Research Article: 2022 Vol: 25 Issue: 5S

House Ownership Credit Takeover Process: A Case Study of Bank BTN Central Java Region

Bagus Rahmanda, Diponegoro University

Rinitami Njatrijani, Diponegoro University

Alya Febrita Aulia, Diponegoro University

Citation Information: Rahmanda, B., Njatrijani, R., & Aulia, A.F. (2022). House ownership credit takeover process: a case study of bank btn central java region. Journal of Legal, Ethical and Regulatory Issues, 25(S5), 1-8.

Abstract

With the increasing selling price of houses, it is necessary to have a home ownership loan (KPR) in overcoming the problem of housing needs. However, there is no regulation that specifically regulates the takeover of housing loans. For this matter, there is no legal protection for the parties as well as legal certainty that specifically underlies it. The method used in this study is an empirical research method, namely legal research that highlights the main research issues regarding the application of positive law. The results of the study indicate that credit takeover activities are based on general provisions, namely the Civil Code regarding subrogation and agreement clauses based on the principle of freedom of contract. The debtor transfer process at KPR-BTN is classified as Passive Subjective Novation because the replacement of the old debtor and the new debtor with the approval of the creditor results in the release of the old debtor's legal obligations.

Keywords

Debtor Transfer, Credit, Juridical Analysis, House Ownership, KPR BTN.

Introduction

Along with the passage of time, the primary human needs are increasing in number, apart from clothing, food, shelter, which is also indispensable. Sometimes this is even used as a business area for business people, including developers and banks. The value of the selling price of the house will increase over time, so that this can be used as an investment for property business people. In article 1 number 7 of Law No. 1 of 2011 concerning Housing and Settlement of buildings that function as a decent place to live, a means of fostering a family, a reflection of the dignity and worth of the occupants as well as an asset for the owner. Since the first house has become a primary need for everyone to ensure their survival. In reality, the house is not something that is affordable for all levels of society due to the high price. The uneven economic conditions of the Indonesian people have resulted in not everyone being able to have the house they need and desire. In meeting these needs, the community needs assistance, one of which is in the form of home ownership loans or commonly known as mortgages.

In Law Number 7 of 1992 concerning Banking as amended by Law Number 10 of 1998 (hereinafter referred to as the Banking Law) article 1 paragraph 2 states, a bank is a business entity that collects funds from the public in the form of deposits and distributes them to the public in the form of deposits in the form of credit and in other forms in order to improve the standard of living of the community. It can be concluded that the bank is an intermediary institution. Apart from being an intermediary institution, banks are also payment traffic. One of the bank's products in channeling funds to the public is credit.

A credit reaches its function if socially and economically, both for debtors, creditors, and the community, it has an impact on a better stage. One of them is the method of credit transfer or takeover home ownership loans to other banks. The customer automatically becomes a new customer by taking over the mortgage. When you become a new customer, the interest rate charged is a fixed rate, which is far below the normal interest rate. The customer will conduct a survey first to the new bank before taking over the mortgage. The customer will compare interest rates, penalties, discounts, notary fees and other fees. Currently, there are several websites or internet sites that offer a simple, fast and accurate simulation of calculating takeover mortgages.

The implementation of takeover mortgages is one solution for customers to avoid the inability to pay monthly installments which can lead to potential and result in bad loans (Justitia & Aidi, 2018). Takeover is a term in the banking business world that is used in the event that a third party gives credit to the debtor with the aim of paying off the debtor's debt to the initial creditor and providing new credit to the debtor so that the position of this third party replaces the position of the initial creditor (Firdaus, 1986). The process of implementing a mortgage takeover is simple as follows: the bank will conduct a credit analysis and re-appraisal the collateral because over-credit is carried out like a new loan process. Another process is the reassessment of the guarantee. In addition to wanting to know the current value of the guarantee, the bank will recheck the related documents, especially the validity of the building permit. BTN (Persero) as one of the government commercial banks, one of its activities is to provide consumer credit which is a type of financing in general which includes housing loans (KPR). Although Home Ownership Credit (KPR) can help overcome housing needs, in practice it also has several obstacles or problems that need further scrutiny in aspects related to law. As for in this article, we will discuss the process of taking over home ownership loans in Central Java, especially at Bank BTN.

