Research Article: 2019 Vol: 22 Issue: 5

Financial Law as a Public Law Branch: A Fresh Look at the Signs of Publicity

Imeda A Tsindeliani, Russian State University Justice

Svetlana V Miroschnik, Rostov branch Russian State University Justice

Inessa V Bit-Shabo, Russian State University Justice

Anatoly D Selyukov, Russian State University Justice

Maxim M Proshunin, Russian State University Justice

Svetlana V Rybakova, Tambov State University named after GR. Derzhavin

Ekaterina G Kostikova, Russian State University Justice

Svetlana S Tropskaya, Russian State University Justice

Abstract

The purpose of this research is to identify new characteristics reflecting publicity of financial and legal relations. This article formulates evidence on the preponderance of public interest over private interest, justifies a new perception of the subject through the prism of financial activities of the state, and shows the dependence of financial law characteristics on social development. The attention is focused to the circumstances that indicate the priority of publicity in finance as in public relations. Even though the state actively uses private-law mechanisms in the sphere of finances, it is necessary to search for and identify characteristics reflecting publicity. This article articulates forms and methods the state uses to influence activities of private entrepreneurs with public law, specifies the forms and types of state influence on the financial sphere, as well as signs that speak of the need for addressing public law. The main provisions and results are relevant for further studies to assess the effectiveness of state financial regulation, and for the development of projects for reforming fiscal and social policies and strategic development programs.

Keywords

Public Financial Law, Public Goals, Public Financial Activity, Regulatory Method, Subject of Financial Law, Science of Financial Law, Financial Legal Relations, Publicity.

Introduction

In the science of financial law, in the most cases, the understanding of the publicity of financial law is often tied up in a single link with the understanding of the subject of the branch as a set of relations concerning funds of money (funds of funds) (Koziel, 2015). However, in recent years, the nature of a complex branch of law is increasingly being assigned to financial law, implying public-legal and private-law methods for regulating relations about finances (Schmulow, 2015). One of the reasons for such approach is the fact that in addition to public funds, in the object of financial relations in real practice many other relationships that are not funds of money are included. Therefore, there is a contradiction between the declared subject of financial law and the fact that the other relationships not connected with funds are included (Benjamin, 2010). One can notice inconsistency in the subject of the financial law, which regulates the formation, allocation and use of public funds; banking law and insurance law are included into the system of financial law without a good reason (Khudyakov, 2009).

No doubt, that the turning point in the understanding of the subject of financial law has become noticeable in the period since the early 1990s. But until today there has been a gradual departure from the stock understanding of the subject of financial law to other positions (Tsindeliani, 2011).

The State takes part in the economy, operating in two dimensions. Through the authorized entities, it acts as an economic entity but also regulates, controls, licenses, uses tax mechanisms to influence socio-economic processes, carries out budgetary and other support for national business (Mankiw, 2014). The criterion of such participation is considered a comprehensive indicator of fulfilling public interests through the implementation of general social functions and through the use of financial instruments (Varian, 2014). If the state succeeds in this, then its role in supporting and developing social life can be considered meaningful. Consequently, to ensure the functioning of the financial system, the above authorities perform managerial functions that are primarily expressed in various forms, methods and means of conducting financial activity (methods of financial and legal regulation) (Borsa, 2009). The State, represented by the authorized bodies, does the financial management.

Thus, financial law is classified as public law mainly due to the nature of its subject matter. Because the law is primarily about the formation, allocation and use of public funds, the publicity can be attributed to it (Drwillo, 2011). However, inconsistency between the subject and methods of regulation makes the use of private legal mechanisms to influence financial relations more frequent. When this happens, there is a need to search for new characteristics representing publicity of financial law. The existing studies are evidently focused on the one and same set of attributes related to financial and legal relations. Some of them are outdated.

There is a discernible trend in European and American studies-banking law, tax law and budget law are considered systems with unique methods and a unique subject (Brunnermeier et al., 2009). Therefore, it is not surprising that they are studied outside the field of financial law. However, one should not forget about the peculiarities of financial relations with which the state is engaged. These are the relationships that should be considered as the key ones in the financial law system (Mastalski, 2013).

