Research Article: 2021 Vol: 20 Issue: 3

Financing Decision, Human Capital Investment, and Entrepreneurial Performance: An Empirical Study on SME in Makassar

Mursalim Nohong, Hasanuddin University

Abdul Razak Munir, Hasanuddin University

Haeriah Hakim, Hasanuddin University

Abstract

This study aims to analyze the effect of funding policies on human capital investment and entrepreneurial performance. The data and information in this study were obtained from the owners of UKM in Makassar City by using a questionnaire. Of the 125 samples, only 105 questionnaires were filled in completely and were feasible to be processed and used in the discussion.

This study found that funding policies to fund working capital and company investment were able to increase entrepreneurial performance as reflected by the increase in sales and profits each period. The availability of sufficient funds for investment and business development, especially for human capital, also has a positive and significant impact on entrepreneurial performance. In other words, human capital investment can mediate the effect of funding policies on entrepreneurial performance.

Keywords

Financing Decision, Human Capital Investment, Entrepreneurial Performance.

Introduction

Small and Medium-sized Enterprises (SMEs) as one of the business people is believed to have a strategic role even until today. When the business environment is experiencing turbulence, the Micro, Small, and Medium Enterprises (MSMEs) sector become the biggest contributors in the economic movement. SMEs also play a critical role in the development of the private sector in every nation. In Indonesia, MSMEs' contribution to economic growth is very big and very crucial because it occupies 99% of the businesses in Indonesia. MSMEs contribute 97% to employment, therefore in total, the contribution of MSMEs in the national economy is as big as 60%. MSMEs also contribute 58% of total investments and 14% of total exports (Hartomo, 2020). Meanwhile, in European Union (EU) countries, Small and Medium-sized Enterprises (SMEs) are considered to be the backbone of the economy (European Commission, 2020).

The importance of studying SMEs' performance derives from several aspects. SMEs have a major influence on both Gross Domestic Product (GDP) and unemployment (Cicea et al., 2019). SMEs can adapt to the environmental changes challenge including at crisis times (Carson & Woodley, 2013). SMEs represent the framework of the appearance of entrepreneurship and are a vital element in defining a competitive economy (Misoska et al., 2016). The development of large companies is also not apart from the existence of SMEs. Large companies depend on SMEs in the provision of supporting products that allow large companies to concentrate on their core business. SMEs are very appreciated because they have creativity, flexibility, and fast response towards environmental changes easily, including the application of innovative decision making (Foreman-Peck & Nicholls, 2012; Potkany & Krajcirova, 2015).

With that position, SMEs still are objects of study of academics and practitioners which most of which refers to performance development (Sohilauw et al., 2020; Nohong et al., 2019; Munir et al., 2019). The achievement of business performance is a general issue in many organizations, especially in the globalization era, where innovation and competitiveness are the main terms (Ukenna et al., 2010).

Al Mutairi et al. (2010)’s research found that there are negative relations between debt levels as an indicator of funding decision and financial performance. This finding shows that the decision to increase debt is not significant in pushing the company performance and contrary to trade-off theory capital structure. Al Mutairi et al. (2010)’s finding is contrary to Younus et al. (2014); Daud et al. (2016)’s finding which confirms the validity of trade-off theory capital structure which explains that companies with high performance (profitability) levels will try to decrease their taxes by increasing their debt ratios so that the debt addition will decrease existing taxes which in the end will affect company performance.

Meanwhile, Subramony et al. (2008) and Ukenna et al. (2010)’s research found the importance of Human Resource Management (HRM) investment to strengthen the achievement of company performance. Subramony et al. (2008) found that a company’s HRM investment in forms of appropriate salary will increase employees’ productivity and imply company productivity overall. Meanwhile, Ukenna et al. (2010)’s research states that the company policies towards HRM such as giving training and skill development will be an effective policy to increase company performance.

This research analyzes one of the corporate decision forms, that is the decision or policy of funding to encourage HRM investment and company performance. Company organization environmental changes including for SME demands the quality of the product made could compete in the market. To produce a good quality product as is needed by the consumer, a skilled HRM by training is needed. Therefore, SME products will compete in the market thus potentially increasing company performance. This research was done in Makassar City because according to Bank Indonesia’s data in 2019, the economic growth shows a positive value, even at a higher rate compared to the provincial and national levels. Specifically, the growth level was 7.39(2014), 7.55(2015), 8.03(2016), 8.23(2017), 8.4(2018), and 8.4(2019). One of the sectors that played a role in it was SME (Sohilauw et al., 2020).

