Research Article: 2022 Vol: 25 Issue: 4S

How takaful started in middle east

Ahmad Alrazni Alshammari, Qrar Co. Platform

Basheer Hussein Motawe Altarturi, Hebron University

Othman Ibrahim Altwijry, Qassim University

Citation Information: Alshammari, A., Altarturi, B., & Altwijry, O. (2022). How Takaful started in middle east. Journal of Legal, Ethical and Regulatory Issues, 25(S4), 1-16.

Abstract

Takaful in the Middle East represents the lion’s share of the global Takaful market. Past Takaful research have focused on the aspects of Shariah, financial performance, consumer behaviour, etc. However, there is a dearth in tracing and documenting the early beginnings of Takaful in each country from both the business and regulatory development perspectives. The Middle East consists of 16 countries – Bahrain, Egypt, Iran, Iraq, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Syria, Turkey, UAE, Yemen, as well as Cyprus & Northern Cyprus. This paper intends to achieve two objectives: 1) to identify the early beginnings of Takaful in all the Middle East countries; and 2) to find the key challenges faced by the Middle East Takaful markets. In the initial exploration, the researchers found several observations: such as 1) Takaful business currently exists in all Middle East countries, except Cyprus & Northern Cyprus where there are no Takaful companies nor any regulations pertinent to Takaful; 2) all the markets operate based on a dual-system that allow both Takaful and conventional insurance businesses, except the Saudi and Iranian insurance markets which only allow the Islamic insurance business; and 3) the UAE Takaful market witnessed two pioneer initiatives which are the establishment of first Takaful company in 1979 (the same year of Takaful establishment Sudan) and the issuance of the first dedicated Takaful regulation in 2010. The paper also found four key challenges generally faced by the Takaful industry in the region: 1) Takaful regulatory framework; 2) political and macro environment; 3) awareness, education and human capital; and 4) standardization and public disclosure.

Keywords

Takaful, Islamic Insurance, Middle East

Introduction

The Middle East is a unique region. Geographically strategic from the economic and geopolitical perspectives, the region is known for its rich history dating back to the ancient times. More significantly, it has been, and still is, the world’s main source of energy. Another less known but salient feature of this region is its remarkable value and worth in the Takaful global market, which represents over 78% of the market based on the Islamic Financial Services Industry Stability Report 2021 issued by the Islamic Financial Services Board (IFSB). The overall contributions of Takaful from this region reached USD 23.1 billion, which represents around 0.036% of the global insurance premiums (IFSB, 2021; Aizpun, Dai & Lechner, 2021).

Takaful is a risk management tool, and an alternative for conventional insurance. Its mechanism is structured in line with Shariah principles and it operates based on the concept of cooperation and mutual responsibility. It also operates by avoiding the elements prohibited by Islamic law (Shariah), such as interest (Riba), uncertainty (Gharar) and gambling (Maysir) (Htay, Arif, Soualhi, Zaharin & Shaugee, 2012). Like conventional insurance, Takaful plays a significant role in supporting the economy, contributing in terms of mobilisation of savings, empowering trade and commerce, and promoting investment (Ul Din, Abu-Bakar & Regupathi, 2017; Sümegi & Haiss, 2006).

The first Islamic insurance company was established in Sudan in 1979 (Alhabshi & Razak, 2009). Since then, the market has witnessed an evolution with the development five different operational structures – mutual structure in Sudan, cooperative structure in Saudi Arabia, insurance structure in Iran, participation structure in Turkey; and Takaful structure in Malaysia, which have then spread across the world.1 The structure of Takaful has also advanced into various other models like the Wakalah model, Mudarabah model, Hybrid model, and Waqf model (Alshammari, Altarturi & Alokla, 2021).

Nasir, Farooq & Khan (2021) grouped Takaful literature into four themes: comparative studies between Takaful and conventional insurance; business model and Shariah-compliant issues; marketing and consumer behaviour; and corporate governance and financial aspects. However, the researchers noted the lack of current literature on the most significant region of Takaful. Thus, this paper aims to explore the beginnings of how Takaful came to the 16 Middle East countries, providing a brief history and highlighting the significant regulatory developments of Takaful in each country. The paper also aims to illustrate the key challenges confronting the Middle East Takaful markets. The paper will contribute to enrich the literature of Takaful, as it is the least-explored and least-documented financial sector compared to banking (Altarturi & Ajouz, 2021) and capital market (Alshammari et al., 2020). The paper will provide a reference point to researchers in understanding the establishment of the Takaful market in all the Middle East countries (further divided into three sub-regions) by focusing on the beginnings of the industry – the first Takaful company, the first (and key) regulations that support the operations of Takaful in each jurisdiction.

The paper is structured into five sections, including the introductory and conclusion sections. Section 2 provides an overview on evolution of the Takaful concept among jurists until its’ establishment in 1979. Section 3 focuses on the Takaful sector in the Middle East markets, stating the key milestones in each jurisdiction by identifying the first insurance firm operating based on Islamic law and whether the regulatory body has specifically addressed the Takaful business requirements in its regulations. Section 4 compares the three sub-regions and shows the key challenges faced by Takaful in the Middle East.

The Evolution Takaful Concept

It is a well-known fact among those interested in insurance and Takaful that the first Islamic insurance company was established in Sudan in 1979. Howe er, what is much less known are the ste s that it took to reach the stage of actual establishment. n actual fact, discussions on the sub ect of insurance started much earlier among urists and can traced bac to the 1 th century, where Mu ammad ibn Abidin (of Hanafi school) was the first scholar to discuss an insurance contract from a jurisprudence perspective in 1784. Muslims had been exposed to insurance contracts from the European sailors who used to cover their ships with marine insurance (Islahi, 2014). At that time, the term Su rah (security)2 was used to refer to insurance and is explained in the book, Radd al-Muhtar ala Durr al-Mukhtar written by Muhammad ibn Abidin. He stated it is not allowed for the Muslim Merchant to ta e compensation for any damage of his ro erty. Because it is not binding under Law . This iew was built based on Qias to other contracts such as ‘Aqilah, Kafalah and al-Wa’ad ul-Mulzim (Anwar & Hussain, 1994; Khorshid, 2001).

