Research Article: 2021 Vol: 24 Issue: 5

Identification Conflicts Arising from the Relaxation of Credit Regulation in Relations between Creditors and Debtors in Indonesia

Theresia Anita Christiani, Universitas Atma Jaya Yogyakarta

Djoko Budiyanto Setyohadi, Universitas Atma Jaya Yogyakarta

Chryssantus Kastowo, Universitas Atma Jaya Yogyakarta

Abstract

Relaxation is needed due to encouraging banking performance, maintain financial system stability, and support economic growth. Furthermore, it will impact some problems, particularly conflict arising among its stakeholder. Therefore, identifying conflicts arising caused by the relaxation of credit regulation is essential. This research is performed by a normative juridical study, using secondary data as the primary data. The data were processed by using qualitative analysis. The statutory and conceptual approaches are used in this study. This article informs about identification conflicts arising from relaxation credit regulation in the relationship between creditors (banking institutions) and debtors (society). The research result are that identification conflicts with the flexibility of regulation for banking institutions and debtors that have become obstacles to achieving legal objectives. Based on the theory of utilitarianism, the conflicts that have been identified must be immediately resolved on the ethical-moral basis of the law, to support the achievement of the aim of the law is the greatest happiness for the greatest number. This research's limitation is that this study finds answers to identification conflicts against flexibility banking principles in relations between creditors (banking institutions) and debtors. Research has not explicitly sought answers for comprehensive solutions to the identification conflicts. Further research that discusses and finds answers to identifying this conflict will help achieve legal objectives.

Keywords

Banking, Conflicts, Flexibility, Law, Utilitarianism.

Introduction

The emergence of COVID - 19 impacts the payment capability of the Debtor and the Creditor. The effect is concerning credit or financing agreements between banks and customers. The reduced capacity will see the impact on debtors of debtors in carrying out their obligations. The Debtor's situation with repayment ability problems will affect the risk of credit repayment. For Bank will increase the credit risk may interfere with the Bank's existence as an intermediary institution of capital aspect. There is a relationship between capital, risk, and competition (Philip et al., 2020). The disruption of banking institutions will undoubtedly trigger a crisis (Claudio, 2020) economic stability, which is the cornerstone of people's economic growth. All countries, including the United States, issued various regulations to overcome the pandemic situation's adverse effects. Likewise, in China, this felt the impact of the spread of coronavirus disease 2019 for the banking sector. In connection COVID-19 pandemic, Financial Services Authority issued Regulation of the Financial Services Authority of the Republic of Indonesia Number 11 / FSA Regulation.03 / 2020 concerning National Economic Stimulus as a Countercyclical Policy Impact of the spread of Coronavarius Disease 2019 as amended by the Republic of Indonesia Financial Services Authority Regulation Number 48 /FSA Regulation 03 / 2020.

There are two objectives of the FSA regulation. The first objective is to encourage banking performance, especially the intermediation function, to maintain the financial system stability. The second objective, to support economic growth, namely by providing special treatment for bank credit or financing with a certain amount and restructured credit or funding to debtors affected by the spread of coronavirus disease 2019 (COVID-19), includes micro, small and medium business debtors.

Conflict can be interpreted as squabbling; dispute; contradiction. The article's contradiction in this article refers to the contradiction between the issuing Regulation's purpose and the implementation. Meanwhile, the word "Identification" has the meaning of determination. Conflict identification can be interpreted as the determination of contradictions in the implementation of regulations in their implementation. This determination is essential to achieve the objective of Regulation of the Financial Services Authority of the Republic of Indonesia Number 11/FSA Regulation.03/2020 concerning National Economic Stimulus as a Countercyclical Policy Impact of the spread of Coronavarius Disease 2019 as amended by the Republic of Indonesia Financial Services Authority Regulation Number 48 / FSA Regulation.03 / 2020 was issued with the aim of, first, to boost banking performance, especially the intermediation function. Second, maintaining financial system stability. Third, supporting economic growth. This objective is carried out by providing special treatment for bank credit or financing with a certain amount of credit or restructured financing to debtors affected by the spread of COVID-19, including micro, small and medium business debtors. This particular treatment is known as the banking relaxation policy. The Form of credit relaxation is the leniency of micro and small business credit for a value below 10 billion IDR, both for credit/financing provided by banks and the non-bank financial industry to bank debtors.

