Research Article: 2022 Vol: 25 Issue: 1S

Financial ratio model and application of good corporate governance to NPL with inflation as a moderate variable

Muhammad Yusuf, Institut Teknologi and Bisnis Bank Rakyat Indonesia

Fathihani, Universitas Dian Nusantara

Laynita Sari, Sekolah Tinggi Ilmu Ekonomi KBP

Renil Septiano, Sekolah Tinggi Ilmu Ekonomi KBP

Siti Nuryati, Institut Teknologi dan Bisnis Bank Rakyat Indonesia

Indah Dwi Lestari, Universitas Islam As-Syafi’iyah, Jakarta

Zaenal Arief, Institut Teknologi dan Bisnis Bank Rakyat Indonesia

Moch Arif Hernawan, Institut Transportasi dan Logistik Trisakti Jakarta

Moch Arif Hernawan, Institut Transportasi dan Logistik Trisakti Jakarta

Kumiko Azizah, STIT Rakeyan Santang, Karawang, West Java

Citation Information: Yusuf, M., Fathihani, Sari, L., Septiano, R., Nuryati, S., Lestari, I. D., Arief, Z., Hernawan, M. A., Nurhayati, S., & Azizah, K. (2022). Financial ratio model and application of good corporate governance to NPL with inflation as a moderate variable. Journal of management Information and Decision Sciences, 25(S1), 1-12.

Abstract

The Non-Performance Financing Ratio (NPF) is a ratio that is a very serious concern for banks because if this ratio is allowed to continue to increase, it will have an impact on decreasing profits, which, in turn, will reduce the Bank's financial performance. This study uses the ratio of Financing To Deposit Ratio, BOPO, and Quality of Implementation of GCG (Good Coverage Governance) to see its effect on NPF (Non-Performing Financing) with inflation as a Moderating variable in Islamic Commercial Banks Registered with the Financial Services Authority for the period 2014 – 2019. The analytical method used is multiple linear regression, which is processed using Eviews 9. The results show that: The implementation of GCG is carried out to comply with the applicable rules regarding sharia bank governance and serves as a reference for shareholders in determining investment decisions. Good GCG implementation has not been able to suppress the non-performing financing that occurs because the increase in NPF is caused by other factors that influence it. The higher the liquidity of third-party funds for financing, moderated by inflation, the higher the funding non-performing that occurs in Islamic commercial banks. Any increase in the BOPO, moderated by inflation, does not affect the condition of Non-Performing Financing. The higher the GCG self-assessment results, moderated by inflation, will lead to higher non-performing financing in Islamic commercial banks.

Keywords

FDR; BOPO; GCG; NPF; Inflation.

Introduction

The national banking industry has experienced ups and downs in recent decades. Declining economic activity, inflation, and changes in interest rates have caused banks to be selective in anticipating surges in non-performing finance (NPF). However, behind this economic situation is a threat of non-performing finance (NPF) and a rise in inflation. If the threat fails to be anticipated by the government, the economy will deteriorate, even leading to a recession.

Non-performing finance (NPF) is one of the key indicators to assess the performance of bank functions because a high NPF is an indicator of a bank's failure to manage its business, including liquidity problems (inability to pay third parties), profitability (uncollectible debts), and solvency (reduced capital).

The bank is a business entity that collects funds from the public in the form of savings and distributes it to the public in the form of credit or other forms to improve the community's standard of living. According to Bank Indonesia Regulation No. 9/7/PBI/2007, commercial banks carry out business activities conventionally and based on sharia principles, which provide services in payment traffic (Auliani and Syaichu, 2016).

The main function of a bank as a financial institution is that the bank acts as a financial intermediary (Financial Intermediary) between parties who have excess funds (Surplus Units) and those who need funds (Deficit Units). In carrying out its function as an intermediary institution, lending or financing is the bank's main activity and is the bank's main source of income, which, of course, is not risk-free. (Hamzah, 2018).

