Research Article: 2021 Vol: 20 Issue: 6S

Gullibility Theory and Ponzi Scheme Participation among University Students in Malaysia

Siti Afiqah A. Halim, Universiti Teknologi MARA

Farah Aida Ahmad Nadzri, Accounting Research Institute, Universiti Teknologi MARA

Salwa Zolkaflil, Accounting Research Institute, Universiti Teknologi MARA

Abstract

Financial fraud can be broadly defined as an intentional act of deception involving financial transactions for purpose of personal gain. Many fraud cases involve complicated financial transactions included the Ponzi scheme which is conducted by 'white-collar criminals' such as business professionals with specialized knowledge and criminal intent. In the 1920s, Charles Ponzi engaged with the Ponzi scheme which also known as money flows from the bottom up. The continuous issues of the Ponzi scheme in Malaysia, especially the involvement of students as victims has become the major problem to look forward to the factors that influence university students to this investment fraud. This paper explores the gullibility factors of individuals' extent of exposure to a Ponzi scheme among Bumiputera university students in Malaysia. This study conducts face-to-face interviews and observations with Bumiputera university students in Malaysia through purposive sampling. Findings show that the victims involved in the Ponzi scheme are gullible, meaning that their level of trustworthiness is high, based on the four elements of Gullibility theory (situation, cognition, personality, and state). This study will benefit the regulators, enforcement agencies, and universities to further understand the reasons why the students are involved in Ponzi schemes. It also benefits the body of knowledge about the characteristics of Ponzi scheme companies that are considered people of choice. Future researchers should investigate the methods to minimize future investors' participation, especially the students and losses in fraudulent investments.

Keywords

Gullibility, Ponzi Scheme, Trust Worthiness, University, Victims

Introduction

Charles Ponzi scam is one of the most massive fraud happen in the twenty-first century, pyramid scheme, and many fraudulent MLMs have been dubbed "Ponzi scheme" (Albrecht, Albrecht, Albrecht & Zimbelman, 2012). Ponzi schemes (pyramid schemes) are fraudulent investments where earlier investors' returns are paid from the contributions of later investors (Wilkins, Acuff & Hermanson, 2012). In other words, the Ponzi scheme is known as a type of investment fraud in which returns are paid to investors either from their own money or out of money paid in by subsequent investors, rather than from profits generated by investment or any genuine business activity (Lewis, 2012).

Nowadays, the number of involved in the Ponzi scheme increasing from time to time. Since 2012, the Central Bank of Malaysia has updated the list of companies and websites which are neither authorized nor approved under the relevant laws and regulations administered by the Central Bank. Table 1 below summarizes the number of companies and websites registered in the list for the year 2012 till 2020:

| Table 1 Total Listed Illegal Investment Companies and Websites |

|

|---|---|

| Year | No of Companies and Websites |

| 2012 | 81 |

| 2013 | 131 |

| 2014 | 197 |

| 2015 | 246 |

| 2016 | 277 |

| 2017 | 407 |

| 2018 | 424 |

| 2019 | 437 |

| 2020* | 445 |

Based on Table 1.1 above, up until June 2020, BNM listed the total number of 445 companies and websites that are conducting the activities of illegal deposit-taking from the public. The number of companies and websites listed in the alert is increasing. While many of these companies and websites were identified by Central Bank, it is believed that many dubious schemes remain undetected and have yet to be included in the list.

Besides, in May 2017, the Bukit Aman Commercial Crime Investigation Department (CCID) reported that the number of Ponzi scheme cases in Malaysia is alarming with RM397.1 million lost nationwide from 1,883 schemes for 2015 until April 2017 (Lim, 2017). It was reported that 408 cases were reported in 2015 (RM70.1 million losses); 1,151 cases in 2016 (RM210.3 million losses); and 324 cases were reported between January and April 2017 (RM98.7 million losses). This involves a total amount of RM 2,222,681,468 losses for 3 years. Interestingly, although it is common for scammers to target those who have money to invest, it was also revealed that university students are also common to become the victims of these Ponzi schemes. As revealed by (Koe & Nga, 2011), Generation Y is challenged with higher costs of basic needs in maintaining the desired modern lifestyle, as such, it is not surprising that college students have been targets of Ponzi companies according to a paper in The Star, 25 August 2010 entitled "Direct way to money."

Also stated by (Alias, Idris & Kamarudin, 2019) from Berita Harian newspaper, Malay and Bumiputera students are believed to be the most vulnerable to investment scams. This shows that students who still lack investment knowledge will be easily influenced by these scams just because they want to get more money to fulfill their needs and wishes. This may be happening due to the gullibility of the students, under the Theory of Gullibility. The theory of gullibility is defined as the acceptance of a false premise in the presence of untrustworthy cues which demonstrates a sense of vulnerability to being manipulated (Caerdydd, 2018). As result by (Teunisse,2015) which the sample from Macquarie University shows that on average students' samples had higher scores of gullibility for their participation in the Ponzi scheme.

Therefore, this study aims to identify the factors influencing students to join the Ponzi scheme by referring to gullibility theory (situation, cognition, personality, and state (emotional)). This study is useful to the regulator, enforcement agencies, university, and university students to further understand the factors influencing Ponzi Scheme participation. The study will also benefit the body of knowledge about the characteristics of Ponzi scheme companies that are considered people of choice.

Literature Review

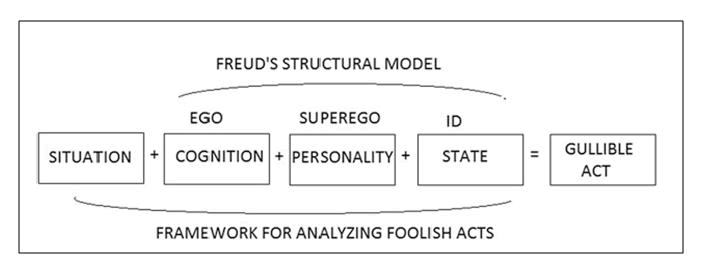

This study seeks to identify the factors influencing University students in Malaysia, mainly Bumiputera students, to join the Ponzi scheme by referring to Gullibility Theory. Gullibility, defined as naive and foolishness is believing other people when there is some evidence that they did not think of it due to some reason. The scam is considered fraudulent or dishonest behavior to deceive people until they get lost. Greenspan (2009) & Jacobs & Schain (2011) used the theory of gullibility to explain the success of Ponzi schemes. It is believed that four factors contributed to the Ponzi scheme. Figure 1 shows the framework of gullibility theory which consists of four elements, with one of these elements (Situation) being external to the victim, and three elements (Cognition, Personality, and State) being internal to the person.