Literature Review

Financing Decision and Human Capital Investment

Financing decisions are a company policy to create an optimal structure between debt and owner’s equity. Financing decision that is taken by the company to provide funds towards working capital and investment such as human capital. Company advantage could be achieved by synergizing external and internal environments. Related to that, some organizations gain a competitive advantage through owned human resources so that it is vital for organizations to choose human resources that fit the strategic goal. Human Capital (HC) is obtained from organization human resources that have the capability and competence that needs to be identified, maintained, and treated as company non-cost investment (Lin & Huang, 2005). Companies will realize more than the available funds to invest in human resources will significantly raise performance which will also encourage the development of company competitiveness (Pinchevska & Šmidriaková, 2016).

H1 Financing decision has positive effects on human capital investment

Financing Decision and Entrepreneurial Performance

The financing decision states debt usage levels towards total assets (Cui et al., 2011). Financing decisions could be measured by using the total debt ratio towards total assets, long term debts towards total assets, and short term debts towards total assets. For companies, appropriate financing decision makings or also known as capital structure concepts will result in expenses in operational. Every company that uses funding sources, either in debt or owner’s equity (like stocks) must bear the capital costs burden. The higher the capital costs incurred by a company, proportionally will affect the obtained profit and will affect the performance (Cui et al., 2011).

Company performance measurement in organizational theory could be done by using the goal-based approach, system approach, and constituency approach. The goal-based approach states that organizations could be rated based on set goals (Etzioni, 1960). It is just today, this approach could not be done to compare performance across companies because of the variety of company goals. The second approach is the system approach which states that to measure performance, simultaneous achievement from some aspects, and generic performance also has to be considered (Steers, 1975). But none of these approaches considers the stakeholder's perspective about performance. Oftentimes the stakeholders tend to assume bad performance based on their perspective only. The constituency approach was developed to know how far the schedule of the stakeholders is fulfilled (Thompson, 1967; Pfeffer & Salancik, 1978). Funding decisions states total asset levels that are funded by debts. For that, management is expected to maximize company performance through the optimization of debt and equity combination (Azhagaiah, 2011; Detthamrong et al., 2017; Jaisinghani & Kanjilal, 2017).

H2 Financing decision has positive effects on entrepreneurial performance

Human Capital Investment and Entrepreneurial Performance

Resources based view which was developed by Barney & Wright (1998) outlines linkages between company resources that are valuable, rare, and costly-to-imitate (idiosyncratic) and company performance and sustained competitive advantage. If a company could maintain the surplus of the utilization of valuable resources and competitive advantage that is expected could be continuous due to valuable resources being unable to easily be transferred to, or used productively by competing companies (Peteraf, 1989). To achieve a continuous competitive advantage, companies could focus on owned human resources (Barney, 1991) including allocating budgets in form of investment. This applies to companies that exist in the middle of a complex and dynamic competitive environment which demands skill in obtaining and assimilating new markets and access technology development compared to competitors. Investment in human resources, in turn, is an activity, such as school, workplace training, medical treatment, or obtaining information about the economic system, which affects real income in the future (Fleischhauer, 2011; Wuttaphan, 2017). The Strategic Human Resources Management’s school of thought theorizes that human resource practices, such as staffing or training, creates mutual acknowledgment, skills, and certain capabilities (or human capital aggregate) which in turn will contribute to company performance (Barney & Wright, 1998; Ployhart et al., 2009).

H3 Human capital investment has positive effects on entrepreneurial performance

Financing Decision, Human Capital Investment, and Entrepreneurial Performance

Interest in HC in entrepreneur literature has been a discussion topic and rising especially in the last two decades. Theories about HC in its early stages of development are still in the process of studying educational values (Weisbrod, 1966; Frese & Rauch, 2001; Farr et al., 2019). So it shows with that process, enables people to have various knowledge and skills and while having economic values. Strengthening in HC investment needs a series of company policy, in which among them is financing decision because, to obtain an HC that has the knowledge and skills, investment is needed, for example through education or training (Azar et al., 1999; Drábek et al., 2017).

Investments in human and social capital are widely believed to improve the performance of employees (Arthur, 1994; Boselie et al., 2001). Employee performance improvement is a vital part of a company’s performance. It means, if the company’s policy to fix and even to raise employee performance, surely they will do a series of policy and activity that is related to education and training. This kind of employee will be the main power in raising the company performance. The same thing could be put into practice at every company level, including SMEs (Marvel et al., 2016).