The concept of insurance continued to evolve among urists, who started issuing atawa regarding the legitimacy and alidity of insurance contracts at the end of 1940s (Al-Saati, 2009), n 19 1, analysing insurance contracts mo ed into broader discussions amongst scholars such as Mu ammad Abu Zahra, Al-Siddiq Muhammad Al-Darir, Mustafa Al-Zarqa. Their views were presented in a Seminar of Jurisprudence (the second session) held in Damascus. The Seminar witnessed the well-known disagreement between Muhammad Abu Zahra and Mustafa Al-Zarqa, with the only resolution recorded being the invitation to create new insurance system (Mohamed, 2020). In 1965, the topic of insurance was again discussed at the Al-Azhar Islamic Research Academy, and scholars reached the point of allowing cooperative societies for insurance purposes. However, there was no resolution related to commercial insurance. In 1972, scholars called a motion to use cooperative insurance instead of commercial insurance in a Legislation Seminar hosted in Tarablus, Libya. The resolution on the non-permissibility of commercial insurance was then issued in the First Conference of the OIC Fiqh Academy in 1978, although it is important to note that it was not a unanimous decision as Al-Zarqa was against it.

The Establishment of Takaful Practice in Middle East Countries

This section provides a brief overview on the establishment of Takaful in all the countries of the Middle East, with focus on documenting the first Takaful practice. To simply discussions, the paper further divides the Middle East into three sub-regions (GCC, Levant and Others) and excludes Cyprus & Northern Cyprus since it does not have any Takaful player, regulator, nor related regulation.

GCC Markets

Saudi Arabia

An active port in Jeddah and a flourishing export and import industry were the key triggers for the penetration of insurance in the Kingdom of Saudi Arabia by foreign agents and branches in the 1950s (Al-Muatq, 2010). Two decades on, in 1974, the Red Sea Company became the first local insurance firm (Insurance Panorama, 2014), followed by the United Saudi for Insurance, which entered the market in 1976, to meet the greater need for insurance in the economy which was propelled by the growing of oil prices. A Fatwa (legal religious ruling) issued in 1977 by the Permanent Committee no.5 1397H was the "game changer for the industry, as it disallowed conventional insurance and permitted cooperative insurance to operate based on Tabbarru’ contracts. As a consequence of this Fatwa , in 1986, the Com any for Cooperative Insurance (Tawuniya) became the first national insurance company licensed in the Kingdom, operating in accordance with the cooperative insurance principles.

The regulatory framework that initiated the real reform of Takaful came with the promulgation of the Supervision of Cooperative Insurance Companies Law by Royal Decree No. (M/32) in 2003, which delegated the supervision of the industry to the Saudi Arabian Monetary Agency, now known as the Saudi Central Bank (SAMA). A further key development came in 2005 with the issuance of Article 1 of the Cooperative Insurance Companies Control Law, which stated that all insurers must operate based on cooperative insurance that is consistent with Shariah rules and principles (Alshammari & Altarturi, 2021).

UAE

Insurance activities first came on the scene in the Emirates in 1959 through an Indian firm, Oriental Insurance. Many more foreign insurers followed suit by establishing operations in the Emirates in the 1960s (Insurance Authority, 2017). This domination of foreign players was diluted by the establishment two national insurers, Sharjah Insurance Company and Dubai Insurance Company, in 1970. UAE is considered one of the pioneers in Takaful when, in 1979, the Arab Insurance Company (SALAMA) was incorporated and started providing insurance solutions in line with Shariah principles.3

Federal Law No. 9 of 1984 was then issued to regulate the work of insurance companies. In less than a decade, the Ministry of Economy & Commerce established the Supreme Insurance Committee to undertake the task of formulating the general insurance policy (which was issued in 1993). This Committee later became the country’s insurance regulatory and su er isory authority, and named the Insurance Authority based on the Federal Law No. 6 of 2007. The industry went through another significant development when the responsibility of supervision was transferred to the Central Bank of the UAE in 2020.

The Insurance Authority (2010) stated that the UAE is first Arab country to establish a comprehensive regulatory legislation for Takaful i.e., Resolution No. 4 of 2010 concerning Takaful Insurance (or the Takaful Regulations). It discusses various aspects pertaining to Takaful such as the Supreme Committee for Fatwa and Shariah Supervision, Takaful models, and Takaful operations. Article 3 indicates the practice of Takaful windows is not allowed.

Kuwait

The Kuwaiti insurance industry was dominated by foreign insurers for eleven years from the entrance of the Lebanese insurer, Arabia Insurance Company, in 1949 (Alshammari, Alhabshi & Saiti, 2018). The Kuwait Insurance Company was only established in 1960 as the first national insurer based on Law No. 7 of 1960. Law No. 24 of 1961 pertaining to Insurance Companies and Agents was then issued to govern the industry, and its supervision was put under the Insurance Department in the Ministry of Commerce and Industry. The year 1972 witnessed the establishment of Kuwait Re as the first reinsurance firm in Kuwait and in the Gulf region, according to Kuwait Re’s official website.4

Law No. 24 of 1961 was modified twice – No. 13 of 1962 and No. 5 of 1989. However, global de elo ments led to the issuance of Law No. 1 5 of 2019, transforming the industry’s supervision from a department under the Ministry of Commerce and Industry, into an independent Insurance Regulatory Unit, supervised by the Minister of Commerce and Industry. Law 125 of 2019 also recognized the presence of the Takaful business and Part Five of the Law discusses its features. The first Takaful players – First Takaful and Wethaq Takaful – only came into the market in 2000 (Alshammari, 2021).

Oman

The Sultanate of Oman saw its first insurance operations in 1971 by foreign insurer, the American Life Insurance Company (ALICO). The development and supervision of the insurance industry was initially under the Ministry of Commerce and Industry, and later transferred to the Capital Market Authority (CMA) based on Royal Decree No. 90 of 2004.

Its first national insurance company, National Life & General Insurance (NLG) was established in 1983.5 It was only in 2014 that the regulator granted licenses to two Takaful operators, Al Madina Takaful and Takaful Oman, to operate. The country also has one reinsurance provider, Oman Reinsurance, established in 2009. The law governing Takaful operations came with Royal Decree No. 11 of 2016 Promulgating Takaful Law.

Qatar

Foreign insurer, ALICO, was also the pioneer for the Qatari insurance industry in 1962. However, it took the Qataris significantly quicker to respond, when two years later, the Qatar Insurance Company was established as the first national insurance provider. The Insurance Law No. 1 of 1966, issued to govern the operations of insurance business, assigned the regulatory responsibility of the sector to the Ministry of Economy and Commerce. However, this function was transferred to the Qatar Central Bank (QCB) based on Law No. 13 of 2012. The Law officially recognized the Takaful business in Article 78, although the first insurer in the country, Qatar Insurance Company (QIIC) had been established since 1995.

