Research Article: 2021 Vol: 20 Issue: 2

How Intellectual Capital Dimensions Impacts Strategic Innovation in Manufacturing SMEs

Nagwan AlQershi, Universiti Tun Hussein Onn Malaysia

Zakaria Bin Abas, Universiti Utara Malaysia

Sany Sanuri Mohd Mokhtar, Universiti Utara Malaysia

Abstract

Intellectual capital (IC) is now the primary factor for value creation and competitive advantage among firms. Also Strategic Innovation (SI) may contribute to increased operational effectiveness and efficiency; it is, therefore, reasonable to say that consistent strategic innovation would lead to exploring new marketing methods and improving customer satisfaction to meet their changing needs. However the current study fills the existing gaps in theory and practice by investigating the nature of the relationship between intellectual capital and SMEs’ strategic innovation in the manufacturing industry of Yemen. The survey method was used to collect data from 284 SMEs in the manufacturing industry of Yemen. Results indicate that intellectual capital dimensions have a significant effect on strategic innovation. This is the first statistical study to demonstrate the influence of intellectual capital and strategic innovation in manufacturing SMEs in Yemen, Middle East and developing counties. Our finding may help owners in enhancing intellectual capital in order to achieve higher strategic innovation effectiveness and efficiency.

Keywords

Intellectual Capital (IC), Human Capital (HC), Structural Capital (SC), Relational Capital (RC), Strategic Innovation (SI).

Introduction

Intellectual capital is recognized as a critical resource for gaining a competitive advantage. It refers to the knowledge, information and experience that can be combined for wealth creation (Meret et al., 2020). Several researchers have dedicated their work to intellectual capital management by explaining the role of intangible resources and capabilities in developing superior performance (De Frutos-Belizon et al., 2019; Agostini et al., 2017). The introduction of the knowledge-based economy, where knowledge has a major role in wealth generation, has brought about the erosion of traditional ways of achieving high performance.

Intellectual capital is the set of intangible assets and social relationships that create value for an organization (Nawaz & Haniffa, 2017). Current economic changes include the globalization of businesses, dynamic competition, increased customer demand for sophisticated and innovative products/services, changes in technology, and shortened life-cycle of products. Intellectual capital practitioners and researchers agree that firms have now entered the realm of a competitive economy driven by information rather than by industry (Liu, 2017). In this realm, knowledge and innovation is the major driver of the global economy (Dumay & Guthrie, 2017). In addition, it is widely accepted that an organization’s ability to innovate is closely tied to its intellectual capital, or its ability to utilize its knowledge resources.

Related to this, several quantitative studies on intellectual capital have explored its function and influence in specific sectors in developed countries. However, it remains to examine and confirm the applicability of the concept of IC specifically in manufacturing industries and in developing countries (AlQershi et al., 2020a; Eniola et al., 2015). Emerging markets may exhibit different characteristics (Bello, Radulovich, Javalgi, Scherer and Taylor, 2016).

In same scenario, the Yemeni Ministry of Technical Education and Vocational Training (2019), in referring to the development of SME manufacturing industries in Yemen, claimed that intellectual capital (lack of quality human capital, insufficient knowledge about market and customers) is the most significant challenge to improving performance. The World Bank (2015) and Aljazeera (2012) shared the same view, that the most common reasons for business failure in manufacturing industry in Yemen are the inability to compete, poor management competency and lack of experience. Similar factors for business failure have been found in many Arab countries, including Jordan, Iraq, Kuwait, Sudan and Egypt (Dzenopoljac et al., 2017; Marwa, 2014; AlDomoor, 2013; Ebtisam, 2013; Naseba, 2012; Sharabati et al., 2010; Bontis, 2004 ; Seleim et al., 2004).

This observation by scholars points to a theoretical gap in terms of SMEs’ intellectual capital and strategic innovation researches. Moreover, developing economies which tend to lag behind advanced countries. This study therefore investigates SMEs’ strategic innovation in Yemen, including the relationships with IC, concepts again developed in the literature review, and providing fresh insight in the context of a developing country. As noted by several authors (AlQershi et al., 2020c; Dzenopoljac et al., 2017; AlQershi et al., 2019a&c), developing countries have peculiar economic problems which also affect the innovation of SMEs in their region.