One of the risks the banks faced is the risk of non-payment of loans that have been given to debtors or called credit risk. The credit risk can be in the form of failure or loss. Credit classification, commonly referred to as the collectibility criteria of Substandard (KL), Doubtful (D), and Loss (M), is classified as non-performing loans or non-performing financing. The risk of default means Islamic Commercial Banks need to pay attention to the risk of being exposed to non-performing funding. The level of funding non-performing is described by the ratio of non-performing financing (NPF). The amount of non-performing funding applied in Bank Indonesia regulation Number 15/2/PBI/2013 is a maximum of 5%. A high level of non-performing financing indicates low bank health because this shows that there are many non-performing financing in bank operations (Aryani, Anggraeni, and Wiliasih, 2016). This results in the ability of Islamic banks to generate smaller profits and disrupt the bank's main function, namely collecting and distributing funds (Pradana, 2018).

NPF also reflects credit risk. The higher the NPF level, the greater the credit risk borne by the bank. The amount of NPF becomes one of the causes of the difficulty of banks in disbursing credit. The lower the NPF ratio, the lower the level of non-performing loans, which means the better the bank's condition.

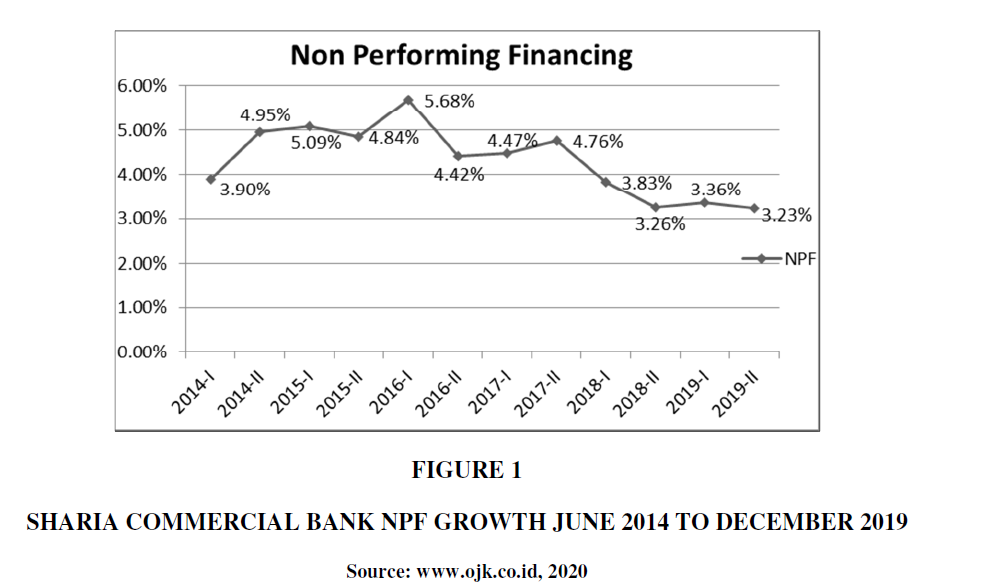

Based on Figure 1, it can be seen that the average NPF owned by Islamic Commercial Banks registered with the Financial Services Authority for the period 2014 – 2019 experienced fluctuations that tended to increase were in June 2016, and the highest average NPF value was 5.68%. One of the Islamic commercial banks with the highest NPF ratio in 2016 was Bank BJB Syariah, which reached 17.91%. This figure has exceeded the safe limit set by the regulator, which is 5%. (Hamzah, 2018).

Internal or external sides can cause problems financing. Internal influence comes from operational activities within the banking sector itself by looking at financial ratios, some of which are FDR, BOPO, and GCG. A good quality GCG implementation mechanism is expected to improve the credit risk management faced by banks. Meanwhile, external influences come from outside banking operations, including macroeconomic factors, one of which is inflation (Auliani and Syaichu, 2016).

Several studies on non-performing financing have been conducted, but the results of these studies are still inconsistent. Some of them have been researched by (Aryani et al. (2016) and Pradana (2018), which show that the Financing to Deposit Ratio has a positive effect on Non-Performing Financing. This is different from the research conducted by Hafilah and Mahardikai (2019), which showed the results had a negative effect, and the research conducted by Auliani and Syaichu (2016), whose research results showed that FDR did not affect NPF.

Then the research on the effect of BOPO on NPF was conducted by Hafilah and Mahardikai (2019), Perdani (2019), and Auliani and Syaicu (2016), which showed that BOPO had a positive effect on NPF, in contrast to Nurhaliza et al. (2018), which indicates that BOPO does not affect NPF.

