quarter of the companies reported on Board oversight in regard to matter concerning ecological, climate change or green-gas substances issues. Meanwhile, only 18 companies (12%) that disclosed information on their respective Board or Board council directed occasional surveys on climate change efforts.

The subjects "Opportunity from Climate Change" and "Hazard from Climate Change" are also amongst the subjects who are least disclosed in climate change reports. Only 6% disclosed information on the credits they received from Clean Development Mechanism (CDM) ventures under Kyoto Protocol, whilst 8% reported on information concerning other business opportunities that they could promote as a result of climate change. Meanwhile, only four (4) companies gave an account of the ramifications of expanded protection premium due to environmental change and physical changes (e.g. floods, dry seasons, rising ocean level and/or accessibility of water) which might interrupt their business operations.

| TABLE 3 Path Coefficient – Board Diversity And Climate Change Reporting, Climate Change Reporting And Firm Performance, Board Diversity And Firm Performance |

|||

|---|---|---|---|

| Paths | Path Coefficient | Standard Deviation | t - value |

| FEMALE – CCR | 0.132 | 0.055 | 2.413 |

| CCR – FP | 0.342 | 0.055 | 6.221 |

| FEMALE – FP | 0.035 | 0.046 | 0.755 |

| ROA | 2.394 | ||

| SALES | 8.562 | ||

| PROFIT MARGIN | 8.99 | ||

The regression results presented in Table 4.3 supported Hypothesis 1, i.e. there is an existence of a significant positive relationship between female representatives in the boardroom and CCR at 10% level (path coefficient of 0.132). This signify that inclusion of female directors (which is also a proxy for board diversity) improves company’s CCR engagement. This finding supports Nekhili et al.’s (2017) study which found that the inclusion of female representation in the boardroom’s composition enhances the credibility of corporate disclosure of the company. This resulted in CSR reporting to be viewed by stakeholders as economically viable information in determining the firm value. This finding is also consistent with Gulzar et al. (2019), which stated that the higher the percentage of female representatives in the boardroom of an organisation resulted in stronger the CSR engagement by the organization. Meanwhile, study by Nooraisah et al. (2019) which used robust regression analysis revealed that there is an existence of significant positive correlation between the board gender diversity in boardroom and the corporation’s CSR disclosure.

However, there is an absence of positive significant result between the relationship of the board gender diversity, namely the presence of female representative in the board of director’s composition, and the firm’s financial performance, hence Hypothesis 2 is not supported. This is consistent with findings by few studies on the insignificant relationship between female directors in board room and the firm performance. Rose (2017) stated that board members whom have unconventional background, unconsciously adopt the ideas of the majority of board members with conventional background, and hence caused the potential performance effect is not able to be materialized. In addition, Maran & Indraah (2009) also suggested that the element of gender diversity in boardroom does not have any significant impact to the firm’s financial performance in Malaysia. In their study, only data from year 2005 showed that there is an existence of significant positive correlation between the board gender diversity and the firm performance. Thus, they concluded that women’s roles were not felt in boardroom, but such condition might change in the long run.

Conclusions

This research used secondary data of top 150 public listed companies by market capitalization as a sample to analyse the relationship between good corporate governance practices, specifically the board gender diversity using female directors’ presence in board room as proxy, and environmental corporate disclosure (or climate change reporting). Subsequently, this research also attempted to examine the impact of board gender diversity towards the firm performance. The framework developed for this research predicts that the implementation of good corporate governance practices will lead to disclosure of better environmental corporate reports, which in turn will result in better firm performance. Reviews on various related literatures highlight that the board diversity positively affects firm’s environmental corporate disclosure, as well as firm performance. Consistent with the hypothesis, this research reveals that the presence of female participation in the boardroom (as proxy for board diversity) has a significant positive association with the disclosure of corporate’s environmental or climate change reporting. The result reveals that composition of female director in the company’s boardroom leads to better environmental corporate disclosure. However, the research results also found that there is insignificant evidence that shows the board diversity, i.e. female representatives in boardroom, leads to better firm performance. The findings of this research are crucial in addressing the role of female corporate leaders on the environmental corporate disclosure, and the impact of participation of female directors in boardroom of a public listed company in Malaysia towards its financial performance, as additional literature to the relevant future studies on corporate governance, sustainability and firm performance. However, as the sampel used in this research only limited to the top 150 public listed companies, findings form this research may not be comprehensive enough to reflect the impact of such variables on non-listed firms, as well as micro, medium and small-sized firms in Malaysia.

