Research Article: 2021 Vol: 20 Issue: 6S

Fraud Detection Techniques To Prevent Double Billing Fraud: Case of Zimbabwe's Medical Aid Societies

David Chisunga, Harare Institute of Technology

Norazida Mohamed, Accounting Research Institute (ARI), UiTM

Lisa Dambamuromo, Harare Institute of Technology

Abel T Gwanzura, Harare Institute of Technology

Jamaliah Said, Accounting Research Institute (ARI), UiTM

Abstract

The healthcare industry in Zimbabwe is competitive in reference to international standards. The medical insurance, as a part of the healthcare industry, is adversely suffering from the high rate of double billing fraud perpetrated against them and this leads to the societies funding fraudulent claims. The aim of the study was to investigate fraud detecting techniques that are employed in Zimbabwe’s health insurances in stopping double billing fraud. A quantitative research methodology was followed during this study, which adopted a survey research approach. With the assistance of PASW Statistics 18 software and NVivo 11, the empirical data was analyzed. The study revealed that the present fraud detecting techniques employed are ineffective within the detection and prevention of double billing fraud. Consequently, ineffectiveness in detection and prevention of double billing fraud has led to an increase in costs due to inflated claims, increased costs of operations realization of less revenue from insurance premiums, reputational damage among other effects. An all-inclusive approach should be followed to detect and alleviate double billing fraud against these societies. This approach should encompass a budget which should be allocated by the societies to teach and make awareness about the causes and effects of double billing fraud to employees, members, and service providers. A specialized team of research and developers must be established by the Association of Healthcare Funders in Zimbabwe to further look into double billing fraud and proffer new solutions in the fight against such fraudulent acts. There should be a continuous development of better detecting systems which prevent double billing fraud perpetrated against the Medical Aid Societies. Implementing the recommendations from the study will assist healthcare funders to scale back the funds exhausted on fraudulently billed claims, in turn improving their financial feasibility, and decreasing the financial contributions for members.

Keywords

Health Care Fraud, Fraud Detection, Double Billing Fraud

Introduction

Fraud in healthcare is regarded as a worldwide problem and Zimbabwe is one of the countries that is not immune to this risk (Ogunbanjo & van Bogaert, 2014; Board of Healthcare Funders of Southern Africa, 2013). The perpetration of fraud against medical schemes was pointed out as one of the factors contributing to rising costs (Rama & McLeod, 2001). Erasmus, Ranchod, Abraham, Carvounes & Dreyer (2016) went on to categorized double billing fraud as one of the reasons of increasing healthcare costs.

From the claims made in several studies that fraud is a risk in medical claims, Zimbabwe’s medical aid societies, as part of the healthcare system, would also face a similar challenge. Medical Aid Societies (MAS) in Zimbabwe are utilised by about a tenth of the population and approximately 80% of income, which is channelled to private health care providers in Zimbabwe comes from MAS and statistics show that, they contribute more than 20% of the country’s total health expenditure.

In Zimbabwe, medical aid schemes are voluntary as they deal directly with employers and consumers, avoiding agent costs. However, this also limits employee discretion in choice of society and inhibits competition in the industry (Munyuki & Jasi, 2009).

Healthcare is susceptible to fraud because of the way it's designed. Unlike other industries, the value of services or goods is usually paid by the third party, which can be government programmes or private insurance (Benson & Simpson, 2015). Seldom do perpetrators target only one insurer or either the public or private sector exclusively. Rather, most are found to be defrauding public sector victims such as medical aid societies and private sector victims simultaneously. Though the amount lost to health care fraud and abuse cannot be precisely quantified, the consensus is that a significant percentage is paid to fraudulent or abusive claims. Many private insurers estimate the proportion of healthcare dollars lost to fraud to be in the range of 5-10% (ACFE, 2018), which amounts to more than millions annually. It is widely accepted that losses due to fraud and abuse are an enormous drain on both the public and private healthcare systems.