Formulation of the Problem

Based on the description above, the formulation of the problem in the study is as follows:

1. What are the rules governing the takeover of home ownership loans in Indonesia?

2. How is the process of taking over home ownership loans at Bank BTN?

Research Methodos

The method used in this study is a normative research method, namely an empirical research method (Empirical Legal Research), namely legal research that highlights the main issues of research regarding the application of positive law (Soekanto, 1986). Furthermore, in terms of the purpose of conducting research, this research is also intended to conduct research on problem identification and problem solutions. This research is intended to obtain more in-depth knowledge of a certain legal phenomenon, also to obtain information about the frequency of certain legal events, also to obtain data regarding the relationship between one legal phenomenon and another.

Home Ownership Loan Takeover Arrangements in Indonesia

The origin of the word "credit" is from the Roman word "credere" which means to believe. According to Sinungan (1991), credit is a gift of achievement by a party to another party and that achievement will be returned at a certain time in the future accompanied by a counter achievement in the form of interest. This understanding is in line with the definition of credit as stated in Law Number 10 of 1998 concerning Amendments to Law Number 7 of 1992 concerning. Based on Article 1 number 11 of the Banking Law, Credit is defined as the provision of money or equivalent claims, based on an agreement or loan agreement between a bank and another party that requires the borrower to repay his debt after a certain period of time with interest.

In general, credit is an agreement so that its implementation is subject to the law of agreement as regulated in Book III of the Civil Code. In this condition credit is an agreement entered into between the bank and the prospective debtor to obtain credit from the bank concerned. Authentic, the Banking Law does not mention credit agreements as the basis for granting credit, even the term "credit agreement" is also not found in the provisions of the Banking Law (Djuhaendah, 1996). Based on the Circular Letter of Bank Negara Indonesia Unit 1 Number 2/539/UPK dated October 8, 1966 in conjunction with the Circular Letter of Bank Negara Indonesia Number 2/643/UPK/Pemb. On October 20, 1966, it was instructed that in any form of credit, Banks are required to use a credit agreement, and from the word credit agreement, in banking practice, it is known as a credit agreement (Badrulzaman, 1991).

The problem of non-performing loans is a legal issue in the civil aspect, namely the relationship between debtors and creditors (banks) as credit providers. The relationship was born from an agreement. The debtor promises to return the loan along with fees and interest, and the creditor provides credit facilities. Arrears in credit or bad loans are a form of risk in banking credit that must be addressed as soon as possible so that banks do not experience losses (Njatrijani & Prananda, 2020). Some efforts to overcome the occurrence of bad loans are by disbursing credit guarantees and the results of the disbursement are used to fulfill debtor obligations to the bank or through takeovers credit (takeover) from other banks.

In the world of banking business, takeover is a term used in the event that a third party gives credit to the debtor with the aim of paying off the debtor's debt to the initial creditor and providing new credit to the debtor so that the position of this third party replaces the position of the initial creditor. The takeover event in the Civil Code is also known as "subrogation". The definition of subrogation is contained in Article 1400 of the Civil Code which states that subrogation is "the replacement of creditor rights by a third party who pays the creditor and the third party in the context of this discussion is named a new creditor, while the creditor who receives payment from a third party is named old creditor (Thong, 2000). It is further explained in Article 1400 of the Civil Code regarding the manner in which subrogation occurs, that is, it occurs because of approval (directly) and occurs because of the law (indirectly). Subrogation can occur because of the agreement and can also occur because of the law. According to Herlien Budiono (2011), subrogation is divided into 2 (two), namely: First, subrogation at the initiative of creditors, as referred to in Article 1401 paragraph (1) of the Civil Code, which is said to have occurred subrogation whose initiative came from the creditor by receiving payment from a third party (new creditor) stipulates that it is this person who will replace the rights he has against the debtor. Second, subrogation at the initiative of the debtor, in this subrogation the debtor first takes money borrowing between the debtor and the new creditor, then it is stated that the debtor in paying off his debt to the old creditor used borrowed money from the new creditor.