Bahrain

Insurance Market Review 2016 issued by the CBB in its section on historical development of insurance in the country stated that in 1950, The Norwich Union, a prominent British insurer, opened its first office in the Arabian Gulf through an agency agreement with Yusuf bin Ahmed Kanoo as Norwich Union’s rinci al agent in Bahrain. Bahrain, at the time, was a trade centre in a region with lots of growth potential. Other players started penetrating the market including the New India Assurance and General Accident Insurance. In 1955, a group of taxi drivers formed an insurance society called the Cooperative Compensation Society (CCS) to provide Third Party Liability insurance cover for their vehicles. In 1982, the CCS was renamed the Vehicle Insurance Fund (Central Bank of Bahrain, 2017).

ALICO was the first firm to be granted a license to offer long-term insurance products, and it started operations in 1961. In 1969, the Bahrain Insurance Company (BIC) was established as a first public shareholding company, which later merged with another insurance company to form the Bahrain National Holding Company (BNH).

The birth of Takaful in Bahrain came in 1989 with Bahrain Islamic Insurance Company (BIIC) as the first Takaful provider (Alshammari, 2021). It was later renamed as the Takaful nternational Com any. The country’s regulations address the Takaful industry’s s ecificities in the Takaful Module 2005. The insurance sector has been under the supervision of the Central Bank of Bahrain (CBB) since 2002.

Levant Markets

Syria

The Syrian Daman Company is the first national insurance company established under Legislative Decree No. 226 of 1952. The company, wholly-owned by the government, became the only player to offer insurance business in the country as a result of the Nationalization Law No. 117 of 1961. Ten years later, its name was changed to the Syrian General Insurance Corporation. In 2004, the industry witnessed a new development when legislative decree No. 68 of 2004 assigned the responsibility of insurance supervision to the Syrian Insurance Supervisory Commission. In 2005, Legislative Decree No. 43 of 2005 put an end to the monopoly, and opened the market to private insurance companies.6 It stated that private insurance and reinsurance companies may be incorporated as joint stock companies. Subsequently, seven insurers were established in 2006, such as United Insurance Company and AROPE. Meanwhile, Takaful operations started with the establishment of Al-Aqeelah Takaful Insurance in 2007 (Mahaini & Al Sabban, 2018).

Lebanon

Insurance officially became available in Lebanon by ARABIA Insurance in 1948, which had mo ed from Jerusalem to Beirut due to political instability. The country’s insurance regulatory authority is the Insurance Control Commission (ICC), that is supervised by the Minister of Economy and Trade. Decree No. 9812 of 1968 (Insurance Law), was the first regulation to govern the industry (Hachem, Saad & Fayad, 2018). For the Takaful business, the industry witnessed its first and only full-fledged Takaful player in 1988, Al Aman Trust Insurance. In 2015, AROPE Takaful window started offering Shariah-compliant products (Mustaqbal Web, 2019). The ICC has not issued any regulations pertaining to Takaful.

Iraq

The insurance market in Iraq started via foreign companies, branches, or agents. This changed slightly with the issuance of the Insurance Companies Law No. 74 of 1936. As the first insurance law, it set certain controls on the insurance com anies’ wor . n 1946, Rafidain Insurance Company was established as the first Iraqi private insurance company (Kamal, 2014; Khan, 2016). Four years later, the National Insurance Company was established as a first state-owned insurance company. Due to nationalization, (which started in 1964), the number of insurers were reduced to three companies – National Insurance Company, for non-life insurance; Iraq Insurance Company, for life business; and Iraq Reinsurance Company, for the reinsurance business. At that time, these three players were governed and supervised by the State Insurance Organization (SIO), which later transformed into an insurance commissioner at the Ministry of Finance in 1988.

The Insurance Business Regulation Law 2005, issued to enhance and develop the insurance sector in the country, provided for the establishment of the Iraqi Insurance Diwan as a supervisory and regulatory authority of the sector. For the Takaful business, the Central Bank of Iraq (CBI), with the cooperation of the Insurance Diwan, issued a Takaful regulation in 2019. It also decided to establish a Takaful company that was supported by all the banks in the country (Hassani & Al-Ghabban, 2019; Kamal, 2014).

Palestine

Wafa ( 1 ) showed a historical sna shot of the country’s insurance sector showing that insurance activities started in Palestine through the Law of Insurance Companies since the Ottoman rule. This was then nown as the Security Contract Law of 1845, The eriod under the British mandate (1918 to 1948) witnessed several developments in the sector, such as Law No. 18 of 1929 on foreign insurance companies, and Law No. 8 of 1947 on motor vehicles. The situation changed in 1948 onwards. Some areas such as the West Bank followed the Jordanian rules, where the Jordanian RSA issued the Law No. 24 of 1959 and the Law No. 5 of 1965. Other Palestine lands followed the Israeli rulings, that is Law No. 662 of 1976.

The political situation relatively stabilized in the 1990s, and many Palestinian insurers were established. The first of them was the National Insurance Company, which started operations in 1992. With regard to Takaful, the Palestinian Takaful Company penetrated the market in 2008 to operate based on Shariah rules and principles (Abu Farha, 2018). In terms of supervision, the Palestinian National Authority was the responsible authority for controlling and supervising the insurance sector in Palestine since 1993. The industry faced several challenges that required improvements in their regulatory framework. To fulfil this need, the Palestinian Capital Market Authority was established in 2004, and the authority issued Law No. 20 of 2005 as a base for governing the market (Palestine Capital Market Authority, 2021).

Jordan

Post-World War II saw a growth of economic activities in the Kingdom. In 1946, insurance penetrated the market via an agency founded by Raouf Saad Abu Jaber in Amman, which was affiliated with Al-Sharq, an Egyptian insurance company specializing in the life insurance business. Five years later, the Jordan Insurance Company was established as a first national company in the Kingdom (Jordan Insurance Federation, 2018). In terms of regulations, the Insurance Regulatory Act No. 5 of 1965 was the first dedicated legislation and regulation issued for governing and monitoring the insurance business in Jordan. Since then, the regulations ha e e ol ed to cater to the mar et’s needs, where regulations ha e been amended or repealed. The most recent is the Insurance Regulatory Law No. 12 of 2021 to accommodate the global regulatory developments and provide guidance for Takaful business. The first Jordanian Takaful company was the Insurance Company, established in 1996.

Various bodies were assigned the supervision of insurance sector over the years as illustrated in the following points:

• Insurance Regulatory Act No. 5 of 1965: Insurance Business Regulatory Directorate under the Ministry of National Economy. (The name of the ministry was changed various times, and became known as the Ministry of Industry and Trade in 1975).7

• Insurance Supervision Act No. 33 of 1999: Insurance Regulatory Commission (was established) to regulate and supervise the insurance sector.

• Law No. 17 of 2014 (the Restructuring of Institutions and Government Departments): (Returned to) Insurance Directorate under the Ministry of Industry, Trade and Supply.

• Insurance Regulatory Law No. 12 of 2021: Insurance supervision transferred into the Central Bank of Jordan (Regulating Insurance Business Act, 2021).

