Research Article: 2021 Vol: 20 Issue: 3

Formation of the State Financial Control System in the Context of Digitalization

Veronika Olegovna Kozhina, Moscow International University

Natalia Aleksandrovna Zavalko, Financial University under the Government of the Russian Federation

Olga Evgenievna Matyunina, Russian New University

Galina Stanislavovna Dyakova, Russian New University

Naylya Rifatovna Amirova, Plekhanov Russian University of Economics

Lyudmila Vasilyevna Sargina, Plekhanov Russian University of Economics

Abstract

The article deals with the development of approaches to forming a system of state financial control in the context of digitalization. It is established that the system of state financial control should meet the requirements of economic efficiency, that is, control costs should not exceed forecast losses when no control measures are taken. This requirement also implies the need to optimize the organizational structure of state financial control, that is, identify and simplify superfluous elements, the perfect combination of centralized and decentralized management in the structure of bodies. It is proven that the efficiency of the state financial control system is associated primarily with whether control activities are regulated, that is, all elements of a control organization cannot operate smoothly without regulations and without applying standard solutions in certain situations. That is why one must establish procedures that determine the nature, scale, frequency and timing of control procedures. It is determined that a joint system of state financial control is a complex multilevel system formed with some subsystems, each of which has a particular structure and development logic. Therefore, an important requirement for a common system is the need to control bodies based on smooth cooperation and coordination of all efforts for financial control in the context of digitalization. That is why at present it is so important to develop various digital systems that foster process optimization in state financial control bodies.

Keywords

System, State, Financial Control, Digitalization, Management, Efficiency, Strategy, Development.

Introduction and Literature Review

An urgent and important scientific and practical task of state administration as a science is to substantiate the use of form-building mechanisms of public management of financial resources by forming an effective system that implements certain functions of the state and its institutions in the context of digitalization. Therefore, it is necessary to actualize the issues of improving the mechanisms of state financial control and clarifying the main aspects of state administration.

In this case, it is important to determine the best ways of developing the system of state financial control in the Russian Federation based on the results of performing delegated duties by the control subjects in the digital economy. Moreover, the analysis of the current legislative and regulatory legal acts allows one to note the absence of an integral system of state financial control, which entails a slowdown in the processes of socio-economic development of Russia.

The aspects of the functioning of the state financial control system were described in the works by Aliyev et al. (2017); Buletsa & Deshko (2018); Datta et al.(1998); Evstratova (2017); Kari (2015); Loseva & Zabolotina (2017); Lozovanu & Pickl (2010); Lukin (2019); Mikhaseva (2016); Muratbekova (2016); Pikhotskyi (2017); Shvagla (2019) and others. However, the review of academic works indicates the presence of basic contradictions between the need and the feasibility of forming a system of state financial control in the context of digitalization.

Methodology

We used the formalization method as the main research method, which was used to structurally substantiate the components of the state and financial control system. The procedure entailed formalizing the strategy of the state financial control subjects, which made it possible to strengthen and formulate a clear development plan and create the basis for the development of detailed measures for forming a system of state financial control in the context of digitalization.

We used analysis which includes the collection and processing of the necessary information as a theoretical subject of research into the system of state financial control. The uncertainties of the external environment, its constant volatility and unpredictability as well as the specific features of the internal environment determine the particular importance of the state financial control system for government bodies. To use specific tools, the problem of information support and the choice of methods for analytical processing of information in the system of state financial control were solved.

For an empirical direction, we used the mechanism of integration of financial and non-financial characteristics, a system of strategic regulation based on detailed performance monitoring for choosing a set of optimally selected indicators that fully reflect all aspects of state financial control in the context of digitalization. Therefore, the development strategy for the system of state financial control will be efficient when the issues related to various activity areas of state structures are considered.

Results and Discussion

Research shows that the system of state financial control in its entirety is an important component of a country's socio-economic development. At the same time, the relationship between the categories “finance and system of state financial control” appears when building a logical chain of concepts: “finance–financial system–public finance–budget system-financial security of the state–system of state financial control”.