Greenspan & Woods (2016) shows that a person who has high education can still be gullible due to trust in the investors that are trying to persuade the victims to get involved in this scheme. This statement is supported by (Lewis, 2012) who mentioned that victims of Ponzi schemes are often said to be at fault because they are too greedy or too gullible. When they are too trusting, they might be caught up in the systems as a victim because of the mistake that was made by trusting the wrong person, especially the investors themselves.

A previous study by Tennant (2011) examines the factors determining individuals' extent of exposure to Ponzi schemes. The theoretical literature on investor gullibility and risk tolerance was used to develop an economic model to explain such disclosure towards the Ponzi scheme. The study was being conducted by performing a survey of 402 investors in Jamaican Ponzi schemes. The result shows that the investors' extent of exposure to Ponzi schemes was driven by both gullibility and sensitive risk tolerance, but with some factors exerting considerably more significant influence than others. Therefore, this study will discuss further the four elements of the gullibility act; situation, cognition, personality, and state (emotional) as mentioned by Gullibility Theory.

Situation

The situation is the first element in the gullibility theory, which indicates the external factor that influences the victims to participate in the Ponzi scheme. This situation can be defined as over-trusting behavior when the social and other situational pressure occurs to the individuals (Lewis, 2012). The situational factor is also considered in the current economic situation because it can be one of the reasons why an individual participates in the Ponzi scheme. Usually, people are easily influenced by any person around them, especially family and friends. As mentioned by Greenspan & Woods (2016), it is difficult to break off a relationship once we developed a personal relationship with others. Researchers claimed that when someone has a good relationship with anybody, they are scared to say no because they do not want to break other parties' hearts. Besides, Preece & Baxter (2010) claimed that after interview sessions with school students, it has been shown that superstitions are caused by family and friend's influence (Obamuyi et al., 2018), television, and personal experiences that show the gullibility of students.

Besides, Obamuyi et al., (2018) also mentioned that the current economic situation can also be one of the factors of the participation in the Ponzi scheme, and they classify it as a third factor out of five elements suggested in their research. The current economic situation here is close enough to relate with the financial system of the country; it is because, in Nigeria, there was a strong negative relationship between the economic status and the Ponzi scheme. Meaning that, if there is a weak economy in the country, it will lead the people to invest in a Ponzi scheme because they believed in the profit in the future. The same result has been shown by (Amoah, 2018) where it has been reported that financial challenge is one of the challenges that led people to invest in this scheme.

Nonetheless, it will be different when it comes to the personal economic situation because the result shows that when a person has high incomes, they will have a high tendency to invest in the Ponzi scheme (Tennant, 2011). For this situation, it can happen for anyone who has a low income, but they still want to invest in a Ponzi scheme for them to meet their needs and wants. That is the reason why they put so much trust in the Ponzi scheme as it is for them to get more money after they have invested lots of funds in that scheme. Thus, economic pressure can be classified into two different perspectives, which are current economic and personal economic with close reference to financial stress.

Cognition

Cognition is an element of gullible, which is defined as people with a lack of high IQ (education) who failed to use their intelligence when making any decisions (Jacobs & Schain, 2011). It is also found that investors are vulnerable to being scammed due to a combination of social isolation and cognitive impairment (Langenderfer & Shimp, 2001). Sometimes scammers have their judgment on people, and they can know who are potential to be their next victims due to some reason. Scammers will approach someone who did not have full knowledge about investment so that they can easily deceive the investors. When people did not have so much knowledge about investment plus other factors that influence, they will simply decide to join investment even though they do know about the investment in detail (Judges, Gallant, Yang & Lee, 2017).

It is similar when someone does not practice their due diligence toward the investment scheme before making any decision. Wilkins, Acuff & Hermanson (2012) showed that most of the investors do not perform their due diligence to investigate the background of the scammers even though they are knowledgeable about investment. The researchers have conducted semi-structured interviews of 17 investors in a Ponzi scheme, but only one of them has hired a professional detective to check the background of the scammers. Therefore, limited investment knowledge and having no experience in investment would be the reasons why investors become a victim while trusting someone without due diligence on their background can lead them to be cheated by the scammer.

Personality

Believing a person too much can be considered as interpersonal behavior which puts trust in others (Langenderfer & Shimp, 2001). Risky personality and at the same time, impulsive in decision making especially when the investors start to be overconfident with the others, can fall as a gullible act (Greenspan & Woods, 2016). According to Jacobs & Schain (2011), the relationship of humans depends on their trusting behavior to others because sometimes distrust can break the tie. Therefore, people decided to trust rather than having suspicion to avoid the negative consequences of their relationship as friends or family.

The personality behaviour of a person is hard to measure and identify; at the same time, this is unique for all in which everyone has a different personality (Carey, Webb, & Webb, 2018). However, they managed to get the result by the action, and the reason why the investors participated in the Ponzi scheme would be the proxies. Due to that, the authors stated that trust and risk attitude is the indicators of the personality of the investors which pushes them to the gullibility act. Some people are risk-takers, by which they did not bother about what will happen in the future either they are gaining profit or loss. Base on Tennant (2011), the result from 402 respondents of the Caribbean Policy Research Institute (CAPRI) indicated highly exposed Ponzi investors who tend to show risk-taking tendencies in what they choose for their futures. This has been supported by (Lokanan, 2014) investors who are willing to take some risk because they aimed for their goals which is more towards the incomes from the investment they did. Somehow, risk-takers will challenge themselves to be potential victims (Titus & Gover, n.d.). Up till now, people believe in the term of high risk, high return for them to challenge themselves.

In contrast, Yamagishi & Kikuchi (2016) revealed that when investors put so much trust, they are more prudent and less gullible. Trust can be driven by the short-term mood of someone to trust or distrust others and the ability to detect fraud (Forgas & East, 2008; Forgas, 2019). The behavior of someone can describe the short-term mood here during that time based on the situation faced by them (Forgas & East, 2008). Maybe during that time, they feel confident and built trust with others quickly. Trust is generated and supported by social intelligence (Yamagishi et al., 1999). People with high social intelligence who are good at understanding themselves and other internal ones and using that understanding in social relations can maintain high levels of public trust, while those with low social intelligence do not. Yet, when someone is unwilling to say no to something due to overconfidence to trust and willingness to take a risk, they are a danger to fall as victims in the Ponzi scheme and still can be considered as gullible.