Furthermore, research on the effect of Good Corporate Governance (GCG) on Non-Performance Financing (NPF) was conducted by Putri and Kusumaningtias (2020), Rahayu and Azib (2019), and Eliza (2016), which showed that Good Corporate Governance had a positive effect on NPF. This is different from the research conducted by Ningsih (2019), which shows that Good Corporate Governance does not affect NPF.

The research on inflation conducted by Amelia (2019) and Ramadhan (2017) showed that inflation negatively affected NPF. In contrast to research conducted by Haryanto (2018), which showed positive results and research conducted by Perdani (2019) showed that inflation did not affect NPF. The formulation of the problem in this study is whether inflation can moderate the effect of Financing to Deposit Ratio, BOPO, and the quality of GCG Implementation on Non-Performing Financing. The purpose of the study is to find out and analyze inflation to moderate the effect of Financing to Deposit Ratio, BOPO and the quality of GCG Implementation on Non-Performing Financing.

Because the NPF is a ratio that is a very serious concern for banks and has an impact on the bank's financial performance, and there are inconsistencies from the results of previous studies, this study was appointed with the title “Financial Ratio Model and Implementation of GCG on Non-Performing Financing with Inflation as Moderating Variable (Empirical Study on Islamic Commercial Banks registered with the Financial Services Authority for the period 2014-2019).”

Literature Review

Compliance Theory

Compliance with laws, rules, and norms helps maintain the reputation of banks so that they meet the expectations of customers, markets, and society as a whole. Banks that fail to carry out the role and function of compliance will directly face what is known as compliance risk, which the Basel Committee on Banking Supervision defines as legal risk or legal sanctions, losses/materials, or damage to the bank's reputation as a result of violating the law, regulations, and rules associated with organizational norms that become the internal rules of a bank. (Indonesian Bankers Association, 2013: 254).

Islamic Bank

According to Law No. 21 of 2008 concerning Islamic Banking, Sharia carry out business activities based on sharia principles or Islamic legal principles regulated in the fatwa of the Indonesian Ulema Council, such as the principles of justice and balance ('adl wa tawazun), benefit (maslahah), universalism (naturalism), and does not contain gharar, maysir, usury, injustice, and unlawful objects. In addition, the Sharia Banking Law also mandates Islamic banks to carry out social functions by carrying out procedures such as baitul mal institutions, namely receiving funds from zakat, infaq, alms, grants, or other social funds channeling them to waqf managers (nazhir) as desired. waqf (wakif).

Non-Performing Financing

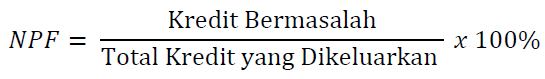

Credit risk is the risk caused by the inability of debtors to fulfill their obligations as required by the creditors. Credit risk arises if the bank cannot recover the principal and/or interest installments from the loans it provides or the investments it makes. Credit or financing risk in Islamic banking is reflected in the NPF (Non-Performing Financing) ratio (Fahmi, 2014).

Based on SE BI No. 13/24/DPNP 25 October 2011, NPF is a ratio used to measure the level of financing problems faced by Islamic banks. The higher this ratio indicates the quality of Islamic banks is getting worse. Risk management and internal control are substantial tools for a company's governance, management, and operations to be effective (Chin et al., 2019).

Based on the results of the research (Sari et al., 2020), shows that LDR has a significant negative effect on ROA, and the NPL variable is not a moderating variable between LDR and ROA, so it can be concluded that the NPL/NPF variable is not a moderating variable.

Then the NPF can be formulated as follows:

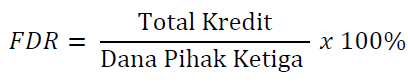

Financing to Deposit Ratio

FDR is a ratio to measure the composition of the amount provided compared to the amount of public funds and own capital used (Andrianto, Fatihuddin, and Firmansyah, 2019:383).

The greater the distribution of funds in the form of credit than third-party funds or public deposits in a bank, the greater the bank's risk (Umam, 2013).

According to SE BI No. 13/24/DPNP dated October 25, 2011, the standard for the value of the Financial to Deposit Ratio (FDR) is 78%-100%, the FDR ratio formula is:

BOPO

BOPO is also referred to as the efficiency ratio used to measure the ability of bank management to control the bank's operating expenses against the operating income received by the bank (Hasibuan et al., 2020).