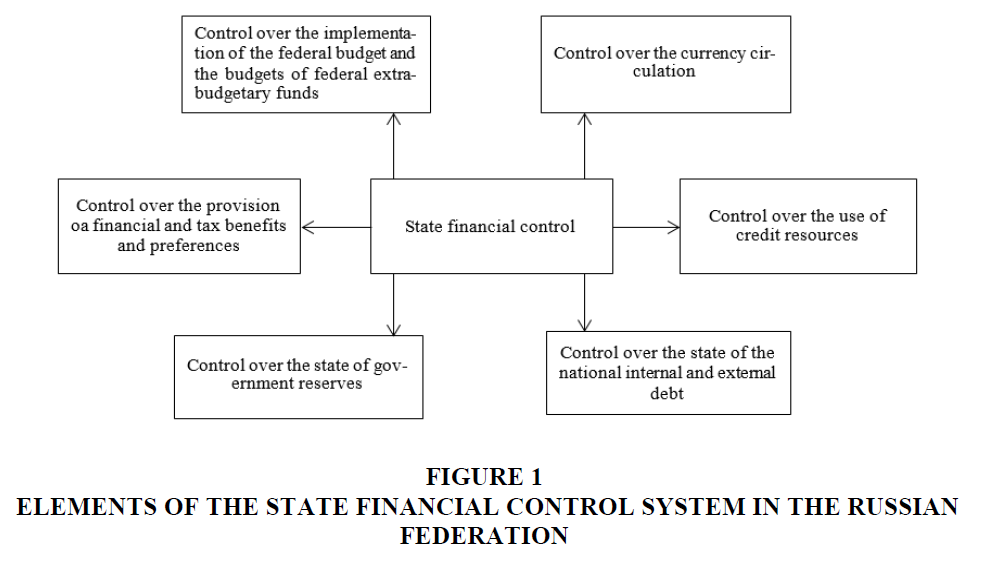

The system of state financial control combines many elements and connections of a lower order and produces a system of a higher order capable of self-development (Abanina et al., 2018; Frolova et al., 2018; Kozhevnikova et al., 2020). At the same time, the criteria for the integrity of the state financial control system take into account control over the implementation of the federal budget and the budgets of federal extra-budgetary funds, as well as control over the provision of financial and tax benefits and advantages (Figure 1).

Moreover, the imperfection of the implementation of control measures in the Russian Federation, namely, the poor administration of state budget revenues, makes it necessary to increase borrowing, as a result of which there may be a threat to the financial security and financial independence of the state. All this requires an increase in the efficiency of the use of funds by improving the system of state financial control.

In this case, the assessment of the functioning of individual institutions as components of the state financial control system indicates that the lack of consistency in the application of methods and forms of organization, planning and control activities by various subjects of control is due to the imperfection of the methodological framework of control and shortcomings in the distribution of powers in the context of digitalization.

At the same time, the main factor in the efficient implementation of control functions for compliance with budget legislation is preliminary control of treasury services for the state and local budgets. Such control is based on maintaining a single account, improving the quality of the exercise of powers when crediting receipts, making obligations and making payments under these obligations, compliance to uniform rules by the participants in the budgetary process, timeliness of reporting on the implementation of state and local budgets.

At the same time, the analysis of financial control testifies to the actual growth of revenues and expenditures of the Russian Federation State budget, receipts of funds from the ownership and use of state property, expenditures on public procurement (Demkina et al., 2019; Kosevich et al., 2020; Levchenko et al., 2018). In these conditions, the results of assessing the functioning of the subjects of state financial control, in particular, the divisions of internal control and audit work will be useful for justifying the newest conceptual model of the state financial control system in the context of digitalization.

Research shows that state administration mechanisms are instruments for achieving goals, and their efficient use depends on the availability of the necessary resources. Therefore, the improvement of the system of state financial control and ensuring its integrity occurs through the use of closely interacting financial, organizational and regulatory mechanisms of state administration.

Moreover, the system-forming function of the state organizational mechanism of managing the development of an integral system of state financial control is to form its internal structure and streamline structural links between its elements. In these conditions, the organizational structure with its formative connections that integrate the subject of activity into a complete structure is a set of types (higher, external, internal control), principles (obligation, frequency, priority of control), forms (preliminary, current, follow-up control), methods (review, audit, inspection), elements (subject of control, object and topic of control) and the nature of control (planned, unscheduled, additional).

