Research Article: 2022 Vol: 21 Issue: 2

Guidelines for Strategy Formation as an Element of Financial Security Strategic Management

Nosan Nataliia, Bohdan Khmelnytsky National University of Cherkasy

Nazarenko Serhii, Bohdan Khmelnytsky National University of Cherkasy

Citation Information: Nataliia, N., & Serhii, N. (2022). Guidelines for strategy formation as an element of financial security strategic management. Academy of Strategic Management Journal, 21(S5), 1-8.

Abstract

The author's definition of strategic management of the financial security system and financial security strategy is given. Alternative approaches to the establishment of strategic guidelines for ensuring the financial security of economic systems are proposed and priority strategic guidelines for strengthening the state of various subsystems of a comprehensive financial security system are outlined. The criteria for evaluating the strategy of financial security are generalized and systematized. Four options for financial security strategies are recommended: a strategy for achieving financial security based on branding, image and reputation, a strategy for achieving financial security through partnership with stakeholders and ensuring their interests, a strategy for achieving financial security through expert relations, control and standardization; strategy with a focus on risks, trends and sustainable development. An algorithm for developing a financial security strategy is proposed.

Keywords

Strategic Management, Economic Security, Financial Security, Risk, Threat

JEL Classifications

D18, F65, G32, H12

Introduction

The issues of strategic management of economic security in general, and its financial component in particular, are becoming increasingly important at the micro and macro levels, given the large number of threats and risks that accompany the activities of economic and socio-economic systems. At the state level, there are no financial security strategies in the vast majority of countries around the world. For economic entities of different types of economic activity, financial security management is considered as one of the vectors of financial work, and is not recognized as a separate area of strategic management. At the same time, the tasks that can be declared in financial security strategies and their successful implementation at the applied level are able to guarantee economic systems financial autonomy in the long run, prevent or minimize the impact of economic risks and threats to their financial condition, promote sustainable development. Businesses and countries that are in a state of financial security are left out of the danger of involving them in the phenomenon of financial crisis, both local and global. Thus, strategic management of financial security should be recognized as one of the important, obligatory and permanent directions of management of activity of economic structures and public management and administration.

Literature Review

Problems of financial security are studied by scientists in several areas. First, research is conducted on the issue of ensuring financial security at the macro level ? the object of study in this case is the state and government. Secondly, the issue of guaranteeing the financial security of economic entities, participants in the financial system and financial risks, the economic condition of which largely determines the level and prospects of economic development of the country, is increasingly raised. A separate area of research is the problems of financial security management, in which the emphasis is on financial security as a management category, which, accordingly, is implemented through the classical functions of management, but aims to achieve its own effect ? not profit or social effect, but financial stability and security and its defense from financial risks and threats. Financial security is also considered as one of the desired results of the overall effective management of the economic system. From time to time we come across publications on specific aspects of financial security management, including strategic management. We consider the generally accepted classical postulates of strategic management worthy of attention in the context of this research (Ansoff, 1980), as well as the works of scientists who have dedicated their research to solving problems of financial and economic security management at various levels. Yes, it is an important issue is the research and methodological framework for managing the economic security of financial intermediaries in Ukraine (Zachosova et al., 2018). A comprehensive study that cannot be overlooked is «Economic security: the theory, methodology, practice (Economic Security: Theory, Methodology, Practice, 2016). At the enterprise level, financial security issues are most often considered in the context of economic security research (Zhyvko, 2013). The security of financial markets has its own specifics of providing at the applied level (Athanasoulis et al., 1999). Of course, in countries with different levels of economic development and financial well-being, approaches to financial security and governance differ significantly (Semjonova, 2016). A separate methodological problem that can be solved at the theoretical level is the organization and implementation of the procedure for assessing the level of financial security as a component of economic security (Hacker et al., 2014) or as one of the indicators of the state of financial development and financial stability (Rodica et al., 2014). As mentioned above, research on strategic financial security management has begun in recent years (Zachosova, 2019, Cherevko et al., 2019, Shevchenko et al., 2019). It is planned to base them on this article as a theoretical basis and framework for building our own theory of effective financial security management at the micro and macro levels.