BOPO is the ratio between operational costs and operating income in measuring the level of efficiency and ability of banks to carry out their operations (Rivai et al., 2013).

According to SE BI No. 13/24/DPNP dated October 25, 2011, the standard for the value of Operating Income Operating Expenses (BOPO) is 83%-85%, the formula for the BOPO ratio is:

Good Corporate Governance

Corporate governance is a set of relationships between a company's board, its shareholders, and other stakeholders (Okofo-Darteh & Asamoah, 2020). Corporate governance, in general, is related to the system and mechanism of relations that regulate and create appropriate incentives between parties who have an interest in a company so that the company in question can achieve its business goals optimally. (Umam and Veri, 2018). Corporate governance helps varied participants and shareholders, such as managers, shareholders, employees, and creditors, manage potential conflicts of interest by putting the right control mechanisms into place (Kahveci & Wolfs, 2019). Improving the quality of corporate governance enables the firm to attract foreign investors by informing all stakeholders about its financial situation, performance, ownership structure, and other conditions in a timely and accurate manner (Kwilinski et al., 2020).

Based on SE BI No. 15/15/DPNP, in 2013, banks were required to conduct periodic self-assessment, covering eleven aspects of GCG implementation assessment. The assessment includes an evaluation of the parameters/indicators consisting of:

a) Implementation of the duties and responsibilities of the Board of Commissioners;

b) Implementation of the duties and responsibilities of the Board of Directors;

c) Completeness and implementation of the duties of the committees and work units that carry out the internal control function of the bank;

d) Handling conflicts of interest;

e) Implementation of compliance function;

f) Implementation of the internal audit function;

g) Implementation of the external audit function;

h) Implementation of risk management, including internal control system;

i) Provision of funds to related parties;

j) Provision of large funds (large exposures); and

k) Transparency of the Bank's financial and non-financial conditions, reports on GCG implementation, internal reporting, and the Bank's strategic plan.

Given the purpose of the report on the implementation of good corporate governance (GCG) to provide maximum corporate value for stakeholders, the principles of implementing good corporate governance.

Inflation

Inflation is the process of increasing the price of goods in general and is continuously caused by a decrease in the value of money in a certain period (Mashudi et al., 2017).

Meanwhile, Bank Indonesia defines it as an economic condition characterized by a rapid increase in prices that decrease purchasing power, often followed by a reduction in the level of savings and investment due to increased public consumption and only a small amount for long-term savings.

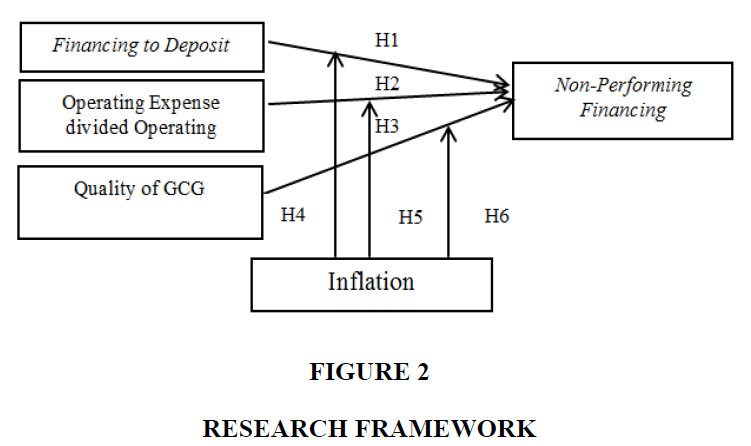

Framework

Detailed research framework has been provided in Figure 2.

Hypothesis

H1: Financing to Deposit Ratio has a positive effect on Non-Performing Financing

H2: BOPO has a positive effect on Non-Performing Financing

H3: The quality of GCG implementation has a positive impact on Non-Performing Financing

H4: Inflation can moderate the effect of Financing to Deposit Ratio on Non-Performing Financing

H5: Inflation can moderate the effects of BOPO on Non-Performing Financing

H6: Inflation can moderate the influence of the Quality of GCG Implementation on Non-Performing Financing

Research Methods

Population, Sample, and Sampling

The population used is Islamic Commercial Banks registered with the Financial Services Authority for 2014-2019. The purposive sampling technique carries out the determination of the sample. As for some of the criteria used in the study to select the sample, among others:

1. Sharia Commercial Banks registered with OJK for the 2014-2019 period.

2. Sharia Commercial Bank has been operating since 2014.

3. Sharia Commercial Banks publish annual financial reports and complete GCG implementation reports for the 2014-2019 period.