However, there is limited studies evidence on how the influence of intellectual capital dimensions and SMEs strategic innovation in Middle East countries. This study aims to examine the joint influence of IC dimensions and SMEs SI in Yemen. It concentrates on three questions:

- RQ1. How does human capital effect on SMEs strategic innovation?

- RQ2. How does structural capital effect on SMEs strategic innovation?

- RQ3. How does relational capital effect on SMEs strategic innovation?

Finally, the findings of this study will help and useful the policy makers; researchers and managers In particular, it provide current knowledge of the effect of human, structural and relational capital and SMEs strategic innovation, contributing to enhancing the firms innovation.

Research Objectives

The research objectives are developed from the research questions, as follows:

1. To examine the relationship between the human capital and the strategic innovation of Yemen’s SMEs.

2. To examine the relationship between the structural capital and the strategic innovation of Yemen’s SMEs.

3. To examine the relationship between the relational capital and the strategic innovation of Yemen’s SMEs.

Literature Review

Intellectual Capital and Strategic Innovation

There is general consensus that IC encompasses human capital, relational capital and structural capital (AlJinini et al., 2019; AlQershi et al., 2020b; Zeinali et al., 2019; Bontis et al., 2018; Nhon et al., 2018; Kianto et al., 2017), the three IC elements are not equally important in influencing the competitive position of the organization (Bontis, 1998; Stewart, 1997). And there is little literature on integrated models for the IC of Yemeni manufacturing SMEs (Yemeni Ministry of Industry and Trade, 2019; Yemeni Ministry of Technical Education and Vocational Training, 2019; AlQershi et al., 2018).

Previous studies have investigated the relationship between IC and firm innovation. For example, Kianto et al. (2017) investigated the impact of IC and firm innovation among companies in Spain. They found a significant positive association between IC and firm innovation. Cassol et al. (2016) investigated the relationship between IC and firm innovation in Brazil, finding a significant positive relationship between IC and firm innovation in the study population. Similarly, Waseem et al. (2018) investigated the relationship between IC and firm innovation among large firms in Pakistan and found a positive association.

In addition, the relationship between IC and innovation has also been examined in several studies in the business innovation field, and considerable positive evidence has been gathered. For example, the strength of the IC and innovation link has been proven in a variety of contexts, including industrial and manufacturing firms (Qurashi et al., 2020; AlQershi et al., 2019b; Agostini & Nosella, 2017).

Related to this, a few studies on intellectual capital in Yemeni and Arab manufacturing industries do exist; for example, Sharabati et al. (2010) explored a broad domain of firm- or industry-specific processes pertinent to intellectual capital, although their findings remain disconnected. In the field of human resources, various suggestions for creating and validating a new theoretical model have been proposed (Kianto et al., 2017; Seetharaman et al., 2002). Meanwhile, several authors remain sceptical about the function, nature and role of the intellectual capitals concept (Kianto et al., 2017; Resh, 2015).

Finally, the importance of IC in affecting firm strategic innovation has attracted global attention. Several countries have published procedures and requirements for firms to provide financial statements encapsulating their intangible assets (AlQershi et al., 2020a; Osadchy & Akhmetshin, 2015). IC refers to the non-financial resources of the firm that imply ideas for future wealth creation. Therefore, including IC in financial statements indicates that it is significant and recognized as a part of a firm’s book and market value.

Added to the above reasons, attracting investment means obtaining the trust of investors, so IC reporting not only helps in creating value but is also important for gaining trust. In this regard, potential investors generally invest in firms that they trust to do good business and those that can maintain their return on investments. Hence, it is more crucial to highlight the IC statement than to show how IC has been used in the value creation of the firm. And based on this and the literature and the report of the World Bank (2015) which spells out that intellectual capital is low in Yemen, the present study hypothesizes the effects of the three dimensions of intellectual capital as follows:

H1a There is a significant relationship between human capital and manufacturing SME strategic innovation in Yemen

H1b There is a significant relationship between structural and manufacturing SME strategic innovation in Yemen.