In implementing the relaxation credit regulation, the Bank and the Debtor have the potential to face obstacles. These obstacles are in the form of conflicts of interest experienced by bank institutions and debtors. The Identification of such conflicts is essential to be researched and discussed to achieve the Financial Services Authority Regulation (FSA Regulation). As stated by Jeremy Bentham, the purpose of Law is to provide benefits to most societies. The public as debtors and banking institutions will benefit from the enactment of this Regulation. Conflicts in the Form of obstacles in the implementation of this Regulation are essential to be identified.

The research's novelty that this research examines State regulations in Financial Services Authority Regulation provides solutions to the impact of the coronavirus's spread in society's financial institution sector intermediary functions. Previous research conducted by Elizabeth A. Berger et al., Which said that deregulation would affect economic growth with a particular condition (Bashir et al., 2020), the relationship between the emergence of deregulation from the Government and the presence of economic growth when it meets specific requirements. The study identifies the relationship between government regulations and economic development. The study discusses the Identification of the conflict due to the Regulation of financial service authorities in Indonesia.

Another study conducted by Leo De Haan& Jan Kakes researched the impact of the crises global happened in 2007-2009 and alternative treatment following the existing Bank type (Leo and Jan, 2020). This study identifies the impact of global crises on types of banks, governments, and economic growth. In contrast, this study discusses conflict identification due to the Regulation of financial service authorities. Other research was also conducted by Thimothy DN, who outlined how the United States deals with the Coronavirus Pandemic's impact on financial institutions (Timothy, 2020).

Other research was conducted by Amrita Bahri (Bahri, 2020), who analyzed the contents of the impact of the corona pandemic on women's position. The COVID- 19 virus's spread also impacts gold and Bitcoin (Khaled, 2020). This research identifies the impact of the spread of COVID-19 on women's position, while this research discusses the Identification of conflicts against banking institutions and debtors due to financial service regulations. Authority in Indonesia due to the impact of the spread of COVID-19. Several researches have been conducted, among others, the effect of Covid on small companies in Switzerland (Brülhart et al., 2020) and COVID-19 on the socio-economic situation was also studied by Gangemi et al. (2020). These studies identify the impact of the spread of COVID-19 on small companies in Switzerland, while this study discusses Identification. Conflict with banking institutions and debtors due to Financial Services Authority regulations, due to the impact of the spread of COVID-19, there is research conduct d by Devi and Bambang in Indonesia. They researched the Regulation of the Financial Services Authority of the Republic of Indonesia Number 11 / FSA Regulation.03 / 2020 (Devi and Bambang, 2020; Januarita and Sumiyati, 2020). The research conducted did not discuss the Identification for conflict in economic stimulus regulations from potential matches that arise. Indonesia, related to the Force Majeure situation in the contract (Januarita and Sumiyati, 2020). The research also conducted by Ratna and Yeti identified the Financial Service Authority regulations before the regulatory change. In contrast, the study was undertaken by Januarita and Sumiyati discussed the relationship between the spread of COVID-19 and the State of force majeure in Indonesia. Meanwhile, this research examines the Identification of conflicts with banking institutions and debtors due to FSA regulations.

This research is different from previous research. The study is based on the idea that the existing Regulation of the Financial Services Authority of the Republic of Indonesia Number 11/ FSA Regulation 03/2020 can be seen as flexible banking principles and a concrete manifestation of the legal principle's application that the Law changed in tune with society's changes. This study aims to identify conflicts arising from the flexibility of banking principles in relations between creditors (banking institutions) and debtors (public) due to the implementation of FSA regulations. The purpose of this study was not and has not been produced by previous research. Law is not something sterile but changes influenced by non-legal (economic) factors. The fact that occurs in the community is that financial institutions as intermediary institutions are not only banking institutions. On the other hand, the Regulation has weaknesses in its implementation.