Other Markets

Egypt

During the time of the British rule (1882-1956), cotton agriculture was a core industry fuelling the Egyptian economy. This development encouraged British and French insurance companies to penetrate the market as agents in 1882 (Wagdi, 2014). Twelve years later, the market witnessed the emergence of the first Egyptian insurance company, the National Insurance Company (later renamed to Misr Life Insurance in 2011). The National Insurance Company was the only national player until 1928, when other insurers started operations. Egypt is first Arab country on record that has issued an insurance regulation – Law No. 92 of 1939, that included provision to establish the Egyptian General Authority for Insurance. Nationalization of the industry based on Law No. 23 of 1957, and a Merger Decree in 1964 led the industry to have four fully-State-owned insurance companies (Abul Fadl, 2019; Al-Shaqwiry, 2020). The involvement of private insurance sector started in 1979 with the establishment of the Suez Canal Company for Insurance. Takaful was introduced in the market via the Egyptian Saudi Insurance House (ESIH), licenced in 2002 and started operations in 2004. ESIH and other Takaful operators had minimal guidance for almost a decade, until the regulator issued Decision No. 8 of 2014 for Shariah Governance, and Decision No. 23 of 2019 for Takaful Regulation, to monitor and govern Takaful firms.

Abul Fadl (2019) showed the evolution of insurance supervision, which showed that the insurance industry has been governed by different authorities over time. The supervision of the industry started under the Ministry of Finance in 1939. It was then transferred to the Egyptian General Insurance Corporation in 1961, which was, 15 years later, replaced by the Egyptian General Insurance Authority. Another evolution in the industry came with the Law No. 10 of 1981, which established the Egyptian Insurance Supervisory Authority. From 2009, the insurance sector is supervised and monitored by the Financial Regulatory Authority.

Iran

Insurance activities in Iran can be traced back to the Achaemenes times. However, it was only formally introduced in Iran in 1890 through an arrangement between the Iranian government and the Russian Embassy. This was followed by establishment of two branches of the Russian insurers, Nadezhda and Kafkaz, in 1910. Other European insurers were established in 1931 with the enactment of a law on the registration of companies in Iran (Nia & Thimmarayappa, 2018). The domination of foreign insurers was ended in 1935 with the establishment of first national player, the Iranian Insurance Company (Hashempoor, 2013).

In terms of regulations, the Insurance Law was enacted in 1937, which provided the base for the insurance industry’s foundations. Shargh nsurance was established as the first private insurer in 1950. The Central Insurance of Iran established in 1971 mandated to develop the insurance industry and monitor its activities. The financial system transformed into an interest-free system during the Iranian Revolution of 1979 (Eskridge, 1981). Nationalisation was adopted in the industry in 1980, but only involved private insurers in 2001.

Takaful was only recently introduced in December 2021, with Dana Insurance Company offering the first Takaful product in the Iranian market. This development came as an initiative to promote financial inclusion among the followers of the Sunni doctrine who, unlike the followers of the Shi'a doctrine, did not consider insurance as permissible (IFN, 2021).

Yemen

Insurance operations in Yemen started through branches of foreign insurance companies in the city of Aden in 1950s. Supporting the thriving trade activities, the number of insurance layers reached up to 40. The inde endence of Yemen in 1967 saw a change in the industry’s development, and the Yemen Insurance and Reinsurance Company was established in 1969 (as a result of go ernment’s nationalization initiative) as the first Yemeni company affiliated with the government sector (Shabah, 2007). In 1974, the Ministry of Economy and Industry was mandated as the insurance regulatory authority to govern and supervise insurance companies and brokers. In the same year, the first Yemeni private insurance company, Marib Insurance Company, was established.

The situation changed in 1990, with the unity of North and South Yemen impacting the industry’s supervision, where in 199 , it was assigned to the Ministry of Finance, then transferred to the Ministry of Supply and Trade in 1997, and finally transferred to the Ministry of Industry and Trade in 2001. In terms of Takaful, it was first introduced by the Yemen Islamic Insurance Company in 2001. Currently, Takaful products are offered by many insurers, including Takaful windows. However, there is an obvious gap in regulations to govern Takaful operations (Insurance Panorama, 2019).

Turkey

During the time of the Ottoman Empire, the concept of insurance started to be of interest following a fire that destroyed a large art of stanbul's Beyoğlu district in 1 7 . n 1 7 , three British insurance companies started to operate as insurance agencies, followed by a French insurance company in 1878. The sector was almost entirely in the hands of foreigners as there was no insurance company operating entirely with domestic capital and workforce. The first local insurance com any to be established was Osmanlı Umum Sigorta in 1 93. Later, in 19 3, Şar Sigorta and other com anies followed (Ercan & Onder, 2016).

Upon proclamation of the Republic of Turkey, the aim shifted to operate and strengthen domestic capital in all areas of the economy, primarily the financial sector. Within this framewor , the first national insurance com any, Anadolu Anonim Tür Sigorta Şir eti, was established in 1925. In 1927, the Law on Inspection and Supervision of Insurance and Insurance Com anies came into force. Doğan Sigorta, the first ri ately-owned insurance company was then established in 1942, followed by other companies in the following years. In 1959, the Insurance Supervision Law No. 7397 came into effect, in which the duty and authority for insurance supervision was assigned to the Ministry of Industry and Trade. The authority and powers regarding insurance services under this Law, as well as under other relevant legislation were then transferred to the Prime Ministry, and subsequently to the Under secretariat of Treasury and Foreign Trade with the Decree Law No. 303 in 1987. In the Takaful space, Neova Sigorta started operating in non-life branches based on the principles of Takaful in 2009, while Katılım Emeklilik ve Hayak introduced family Takaful in 2013 (COMCEC, 2019).

The year 2017 brought significant changes to the Turkish insurance industry when its regulatory and supervisory authority, the Ministry of Treasury and Finance, introduced a new regulation named "Procedures and Principles of Participation Insurance Business . The regulation aimed to set out the procedures and principles with regard to participation insurance (one of the forms of insurance), to ensure the system's reliability and safeguard the participants' rights and interests. Participation insurance, the Turkish Model, is one of the models that is classified as islamic insurance (Öz & şı , 2019).

