Research Article: 2019 Vol: 22 Issue: 3

Forensic Economic Examination as a Means of Investigation and Counteraction of Economic Crimes in East Europe (example of Ukraine)

Khalymon Serhii, National Academy of the State Border Guard Service of Ukraine named after B. Khmelnitsky

Polovnikov Vadym, National Academy of the State Border Guard Service of Ukraine named after B. Khmelnitsky

Kravchuk Oleg, Khmelnytsky University of Management and Law

Marushchak Oleksandr, Chernihiv National University of Technology

Olena Strilets, Chernihiv National University of Technology

Abstract

The countries of Eastern Europe, in their quest for European and global space, must carry out a great work on the unshadowing of economy. Today, Ukraine is a prime example of such work, using one of the most effective tools economic expertise’s. The purpose of this study is to analyze the essence of economic expertise, its practical significance both for investigation and for counteracting economic crimes. Ukraine’s experience should be a qualitative example for Eastern European countries that are striving to counteract economic crime and the shadow economy.

Keywords

Shadow Economy, Economic Crime, Economic Expertise.

Introduction

The unstable socio-economic, socio-political situation and aspirations of Ukraine to the European legal and economic space requires the construction of a comprehensive system of measures for the unshadowing of national economy. Being in the center of Eastern Europe and having territorial borders with the European Union, Ukraine can become a vivid example of positive transformations and shifts in the economic sphere. The basis of the shadow economy of Ukraine consists of economic crimes and therefore it is necessary to foresee effective means and mechanisms aimed at preventing economic crimes. The relevance of this study is also explained by a complex of threats to the national security of the state, reflected in the Strategy of National Security of Ukraine, approved by the Decree of the President of Ukraine (National Security and Defense Council of Ukraine, 2015). The urgent threats to the national security of Ukraine of economic direction are: spread of corruption, its rooting in all areas of public administration; weakness, dysfunctionality, outdated model of public institutions, deprofessionalization and degradation of civil service; actions by state bodies in corporate and personal interests, which leads to violations of the rights, freedoms and legitimate interests of citizens and business entities; monopoly-oligarchic, low-tech, resource-cost economic model; high level of "shadowing" and criminalization of the national economy, criminal-clan system of distribution of public resources; deformed state regulation and corrupt pressures on business.

The development of market relations in the economies of Eastern Europe has led to an increase in the number economic and tax crimes. A criminal case of embezzlement and economic mismanagement associated with the violation of the established rules of conducting accounting and drawing up accounting (financial) statements, obfuscating, and veiling the commodity-monetary transactions and forgeries in the documents. This is due to the fact that economic and production operations, the movement of inventory and cash are issued by the relevant documents and accounting records. Therefore, officials, committing forgery, theft and other violations and abuses, as it were forced to leave their "

Yanchuk et al. (2016) note that there are no universal mechanisms for combating shadowing, reducing tax base and moving profits abroad, though there are internationally approved successful practices. Ukraine must discover a set of tools that would stimulate acknowledge by all the subjects of public relations the civil responsibility for taxes payment.

One of the important directions for the prevention of economic crime is an economic examination, primarily as a means of studying the activities of economic entities. The development of accounting and raising the level of understanding of its role led to its significant expansion in various spheres of society. As a result, the emergence of new fundamentally new economic and legal relations between economic entities of various organizational-legal forms and government bodies, the diversification of ways to conceal income, distortions in accounting financial reporting necessitate a comprehensive study of theoretical, methodological and organizational-methodical aspects of conducting economic expertise.

Despite the study of the problems of using economic expertise, the theoretical and practical principles of conducting economic examinations remain insufficiently covered in scientific publications. The study of this issue is relevant for both foreign and domestic scholars, but it should be noted that the impact of forensic economic expertise in counteracting economic crimes remain insufficiently studied.

Concept and Essence of Economic Expertise

It should be noted that there is a stereotype on the identification of the concepts of forensic accounting expertise and forensic economic expertise. This conception of identification has arisen as a result of the fact that there was no forensic economic examination before, and there was a complex interdisciplinary science judicial accounting, which was used for solving such tasks. Judicial accounting required reform in a result of the development of economic relations, the system of settlements and transfers, the development of the banking sector, changes in the tax system, as the questions list, which were addressed to expert accountants has considerably expanded. This list went beyond their competence. The Institute for Forensic Economic Expertise was established in 2001. Today it consists of three types of expertise: the study of accounting documents, tax accounting and reporting; the study of documents on the economic activities of enterprises and organizations; and the third the examination of financial and credit operations. Today, this structure does not cause contradictions, but it is quite possible that with the development of market and technology this structure will also undergo changes in the future.