H1c There is a significant relationship between relational and manufacturing SME strategic innovation in Yemen.

Methodology

Sample, Data Collection and Study Measures

The study’s target population is Yemeni manufacturing SMEs, identified from the 2019 Directory of SME firms (Ministry of Trade and Industry of Yemen, 2019). A quantitative cross-sectional survey research design was employed, and a total of 475 self-administered questionnaires were distributed to SME managers; 307 responses were retrieved and 23 of these were incomplete, leaving a total of 284 responses for analysis. In this study, the researcher used quantitative design to distribute the questionnaires because quantitative design approach is considered suitable for exploratory study since it much relies on literature review. In addition a cross-sectional survey method used also to conduct this study as specified by Sekaran & Bougie (2016). The unit of analysis is the organization level, where the owners of the SMEs are representatives of their firms. A 5-point Likert scale 1 (strongly disagree) to 5 (strongly agree) was used to rate the responses from the survey. IC was measured with an initial 26-items scale adopted from Sharabati et al. (2010). In measuring SI, we adopted Yang’s (2014) measures.

Results

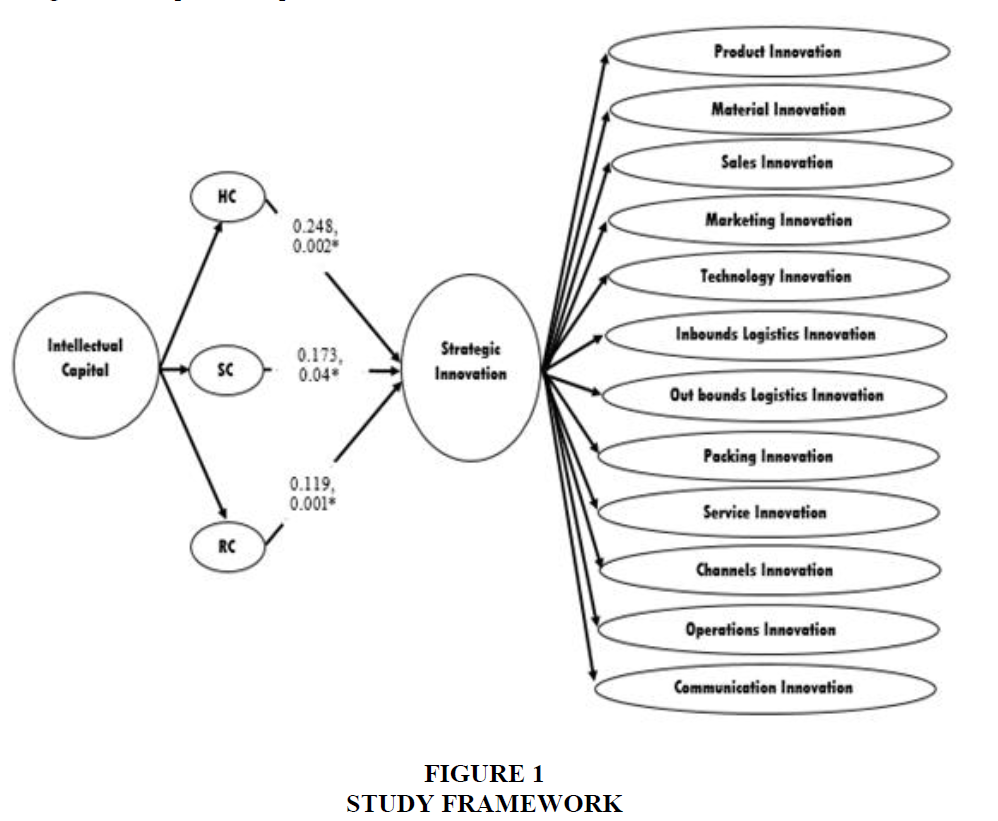

In line with study hypothesis, the study investigated the relationship between intellectual capital dimensions (HC, SC & RC) and strategic innovation among Yemeni SMEs. Figure 1 presented the study results. Results revealed that intellectual capital dimensions (HC, SC & RC) have significant relationship with strategic innovation, (β=0.248, t=3.761, p<0.02); (β=0.173, t=2.618, p<0.04) and (β=0.119, t=0.615, p<0.01) respectively. Creating and accumulating three dimensions of IC contributes to SMEs SI. The direct relationships in the model of this study are presented in Table 1.

| Table 1 Direct Relationship | |||||

| Constructs | Std. Beta | Std. Dev | t-values | p-values | Decision |

| HC -> SI | 0.248 | 0.035 | 3.761 | 0.002 | Supported |

| SC -> SI | 0.173 | 0.069 | 2.618 | 0.004 | Supported |

| RC -> SI | 0.119 | 0.076 | 0.615 | 0.001 | Supported |

In line with the objectives of this study, the study sought to examine the effect of intellectual capital dimensions and SME SI, and found it to be significant. This finding is an important contribution to the literature because previous studies only focused on the direct relationship between intellectual capital and innovation, but not strategic innovation. However, strategic innovation can only lead to improved performance when good intellectual capital is available. In other words, IC’s role is to explore and improve the skills and knowledge of employees, leading to high performance in terms of profitability and market share (Barkat & Beh, 2018; Hassan et al., 2017). The agrees with recent linear studies on SMEs, intellectual capital capability, successful product innovation and explorative