The modern challenges of globalization have affected the financial sector as well. Crisis phenomena emerge on a frequent basis. This necessitates a rapid reaction on the part of the state, including state intervention in the sphere of private finances (Gourinchas, 2010). Because of such phenomena, in particular, financial law has blurred contours. With that, doubts about the uniqueness of its orientation arise. Financial regulation exists to fix specific failures in the financial system. For example, with a high degree of risk, unconventional mortgage lending by non-bank lenders flourished in the 2000s, but with ineffective regulation caused enormous damage and led to a financial crisis (Financial Times, 2009). Most experts believe that the crisis could have been avoided if only the United States applied stricter regulation and supervision of financial activities. This conclusion largely ignores the global nature of the crisis (Korolev, 2013). Thus, a fairly liberal economic country could have avoided a crisis if the financial system had more significant intervention by state institutions.

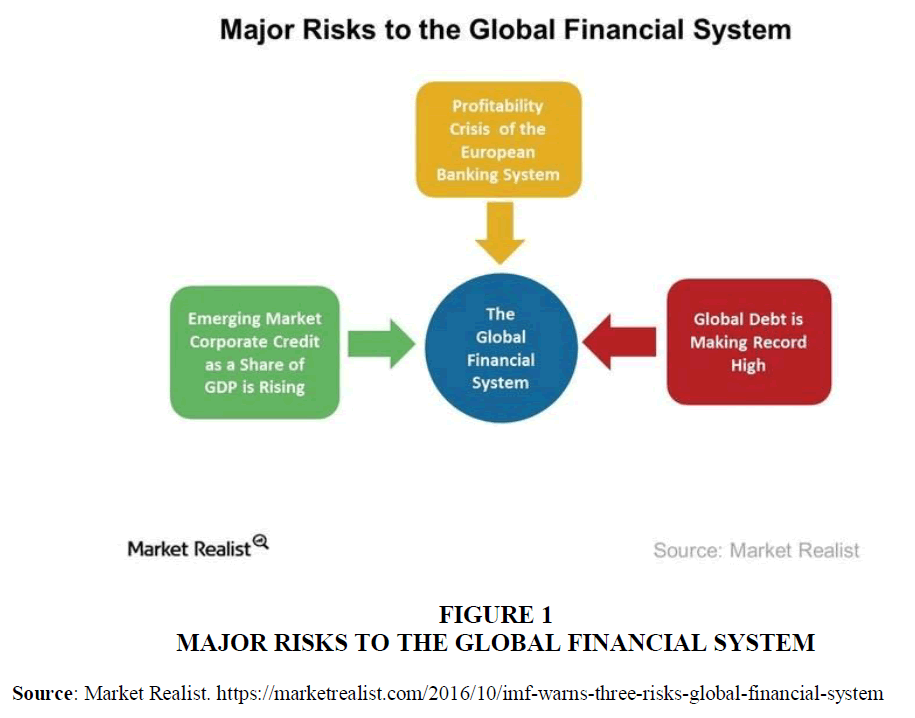

The International Monetary Fund also warns governments of various risks, which are now particularly relevant in the global economic community. According to the IMF report, the short-term risks to the global financial system have been declining since April 2016, while the medium-term risks to the global financial system are increasing gradually (Sands, 2016). At the same time, in the context of globalization, there are new category of threats to the global financial system. Namely, crises are not national, but supranational (Figure 1), which requires conceptually different management methods that are focused not on the regional markets’ condition, but on global sustainable development.

Thus, there is an extreme actualization of intervention in the financial system on the part of both the state and the supranational institutions. Such trends indicate new challenges to financial law, new order, and new elements of the subject of financial law. They also indicate the need to identify new characteristics reflecting publicity of financial law.

In this regard, there is a need to clarify or refute the signs of referring the financial right exclusively to public law branches of law.

Methodology

Social relations constituting the subject-matter of the financial law were developing, changing, and became established before the financial law has been constituted. The specificity of the subject-matter of regulation, solidarity and methodological specificities of the financial and legal standards sufficiently define superstructure which has the nature of natural law. The superstructure is based on constitutional system of national states.

One of the methodological grounds for solving this problem is the understanding of financial law as a set of national legal norms governing a fairly large group of social relations.