Discussions on Takeful Markets in the Middle East

Comparison

GCC Countries Dominate the Takaful Market

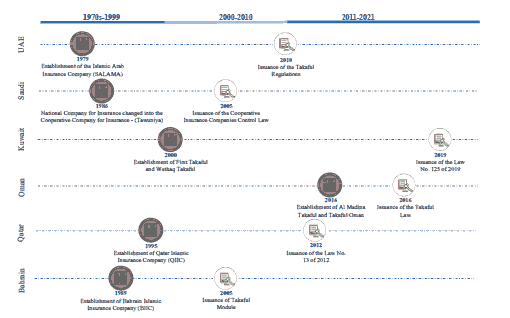

According to IFSB Stability Report 2021, the GCC Takaful business represents an estimated 53% of the global Takaful market. This market dominance has developed and grown over decades. A quick chronological view as illustrated in Figure 1 shows that the industry was driven by market developments, which preceded regulation in all GCC countries. The UAE was the market pioneer with the first offering of Takaful in the region in 1979, while Oman, the last entrant, came on board in 2014. Regulatory developments only came much later. All the GCC regulators were late in enacting Takaful regulations and recognizing the specificities of the Takaful business, despite Takaful firms already operating in their markets. The Insurance Regulatory Unit in Kuwait is the last RSA to recognize Takaful business in their regulations in 2019, while the Central Bank of Bahrain and Saudi Central Bank were the first, recognizing Takaful in their regulations in 2005. The first dedicated regulation for Takaful was issued by the UAE in 2010. It is also worth noting that Saudi Arabia is the only country that fully operates in compliance with Shariah rules and principles.

Levant Countries Missing Takaful Regulation

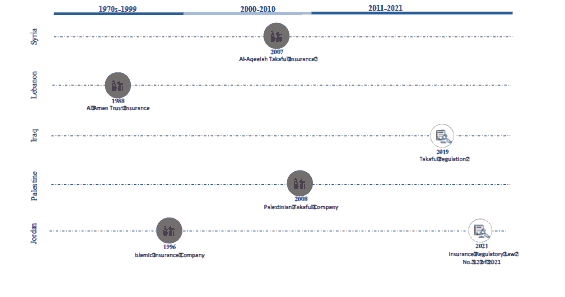

Figure 2 shows that the emergence of Takaful in the Levant region started via a Lebanese company, Al Aman Trust Insurance, in 1988. Three countries have not issued any regulations pertaining to Takaful, which are Syria, Lebanon and Palestine. However, the case of Iraq is unique in two aspects, where firstly, Takaful regulation has been issued by the Central Bank of Iraq, not the Insurance Diwan whose authority it is to govern and supervise the insurance sector, and secondly, there is currently no Takaful company operating in the country. The Jordanian Takaful market fares relatively better than its neighbors – it has recorded around 11% market share of the Jordanian insurance industry, and the RSA has in 2021 issued a comprehensive reform in its insurance regulations which address the specificities of Takaful.

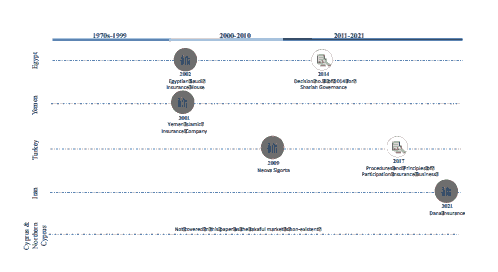

Countries with Underdeveloped Takaful Markets

The five remaining countries in the Middle East are highly populous countries. Iran, for example, is the second largest Islamic insurance market globally. It is to be noted however that the Iranian insurance structure follows the Shi’a school of thought, which does not see conventional insurance structure as prohibited. However, Takaful products were introduced in December 2021 as a means to promote greater financial inclusion to the followers of the Sunni doctrine, as they make up almost 10 million in number. In terms of regulatory development, the Egyptian and Turkish regulators have issued guidance for Takaful business. Meanwhile, in terms of Takaful business, the existence of Takaful players relatively late, by Yemen Insurance Company in 2001.

Challenges

The Takaful business faces several challenges, the main ones being awareness of the Takaful concept, gaps in knowledge and skills relevant to Takaful, many Takaful models, lack of standardization, scarcity of human resources, poor corporate governance, inadequate technology capabilities, low number of Shariah reinsurance, low income level of participants and small size of Takaful companies (Omer, 2011; Salman, 2014; Fauzi, et al., 2016; Husin, 2019). In this section, the researchers will focus on those challenges that are relevant to Middle East markets.

Takaful Regulatory Framework

A number of distinguishing features of Takaful are not compatible with conventional insurance, which means that the regulatory requirements of conventional insurers/reinsurers are not sufficient to meet the needs of Takaful operations. These features include the models within which most modern Takaful and reTakaful undertakings (TUs/RTUs) operate; multiple funds within a single legal entity, some attributable to participants and some to shareholders, but with financial flows between them; and the specific requirements of Shariah governance, which include having a Shariah-compliant investment programme, and the possibility of surplus distributions to participants (IFSB, 2020). These unique aspects of Takaful necessitate regulators to develop a Takaful regulatory framework that incorporates laws, rules and guidelines enacted to effectively regulate Takaful operations (Dikko & Bakar, 2018). A robust regulatory framework should aim to achieve the objectives stated by the International Association of Insurance Supervisors (IAIS),8 which are to (1) protect policyholders, (2) promote/maintain a fair, safe and stable insurance market, and (3) contribute to financial stability.

In the case of Takaful, the IFSB and the IAIS established a joint working group (JWG) to identify key regulatory issues that concern Takaful. The JWG issued a a er in 2005, "Issues in Regulation and Supervision of Takaful ( nsurance) which outlined four ma or themes for dealing with the regulatory issues associated with the Takaful/reTakaful industry. These themes, which have thus far guided the work of the IFSB in developing standards and guiding principles for the industry, are as follows: 1) corporate governance; 2) financial and prudential regulation; 3) transparency, reporting and market conduct; and 4) supervisory review process (IFSB & IAIS, 2006). The IFSB has since published six standards and one guidance note specific to Takaful aimed to promote and enhance the soundness and stability of the industry where the standards provide guidance to regulatory and supervisory authorities in drafting and developing their Takaful regulations.

In the Middle East, there are four countries – Syria, Lebanon, Palestine, and Yemen – which have yet to issue a regulation related to Takaful, although Takaful services are offered in their jurisdictions. The other countries have addressed the Takaful in their regulations but the depth and details of these regulations vary. Capital requirements and risk management for Takaful are some of the areas ignored by the regulators in the Middle East. Three jurisdictions i.e., Kuwait, Turkey and Jordan, have only recently acknowledged Takaful practices in their regulations, in 2017, 2019 and 2021 respectively. The absence of a comprehensive Takaful regulatory framework may lead into ambiguity and uncertainty in the market, where for instance, a Takaful firm may operate without a segregation of accounts between shareholder fund and artici ants’ funds; a Takaful firm may invest in non-Shariah-compliant instruments; or a Takaful firm may have poor corporate governance as agency-related issues are significant in the Takaful operational structure. These potential issues may be better handled within a regulatory framework that addresses their specific nature (of Takaful). In this regard, the regulatory authority needs to always be proactive in developing their Takaful regulations.