capabilities (AlQershi et al., 2020b; Obeidat et al., 2017; Buenechea-Elberdin, 2017; Agostini et al., 2017). Their results also confirm earlier findings that innovative firms can improve performance in a fast-changing world, necessary to survive in with strong market competition. Hence IC is crucial; in particular, SMEs must be more innovative in improving their productivity and also take more proactive approaches to looking up the resources and through business partnerships.

Discussion and Conclusions

It is generally believed that strategic innovation could lead to new products/services, business models, business processes and/or positioning in relation to rivals in the light of improved performance. The firm’s adoption of a new strategy could allow it to either enhance its performance or regress it through the use of strategic innovation (AlQershi et al., 2018; Yang, 2014). Hence, to outperform its rivals in the face of technological change, a firm has to use appropriate strategies in order to keep abreast with and to thrive in a changing environment. Strategic innovators should adopt innovative and differentiation strategy to be successful. Without such strategies, they are unlikely to withstand larger and more established competitors.

In short, for firms to be successful in business, the entrepreneur or SME owners and manager should have an innovation advantage in order to compete with bigger and more established firms (Love & Roper, 2015). Smaller firms can profit by their ability to adjust faster to environmental changes than bigger companies, given their flexibility, less hierarchical structure and faster decision-making ability. However, the association between intellectual capital and strategic innovation of SMEs has not gained much attention in the existing literature. Finally, the results disclosed that IC is the hidden treasure of organizations through strategic innovation.

Implications

The findings of this study have implications for government policy as well as managerial implications for managers and owners of SMEs in Yemen. The implications are not necessarily limited to Yemen, as owners/managers and government policy makers in other developing countries may also learn from these findings. Lessons from the study are discussed below.

The policy implication of the study consists of advice for the government, the Yemeni Ministry of Industry and Trade and the Yemeni Ministry of Technical Education and Vocational Training. Given the large number of manufacturing firms in Yemen, government should pay very close attention to this sector. It a surprise that Yemeni manufacturing SMEs do not contribute much to the country’s GDP. The World Bank (2015) critically appraised the innovation of the Yemeni economy in recent years and concluded that it has been very poor, with the manufacturing sector being especially weak. The World Bank put the blame for the low innovation of the manufacturing sector on insufficient intellectual capital.