Hypothesis

Financial security system strategic management should be considered as the process of preliminary definition of long-term goals of the financial security system from the standpoint of foresight in terms of the impact of existing and potential risks of external and internal environment of the system, a set of preventive actions for effective implementation of the concept through a set or sets of multi-vector strategies, the content of which can be adjusted according to the requirements of the time and specific conditions and circumstances that affect the normal operation of the object to be protected. Given the current operating conditions of domestic enterprises and the economy as a whole, it is advisable to improve, update and modernize the theoretical and methodological support of the process of strategic management of financial security, as well as offer several alternative strategies for financial security management depending on strategic priorities of the economic system functioning.

Methodology

Theoretical and methodological basis of the study were the conceptual foundations of financial and economic security management at different levels of economic systems. The methodology of the study was based on the theory of strategic management. The following general and specific methods were used to ensure the reliability of the obtained results and conclusions: dialectical, epistemological and logical methods, in particular terminological analysis ? to study the conceptual apparatus and clarify the basic concepts of security science; methods of scientific abstraction and generalization ? in substantiating economic categories and definitions that have been updated or proposed in the study; monographic and comparative methods ? to systematize the scientific approaches of domestic and foreign scientists to address the issue of strategic management of financial security; system-functional, functional-structural methods ? during the development of conceptual bases for ensuring the financial component of economic security; methods of strategic management ? in determining strategic priorities in financial security management; methods of expert evaluation. Techniques of abstract-logical method and generalization method were used in the development of theoretical and methodological generalizations and formulation of conclusions based on the results of the study.

Research and Discussion

Under the strategy of financial security in this study we propose to understand the development of a long-term plan to achieve the goals and objectives of the facility, including the financial component of the economic security system, as well as resource allocation planning in conditions of constant instability and adaptation to it, to protect this facility from the effects of threats, risks and to achieve its normal and safe operation. The financial security strategy should include the definition of the purpose and objectives of the financial security subsystem, areas for their solution, as well as forms and methods of using appropriate forces and means, the possibility of regrouping, creating the necessary reserves to neutralize and localize possible threats.

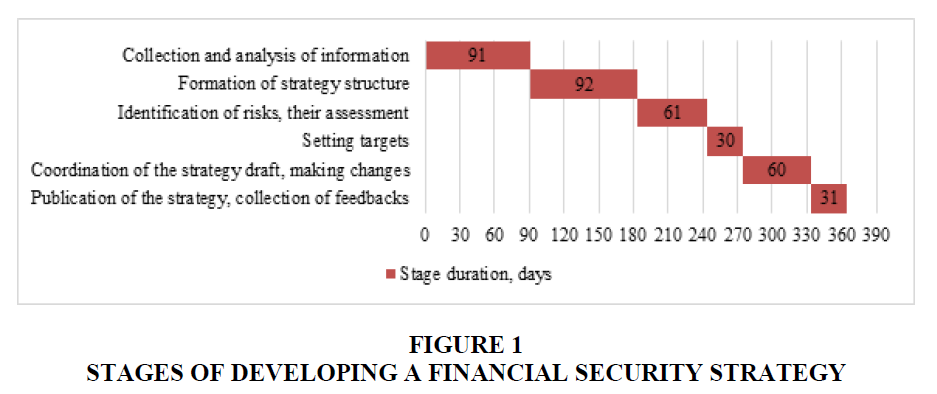

The following algorithm for developing a financial security strategy is proposed, which contains the following stages:

1. Collection of information on the features of strategic planning for the development of similar basic characteristics of economic systems that have overcome negative trends or similar to the threats inherent in the object and have shown the ability to obtain financial advantages in the market of goods or services;

2. Establishment of strategic guidelines for achieving within the security of various components of the financial security system of the economic system, taking into account the need to pursue the goals of sustainable and progressive development, the formation of financial capacity;

3. Development of strategic maps, risk maps and identification of threats to the implementation of strategic plans; it is expedient to assess separately the risks that are inherent in the economic system, taking into account the processes of European integration, in the context of the spread of trends in Industry 4.0, the development of trends in the digital and information economy;