Thus, there are the following research methods:

1. An institutional method for determining the mechanism of public financial regulation.

2. Synthesis of the practice of such regulation in different countries to argue the position on the nature of financial law.

3. A comparative analysis of the imperatives of financial systems at various levels.

4. Abstraction from the regulatory framework of international financial law.

In this study, the authors rely on the fact that the need to take into account the state of society for the purpose of organizing relations in the sphere of the functioning of finance with the application of a particular legal method may be considered the main criterion for assigning financial law to public branches of law.

Literature Review

The Necessity of Taking into Account of the Updated Understanding the Subject of the Financial Law to Clarify Definition of the Degree of its Publicity

To solve the assigned task, it is necessary to define finance, concerning which the State carries out its financial activity, applying various legal methods. In terms of economics, the view that finances, in addition to centralized and decentralized funds, include all types of relations in the case of money, regardless of their form of ownership, as well as other financial instruments related to money (Tropskaya, 2012). The availability of money was considered the single ground of the financial law (Belsky, 1994). However, the relations by themselves regarding money can be regulated by public and private law. Currently, all types of monetary relations and other financial instruments are related to finance. In this case, if we agree with the definition of the subject of financial and legal regulation as the aggregate of economic relations with regard to the functioning of public and private finances, and the group of organizational and control relations adjacent to them, it should be recognized that the property right is not always a guideline for the election of a legal method of ensuring the relevant goals of the State. Currently, for many phenomena of public life, attribution to the branch of law is ambiguous and even problematic (Veresha, 2016), which allows the possibility of revising the nature of financial regulation in the future.

The fact that in modern conditions, funds of funds can have any form of ownership is an objective reason for refusing to understand the subject of financial law only as an aggregate of relations involving the State with regard to centralized or decentralized funds of funds (Mrkývka, 2012). It is also important to take into account that the State actively influences by applying the public legal method to the functioning of public and private finances in order to meet the needs of society. The fact is that the aggregate interests of private persons having a public character in private finance are provided by public law. These are, for example, customs duties aimed at protecting the interests of domestic producers of goods. Otherwise, anti-corruption legislation ensures the protection of individuals and legal entities from financial crimes and the abuse of authority by government officials (Veresha, 2018).

The criterion for the application of the public law method in the sphere of private finance is the existence of public interests in this sphere, if we take into account the aggregate of private interests that dialectically pass into the quality of public interests. The imperative of regulation and the monetary nature of relations are the criteria for classifying the rules governing relations in the sphere of private finance to financial law (Tropskaya, 2013). In connection with the above, it can be argued, that the approach to understanding the subject of financial law, expressed by the well-known foreign classics, that financial law had its own relationship with the public finances, is outdated (Godme, 1978). In this regard, there is a tendency that the new features of financial law consist in the fact that from the regulator of public finance it has become the regulator of relations existing in parallel with public finances and connected with private finances (Tsindeliani, 2015). As, for example, aspects of financial flows passing through global information networks, and the cybercrimes provoked by them, where financial threats to the security of individuals and the state are equally high (Veresha, 2018).

The non-compliance with the state-established procedure for conducting financial activities violates the interests of the whole society, and thus, falls within the public law. The combination of factors from earlier creates the prerequisites for committing many financial offenses. The state, in turn, has to protect its property interests. The desire of the state to preserve and maintain the legal order in the financial sphere necessitates the legal protection of this sphere. This explains the necessity and possibility of public enforcement. Financial and legal responsibility is one of its forms.

In connection with the foregoing, there are reasons and, moreover, a need to expand the scope of the notion of "public finance". For this it is necessary to include in addition to money funds, which belong to the State on the basis of ownership, also money belonging to State corporations. It is also necessary further research of the problem of including in the public finances of all funds that belong to individual organizations, but are designed to meet public needs. To solve this problem, one should also think about taking special measures that not only oblige, but also create personal interest for the management of State corporations, joint-stock companies with State participation, unitary enterprises, State institutions, so that it encourages them not to substitute State interests for private interests. In Poland, similarly as in the majority of the EU counties different types of fiscal rules that should enable the limitation of the level of public expenditures and in consequence the level of public deficit and debt are implemented. Therefore, these rules aim at the ensuring the public finances sustainability (Zawadzka-Pak, 2014). The importance of such sustainability is also due to the fact that it affects the investment decisions of domestic companies (Yung & Root, 2019). At the same time, the influence of the financial institutional structure, its adequacy and sustainability spread beyond the national borders. The latter is through the influence on firms operating abroad. Since companies from countries with a stable rule of law in the field of finance are more effective in interacting with foreign counterparties (Chen et al., 2019).