State (Emotional)

Most of the previous researchers use the term emotional to represent the state of being the last element of gullibility theory. Emotional is the internal feeling of a person, which is generally described as mental health either that person is normal or distress (Ganzini et al., 2014). In gullibility, the theory describes the emotions of a person to protect their wealth and their fear of losing it (Jacobs & Schain, 2011). It also means that investors have an obsessively strong desire for future wealth as their primary goal from the investment they joined.

Similar findings from Amoah (2018) stated that emotion is the motivation of people to make money and wealth once they joined this scheme. Motivation is a good thing to encourage people for something virtuous, however, in this case, the investors are motivated by the future outcome, which did not exist. The scammers will persuade the investors with a future gain by promising them to get the profit after they invest. From this situation, it will distract the emotion of people, then let them decide without further investigation. As reviewed by Button et al. (2012), the emotion of people will be affected before, during, and after they become victims especially when they lose the sum of money. Hence, whatever motivates the investors for future gain are the things that have been deceived by the scammers.

According to Greenspan & Woods (2016), it has been mentioned that someone can act foolishly when they have the fear of losing what they have. Sometimes this kind of person has greed and extremely eager to make money quickly (Tennant, 2011). The analysis from Americans shows that people who are eager and greedy believed that some investment can turn into profit (Lewis, 2012) (Titus & Gover, n.d.). Based on the article, the characteristics of people who are greed and become gullible are (1) carelessness, (2) lack of interest in the current news on scams, (3) risk-takers, and others. After the scammers explained about the future profit, investors are overwhelmed by uncertainty and it made them feel greedy for profit.

Based on prior studies, it seems most of the victims showed their gullible acts with less or more the same situation, cognition, personality, and state (emotional). Since this study aims to identify the factors influencing them to join the Ponzi scheme by referring to gullibility theory, the factors are divided into two, which consist of internal factors (cognition, personality, state emotional) and external factors (situation).

Research Methodology

This study used the research design model provided by (Cavana, Delahaye & Sekaran, 2003) which described the research method, population, sampling, and data analysis. Due to the exploratory nature of the study and sensitivity of data, this study uses face-to-face interviews and observation of the respondents to collect data on the behavior that is natural in their normal context. This study conducted a series of face-to-face interviews with the victims of the Ponzi scheme, using semi-structured interviews to allow the participants to express their experience and knowledge to answer questions through their own words. Since most of the victims consist of Malay and Bumiputera university students (Harian, 2019), Bumiputera university students are the best choice to be the respondents to classify the gullibility factors among university students towards the Ponzi scheme.

Purposive sampling was used in this research to select respondents and sites that would inform in terms of the focus of the investigation (Krathwohl, 1998). Decisions for interview selection were primarily based on the availability of interview times between the respondents and the researcher. This study interviewed 6 respondents and conducted an interview session with the expert party (Royal Malaysia Police) to check the validity of the information provided by the respondents. The names of the respondents are not included to protect the confidentiality of the respondents. The criteria in selecting the respondents are: (1) previously or currently, university students and (2) Bumiputera joined the Ponzi scheme while studying at the university. The interview sessions were done by referring to research protocol as a guideline.

The interview questions were designed to determine the factors that influence Bumiputera university students in the Ponzi scheme. The questionnaire from (Amoah, 2018) in a study in the capital city of Accra, Ghana was adapted and it serves as the main basis for the development of interview questions used in this study. The interview questions were structured into the following six sections:

• Section A: Interviewee Background

• Section B: Perceived of Gullibility Act

• Section C: Situation - Challenge faced by investors

• Section D: Cognition – IQ of investors in making a decision

• Section E: Personality – Interpersonal behavior which put trust in others

• Section F: State– Internal feeling of the person (emotional)

During the interview, the researcher assisted the respondents in answering the question by explaining any terms that they are not familiar with.The interviews conducted in mixed languages (Bahasa Melayu & English). Each respondent was presented with a set of questions related to their overall experience of participating in the Ponzi scheme and the impact they experienced during and after their participation. The items were mainly open-ended questions with a small number of closed issues related to information such as age, length invested and so on. The data were then analysed using NVIVO software as it helps the researcher to do coding and analyze the theme from the data by the respondents. The audio recordings werethen transcribed using Microsoft Word, and analyzed, categorized and organized into themes and further sub-themes that emerged through the coding process. During this process, all the information was restructured and inferred in meaningful ways based on the relevant theme.

Findings

This section will discuss the findings derived from the interviews conducted with respective respondents. Table 2 first summarizes the backgrounds of the interview respondents in this study based on their investment scheme and the total amount invested, as found out during the interview. Each participant in the table was given a numerical code name.

| Table 2 Profile of the Interview Respondents |

|||||

|---|---|---|---|---|---|

| Respondents | Gender | Age | Marital status | Ponzi scheme | Total amount invested |

| R1 | Male | 25 | Single | Score A(e-Learning) | RM800 |

| R2 | Male | 24 | Single | Pencil.my (e-Learning) | RM1,000 |

| R3 | Female | 25 | Single | Haji Halim (Gold investment) | RM14,000 |

| R4 | Female | 24 | Single | Pencil.my(e-Learning) | RM3,000 |

| R5 | Female | 26 | Single | MOH Academy (e-Learning) | RM4,647 |

| R6 | Male | 30 | Married | Tok Belagak(Gold investment) | RM10,000 |

Respondent one (R1), 25 years old, claimed that he had joined the Ponzi investment scheme named “Score A” in 2012 while studying. Respondent two (R2), 24 years old, joined the Ponzi investment scheme named “Pencil.my” in 2015 while studying. Respondent three (R3), 25 years old, had joined the Ponzi investment scheme known as “Haji Halim”, which focuses on the Gold investment while studying. Respondent four (R4), 24 years old, had joined the Ponzi investment scheme, also known as “Pencil.my” in early 2014 while studying. Respondent five (R5), 26 years old, had joined the Ponzi investment scheme known as “MOH Academy”, which promotes the digital online class in early 2018 while she was studying. Lastly, Respondent six (R6), 37 years old, had joined the investment scheme offered by a company known as “Darul Emas Perak (Tok Berlagak)” in 2014 during his bachelor's degree. Also, to check the validity of the information provided by the respondents, an interview was conducted with Supt. Leow Kian Heong, a Senior Criminal Investigating Officer of a Commercial Crime Investigation Department Bukit Aman on 13 November 2019.

The following sub-sections discuss the findings derived, based on the four themes outlined from gullibility theory. the four themes are situation, cognition, personality, and state factor.