It is also should be noted that the economic expertise should not be identified with the traditional practice of auditing, which is more general and uses a random sample. Unlike the audit, the economic expertise is localized and usually focuses on a specific problem (Overchuk, 2013).

Economic expertise is a study of the financial and economic activity of a business entity that is carried out by a person with special knowledge in the field of economics and accounting (expert accountant) within the framework of the current legislation with a view to present a conclusion on the range of issues posed by operational units, bodies of pre-trial investigation or court.

Forensic accounting can be defined as assistance in disputes regarding allegations or suspicion of fraud, which are likely to involve litigation, expert determination, and enquiry by an appropriate authority and investigations of suspected fraud, irregularity or impropriety which could potentially lead to civil, criminal or disciplinary proceedings. The focus is primarily on accounting issues, but the role of the forensic accountant may extend to more general investigation which includes evidence gathering. It is because of the fact that by definition, forensic assignments are related to judicial or quasi-judicial dispute resolution, that the forensic investigator requires a basic understanding of the applicable statutory and common law, the law of evidence and the law of procedure. The most competently conducted investigation will be of no value to the client should the evidence gathered be ruled to be inadmissible or the expert accounting witness be found to fall short in respect of the requirements of expertise, credibility, or independence (Institute of Certified Public Accounting Pakistan (ICPAP), 2010).

We agree with Perevozova (2013) opinion that economic expertise is undoubtedly a form of implementation of financial and economic control, including its judicial form, is initiated by judicial and law enforcement agencies in order to combat economic and tax crime. The feasibility of using it is a proven reality for the study and evaluation of the activities of individual enterprises, their separate units, as well as management systems regarding their compliance with legislative, normative and regulatory aspects.

One of the main objects of the forensic accounting study is operations with cash. Since cash is the most liquid assets, it can be easily removed from circulation, hidden and spent. That is why it is the most likely to be abducted both at enterprises and in budgetary institutions. When cases involving theft of funds are considered, conducting of forensic examination is obligatory for determining the degree of person's responsibility, determining the amount of theft and setting the time for theft of money (Rozborska et al., 2016).

Proper use of case materials helps the expert accountant to clarify the circumstances related to the process of registration of accounting documents on their purpose, the conditions under which they were then presented, as well as to obtain information about the stages of passing documents in the accounting system and about the actions performed on their basis (for example, on settlements with debtors and creditors, accountable persons, etc.). Only using all case materials relevant to the subject matter of the examination, the expert can conduct a full study and give exhaustive answers to the questions. This goal will not be achieved if the expert is limited by accounting documents and conclusions of other experts or if to prohibit taking into account the testimony of witnesses, defendants, victims, etc. (Uzhva & Rotaru, 2014).

Application of Economic Expertise in Investigation of Economic Crimes

Economic expertise is the most common type of forensic examination, which is appointed during the investigation of criminal offenses (especially crimes in the sphere of economic activity), and in civil and economic litigation when resolving disputes on economic issues in cases when it is necessary to apply special knowledge of accounting and analysis of financial economic activity of the enterprise.

Analysis of judicial practice shows that among economic crimes the most common are crimes related to the illegal spending of targeted budget funds, tax evasion and obligatory payments, legalization (laundering) of income obtained criminally, fictitious entrepreneurship, etc. The so-called “white-collar” crime organizes its criminal activities by creating criminal groups, including representatives of state authorities, and requires proper qualifications to conduct pre-trial investigations of such crimes, including due to the knowledge of economic processes.

In Ukraine in 2011, taxes accounted for 83.15% of the state budget revenues, in 2012-83.4%, in 2013-70.17%, in 2014-73.18%, in 2015-68.98%. After analyzing the data of the socio-economic burden in Ukraine, it should be recognized that in 2013-2014 there was a slight decrease in this indicator, but in 2015 the tax burden increased again. At the same time, in 2015 the percentage of state budget revenues from taxation was the lowest. This indicates that the increase in the level of tax burden is accompanied by the transition of some part of the business to the shadow sector. The amounts of unpaid taxes from the shadow economy of Ukraine indicate an increase in the country's budget losses in recent years. Thus, in 2011 about 130.8 billion UAH were lost, and in 2014 this amount was 140.1 billion UAH, and in 2015 the loss from shadowing was already UAH 204.7 billion, which was 38.3 % of the country's budget. This shows that the problem of tax evasion is directly related to a decrease in economic activity, a movement of capital abroad, a slowdown in the growth rate of gross domestic product. With a low tax burden, budgets of all levels receive less money and cannot finance economic and social development programs (Tokarieva and Timoshchenkova, 2018).