Based on the fact juridical and empirical above the significant issues will be carried out research which aims to provide a solution that comprehensively to find answers to problems of Law, namely, how identification conflicts arising from the Relaxation credit regulation in relations between creditors (banking institutions) and debtors (society)? The research aims to identify disputes arising from the Relaxation of credit regulation in relations between creditors (banking institutions) and debtors (community).

Elaboration of conflict identification is used to find obstacles in achieving legal objectives. Jeremy Bentham stated that the Law's purpose is to identify conflicts in implementing the FSA Regulations. The public as debtors and banking institutions will benefit from the enactment of this Regulation.

Methods of Research

This research is a type of normative research. Normative research is research that prioritizes secondary data. This study does not use primary data. Secondary data used include the FSA Law, FSA Regulation which is the primary legal material. Secondary legal materials used include data sourced from books and sources from various journals and sources from the internet. The approach taken in describing and analyzing data is carried out with a conceptual and statutory approach. The analytical method chosen is qualitative analysis. Clarifying conclusions using the deduction drawing method

The Content of Regulation of the Financial Services Authority as Relaxation Credit Regulation

In Indonesia, situation coronavirus pandemic caused a bad one against the activity Economy (Gangemi et al., 2020). COVID-19 caused a situation of weak demand in the consumption and production sectors. The low bank lending level, which only grew 1.49% (YoY), although TPF grew at a higher rate of 7.95% (YoY) (FSA, 2020). This situation impacted the LDR level of banks, which experienced 88.64% (FSA , 2020). This situation shows that liquidity conditions are exceptionally well maintained. A CAR of 22.50% indicates that the Bank's capital is quite good. Besides, in general, banking resilience was also strengthened, as evidenced by the stable bank capital condition with a CAR of 22.50%. However, it must remember that COVID- 19 would increase credit risk and a decrease in profitability. It is due to the reduction in economic activity. If this situation continues, it will harm bank capital in the future.

Based on this situation, the Republic of Indonesia Financial Services Authority Regulation Number 11 / FSA Regulation.03 / 2020 concerning National Economic Stimulus as a Countercyclical Policy was issued as the impact of the spread of Coronavarius Disease 2019 as amended by the Republic of Indonesia Financial Services Authority Regulation Number 48 /FSA Regulation.03/2020.

The Regulation background is that the spread of COVID- 19 creates a situation for debtors' ability, including debtors who are included in a small and medium business. If this situation is left unchecked, it will potentially interfere with the Debtor's ability to pay. This situation will adversely affect the health of the Bank and disrupt economic growth. A boost is needed for the stability of the intermediation function that the Bank has. The main things stipulated in the Regulation of the Financial Services Authority of the Republic of Indonesia Number 11 / FSA Regulation.03 / 2020 are that: First, this Regulation applies to commercial banks operating in sharia, Islamic retail banks, Syariah units, rural banks, and sharia rural banks. Second, Banks are given the authority to implement various policies expected to provide support to debtors affected by the spread of COVID-19. Efforts and forms of support from bank institutions remain principled by bank prudence. Third, Debtors who will accept this policy are debtors whose businesses have been affected by the spread of COVID -19 in Indonesia. The intended Debtor is a debtor with companies in transportation, tourism, hotels, trade, agriculture, processing, and mining. Fourth, Form of policy that gives Stimulus among others: First, in assessing quality credit or financing (sharia) or the provision of other fund shares based on the precision of the obligation to pay only the principal and interest on the loan agreement/financing or condition of additional funds with allocation number IDR 10 billion. Second, it will upgrade the Government's quality of credit or funding to the current rate after restructuring. This second step is determined by the Bank regardless of credit or financing ceiling limits and Debtor type. Fifth, there are six ways of restructuring credit that the interest rates are lowered. The extended period mounts principal, and interest arrears were reduced by government additional credit facility/financing or credit conversion or financing (sharia) to be a temporary investment. Sixth Banks are allowed to offer credit or funding forms or provision of funds to borrowers given special treatment from this Regulation. Banks can determine the quality of credit or financing or other funds separate from the previous rate. Submission of the end of April 2020 data reports to the Financial Services Authority for monitoring purposes. This Regulation is valid until March 31, 2021. This Regulation was steering an experienced change with the regulations of the Financial Services Authority Republic Indonesia Number 48 /FSA Regulation.03/2020. There are additions about, Regulations in risk management implementation, Credit / Financing Restructuring, Bank Policy, and Reporting. The Government will conduct Financial Services Authority Regulation will be implemented until March 31, 2022.