As the researcher looks at it, in the case of Zimbabwe, ethical transgressions sanctioned against healthcare professionals by the Association of Health Funders of Zimbabwe (AHFoZ) were predominantly for fraud cases, which constituted 41.6% of all transgressions. Ogunbanjo & van Bogaert (2014) suggested that fraud in Southern African medical aid schemes is mounting. Although healthcare fraud in the Zimbabwean private healthcare has not been measured, it is estimated that US$150 Million is lost annually to fraud (Ndlovu, 2018). Losses resulting from fraudulent claims will negatively affect medical aid societies’ ability to meet the obligation to pay out beneficiaries’ claims for health the services rendered. This will also result in low solvency levels, which will affect the financial viability of medical aid societies, thereby resulting in them being unable to reach and maintain the regulatory reserve of members’ contributions.

Motivated by the above discussions, the main objective of this study was to examine the current fraud detecting techniques used in medical aid societies in prevention of double billing fraud. The remainder of the paper includes the literature review, methodology, results and discussions, and conclusions.

Literature Review

In order to apprehend the motives why people commit health care fraud, the Fraud Triangle theory was proposed by Donald Cressey in 1971. Cressey (1971), argued that financial fraud is driven by what he referred to as a ‘non-shareable problem’. In addition to motivation, opportunity and rationalization explain the causes of fraud (Albrecht & Zimbelman, 2012; Cressey, 1971).

The fraud triangle theory is based on the assumption that the model is an equilateral triangle whose elements contribute equally. The fraud triangle theory whilst acknowledged across various professions has many flaws. The limitations of the fraud triangle are a lack of questioning on the properties that underpin motivation and the explanatory power of the fraud triangle as a theory of financial crime (Donegan & Ganon, 2008).

Reviews on the fraud triangle theory have then called for an adjustment to the fraud triangle to create, either a Fraud Diamond (Wolfe & Hermanson, 2004) or Fraud Pentagon (Marks, 2009). Wolfe & Hermanson (2004) claim that ‘capability’ arising from a person’s position within an organization, combined with academic and intellectual traits and abilities, allow potential offenders to recognize a fraud opportunity and turn it into a reality. In simpler terms, for fraud to occur the perpetrator should have the appropriate capabilities to defraud. Marks, (2018) similarly states that it is an employee’s expertise creates the conditions for fraud to occur.

In addition to expertise, Marks (2018) added arrogance to the model, to produce a fifth element introducing what became known as the Fraud Pentagon. Requests to amend the Fraud Triangle such as those suggested by Wolfe & Hermanson (2004); Marks (2018) rely on self-developed assertions which have a significant empirical testing and support.

Using Tamsik-Rajsik-Sattvik framework and the LAG Lust-Anger-Greed cycle, Raval (2013), suggested a detailed research into the rationalization condition of the fraud triangle theory by Cressey (1971). He indicated that healthcare insurance fraud is a human act and suggested a string of proposals in a predictive manner for future research.

Distinctive features of the health industry make the sector susceptible to fraud. Debpuur, et al., (2015) delve into the moral behaviors and practices of service providers and members in the national health insurance scheme. The study population which encompassed community members, medical employees and healthcare providers, were picked from one of the 22 districts in Ghana (Debpuur et al., 2015). The conclusions indicated that the system was abused by members seeking non-required healthcare services, service providers billed insured members for services not rendered, insured members were overbilled, and there were over prescriptions for medication (Debpuur et al., 2015).

In a study similar to that of Debpuur, et al., (2015); Flynn (2016) adopted a qualitative research methodology in a study of fraud in the private health insurance sector in Australia. His study objective was to highlight different fraud acts committed against the sector, explore the strained relationships between the private and public health sector, and the adverse effect of the Privacy Act on fraud, detection and related recoveries.

Flynn (2016) uncovered that the private health insurance industry was unprotected from various types of fraud. In light of this, the health sector was defrauded by identity thieves and service providers (Flynn, 2016). The service providers were billed unduly for services; claimed for superficial surgery as a covered benefit; and claimed for services not rendered (Flynn, 2016). Thornton, et al., (2015) re-evaluated the literature to rank healthcare fraud. The study found similar methods through which this risk expressed itself. The other types of fraud that were found encompassed up-coding, splitting of codes, the use of unauthorised providers, kickback schemes, ignoring members’ deductibles, and duplicate claim submissions (Thornton et al., 2015). In their 3013 study, Pande and Maas uncovered illegible service provider fraud, where there were certain individuals who misrepresented their qualifications to provide for services.