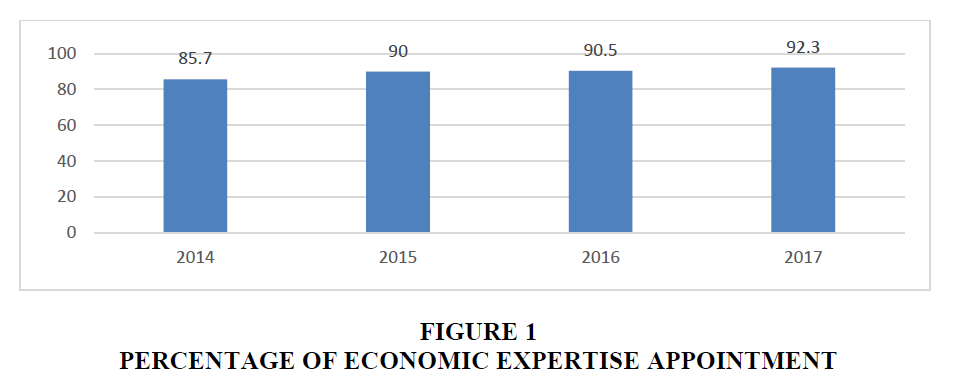

As a result of our research, the questionnaire survey of SFS investigators was conducted (the State Fiscal Service of Ukraine is the central executive body, which is directed and coordinated by the Cabinet of Ministers of Ukraine and implements state tax policy and state policy in the fight against crime when applying tax and customs legislation, as well as legislation on the payment of a single fee), and it was found that when investigating crimes related to evasion of taxes, fees (compulsory payments), the following types of expertise are the most common: forensic-graphological–66.7%; technical-criminalistics–38.1%; economic–90.5%; computer forensics–4.8% (Marushchak, 2017).

To establish more substantial data, an additional survey was conducted and an economic expertise was established during the investigation of 90% (average 2014-2017) proceedings (Figure 1)

The PwC’s 2014 Global Economic Crime Survey, which was based on the responses of over 5,000 respondents, stated that accounting fraud had always been one of the major crimes reported in their surveys. In 2014 22% of respondents reported experiencing accounting fraud (Zagera et al., 2016).

It should be noted that economic expertise is carried out on the principles and rules inherent in all forensic examinations. Forensic science therefore requires a specifically ‘forensic science’ evidence base that underpins each part of the forensic process. That evidence base needs to incorporate data that address the two major aspects of trace interpretation: trace evidence dynamics: the transfer, persistence, preservation of trace materials to allow inferences to be evidence based and the significance and weight of evidence to be transparently established; human decision-making in the interpretation of trace materials: the interaction of expertise, experience, and cognitive biases and their impact on decision-making, particularly probabilistic decision-making, under conditions of uncertainty (Morgan, 2017). One of function of forensic accounting to assist in investigations. Investigation is the initial stage of punishing criminals and investigating into the criminal responsibility (Renzhou, 2011). So, the study of the problems of using economic expertise as a means of forensic support for economic crime, including in the field of taxation, is acquiring particular relevance.