H4 Financing decision has positive effects on entrepreneurial performance mediated by human capital investment

Methodology

Research Model

Data and information in this research are obtained from an SME owner in Makassar city by using a list of questions (questionnaire). Research variables include a dependent variable that is entrepreneurial performance, the independent variable that is financing decisions, and mediating variables that are a human capital investment. Financing decisions include the source of capital (owner’s equity or loan capital), use of operating profit for development, information access about sources of capital, and accompaniment of management of loans from financial institutions (Nohong et al., 2019). Human Capital investment includes educational background, skill, competence, appreciation towards employee achievement, and training and development activities (Han et al., 2008). Entrepreneurial performance includes sales growth, market share, company profit, the capability to pay off short-term goals, and company reputations (Zhao et al., 2013).

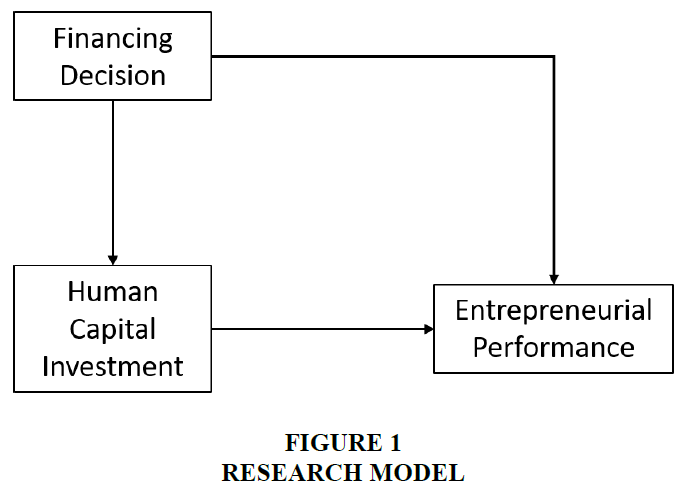

As we can see in Figure 1, shows that this research consists of four connections between variables. The first variable’s connection is financing decision’s influence towards human capital investment. The second variable’s connection is financing decision’s influence on entrepreneurial performance. The third variable’s connection is human capital investment’s influence on entrepreneurial performance, and the fourth variable’s connection is financing decision’s influence towards entrepreneurial performance through human capital investment.

Research Sample

The population of this research is the SMEs that specializes in the manufacturing sector. Data and information gathering in this research were done by using the sampling purposive approach with the criteria 1). Never experienced losses in the last three years, 2). Has various sources of capital, 3). The laborers have an educational and training experience, 4), Company has been established in the period of five years. Based on those criteria, there were a total of 125 SMEs that were appointed as samples. However, from the 125 samples, there were only 105 questionnaires that were filled and were considered proper enough to be processed and used in the discussion.

Results and Discussion

Evaluation of Measurement Model

Variable indicators in this research are reflective. According to Mahfud & Ratmono (2013), reflective measurement criteria include convergent validity, discriminant validity, and internal consistency reliability; composite reliability and Cronbach alpha.

Convergent validity test is done by using loading and p-value (Hair Jr et al., 2016). Construct that has a loading factor value above 0.70 and p-value <0.50 is stated as valid. However, according to Hair Jr et al. (2016) loading factor values of 0.40-0.70 are still considered and maintained (Table 1).

| Table 1 Convergent Validity | ||||

| Variable | Indicator | Loading factor | p-value | Conclusion |

| Financing Decision (X1) | Owner’s Equity (X1.1) | 0.734 | <0.001 | Valid |

| Add. Capital from family (X1.2) | 0.690 | <0.001 | Valid | |

| Benefit-cost analysis from debts (X1.3) | 0.726 | <0.001 | Valid | |

| Profit allowance (X1.4) | 0.753 | <0.001 | Valid | |

| Savings from profit(X1.5) | 0.814 | <0.001 | Valid | |

| Capability to fulfill assurance(X1.6) | 0.794 | <0.001 | Valid | |

| Financing information disclosure (X1.7) | 0.846 | <0.001 | Valid | |

| Accompaniment from financial institutions (X1.8) | 0.789 | <0.001 | Valid | |

| Human capital investment (Z1) | Educational Background (Z1.1) | 0.825 | <0.001 | Valid |

