Research Article: 2020 Vol: 19 Issue: 6

Hindsight Thinking Met Waterloo for Thomas Cook Plc, UK. Could Gartner Hype Cycle Have Been the Harbinger for Rescue

Mohammad Rishad Faridi, Prince Sattam Bin Abdulaziz University

Shaha Faisal, Prince Sattam Bin Abdulaziz University

Mohammad Naushad, Prince Sattam Bin Abdulaziz University

Saloni Sinha, Birla Institute of Management Technology

Abstract

Thomas Cook Group Plc. (Thomas Cook), a multinational British travel company that arose to global fame, topped among Forbes Fortune 500 list. A company that completely revolutionized the package holiday; operating continuously for 178 years, earned credibility over time. In the early hours of Monday, September 23, 2019 this great global travel group was forced into compulsory liquidation and immediately ceased trading. Taxpayers ended up contributing at least 195 million USD due to its collapse. The British Department for Transportation (DfT) who had engaged in organizing the largest peacetime repatriation since World War two (WW2), agreed to pay an estimated 104 million USD towards the total cost of repatriating the travel giant’s customers (not covered by the -Air Travel Organizers’ License (ATOL) scheme), as well as 150,000 overseas holidaymakers. Other governmental costs included 73 million USD in redundancy and related payments to Thomas Cook’s former employees, and at least 19 million USD in liquidation costs.

The collapse of the 178-year-old Thomas Cook travel giant wreaked chaos making them lose global mistrust, which raised that, raised questions, such as, “how and why it collapsed”. This case study considers the “Gartner Hype Cycle” in order to exploring the yoke and leverage technology that could have prevented Thomas Cook’s catastrophic failure.

This is a first endeavor by the researchers to analyze the failures of Thomas Cook in light of the Gartner Hype Cycle. It can be assumed that Thomas Cook may have averted collapse by adopting technologies suggested by “Gartner Hype Cycle” and bounced back like a Phoenix.

Keywords

Gartner Hype Cycle, Thomas Cook, Digital Transformation.

Introduction

Thomas Cook was founded back in 1841 by a businessperson and Baptist preacher Thomas Cook. This company is widely considered the world’s oldest travel firm. It took off by organizing railway excursions across England and expanded steadily to develop a broader range of travel-related businesses. From conducting personal tours, it became an agent for the sale of domestic and overseas travel tickets, and further took on military transport and postal services while thriving to go on to become one of the largest travel agencies in the world. As we all know, his business expanded beyond Europe to Africa. Not to mention, Thomas Cook was considered the “Father of Modern Tourism” and a travel pioneer. However, World War-2 significantly affected its business operations, subsequently becoming a part of the state-owned British Railways and benefitting from a holiday boom after the skirmish, which witnessed millions of Britons travelling abroad by 1950. It was privatized in the 1970s with Midland Bank becoming its sole owner in 1977 and had its reputation enhanced for provision of excellence by launching a Money Back Guarantee scheme in 1974 for its patrons.

Witnessing exponential growth, the company ran an advertisement slogan “Don’t just book it, Thomas Cook it!” which became an extremely popular and compelling tagline. In 1972 the company was renamed Thomas Cook, and in 2001 it was wholly owned by Thomas Cook AG, one of the largest travel groups in the world.

Literature Review

Cooking a Recipe for Disaster

Thomas Cook with a robust financial backbone and one of the world’s biggest leisure travel groups, with sales of USD 9.75 billion, 19 million annual customers and 22,000 employees, ceased trading in September 2019. In May, 2019 the company reported a loss of USD 1.88 billion impacting around 600,000 customers globally including 1,65,000 Britons, and about 10,000,00 travelers who had already paid in advance.

It had employed more than 21,000 people, 9,000 of whom were located in the United Kingdom who had eventually ended up losing their jobs. Thomas Cook’s management failed to secure a bail out deal for the sum of USD 1.38 with the governments’ refusal to offer a lifesaving survival deal or guaranteeing short-term funding. It seemed nearly inconceivable that one of the industry’s longest-running stalwarts could result in such a catastrophic failure. Consequently, a bidding chaos evolved, sorting out the damage that Thomas Cook’s collapse created nearly though the estimates of USD 750million.

Renowned consultants, researchers, academicians, management experts pondered over and shared their theories while investigating the root cause of the collapse. The industry experts argued three major areas (financial, social and climatographic) that caused the collapse of Thomas Cook (Forbes). However, this was not reason enough that led to its failure. There had been other contributory factors such as collateral damage.

Intrigued by this, our case study team performed a thorough analysis on digital transformation phenomenon as a dimension to deliberate upon. One question to ponder over was, “What went wrong between 2016 and 2019?”, It was contemplated that the political unrest in Turkey in 2016, heat wave in 2018, stiff competition from small rival operators, plunging stocks, weak sterling, lack of technology adoption, failing to operate with the adoption curve, lavish gratuities dished out to directors, and insurmountable debt in the end contributed to seal its fate.