References

- Ahmad, M., Raja Kamaruzaman, R.N.S., Hamdan, H., & Annuar, H.A. (2019). Women directors and firm performance: Malaysian evidence post policy announcement, Journal of Economic and Administrative Sciences, 36(2), 96-109.

- Alazzani, A., Wan Hussin, W.N., & Jones, M. (2019). Muslim CEO, women on boards and corporate responsibility reporting: some evidence from Malaysia. Journal of Islamic Accounting and Business Research, 10(2), 274-296.

- Amran, A., Ooi, S.K., Wong, C.Y., & Hashim, F. (2015). Business strategy for climate change: An ASEAN perspective. Corporate Social Responsibility and Environmental Management, 23(4), 213-227.

- Amran, A., & Haniffa, R. (2011). Evidence in development of sustainability reporting: a case of a developing country. Business Strategy and the Environment, 20(3), 141-156.

- Amran, A., Lee, S.P., & Devi, S.S. (2014a). The influence of governance structure and strategic corporate social responsibility toward sustainability reporting quality. Business Strategy and the Environment, 23(4), 217-235.

- Amran, A., Ooi, S.K., Nejati, M., Zulkafli, A.H., & Lim, B.A. (2012). Relationship of firm attributes, ownership structure and business network on climate change efforts: evidence from Malaysia. International Journal of Sustainable Development & World Ecology, 19(5), 406-414.

- Amran, A., Periasamy, V., & Zulkafli, A.H. (2014). Determinants of climate change disclosure by developed and emerging countries in Asia Pacific. Sustainable Development, 22(3), 188-204.

- Amran, N.A., & Ahmad, A.C. (2011). Board mechanisms and Malaysian family companies’ performance. Asian Journal of Accounting and Governance, 2, 15-26.

- Anderson, N., & King, N. (1993). Innovation in organizations. International Review of Industrial and Organizational Psychology, 8, 1-34.

- Ararat, Melsa, A. & Burcin, Y.B. (2019). Female Directors, Board Committees, and Firm Performance: Time-Series Evidence from Turkey. Retrieved from http://dx.doi.org/10.2139/ssrn.3486091.

- Atan, R., Razali, F.A., Said, J., & Zainun, S. (2016). Environmental, social and governance (ESG) disclosure and its effect on firm’s performance: A comparative study. International Journal of Economics and Management, 10(Special issue), 355-375.

- Axjonow, A., Ernstberger, J., & Pott, C. (2018). The impact of corporate social responsibility disclosure on corporate reputation: a non-professional stakeholder perspective. Journal of Business Ethics, 151, 429-450.

- Bear, S., Rahman, N., & Post, C. (2010). The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics, 97, 207-222.

- Cullinan, C.P., Mahoney, L. & Roush, P.B. (2019). Directors & Corporate Social Responsibility: Joint Consideration of Director Gender and the Director’s Role, Social and Environmental Accountability Journal, 39(2)

- Daniel C.M., Roberts, L.H. and Whiting, R.H. (2015). Board gender diversity and firm performance: Empirical evidence from Hong Kong, South Korea, Malaysia and Singapore. Pacific-Basin Finance Journal, 35, 381-401.

- Darmadi, S. (2011). Board diversity and firm performance: the indonesian evidence. Corporate Ownership and Control Journal, 8.

- Deng, G.Y., & Xu, Y. (2017). Accounting and structure decomposition analysis of embodied carbon trade: a global perspective. Energy 137, 140-151.

- Fuente, J.A, Sanchez, I.M., & Lozano, M.B. (2017). The role of the board of directors in the adoption of GRI guidelines for the disclosure of CSR information. Journal of Cleaner Production, 141, 737-750

- Gond, J., Akremi, A.E., Sawen, V., & Babu, N. (2017). The psychological microfoundations of corporate social responsibility: A person-centric systematic review. Journal of Organizational Behavior, 38, 225-246.

- Gulzar, M.A, Cherian, J., Hwang, J, Jiang, Y., & Muhammad Safdar, S. (2019). The impact of board gender diversity and foreign institutional investors on the corporate social responsibility (CSR) engagement of Chinese listed companies. Special Issue Corporate Social Responsibility (CSR) in Developing Countries: Current Trends and Development, 11(2), 307.

- Hambrick, D.C., & Mason, P.A. (1984). Upper Echelons: the organization as a reflection of its top managers. The Academy of Management Review, 9, (2), 193-206.