Thus, it is necessary to support the view that the sign of publicity in relation to the objects of legal regulation in the sphere of monetary relations and related to other financial instruments should mean not only the ownership of the objects themselves, but also the nature of the purpose of the objects (Alexander & Nobes, 2004). It means-whether they serve private or public interests. Despite the fact that the money of State corporations is assigned to them as property, they should be considered public finances for their own purposes.

In Germany the Deutsche Bundesbank (DB) and the Federal Financial Supervisory Authority (BaFin) are responsible for system stability, and a smoothly functioning banking supervision regime. The DB’s regulatory philosophy is one of safeguarding the viability of the financial sector, which is sensitive to fluctuations in confidence, by pursuing creditor (note, not purely depositor) protection. In the case of Switzerland, the Swiss National Bank is responsible for financial stability. The Swiss National Bank (SNB) defines a stable financial system as a system whose individual components-financial intermediaries and the financial market infrastructure-fulfill their respective functions and prove resistant to potential shocks (Swiss National Bank, 2014). In Japan, The Financial Services Agency is responsible for overseeing banking, securities and exchange, and insurance, in order to ensure the stability of the financial system. It is responsible for the protection of depositors, insurance policy holders, and securities investors. It is responsible for the inspection and supervision of private sector financial institutions, and the surveillance of securities transactions. Thus, in the national economy of any state, property relations are regulated through two complementary representations of which do not imply opposition or cross-use-the civil law and the financial law. In modern settings, public law is interacts with private law more closely and I a more smooth way, as evident from manifestation in various legal planes, primarily in financial law.

In financial law, dispositivity is conditional: its action somewhat specific, namely the harmonization of any conditions of financial activity is possible only in cases specified by financial law. Most often, the dispositive nature of regulation prevails in the credit and banking sector, and occasionally in the tax law.

Results

Public Interests as a Criterion for Determining the Subject of Financial Law and the Sign of its Publicity

Another significant indicator of the criterion of the subject of financial law is the existence of public interests, which can be provided by the State as by a private law method, and publicly-legal method. Where the method of legal equality gives a positive result for achieving the assigned task, the State should strive to rely on its application. And on the contrary, where one can’t rely on the private-legal method, since it will not lead to a given result for securing public interests, there should relied on a powerful, imperative method that allows the State to achieve firmly the goals set in the financial sphere (Bakaeva, 2010). In our understanding, public interests are considered as a broader phenomenon than State interests, since they are inherent in the majority of the society, reflect the root and some current needs of an undetermined circle of people. State interests as a part of public interests, in essence, is their most significant element, are strategically important needs of society as they are called upon to provide long-term. In addition, they are provided with all the power of the State. The State as a product of the development of society in its essence represents the entire population politically organized and residing in a certain territory. In this capacity, it acts as a form of organization of the society. However, public interest is the interest of all or most part of the socio-space organized by the State, it predetermines the direction and level of interests of the State and its territorial manifestations. The State forms a sphere of its interests out of the total number of public interests, but at the stage of formation of the interests of the State in the form of specific goal-setting tasks there is an active struggle of various forces. Interests of clan or groups are often given out under the guise of State interests. At the same time, the ways of individual interests to become public interests are carried out through a struggle that is hidden from the eyes of society, which is affected by the level of culture, traditions, and beliefs of individual leaders, the lobbying mechanism and backstage forces.