Another factor could be its fiasco to prepare for the future by failing to adopt the technological shift at the time and to recognize the importance of five trends in Gartner Hype Cycle as released in “Trends Emerge in the Gartner Hype Cycle for Emerging Technologies, 2018-2019”. Coupling Gartner’s Hype Cycle into its business model would have kept it in the Blue Ocean and leveraged its competitive advantage. Accepting and adapting to the rapid technological disruption enhances visibility, transparency, and speed that aids in features like value addition and risk reduction is essential for any company

This case study explored the power of technology and how to harness and leverage to be agile from a qualitative case study approach.

Anthony et al. (2019) suggested that top global companies who quickly shifted to new growth areas away from their traditional core business simplified their growth potential to higher level. They further reiterated that growth strategy during business disruption due to technology transformation in the organization, needed to explore new growth avenues and new business models repositioning its core business and monitor finance management (performance) effectively.

Genesis of Thomas Cook

Thomas Cook was a passionate man with a vision to tour the world. In 1841, he persuaded the Midland Counties Railway Company to run a special train between Leicester and Loughborough for a temperance meeting, which was believed to have been the first publicly advertised excursion train in England. Three years later the railway agreed to make the arrangement permanent if Cook would provide passengers for the excursion trains. Cook operated tours and excursions from Leicester to France, and in later years, he led his first Grand Tour of Europe.

With the taste of success, he ceased to conduct personal tours and became a sales agent for domestic and overseas tickets. His firm took on military transport and postal services for England and Egypt during the 1880s. After his death, the business passed on to his only son who expanded the business before handing it over/along with to his sons until 1928. They offered bespoke tours and excursions by bus, rail, and plane.

In 1920, the company was sold to the Belgian firm Compagnie Internationale des Wagons-Lits et des Grands Express Européens, which operated Orient Express, one of the Europe’s luxury sleeping cars (Britannica).

Nationalization of Thomas Cook

Thomas Cook was nationalized shortly after the World War II to become part of the state-owned British Railways. It benefited from a holiday boom after the skirmish, and witnessed one million Britons travelling abroad by 1950. In 1965, Thomas Cook's profits exceeded USD 1.25 million for the first time. In 1972 the company was renamed Thomas Cook, and in 2001 it was wholly owned by Thomas Cook AG, to become one of the largest travel groups in the world. Travel business was expanded to Africa and the Middle East and later to the rest of the world.

Privatizations Story

It was privatized in the 1970s with Midland Bank becoming its sole owner in 1977. After nearly three decades, it again became a private corporation when it was acquired by German Bank (Westdeutsche Landesbank) in 1992. In 1999 they invested in airline business as a backward integration strategy. In 2001, it was owned solely by C&N Touristic AG, one of Germany’s largest travel groups, who renamed the company, Thomas Cook AG. They brought back the original name of Thomas Cook Group.

The Expensive Merger

In 2007, Thomas Cook merged with My Travel and consolidated to become globally competitive. As per Marketline (2019), Thomas Cook’s assets as of September 2018 consisted of approximately 100 aircrafts, 186 hotels and resorts, with a stronghold of 20 million consumer based worldwide. This proved to be an expensive merger, and by 2010 net debt had risen from USD 311 million in 2007 to USD 1 billion.

Thomas Cook incurred heavy losses, which piled up due to non-optimal aircraft and flight operations, as well as, asset utilization that yielded in high fixed costs. By late 2011, Thomas Cook appealed to lenders for a USD 125 million extensions to its loans. Back in 2011, the company wobbled close to insolvency when the pension deficit took debts to USD 2.5 billion which was averted by a USD 530 million fundraises. With all the rescue money depleted, the debt pile surged to USD 2 billion. The company’s botched attempt to liquidate its assets during recession period failed to secure any successful survival deal. Finally, in May 2019, the company incurred an insurmountable loss of USD 1.88 Billion financial in losses.

In August 2019, USD 1.12 billion funding package was secured as part of a rescue deal led by a Chinese conglomerate Fosun International, a main shareholder in Thomas Cook’s. The terms allowed Fosun to inject half this amount in return for receiving at least 75 percent of Thomas Cook’s tour-operator service, and 25 percent of its airline businesses. The remaining USD 562 million was to be provided by Thomas Cook’s creditor banks and bondholders. However, a last moment request which came from the creditor banks to obtain a further USD 200 million in contingency funding in order to sustain them during off peak and slow winter months. In addition, this domino effect resulted in the collapse of the deal that pulled down Thomas Cook along with it.

Creditors requested another USD 250 million in funding. One of the bank advisors suggested that even sourcing USD 1.13 Billion would be insufficient to revive the company and its reputation. Minimum USD 1.38 billion would be the bailout amount needed. Fosun balked from the deal that led to final collapse in September 2019.