The regulations of the Financial Services Authority of the Republic of Indonesia Number 48 /FSA Regulation. 03/2020, in essence, provide additional rules in applying risk management, credit/financing restructuring, and bank policies as a result of the spread of the coronavirus. These Regulations contents are the same as the Financial Services Authority Regulation of the Republic of Indonesia Number 11/ FSA Regulation .03 / 2020 policy. The contents of this Regulation are still the same as the existing policies. The FSA added several provisions aimed at improving risk management, as well as reducing moral hazard. There are changes in Regulation from the aspect of substance. The substantive element concerns regulations concerning risk management, governance, and credit, including reporting. The Financial Services Authority Regulation extension is intended to enable bank institutions to perform an intermediary function. The addition of rules in the Republic of Indonesia Financial Services Authority Regulation Number 48 /FSA Regulation.03/2020 emphasizes how banks, which are given, full authority to implement this Regulation, can apply the principle of prudence in determining debtors and credit objects given credit stimulus.

Based on that explanation, that required research to identify potential conflicts arising from the banking principle's flexibility in the relationship between creditors (banking institutions) and debtors (people) as the battery bat implementation of the 11 / FSA Regulation. 03 / 2020 and its amendments. Financial Services Authority Regulation No. 11 / FSA Regulation. 03 / 2020 are given to provide legal protection for both debtors and creditors. State intervention is needed in economic activity, said Eric and Glen said that Private property is inherently monopolistic. How we would all be better of if it converted private ownership into a public auction for public benefits (Eric and Glen, 2018).

This opinion shows that the State's interference in arrangements that will regulate a specific economic position. They aim to provide benefits to the public at large. Following Jeremy Bentham's Law's purposes, the Law is made for all the community's Utilization of magnitude. Interest Law according to the purpose of the Law proposed by Jeremy Bentham. Jeremy Bentham argues that something is considered acceptable or not measured by the consequences of that action. Jeremy Bentham is a thinker whose teachings are known as Utilitarianism (Lorenzo, 2020).

Conflict Identification in Credit Relaxation Regulations Uses the Theory of Utilitarianism

In connection with the previous section explaining the FSA Regulation contents, this section will present the Identification of conflict against flexibility banking principles in relations between creditors (banking institutions) and debtors. Conflict identification is made using the Utilitarianism theory line of mind. From the aspect of benefits theory, Identification is essential to know to minimize the obstacles that arise in achieving the Law's aim is the greatest happiness for the most significant number. Implementation of FSA Regulation will raise conflict for the Bank. The scarcity of sources of funds for business actors is solved by the formula provided by the Government Regulation. This Financial Service Regulation offers solutions to real problems for business actors to continue production with capital availability. This Financial Services Authority Regulation was made with the assumption that the COVID-19 Pandemic will end soon. This Financial Services Authority Regulation provides a solution that will not affect the Bank's health in the long term. The consequence of the Financial Services Authority Regulation for banks is that banks must provide various stimulus and relaxation to their debtors. Relaxation means peace as a form of flexibility. There are forms of credit restructuring that are allowed to be carried out. Identification conflicts from the economic stimulus in the form of credit stimulus include identification conflicts against bank health in the long term and the Bank's authority to decide on a credit stimulus request for Identification.

The inability of the Debtor to fulfill his obligations when the payment is due. It is because economic instability is a determining factor in the payment capacity of debtors. If the Debtor does not pay, it will significantly affect the health of the Bank. Based on this situation, banks still have to implement the prudential principle (a decrease from the strict implementation of principles under standard conditions). The focus of prudence, in this case, means that banks must remain careful in determining which credit restructuring will be appropriate to be given to debtors. Assessment data on the intermediation function and interest rates Stimulus was provided in the period from April 2020 to March 2021. The data shows a downward trend in the banking intermediary function and the development of interest rates, both credit interest rates and average interest rates for deposits and savings, and shows that the relaxation in the Form of restructuring has a significant effect on the Bank's health. It means that policies in the form of economic stimulus in the form of procedures for determining asset quality and credit or financing restructuring policies are only good policies for banks' health in a certain period. If the economy does not recover soon, this relaxation will have a potential conflict that is bad for the Bank's health in the long-term.