| Skill (Z1.2) | 0.732 | <0.001 | Valid | |

| Competence (Z1.3) | 0.866 | <0.001 | Valid | |

| Appreciation towards employee achievement (Z1.4) | 0.828 | <0.001 | Valid | |

| Training and development activities (Z1.5) | 0.738 | <0.001 | Valid | |

| Entrepreneurship performance (Y1) | Sales Growth | 0.834 | <0.001 | Valid |

| Profit Growth | 0.848 | <0.001 | Valid | |

| Liquidity | 0.848 | <0.001 | Valid | |

| Market Share Growth | 0.818 | <0.001 | Valid | |

| Company Reputation | 0.740 | <0.001 | Valid | |

By paying attention to the loading factor values which are generally greater than 0.70 and p-value less than 0.05, it can be concluded that each variable’s indicator fulfills the convergent validity.

The discriminant validity test is done by using values from AVE (Average Variance Extracted) roots of every construct with the correlation between one construct and other constructs in the model. If the AVE root value is greater than the coefficient of correlation between other variables, then the questionnaire is assumed to have a good discriminant validity (Hair Jr et al., 2016).

Based on Table 2, we can see that every variable has an average variance extracted (AVE) and Square Average variances extracted values greater than 0.50 therefore we could say that the model measurement evaluation has good discriminant validity.

| Table 2 Average Variances Extracted (AVE) | ||

| Variable | Average variances extracted | Square Average variances extracted |

| Financing decision (X1) | 0.593 | 0.777 |

| Human capital investment (Z1) | 0.640 | 0.800 |

| Entrepreneurial performance (Y1) | 0.670 | 0.819 |

The reliability test uses Cronbach's alpha and composite reliability value. Cronbach’s alpha measures the bottom border of the reliability value of a construct, while composite reliability measures the true value of a construct’s reliability. The rule of thumb that was used for the Composite Reliability value is greater than 0,7 and Cronbach’s alpha value is bigger than 0,7 (Ghozali & Latan, 2015).

As we can see in Table 3, every variable has composite reliability and Cronbach’s alpha value greater than 0.70 therefore we can conclude that every variable in this research is reliable.

| Table 3 Composite Reliability and Cronbach's Alpha Values | |||

| Variable | Composite reliability | Cronbach's alpha | conclusion |

| Financing decision (X1) | 0.921 | 0.901 | Reliable |

| Human capital investment (Z1) | 0.898 | 0.858 | Reliable |

| Entrepreneurial performance (Y1) | 0.910 | 0.876 | Reliable |

Structural Model Evaluation (Inner Model)

Structural model evaluation is done by paying attention to the R-Squared value (R2) or determination coefficient between constructs. The greater the R-Squared value, the better the model. According to Hair Jr et al. (2016) R-Squared category consists of a strong model if the value is greater than 0.70, moderate if the value is 0.50, and weak if the value is 0.25.

By paying attention to the values in Table 4, we can say that human capital investment is stated by financing decisions by 15 percent, while the rest is stated by other variables outside of the research model. Meanwhile, the entrepreneurial performance variable in this research is stated by human capital investment.

| Table 4 R-Squared Dan Adjusted R-Squared Values | ||

| Variable | R-squared | Adjusted R-squared |

| Human capital investment (Z1) | 0.155 | 0.149 |

| Entrepreneurial performance (Y1) | 0.300 | 0.289 |

Structural Equation Modeling Partial Least Square Result

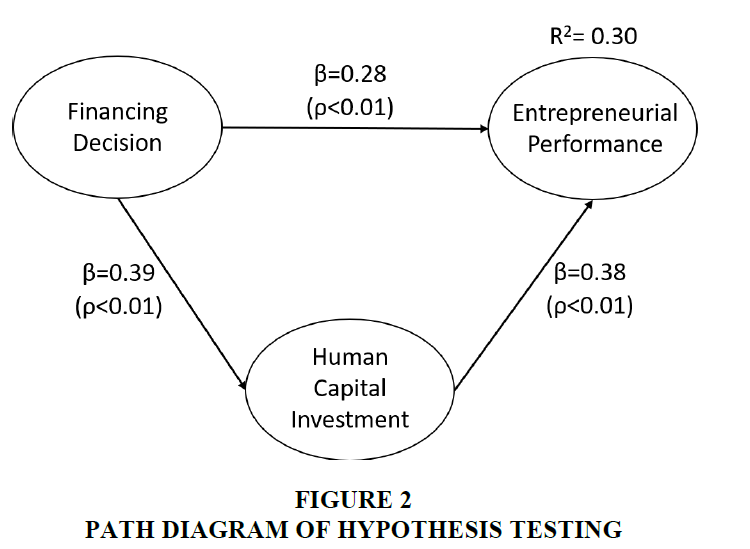

As a result of the test, it obtained the structural model of the research path like in Figure 2. The Figure 2 shows the path coefficient value and significance of each connection between variables. The coefficient value of the Financing Decision path towards Entrepreneurial Performance is positive 0.28 with the significance level smaller than 0.01 which shows that there is influence between Financing Decision towards Entrepreneurial Performance.

