Research Article: 2021 Vol: 20 Issue: 6

Identifying the Challenges of Small Business and Business Recovery during Turmoil Business Environment

Siti Nurulaini Azmi, Universiti Malaysia Kelantan

Muhammad Khalique, Universiti Malaysia Kelantan and Mirpur University of Science and Technology

Azianis Bt Mohd Noor, Universiti Malaysia Kelantan

Mohd Rafi bin Yaacob, Universiti Malaysia Kelantan

Khushbakht Hina, National University of Modern languages Islamabad

Citation Information: Azmi, S.T., Khalique, M., Noor , A.M., Yaacob, M.R., & Hina, K. (2021). Identifying the challenges of small business and business recovery during turmoil business environment. Academy of Accounting and Financial Studies Journal, 25(6), 1-8.

Abstract

In contemporary business environment only those small business can survive and recover their business performance having innovation and learning capabilities. The main purpose of the research was to examine the difficulties faced by small businesses during flood disasters in developing countries, specifically Malaysia. In 2016, a survey of small businesses in Kelantan was conducted to identify the challenges that small businesses face when dealing with natural disasters. 380 self-administered questionnaires were collected among small businesses in Kelantan that were affected by the flood disaster, using purposive sampling, which is the sample was collected from a specific target group. Based on theoretical foundation one research hypothesis was established. The findings of this study show that natural disasters have a significant impact on small businesses in Malaysia, with flooding being the most common natural disaster. This is study provides policy guideline for the policymakers, entreprenurer and researchers.

Keywords

Small businesses, Innovation, Disasters, Business Recovery.

Introduction

Innovation and organizational learning are considers the most important and crucial for the success and survival of small business (Kawamorita et al., 2020; Farzad et al., 2020). Small businesses having these capabilities can sustain and recover successfully during the natural disaster. Innovation is a prime catalyst for the success of organization and long-term strategy (Tajpour & Hosseini, 2021). Innovation can help SMEs to sustain during natural disasters. In the last decade, the United States, the Philippines, have been the top five countries most affected by natural disasters. China had the third-highest number of natural disasters in the last decade in 2015, with 36 natural disaster, that equal to 20 percent more than the annual average of 30 from 2005 to 2014 (Guha-Sapir et al., 2015). The number of natural disasters in the United States remained at 28, the same as in 2013, and was 33% higher than the decadal annual average of 21. With 21 disasters, India is 24 percent below its annual average of 27 disasters from 2005 to 2014, the third-highest number since 2005. In contrast, with 15 and 10 natural disasters, respectively, Indonesia and the Philippines experienced their fourth and second-lowest numbers since 2005, falling short of their respective annual averages of 18 and 14. Due to geography, Asia is the most vulnerable region compared to other areas in the world. Natural disasters, however, have an impact not only on individuals, but also on businesses of all sizes, from large corporation, to medium, small and micro enterprises. For example, in Thailand, there were at least 557, 637 businesses in the flood disaster areas affected, that involved 90 percent of SMEs in 2011 flood (Auzzir et al., 2018). Meanwhile, there were 2.3 million workers have losing their jobs due to the disaster (Perwaiz, 2015; Auzzir et al., 2018).

Flooding is a common occurrence on eastern coast of Peninsular Malaysia every year, because of the monsoon seasons, their severity and annual impact depends on the amount of rainfall in the area. In December 2014, floods hit the Kelantan region and the state was being the worst-affected, with over 160,000 people evacuated and several deaths reported. When roads were inundated by floods, Kelantan was cut off from the rest of the country for fourteen days, and intercity train services along the East Coast route were also disrupted. The majority of businesses were also severely impacted. Although flood victims were given financial assistance and relief aid right away, little is known about how small businesses of SMEs deal with the damage and losses. There was no record of those small businesses in Kelantan that were impacted by the massive flood, and the situation was unclear. Business interruption, such as the organizational impact, loss of utilities is the common impacts experienced by an organization, particularly small businesses. The primary purpose of the research was to explore the small business operations on the basis of flood disaster impacts such as physical damage (structural damage, and loss of business assets such as inventories/crops, equipment, supplies and records), various problems such as losses of lifelines and various types of reopening delays. The global government has acknowledged small businesses in the developed and emerging economies for their contribution to economic growth, job creation, social cohesion, and development. SMEs, moreover, which account for nearly 66 percent of all private-sector jobs in the developed region, such as the European Union, are, represent 99 percent of economic activity in the world.

Generally, the disaster literature in Malaysia did not focus and relate to businesses, rather concentrated on climate change adaptation (Pereira et al., 2010), community resilience towards disaster (Chong et al., 2018; Samsuddin et al., 2018), and how to carry out the flood management procedure in Malaysia (Rahman, 2012). Chan et al. (2019) investigated the social capital’s role in helping to handle inundations by private, non-governmental organizations, universities, the public, and others, and found that social capital builds associations and partnerships related to disasters, mobilize the public as disaster volunteers, builds resilience and creates family links. However, none of the scholars is deeply studies how small businesses cope with the floods. This study focused on fulfilling this gap.