The granting of authority to banks to establish implementation guidelines and determine which debtors can be given a credit stimulus does not create a potential conflict for the Bank. This provision is not mandatory for banks to implement. The Bank's non-compliance in implementing these regulations creates a possible match for the Bank. The spread of COVID-19 affects the ability to pay debtors. The risk of bad credit makes the Bank's Non-Performance Loan (NPL) High. High bank NPL indicates high bank terrible credit. The high number of bad credit will cause losses for banks. Therefore, the Bank will continue to strive to prevent too much lousy credit. The implementation of this Regulation is the basis for implementing the prevention and rescue of bad debts. This credit stimulus will allow debtors who do not have good potential to be given this regulatory stimulus. Even though given a fixed term, the Debtor will not pay his obligations to the Bank. This situation will only burden the Bank in the future. This situation will positively disturb the objectives of this Regulation. This Regulation aims to encourage the optimization of the banking intermediation function, maintain financial system stability, and support stunted economic growth. Banks' role in carrying out due diligence to customers who apply for credit stimulus is significant to be consistently implemented. In determining whether the stimulus given to specific debtors can be following these relaxation objectives without sacrificing the Bank's health, which is the basis for the Bank's sustainability.

Implementation of FSA Regulation will raise conflict for the Debtors. Regulation's objective is to improve the Debtor's performance and capacity in meeting credit or financing payment obligations. With the statute approach, three provisions that could be potential conflicts for debtors of the Regulation can be analyzed. There is no obligation for banking institutions to implement this Regulation for debtor customers. The provisions in article 2, section 1 of the Financial Services Authority Regulation of the Republic of Indonesia Number 11 / FSA Regulation.03 / 2020 state that: Banks can implement policies that support economic growth stimuli for debtors affected by the spread of the COVID-19), including micro, small and medium business debtors. These provisions are analyzed in 2 aspects to find conflicts for debtors. First: The first phase of article 2, paragraph 1, states that: "a bank can ... ..” the word can have the meaning not obligatory or mandatory. This phrase means that the Bank is not obliged or does not have to provide the stimulus or relaxation with grammatical interpretation. This provision makes banking institutions not obligated to provide stimulus in the form of relaxation.

For Debtors, the condition of non-obligation for banks to offer peace harms the Debtor. Application for debtors based on this provision is highly dependent on the decision of the banking institution. There will be no sanctions on banking institutions if they do not provide stimulus to debtors following this Financial Services Authority Regulation. The nature of no obligation for banks to offer credit stimulus results in the absence of debtor rights. This situation causes a potential conflict with the Debtor. In the form of a possible war against debtors, even though there are provisions for credit stimulus, the Debtor cannot claim the right to provide the credit stimulus. However, the decision to give it still depends on the Bank's assessment. This Regulation is not more than a suggestion or suggestion is not an obligation that the witness will impose if the Bank does not do it. From the perspective of legal objectives in economic activities, this provision does not support legal economic activities to provide legal protection for debtors. The dominance of banks will be increasingly prominent in these regulations. Second, Article 2 paragraph 1 states that this Regulation is aimed at debtors affected by the spread of COVID-19. Elucidation to article 2 explains that debtors affected by the spread of COVID-19. They are debtors who are experiencing difficulties fulfilling their obligations to the Bank. This difficulty is due to the Debtor or Debtor's business being affected by the spread of COVID-19either directly or indirectly in the economic sector, including tourism, transportation, hotels, trade, processing, agriculture, and mining. The provision in Article 2 means that the Debtor who can be given credit stimulus is the one who is directly or indirectly affected.