Therefore, it is important to determine the goal-setting of the financial activity of the State in the maximally publicized form and under the control of the society itself, its structures. In general, it is necessary to further study the question of the degree of statehood (as a criterion reflecting the essence of the State) of specific State interests that are promulgated by subjects of State policy and fixed in relevant documents. The fact is that not always declared on behalf of the State is in fact in an interest that meets the needs of society. Unfortunately, only history allows to estimate correctly what chances for the accelerated development the country has lost, due to substitution of strategic interests of the state for immediate interests of politicians themselves. Public interests transformed into State interests are called upon to ensure, in the process of financial activity of the State, the quality of the goal-setting of the indicated activity, to unite the efforts of the State in the sphere of finance and the expectation of the society in the form of appropriate results in a unified logical line. In this regard, setting goals in the process of financial activities should include at least two elements: determine the final result of the financial activities of the State in the form of certain indicators of the needs of society, as well as determine the procedure for the implementation of activities, the mechanism for its implementation, including proper control over the extent to which the goal and the result achieved coincide.

Proceeding from the same positions of ensuring public interests, the institution of financial and legal regulation of public finance assigned to State corporations, the institution of financial and legal support for public procurement at the expense of public finances, etc. must be also included into the system of financial law. In general, the need for accounting in the process implementation of financial activities of the State with respect to public interests, transformed into State interests, is not only a sign of the direction of such activities and goal-setting component, but also a sign of his publicity.

Signs and Structure of the Public Legal Method as a Sign of Publicity of Financial Law

For a more complete understanding of the signs of publicity of financial law, it is necessary to clarify the manifestation of the public-legal method in the sphere of finance. Proceeding from the fact that the legal method of influence inherent in the essence of the legal rule as a leverage of its application is determined by the properties of the emerging relations between the subjects of legal relations and in this respect the fact that the State carries out its activity in the sphere of finance is the decisive basis for applying the imperious method as the main way of its implementation (Petrov, 2015).

Public-legal method is a way of one subject’s impact by law on the behavior and will of another subject. It is important that the law restricts the limits of the use of the authoritative method, makes them legally unequal in the mechanism for realizing specific relations, but preserves their equality before the law itself. In this sense, the law should protect the subordinate from excessive influence of the power. Another indicator that the public legal method in the sphere of the financial activity of the State will be aimed at securing public interests is a qualitative goal-setting, which also serves as a criterion for the proper orientation of the activities of the State and its authorized representatives. The need to create and then apply the design of the impact on social relations, which is called as a public law method, follows from the manifestation of the shortcomings of human consciousness. It can be assumed that the contractual method of organization of relations requires a fairly high level of morale among the parties of such relations. But where there is a lack of morality, where there are a lack of a proper legal culture and a danger of violating the required order, a compulsory law is required. If it is not possible to achieve people's voluntary fulfillment of certain rules in order to achieve socially significant positive goals, the State requires in mandatory form and with the use of compulsory ways to implement such rules (Stigliz, 2015). In fact, the indicator of the degree of readiness of the participants of future legal relations to the implementation of public interests can act as a criterion for the admissibility of applying the private legal method of legal regulation of relations. Granting freedom to participants in civil law relations in general, the State in the same Civil Code of the Russian Federation included norms and entire institutions based on the public-law method, since a dispositive method in certain situations can only bring a harm.

The objectives of the financial activities of the State, the peculiarities of the status of entities with which the State enters into legal relations, are the basis for choice of legal methods of State influence. At the same time, as the general rule for the necessity of applying an authoritative, imperative method, it can be said the following. We believe that the State in the sphere of finance should strive to apply private-law mechanisms in the fields where such mechanisms work, where the degree of maturity of social relations allows such an approach. However, if the introduction of the method of disposability does not give a proper result, the State must orient to the application of the public legal method. By the way, such an approach can serve as a criterion for including in the subject of financial law the relations that develop in the sphere of private finance, as well as the inclusion of relations in relation to public finance. From the available literature in the field of financial law, from the analysis conducted above, and from all the innovations and current trends in the public activity in the field of finance, one can claim the importance of the publicity issue. Because the subject of financial law is piled up by relations in the banking sector and in the sectors of private economy that deal with public money funds, the publicity of financial law is becoming more and more blurred. At this point, the mechanisms of private law come into play. However, this is only on one side. After all, if you look at financial activity from a different angle, then characteristics of publicity may be attributed to the private sector of economy as well.