Economic Expertise as a Tool for Counteracting Economic Crimes

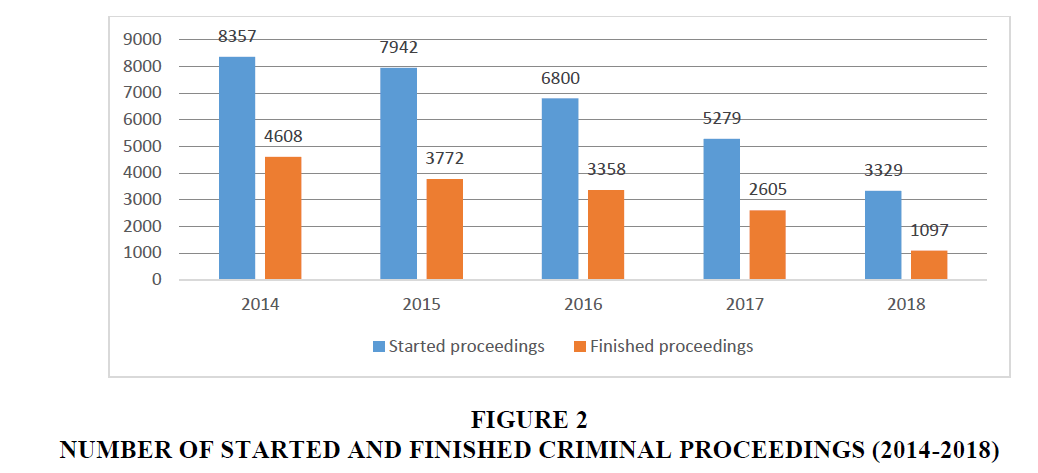

One of the functions of a forensic examination is its preventive activity; a synthesis of expert practice and the development of scientific recommendations for effective counteraction to crimes is carried out as a result of forensic expertise. In the case of economic expertise, the preventive function is implemented in the proper way. According to reports of the pre-trial investigation authorities of the State Fiscal Service of Ukraine for 2014-2018, we can state that the total number of criminal proceedings initiated by the pre-trial investigation authorities of the SFS of Ukraine is rapidly decreasing. At the same time, we observe that the statistics on the termination of criminal proceedings are not very comforting; despite the decrease in the total number of initiated criminal proceedings the percentage of their closure remains at the same level - on average 49.5% and 33% in 2018 (Figure 2).

In conclusion, it is important to note that while forensic accounting is gaining significant research interests among academics, progress in forensic accounting research will continue will depend on the extent to which fraud perpetrators leave traces. This is because fraud perpetrators do leave traces after performing the act. However, in the coming years, regulators will be more concerned about fraud perpetrators who do not leave any trace of some sort. This will pose a problem for regulators if perpetrators have thorough knowledge of accounting standards, auditing techniques and investigative skills. This knowledge will help perpetrators to eliminate a possible trace of fraud. This will remain a supervisory and policy issue in the coming years. Finally, the progress in the forensic accounting literature will also depend on the extent to which forensic accounting informs practice and policy (Peterson, 2015).

The fight against financial crimes is based on the norms of national legislation, at the same time; other countries in the context of globalization are trying to combine efforts and resources to effectively counter this type of crime. Such intentions find their reflection in international legal acts. Such acts that directly relate to the fight against financial offenses are: Council of Europe Convention on Laundering, Search, Seizure and. Confiscation of the Proceeds from Crime and on the Financing of Terrorism, 2005; The UN Convention against Transnational Organized Crime, 2000; United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, 1998, etc. (Vakulyk et al., 2019).

Prospect of Development and Application of Economic Expertise

Avey (2004) believes that forensic economic expertise as discipline will continue to respond to business and government conditions and will always strive to upgrade its professional standards. Probably the need for forensic economic experts will not decrease as fraud (economic crime) is an increasing industry.

During the last years, any solution wasn’t elaborated in terms of making changes and amendments to the tax legislation that would offer specific ways of counteracting fraud schemes of taxes evasion. However, it is important to note that the need to improve legal mechanisms of tax administration is conditioned by modern realities and recent events. Besides, the imperfection of legal provisions that regulate taxes and cash-flaws between legal entities is still relevant. It favors the development of pseudo-entrepreneurship. Pseudo-entrepreneurship and pseudo-bankruptcy represent one of the main problems of tax control. This implies that a person becomes criminally liable only in case of registering a legal entity as a commercial organization. Such organizations are established with the only purpose of accessing the credits, of tax exemption, achieving other property gains or concealing proscribed activities (Turuntayeva et al., 2019).

Accordingly, an expert in the field of economic crime must meet not only the qualification requirements, but to be developed in many spheres in order to be a true professional of his business. In Stevenson (2015) opinion today’s forensic accountant must be able to run the gamut of investigative assignments, from developing income forecasts to identifying fraudulent digital information, and-in an expanded perspective of forensic practice-preventing cyber-attacks against company systems. All work product information must be presentable in the courtroom and include digital metadata. The computer skills required for this analysis go beyond the proficiency used to create spreadsheets. A forensic accountant must be able to administer personal computer and mobile device electronic evidence that must be forensically extracted and properly preserved. These communication devices can provide key evidence in fraud investigations. The forensic accountant’s identification of financial risks go beyond the evaluation of weak internal controls, and are related to the security of Internet connections and ability of cybercriminals to penetrate a company’s systems.

Davis et al. (2010) undertook a survey involving 779 respondents from forensic professionals and fraud examiners to identify core skills of a forensic accountant or investigator. Their result was divided into three categories: core skills for forensic academics, practitioners (CPAs) and attorneys; enhanced skills and professional skills. According to Davis et al. (2010), the top five core skills for the academics include: critical and strategic thinking, auditing skills, investigative ability, synthesis of results and thinking like the wrong-doer, etc., while the top five skills for the practitioner (e.g., a CPA) include: Critical and strategic thinking; effective written communication; effective oral communication; and investigative intuitiveness (Peterson, 2015).