Political and Macro Environment

The Middle East may be considered as the most politically-unstable regions in the world. Political turmoil exists in Syria, in Yemen, in Egypt, in Turkey, and in the Gulf areas. Aisen & Veiga (2013) stated that political instability can make disorder to economic performance. They summarized the effect of political instability on economic growth as follow: it works to shorten olicyma ers’ horizons leading to sub- optimal short term macroeconomic policies. It may also lead to a more frequent switch of policies, creating volatility and thus, negatively affecting macroeconomic performance. Suter & Keller (2012) stated the region has become heightened with political risk since the Arab Spring, which led investment inflows to decline in several indicators, mainly the Foreign Direct Investment.

Syria, for example, has been facing prolonged and ongoing conflict since 2011 which has impacted all aspects of the country. Gobat & Kostial (2016) mentioned that the Syrian civil war has set the country back decades in terms of economic, social and human development. Another exam le, Tur ey is facing a financial and economic crisis, referred to as the Tur ish currency and debt crisis , which started from the de reciation of the Tur ish Lira that resulted in high inflation and rising borrowing costs, and subsequently rising loan defaults. This crisis impacted the overall Turkish economy, including its stock market. Demir (2019) mentioned that the Istanbul Stock Exchange Market needs stronger domestic currency, higher international capital inflows, and lower energy and investment costs. In general, insurers invest significant parts of their premiums into stock markets to generate in estment income as one of the country’s main income sources. The risk is that any fluctuation in the stock market would impact the performance of the insurance company.

Awareness, Education and Human Capital

Takaful as an Islamic financial instrument can be seen as a complex and sophisticated instrument due to the variety and complexity of Takaful products. Its contract involves various detailed technical information such as the model adopted, segregation of funds, and participant rights and obligations, among others. The Takaful industry, in addressing its customers’ needs, require eo le to be aware of the industry’s ractices and roduct features to a oid information asymmetry. There is literature on studies that have been conducted on the awareness level of Takaful in different countries, e.g., in Saudi by AlNemer (2015), in Kuwait by Soualhi & Al Shammari (2015), in Bahrain by Hiday at (2015). The common observation of those studies is that people generally have a lack of understanding on how a Takaful firm operates. Addressing this issue of awareness requires cooperation among all relevant parties to enhance the consumer education.

In the Middle East, there is a minimal exposure to financial risk management in the education system in general, and on insurance and Takaful in particular. For example, in Kuwait, a country with over 30 insurance/Takaful providers and over 100 agency and brokerage firms, there is no department in any university in Kuwait that offers risk management and insurance as a field of specialization. This could be among the reasons why there is a low level of Takaful awareness. AlNemer (2015) found people have very poor knowledge of the basic principles of Takaful in Saudi Arabia. Similarly, awareness and knowledge should always be supported by education, and Hiday at & Rafeea (2014) established the important role of education in enhancing public awareness towards Takaful concept and principles. According to research by Pień ows a-Kamieniecka & Walczak (2016), insurance knowledge has a strong influence on the growth of awareness in this area, and consequently, having adequate insurance coverage corresponding to the customer needs.

The shortage of qualified human capital is one of the challenges facing the Takaful industry. Those who work in the Takaful sector may lack knowledge in both Shariah and conventional insurance, and both sets of knowledge are critical for the optimum delivery of Takaful products. COMCEC (2019) stated that Takaful market faces a challenge pertaining to human capital, where the market lacks qualified personnel, and suffers from inadequate education, continuous development and training for agents and brokers. Building awareness and increasing education in this field needs the cooperation of many stakeholders, especially as seen from the spectrum of awareness as defined into six areas by Przybytniowski (2017) needs and in particular the extent and scale of safety needs; 2) knowledge of security measures; 3) own insurance experience; 4) environment-specific customs and traditions; 5) insurance marketing of companies; and 6) insurance education of society. Hence, responsible authorities should be educating and informing consumers and ossibly coordinating other sta eholders’ initiati es such as insurance regulator and insurance/Takaful providers collaborations with the education ministry, interior ministry and health ministry in spreading awareness about insurance/Takaful products. In the Middle East, some insurance regulators work hard in educating customers e.g., the Saudi regulator, SAMA, has launched a unique initiati e called SAMACares , which aims to raise community awareness on financial literacy as part of its role in social responsibility towards the Kingdom of Saudi Arabia. The initiative was established around a goal to have a financially literate and informed society that is aware of its rights and responsibilities.

Standardization & Public Disclosure

Lack of standardization among countries is often seen as one of the key challenges that hamper the growth of the Takaful industry (El-Qalqili, 2017; Globe Newswire, 2021). In Islamic insurance, there are five different operational structures, and four of them operate in Middle East – mutual structure in Sudan, cooperative structure in Saudi Arabia, insurance structure in Iran, participation structure in Turkey. However, the Takaful structure (developed in Malaysia) has also spread and is practiced in Middle East. Within the structure of Takaful has been evolving to various models like Wakalah model, Mudarabah model, Hybrid model, and Waqf model. Another point that needs to be addressed within the scope of standardization is the accounting and financial reporting, where some jurisdictions adopt the AAOIFI standards e.g., Bahrain and Qatar, while others adopt the IFRS and national accounting standards. This makes it difficult for Takaful firms to operate across jurisdictions. Although the majority Takaful operators globally use a hybrid Takaful model as their modus operandi, standardization may be challenging as it is acknowledged that no one size fits all. However, harmonization could be a better and more viable option, where the different structures and/or models could be managed if there is clear disclosure and transparency adopted in their practices.

Conclusion

Takaful has proven its viability globally as an alternative insurance model, showing remarkable developments and progress in the Middle East region where the largest amount of Takaful contributions have been recorded. The region has seen diversified experiences in Takaful development, and the researchers are of the view that tracing the beginnings of the Takaful business is important, as looking at the gap between the establishment of first Takaful company and the issuance of the first Takaful regulation in a respective country could provide an indication of the dri e and de th of the country’s Takaful growth. Documenting the chronological history of Takaful development in an accurate and proper manner could assist in better understanding the causes and events that could happen in the future. As such, this paper is structured around two objectives: 1) exploring the beginnings of how Takaful came to the 16 Middle East countries; and 2) illustrating the key challenges faced by the Middle East Takaful markets. For simplicity and ease of comparison, the 16 countries are further divided into three sub-regions, i.e., the GCC countries (comprising six countries – the UAE, Saudi Arabia, Kuwait, Oman, Qatar and Bahrain), the Levant countries (comprising five countries – Syria, Lebanon, Iraq, Palestine and Jordan) and Others (the remaining five countries – Egypt, Yemen, Turkey, Iran and Cyprus & Northern Cyprus). The paper found that the Takaful business exists in all jurisdictions in the region, except Cyprus & Northern Cyprus where there is no Takaful company and no regulation pertinent to Takaful. It also found that all the markets in the region operate based on a dual system that allows both the Takaful and conventional insurance businesses, except Saudi Arabia and Iran, whose insurance markets only allow the Islamic insurance business.