4. Specification of intermediate targets during the implementation of the financial security strategy; it should be noted that existing strategies, which set the vision of government or company management, rarely take into account the interests of all categories of stakeholders involved in financial processes or at least mention the need to take them into account; this situation leads to lobbying of financial interests by owners of large capital (at the macro level) and controlling stakes (at the micro level), which ultimately manifests itself in an increase in the level of financial dependence of the economic system on external sources of financial resources;

5. Structuring the strategy as a document should provide for the separation of several sections to simplify the perception of the information component; in particular, in the context of financial security, a separate content section should be devoted to each of its subsystems, within which such structural elements as lists of threats and challenges for specific subsystems of financial security, current indicators of security of a particular component, their guidelines for future achievement, specific ways, measures, tools, the use of which will achieve certain indicators; their placement should be carried out in chronological order;

6. Identification of centers of responsibility for the implementation of planned activities; establishing personal responsibility of officials and representatives of top management for non-compliance with financial security indicators;

7. Planning the resource base to achieve the desired financial results with the distribution and linking them to specific targets and to the identified responsible for their efficient and rational use of resources and potential of the economic system;

8. Establishing the periodicity of control and monitoring of the state of achievement of strategic guidelines of financial security; specification of the procedure for their revision and adjustment (if necessary);

9. Definition of reporting forms, channels of disclosure of information on the state of financial security of the economic system.

Figure 1 offers a chronology of the development of financial security strategy.

The choice of a particular strategy model at the micro level is the prerogative of company management, and at the macro level is the responsibility of the current government and its representatives. Traditional approaches to the formation of strategic principles of financial security have a number of significant shortcomings, which makes the existing strategic documents in practice unrealistic, formal, and detached from reality bureaucratic elements of information and analytical support of the financial component of economic security. However, in the development of the information economy, the strategy of financial security as one of the guidelines of financial policy at the state level and the mainstream of financial activities of the entity at the micro level must be extremely clear, understandable and specific.

The first of the list of sustainable development goals, the vectors of which most countries seek to adhere to in the near future, is to overcome poverty in all its forms. The role of business is also important in this process, which once again emphasizes the need to ensure financial security in the complex ? both at the micro and macro level. On the way to effective strategic management of financial security there are such threats that should be taken into account in financial security strategies: conflict of financial interests of the main categories of stakeholders; low level of quality of financial services in financial markets, their high cost and insufficient range; low level of financial literacy and financial inclusion; distrust to professional financial market participants and national regulators; lack of financial service standards; loss of financial sovereignty at the time of raising capital from external sources; high share in the financial system of foreign capital; uncontrolled development of the shadow financial sector, including through the mechanisms of using cryptocurrencies; a large amount of financial debt; exchange rate fluctuations, inflation.

Avoiding the negative impact of identified threats on the state of financial security, minimizing their number will be possible provided the development of national and corporate Financial Security Strategies, which will contain the conceptual framework for regulating the state of financial security.

Traditional approaches to the formation of financial security strategy can be presented in the form of the following list: strategy of financial security as a way to determine the goals of development of the financial component of the economic system; strategy of ensuring financial security as a model of efficient allocation and use of own and borrowed financial resources of the system in the future; strategy of financial security as a program of actions to achieve the results of the financial processes necessary to preserve the financial potential; financial security strategy as a mechanism for responding to existing and potential challenges, threats and risks of a financial nature; financial security strategy as a plan to meet the financial interests of stakeholders through the use of available financial resources; financial security strategy as a set of opportunities to achieve financial benefits without excessive financial risks.