In the takeover process, both home ownership loans (KPR) and other productive loans are included in the subrogation by agreement and are also included in the subrogation at the initiative of the debtor. Thong (2000) stated that according to the law, subrogation must be carried out strictly (uitdrukkelijk) and at the same time (gelijktijdig). These conditions absolutely must be met. Until now there is no legislation that specifically regulates takeover, especially regarding the takeover of home ownership loans (KPR), so that in general the takeover is still subject to the subrogation provisions contained in the Civil Code. To complete matters which are generally not regulated in the provisions regarding subrogation in the Civil Code, additional clauses in the takeover agreement are used which are further binding based on the principle of freedom of contract as stated in Article 1338 of the Civil Code.

The Process for Home Ownership at Bank BTN

Various factors can affect the course of credit, including the occurrence of transfers of debtors before the credit period ends. The transfer of debtors or known to the public as credit transfers occurs due to several factors.

First, after the credit period runs, the debtor is no longer able to carry out his obligations to pay KPR-BTN installments due to many things such as: the debtor has lost his job, the debtor's business has declined or because the debtor does not have good faith to fulfill his obligations.

Second, the debtor changes domicile. Debtor transfer in practice at PT Bank Tabungan Negara (Persero) can be carried out by debtors by meeting the requirements, such as submit a request for transfer of debtor to PT. State Savings Bank (Persero). The request for transfer of the debtor has been provided by the bank in the form of a form that must be filled out by the applicant (old debtor), fill in the applicant's data (old debtors) and new debtors, attach the following requirements, including photocopy of the applicant's husband and wife ID card (old debtor) which is still valid as much as 1 (one) sheet, 1 (one) copy of the new valid buyer/debtor ID card of husband and wife, photocopy of the applicant's Family Card (old debtor) which is still valid as much as 1 (one) sheet, photocopy of Marriage Certificate of the applicant (old debtor) which is still valid as much as 1 (one) sheet, photocopy of job description legalized by the Office or related agency, for applicants who are employees or employees, salary slips or income statement known by the office or related agencies, for applicants who are employees or employees, and photocopy of other business permits for self-employed applicants, and photocopy of Business Report or Business records for the last 3 (three) months, for selfemployed applicants, and current year of provisional land tax (Njatrijani et al., 2020).

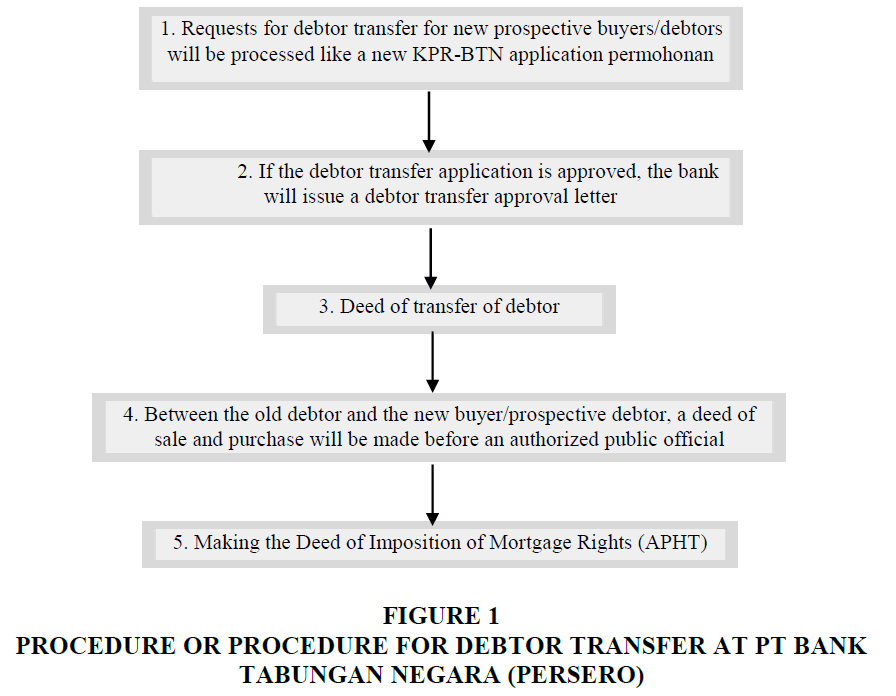

The procedure or procedure for transferring debtors at PT Bank Tabungan Negara (Persero) is as follows. First, applications for transfer of debtors for new prospective buyers/debtors will be processed like new KPR-BTN applications; in this case the new prospective debtors must continue to go through the stages of credit application and credit assessment to assess the feasibility or ability of the new prospective debtor.