Situational Factor

The situational factor is considered as the first element of gullibility, which indicates the external influence that affects the victims. This element shows the condition of how the respondents can fall into the Ponzi scheme. This situation focuses on the pressure that has been faced by the respondents when they decided to participate in the Ponzi scheme. The results from the respondents' perception of situational pressure have produced three main themes which are: friend pressure, financial pressure, and threat. Based on the interviews, 5 of them admitted they were joining the investment scheme because of friends' pressure; 3 of them agreed they participate because of the financial strain, and 3 of them mention they have been threatened by their friends who force them to join the scheme.The result is summarised in the following table.

| Table 3 Situational Factor |

|||

|---|---|---|---|

| Respondents | Friends pressure | Financial pressure | Threatening |

| 1 | Y | Y | |

| 2 | Y | Y | Y |

| 3 | Y | ||

| 4 | Y | Y | |

| 5 | Y | Y | |

| 6 | Y | ||

Friends Pressure

The first theme, which represents the situation faced by the respondents, is friend pressure. This situation indicates how their friend persuades them to invest in the Ponzi scheme. Most of the respondents admitted that they participated in the investment scheme because of their friend's recommendation. For example:

According to R1:

"Well, actually, my friend always repeats that he can make more money after he joined the business (SCORE A), he continues to introduce me to a business when he knows about my plan to do some business, but I do not have enough capital. Yeah, after a while, I feel interested and decided to join him."(Respondent 1)

The finding shows that the respondents were easily influenced by others especially those they trust, such as their friends. It can be concluded that people will quickly be influenced by their friends no matter how long they were being friends either long or in a short period.

Financial Pressure

The second theme discovered is financial pressure. Financial pressure explains a circumstance where a person has a problem in managing their money which sometimes not enough to fulfill what they want. The results from the respondents' perceptions of their financial condition have encouraged them to participate in the Ponzi scheme. Based on the interview, R3 admitted that they faced a financial problem that may lead them to choose this investment scheme as a platform for them to get extra money.

According to R1:

“It was in my early 20s, so I was thinking about money. I want to make more money and do not want to burden my parents, and then there is always more money to ask. Based on my allowance given by my parents, it was enough for me, but when I have my desire, I feel like I have to spend more money on sports goods, like sports shoes, jerseys, and also car accessories. That is what I thought by doing business like selling Jersey, can help me to get extra money. However, I have no capital". (Respondent 1)

At times, Respondent 3 also expressed her attention in making savings at an early age:

"The reason is that I think young people want to make money. For me to make savings, it must take a long period that is why I try to think for any chances for me to make quick money". (Respondent 3)

From the observation, Respondent 3 is more matured because she realized that saving money will take an extended period. Nevertheless, then, it might be that they have their own money, which can be used as the first investment finance of funds. However, she has chosen the wrong way to make more money in a short period; that was the reason she became a victim of the Ponzi scheme.

Threatening

Another new factor that can be considered as situational pressure faced by the respondents is a threat. In this situation, some of the respondents have been forced and threatened by the scammers, by which their friends offered them to join the Ponzi scheme. From the interview, two (2)of the respondents mentioned that they were forced to join the Ponzi scheme by their friend.

"After my friend saw me trying to change my mind, he started to threaten me. Yeah, by the time I got there from the Ipoh by bus, she was there to take me to the Acapella hotel. So, I did not have any transportation to go anywhere. She threatened me to stay there and did not want to send me back". (Respondent 2)

Truly he felt something weird and tried to change his mind not to join the investment because he did not expect that the part-time job offered by his friend is an investment scheme which is almost the same as MLM. However, his friend forced him to join it, or otherwise, his friend will leave him there. Hence, because of that, he had to accept the offer unwillingly.

Moreover, a similar situation was faced by Respondent 4 in which she had been forced by her senior even though she tried to negotiate the time to respond about the offer.

"I feel depressed when my senior continually forced me to invest in this PENCIL.MY. On my way from JB at 3 am, it was my senior who still persuaded my friend and me to invest. We do not have time to think, even though we try to convince her to answer later, but my senior still forced us to a bank in the money that morning". (Respondent 4)

Based on the interview, it seems that the respondents have been forced by their friends, which lead them to participate in the Ponzi scheme unwillingly. Thus, the threat can be implied as a new theme under situational factors that can influence the university students, and unluckily they become the victims.

As to conclude, the first factor, the situational factor that consists of three categories, which are friends' pressure, financial pressure, and also a new category which is a threat that can influence the university students in Malaysia to join the Ponzi scheme.

Cognition Factor

The second theme under gullibility theory is the cognition factor. The cognition factor refers to the ability of the person to understand the scheme either the scheme offered is legal or illegal. Somehow, people who are knowledgeable about investment are impulsive to make a wrong decision in their life. There are four categories produced under this element, which can explain the cognitive: lack of financial knowledge, rationality, lack of sound decision-making skills, and due diligence. Based on the interview conducted, most of the respondents give almost the same impression that can be related to cognition factors.

| Table 4 Cognition Factor |

||||

|---|---|---|---|---|

| Respondents | Lack of Financial Knowledge | Lack of Decision Making | Rationality | Due-Diligent |

| 1 | Y | Y | ||

| 2 | Y | Y | ||

| 3 | Y | |||

| 4 | Y | |||

| 5 | Y | |||

| 6 | Y | Y | Y | |

Lack of Financial Knowledge

Financial knowledge is considered a crucial element to ensure the respondents know how to manage their money as well as in investment. During the interview, only Respondent 3 confessed she has experience with investment; otherwise, 5 other respondents mentioned their lack of financial knowledge on finance, and that is the first time they participate in this investment scheme.

"I do not know about investment. Zero-knowledge. That is when I was young, during my diploma. Still do not know how to calculate profit when we invest, dividend pay-out. It is not known at all. I just follow what my friend asked me to do". (Respondent 1)

Nevertheless, Respondent 6 stated that he learned about investment on his own and seemed like he depended on his understanding from what he discovered:

"My background is from accounting, but as for this investment personally, I have no solid knowledge, I just read a bit, and from that, I discovered a bit about an investment that is based on my reading, because I have never invested anywhere. I guess this is my first time investing". (Respondent 6)

Lack of Sound Decision-Making Skills

Having a higher level of education will not ensure that someone can make the right decision for themselves. It can be proven by seeing the ability of the respondents when they make any decision for themselves. All of them are higher education with their major of studies; however, it does not guarantee that they can make the right decision.

"I am a person who likes to take advantage of opportunities. I want extra money and aim to save money when I was young for my future wedding event. Then, when I get any opportunities, especially when it comes to making more money. I will continue to make decisions". (Respondent 2)

Assuming that by investing in the scheme, Respondent 2 can earn money and start his savings for a future life that was the reason why he decided to invest and take it as an excellent opportunity. Another respondent has her reason for joining this scheme.