Based on these criteria, the results obtained are 10 Islamic commercial banks suitable as research samples with a total of 60 data (Table 1).

| Table 1 Sampling Criteria | ||

| No | Criteria | Amount |

| 1 | Sharia Commercial Banks registered with OJK for the 2014-2019 period. | 14 |

| 2 | Sharia Commercial Banks operating since 2014 | (2) |

| 3 | Sharia Commercial Banks publish annual financial reports and complete GCG implementation reports for the 2014-2019 period. | (2) |

| Bank Amount | 10 | |

| Research Period | 6 | |

| Total Research Data | 60 | |

Method of Collecting Data

The data collection method used is literature study and documentation. Literature studies are carried out by processing literature, articles, and other written media related to research discussion. While the documentation method is by obtaining samples collected by recording data on secondary data sourced from the official website of each Islamic Commercial Bank and data from the Financial Services Authority (OJK).

Data Analysis Method

The analysis was conducted to determine the relationship between the dependent and independent variables using multiple linear regression analysis with the reviews version 9. This is because this study uses panel data, a combination of time-series data (time-series) and cross-sectional data.

Variable Measurement

Dependent variable

The dependent variable in this study is Non-Performing Financing. NPF is a ratio used to measure the risk of disbursed financing. The NPF ratio is a comparison between non-performing financing and total financing.

Independent variable

Finance to Deposit Ratio

Based on the Circular Letter of Bank Indonesia Number 13/30/DPNP, the FDR ratio is the total financing compared to third-party funds.

BOPO (Operating Expenses versus Operating Income)

BOPO is a ratio used to measure efficiency and ability in carrying out its operations by calculating the balance between operating costs and operating income.

Quality of GCG Implementation

GCG is the principle that underlies a mechanism regarding corporate governance by applicable regulations to control corporate governance. To determine the quality of GCG implementation by calculating the Self Assessment composite value from the annual GCG assessment report with indicators: (1) Implementation of the duties and responsibilities of the board of commissioners, (2) Implementation of the duties and responsibilities of directors, (3) Completeness and implementation of committee duties, (4) Implementation of the duties and responsibilities of the sharia supervisory board, (5) Implementation of sharia principles in the activities of collecting and distributing funds and services, (6) Handling conflicts of interest, (7) Implementation of the bank compliance function, (8) Implementation of the internal audit function, (9) Implementation of the external audit function.

Moderating Variables

Inflation

The inflation value used in this study is the rate of inflation growth, which is measured using the Consumer Price Index (CPI) with the following formula:

Results and Discussion

Effect of Financing to Deposit Ratio on Non-Performing Financing

Based on the results of statistical tests that have been carried out, it can be seen that the Financing to Deposit Ratio has a regression coefficient value of 0.0429 with a probability value of 0.4418, meaning that the Financing to Deposit Ratio does not affect Non-Performing Financing. This result does not follow the research hypothesis, which states that the Financing to Deposit Ratio positively affects Non-Performing Financing (Table 2).

| Table 2 Test Statistics T | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -0.097208 | 0.049435 | -1.966363 | 0.0548 |

| X1 | 0.042861 | 0.055284 | 0.775294 | 0.4418 |

| X2 | 0.103111 | 0.021267 | 4.848332 | 0.0000 |

| X3 | 0.004522 | 0.006338 | 0.713562 | 0.4788 |

According to Kasmir (2012), FDR is a ratio to measure the composition of the amount of financing provided compared to public funds, commonly called third-party funds. The higher the FDR ratio, the higher the third-party funds channeled as financing, but this does not affect the ability of the customer receiving the funding to repay the financing. So it can be concluded that good liquidity of third-party funds does not always suppress the increase in funding non-performing.