Second, if the debtor transfer application is approved, the bank will issue a debtor transfer approval letter, followed by making the deed of transfer of the debtor. Furthermore, between the old debtor and the new buyer/prospective debtor, a deed of sale and purchase will be made before the authorized public official, in this case PPAT, witnessed by the Bank and ended by making a Mortgage Deed (APHT) (Figure 1).

Judging from the legal aspect of the engagement, the debtor transfer process carried out in the distribution of Housing Loans (KPR-BTN) is a legal act of novation. Novation is a process of replacing the old agreement by a new agreement, which causes the old agreement to be deleted, so that what follows is a new agreement with changes to its terms and conditions, and or changes to the parties in the agreement (Fuady, 1999). The Civil Code regulates Novation from Article 1413 to Article 1424, namely in the section on the abolition of an engagement. From the provisions of Article 1413 of the Civil Code, it can be seen that there are 3 (three) ways to carry out novation. If a debtor makes a new debt agreement for the person who owes it, which replaces the old debt, which is written off because of it. If a new debtor is appointed to replace the old debtor, the debtor is released from his engagement, and if, as a result of a new agreement, a new debtor is appointed to replace the old debtor, to whom the debtor is released from his engagement.

The novation or renewal of the debt can only be carried out between people who are capable of entering into engagements (Article 1414 of the Civil Code). The legal act of novation must meet the juridical requirements, including some matters.

1. Firmly done. Innovation must be done firmly. Novation should not be suspected, in accordance with the provisions in Article 1415 of the Civil Code, which states that there is no alleged debt renewal novation; a person's will to make debt renewal must be clearly evident from his actions.

2. Pre-emptively there is a Legal Debt. Because with the act of novation, a debt is renewed, so that a new debt is formed, then at the time of novation. First, there must be a legal debt. Because if the debt does not exist or the debt is invalid, then there is no debt that can or deserves to be renewed.

3. Change of Debt, Change of Debtor or Change of Creditor in terms of replacement of old debt with new debt, replacement of old debtors with new debtors, and replacement of old creditors with new creditors.

4. Meet Contract Making Conditions. With a novation, a new debt will be formed (based on a new contract), then the conditions for the validity of a contra must be met for a novation, even though the law only requires skills to make a contract for the parties (Article 1414 of the Civil Code).

5. Delegation alone is not an innovation. What is meant by delegation is the replacement of debtors while still having the right of regress. So, with delegation, it cannot be a debtor replacement or debt renewal (novation). Only if the creditor agrees to change the creditor without the right of recourse (without recourse), that is, by releasing the old debtor from his obligations, the delegation turns into novation. If this is not the case, then even though the obligation is delegated to another party, the creditor can still collect directly from the original debtor. Delegation action is also known as “unfinished innovation” (onvolndige novatie).

Article 1417 of the Civil Code exclusively states Fuady (1999) that delegation or transfer, whereby a debtor gives to the person who owes him a new debtor binds himself to the debtor, does not issue a debt renewal, if the debtor does not expressly state that he intends to release the debtor who made the transfer, from his engagement.

In connection with the process of transferring debtors to KPR-BTN which according to the author is a legal act of novation, it will bring legal consequences. The old debtor will be released from his obligations, and the bank as the creditor can no longer collect the old debtor. All assessor rights or privileges that were originally attached to the old agreement shall not be carried over to the new agreement, unless the assessor's rights or privileges are expressly maintained by the creditor. In law, there are several models of novation, namely as stated in Article 1413 of the Civil Code. First, objective novation. Objective Novation is a debt renewal by which the debtor makes a new debt contract to replace the old debt. So, in this case what is replaced with a new contract is solely the debt and there is no change to the debtor or creditor. To be called a novation, the change in the object of the contract must be substantial. If the changes are not substantial, it cannot be said that novation has occurred. This can also be seen in the provisions of several articles of the Civil Code. Article 1428 stated that a debt rescheduling does not prevent the implementation of debt compensation. Article11850 stated that a debt rescheduling does not relieve the personal guarantor from his obligations. However, in this case the personal guarantor can demand the debtor to pay the debt or release the personal guarantor and his obligations.