The need for an in-depth study of the structural links of the formative mechanism in the state financial control system is determined by the need to improve the state management of this process. Therefore, the integrity, that is, the mutual integration of the elements of the system, can be enhanced by adjusting their hierarchy. Based on the integrity of the state financial control system, it is possible to establish structural links between its constituent elements and determine their hierarchical connection.

The first connection is the conformity of control forms to the methods, namely: preliminary control corresponds to audit, current control – to inspection, and follow-up – to review. In this case, the second connection consists in determining the priority of each type of control with the corresponding forms and methods. The third connection is revealed through the principles of the necessity and periodicity of control measures. The fourth connection is the need to overcome the methodological uncertainty of the category, types, forms and methods of control.

The requirement to comply with the principles of frequency, priority and necessity in planning, organizing and implementing control measures is dictated by the need to improve the quality of functioning of an integral system, its ability to carry out control measures using all types of control in relation to all state financial resources (Konovalova et al., 2018; Lebedev et al., 2018; Shaimardanova et al., 2019).

In this case, one must develop a system-forming normative act in the format of the Code of State Financial Control of the Russian Federation. Such an act should secure in state administration a modern conceptual model of an integral system of state financial control, which will make it impossible to deform and destroy the system. The implementation of this provision will increase the efficiency of the entire state financial control system in the context of digitalization.

Research shows that state financial control has recently ceased to be efficient. This is largely because state financial control did not manage to adapt to the changing market environment, and the action, which used to be efficient in the centrally controlled economy, has lost its relevance. Moreover, the system of state financial control is undergoing radical reform and radical restructuring and consists of separate types, methods, forms and subjects.

Meanwhile, each element of the state financial control system has its shortcomings and is far from perfect. In this case, the existing list of shortcomings should be supplemented with general shortcomings that cannot be attributed to a specific element:

1. The system of state financial control does not act as a single system but exists as separate units.

2. The system of state financial control does not meet global requirements due to some circumstances, for example, the prevalence of follow-up control over the preliminary and current.

3. The system of state financial control is not based on a specific model and most of the key provisions are not even enshrined in legislation, which hinders the development of the state financial control system and creates certain difficulties on the way of updating them in the context of the digitalization of the economy.

At the same time, the management system in the Russian Federation is characterized by an imbalance of direct and indirect connections. The country has developed an extensive but insufficiently mobile and capable system of state financial control bodies (Markova et al., 2018; Nikiforov et al., 2018; Zavalko et al., 2018).

State measures in certain areas should ensure the creation of a unified system of state financial control, provided that the requirements for the activities of both state bodies and the entire system are met. Therefore, an important condition for ensuring the efficient functioning of state control bodies is the focus of their control actions, that is, their consistency, optimality and balance, and failure to comply with at least one of these conditions results in inefficient functioning of the entire system of state control. Table 1 shows a list of issues in the implementation of state financial control by the Treasury of Russia and possible ways to solve them.

| Table 1 Possible Ways of Eliminating Issues with the Implementation of State Financial Control by the Treasury of Russia | ||

| Action | Problems in the implementation of procedures related to scheduling, conducting and implementing control activities | Proposals to eliminate problems and reduce the risks of their occurrence |

| Planning control measures in the financial and budgetary sphere | Lack of clear, normatively defined, uniform, regulated and systematized sources of information which are the basis for planning and assigning control measures | Integration into the applied software product Automated Planning System (ASP) of the Federal Treasury of systematized information from various sources (information from information systems of the Federal Treasury as well as other publicly available open information posted on the Internet to select objects of control according to the established criteria of risk intensity when planning control measures |

| Organization and implementation of control activities (planned and unscheduled) | The classification system of violations (risks) does not detail violations (risks), including those associated with illegal and inefficient spending of the federal budget. | The classification system of violations (risks) should be changed including due to changes in the law. It is proposed to clarify the procedure for the implementation of control measures in the departmental standard of the control body. |

| The organization of work on the implementation of the results of the control measures carried out | The absence of a normatively established period associated with the implementation of the carried out control measure and its accounting in the cost of working time, taking into account the timing, results in the fact that after completing the control measure, the verifiers are forced to simultaneously participate in the next control event and collect the materials of the previous one, which affects the quality of the control event. | It is proposed to amend the methodology for calculating load indicators on structural subdivisions of the Treasury of Russia when planning control measures, providing the controller-auditor with the chance to: - initiate cases of administrative offenses and conduct administrative investigations; - enter the results of the control activities into the digital Automated Planning System (ASP); - enter information about the results of the control event in the state information system "Official site of the Russian Federation in the information and telecommunications network “Internet”. |