In the mitigation of healthcare fraud, data mining techniques can be used. According to Abdallah, et al., (2016), data mining includes the application of statistics, mathematics, AI and machine learning to large amounts of data, in order to derive patterns and meanings. In healthcare fraud detection, the mostly used data mining techniques are supervised and unsupervised machine learning (Joudaki et al., 2015). Supervised data mining involves the use of previously known and determined data that has been marked as fraudulent in nature, whilst the unsupervised approach detects fraud in data that is not categorized as fraud (Abdallah et al., 2016). This implies that, a detection of healthcare fraud through the support of

Furlan & Bajec (2008) researched on the ways in which a fraud management system could be implemented in the support of all activities targeting fraud, as the prior research only focused on the detection of fraud. The authors gathered empirical data through the use of semi-structured interviews with law experts who were well versed with fraudulent activities, service providers from various medical disciplines, and 15 fraud investigators from the public compulsory insurance and insurance companies of Slovenia (Furlan & Bajec, 2008). Adding on, they assumed a case study research approach where they developed a fraud management system for one of Slovenia’s voluntary health insurance company. The main aim of the study was to gain an understanding on the practical challenges of assuming a comprehensive management system that supports all activities for fraud detection. The results supported the proposal for the application of the fraud management system, not only for healthcare fraud detection, but also for the support of other activities which are inclusive of investigation, deterrence, monitoring and prevention.

Method

This study adopted a pragmatic philosophical stance, whose theory proposes that there are various ways of seeing the world and, in undertaking a research, a single point of view can never give the entire picture as there may be multiple realities (Saunders et al., 2012). The researcher chose the pragmatism philosophy so as to explore all possible outcomes as well as to take advantage of each method’s strength and reduce the weaknesses of using a single method.

This study followed the inductive research approach and according to Saunders, et al., (2015), the purpose would be to understand better the nature of the problem. The resultant data is analysed with the view to discover theory implicit in the data. The researcher opted for the convergent parallel design for this research.

The population for this study included thirty-one medical aid societies registered with the Association of Healthcare Funders of Zimbabwe as of 30 September 2019.

The researcher has used non-probability complemented with probability sampling techniques. The combination of the two is meant to maximize the validity and reliability of the study. Because of the population size being small, the researcher’s sample size constituted 15 Medical Aid Societies whose headquarters are in Harare. This sample was used as the population was hypergeometric.

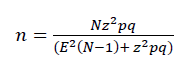

The sample used for a hypergeometric population is calculated using Leonhard Euler’s equation:

An inductive statistical analysis technique, which is the Pearson’s Chi-Square method, was used to test whether a relationship exists between the variables indicated in the hypotheses. Pearson's Chi-Square test was used to test the null hypothesis of whether the frequencies in the columns of a cross-tabulation shall not be significantly associated with the frequencies in the rows. The Pearson’s Chi-Squared statistic (χ2) computation was done through the SPSS using the "Analyze - Descriptive Statistics - Crosstabs" menu option (Field, 2009). The χ2 test statistic was then interpreted to infer whether or not the probability (p-value) of an association between the frequencies in the rows and the columns of the cross-classification was due to random chance. In this study the null hypothesis is to be rejected if the p-value of the χ2 test statistic is less than the conventional significance level of 0.05. The significance level reflects the probability of the test producing a false rejection of the null hypothesis when, in fact, it should not be rejected (Type I error). This limit is set to a small value, typically α=0.05, so that the probability of a Type I error is reduced. The use of α=0.05 implied a 1 in 20 chance of making a Type I error, which is traditionally agreed to be an acceptable level (Field, 2009). Simply put, the confidence level to be used for analysis is 95% (p<0.05).

All null hypothesis statistical tests, including the Chi-Square test, have a limitation as the test statistics and p-values are extremely sensitive to sample size. If the sample size is too small then there is an elevated probability of a Type II error (i.e., not rejecting the null hypothesis when, in fact, it should be rejected).