Effect of BOPO on Non-Performing Financing

Based on the results of statistical tests that have been carried out, it can be seen that BOPO has a regression coefficient value of 0.1031 with a probability value of 0.0000, meaning that BOPO has a positive influence on Non-Performing Financing. These results follow the research hypothesis, which states that BOPO has a positive effect on Non-Performing Financing.

According to Rivai (2013), BOPO is the ratio between operational costs and operating income in measuring the level of efficiency and the ability of banks to carry out their operations. A large BOPO means that the operational expenses borne are caused by non-performing financing greater than the operating income received. Suppose there is a financing problem in the distribution of financing, for example. In that case, there is a bottleneck in the return of funds distributed, and the margin obtained by the bank is relatively large, while the income received will be reduced.

The Influence of the Quality of GCG Implementation on Non-Performing Financing

Based on the results of statistical tests that have been carried out, it can be seen that the quality of GCG implementation has a regression coefficient value of 0.0045 with a probability value of 0.4418, meaning that the quality of GCG implementation does not affect Non-Performing Financing. This result does not follow the research hypothesis, which states that the quality of GCG implementation positively affects Non-Performing Financing.

According to Anwar (2018), GCG is a system that regulates and controls the company. GCG is used as a sharia bank as a reference and benchmark in carrying out its operational activities to add value in the eyes of stakeholders. The implementation of GCG is carried out to comply with the applicable rules regarding sharia bank governance and serve as a reference for shareholders in determining investment decisions. Furthermore, corporate governance concerns the effectiveness of the management structure and risk management systems (Darussamin et al., 2018). Good GCG implementation has not been able to suppress the problematic financing that occurs because the increase in NPF is caused by other factors that influence it.

Effect of Financing to Deposit Ratio on Non-Performing Financing with Inflation as Moderating Variable

Based on the results of statistical tests that have been carried out, it can be seen that the Financing to Deposit Ratio moderated by inflation has a regression coefficient value of 0.4104 and a probability value of 0.0000, meaning that inflation strengthens the influence of the Financing to Deposit Ratio on Non-Performing Financing. These results follow the research hypothesis, which states that inflation can moderate the Financing to Deposit Ratio on Non-Performing Financing (Table 3).

| Table 3 MRA T Statistic Test | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | -0.073621 | 0.041642 | -1.767950 | 0.0836 |

| X1 | 0.038645 | 0.047738 | 0.809521 | 0.4223 |

| X2 | 0.091920 | 0.026749 | 3.436388 | 0.0012 |

| X3 | 0.035904 | 0.018888 | 1.900900 | 0.0635 |

| X1*Z | 0.410371 | 0.013524 | 30.34379 | 0.0000 |

| X2*Z | -0.024524 | 0.021112 | -1.161625 | 0.2513 |

| X3*Z | 0.036351 | 0.009500 | 3.826401 | 0.0004 |

Inflation strengthens the influence of the Financing to Deposit Ratio on Non-Performing Financing, meaning that if the Financing to Deposit Ratio increases, the Non-Performing Financing will also increase with moderated inflation. This can be seen from the data that has been presented, one of which is the increase that occurred in 2019. The average Financing to Deposit Ratio in 2018 was 0.8403, which increased in 2019 to 0.8528. With moderated inflation, which, in 2019, was 0.0303, Non-Performing Financing experienced an increase from 0.0405 in 2018 to 0.0415 in 2019.

Effect of BOPO on Non-Performing Financing with Inflation as Moderating Variable

Based on the results of statistical tests that have been carried out, it can be seen that BOPO moderated by inflation has a regression coefficient value of -0.0245 and a probability value of 0.2513, meaning that inflation cannot negotiate the effect of BOPO on Non-Performing Financing. This result does not follow the research hypothesis, which states that BOPO can moderate the effect of BOPO on Non-Performing Financing.

Inflation is not able to moderate the effect of BOPO on Non-Performing Financing. This can be seen from the BOPO condition, which fluctuated from 2014 to 2016, in contrast to the NPF, which continued to increase. It can be concluded that any increase in the BOPO, moderated by inflation, does not affect the condition of Non-Performing Financing.

The Effect of the Quality of GCG Implementation on Non-Performing Financing with Inflation as a Moderating Variable

Based on the results of statistical tests that have been carried out, it can be seen that the quality of GCG implementation with moderated inflation has a regression coefficient value of 0.0364 and a significance value of 0.0004, meaning that inflation strengthens the influence of the quality of GCG implementation on Non-Performing Financing. This result follows the research hypothesis, which states that inflation can moderate the effect of the quality of GCG implementation on Non-Performing Financing.