The world or regional economic phenomena have a significant impact on the economic sector and on the degree of government intervention in the economy. For example, in the event of a serious economic crisis, any subject of the private sector of economy will hope for the government intervention. On the other hand, the state benefits from assistance to all economic actors because it considers any actor as a source that brings money to the budget, those are taxpayers. Thus, by taking certain anti-crisis measures, the state also intervenes in the private sector. In this way, however, the publicity of financial law is not only proved but acquires new forms. The analysis of these processes resulted in the emergence of prerequisites for a new look at the legal content of state market regulation. The time of non-interference principle to shine was buried by the crisis. The economic functions of the state should not be limited to administration. Methodologically, the sequence of events plays an extremely important role in developing the tactics and strategy of any financial reform and reorganization. The use of financial and legal methods alone cannot lead an expected result.

Financial and legal regulation is effective only when a common legal environment is created, when legal organization reaches a level at which it becomes possible to form a special financial and legal regime of interaction. Financial activities are carried out by the state in both protective and regulatory ways using administrative and economic methods. In a market economy, administrative methods are less used in financial activity. They may be used in combination with dominating economic methods. In modern settings, the government and municipal structure regulate financial activities to strengthen the economic feasibility of any administrative decision and to shift from administrative elements in financial activity.

Discussion

The Financial Activity of the State gives Rise to the Application of Various Legal Methods

It is necessary to consider the role of the concept of "financial activity of the state" in order to understand the signs of publicity of financial law. It should be considered that the concept of "financial activity of the State" in content is broader than the concept of "financial law". Financial law is a consequence, one of the results and methods of manifestation of the financial activity of the State. At the same time, it is the most significant form of financial activity of the State. This type of State activity is one of the most important functions of the State in ensuring public interests, so it’s mission in the sphere of formation and functioning of public and private finances. The financial activity of the State actively determines the specifics of the entire system of financial law, allocates for the financial law the appropriate legal space in the structure of all aspects of the financial activity of the State.

Being in its essence an illegal phenomenon, but formalized by the rules of law, the financial activity of the State generates various types of legal relations, applying public law and private law methods. It is the causal basis for the development of financial and other legal relations. For the purposes of legal support, the financial activity of the State acts as an integral, complex phenomenon ensuring the emergence of various types of legal relations. It is this approach that makes it possible to see the integrity of all elements of financial law as a unified system, united by the common task of implementing financial activities for the sake of securing public interests in the sphere of finance. In the process of affecting centralized monetary funds, the State establishes the mode of operation of public funds of money belonging to the State or municipal entities on the basis of a public legal method. However, when entering non-governmental legal entities and individuals into legal relations with regard to the use of budgetary funds or levying tax revenues, the State enters into civil-law relations with them, thereby forming complex legal institutions (Tsindeliani, 2015).

At present, the authorized bodies of the State actively conclude deals with representatives of the private sector of the economy to purchase goods, works and services from the budget (Auerbach, 2006), take part in public-private partnership programs, apply the concession mechanism and other forms of cooperation with private sector entities, including the sphere of financial services (Hayashi, 2010). The State is increasingly influencing the functioning of the private financial sector: it establishes a regime for ensuring the financial stability of credit and insurance organizations; applies certain forms of protection to the rights of non-professional participants in investment relations; monitors compliance with legislation by professional participants in the financial services market; obliges all types of economic entities, forms of ownership, pay taxes and fees, keep records and report. In this connection, it can be concluded that everything that the State implements with the use of a public law method in the functioning of private finance is the financial activity of the State, as a result of which, for the purposes of public interest, a number of restrictions are imposed on the activities of private sector finance entities, taxation, accounting and other similar cases. Corresponding types of relations are regulated by the rules of financial law. In this case, the State subordinates private interests of subjects to the interests of the entire society.