The financing decision path’s coefficient value towards Human Capital Investment is positive 0.39 with a significance level smaller than 0.01 which shows that there is an influence between financing decisions towards human capital investment. So does the path coefficient value between human capital investment towards entrepreneurial performance is positive 0.38 with the significance level smaller than 0.01 which shows that there is influence between human capital investment towards entrepreneurial performance. Also based on Figure 2 we can see that human capital investment is a mediating variable between financing decision and entrepreneurial performance.

Model Fit and Quality Indices

Model fit and quality indices tests are done to know if the connections between variables are hidden and are the assumptions are used to have a good index and size. Based on the calculations as in Table 5, we can see that every indicator has fulfilled fit and quality indices criteria so we can conclude that the research model has fulfilled the goodness of fit model.

| Table 5 Model Fit Dan Quality Indices | ||||

| No | Indicator | Criteria | Result | conclusion |

| 1 | Average path coefficient (APC) | P<0.005 | 0.352, P<0.001 | Good |

| 2 | Average R-squared (ARS) | P<0.005 | 0.228, P=0.002 | Good |

| 3 | Average adjusted R-squared (AARS) | P<0.005 | 0.219, P=0.003 | Good |

| 4 | Average block VIF (AVIF) | Acceptable if <= 5, ideally <= 3.3 | 1.145 | Acceptable |

| 5 | Average full collinearity VIF (AFVIF) | Acceptable if <= 5, ideally <= 3.3 | 1.323 | Ideal |

| 6 | Tenenhaus GoF (GoF) | small >= 0.1, medium >= 0.25, large >= 0.36 | 0.380 | Ideal |

| 7 | Sympson's paradox ratio (SPR) | Acceptable if >= 0.7, ideally = 1 | 1.000 | Ideal |

| 8 | R-squared contribution ratio (RSCR) | Acceptable if >= 0.9, ideally = 1 | 1.000 | Ideal |

| 9 | Statistical suppression ratio (SSR) | Acceptable if >= 0.7 | 1.000 | Ideal |

| 10 | Nonlinear bivariate causality direction ratio (NLBCDR) | Acceptable if >= 0.7 | 1.000 | Ideal |

Discussion

Direct Effect of Financing Decision on Entrepreneurial Performance

Financing decisions are one of the forms of strategic decisions. Companies that make mistakes in determining their financing sources will face a great burden, therefore it will affect efficiency and performance. Pecking Order Theory (POT) states that companies are prioritizing their financing source from internal funding to equity more. The use of equity in the source of capital is the last resort. This theory states that business obeys the sources of financing hierarchy and tend to choose internal funding if available, and debts are more liked rather than equity if external funding is needed (Caselli & Negri, 2018).

Findings in this research show that financing decisions affect positively and significantly entrepreneurial performance. Therefore we could say that the more SME owners optimize their financing sources, especially parts from its profit for business activities, the higher the SME performance that will be reflected by sales growth and profit compared to the previous period.

This research result is in line with the Pecking Order Theory (POT) which gives main priority to owner’s equity (internal capital) in business development as shown by loading factor value of 0.734 with the significance level smaller than 5 percent. In the meantime, this research result is in line with Ghadome (2008) and Bolubunmi (2018)’s finding which found that company financing decisions through the combination between debts and equity will result in company performance.

Direct Effect of Financing Decision on Human Capital Investment

Company business growth will be in line with funding needs. Some research has stated the negative effects of credit constraints in capital investment (Love, 2003), R&D Investment (Brown et al., 2009), and advertising costs (Fee et al., 2011) compared to others. One of the alternative paths which are potentially important is an investment in human resources, for example through training in the workplace. Company investment in human capital is one of the forms of expensive investment, oftentimes making it a hard decision compared to physical assets. Therefore, company funding limitations including SMEs could push efficient investment in training, due to funding sources limitation (Popov, 2014). This research result shows the existence of significant positive values between financing decisions on human capital investment. This shows that company decisions to allocate its funding will support the availability of human capital in SMEs that has the competency and capability. The availability of human capital with competency and capability will only be obtained by every company including SMEs if infestation through appropriate education and training which fits the company's needs and the market is done. This finding supports (Kaaro, 2001)’s research which found the connection between financing decisions and company investment decisions and supports the financing decision-relevant proposition.