At present, despite the issues, all executive bodies including the Treasury of Russia are being transformed in the process of digitalization and automation. In view of this, the implementation of state financial control and the mechanism for detecting violations in the financial and budgetary sphere also requires the development of other principles and methods of control. It is also necessary to expand the forms of existing control methods (for example, introduce remote forms when carrying out office audits) while using international experience.

It should be noted that the increase in the volume of information through the expansion of the sources from the control bodies within the framework of the unified system of state financial control significantly complicates the process of analytical processing and decision-making. This, in turn, reduces the efficiency of state financial control; therefore, efficient financial control can only be carried out when control bodies use digital technologies.

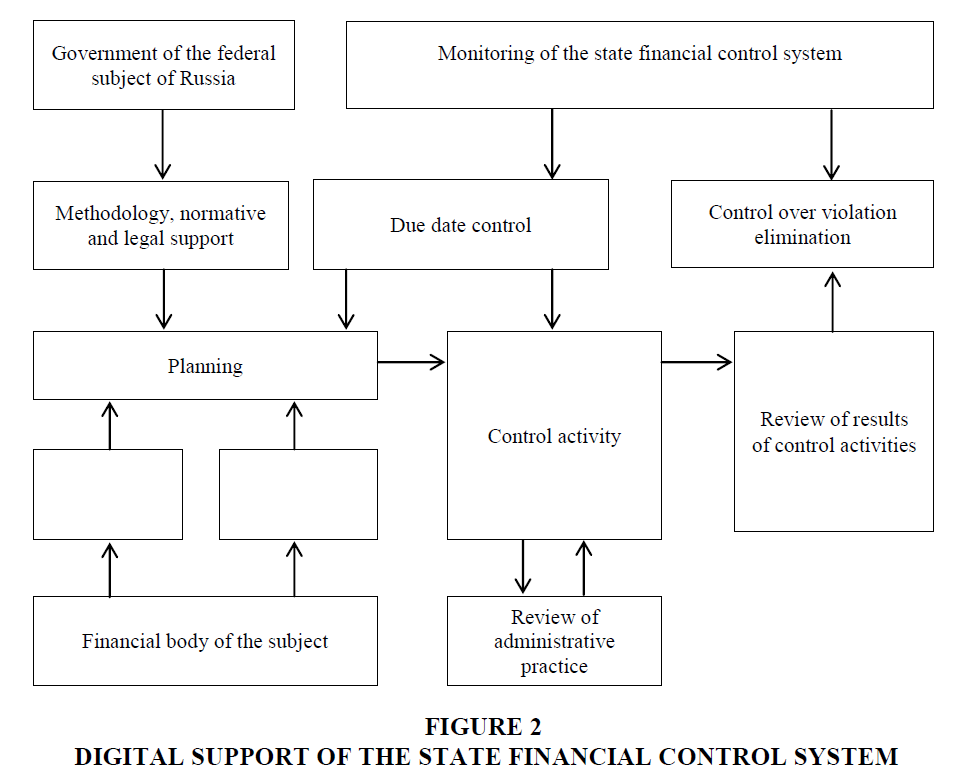

Moreover, the Russian Federation currently lacks a unified concept for designing a digital support system for state financial control bodies. Therefore, the main tasks of the digital system for ensuring financial control should be the formation of plans for control measures; implementing control activities; preparing reports on the results of control measures, their systematization and storage; formation of a database of existing regulatory legal acts; formation of a list of specialists involved in control measures and control over the implementation of decisions on violations within the framework of control issues.Thus, an important requirement for building a unified system of state financial control is the creation of an efficient automated digital analytical system in Russia based on modern technologies, which is designed to collect, store, search and provide information about all control measures carried out and their results, that is, for systematization of control data and generalized provision.