The Roller Coaster from Here On

The collapse of Thomas Cook impacted around 800,000 cancelled customer orders with advance bookings. 21,000 employees lost their jobs worldwide. Its long-term channel partners, hotels, and resorts took a significant financial hit including loss of reputation and jeopardy of trust. The United Kingdom (UK) government undertook a mammoth repatriation task. As per Mark Tanzer, Chief Executive of Association of British Travel Agents (ABTA), Thomas Cook paid USD 1.5 Billion in the form of loan interest in the last six years, which had depleted profits. Thomas Cook’s “inside out strategy” than being “outside in strategy” proved a rather slow transition and weak adaptation to novel business models. Their hindsight on numerous acquisitions (MyTravel Partner, Expedia etc.) failed, leaving a burden of huge overheads (560 travel operators on high end street and large number of employees), economic shockwaves (Currency fluctuation), natural disaster (Hurricane, Tsunami), and political instability, especially at Sharm El-Sheikh, one of the most preferred sites in Egypt.

Snookered

With Thomas Cook’s failure to shift with the adoption curve, embrace new technology, create a blue ocean strategy, and become a fast mover led to its collapse. This collapse however, proved to be a godsend for late comers in the industry who rivaled with it, and transcended in offering similar products and services at a very rapid speed and competitive prices. They lowered their operating expenses, unlike Thomas Cook, by adopting low cost business strategies like sustaining and scaling up business approaches.

The situation only worsened in 2016 when political unrest in Turkey, 2018’s heat wave, and Brexit compounded its problems with recession by the harsh waning of the Pound, which hit UK customers’ purchasing power abroad. This kept Thomas Cook at the receiving end, which ultimately failed to overcome. Last CEO, Fankhauser quoted after declaring bankruptcy in 2019 “This marks a deeply sad day for the company which pioneered package holidays and made travel possible for millions of people around the world”.

The company had long struggled to gain traction owing to weak trading, unremitting debt balance sheet, nearly avoided insolvency compounded with the weak performing sterling made the business untenable and unsustainable in the long run.

Even though Thomas Cook was the first mover in the industry, yet it failed to innovate and evolve fast enough with an ever-changing society, latest technology adoption, and a deep insight into consumer behavior. Over the recent years, it failed to ward off intense competition from online providers and low-cost airlines. Consumers became more autonomous and tech savvy with the internet allowing them to offer bespoke travel packages at lower prices.

Frustrations around consistently poor weather conditions back home also proved to be a tough sell for Thomas Cook when travelers preferred satiations.

Fat Cats Had Creamed

As per David (2019) in his article in Travel Weekly, Mark Tanzer the CEO of ABTA said “The failure of Thomas Cook, in my view, is more a failure of corporate finance than a failure of travel”.

As per Ledwith M & Witherow T (2019) published in Daily Mail, alleged the misappropriation of funds, an accusation targeted at the top management; alluding to mismanagement through bonuses. A pressing question was, how could USD 12.10 Billion revenue yield, reported in 2018, could go in vain, subsequently resulting in a collapse in May 2019 with a reported loss of USD 1.88 Billion? This was a perplexing scenario.

The non-UK customers also took a massive hit both financially and emotionally. Other competitors took an undue advantage of the crisis by exorbitantly charging those Thomas Cook customers who were not covered by ATOL. This nightmare would surely haunt these Thomas Cook customers for years to come.

Chiefs Led the Doom

A Daily Mail audit revealed that the three top executives, who led the beleaguered firm since 2007, raked in more than USD 45.125 million in pay and bonuses. This also includes the top management who took a whopping USD 10.5 million since 2014, including USD 5.75 million in form of bonus payments. One of the manager faced controversy of yearly shelling of USD 100,000 in hotel and travel bills with just USD 13.75 million as his total pay.

Last but not least, for a couple of months in the year 2015, top management got USD 7.875 million, but were generous enough to donate one third of USD 7 million to the parents of those struck by tragedy in Corfu. Additionally, another top management was paid a huge sum of USD 21 million between 2007 and 2011. Likewise, another chief pocketed USD 10.375 between 2012 and 2018. USD 58.75 million was made by five executives between 2012 and 2018 as stated by the article (Mario & Tom, 2020).

The Customer Bank

As per David (2019) in his article in Travel Weekly, European passengers had always invested high levels of blinded trust in Thomas Cook. Huge amounts of advance bookings were made with the company especially before summer and fall each year. This advance customer cash was parked for around six to nine months without any interest to the customers. This amount was between USD 1.25 billion and USD 2.50 billion at a specific given time period.

Money Matters

If a bank like “The Customer Bank” was created with all the reserved money deposited in it, this could have benefited the customers with the interest money paid back to them against the money they deposited. Thomas Cook apparently gorged onto customers’ advance payments and scrupulously manipulated the finances to have its credit limit expanded with its suppliers.