"Honestly, at that time I was thinking of changing jobs, so I was quite excited about the online classes offered, one of the subjects I could learn was editing skills, so I thought I could improve my knowledge and find other jobs suitable to my field of interest." (Respondent 5)

Respondent 5 mentioned that she was attracted by the online digital class offered by the promoters and assumed that after she joined that class, she can improve the skill and then can find another job.

Related to thecategory of threat, Respondent 4 mentioned:

"As I told you, under pressure and at the same time, I was thinking about the possible return I would get as they indicated during the briefing which had made me accepted to invest even though I had no idea and knowledge." (Respondent 4)

Two reasons lead her to decide which are the pressure from her friend and the act of still thinking to think about the possible income. Even though her friend forces her that is not the only reason why she decides to invest.

Meanwhile, only Respondent 6 showed that he realized what he decided:

"It also took me months to make the decision, as I observed the progress of my friend. From my evaluation of the way he earns money each month, I started to think that why don't I decide to invest, but in the low value of start-up is RM 2,000-RM 3,000 with one gold ring item". (Respondent 6)

By observing the achievement of his friends who received the income every month, he started to believe and tried with the lowest amount of investment. He looked so excited when he explained it because he knew that he had made the right decision. Nevertheless, most of the respondents have their motive why they accepted to join the investment. All the intentions were only to fulfil their needs as well as to get what they want in their life.

Rationality

The next category which can be related to cognition is rationality which highlights the level of rationality of victims in their decision making. Somehow people with good knowledge and intelligence can also lead them to make irrational decisions. But two (2) respondents shared that they are very rational while they decided to join the Ponzi scheme.

“At first, I did not think anything negative about my friend's offer. After coming to hear the briefing, I became interested and determined to become a successful person”. (Respondent 2)

The contrast answer was given by Respondent 2, even though he was forced at first, but suddenly after hearing the talk by the representative of the investment scheme, he became excited to invest and grow as a prosperous person too.

Similar to R3, he mentioned that:

"After joining the WhatsApp group, a few days later, I became interested in an advertisement from HAJI HALIM, he advertised on the investment he was going to make through GOLD. And it can be said that every advertisement he shared will be attributed to Islamic as well. Therefore, I believed in what he has shared. But at that time, I was not doing any research on HAJI HALIM. It all depended on the ads he shared. Within 2 days, I also had texted the person known as HAJI HALIM. That's when he explained everything to me". (Respondent 3)

Calmly and informally, both respondents said they realized what they think and decided during that time. Respondent 2 mentioned that he was interested to become a successful person after hearing the briefing from the Ponzi organizer. He knew what he was doing and decided it himself. The same goes for Respondent 3 who was attracted by the advertisements posted by the scammer, which influenced her mind to participate in that investment. All the victims realized what they are doing in their life, but they only realized when they become victims. Thus, rationality is a category of cognitive factor which shows that the respondents have made an optimist decision in their decision making.

Due-Diligence

Due diligence will represent a category of cognitive factors, which can also influence the respondents to participate in the Ponzi scheme. Due diligence means that people exercised a reasonable duty to ensure proper decision-making. The findings showed that some respondents do not perform their due diligence, for instance like searching or asking any advice from professionals. However, Respondent 3 frankly said that:

“I asked a friend of mine who has also invested in HAJI HALIM, and she encouraged me to join it too.” (Respondent 3)

Respondent 3 mentioned that her friend was also one of the investors in Haji Halim and encouraged her to participate in that investment. Previously, she mentioned that she believed in the ads shared by the scammer, and after her friend convinced her to join it, it reinforced her decision to accept the offer by the scammer.

Nevertheless, based on Respondent 1, who also asked for a piece of advice from their parents mentioned that:

"As usual, I will ask for advice from my parents. I told them about my friend's offer to join SCORE A. My dad disagreed because he said he had discovered many are deceived and lost. He said SCORE A is a real MLM, but when this was only focusing on finding a downline without promoting the item, it becomes illegal. However, during that time, I was naive and only thinking about making more money, I accepted that offer".(Respondent 1)

He calmly told his father, who advised him not to join that investment because his father noticed that this Ponzi scheme is illegal and has deceived so many people. Though, he was still with his own decision and ignored his parents' advice.

Unlike R6, he tried to find any platform to know the existence of the company to ensure that the company is legal:

"After my friend offered it, he was a Wakalah in this investment, he explained all the information to me. So, I did some research about this investment because I wanted to know the existence of that company. Then, it is true that the company existed and operated in the legal business. Starting from that I had no idea to argue".(Respondent 6)

The concept of due diligence showed that even though they have asked for advice from others or try searching, that can show either the investment offered is legal or not. Nonetheless, they are still with their own decision.

Personality Factor

Personality is sometimes equated with self-confidence and trust. The key to surviving in a world full of fraudsters or accidental masquerades is knowing when to believe and when not to. Therefore, even sophisticated professional investors often make assumptions about the security of investments they make and rely on the judgment and advice of others whom they believed. There are three categories produced under this personality factor when all the respondents were asked about their real personality, and while they faced that situation i.e. i) trust nature, ii) risk-taker, and iii) self-confident.

| Table 5 Personality Factor |

|||

|---|---|---|---|

| Respondents | Trust nature | Risk-taker | Self-confident |

| 1 | Y | Y | |

| 2 | Y | Y | Y |

| 3 | Y | Y | Y |

| 4 | Y | Y | |

| 5 | Y | ||

| 6 | Y | Y | Y |

Trust nature

Sometimes people relate human relationships with interpersonal trust because they assume a good relationship when people trust one another. However, foolish trust or gullibility can lead them to negative consequences, by which sometimes they are unwillingly trusting people to make sure their relationship disintegrates. The same situation happens to 3 respondents who put full trust in their friends who influenced them to participate in the Ponzi scheme.

According to R1:

"He was my schoolmate and also my futsal playmate. Before this, he never did something weird against me like he wanted to cheat or something. I believed that he will not fool me as a friend. But that does not mean I can trust my friend completely. At a certain time, there was something I disagreed with what my friend said. Maybe, in this case, I did not think that long". (Respondent 1)

Believing that his old friends will not cheat on him, unfortunately, had made him succeed in persuading him to participate in the Ponzi scheme and then became a victim. A similar situation was faced by Respondent 2 and Respondent 4 by which her senior who only befriended him for three months at the university persuaded her to participate in the Ponzi scheme.