Results and Discussion

Cause Double Billing Fraud Summarized

A summary on the quantitative analysis of the causes of double billing fraud will be highlighted by the one sample t-test in Table 1 below.

From the table, N=140 and the test value being 3, the sample population agrees that Manager or employees with external business interests putting pressure on them to satisfy external parties cause double billing fraud. The respondents from the survey indicated an agreement to this fact given a mean of 3.88 with a standard deviation of 1.401 and a margin of error of 0.118.

This is in support of the study by Schuchter & Levi (2016) where they proposed that the element of pressure exists because the person views the problem as non-shareable. This then serves as a motive for perpetrating a white-collar crime. In this instance, it can be asserted that a person may have a non-sharable problem emanating from external business interests. These will pressurize the offender to commit double billing fraud on the medical aid society in question.

Service provider’s attitude to defraud as another cause has a mean of 3.24 with a standard deviation of 1.449 and a margin error of 0.122. This is interpreted as relevant to this study. The mean is above the acceptance level mean of 3. The survey confirms the assertion of Browling, et al., (2000) who pointed out that every person, performs a personal cost and benefit analysis in order to determine whether the action is worth pursuing for an outcome which is best suited for them.

From the rational choice theory, they pointed out that, the rational agent is assumed to take account of available information on the medical claim to be submitted for processing, probabilities of events, and possible costs and benefits in determining whether or not to commit double billing fraud against the Medical Aid Society in question, and to act consistently in choosing the self-determined best choice of action (Table 1).

| Table 1One-Sample Statistics T-Test on the Causes Of Double Billing Fraud | ||||

|---|---|---|---|---|

| N | Mean | Std. Deviation | Std. Error Mean | |

| Manager or employees with external business interests putting pressure on them to satisfy their external parties’ clause double billing fraud? | 140 | 3.88 | 1.401 | 118 |

| Service provider's attitude to defraud: aggressive, pushes for quick settlement, is unwillingly to cooperate, avoids the use of telephone or mail, wants cash payment | 140 | 3.24 | 1.449 | 122 |

| Falsified and strange documents- no original documents, no name on the documents (or filled in later), different handwriting, new documents concerning old events, strange dates, inconsistencies between the application form and the claim form or too well documented claims. | 140 | 2.69 | 1.439 | 122 |

| History and nature of policyholder: bad claim history, claimant provides a post office box or hotel as address, does not pay premiums | 140 | 3.11 | 1.508 | .127 |

| Poor supervision of service provider's activities: Policyholder lives beyond the region were the service provider operates. | 140 | 3.14 | 1.317 | .111 |

Respondents disagree that falsified and strange documents are a factor causing double billing fraud. It can be deduced from the statics which show a mean of 2.69 with a standard deviation of 1.439 and a margin error of 0.122 on a T-test value of 3.

According to Chavez (2015), lack of complete or appropriate supporting documentation is a potential indicator of various fraud schemes which may also include fraud in the healthcare sector. With reference to this, falsified and strange documents may be characterized by an absence of original documents, incomplete information, different handwriting, and new documents concerning old events, strange dates, inconsistencies between the application form and the claim form or too well documented claims. However, these should be investigated before a claim is paid for.

Again, from the Table 1 above, respondents strongly agree that the history and nature of policyholder is a factor that leads to double billing fraud. This is evidenced by a mean of 3.11 with a standard deviation of 1.508 and a margin of error of 0,127 on a t-test value of 3. Where a policy holder has a history of committing fraud, it is a factor that contributes to double billing fraud. Claims paid for such policy holders should be investigated since there may be a likelihood of fraud occurring.

From the survey, as indicated from the Table 1 above the mean of Poor supervision of service provider’s activities as a cause of double billing fraud is 3.14 with a standard deviation of 1.317 and a standard margin of error of 0.111 on a T-test value of 3. The factor has the characteristics that contributed to double billing fraud perpetrated against Medical Aid Societies.