In practice, only debtors directly affected by COVID-19 are prioritized to be offered this regulatory policy (Michelle, 2020). The provisions of article 2 create a potential conflict with the rights of debtors who are not directly affected. Article 2, paragraphs 4, and 5 states that the Bank must have guidelines for determining debtors affected by the spread of COVID-19, including micro, small and medium business debtors. Article 2 paragraphs 5 ads a provision that banks prepare guidelines for determining debtors who are affected by the spread of COVID-19. Including micro, small, and medium business debtors as intended, at least containing: •criteria for debtors who are determined to be affected by COVID-19. The word "must" contained in the provisions of article 2 paragraph 4 has a mandatory meaning. It means that banks are required to have guidelines for providing for debtors and sectors granted this regulatory stimulus policy. Normatively and factually, it can observe that regulations will show more domination of banking institutions towards customers. The provision creates a potential for conflict on the weak position of the Debtor. Since the beginning of the agreement, the Debtor's place has a vulnerable rewarding position compared to banking institutions. This Regulation further strengthens the dominance of banking institutions.

The Form of reporting on the implementation of this Regulation to the Financial Services Authority. Reporting requirements are stated in Article 8.

1. Banks that determine the quality of credit or financing and other provision of funds are only based on the accuracy of principal and interest or margin/profit sharing /Syariah payments as referred to in Article 3 paragraph (1) or Article 4 paragraph (1). Submit a Report on the Stimulus of Credit or Financing and Provision of Other Funds Assessed Based on Accuracy of Payment.

2. A Bank conducting a credit or financing restructuring as referred to in Article 5 paragraph (1) submits a Credit Stimulus Report or Restructuring Financing.

3. The report's format as referred to in paragraph (1) and paragraph (2) is contained in the Attachment, which is an integral part of this Financial Services Authority Regulation.

The above provisions state that the Bank submits a report on the implementation of this Regulation. It should even be mandatory in the reporting sentence. It shows that the Government gave this Regulation without any implementation supervision. This situation creates a potential conflict for debtors due to banks with all positions, positions, and authorities, as a result of the agreement strengthened by this Regulation, without including the Financial Services Authority's supervisory role as the authority of the financial services sector.

Economic stimulus in the banking sector is manifested in restructuring, namely by lowering interest rates, extended terms, reduced interest arrears and arrears, additional credit/financing facilities, and conversion of credit or financing (sharia) temporary equity participation. It means that borrowers who received loan restructuring will have potential conflicts for the ability to pay at maturity, such terms. The macroeconomic progress very much determines the Debtor's repayment capacity. Therefore, the Debtor's potential to fail to meet the payment obligation will significantly depend on economic recovery development. Micro s stimulus tangible economy credit restructuring. The Debtor will create a potential conflict with the Debtor's ability to pay if the Debtor is not professional in managing capital. This stimulus will provide benefits if the Debtor is professionally responsible for accepting restructuring. The professionalism of the Debtor will determine the ability of the Debtor to pay at maturity. For example, a credit restructuring with an extended-term (or other forms) will only be given by Bank within a predetermined period. It means that if the economy does not behave as expected, of course, this stimulus will not be sufficient. Even a heavier burden will appear after the stimulus period ends and the economy has not experienced significant improvement.