Another requirement should be comprehensiveness and priority. This means that objects of different types for a comprehensive view of their state must be covered by comprehensive control. In this case, the comprehensiveness presupposes the need to cover all the main objects with control over a wide range of issues under control, which requires control of the most important objects.

It is also worth noting that in recent years, the implementation of state financial control in the context of the digitalization of the economy is funded through various national programs. Moreover, the processes of digitalization of the economy determine the development trends of state financial control. In this case, one of the main tasks of the transition to the digitalization of state financial control bodies is the digital support of the state financial control system (Figure 2).

One should note the positive experience of organizing state financial control in several states. For example, in some countries (Australia, Canada, Great Britain, Denmark, India, Egypt, Ireland), the functions of state financial control are performed by individual officials using various digital systems which greatly facilitates and reduces the burden on the budget in the field of financial control.

It is worth noting that in recent years, an important part in reducing the efficiency of implementing state financial control functions has been played by cyber threats, which represent a combination of factors and conditions that create a threat of information security breach. To avoid all negative consequences from cyber threats, it is necessary to further develop digital systems of state financial control.

Currently, the main areas of improvement and development of state financial control from the standpoint of digitalization include the following:

- Unification on one web platform (portal) of identical business processes on different government levels: federal, regional and local;

- Development and application of block chain technology, with the help of which one can increase the level of control over some processes and reduce the time for processing one operation within the framework of state financial control;

- The creation of specialized institutions for the training of specialists who could be competent not only in the economic sphere but also in the legal field. E-Learning is a suitable format for this.

The above requirements should be supplemented with the requirements for optimal centralization and a clear division of the functions of state financial control bodies. Moreover, the dynamism, stability, continuity of the functioning of the system as a whole and each of its bodies is due to the unity and optimal level of centralization and organizational structure.

At the same time, each particular control function should be assigned to only one state financial control body, that is, the assignment of one function to several control bodies is unadvisable. However, the assignment of several control functions to one control body is permissible. Despite this requirement, it is necessary to establish procedures for resolving disagreements that may arise between the employees carrying out the control measure and those who check.

Conclusion

All in all, it can be noted that the system of state financial control should meet the requirements of economic efficiency, that is, control costs should not exceed forecast losses when no control measures are taken. This requirement also implies the need to optimize the organizational structure of state financial control, that is, identify and simplify superfluous elements, the perfect combination of centralized and decentralized management in the structure of bodies.

The efficiency of the state financial control system is associated primarily with whether control activities are regulated, that is, all elements of a control organization cannot operate smoothly without regulations and without applying standard solutions in certain situations. That is why one must establish procedures that determine the nature, scale, frequency and timing of control procedures.

At the same time, one must consider that the joint system of state financial control is a complex multilevel system formed with several subsystems, each of which has a particular structure and development logic. Therefore, an important requirement for a common system is the need to control bodies based on smooth cooperation and coordination of all efforts for financial control in the context of digitalization. That is why at present it is so important to develop various digital systems that foster process optimization in state financial control bodies.

References

- Abanina, I.N., Ogloblina, E.V., Drobysheva, N.N., Seredina, M.I., & Lebedev, K.A. (2018). Methodological techniques for assessing the unevenness of economic development in the world. The Journal of Social Sciences Research, (S3), 8-12.

- Aliyev, M.K., Altynbekov, M.A., Tussibayeva, G.S., Yussupov, U.B., Sagindykova, G.M., Tokbergenov, A.A., & Akimova, B.Z. (2017). Some issues of state audit and ways to address them. International Journal of Economic Research, 14(10), 183-189.

- Buletsa, S., & Deshko, L. (2018). Comprehensive reforms of the health care system in different regions of the world. Medicine and Law, 37(4), 683-700.

- Datta, A., Mukherjee, S., & Viguier, I.R. (1998). Buffer management in real-time active database systems. Journal of Systems and Software, 42(3), 227-246.

- Demkina, N.I., Kostikov, P.A., & Lebedev, K.A. (2019). Formation of professional competence of future specialists in the field of information environment. Espacios, 40(23), 3.

- Evstratova, M.V. (2017). Ways of improvement of the Russian governmental and internal financial control systems. Economics, 9(30), 16-19.