Conclusion

Today the creation of a single, affordable world economic space, which the countries of Eastern Europe seek to fully integrate, is under the influence of globalization. Ukraine is the largest country in Europe with huge potential and has large socio-economic and socio-political problems caused by the shadow economy, which is based on economic crimes. As a result of the research of the scientific component and statistical data provided by SFS, it can be stated that economic expertise in Ukraine is an effective means of both investigating and counteracting economic crimes, thanks to the qualitative work on analyzing the results of examinations and developing effective methods for preventive activities in this area and as the result of unshadowing national economy. In general, the value of forensic economic examination is that the expert opinion is evidence in the courts, on its basis, together with other evidence can be established guilt or innocence of a person in the commission of an offense or a crime, the issue of his criminal prosecution. Forensic expertise in the field of economics is rapidly developing, as it responds to technological changes and innovations that take place in the field of accounting, and in the field of settlements and remittances. The Institute of Economic Expertise is developed very well in Ukraine as well as throughout the Soviet space, and accordingly it needs to be used qualitatively for counteracting economic crime. The results of Ukraine can be a vivid example of positive changes and shifts in the economy. Ukraine's experience should be a good example for Eastern Europe, which seeks to counteract economic crime and the shadow economy.

References

- Avey, T. (2004). The evolution of forensic accounting. The Metropolitan Corporate Counsel.

- Davis, C., Farrell, R., & Ogilby, S. (2010). Characteristics and Skills of the Forensic Accountant. American Institute of Certified Public Accountants.

- Institute of Certified Public Accounting Pakistan (ICPAP). (2010) Forensic accounting, study note. Specialization Module 6 SP 611.

- Marushchak, O.A. (2017). Criminalistic characteristics of evasions from payment of taxes, duties (obligatory payments) and main principles of their investigation. Dissertation in support of candidature of Juridical Degree (Doctor of Philosophy). Kryvyi Rih.

- Morgan, R.M. (2017). Conceptualizing forensic science and forensic reconstruction. Part I: A conceptual model. Science and Justice, 57(1), 455–459.

- National Security and Defense Council of Ukraine. (2015). National security strategy of Ukraine. Retrieved from URL:http://zakon5.rada.gov.ua/laws/show/287/2015/

- Overchuk, D.S. (2013). Development of forensic accounting expertise in the USA and Canada at the turn of XX century. Actual problems of Russian law, 8(1), 1017-1023.

- Perevozova, I.V. (2013). Nominative field of the concept economic expertise in the modern conditions of its application in the process of financial control. Economics: The realities of time, 2(7), 150-156.

- Peterson, O. (2015). Forensic accounting and fraud: A review of literature and policy implications. International Journal of Accounting and Economics Studies, 3(1), 63-68.

- Renzhou, D. (2011). Research on legal procedural functions of forensic accounting. Energy Procedia, 5(1), 2147–2151.

- Rozborska, A., Datsenko, V.G., Ksonshka, A.V. (2016). Peculiarities of conducting a forensic accounting of operations with cash. Economy and society, 2(1), 720-724.

- Stevenson, S.G. (2015). The past, present and future of forensic accounting.

- Tokarieva, K.O., & Timoshchenkova, N.V. (2018). Deprivation of the payment of taxes and ways of its overcoming in Ukraine and foreign countries. Law and Innovation, 1(21), 69-74.

- Turuntayeva, A., Tlegenova, F., Kassiyenova, K., Abrakhmatova, G., Radzhapov, A., Alshymbek, D. (2019). Improving the effectiveness of tax administration through the example of the republic of Kazakhstan. Journal of Legal, Ethical and Regulatory Issues, 22(2), 1-8.

- Uzhva, A.M., & Rotaru, T.V. (2014). Conducting forensic accounting as a component of economic control. Finance, accounting, banks, 1(1), 264-269.

- Vakulyk, O.O., Andriichenko, N.S., Reznik, O.M., Volik, V.V., Yanishevska, K.D. (2019). International aspect of a legal regulation in the field of financial crime counteraction by the example of special services of Ukraine and the Cis countries. Journal of Legal, Ethical and Regulatory Issues, 22(1), 1-7.

- Yanchuk, A.O., Klemparskiy, ?.M., & Zaverbnyy, Y.A.S. (2016). Modern trends of development of shadow economy and methods of public policy of counteraction. Scientific Bulletin of Polissia, 4(8), 51-56.

- Zagera, L., Malis, S.S., & Novaka, A. (2016). The role and responsibility of auditors in prevention and detection of fraudulent financial reporting. Procedia Economics and Finance, 39(2), 693-700.