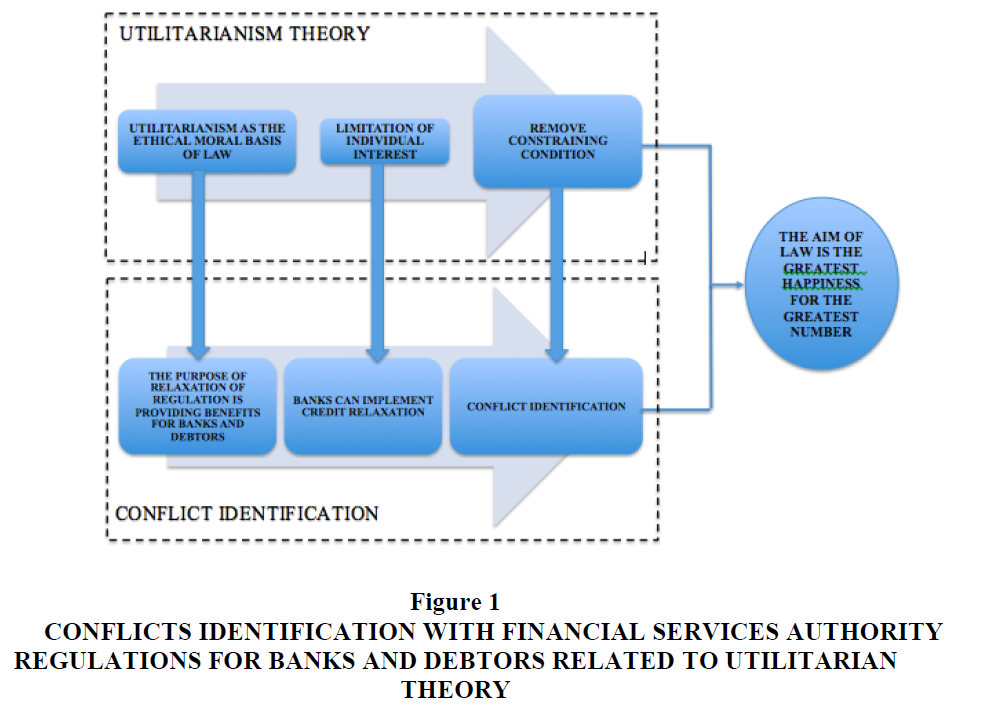

Identification conflicts implementing regulations for debtors and banks as a consequence of implementing the Regulation of the Financial Services Authority of the Republic of Indonesia Number 11/FSA Regulation.03/2020 concerning National Economic Stimulus as a Countercyclical Policy Impact of the spread of Coronavarius Disease 2019 as amended by the Republic of Indonesia Financial Services Authority Regulation Number 48 / FSA Regulation.03 / 2020. It will analyze by Utilitarian Theory. The flow can be described below in Figure 1.

Figure 1 Conflicts Identification with Financial Services Authority Regulations for Banks and Debtors Related to Utilitarian Theory

The basic concept of Utilitarianism is the ethical-moral basis of Law. Helpful something will give happiness. Concrete laws outlined in the Financial Services Authority Regulation have the objective of providing benefits to debtors and banks as creditors. It is following the Legal Purpose put forward by Jeremy Bentham. The purpose of the Law is to provide services and happiness to as many people as possible. In issuing these regulations, the State aims for the happiness and benefit of the majority of people. The line of thought of Jeremy Bentham's benefit theory is described as follows:

1. The basic concept of Utilization as the ethical-moral basis of Law. Helpful something will give happiness. Good and bad actions will be measured by whether an effort will bring profit and happiness or not. The basic concept of Utilitarianism is in line with the basis for the Financial Services Authority Regulation's issuance, namely providing benefits for banks and debtors.

2. According to Utilitarian theory, efforts to achieve goals require limiting the interests of individual interests. The concept of Utilitarianism is in line with the Financial Services Authority Regulation contents, which provides opportunities for banks to offer credit relaxation. This Regulation certainly limits the freedom of banks to get repayments of debtors' obligations. From a bank perspective, this Regulation defines the rights of banks to obtain their rights.

3. Consequently, only regulations that can benefit most of these people will be considered as laws and regulations. In the concept of Financial Service Authority regulation, it is necessary to identify which articles become obstacles and cause conflicts in implementing these regulations. Pieces that can hinder the purpose of making FSA regulations are article 2 and article 8. The article should be changed or replaced because it does not bring benefits. Following the theory of Utilitarianism, which states that only provisions that provide services will be used.

4. All steps in the flow to achieve the Law's aim are the greatest happiness for the most significant number.

Measuring how much benefit is obtained from the FSA Regulation's existence, the measuring methods do not have to be qualitative. It is in line with the opinion of John Stuart Mill (1806-1873). He agreed with Bentham, that humans aim to achieve happiness. Mill, slightly different measuring satisfaction is not quantitative but more qualitative. Mill also considers the quality of happiness and usefulness because happiness has a value with high and low quality. (Mill, 2009). Positive Law, according to Thomas Aquinas, is based on his study of the nature of Law. Law must aim for the Bonum Commune. Law is made for the general benefit of all citizens. The theory of Utilitarianism is used in identifying conflicts that arise in the implementation of these regulations. The purpose of Law for the benefit can be achieved (Sumaryono, 2002). It is essential that the Law's objective to provide benefits as stated by Jeremy Bentham and John Stuart Mill will be realized.