Trust nature also can be proved by believing something other than a person, for an instance, happened to Respondent 3 who believed the investment scheme due to the return after investing in the investment offered by the scammer. Quoted by R3:

"I am more interested in the promised return. At that time, I invested the highest amount based on the investment level of RM 14, 000 and HAJI HALIM has promised that my return will be on a daily and not monthly basis like any other investment. Therefore, this has made me more interested and more concerned with the returns I will receive. If I get the return, within a month it is about RM30, 000 that I will receive".(Respondent 3)

Thus, it seems that trusting nature from the respondents not only with people but also other things. It can be concluded that foolish trust can lead them to be gullible and easily to be cheated by fraudsters.

Risk-Taker

Moreover, highly trustful people would be inclined to believe others generally and therefore put themselves at risk of victimization. Some respondents acknowledged that all investments have their own risk though they still convince themselves the scheme that they chose is the safest one (Tennant, 2011). R3 revealed that:

"HAJI HALIM does tell me that what the investors offered is high risk because, with the amount I have invested, I will face a very high risk. But I was not stressed about that risk, because I want to look for high-risk investments. After all, I know that if the risks are high, the returns are also high. All I want is a return". (Respondent 3)

Confidently Respondent 3 expressed that she is a risk-taker because although the promoter has to brief her about the risk, she still decided to invest. After all, she only aimed for a higher return. R6 responded the same way. Noted with the investment risk once Respondent 6 finance his money in the gold investment, he still agreed to invest. It seems like he is the risk-taker is not scared of future consequences. Most Respondents admitted that they were risk-takers and they were only focusing on the return after investing. Hence, it can be concluded that a risk-taker can be one of the factors influencing the respondents to join the Ponzi scheme.

Self-Confident

The third sub-theme under the personality factor is self-confident, which refers to the positive mood and optimistic interpretation of investment and can reduce the level of suspiciousness. Most of the respondents confidently decided to join the Ponzi scheme. Quoted by R1:

"I also have searched for SCORE A during that time, and it was somebody who shared that he succeeds after joining this investment, and that makes me more confident that the website existed, and the KIT ID that they gave can be used. So, I believe this SCORE A is not a lie".(Respondent 1)

Due diligence has been done by Respondent 1 by searching about the investment offered to him and he discovered that there was some people's success after joining the scheme thus making him more confident to accept the offer. A different situation was faced by Respondent 2 that would encourage him to participate as he stated that:

"When I heard the briefing that they had given me at the hotel that night, I became convinced when I heard them talking about the success of people who had joined PENCIL.my. It makes me confident, and they told me that PENCIL.my will be officiated by the Minister of Education. So, I believed that PENCIL.my is a true and recognized system”.(Respondent 2)

The fraudster keeps repeating on mentioning that the investment scheme will be officiated by the Minister of Education, which makes him feel confident with that scheme and believed that nothing was suspicious. Next, Respondent 3 also shared that she felt sure to invest in the scheme because of the behavior of the scammer who was willing to use his money to pay on behalf of her:

“So, the first time I transfer the money to HAJI HALIM that night was only RM4, 900 and I was short by RM100. Nevertheless, HAJI HALIM offered himself to pay the RM100 to make sure the total is RM5, 000. Yeah, I became more convinced of the good in him who was willing to invest his own money for me”.(Respondent 3)

Overall, from the interviews conducted, it can safely be said that to some extent, personality factor consists of trust nature, risk-taker and self-confident do influence the participation of university students in Malaysia in the Ponzi scheme. The majority of them showed almost the same personality, which contributed them to become a victim. Also supported by Supt Leow Kian Heong, all the victims are easily being deceived by showing the luxurious things to influence them:

"These fraudsters know their victims' weaknesses. When they begin to offer lucrative returns, of course, they will be attracted and believe. Again, fraudsters showed luxury cars, lots of money, and successful people. Yeah, of course, anyone would believe that. They are also confident that they will be as successful as they said. Whereas it is only a deceptive tactic to attract investors. They are not like what they showed off". (Supt Leow Kian Heong)

Therefore, from this factor, all respondents indicated that they are gullible and easy to be foolish.

State (Emotion) Factor

The state factor will represent the emotion of the respondents that will explain the last elements of the gullibility theory. The excitement always motivates people on how they encourage themselves to make more money and wealth. Some people believed that joining the investment scheme can help them to cultivate their life in the future. Based on the interview, most of the respondents aimed to make more money by finding a way to make other sources of income. Two categories can be developed under this factor: i) materialistic (greedy) and ii) amount gain/loss.

| Table 6 State (Emotion) Factor |

||

|---|---|---|

| Respondents | Greedy | Amount gain/ loss |

| 1 | ||

| 2 | Y | |

| 3 | Y | |

| 4 | ||

| 5 | ||

| 6 | Y | Y |

Greedy (Materialistic)

People who are motivated by greed, habit, and the promise of unbalanced returns are only to be blamed if these investments are lost. The victims who are motivated by desire are more likely to ignore the false signals embedded in a typical fraudulent message than those who are less motivated. 2 respondents expressed themselves as greedy by which they are aiming for something and therefore ignoring the negative vibes by the fraudsters. Quoted by R2:

“I want extra money and aim to save money when I was young for my future wedding event. So when my friend offered me a part-time job, I was excited to join”. (Respondent 2)

As stated above, Respondent 2 has joined this investment because of accepting an offer from his friend and due to threat too. He also mentioned that he aims for extra money because he wanted to make savings for his wedding event soon. It seems that he does not look at the negative side in which his friend might cheat him.

Related as R3:

“HAJI HALIM promises daily returns, for example like me who has invested RM14,000, in one day I will receive RM1, 000, and when summed up in a month, there will be RM30,000”.(Respondent 3)

Daily return promised by the fraudster attracted Respondent 3 to invest with a tremendous amount of money. On the other hand, Respondent 6, who has received the profit, feel happy, and want to try more:

“When I firstgot my return after investing, I had fun to try again, since when I got my money back, I became more confident that the Wakalah did not fool me. My total investment was up to RM10, 000 and I was earning about RM1, 000 more for a month.(Respondent 6)

Earning the return as promised by Wakalah makes Respondent 6 to be eager to invest more and ensure to receive more profit in future spending.

Amount Gain/Loss

Some investors were attracted to the investment scheme once they earn the benefit as promised by the promoters. This amount of gain or injury can be one of the categories under

emotion because by receiving the benefit, people will build more trust and confidence to invest more in future. As mentioned by R6:

“My total investment was up to RM10,000, and I was earning about RM1,000 more per month. The total to sum up my gain before I realized I was being cheated is about RM8,000. I almost meet my breakeven”.(Respondent 6)

Income received by Respondent 6 was almost every month consistently. Meaning that, the level of disappointment by Respondent 6 is low because he practically achieves the breakeven which the amount invested almost reaches the amount of gain.