Inflation strengthens the influence of the quality of GCG implementation on Non-Performing Financing. This can be seen from the data that has been presented, one of which is the increase that occurred in 2019. The average GCG in 2018 was 1.83, which increased in 2019 to 1.99. With moderated inflation, which, in 2019, was 0.0303, Non-Performing Financing experienced an increase from 0.0405 in 2018 to 0.0415 in 2019. It can be concluded that the higher the GCG self-assessment results, moderated inflation will cause more heightened non-performing financing in Islamic commercial banks.

Conclusion

1. The implementation of GCG is carried out to comply with the applicable rules regarding sharia bank governance and serve as a reference for shareholders in determining investment decisions. Good GCG implementation has not been able to suppress the problematic financing that occurs because the increase in NPF is caused by other factors that influence it.

2. The higher the FDR ratio, where the more credit is disbursed and moderated by inflation, the higher the problematic financing of Islamic commercial banks.

3. Any increase in the BOPO, moderated by inflation, does not affect the condition of Non-Performing Financing.

4. The higher the GCG self-assessment results, moderated by inflation, will lead to higher non-performing financing in Islamic commercial banks.

Suggestions

Increase the efficiency and effectiveness of costs and operating income at Islamic commercial banks to pay attention to the BOPO ratio. If this ratio is higher, the income generated by the bank will decrease, so it can be concluded that the bank will bear more of the financing risk.

If investors want to invest in Islamic commercial banks, they can use the FDR and GCG of Islamic retail banks as material for consideration in making investment decisions.

Based on the results of the study, FDR and GCG have a positive effect on NPF with inflation as a moderating variable, meaning that when the amount of liquidity of third-party funds for Islamic commercial banks is high, and the results of the GCG assessment are not good when inflation is high enough, it indicates the risk of non-performing financing is also high. Hence, investors need to be careful if they want to invest because non-performing increased funding will cause the income of Islamic commercial banks to decrease.

References

Andrianto, Fatihuddin, D., & Firmansyah, MA (2019). Banking management. CV. Qiara Media Publisher.

Aryani, Y., Anggraeni, L., & Wiliasih, R. (2016). Factors Affecting Non-Performing Financing at Indonesian Islamic Commercial Banks for the 2010-2014 Period. Journal of Al-Muzara'ah, 4(1), 44-60.

Auliani, MM, & Syaichu. (2016). Analysis of Internal and External Factors on the Level of Non-performing Financing at Islamic Commercial Banks in Indonesia for 2010-2014. Diponegoro Journal of Management, 5(3), 1-14.

Fahmi, I. (2014). Introduction to Banking Theory and Applications. CV. Alphabet.

Hamzah, A. (2018). The Effect of Macroeconomic Factors on Non-performing Financing (Research on Islamic Commercial Banks in Indonesia 2010-2017). Journal of Islamic Finance and Accounting, 1(2), 73-90.

Hasibuan, AN, Annam, R., & Norfinawati. (2020). Islamic Bank Audit (1st ed.). date.

Indonesian Bankers Association. (2013). Understanding Bank Business (1st ed.). PT. Main Library Gramedia.

Mashudi, PDD, Taufiq, DM, & Priana, DW (2017). Introduction to Economic Theory (first). Goshen Publishing.

Pradana, MNR (2018). The Influence of Liquidity and External Variables on Non-Performing Financing in Islamic Banks. EXIS, 13(2), 131-144.

Rivai, HV, Basir, S., Sudarto, S., & Veithzal, AP (2013). Commercial Bank Management: Banking Management from Theory to Practice. Press Eagle.

Sari, L., Tanno, A., & Putri, AJJIAB d. I. (2020). The Role of NPL on the Relationship Between LDR and Company Performance (Empirical Study on State-Owned Banks Listed on the IDX). 3(2), 45-5

Umam, Khaerul. (2013). Islamic Banking Management. CV. Faithful Library.

Umam, Khotibul, & Veri, A. (2018). Corporate Action Establishment of Islamic Banks (Acquisition, Conversion, and Spin Off). Gadjah Mada University Press.