This is supported by Felson & Cohen’s Routine Activity Theory (2014) who propose that, in this case, the perpetrators may defraud the medical aid society through double billing fraud as they know they will not be caught. They have gained an understanding of how the systems operate and they know how to by-pass the system because doing the job has become a routine. In having a routine, it is easy for medical societies to be defrauded as the perpetrator has knowledge of how they cannot be caught.

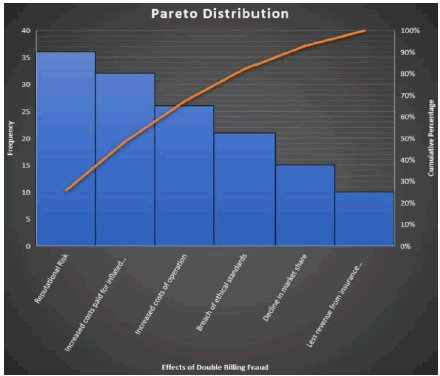

Summary on the Effects of Double Billing, Fraud

Participants were then asked to state the effect which they considered dire to the medical aid society. Upon summarizing the results as shown in Figure 1, it can be conclusively admitted that, double billing fraud presents a reputational risk to medical aid societies. From the rankings, it topped the list as it rated 25.7%. Where the organisation will experience a fraudulent event like double billing, if the case is exposed, its reputation will be tainted on both the organisation and the future of the employees if they decide to join another organisation.

Increased cost paid for inflated claims were rated second with 22.9% of the participants agreeing to believe that it was dire to the business. This arises from the fact that, a claim is paid for twice. With claims paid for twice, the expenses of the medical aid society will at the end of the year be inflated.

Double billing fraud causes an increase in the costs of operations. This is evidenced with 18.6% of the population study believing so.

15.0% of the population study believes that double billing fraud will lead to the breaking of ethical standards. Once fraud has been uncovered, the medical aid society faces an ongoing problem of public trust. Therefore, to prevent this pending doom, organisations are most likely to breach ethical standards through non-disclosure. Consequently, the medical aid society may have to pay a higher price for credit or might not be considered for a strategic alliance. More-so, 10.7% believe that the medical aid society will experience a decline in market share while only 7.1% purports the medical aid society will realise less revenue from insurance premiums.

Summary of Effectiveness of Current Fraud Detecting Techniques

| Table 2 Hypothesis Testing on the Effectiveness of Current Fraud Detecting Techniques to Prevent Double Billing Fraud |

||

|---|---|---|

| Pearson's Chi | Square Test | |

| Test Variable | Value | Asymp. Sig. (2- sided) (p-value) |

| Fraud policy | 10.475 | 0.841 |

| Central anti-fraud function or unit | 8.87 | 0.919 |

| Robust internal audit team or function | 17.186 | 0.374 |

| Thorough client acceptance procedures | 8.893 | 0.918 |

| Pre-employment and in-employment screening of management and staff especially those in claims and underwriting department | 17.662 | 0.344 |

| Robust claim assessment processes | 8.6 | 0.929 |

| Application of IT tools and techniques | 6.448 | 0.982 |

Results from the questionnaire were subjected to the Pearson chi square as illustrated in Table 2 above. For the purposes of this research as the hypothesis tested was:

H0: the current fraud detection techniques are not effective enough to detect double billing fraud

H1: the current fraud detection techniques are effective enough to detect double billing fraud

The dependent variables were the fraud detecting technique in question where the independent variable were the years of experience of the participant. From the test, the null hypothesis is rejected if the p-value is less than 0.05.

As shown from Table 2, all the test variables have a p-value greater than 0.05. This is to say that we accept the null hypothesis for all factors as they have a p-value of greater than 0.05. There is a stronger the association of the test variable and the independent variable if the p-value is closer to 1. As evident from Table 2, the application of IT tools has a p-test value of 0.982. This means to say that the current application of IT tools and techniques is strongly in effective to prevent double billing fraud.

Also, from the table, the claims assessment process scored a p-value of 0.929. This implies that, it also is strongly in effective enough in the prevention of double billing fraud.

Basing on the findings, it is to say that, the current fraud detecting techniques are not effective enough to detect and deter double billing fraud hence a need exists for systems, methods, and software that discourage and prevent double billing fraud in Medical Aid Societies.