Direct Effect of Human Capital Investment on Entrepreneurial Performance

SMEs as business people apart from competing with other SMEs also have to compete with middle and large-sized companies. The flexibility that SMEs have still could not fully become a source of good advantage and performance. SMEs are also demanded to have human capital as other companies do through investment. Human capital investment has a huge effect on every business and government organization. Human capital is a set of individual capabilities that is obtained which substantially last long, can survive for a long time in the individual life of company human capital. With the competency owned by human capital, will be formed capability that will be a source for companies to achieve an advantage through bigger profit raises compared to others (David, 2017).

This research result shows that there are positive and significant effects between human capital investment and entrepreneurial performance. This means the better the SME investments in the human capital, the better the performance will be. If we relate this to the loading factor values of each variable, we could say that the competency that is owned by the human capital from the investment activities will boost the profit raise and company capability to manage its short term obligations.

Direct Effect of Financing Decision on Entrepreneurial Performance Through Human Capital Investment

Capital for a company nowadays doesn’t only focus on many assets, as company size, lots of funds, equity, but the capability of company resources is also a crucial capital; talented people that have knowledge and skills are a crucial aspect of factors of production. The company’s ability to compete is affected by the capability of its founder, education, and experience. According to Becker (1993), the main focus of the human capital theory is on the education and work experience investment result. Human capital includes skills that are developed partly in genetics factors (such as intelligence, health, personality, attraction) and environmental factors (such as skills, education, work training, years of service, work experience, and interpersonal connections). Findings in the research show that human capital investment that is supported by optimal financing decisions will boost company performance raise. It means appropriate company financing decisions will result in human capital with good knowledge and competency, which will be a major factor in raising performance. Nevertheless, some companies such as SMEs are still facing obstacles obtaining those resources because the funding that is needed is not little at all. Execution of training to get a talented resource is one of the examples of activity that needs big funding. With those obstacles, usually companies include their resources in activities that are run by the government.

Conclusions

Small and Medium Enterprises have been trusted to be one of the driving forces for the economy and development. In the meantime, SMEs also play an important role in enhancing entrepreneurial character which is one of the capital in the development of small and medium enterprises. Entrepreneurial character and other resources are part of human capital which in its management will be a source of excellence for small and medium enterprises. This study found that funding policies to fund working capital and company investment were able to increase entrepreneurial performance as reflected by the increase in sales and profits each period. This means that SMEs need to allocate funds not only for strengthening working capital but also for business development through long-term investment. The availability of sufficient funds for investment and business development, especially for human capital, also has a positive and significant impact on entrepreneurial performance. In other words, human capital investment can mediate the effect of funding policies on entrepreneurial performance. Therefore, this study theoretically supports the resource-based view concept developed by Barney & Wright (1998).

Small and Medium Enterprises have been trusted to be one of the driving forces for the economy and development. In the meantime, SMEs are also expected to play a role in enhancing the entrepreneurial character which is one of the capital in the development of small and medium enterprises. Entrepreneurial character and other resources are part of human capital which in its management will be a source of excellence for small and medium enterprises. This study found that funding policies to fund working capital and company investment were able to increase entrepreneurial performance as reflected by the increase in sales and profits each period. The availability of sufficient funds for investment and business development, especially for human capital, also has a positive and significant impact on entrepreneurial performance. In other words, human capital investment can mediate the effect of funding policies on entrepreneurial performance.

The limitation of this research is that the determinants of SME performance improvement are only formed from the internal environment of the company. Therefore, further research needs to include external environmental variables such as government policies and capability and innovation variables in encouraging the formation of competitive advantage for SMEs.

References

- Al Mutairi, M., Hasan, H., & Risik, E. (2010). The impact of corporate financing decision on corporate performance in the absence of taxes: Panel data from kuwait stock market.

- Arthur, J.B. (1994). Effects of human resource systems on manufacturing performance and turnover. Academy of Management Journal, 37(3), 670-687.

- Azar, Y., Bartal, Y., Feuerstein, E., Fiat, A., Leonardi, S., & Rosén, A. (1999). On capital investment. Algorithmica, 25(1), 22-36.