If Thomas Cook borrowed this sum of money from any financial institutions, there would be a requirement to incur overhead, administration, and legal costs etc. along with high interest paybacks. On the contrary, “The Customer Bank” would have paid some kind of credit notes or bonuses to the customers in order to display their appreciation for keeping their advance money. In the UK, the ATOL scheme came into action by protecting the customers’ rights in paying, by covering the advances made in the event if company defaulted.

Research Approaches & Methods

In Dire Straits: A Paradigm Shift

As per David (2019) in his article in Travel Weekly, genius Albert Einstein defined insanity as “doing the same thing over and over again and expecting a different result”. This quote very well rhymes with Thomas Cook’s nadir state of affairs and bad operations. Some of the broad factors of failures are as follows:

Shallow government intervention

At a critical junction as per Bhadrapur (2019), the Government refused to intervene in the year 2019 as a bailout package to revive the company, stating that it’s their commercial issue, and advances of the customers during bankruptcy will be compensated by ATOL protection scheme and insurance. UK government said, their lies no strategic national interest in support of Thomas Cook. They had incurred USD 2.125 billion debt, and a bailout of worth USD 313 Billion was turned down by the Government.

Number crunch

The company had a strong base of 500 retail locations. It was a plan to swap the debts by taking the majority shares of Thomas Cook’s tour-operating business which Fosun, (the Chinese investor who was also Thomas Cooks major stakeholder) was initially interested in buying under certain terms and conditions. As per Davis & Morales (2019), this was unconquerable, since hedge fund entities stopped this plan because it would hinder in cashing in on holdings of credit-default swaps that pay out when a company default. They predicted that the news of huge debt of Thomas Cook would stop customers in paying advances. In fact till the last night of official declared bankruptcy, Thomas Cook continued booking holidays, proving that the company had unethical intentions.

Travel industry reinvented

As per Marlow (2019) & Ashworth et al. (2019) there is a long litany of unanswered questions. The most obvious was “how a company’s misrepresented turnover of USD 12 billion ended up in the hands of liquidators”. Thomas Cook was a private entity, but historical data facts show they were under government ownership between World War II from 1945 to 1972. It was the series of various mishaps down the road from being unable to find a buyer, to acquiring its airline business, and a write-down of USD 1.375 billion from MyTravel which they acquired in 2007, that proved to be a major financial catastrophe.

Environment scan

Thomas Cook’s marketing policy to stick with traditional brick and mortar consisted of 600 high street retail stores. Thomas Cook failed to innovate, evolve, shift with the adoption curve, kept a pace with changing consumer behaviors. They still believed and relied on their historical brand value. They failed to appreciate and consider the rapidly shifting consumer behaviors across all industries with increased choice and ease of access provided by technology; the internet. Consumers had the flexibility of directly planning their own vacations at affordable costs rather than using an agent such as Thomas Cook. They were shopping around for the best deals. (Forbes). Further, political unrest overseas, Brexit, recession, and heat wave contributed to its collapse.

Technology adaptation more reactive than proactive

As per Lall & Thomas (2020), Simon Calder expert in travel business quotes “Thomas Cook was not ready for the 21st century”. They could not hindsight the need to keep up with dramatic changes in the travel industry, especially, the burgeoning online line tour booking with the advent of the internet. For example, four out of five Britons were booking online at a lower cost while Thomas Cook’s overhead costs of high street retail stores sucked all the profits.

They went on made a strategic alliance with Expedia in September 2017, a renowned online travel-booking platform. They extended the “White label” online booking with Expedia. This would help Thomas Cook to leverage the state-of-the-art technology adopted by Expedia as well as access 60,000 hotels from Expedia data, thus cost and complexity reduced. This bold step was their group wide transformation plan. As per Gill (2018), the last CEO, USD 75 million was invested in technology up-gradation each year. Thomas Cook’s main competitor, TUI group was proactive in digital transformation. Consumers preferred TUI app recently.

Digital advisory coated with ego and internal conflicts

As per MacLeod (2013), Thomas Cook formed a Digital Advisory Board (DAB) with the main aim to develop digital strategies capabilities for the entire group. A committee was formed with the main objective to enhance customer experience with digital transformation, particularly focusing on digital marketing, search engine optimization, interactive social media, online retail, mobile solutions, community collaboration etc. E-commerce Centre of Excellence (ECE) was established in order to strengthen its functional operations and to improve online customer experience across the board.

This was a paradigm shift from a “traditional old fashion” tour operator to digital independence in being your own tour operator. However, this move came in too late, since the company was already struggling with internal conflicts, resistance to change, differences of opinions, area of focus, priorities, strategy with changing CEOs, which led to sluggish technological response leading to further deepening of the crisis and shifting away from core focus to digital technology. Thus, the digital strategies could not be transformed at the retail level. Thomas Cook was still using very old customer relationship software from 1950s that was of no match to the evolving technological era Bhadrapur (2019). Board members were displeased with CEO Harriet Green’s ambitious digital initiatives that led to her departure. This clearly indicated a resistance to change a major challenge and a collapse-contributing factor.