Conclusion

Lack of co-operation between the different role players is one of the main challenges in the fight against double billing fraud is not only in Zimbabwe, but on a global scale. Only a countable number of health insurers share fraud data among themselves, with the Association of Healthcare Funders of Zimbabwe and even less with the law enforcement agencies. This can only be reduced if situation is changed. All double billing fraud cases above a stipulated number should have to be reported to the law enforcers and the governing board of healthcare funders and practitioners committing fraud should be blacklisted from practicing for a period of time.

Billions of United State dollars, European euros, British pounds, and the Zimbabwean RTGS, Bonds are lost yearly as a result of fraud without a plausible solution. Coming up with a solution that could prevent fraud can save a lot of money that can be reinvested towards the delivery and provision of healthcare. For this to be achieved, it is of uttermost importance that all key players the in Zimbabwean health sector adopt a zero-tolerance policy approach and work together in the fight against double billing fraud. It is of importance to keep in mind that not all healthcare service providers commit fraud. There are men and women who are dedicated, truthful and hold themselves to the highest standards. However, there is a small percentage that commits fraud which is on the other hand, gradually increasing.

As a proposal to tie down on double billing fraud perpetrated against Medical Aid Societies, an allocation should be budgeted for to educate and create awareness about the causes and effects of double billing fraud this is because, lack of awareness has seen the increase of double billing fraud against the medical aid societies. Also, a special team of researchers must be established to investigate this area and proffer new techniques to fight against these fraudulent acts.

This study contributes to solutions that can be implemented in the eradication of double billing fraud in Zimbabwean medical claims. The solutions proposed by this study could be applied by Zimbabwe’s medical insurers to mitigate double billing fraud in claims effectively. This in turn reduces the amount exhausted on fraudulent claims and supporting cost control strategies. Effectively controlling this risk could improve the financial sustainability of medical insurers in Zimbabwe.

In this study, the aim was to get an understanding on the various fraud experiences in medical claims and the approaches that are in place to eradicate this risk, by using a quantitative research approach.

Future researchers may use a different research methodology, which may give different results on the double billing fraud in medical insurance claims.

Sed a survey study strategy. A similar study can be replicated in future using a case study strategy since a survey study was used in this case. This will permit deeper insights on the results to medical insurers in Zimbabwe.

This study’s population was only restricted to medical insurers in the Zimbabwean context. However, these insurers only form a part of the Zimbabwe’s healthcare financers. Therefore, a study which also focuses on double billing fraud in the public healthcare sector in Zimbabwe is recommended for further research. Additionally, studies which are focused on employees and insurer fraud in healthcare are recommended for future research.

Additional studies are needed on a continuous basis to keep track of the changes that occur in double billing fraud in Zimbabwe.

References

- Bauder, R., Khoshgoftaar, T.M., & Seliya, N. (2017). ‘A survey on the state of healthcare upcoding fraud analysis and detection’. Health Services and Outcomes Research Methodology, 17(1), 31–55.

- Benson, M.L., & Simpson, S.S. (2015). Understanding white-collar crime: An opportunity perspective, (2nd edition). New York: Routledge.

- Boudaki, H., Rashidian, A., Minaei-Bidgoli, B., Mahmoodi, M., Geraili, B., Nasiri, M., & Arab, M. (2015). 'Improving fraud and abuse detection in general physician claims: A data mining study'. International Journal of Health Policy and Management, 5(3), 165-172

- Bryman, A. (2001). Social research methods. London: SAGE Publications Ltd

- Bryman, A. (2001). Social research methods. Oxford: Oxford University Press

- Clarke, R.V. (1992).Situational Crime Prevention. Harrow and Heston.ISBN978-1-881798-68-2.

- Collis, J., & Hussey, R. (2014). “Business research: A practical guide for undergraduate and postgraduate students” (4thedition). Palgrave Macmillan, 54.

- Cornish, D., & Ronald, V.C. (1986).The reasoning criminal. Springer-Verlag.ISBN978-0-387-96272-6.

- Creswell, J.W., & Plano Clark, V.L. (2011). Designing and conducting mixed methods research. Thousand Oaks, CA: Sage.