- Hoang, T.C, Abeysekera, I., & Ma, S. (2018). Board Diversity and Corporate Social Disclosure: Evidence from Vietnam. Journal of Business Ethics, 15, 833-852.

- Husted, B.W., & Sousa-Filhoa, J.M. (2019). Board structure and environmental, social and governance disclosure in Latin America. Journal of Business Research, 102, 220-227

- Julizaerma M.K., & Zulkarnain, M.S. (2012). Gender diversity in the boardroom and firm performance of malaysian public listed companies. Procedia - Social and Behavioral Sciences, 65, 1077-1085

- Kazemian, S., Al-Dhubaibi, A.A.S., Zin, N.M., Sanusi, Z.M., & Zainudin, Z. (2020). Pro-human economic indicators and their relationship with environmental sustainability in asean countries: analyzing human capital investment, brain drain and immigration through panel data. Journal of Security & Sustainability Issues, 10(November), 360-371.

- Kazemian, S., Djajadikerta, H.G., Roni, S.M., Trireksani, T., & Mohd-Sanusi, Z. (2020). Accountability via social and financial performance of the hospitality sector: the role of market orientation. Society and Business Review, 16(2), 238-253.

- Kahreh, M.S., Babania, A., Mohammad, T. & Mirmehdi, S.M. (2014). An examination to effects of gender differences on the corporate social responsibility (CSR). Procedia - Social and Behavioral Sciences, 109, 664-668

- Khalid, M., Alam, M., & Said, J. (2016). Empirical assessment of good governance in the public sector of Malaysia. Economics and Sociology, 9(4), 289-304.

- Kweh, Q. L., Norazlin, A., Ting, I.W.K., Zhang, C. & Hasahudin, H. (2019). Board Gender Diversity, Board Independence and Firm Performance in Malaysia. Institutions and Economies, 11(2), 1-20.

- Liao,L., Luo, L., & Tang, Q. (2015). Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review, 47, 409-424

- Liu, C. (2018). Are women greener? Corporate gender diversity and environmental violation. Journal of Corporate Finance, 52, 118-142

- Maran, M. and Indraah, K. (2009). Ethnic and gender diversity in boards of directors and their relevance to financial performance of Malaysian companies. Journal of Sustainable Development, 2(3), 139-148

- Maria, C. P., Inmaculada, B. O. & Gustau, O.S. (2019). Commitment of independent and institutional women directors to corporate social responsibility reporting. Business Ethics A European Review, 28(3), 290-304.

- McGuinnes, P.B., Vieito, J.P., & Wang, M. (2017). The role of board gender and foreign ownership in the CSR performance of Chinese listed firms. Journal of Corporate Finance, 42, 75-99

- Nekhili, M., Nagati, H, Chtioui, T., & Nekhili,A. (2017). Gender-diverse board and the relevance of voluntary CSR reporting. International Review of Financial Analysis, 50, 81-100

- Nooraisah, K., Zam Zuriyati, M., Norlia, M.N. and Al Farooque, O. (2019). Comprehensive board diversity and quality of corporate social responsibility disclosure: evidence from an emerging market. Journal of Business Ethics, 157(2), 447-481.

- Ooi, S.K. (2016). Climate Change Reporting in Malaysia: Application of Institutional Theory and Resource Based View (University Sains Malaysia’s Doctoral thesis).

- Rose, C. (2017). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), 404-413.

- Slama, R.B., Ajina, A., & Lakhal, F. (2019). Board gender diversity and firm financial performance in France: Empirical evidence using quantile difference-in-differences and dose-response models. Cogent Economics & Finance, 7, 1-25.

- Suwongrat, P., Pattanaporn, C., Pornsit, J., & Sirisak, C. (2019). The effect of female directors on firm performance: Evidence from the great recession.

- Uribe –Bohorquez, M.F. (2019). Women on boards and efficiency in a business-orientated environment. Corporate Social Responsibility and Environmental Management, 26, 82-96

- Vilk?a, R., Raisiene, A.G., & Simanavisiene, Z. (2014). Gender and corporate social responsibility: ‘big wins’ for business and society? Procedia - Social and Behavioral Sciences, 156, 198-202

- Williams, S.M. (1999). Voluntary environmental and social accounting disclosure practices in the asia-pacific region: an international empirical test of political economy theory. The International Journal of Accounting, 34(2), 209-238.