In contrast with the other 3 respondents who were only being promised by the promoters, they will earn a profit if they flourish to find their downline. According to R1:

“The profit is obtained when I can find a downline. If I cannot get it, it is zero because this SCORE A’s focus is looking for downlines who are not the focus of the education web site”. (Respondent 1)

This explanation shows that the investment he joined which is the Ponzi scheme only focused on searching for a downline, not selling the products. Then, if Respondent 1 failed to find a downline, thus the amount invested will burn. Moreover, based on Supt Leow Kian Heong, he insisted that all the victims are too greedy in earning their extra money without thinking about the consequences:

“Greedy, that is the right word for the victims of the Ponzi scheme. If the promised return is 10% to 30% that is not very logical. But they still believed, for what reason? Because they are greedy, they want to be rich in making wrong decisions”. (Supt Leow Kian Heong)

Yet, when the victims are only focusing on making money, they will easily be cheated. From that, they show their gullibility act.

Other Factors

Based on the interview with all the respondents, other elements arise which not included in the Gullibility theory. The features are i) social influencer and ii) products, which also influence the participation of the respondent in the Ponzi scheme.

Social Influencer

Most of the respondents admitted that social influencer, including Medium platform (social media, television commercial) and also Person Characteristics, could be the aspects that contributed to the participation of university students in Malaysia to invest in the Ponzi scheme. Nowadays, people are more likely to use social media and also television commercials as their platform to promote businesses. They believed that by using this platform they will easily get the customers rather than they approach directly one-by-one. Thus, these two platforms contributed to be the factors influencing university students to be involved in the Ponzi scheme.

Nowadays, there are so many advertisements that appear in social media such as Facebook, Instagram, Twitter and others. Every business is on digital, and more people can currently sit in one place, but they can know all issues all over the world. After interviewing the respondents, 2 of them mentioned that they see this kind of investment scheme published on Facebook, WhatsApp and also their company’s website.

Quoted by R3:

“Every ad he sent was mostly Islamic. Like hadiths and Quranic verses. Every day he shares about Islam at his Facebook and also WhatsApp group, and at the same time, he advertised the investment offered. He always highlights the amount of return if someone joins the investment. That is what that makes me interested in investing”. (Respondent 3)

The fraudster used Facebook and also the WhatsApp group as his platform to attract investors to join the scheme. By highlighting the amount return and also followed by Hadiths and Surah, he convinced the reader to know more and join the investment. Thus, as happened to Respondent 3 who invested in gold investment, she was interested in the amount that will be earned: “HAJI HALIM has promised that my return will be on a daily and not monthly basis like any other investment.”

Besides, Respondent 6 also invested in gold under Darul Emas Perak Company and he stated that:

“It has been promoted on social media such as Facebook, any website platform such as their company’s website. The founder and the Wakalah were active in promoting their investment scheme in that social media”.(Respondent 6)

The most challenging part faced by the investigators is when the scammers used social media to promote their investment because sometimes, they are using fake accounts, and it might be challenging to know who is the owner of the report is. According to Supt Leow Kian Heong, he stated that:

“Today, our challenge is to investigate this Ponzi case when fraudsters deal with social media. It is hard to keep track of fraudsters. Finally, we can trace it through where the money was deposited”. (Supt Leow Kian Heong)

In this age of technology, everything will use the digital platform to sell and promote something. Hence, it becomes difficult to trace the fraudster activity because of their actions are incyberspace.

In conclusion, social influencers are divided into two categories, which are common platform and person characteristic which gives a significant impact on the victim because nowadays, many of the respondents are easily being cheated and being fooled by using social media where the scammers were posting and sharing any advertisement that encouraged investors to join. At the same time, they put trust in people who have a good personality; however, they did not realize that the scammers always used ways to influence others.

Products

After interviewing all the respondents, the majority of them showed that the products offered to them tend to attract them. There are 4 respondents who admitted that they joined the investment because of the product provided that is based on e-Learning. There were also 3 respondents who said that they trusted the fraudsters because the product delivered is based on Islamic products. Therefore, based on this theme, it can be divided into two categories, which are e-Learning and Islamic products.

Discussion

The gullibility act consists of four elements, which are Situational Factor, Cognition Factor, Personality Factor, and State Factor.

| Table 7 Gullibility Acts |

||||

|---|---|---|---|---|

| Respondents | Situational factor | Cognition factor | Personality factor | State factor |

| 1 | Y | Y | Y | |

| 2 | Y | Y | Y | Y |

| 3 | Y | Y | Y | Y |

| 4 | Y | Y | Y | |

| 5 | Y | Y | Y | |

| 6 | Y | Y | Y | Y |

This study is focusing on the gullibility theory which refers to the trustworthiness of victims who showed that they are foolish and naïve towards the Ponzi scheme. Based on the interviews conducted, all of the respondents showed that they were gullible as shown in Table 6.6 where almost all of the respondents fulfil the elements of gullibility act especially when they trusted and were confident with the investment scheme they joined.

In addition, this study emerged a new element which contributed to the factors influencing Bumiputera university students which are social influencers and products. From these two extra elements, the respondents expressed their gullible act by putting so much trust in the social influencers and products offered. Quoted by R6:

“It has been promoted on social media such as Facebook, any website platform such as their company’s website. The founder and also the Wakalah were active in promoting their investment scheme in that social media”. (Respondent 6)

Based on this statement, Respondent 6 was quickly to believe in what has been posted by the scammers in the social media. He was also confident the Wakalahdid not have lousy intentions because they promoted the investment publicly.

Thus, it seems that university students who are considered young with limited knowledge, especially in investment are not confident with the decision they made, will show their gullibility act. They are all naïve and natural, being fooled by the scammers who want to take advantage of them. However, the features that can influence them to be victims are not only referring to four elements stated in the gullibility theory but the new aspects that could lead them to involve in the Ponzi scheme. Therefore, the gullibility theory elements are accepted to be the dynamics that influenced university students together with other factors that have been gathered based on the interview sessions conducted.

Conclusion

In this study, the gullibility factors emerged as the central theme across all six interviews. All respondents reported that they are gullible by which they are easily being fooled and are naïve in investment. The main objective of this study is to identify the gullibility factors of individuals' extent of exposure to a Ponzi scheme among university students in Malaysia. The essential elements from (Greenspan, 2009) consist of four items which are the situation, cognition, personality, and state. The previous study by (Jacobs & Schain, 2011) also agreed that these four factors of gullibility could contribute to explaining the success of Ponzi scheme victimization. Hence, the findings of this study also showed the same result by which all the victims involved in the Ponzi scheme are gullible, meaning that their level of trustworthiness is high, based on the four elements of Gullibility Theory (situation, cognition, personality, and state).