- Creswell, J.W. (2013). Qualitative inquiry and research design: Choosing among five approaches, (3rd edition). Thousand Oaks, California: SAGE Publications, Inc.

- Creswell, J.W. (2014). Research design: Qualitative, quantitative and mixed methods approach, (4th edition). Thousand Oaks, California: SAGE Publications, Inc

- De Vaus, D.A. (2002). Surveys in social research. Allen & Unwin, Crows Nest, Australia, 379.

- Denscombe, M. (2010). “The good research guide for small-scale social research projects” (fourth edition). Butterworth-Heinemann.

- Denscombe, M., (1998). The good research guide for small scale social research projects. Glasgow:MacGraw Hill.

- Duckert, G.H. (2011). Practical enterprise risk management: A business process approach. New Jersey: John Wiley & Sons, Inc.

- Engstrom, N.R. (2017). ‘Retaliatory RICO and the puzzle of fraudulent claiming’. Michigan Law Review, 115: 639-706. (Engstrom, 2017)

- Erasmus D., Ranchod, S., Abraham, M., Carvounes, A., & Dreyer, K. (2016). Challenges and opportunities for health finance in South Africa: A supply and regulatory perspective [online]. Available from: https://www.finmark.org.za/challenges-and-opportunities-for-health-finance-insouth-africa-a-supply-and-regulatory-perspective/ [Accessed 05 July 2019].

- Flynn, K. (2016). 'Financial fraud in the private health insurance sector in Australia: Perspectives from the industry'. Journal of Financial Crime, 23(1), 143-158.

- Gee, J., & Button, M. (2014). The financial cost of healthcare fraud 2014 [Online]. Available from: http://www.google.co.za/#q=the+financial+cost+of+healthcare+fraud+report+2014/ [Accessed 08 July 2019].

- Ghauri, P., & Gronhaug, K. (2000). Research methods in business studies a practical guide. Financial Times:Prentice Hall.

- Gray, E.D. (2014). “Doing research in the real World. PDF” Sage, Los Engels

- Jackson, S.L. (2011). “Research methods and statistics: A critical approach”,(4thedition). Cengage Learning, 17.

- Jankowicz, A., (2000). Business research projects., Thomson Learning: London

- Krejcie, R.V., & Morgan, D.W. (1970). Determining sample size for research activities. Educational and Psychological Measurement, 30, 607-610

- Morris, L. (2009). ‘Combating fraud in health care: An essential component of any cost containment strategy’. Health Affairs, 28(5), 1351-1356.

- Munyuki, E., & Jasi, S. (2009). ‘Capital flows in the health care sector in Zimbabwe: Implications for equity and access to health care,’. EQUINET Discussion Paper 79. Rhodes University, TARSC, SEATINI, York University, EQUINET: Harare.

- Myers, M.D. (2013). Qualitative research in business management, (2nd edition). Washington, D.C: SAGE Publications, Inc.

- Neuman C., (2001). Designing Social Research. London: Blackwell Publishing

- Thornton, D., Brinkhuis, M., Amrit, C., & Aly, R. (2015). ‘Categorizing and describing the types of fraud in healthcare’. Procedia Computer Science, 64, 713-720.

- Thornton, D., Mueller, R.M., Schoutsen, P., & van Hillegersberg, J. (2013). ‘Predicting healthcare fraud in Medicaid: A multidimensional data model and analysis techniques for fraud detection’. Procedia Technology, 9, 1252–1264.

- Van Capelleveen, G., Poel M., Mueller, R.M., Thornton, D., & Van Hillegersberg, J. (2016). 'Outlier detection in healthcare fraud: A case study in the Medicaid dental domain'. International Journal of Accounting Information Systems, 21, 18–31.

- Wakoli, L.W., Orto, A. & Mageto, S. (2014). ‘Application of the K-Means clustering algorithm in medical claims fraud/ abuse detection’. International Journal of Application or Innovation in Engineering & Management, 3(7), 142151.

- Wilson, J. (2010). “Essentials of business research: A guide to doing your research project”. Sage Publications.