In term of passive subjective novation, what is meant by passive subjective novation is that the old debtor is replaced with a new debtor, and the creditor agrees that the old debtor is released from his obligations. As a result, the old debtor and creditor no longer have a debt contract. If the release of the old debtor by the creditor is not carried out, then what happens is not a novation legal action, but a delegation legal action. In this case it is said to be subjective novation because what changes/changes is the subject, namely the debtor, resulting in a new contract replacing the old contract.

Meanwhile, in term of active subjective novation, what is meant by active subjective novation is the replacement of old creditors with new creditors. As a result, the debtor and the old creditor no longer have a debt contract. In this case it is said to be subjective novation because it is the subject that changes/changes, namely the creditor, resulting in a new contract replacing the old contract. The process of transferring debtors in the distribution of KPR-BTN according to the author is a Passive Subjective Novation because in this case what happens is the replacement of the debtor with the approval of the creditor with the release of the old debtor from his obligations.

Conclusion

The takeover arrangement in Indonesia is known as subrogation contained in the Civil Code. Takeover is included in the subrogation because of the agreement and is included in the subrogation at the initiative of the debtor or debtor. However, the regulation regarding takeover specifically is not yet contained in the laws and regulations in Indonesia, there are only general arrangements which are subject to the Civil Code. However, for general matters for which there is no regulation, an additional clause is used in a binding take-over agreement based on the principle of freedom of contract in accordance with what is regulated in Article 1338 of the Civil Code. The process of taking over the position of the initial creditor with a new creditor on the debtor or takeover is carried out with several terms and conditions that must be met with several patterns or procedures for transferring the debtor. Based on the legal review, the engagement of the debtor transfer process in the KPR at Bank BTN can be classified as a novation legal act. Where in novation when there is a new agreement, it results in the abolition of the previous agreement. This causes the entry into force of a new agreement with all changes to the terms and conditions. In the event that the transfer of the debtor is a passive subjective novation, there is a change of the debtor with the approval of the creditor, thereby releasing the old debtor from his obligations.

References

Badrulzaman, M.D. (1991). Bank credit agreement. Bandung: Citra Aditya.

Budiono, H. (2011). General doctrine of covenant law and its application in the notary field. Bandung: Image of Aditya Bakti.

Djuhaendah, H. (1996). Material guarantee agency for land and other objects attached to the land in the conception of application of the horizontal separation principle. Bandung: Image of Aditya Bakti.

Firdaus, M.R. (1986). Bank credit management. Bandung: Purna Sarana.

Fuady, M. (1999). Contract law from a business law perspective. Bandung: PT. Image of Aditya Bakti.

Justitia, W., & Aidi, Z. (2018). Legal protection for banks as new creditors in the transfer of receivables for home ownership loans on a top up basis. Juridical Journal, 4(2), 110-130.

Njatrijani, R., & Prananda, R.R. (2020). Risk and performance in technology service platform of online peer-to-peer (P2P) mode. International Journal of Scientific and Technology Research, 9(3), 5404-5406.

Njatrijani, R., Rsssahmanda, B., & Prananda, R.R. (2020). Business development of copyright and fiduciary guarantee in Indonesia. International Journal of Economics and Business Administration, 8(1), 278-284.

Indexed at, Google Scholar, Cross ref

Sinungan, M. (1991). Basics and techniques of credit management. Jakarta: Bumi Aksara.

Soekanto, S. (1986). Introduction to legal research. Jakarta: University of Indonesia Publisher.

Thong, K.T. (2000). Notary studies, miscellaneous notary practice. Jakarta: PT. New Ichthiat.

Received: 30-Sep-2021, Manuscript No. JLERI-21-8570; Editor assigned: 02-Oct-2021, PreQC No. JLERI-21-8570(PQ); Reviewed: 16- Oct-2021, QC No. JLERI-21-8570; Revised: 24-Feb-2022, Manuscript No. JLERI-21-8570(R); Published: 03-Mar-2022