The financial regulation has some inherent characteristics. Firstly, it is dependent upon macroeconomic and financial policy. In other words, financial regulation is focused primarily on ensuring the effective functioning of economy and on implementing a wide range of socio-economic interests. Secondly, the legal regulation of financial relations is associated with credit, monetary, budgetary and other types of financial policy. Thirdly, the most effective way to carry out financial regulation is to use it dependence on the sphere of influence and objectives. And finally, in market conditions, legal personalities become more equal. The very fact of voluntary entry into specific financial legal relations implies the need and necessity to use liberal methods and instruments of financial regulation. Financial regulation forms the “financial ecosystem” of the country, which comprehensively determines the financial availability and openness or isolation of the state in relation to both other countries and its citizens (Kabakova & Plaksenkov, 2018). At the same time, the availability of finance along with the level of crime determines the prospect of business development in poor and developing countries (Ranasinghe & Restuccia, 2018). In developed countries, such as the USA, state financial regulation ensures the interests of society by taking into account indicators of a social nature, for example, the financial vulnerability of an individual (O'Connor et al., 2019). Thereby, the situation with individual households, states, and the entire country simultaneously becomes more stable.

The level of state intervention, as well as the prevalence of public interest, can be depicted conditionally, depending on the type of financial and legal relations. Indeed, depending on the specific type of relations between an individual, the state and corresponding bodies, the level of intervention, as well as the range of behavioral patterns, which the subjects of financial relations select, will change. For example, at the stage of forming public funds, the state does primary supervision, while the subjects of fund formation are given the opportunity to choose different schemes. In the case of control over the use of public funds, monitoring bodies have to do a thorough work.

Implementation of Results

This study is of high practical value for legislative processes in the field of financial law, regardless of the type of legal system, presenting a paradigm rationale for the principles of state regulation. The results obtained are relevant for further studies to assess the effectiveness of state financial regulation, and for the development of projects for reforming fiscal and social policies and strategic development programs.

The results of the study cannot be applied to countries with planned and closed economies that are not involved in global financial flows. Along with countries with various forms of totalitarian regime. Since their financial regulatory framework is predominantly related to non-market, political and ideological aspects, which is a limitation of this study.

Conclusion

Thus, financial law is still associated with the public sector, but now, it poses completely new characteristics and elements. However, this publicity is absolutely not that publicity, which was discussed in the last century.

In the light of globalization, common economic movements, and aggravated economic problems, when the state does not interfere in the sphere of private finances, state functions tend to transform. With transformational changes, legal regulation can only be a systemic phenomenon. The system of social relations can be effectively regulated only when all the methods and means that make up the regulation method act not separately but in close interaction.

Planning and financial control are two common inherent in management at any stage of financial activity, in any field of activity, with respect to all structural elements of the financial system. These methods apply to both state and municipal financial institutions, as well as to private business. It should also be noted that democratic (market) methods of regulating financial relations are used in an optimal combination with the basic method of financial and legal regulation, known as the authoritative order.

With the help of financial law, the state realizes its economic function. An objective need to regulate financial relations exists in any society because in this way, the state, based on specific imperative means, is able to influence the formation of property relations through direct or indirect intervention.

Thus, with the active liberalization of the financial sector, government intervention in the financial sphere remains a necessary phenomenon at all stages of financial relations. Publicity acquires new forms, while methods of public regulation are not replaced by private ones but are rather integrated and systematized into completely new forms of influence. Public finance remains a key element of the subject of financial law, but to make public financial relations reasonable, an impact must be projected on the private sector as well.

References

- Alexander, D., & Nobes, C. (2004). Financial accounting: An International Introduction. London: Pearson Education Ltd.

- Auerbach, A.J. (2006). Budget windows, sunsets and fiscal control. Journal of Public Economics, 90(1-2), 87-100.

- Bakaeva, O.Y. (2010). The ratio of private and public interests in conditions of reforming the legislation of the Russian Federation: The monograph. Moscow. Yurlitinform.

- Belsky, K.S. (1994). Financial law. Moscow. Jurist.

- Benjamin, J. (2010). The narratives of financial law. Oxford Journal of Legal Studies, 30(4), 787-814.

- Borsa, D. (2009). The past, present and future of the public finances law in Hungary. Days of Law: The Conference Proceedings, 1. Brno: Masarykova univerzita.

- Brunnermeier, M., Crocket, A., Goodhart, C., Persaud, A.D., & Shin, H.S. (2009). The fundamental principles of financial regulation: Geneva reports on the world economy.

- Chen, D., Yu, X., & Zhang, Z. (2019). Foreign direct investment co-movement and home country institutions. Journal of Business Research, 95(1), 220-231.