Disaster Recovery

Recovery was traditionally seen as a return to pre-disaster conditions. However, researchers and practitioners realized that economies are often not returning to pre-disaster countries but can sustain in another new normal state. As the major disasters are often associated with the developing countries or, Asia Pacific region in general (Ferris & Petz, 2012; Smawfield & Brock, 2013), extreme weather events are becoming more common around the world and affecting people on all continents, including those in developed nations (Back et al., 2009). In other words, earthquakes are mostly one of the “famous” disasters as there is no warning sign compared to other natural hazardous disasters such as the storm (Ferris, 2010). Other than Japan, New Zealand is an earthquake-prone country that suffered severe damage in Canterbury, and residents were unprepared for large earthquakes as a possibility because major fault lines were hundreds of kilometres away. Thus, there were created several damages to the local businesses especially the small firms. In a different study, Tierney (2007) argue that business recovery can be predicted firstly in the short term by identifying effects of direct physical impact, on business operations, ecological aspects, and neighbourhood location of the business. Secondly, the scope of its primary market, direct and indirect disaster impacts (e.g. physical damage, forced closure and disruption of operations) and owner perceptions of the broader economic climate all affect business recovery in the long-term by age and financial condition of the business including the economic sector in which the business operates. Many studies have investigated how individual businesses recover from the disasters (Zhang et al., 2009) whereas wholesale and retail businesses usually show experienced significant sales losses while manufacturing and construction companies report gains following disasters (Kroll et al., 1991; Webb et al., 2000). To compare, most business organizations that serve a large market usually tend to recover more rapidly than those who serve the local market (Webb et al., 2002).

Direct Disaster Impacts and Small Business

Natural disasters, such as hurricanes, cause different degrees of damage depending on their nature, severity, and location. Therefore, the external shocks do not always equally affect small businesses. Business interruption losses can occur even when there is no physical or property damage, according to Rose and Lim (2002). Interdependencies and flow-on effects between organizations, employees, suppliers, and customers can all contribute to it. A variety of studies tried to explain and measure related factors that influence how the disaster affects the organization and organizational factors that influence how the disaster affects them and how they recover from the disaster (Brown et al., 2015). Based on the literature, it found that disasters had impacts on all businesses, and the level of severity of impacts depends on the magnitude of disasters and level of resilience of businesses to cushion such impacts. Several scholars concentrated their studies on the relationship between disaster impacts and disaster recovery among small business (Runyan, 2006; Jonkman et al., 2009; Asgary et al., 2012; Kachali et al., 2012; Kachali et al., 2014; Brown et al., 2015). In the US, Pratt (2000) found that most of the businesses double hit, approximately 52% of the business that operated from the owner’s home or property because of Hurricane Katrina which struck and devastated the said country in 2005. Thus, if a property is destroyed by a disaster, it may affect the family and the business itself, therefore contributing to increased demand for goods and services and declining supply, which impacts the prospects both for business and families to recover quickly (Schrank et al., 2013). The direct impact can be harmful to premises, infrastructure, gear, vehicles, inventories and, loss of income resulting straightforwardly from the event (Cochrane, 1992; Lindell & Perry, 1998; Whitney et al., 2001; Rose, 2009). The disaster also able to close down service providers, which forces a business to amend to materials deficiency for a certain period, indeed if it does not involve any physical, harms (Zhang et al., 2009).

In developing countries such as Pakistan, Asgary et al. (2012) in their study found that among the damage and disruption factors, the business facility, damage to inventory, disruption in the supply chain, and disruption to lifelines is significantly impacted by the business recovery (time). The findings indicated that the rate of recovery in flood-affected SMEs varies substantially with a range of factors, suggesting institutional and social environment that influence the recovery of businesses and also the decisions for the businesses can take to recover faster after the catastrophe (Asgary et al., 2012; Asfahani, 2021; Tanveer et al., 2020). According to Zhang et al. (2009), there may be direct physical damage to some of the business, and others may not experience it. The disaster, however, can close down a supplier, obliging a business to adapt to an equipment failure for a certain time, even if there is no physical damage. As a result, the business owner suffers direct impacts when their capital assets are physically damaged, as well as the indirect impacts once the business is linked to other businesses that have suffered from direct and indirect impacts. The organization is forced to close, relocate, or experience decreased productivity due to the damage of their buildings, assets, and inventory that were also referring to direct impacts. On the other hand, the indirect impacts, usually due to losses in customer income that lead to a decrease in sales and supply chain problems, are difficult to measure concerning income loss. In addition to the disruption caused by the direct impact, there was also indirect effect including labor supply, customer, suppliers, and the neighbor hoods (Kachali et al., 2012). On top of that, the organization experienced significant delays and decreased productivity as a result of the disruption of critical infrastructures such as water, sewage, electric power, fuel transport infrastructure, and telecommunications (Kroll et al., 1991; Tierney & Dahlhamer, 1995; Tierney, 1997; Rose, 2004). Business failure may take longer after the precipitating event produce by those impacts, particularly if the business was in economic decline already and among those businesses that were profitable before they were hit by the disaster (Zhang et al., 2009). In fact, Asgary et al. (2012) found that many small businesses in Pakistan operate in the unsafe building after the flood disaster and do not have any business continuity plan or practice in place and also indicate that business was generally not prepared for the unexpected situation and natural hazards.