Conclusion

The basic concept of Utilitarianism is the ethical-moral basis of law. The objective of the law is to provide benefits to as many people Identification of conflict flexibility of banking regulations for banking institutions can be identified as two potential conflicts. Based on the stages in the attainment of these legal objectives, the conflict that becomes an obstacle to achieving these goals must be immediately sought for a solution. There are identification conflicts with the flexibility of regulation for banking institutions and debtors that have become obstacles to achieving legal objectives. Based on the theory of utilitarianism, the conflicts that have been identified must be immediately resolved on the ethical-moral basis of the law, to support the achievement of the aim of the law is the greatest happiness for the greatest number. This research's limitation is that this study finds answers to potential conflict against flexibility banking principles in relations between creditors (banking institutions) and debtors. Research has not explicitly sought answers for comprehensive solutions to the identification conflicts. Further research that discusses and finds answers to identifying this potential conflict will be beneficial for achieving legal objectives.

Acknowledgement

Thanks to Universitas Atma Jaya Yogyakarta, Indonesia, for providing funding this research.

References

- Bahri, A. (2020). Women at the frontline of COVID-19: Can gender mainstreaming in free trade agreements help? Journal of International Economic, 23(3), 563-582.

- Bashir, M.F., Ma, B., & Shahzad, L. (2020). A brief review of socio-economic and environmental impact of Covid-19. Air Quality, Atmosphere and Health, 13(12), 1-8.

- Brülhart, M., Lalive, R., Lehmann, T. (2020). COVID -19 financial supports to small businesses in Switzerland: evaluation and outlook. Swiss Journal of Economics Statistics, 56(1), 1-15.

- Claudio, B. (2020). The Covid - 19 economic crises: Dangerously unique. Business Economics, 55(4), 181-190.

- Devi, N.S., & Bambang, E.M. (2020). Legal analysis of credit relaxation, during the corona pandemic with based credit concessions No.11/POJK.03/2020. Journal of Socio-Humanities Science, 4(2), 1-9.

- Eric, A.P., & Glen, E.W. (2018). Radical markets, uprooting capitalism and democracy for a just society. Princeton University Press, New Jersey, United Kingdom.

- Gangemi, S., Billeci, L., & Tonacci. (2020). Rich at risk: Socio-economic drivers of COVID-19 pandemic spread. Clinical and Molecular Allergy, 18(1), 1-3.

- Januarita, R., & Sumiyati, Y. (2020). Legal risk management: can the COVID-19 pandemic be included as a force majeure clause in a contract. International Journal of Law and Management, 63(2), 219-238.

- Khaled L.A.N. (2020). Coronavirus pandemic impact on the nexus between gold and bitcoin prices. International Journal of Financial Research, 11(5), 1-9.

- Leo, D.H., & Jan, K. (2020). European banks after the global financial crisis: peak accumulated losses, twin crises, and business models. Journal of Banking Regulation, 21(1), 197-211.

- Lorenzo, C. (2020). Jeremy Bentham's vision of international order. Cambridge Review of International Affairs.

- Michelle, W.B. (2020). The pandemic's effect on the economy and banking. Kansas Bankers Association CEO and senior management forum / annual meeting, Topeka, Kansas.

- Mill, J.S (2009). Utilitarianism (from an 1879 edition). London: The Floating Press.

- Philip, D., Dirulba, K., &Denison, K. (2020). The bank capital-competition-risk nexus - A go perspective. Journal of International Financial Markets, Institutions and Money, 65(1), 1-9.

- Sumaryono, E. (2002). Ethics & law: The relevance of Thomas Aquinas natural law theory. Yogyakarta: Kanisius.

- Timothy, D.N. (2020). The coronavirus and similar global issues: How to address them. The Banking Law Journal, 137(6), 1-12.