In an interview Harriet Green, CEO in 2013, stated that Thomas Cook was publicly beleaguered (Taylor, 2020), while it attempted to operate as undisputed solo leader in the industry. The mountain of debt was so overwhelming that even mergers and, acquisitions failed to save Thomas Cook from plunging into insolvency.

Strategic Findings & Discussion

Gartner Hype Cycle: Interpreting Technology Hype

Gartner Group is one of the world’s leading global research and advisory consultancy American firm engaged in creating and disseminating knowledge through research on technologies, programs implementations, consultancy, as well as events and solutions gathering, thus enabling its worldwide customers to make more assertive decisions. They closely monitored around 2000 trending technologies and formalized a graphical depiction of common patterns that arise with each new technology or other innovation in various domains as a way for clients to track technology maturity and potential.

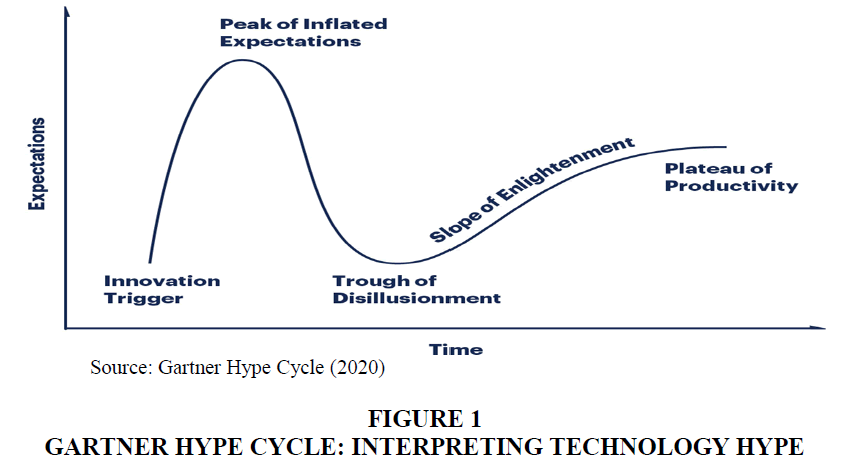

The five phases within the Hype Cycle are the Technology Trigger, Peak of Inflated Expectations, Trough of Disillusionment, Slope of Enlightenment and Plateau of Productivity. This determines how technology and company development capability index is stimulated in order to be ever-present. Now it is pertinent to explore how to distinguish a commercial viability of a new technology entering a market with hype? And if the technology stands up to its claim would recompense? “Gartner Hype Cycle” (GHC) can offer a graphical representation (Figure 1) of different technologies from the conception to maturity stage, and how organizations can adapt technology accordingly to their environment, capabilities, and resource needs.

The technology adaptation decision also measures risk and opportunities, and aids in risk reduction of decisions into technology investment. GHC is an analytical graphical tool that depicts the common pattern that evolves from any new technology or innovation and exploits opportunities with problem solving ability, and its ability to deploy resources during the course of achieving business goals. Emerging technology with risk mitigation factor is calculated in order to adopt a particular technology. Early movers get the competitive advantage while balancing the risk with the investment in other words a cost-benefit analysis is done. As per GHC it consists of five stages, they are as follows:

Innovation trigger

A breakthrough in technology; unusable product with no evidence of commercial viability. Awareness level is confined; gains significant publicity but functionality of the product and its form, features and future yet to be determined and proven.

Peak of inflated expectations

Technology is actually implemented and executed. Outcome is in mixed form of favorable or unfavorable. First movers take the advantage, whereas majorities wait and watch.

Trough of disillusionment

First movers either fail or deliver. Success further encourages investment whereas failures drop out (exit). Producer of technology gets first hand insight.

Slope of enlightenment

The consumers gain confidence in innovative technology embarking on the use of emerging technology. Technology providers release second and third generation products. Early adopters roll out pilot projects while conservative enterprises cautiously wait.

Plateau of productivity

Technology is commercially viable and widely adopted and implemented. Evaluation using certain standard of measurements is available to assess its operational ability.

This cycle studies the trends of the emerging technology, enables its capability by learning, and its commercial viability. It performs investment and risk analysis for optimum decision-making. It fills the technology gap by adding business value and digital strategic alignment.