From these sub-regional classifications, the paper observed that the GCC is the only sub-region where all the countries have both Takaful firms and regulations that recognise Takaful specificities. Within the GCC countries, the UAE was the first market to offer Takaful products in 1979 (the same year of Takaful establishment Sudan). In 2010, the UAE regulator became issued the first dedicated regulation for Takaful in Middle East. Among the Levant countries, Jordan is the only jurisdiction that has both Takaful firms and regulations that address the nature of Takaful. The situation in Iraq is different, where the regulator has issued a specific Takaful regulation, despite not having any offering of Takaful products. In contrast, three insurance regulators in the Levant area – Syria, Lebanon and Palestine – have not issued any regulations for the Takaful business although Takaful exists in their markets. The final sub-region, other remaining countries, are seeing different levels of progress in their Islamic insurance regulations. Egypt and Turkey both have Takaful businesses and Takaful-specific regulations. Meanwhile, the insurance industry in Iran is an exceptional case due to the permissibility of con entional insurance in the Shi’a doctrine.

The Takaful industry faces several challenges, and the applicability of these challenges vary between jurisdictions. The paper identified four themes in relation to the challenges faced by the Takaful industry in Middle East: 1) Takaful regulatory framework – an area that requires further attention by the region’s regulators and decision ma ers. our urisdictions, i.e., Syria, Lebanon, Palestine, and Yemen, do not address the specific features of Takaful in their regulations, even though their markets offer Takaful products. On a positive note however, is that there seems to be growing recognition of Takaful operations and more guidance to market players in the regulations of Kuwait, Turkey and Jordan; 2) political and macro environment – the Middle East region is well-known for its volatility and turbulence with several countries such as Syria, Yemen, Egypt and Turkey suffering from varying levels of government instability. These unstable environments have an impact on the overall Takaful business, including in underwriting and investment performance; 3) awareness, education and human capital – the Takaful business requires specific knowledge and skills, which are currently lacking, and need to be incorporated, in the national education systems. Ensuring exposure to these skills could help in providing qualified human capital to market players specifically, and improve the level of insurance & Takaful awareness and literacy amongst the general public; and 4) standardization and public disclosure – the Takaful business in the Middle East is implemented based on different structures and operational models, all of which have different implications on accounting and reporting. Lack of standardization and poor public disclosure are challenges observed in the region. The scope of this paper is limited to providing an overview of the Middle East markets focusing on the early beginnings and key challenges of the Takaful business. However, future research can expand to studying Takaful developments in different regions and other aspects of the Takaful business.

Footnotes

- The paper will use the term Takaful as it is the term that is most commonly used in the industry.

- For further explanation on the view of Ibn Abidin about Sukrah, please refer to the following reference: https://www.elgaronline.com/view/9781788115827/chapter01.xhtml

- https://www.elgaronline.com/view/9781788115827/chapter01.xhtml

- https://salama.ae/company/

- https://kuwaitre.com

- https://www.nlg.om

- https://www.nlg.om

- http://www.mit.gov.jo/EN/Pages/About_the_Ministry

References

Abu Farha, S. 2018. Last year, it earned more than $2 million: "Takaful Insurance" Continues to reap successes and is looking forward to more.

Abul Fadl, M. 2019. Insurance sector and its origins from the beginning of the nineteenth century until now.

Aisen, A., & Veiga, F.J. 2013. How does political instability affect economic growth? European Journal of Political Economy, 29, 151-167.

Aizpun, F.C., Dai, X., & Lechner, R. 2021. World insurance marketplace. Swiss Re Institute.

Alhabshi, S.O., & Razak, S.H. 2009. Takaful: Concept, history, development, and future challenges of its industry. ICR Journal, 12, 276-291.

Al-Mu q, M.S. 2010. Settling insurance disputes in Saudi Arabia.

AlNemer, H. 2015. c. Intern ional Journal of Business, Economics and Law, 71, 43-53.

Al-Sa i, A.R. 2009. Is the Islamic mutual composed insurance a commercial insurance? Is Islamic compound insurance cooper ive or commercial insurance?Journal of King Abdulaziz University: Islamic Economics, 222, 125-153.

Alshammari, A.A. 2021. Insurance & Takaful regul ory report 2021: Conduct of insurance & Takaful business regul ion in GCC Markets. Qrar.

Alshammari, A.A., & Altarturi, B.H. 2021. Conduct of business regul ion and covid-19: A review of the Gulf insurance industry.Intern ional Journal of Entrepreneurship, 25, 1-14.

Alshammari, A.A., Alhabshi, S.M., & Saiti, B. 2018. A compar ive study of the historical and current development of the GCC insurance and Takaful industry. Journal of Islamic Marketing.

Alshammari, A.A., Altarturi, B.H., & Alokla, J. 2021. System ic review on Takaful and Re Takaful Windows: A regul ory development perspective. Journal of Business School, 41, 1-13.

Alshammari, A.A., Altarturi, B., Saiti, B., & Munassar, L. 2020. The impact of exchange r e, oil price and gold price on the Kuwaiti stock market: A wavelet analysis. The European Journal of Compar ive Economics, 171, 31-54.

Al-Shaqwiry, H. 2020. The origin and development of insurance in Egypt.

Altarturi, B.H., & Ajouz, M.A. 2021. Review of knowledge framework and conceptual structure of Islamic Banking. Al Qasimia University Journal of Islamic Economics, 12, 116-143.

Anwar, M., & Hussain, M. 1994. Compar ive study of insurance and "Takafol" Islamic insurance with comments. The Pakistan Development Review, 334, 1315-1330.

Central Bank of Bahrain. 2017. Insurance Market Review 2016. Central Bank of Bahrain.

COMCEC. 2019. Improving the Takaful sector in Islamic countries. Ankara: COMCEC Coordin ion Office.

Demir, C. 2019. Macroeconomic determinants of stock market fluctu ions: The case of bist-100. Economies, 71, 8.

Dikko, M., & Bakar, M.A. 2018. A compar ive review of Takaful frameworks in Nigeria, Malaysia and Pakistan. Intern ional Journal of Islamic Business, 31, 56-69.