- Drwillo, A. (2011). Introduction to finance and financial law. Warszawa: Lex a Wolters Kluwer business.

- Financial Times. (2009). Brown asks for Europe to back global stimulus.

- Godme, P.M. (1978). Financial law. Moscow. Progress Publishers.

- Gourinchas, P.O. (2010). Written testimony for the FCIC. Conference on forum to explore the causes of the financial crisis, day 1, session 2: Macroeconomic factors and U.S. monetary policy.

- Hayashi, H. (2010). Road investment and local economy: An empirical analysis considering regional interdependence. Keizai-Ronshu, 63(1), 59–75.

- Kabakova, O., & Plaksenkov, E. (2018). Analysis of factors affecting financial inclusion: Ecosystem view. Journal of business Research, 89(1), 198-205.

- Khudyakov, A.I. (2009). Criteria of formation of system of financial law. The system of financial law: materials of International scientific-practical conference (pp. 138).The National University Odessa Academy of Law. Odessa: Feniks.

- Korolev, A. (2013). Housing issue. Retrievefrom http://expertonline.kz/a12204/

- Koziel, M. (2015). Public finances as integral part of financial law. System of Financial Law: General Part: Conference Proceedings (pp. 88-100). Brno: Masaryk University, Faculty of Law.

- Mankiw, N.G. (2014). Principles of macroeconomics. New York: The Dryden Press.

- Mastalski, R., & Fójcik-Mastalska, E. (2013). Financial law. Warszawa: Lex.

- Mrkývka, P. (2012). The determination and diversification of financial law. Brno: Masarykova univerzita.

- O'Connor, G.E., Newmeyer, C.E., Wong, N.Y.C., Bayuk, J.B., Cook, L.A., Komarova, Y., Loibl, C., Ong, L. L., & Warmath, D. (2019). Conceptualizing the multiple dimensions of consumer financial vulnerability. Journal of Business Research, 100(1), 421-430.

- Petrov, D.E. (2015). The distinction between concepts of method of legal regulation and legal regime in the research of differentiation systems of law. Bulletin of the Saratov state Academy of law, 4(1), 147-152.

- Ranasinghe, A., & Restuccia, D. (2018). Financial frictions and the rule of law. Journal of Development Economics, 134(1), 248-271.

- Sands, S. (2016). IMF warns about 3 risks to the global financial system. Retrieved from https://marketrealist.com/2016/10/imf-warns-three-risks-global-financial-system

- Schmulow, A.D. (2015). The four methods of financial system regulation: An international comparative survey. Journal of Banking and Finance Law and Practice, 26(3), 151-172.

- Stigliz, J.E. (2015). Economics of the public sector. New York: W.W. Norton & Company.

- Swiss National Bank. (2014). Financial stability in information about.

- Tropskaya, S.S. (2012). The concept of finance and the subject of financial law in pre-revolutionary literature. Finansovoe pravo, 11(1), 6-8.

- Tropskaya, S.S. (2013). To the question about the subject of the contemporary financial law. Finansovoe pravo, 12(1), 7-12.

- Tsindeliani, I.A. (2011). About the system of financial law: The current state of scientific research, Monograph. Moscow. RAJ.

- Tsindeliani, I.A. (2015). Debatable question of the Russian system of financial law. System of financial law: General part: Conference Proceedings. Brno: Masaryk University, Faculty of Law.

- Varian, H.R. (2014). Intermediate microeconomics: A modern approach. New York: Norton.

- Veresha, R.V. (2016). Mistake of criminal law and its influence on the classification of crime. International Journal of Environmental and Science Education, 11(15), 8017-8025.

- Veresha, R.V. (2018). Corruption-related offences: Articulation of pervasive prevention mechanisms. Journal of Legal, Ethical and Regulatory Issues, 21(4), 1-12.

- Veresha, R.V. (2018). Preventive measures against computer related crimes: Approaching an individual. Informatologia, 51(3-4), 189-199.

- Yung, K., & Root, A. (2019). Policy uncertainty and earnings management: International evidence. Journal of Business Research, 100(1), 255-267.

- Zawadzka-Pak, U.K. (2014). Polish financial law. Byalystok Law Books, Byalystok.