Leveraging and Harnessing Technology Adoption

Chief Information Officer (CIO) must have the acumen to predict which emerging technology in most appropriate to adopt and which will have behavioral impact on business and industry. GHC prepares the CIO to lead during uncertainties, construct agility into strategy, which will lead to decision making. Business models to be implemented should investigate any potential risks, uncertainties, cost, optimization of resources that are real time challenges CIO encounters while aligning with the technology decision making. As per Gartner report, Gartner Hype Cycle for Emerging Technologies are classified into five major trends, they are as follows:

• Sensing and mobility

• Augmented human

• Post-classical compute and Comms

• Digital ecosystem

• Advanced Artificial Intelligence (AI) and analytics

Organizations cannot commit on customer driven revenue growth using old technology with even flatter organization structure.

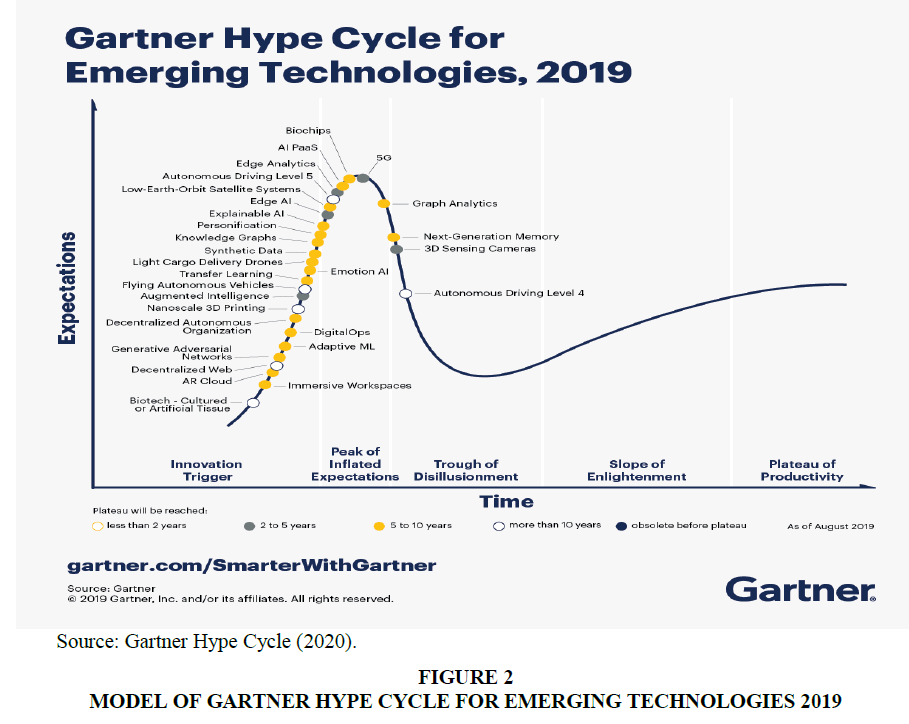

Model of Gartner Hype Cycle for Emerging Technologies

Gartner Hype Cycle for Emerging Technologies (GHCET) is the culmination of around 2000 technologies, which are thoroughly scrutinized to predict the trends, which shape emerging technologies (See Figure 2). Garter is engaged in representing maturity, adoption, and social application of innovative emerging technologies in graphical and conceptual form. In today’s business technology, innovation is a crucial factor for competitive differentiation and transformation of most of the industries.

Sensing and mobility

This is a ground breaking technology wherein enabled mobility and ability to manipulate objects lie. A light cargo drone is a suitable example of this. Sensing technology extends to internet of things (IoT). Sensors capture unlimited data, which help in inferences and insights drawing for decision-making. If Thomas Cook would have spent on sensing and mobility, they would have had a clearer picture of the degree of customer experience while comparing it with the best in class.

Augmented human

A study of an immersive workspace, biotech personification (cultured or artificial tissue), augmented intelligence etc. This is an understanding of the science of human from cognitive as well as physical part of human to explore possibilities in biochips and emotional artificial intelligence to understand real time behavior. Thomas Cook failed to analyze the consumer intelligence, expectation level from travel/holidaying perspective, as well as an understanding of the health perspectives of consumers such as health/fitness/medical issues when booking trips.

Post-classical compute and comms

This state-of-the-art technology focused on binary or classy computing where binary bits are present for computing.

This is a new breakthrough from the traditional architectures. 5G (Generation) is the latest cellular technology, which allows low earth orbit (LEO) satellite to function on global broadband or narrow band voice, which immensely improves the speed, which enables a unique experience for online booking. Thomas Cook could have considered the adaptation of this 5G technology for smart and speedy data transfer with prompt visibility.

Digital ecosystem

This is a value driver for today’s business where connection is purely web-like between various entities (enterprise, people and things). Supply chain is digitalized to the extent of a seamless smart connectivity of various Thomas Cook retailers with company sales office, service providers (Hotels, resorts etc.) and with ultimate users across geographies and industries. Decentralized autonomous organizations (DAOs) constantly explore new avenues and new opportunities to expand and grow. If Thomas Cook would have seriously implemented a digital eco system in 2013, they would have been agile and responsive with encountering business disruption in the travel industry. Synthetic data, decentralized web, digital Ops and knowledge graphs are effective tools in engaging consumers.