El-Qalqili, J. 2017. Takaful–found ions and standardiz ion of Islamic insurance. Electronic Journal of Islamic and Middle Eastern Law, 5, 29-54.

Ercan, M., & Onder, E. 2016. Ranking insurance companies in Turkey based on their financial performance indic ors using VIKOR method. Intern ional Journal of Academic Research in Accounting, Finance and Management Sciences, 62, 104-113.

Eskridge, W.N. 1981. Iranian n ionaliz ion cases: Toward a general theory of jurisdiction over foreign st es, 223, 525.

Fauzi, P.N., Rashid, K.A., Sharkawi, A.A., Hasan, S.F., Aripin, S., & Arifin, M.A. 2016. Takaful: A review on performance, issues, and challenges in Malaysia. Journal of Scientific Research and Development, 34, 71-76.

Globe Newswire. 2021. Worldwide Takaful insurance industry to 2030 - Surge in awareness is driving growth.

Gob , J., & Kostial, K. 2016. Syria’s conflict economy. Intern ional monetary fund working papers.

Hachem, W., Saad, S., & Fayad, F. 2018. Insurance and reinsurance in Lebanon: Overview. Retrieved from UK Practical Law.

Hashempoor, S. 2013. Insurance and history of its origin, and its surrounding issues in Iran. Journal of Basic and Applied Scientific Research, 32, 1217-1230.

Hassani, M.A., & Al-Ghabban, F.I. 2019. Prospects for adopting Takaful insurance and its role in developing insurance services: Applied research in the Iraqi insurance sector. Journal of Accounting and Financial Studies, 1-13.

Hiday , S.E. 2015. The role of educ ion in awareness enhancement of Takaful: A liter ure review. Intern ional Journal of Pedagogical Innov ions, 32.

Hiday , S.E., & Rafeea, A.M. 2014. Public awareness towards Takaful concept and principles: A survey in Bahrain. Intern ional Journal of Excellence in Islamic Banking and Finance, 1821784, 1-31.

Htay, S.N., Arif, M., Soualhi, Y., Zaharin, H.R., & Shaugee, I. 2012. Accounting, Auditing and Governance for Takaful Oper ions. John Wiley & Sons.

Husin, M.M. 2019. The dynamics of Malaysian Takaful market: Challenges and future prospects. Journal of Islamic Finance, 8, 131-137.

IFN. 2021. Iranian insurance company set to introduce Takaful products in response to demand. Islamic Finance News.

IFSB. 2020. IFSB-25: c.

IFSB. 2021. Islamic financial services industry stability report 2021. Kuala Lumpur: Islamic Financial Services Board.

IFSB, & IAIS. 2006. Issues in regul ion and supervision of Takaful Islamic Insurance. Islamic financial services board and intern ional associ ion of insurance supervisors.

Insurance Authority. 2010. The UAE Is The first Arab Country to system ize Takaful insurance.

Insurance Authority. 2017. Insurance Authority - 10 years of success and excellence. Dubai: Insurance Authority.

Insurance Panorama. 2014. History of the insurance industry in Saudi Arabia.

Insurance Panorama. 2019. History of the insurance industry in Yemen.

Islahi, A.A. 2014. Economic ideas of Ibn'Abidin: A legal analysis. Islamic Studies, 83-97.

Jordan Insurance Feder ion. 2018. History of insurance regul ions and development of regul ions in Jordan.

Kamal, M. 2014. Papers in the history of insurance in Iraq: Selective views Papers in the history of insurance in Iraq - selective views. Baghdad: N ional Insurance Company.

Khan, M.M. 2016. The Insurance Market in Iraq.

Khorshid, A.A. 2001. Islamic insurance: A modern approach with particular reference to western and Islamic Banking.

Mahaini, M.G., & Al Sabban, M. 2018. Syria's Takaful market outlook after six years of war. Islamic Finance News, 23.

Mohamed, M.A. 2020. The beginning of Islamic insurance industry principles, found ions and regul ions governing the work of Islamic insurance companies. Sudan model. The Journal of Academic Social Science, 401-418.

Mustaqbal Web. 2019. "Al Aman Takaful Insurance" in Al Baraka Group.

Nasir, A., Farooq, U., & Khan, A. 2021. Conceptual and influential structure of Takaful liter ure: A bibliometric review. Intern ional Journal of Islamic and Middle Eastern Finance and Management, 143, 599-624.

Nia, F.H., & Thimmarayappa, R. 2018. Structure of Iran Insurance Company: History and Perspective. Intern ional Journal for Research in Engineering Applic ion & Management, 43, 774-781.

Omer, A.S. 2011. Issues and challenges facing by Takaful industry in dual system.

Öz, S., & Isik, M.A. 2019. Islamic insurance system: Tekaful. Intern ional Journal of Commerce and Finance, 52, 211-218.

Palestine Capital Market Authority. 2021. Insurance: Sector Overview.

Pienkowska-Kamieniecka, S., & Walczak, D. 2016. Willingness of polish households to save for retirement. European Financial Systems, 27-28.

Przybytniowski, J.W. 2017. The level of insurance knowledge of young people entering professional life – results of questionnaire surveys conducted among students of the Podkarpackie Voivodship. Jagiellonian Journal of Management, 32, 107–121.

Regularing Insurance Business Act. 2021.

Salman, S.A. 2014. Contemporary issues in Takaful Islamic insurance. Asian Social Science, 1022, 210.

Shabah, A.A. 2007. Islamic and commercial insurance: Compar ive study: Applying to insurance companies in Yemen. Bachelor's Dissert ion.

Soualhi, Y., & Al Shammari, A.A. 2015. Indic ors of Takaful awareness among Kuwaitis. Journal of Islamic Banking and Finance, 32, 75-89.

Sümegi, K., & Haiss, P. 2006. The rel ionship of insurance and economic growth: A theoretical and empirical analysis, EcoMod.

Suter, R., & Keller, B. 2012. The role of insurance in the middle east and north Africa. Switzerland: Zurich.

Ul Din, S.M., Abu-Bakar, A., & Regup hi, A. 2017. Does insurance promote economic growth: A compar ive study of developed and emerging/developing economies. Cogent Economics & Finance, 51, 1390029.

Wafa. 2012. Insurance in Palestine: A historical overview.

Wagdi, O. 2014. Egyptian insurance market: History and structure.

Received: 05-Feb-2022, Manuscript No. JLERI-21-10567; Editor assigned: 08-Feb-2022, PreQC No. JLERI-21-10567 (PQ); Reviewed: 21- Feb-2022, QC No. JLERI-21-10567; Revised: 08-Mar-2022, Manuscript No. JLERI-21-10567 (R); Published: 17-Mar-2022.