Recommendations

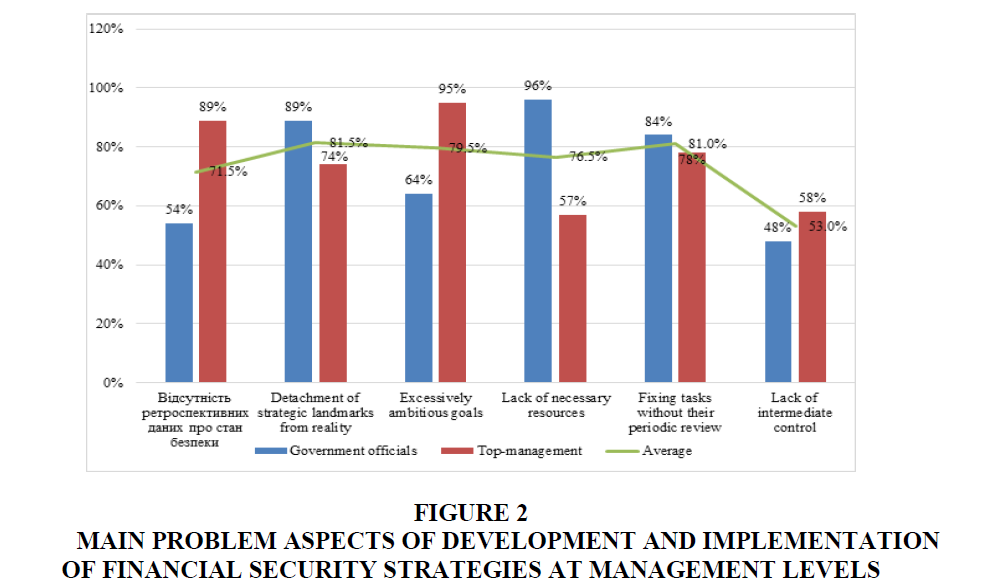

When starting to manage financial security, top management often wonders why, even if there is a financial security strategy, experts deviate from its main vectors, or their strict adherence does not allow achieving the set strategic guidelines in the field of financial security. In order to identify the main problems that arise in the process of strategic planning or implementation of strategies, a survey was conducted of 100 representatives of top management companies of various economic activities and civil servants ? officials who deal with strategic financial planning and financial security issues (Figure 2).

Figure 2 Main Problem Aspects of Development and Implementation of Financial Security Strategies At Management Levels

The presence of so many problematic aspects indicates the need for a preliminary assessment of the proposed strategy for the possibility of its implementation, taking into accounts the available resources and management capacity. We can offer the following list of criteria for assessing the quality of the strategy from the standpoint of its feasibility (Table 1).

| Table 1 Criteria For Evaluation of Financial Security Strategy | ||

| Parameter | Criteria | Questions to evaluate the criterion |

| Development of strategy objects | Intelligibility | Is it clear what exactly is protected by the strategy? |

| Measurable (quantitative or qualitative) | Are the indicators of strategic landmarks measurable and are their indicative values given? | |

| Implementation tools | Do the proposed tools for implementing the strategy meet the stated goals? | |

| Systemic risks | Identified | Does the strategy take into account existing systemic risks? |

| Measurable (quantitative or qualitative) | Has a systemic risk assessment been performed and the results of such an assessment taken into account? | |

| Detection and neutralization tools | Are risk minimization tools offered? | |

| Implementation | Development | Is the phased development and implementation of the strategy indicated? |

| Risks of implementation | Are the risks of implementing the strategy assessed? | |

| Resource | Are the resources needed to implement the strategy planned? | |

| Control and responsibility | Addressability | Is there a division of responsibilities and powers in the process of implementing the strategy? |

| Frequency of inspections | Are the frequency of evaluation of the effectiveness of the implementation of the strategy and tools for evaluation indicated? | |

| Personal responsibility | Is there a personal responsibility for ineffective implementation of the strategy or its unrealistic nature? | |

In modern conditions, we can recommend four options for financial security strategies (Cherevko et al., 2019). Strategy for achieving financial security based on branding, image and reputation (BIR Strategy). The essence of the strategy is to give priority to the information and interface components of the financial security system, the implementation of measures for full transparency of the results of activities aimed at ensuring financial security. Strategy for achieving financial security through partnership with stakeholders and ensuring their interests (IPR Strategy). The essence of the strategy is to ensure maximum satisfaction of the financial needs of those interested in the results of the entity through the formation of a safe environment for their implementation. Strategy for achieving financial security through the relationship of experts, control and standardization (ECSStrategy). The essence of the strategy is to implement and follow financial security management standards at the state level. Strategy (RTS) ? a strategy focused on risks, trends and sustainable development. The strategy is relevant in today's economic environment and adapted to the challenges dictated by the globalized economic world.