Advanced Artificial Intelligence (AI) and analytics: These are the new classes of data science and algorithms that lead to absolutely new resource capabilities. Transfer of learning for big data that can be easily churned into advance analytics, deeper insights, recommendation and predictions for optimum decision-making. Different emerging technologies such as explainable artificial intelligence, graph analytics, platform as a service (PaaS), adaptive machine learning, edge analytics etc. would have enriched Thomas Cook with technology fitness to combat low cost, business disrupters, high overheads etc. and perhaps allowed them to remain the iconic brand not only in the UK but globally. Faridi & Malik (2019) states that technology adaption is not an option, but it is mandatory to adopt it proactively in order to remain competitive.

Conclusion

Thomas Cook’s situation would have been entirely different had he considered thoroughly scrutinizing the Gartner Hype Cycle for Emerging Technologies (GHCET) through the Digital Advisory Board (DAB) formed with a purpose to instill digital strategies in an integrative way. Thomas Cook’s reckless, directionless leadership, lack of vision to adopt modern digital technologies, and failing to pace up the rapidly changing business environment, and customer behavior setup a stage for disaster.

Reality to believe that the travel brand is unchallengeable was a short-lived dream. This iconic brand with a king-size ego that played a prime role in obnoxious decisions was crushed. Technology adaptation with GHCET would have surfaced out the misappropriation of funds, real time funds reconciliation, alert signals during wrong decision making, fraud detection, gauge employee knowledge relationship, augmented reality in travel industry etc. The competitive advantage of Thomas Cook was the high trust and reliability factor from consumer perspective.

Usually companies nowadays fail due to shrinkage in customer size but in this case, on the contrary, as they had huge amounts in the form of advances from customers. Synchronous and asynchronous of various actors and factors caught Thomas Cook like a rabbit in the headlights when it failed to perceive what was coming.

Businesses need a forward-thinking approach of outside-in-strategy. Lesson learnt for Thomas Cook was that digital transformation is no more an operational or tactical move but a necessity to shift from the traditional IT support to a more modern IT strategic path. Innovative technology drives the business; scales up to reduce huge overhead cost. Instead of a backward integration strategy of investing in the airline business, they could have invested in the supply chain business of delivery, and parcel services as well as using their existing fleet, in some cases sharing resources with other courier and delivery companies to leverage fleet. Also collaborated with retailers, online business platforms in delivery and parcel services, especially when online buying increased multifold, could have been an area for other researchers in future to ponder upon or explore.

In the end, such a downward spiraling catastrophe, with an evidently devastating debt record, was bound to force the most prosperous companies to act cautiously and thus, invest elsewhere.

Acknowledgement

This publication was supported by the Deanship of Scientific Research at Prince Sattam Bin Abdulaziz University, Al Kharj, Kingdom of Saudi Arabia.

Appendix

Instructors’ Manual

Target group

This case has been particularly focused upon postgraduate students of higher level pursuing business/commerce programs or mid-level executive attending executive development programs. They are particularly those who are specializing in marketing and strategic management departments. They will study this as a part of the Chapters-Digital Disruption, Strategies in Digital Disruption, Leadership in Digital Disruption, Digital Transformation in Large Organizations, Adaptation process of technology in the digital transformation journey, etc.

Learning Outcomes

By reading and understanding this case study, learners are expected to:

• Build and develop an integrative business plan during the crisis of business disruption of travel industry, and hone their ability to transform crises into opportunities

• Judge the ability to assess the present scenario and predict future business trends

• Test, run and validate the “Gartner Hype Cycle for Emerging Technologies” (GHCET), and leverage this technology during the process of turnaround period

• Propose and decide digital transformation and technology adaptation in order to gain and remain competitive in the business

Triggering Questions

Q1. As a Chief Marketing Officer (CMO) of Thomas Cook PLC, UK suggests your proactive business plan especially in the context of travel industry being transformed due to business disruption?

Q2. Discuss some of the blindfolds which are common with most of the big companies like Thomas Cook PLC, UK. Which lead them to failure? Further discuss how Gartner Hype Cycle for Emerging Technologies (GHCET) would have played a vital role in the turnaround strategy.

Q3. As a Chief Technology Officer (CTO) determine what would be the approach in digital transformation and technology adaptation criterion from Thomas Cook PLC, UK perspective?

Recommended supplement resources to read

Readers may explore the following links for more information on Gartner Hype Cycle for Emerging Technologies (GHCET).