- Frolova, V.B., Dmitrieva, O.V., Biryukov, V.A., Avramenko, G.M., & Lebedev, K.A. (2018). Development of control system of financial and economic results of an enterprise. International Journal of Engineering and Technology (UAE), 7(4.38), 167-170.

- Kari, A. (2015). Monitoring and audit of the state financial resources: The problem of effective system arrangement (the case of the republic of Kazakhstan). Indian Journal of Science and Technology, 8(10), 1-9.

- Konovalova, E.E., Yudina, E.V., Bushueva, I.V., Uhina, T.V., & Lebedev, K.A.E. (2018). Forming approaches to strategic management and development of tourism and hospitality industry in the regions. Journal of Environmental Management & Tourism, 9(2 (26)), 241-247.

- Kosevich, A.V., Novikova, N.G., Gladkikh, V.I., Sharonin, P.N., & Smirnov, M.A. (2020). Improving economic and legal regulation in the tourism sector. Journal of Environmental Management & Tourism, 11(4 (44)), 979-984.

- Kozhevnikova, M.A., Kuznetsova, L.V., Shermazanova, S.V., Lopatinskaya, V.V., & Shelygov, A.V. (2020). The improvement of approaches to service activities teaching. Journal of Environmental Management & Tourism, 11(6), 1508-1514.

- Lebedev, K.A.E., Reznikova, O.S., Dimitrieva, S.D., & Ametova, E.I. (2018). Methodological approaches to assessing the efficiency of personnel management in companies. Journal of Advanced Research in Law and Economics, 9(4(34)), 1331-1336.

- Levchenko, T.P., Koryagina, E.V., Rassokhina, T.V., Shabalina, N.V., & Lebedeva, O.Y. (2018). A project-based approach to ensuring the competitiveness of a region's tourism-recreation complex. Journal of Environmental Management & Tourism, 9(8 (32)), 1706-1711.

- Loseva, N.A., & Zabolotina, A.V. (2017). State audit as a form of financial control budgetary funds. Contemporary Problems of Social Work, 3(1(9)), 31-38.

- Lozovanu, D., & Pickl, S. (2010). Algorithms for solving discrete optimal control problems with varying time of states’transactions of dynamical systems. Dynamics of Continuous, Discrete and Impulsive Systems Series B: Applications and Algorithms, 17(1), 101-111.

- Lukin, A.G. (2019). Risk management technologies within the system of state financial control. TEM Journal: Technology, Education, Management, Informatics, 8(2), 444-453.

- Markova, O.V., Zavalko, N.A., Kozhina, V.O., Panina, O.V., & Lebedeva, O.Y. (2018). Enhancing the quality of risk management in a companyO. Revista Espacios, 39(48).

- Mikhaseva, E. (2016). The ways of improvement of the tax control system in Russia in the new geopolitical conditions based on historical experience and world practice. Eureka: Social and Humanities, 3(3), 13-20.

- Muratbekova, Z.A. (2016). Analysis of the international practices of the occupational potential improvement of the supreme bodies of financial control. Science and Technology, 2, 123-136.

- Nikiforov, A.I., Ryazanova, N.Y., Shishanova, E.I., Lyzhin, D.N., & Lebedeva, O.Y. (2018). Economic and legal support for the use of coastal territories in a tourism-recreation sector. International Journal of Civil Engineering and Technology, 9(13), 1048-1054.

- Pikhotskyi, V.F. (2017). Execution of control functions in public administration. In S.I. Drobyazko (Ed.), Research: tendencies and prospects. Collection of scientific articles (pp. 150-156). Mexico City, Mexico: Editorial Arane, S.A. de C.V.

- Shaimardanova, L.K., Saadulaeva, T.A., Gorshkova, L.V., Pinkovskaya, G.V., & Lebedeva, O.E. (2019). Improvement of the approaches to quality evaluation of transaction cost management. International Journal of Recent Technology and Engineering, 8(1), 129-132.

- Shvagla, M.V. (2019). Problems of development of state financial control in the Russian Federation. Globus: Economy and Law, 6(36), 18-19.

- Zavalko, N.A., Kozhina, V.O., Kovaleva, O.P., Kolupaev, R.V., & Lebedeva, O.Y. (2018). System approach to diagnostics and early prevention of a financial crisis at an enterprise. Journal of Applied Economic Sciences, 13(1).