Therefore, government should intervene in SME operations in Yemen so as to improve innovation, by providing modern technology to SMEs to help them acquire modern industrial equipment and train their employees. However, based on our findings, the problem of low innovation cannot be resolved without skilled human capital, which implies the need for training. In addition, manufacturers are also facing a number of other typical problems with regards to their innovation processes; suffer from the implementation of new ideas in their attempts to create value products. Therefore, there is a need to address customers’ expectations of new standards and to meet their changing needs.

References

- Agostini, L., & Nosella, A. (2017). Enhancing radical innovation performance through intellectual capital components. Journal of Intellectual Capital.

- Agostini, L., Nosella, A., & Filippini, R. (2017). Does intellectual capital allow improving innovation performance? A quantitative analysis in the SME context. Journal of Intellectual Capital.

- AlDomoor, M.I. (2013), The Effect of Intellectual capital on Competitive advantage, Master Thesis, Moota University, Jordan.

- Aljazeera. (2012). Retrieved from https://www.aljazeera.net/

- AlJinini, D.K., Dahiyat, S.E., & Bontis, N. (2019). Intellectual capital, entrepreneurial orientation, and technical innovation in small and medium-sized enterprises. Knowledge and Process Management, 26(2), 69-85. AlQershi, N.A. (2019). Innovation capabilities as a source of inspiration: Towards a sustainable competitive advantage in yemeni manufacturing industry. International Journal of Knowledge Management and

- Practices, 7 (1), 1.

- AlQershi, N., Abas, Z.B., & Mokhtar, S.S.M. (2019a). Investment in the hidden wealth of intellectual capital and its effect on competitive advantage. Anwesh, 4 (1), 17.

- AlQershi, N., Abas, Z.B., & Mokhtar, S.S.M. (2019b). Prospecting for structure capital: Proactive strategic innovation and the performance of manufacturing SMEs in Yemen. International Journal of Entrepreneurship, 23(3), 1-19.

- AlQershi, N., Abas, Z.B., & Mokhtar, S.S.M. (2019c). The mediating effect of human capital on the relationship between strategic innovation and the performance of manufacturing SMEs in Yemen. Organizations and Markets in Emerging Economies, 10 (1), 57-77.

- AlQershi, N., Abas, Z., & Mokhtar, S. (2020a). The intervening effect of structural capital on the relationship between strategic innovation and manufacturing SMEs’ performance in Yemen. Management Science Letters, 11(1), 21-30.

- AlQershi, N., Abas, Z., & Mokhtar, S.S.M. (2018). Strategic innovation as driver for SME performance in Yemen. Journal of Technology and Operations Management, 13(1), 30-41.

- AlQershi, N., Mokhtar, S.S.M., & Abas, Z.B. (2020). Innovative CRM and performance of SMEs: The moderating role of relational capital. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 155.

- AlQershi, N.A., Abas, Z.B., & Mokhtar, S.S.M. (2020c). Investigating the influence of intellectual capital dimensions practices on SMEs performance. Academy of Entrepreneurship Journal, 26(2), 1-7.

- AlQershi, N. (2021). Strategic thinking, strategic planning, strategic innovation and the performance of SMEs: The mediating role of human capital. Management Science Letters, 11(3), 1003-1012.

- Barkat, W., & Beh, L.S. (2018). Impact of intellectual capital on organizational performance: evidence from a developing country. Academy of Strategic Management Journal, 17(2), 1-8.

- Bontis, N. (1998). Intellectual capital: an exploratory study that develops measures and models. Management Decision, 36(2), 63-76.

- Bontis, N. (2004). National intellectual capital index: a United Nations initiative for the Arab region. Journal of Intellectual Capital, 5(1), 13-39.

- Bontis, N., Ciambotti, M., Palazzi, F., & Sgro, F. (2018). Intellectual capital and financial performance in social cooperative enterprises. Journal of Intellectual Capital.

- Buenechea-Elberdin, M. (2017). Structured literature review about intellectual capital and innovation. Journal of Intellectual Capital, 18(2), 262-285.

- Cassol, A., Gon