This study will benefit the regulators, enforcement agencies, and universities to further understand the reasons why the students are involved in Ponzi schemes. It also benefits the body of knowledge about the characteristics of Ponzi scheme companies that are considered people of choice. Most importantly, there are two additional factors discovered, that influences victims in the Ponzi scheme are the famous and unique occurrence in Malaysia which are not included in gullibility theory. They are the medium platform used by the scammers to influence the victims are by using social media and television commercials, and the specialty of the scammers' fake business depends on its products that can attract people to invest. Based on the results of this study, most of the respondents showed that they are gullible to think of what has been revealed by the scammers and directly agreed to invest. They are too young to make a decision related to financing money and higher risk. Thus, the results of the findings showed that university students are easily being deceived because they are too young and naive to make any decisions in their life.

However, this study only focuses on a small number of participants makes it crucial for the researcher in generalizing the findings. Further studies can be conducted on other societies in the public to see their determinants of involvement in the Ponzi scheme.

References

- Albrecht, W.S., Albrecht, C.O., Albrecht, C.C., & Zimbelman, M.F. (2012). Fraud Examination.South-WesternCengageLearning. https://doi.org/10.1017/CBO9781107415324.004

- Alias, W.N.H.W., Idris, R., & Kamarudin, F. (2019). Malay liveliest cheated. Daily News, 1–3.

- Amoah, B. (2018). Mr Ponzi with fraud scheme is knocking?: Investors who may open. 19(5), 1115–1128. https://doi.org/10.1177/0972150918788625

- Bernama. (2019). Social media realm needs to remain a positive platform - Dr Mahathir. 1–4. Retrieved from www.bernama.com/en/news.php?id=1730579

- Button, M., Lewis, C., & Tapley, J. (2012). Not a victimless crime?: The impact of fraud on individual victims and their families. 27(1), 36–54. https://doi.org/10.1057/sj.2012.11

- Caerdydd, P.M. (2018). Cardiff metropolitan university prifysgol metropolitan Caerdydd B . Sc . ( Hons ) Psychology Final Year Project ‘Male Perceptions of Feminism and Gender Equality ’ Dissertation submitted in partial fulfilment of the requirements of Cardiff Metropolitan U.

- Carey, C., Webb, J.K., & Webb, J.K. (2018). Ponzi schemes and the roles of trust creation and maintenance.

- Forgas, J.P. (2019). Happy believers and sad skeptics? Affective influences on gullibility. CurrentDirectionsinPsychologicalScience,28(3),306–313. https://doi.org/10.1177/0963721419834543

- Forgas, J.P., & East, R. (2008). On being happy and gullible: Mood effects on skepticism and the detection of deception. Journal of Experimental Social Psychology, 44(5), 1362–1367.

- Ganzini, L., Mcfarland, B., & Bloom, J. (2014). Victims of fraud?: Comparing victims of white collar and violent crime.

- Greenspan, S. (2009). Fooled by Ponzi: How bernard Madoff made off with my money, or why even an expert on gullibility can get gulled. Skeptic.

- Greenspan, S., & Woods, G.W. (2016). Personal and situational contributors to fraud victimization?: Implications of a four-factor model of gullible investing. Springer International Publishing Switzerland 2016, 141–166. https://doi.org/10.1007/978-3-319-32419-7

- Harian, B. (2019a). Report: MLM targets IPT students to use digital business courses. Malaysia News Now, 2–3.

- Harian, B. (2019). Student scam business seminar join MLM. (September 2016), 1–7.

- Jacobs, P., & Schain, L. (2011). The never ending attraction of the ponzi scheme. Journal of Comprehensive Research, 9, 40–46.

- Judges, R.A., Gallant, S.N., Yang, L., & Lee, K. (2017). The role of cognition, personality, and trust in fraud victimization in older adults. Frontiers in Psychology, 8(APR), 1–10.

- Koe, J., & Nga, H. (2011). The influence of MLM companies and agent attributes on the willingness to undertake multilevel marketing as a career option among youth. 50–70. Langenderfer, J., & Shimp, T.A. (2001). Consumer vulnerability to scams , swindles , and fraud?: A new theory of visceral. 18(July 2001), 763–783.

- Lewis, M.K. (2012). New dogs , old tricks . Why do Ponzi schemes succeed??. 36, 294–309.

- Lim, I. (2019). Why Malaysians still fall for investment scams. Malay Mail, 1–5. Retrieved from https://www.malaymail.com/news/malaysia/2017/05/15/why-malaysians-still-fall-for-investment-scams/1376659

- Lokanan, M.E. (2014). The demographic profile of victims of investment fraud A Canadian perspective.

- Malaysia, B.N. (2018). What is financial fraud?? 1. Retrieved from http://www.bnm.gov.my/microsites/fraudalert/01_what.htm

- Obamuyi, T.M., Iriobe, G.O., Afolabi, T. S., Akinbobola, A.D., Elumaro, A.J., Faloye, B.A., … Oni, A.O. (2018). Factors influencing ponzi scheme participation in Nigeria. Advances in Social Sciences Research Journal, 5, 429–444.

- Preece, P.F.W., & Baxter, J.H. (2010). Scepticism and gullibility: The superstitious and pseudo-scientific beliefs of secondary school students. International Journal of Science Education, 22(11), 1147–1156.

- Securities and Exchange Commision, U. (2019). Ponzi Scheme “ Red Flags .” 1–2. Retrieved from https://www.investor.gov/protect-your-investments/fraud/types-fraud/ponzi-scheme

- Sekaran, U. (2003). Research and markets: Research methods for business - A skill building approach.InJohnWiley&Sons.

- Tennant, D. (2011). Why do people risk exposure to Ponzi schemes? Econometric evidence from Jamaica. Journal of International Financial Markets, Institutions & Money, 21, 328–346. https://doi.org/10.1016/j.intfin.2010.11.003

- Teunisse, A. (2015). Gullibility: A Review and A Scale.

- Titus, R.M., & Gover, A.R. (n.d.). Personal fraud?: The Victims and By, 12, 133–151.

- Wilkins, A.M., Acuff, W.W., & Hermanson, D.R. (2012). Understanding a Ponzi Scheme?: Victims ’, Perspectives, 4(1), 1–19.

- Yamagishi, T., Kikuchi, M., & Kosugi, M. (1999). Trust, gullibility, and social intelligence. Asian Journal of Social Psychology, 2(1), 145–161.