1. www.gartner.com/en/documents/3956735/winning-in-the-turns-a-cmo-action-guide-how-leading-bran

3. www.gartner.com/smarterwithgartner/gartner-top-10-strategic-technology-trends-for-2020/

5. www.travelshift.com/blog/disruption-in-the-travel-industry/

Blindfolds in Business

Cragun & Sweetman (2020) states that following are the blindfolds which organizations must be extremely careful about in order to save themselves from the trap of death.

• Arrogance: Living in false paradise.

• Intolerance towards negative suggestions: Take it as a personal attack and victim of

• false pride

• Unacceptance of competitor’s strengths: Not accepting and recognizing competitors uniqueness

• Customer fallacy: Overconfident about knowing more than the customer itself

• No issue or problem exists: Believe all is well and no issue or problem exists.

• No change and lack of dynamisms: Putting same efforts and expecting different results.

Client Testimonial of Gartner

| Table A1 Client Testimonial of Gartner | ||

| Organization | Industry | Name of Representative |

| Consumers Energy, USA | Public utility company | Patricia Beecherl |

| Pennsylvania State Employees Credit Union (PSECU) USA | Corporate Banking | Barbara Bowker |

References

- Anthony, S.D., Trotter, A., & Schwartz, E.I. (2019). The top 20 business transformations of the last decade. Harvard Business Review, 2-7.

- Ashworth, L., O’Dwyer, M., & Graham, C. (2019). Thomas Cook collapse: Travellers face queues and chaos as UK undertakes biggest repatriation effort since WW2. The Telegraph, Retrieved September 23, 2019, from https://www.telegraph.co.uk/business/2019/09/23/markets-live-latest-news-pound-euro-ftse-100-thomas-cook-collapses/

- Bhadrapur, S. (2020). Thomas cook collapse: What went wrong?. Retrieved March 12, 2020, from https://www.thecasecentre.org/main/products/view?id=166571

- Cragun, S., & Sweetman, K. (2020). Maintaining 20-20 vision in the age of disruption. Retrieved December 01, 2020, from www.leaderonomics.com/articles/business/dodging-six-deadly-blindfolds

- David, S. (2020). Thomas cook’s collapse shows atol scheme’s flaw. Retrieved March 11, 2020, from https://www.travelweekly.co.uk/articles/346547/comment-thomas-cooks-collapse-shows-atol-schemes-flaw

- Davis, A., & Morales, A. (2020). U.K. government suggests Thomas cook won’t be rescued. Retrieved September 14, 2019, from http://search.ebscohost.com.sdl.idm.oclc.org/login.aspx?direct=true&db=bsu&AN=138757109&site=eds-live

- Faridi, M.R., & Malik, A. (2019). Customer engagement technology in sme's in Saudi Arabia: Does it ensue in disturbance or disruption. International Journal of Entrepreneurship, 23(1), 1-8.

- Gartner Hype Cycle. (2020). Retrieved March 14, 2020 from https://www.gartner.com/en/research/methodologies/gartner-hype-cycle

- Gill, R. (2018). Thomas cook talks up expedia deal, tui talks up its app. Retrieved August 21, 2018 from https://www.phocuswire.com/Thomas-Cook-talks-up-Expedia-deal-TUI-talks-up-its-app. Accessed March 15, 2020

- Lall, R.R., & Thomas, C. (2020). Found the age of empire easier than the age of expedia. RetrievedSeptember 23, 2019 from https://qz.com/1714157/thomas-cook-is-bust-because-the-age-of-empire-was-easier-than-that-of-expedia/

- Liimatainen, K. (2019). Thomas Cook collapse to leave bondholders almost empty-handed. Retrieved March 09, 2020, from http://search.ebscohost.com.sdl.idm.oclc.org/login.aspx?direct=true&db=bsu&AN=139117332&site=eds-live

- MacLeod, I. (2013). Thomas cook unveils digital advisory board, The drum. Retrieved March 01, 2013, from https://www.thedrum.com/news/2013/03/01/thomas-cook-unveils-digital-advisory-board

- Mario, L., & Tom, W. (2020). Thomas cook fat cats had creamed off £47M. Retrieved March 03, 2020 from http://search.ebscohost.com.sdl.idm.oclc.org/login.aspx?direct=true&db=rps&AN=138759511&site=eds-live

- Marketline. (2019). A Progressive digital media business. Retrieved March 14, 2020 from http://search.ebscohost.com.sdl.idm.oclc.org/login.aspx?direct=true&db=bsu&AN=139116325&site=eds-live

- Marlow, B. (2019). Management ineptitude and apathy are the reasons for Thomas Cook’s demise. The Telegraph, Retrieved March 14, 2020, from https://www.telegraph.co.uk/business/2019/09/23/forget-brexit-weak-pound-management-ineptitude-apathy-reasons/

- Taylor, I. (2020). Big interview: Harriet green on the transformation of thomas cook. Retrieved March 15, 2020, from https://www.travelweekly.co.uk/articles/43469/big-interview-harriet-green-on-the-transformation-of-thomas-cook