- Azhagaiah, R. (2011). The impact of capital structure on profitability with special reference to IT industry in India. Managing Global Transitions, 9(4), 371-392.

- Barney, J. (1991). Firm reources ad sustained competitive advantege. In Journal of Management (Vol. 17, pp. 99–120).

- Barney, J.B., & Wright, P.M. (1998). On becoming a strategic partner: The role of human resources in gaining competitive advantage. Human Resource Management, 37(1), 31-46.

- Becker, G.S. (1993). Human Capital; A Theoretical and Empirical Analysis with Special Reference to Education. In Notes and Queries (Third, Vols. s1-IV, Issue 92). The University of Chicago Press.

- Bolubunmi, I.O. (2018). The effects of financial decisions on the performance of commercial banks in Nigeria. Journals in Business & Management, 10(8), 123-128.

- Boselie, P., Paauwe, J., & Jansen, P. (2001). Human resource management and performance: Lessons from the Netherlands. International Journal of Human Resource Management, 12(7), 1107-1125.

- Brown, J.R., Fazzari, S.M., & Petersen, B.C. (2009). Published by?: Wiley for the american finance association financing innovation and growth?: Cash flow , external equity , and the 1990s R & D boom. The Journal of Finance, 64(1), 151-185.

- Carson, M., & Woodley, M. (2013). Adapting in tough times?: The growing resilience of UK SMEs. The Economist, 20.

- Caselli, S., & Negri, G. (2018). Theoretical foundation of private equity and venture capital. Private Equity and Venture Capital in Europe, 19-25.

- Cicea, C., Popa, I., Marinescu, C., & ?tefan, S.C. (2019). Determinants of SMEs’ performance: Evidence from European countries. Economic Research-Ekonomska Istrazivanja , 32(1), 1602-1620.

- Cui, J., De Jong, F., & Ponds, E. (2011). Intergenerational risk sharing within funded pension schemes. Journal of Pension Economics and Finance, 10(1), 1-29.

- Daud, W.M.N.W., Norwani, N.M., Mansor, A.A., & Endut, W.A. (2016). Does financing decision influence corporate performance in Malaysia? International Journal of Economics and Financial Issues, 6(3), 1165-1171.

- David, F.R. (2017). Strategic management: A competitve advantage approach. In Pearson Education Limited.

- Detthamrong, U., Chancharat, N., & Vithessonthi, C. (2017). Corporate governance, capital structure and firm performance: Evidence from Thailand. Research in International Business and Finance, 42(July), 689-709.

- Drábek, J., Lorincová, S., & Javor?íková, J. (2017). Investing in human capital as a key factor for the development of enterprises. Issues of Human Resource Management, June.

- Etzioni, A. (1960). Two approaches to organizational analysis: A critique and a suggestion. Administrative Science Quarterly, 5(2), 257.

- European Commission. (2020). Annual report on European SMEs 2019. In Annual report on European SMEs 2019.

- Farr, J.V., Faber, I., Farr, J.V., & Faber, I. (2019). The basic theory of interest. Engineering Economics of Life Cycle Cost Analysis, 93-112.

- Fee, C.E., Hadlock, C.J., & Pierce, J.R. (2011). Investment, financing constraints, and internal capital markets: evidence from the advertising expenditures of multinational firms. SSRN Electronic Journal.

- Fleischhauer, K.J. (2011). A Review of Human Capital Theory: Microeconomics. SSRN Electronic Journal.

- Foreman-Peck, J., & Nicholls, T. (2012). Peripherality and the impact of SME takeovers.

- Frese, M., & Rauch, A. (2001). International encyclopedia of the social & behavioral sciences. International Encyclopedia of the Social & Behavioral Sciences, 4552-4556.

- Ghadome, T. (2008). The decision to finance and its impact on company’s performance: An empirical study on a sample of companies listed on the AMMAN Stock Exchange Securities. Journal of Jordian Applied Sciences, 6(5), 1-24.

- Hair Jr, J.F., Hult, G.T.M., Ringle, C., & Sarstedt, M. (2016). A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications.

- Han, T.S., Lin, C.Y.Y., & Chen, M.Y.C. (2008). Developing human capital indicators: A three-way approach. International Journal of Learning and Intellectual Capital, 5(3-4), 387-403.

- Hartomo, G. (2020). Terkuak, ini kontribusi UMKM bagi Perekonomian Indonesia?: Okezone Economy. 1.