Such priority strategic guidelines for strengthening the state of financial security are proposed as: reforming the system of regulation of the state of financial activity and financial development of the economic system; increasing the level of financial literacy and financial inclusion, reducing the amount of debt, which will help to improve the state of investment attractiveness.

Conclusion

The study allows us to draw the following important conclusions. First, strategic management of financial security should be carried out on the basis of detailed information and analytical support. This means that the basis of such management should be a strategy to ensure the financial security of the state or business entity ? depending on the object of managerial influence. Before developing such a strategy, experts need to analyze the threats and risks that accompany the financial condition of the facility at different stages of its operation and development in the future and develop response scenarios and actions of such factors, taking into account available resources and pessimistic, optimistic and realistic variations. Secondly, there is a methodological problem of assessing the level of financial security. Such diagnostics is necessary both before the start of the strategic management process as an indicator of the state of the object at the start, and after the implementation of part or all management measures to determine their effectiveness, make adjustments for the future, and so on. Modern methods of assessing the level of financial security prove their inability to provide analysts and top management of companies or government officials with timely and relevant information about the state of financial security. At the level of enterprises, institutions, organizations, the practice of assessing the level of financial security is absent. Typically, a financial analysis or analysis of the financial condition of the entity, aimed at identifying reserves to increase the level of profitability of the business structure, rather than the timely identification of risks and threats that will be inherent in their financial condition in the future, which is one of the main tasks of strategic management of financial security. Third, there are no financial security management specialists in the labor market and in the staff of companies and government agencies. Usually, those who position themselves as capable of such management are not ready to effectively perform the tasks of classical strategic management, risk management and crisis management ? namely, such a triangle of management actions and describes the tasks of strategic management of financial security. In addition, the person who will take on the responsibilities of strategic financial security management must have the skills to search and analyze information from various sources, have a well-developed critical thinking, good knowledge of company policy, its mission and goals, and have the competence to financial management and financial analysis.

Thus, the training of professionals with such a wide arsenal of skills and abilities should become mainstream for higher education institutions that train management and administration professionals.

References

Ansoff, H.I. (1980). Strategic issue management. Strategic Management Journal, 1(2), 131-148.

Indexed at, Google Scholar, Cross Ref

Athanasoulis, S., Shiller, R.J., & Van Wincoop, E. (1999). Macro markets and financial security. Economic Policy Review, 5(1).

Cherevko, O., Nazarenko, S., Zachosova, N., & Nosan, N. (2019). Financial and economic security system strategic management as an independent direction of management. In SHS Web of Conferences (Vol. 65, p. 03001). EDP Sciences.

Economic Security: Theory, Methodology, Practice. (2016).

Hacker, J.S., Huber, G.A., Nichols, A., Rehm, P., Schlesinger, M., Valletta, R., & Craig, S. (2014). The economic security index: A new measure for research and policy analysis. Review of Income and Wealth, 60, S5-S32.

Indexed at, Google Scholar, Cross Ref

Rodica, P., Alexandru, S., & Angela, T. (2014). The methodology of financial stability assessment of Republic of Moldova through macroeconomic indicators. Procedia Economics and Finance, 15, 383-392.

Indexed at, Google Scholar, Cross Ref

Semjonova, N. (2016). Financial security in the Baltic states: comparison with selected EU countries. Economics and Business, 29(1), 90-95.

Indexed at, Google Scholar, Cross Ref

Shevchenko, Y., Nosan, N., & Zachosova, N. (2019). Formation of conceptual bases for state financial security supply: Strategic and tactical actions. Modern Economics, (15), 224-229.

Indexed at, Google Scholar, Cross Ref

Zachosova, N. (2019). Financial security: Problems of operational and strategic management, risks and peculiarities of public administration. Przeworsk: WSSG.

Zachosova, N., Babina, N., & Zanora, V. (2018). Research and methodological framework for managing the economic security of financial intermediaries in Ukraine. Banks & bank Systems, 13(4), 119-130.

Zhyvko, Z.B. (2013). Enterprise economic security management under market conditions. Current Economic Problems, 148(10), 138-145.