- Jaisinghani, D., & Kanjilal, K. (2017). Non-linear dynamics of size, capital structure and profitability: Empirical evidence from Indian manufacturing sector. Asia Pacific Management Review, 22(3), 159-165.

- Kaaro, H. (2001). The Association Between Financing Decision and Investment Decision. Jurnal Ekonomi Dan Bisnis, 7(2), 151-164.

- Lin, S.C., & Huang, Y.M. (2005). The role of social capital in the relationship between human capital and career mobility: Moderator or mediator? Journal of Intellectual Capital, 6(2), 191-205.

- Love, I. (2003). Financial development and financing constraints: international evidence from the structural investment model. Review of Financial Studies, 16(3), 765-791.

- Mahfud, S., & Ratmono, D. (2013). Analysis of SEM-PLS with WarpPLS 3.0. Andi.

- Marvel, M.R., Davis, J.L., & Sproul, C.R. (2016). Human capital and entrepreneurship research: A critical review and future directions. Entrepreneurship: Theory and Practice, 40(3), 599-626.

- Misoska, A.T., Dimitrova, M., & Mrsik, J. (2016). Drivers of entrepreneurial intentions among business students in Macedonia. Economic Research-Ekonomska Istrazivanja , 29(1), 1062-1074.

- Munir, A.R., Ilyas, G.B., Maming, J., & Kadir, N. (2019). The Effect of Geo-Cultural Product Attractiveness on Marketing Performance: A Conceptual Framework. Quality-Access to Success, 20(173), 54-58.

- Nohong, M., Ali, M., Sohilauw, M., Sobarsyah, M., & Munir, A. (2019). Financial literacy and competitive advantage: SME strategy in reducing business risk. Espacios, 40(32).

- Peteraf, M. (1989). The cornerstones of competitive Adv: RBV of firm. Smj, 53, 160.

- Pfeffer, J., & Salancik, G.R. (1978). The external control of organizations: A resource dependence perspective. Harper & Row.

- Pinchevska, O., & Šmidriaková, M. (2016). Wood particleboard covered with slices made of pine tree branches. Acta Facultatis Xylologiae, 58(1), 67-74.

- Ployhart, R., Weekley, J., & Ramsey, J. (2009). The consequences of human resource stocks and flows: A longitudinal examination of unit service orientation and unit effectiveness. Academy of Management Journal, 52(5), 996-1015.

- Popov, A. (2014). Credit constraints and investment in human capital: Training evidence from transition economies. Journal of Financial Intermediation, 23(1), 76-100.

- Potkany, M., & Krajcirova, L. (2015). Quantification of the volume of products to achieve the break-even point and desired profit in non-homogeneous production. Procedia Economics and Finance, 26(15), 194-201.

- Sohilauw, M.I., Nohong, M., & Sylvana, A. (2020). The relationship between financial literacy, rational financing decision, and financial performance: An empirical study of small and medium enterprises in Makassar. Jurnal Pengurusan (UKM Journal of Management), 59(0), 1-15.

- Steers, R.M. (1975). Problems in the Mea- surement of Organiza- tional Effectiveness. Administrative Science Quarterly, 20, 546-558.

- Subramony, M., Krause, N., Norton, J., & Burns, G.N. (2008). The relationship between human resource investments and organizational performance: A firm-level examination of equilibrium theory. Journal of Applied Psychology, 93(4), 778-788.

- Thompson, J.D. (1967). Organizations in action. McGraw Hill.

- Ukenna, S., Ijeoma, N., Anionwu, C., & Olise, M.C. (2010). Effect of investment in human capital development on organisational performance: Empirical examination of the perception of small business owners in Nigeria. European Journal of Economics, Finance and Administrative Sciences, 26, 93-107.

- Weisbrod, B.A. (1966). Investing in human capital. The Journal of Human Resources, 1(1), 5-21.

- Wuttaphan, N. (2017). Human capital theory: The theory of human resource development, implications, and future. Rajabhat Journal of Sciences, Humanities & Social Sciences, 18(2), 240-253.

- Younus, S., Ishfaq, K., Usman, M., & Azeem, M. (2014). Capital Structure and Financial Performance: Evidence from Sugar Industry in Karachi Stock Exchange Pakistan. International Journal of Academic Research in Accounting, Finance and Management Sciences, 4(4), 272-279.

- Zhao, Y.L., Song, M., & Storm, G.L. (2013). Founding team capabilities and new venture performance: The mediating role of strategic positional advantages. Entrepreneurship: Theory and Practice, 37(4), 789-814.