Methodology

The study’s target populations are small businesses in Kelantan that were impacted by flood disasters in December 2014. The tropical climate in the Kelantan River Basin is rainy for the majority of the year. Due to its geographical characteristics, such as unplanned urbanization and proximity to the South China Sea, Kota Bharu is one of the districts that has become extremely vulnerable to monsoon floods every year, including the major floods of 2014. Therefore, this study uses the non-probability sampling design. Under non-probability sampling, this study employed purposive sampling in which samples that obtained from a specific target group which is the affected small business of SMEs in Kelantan. The sampling, in this case, is restricted to specific types of people who are capable of providing the desired information, either and they are the only ones who possess it or because they meet certain criteria established by the study.

H1 The direct impact has a positive significant relationship with post-disaster recovery.

Results

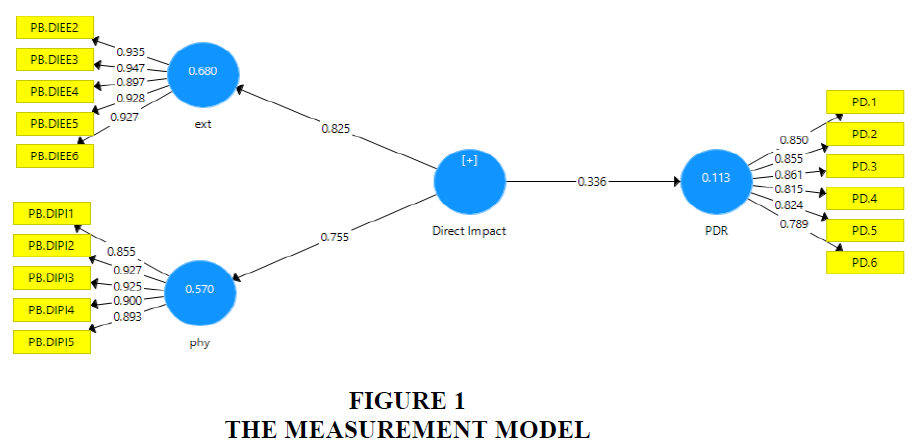

Structural equation modelling (PLS-SEM) has become a viable option to traditional structural equation covariance-based modelling (CB-SEM). PLS-SEM has a number of advantages over CB-SEM, as described in Hair et al. (2011b) along with the fact that it does not involve multivariable standard criteria to be applied. In addition, PLS-SEM is suitable for small samples when focusing on theoretical exploration rather than theoretical confirmation (Hair et al., 2011a). Given the justified use of PLS-SEM by researchers, this study analyzed the data with Smart PLS 3.2.8. Unlike the common factor model for CB-SEM, PLS-SEM is based on the composite factor model. As a result, the sample size of CB-SEM is relatively small (<100) Sarstedt et al., 2017). CB-SEM generally requires bigger samples for a complex model, not PLS-SEM (Hair et al., 2021).

Convergent Validity

For this study, the researcher has tested convergent validity to the extent to which multiple items evaluate the same concept in agreement. We used the extracted factor loadings, composite reliability, and average variance to determine convergence validity, as indicated by (Hair et al., 2017). All of the loadings met the recommended value of 0.5. Meanwhile, the composite reliability values, which depict the degree to which the construct indicator indicates the latent, construct ranged from 0.916 to 0.968 whereby the recommended value suggested is 0.7. Thus, the results were supported. The average variance captured by the indicators relative to measurement error, and the value should be greater than to justify using a construct. For this study, the AVE value range was from 0.523 to 0.859. To assess the inter-item consistency of our measurement items, we used Cronbach’s alpha coefficient.

Discriminant Validity

This study used two different methods of validity assessment, including the traditional Fornell–Larcker criterion and the alternative Heterotrait–Monotrait Ratio (HTMT), to improve the robustness of statistical results (Hair et al., 2011a; Hair et al., 2013). For the Fornell-Larcker criterion, the average variance shared by each construct and its measures should be greater than the variance shared by the construct and the other construct in the model and items should have a higher loading on their constructs in the model. In Table 1, the average variance extracted by the indicators measuring that construct is less than the squared correlations for each construct, indicating adequate discriminant validity (Khalique et al. 2020). Based on the 0.9 threshold value (Gold et al., 2001; Teo et al., 2008). Overall, the measurement model showed reasonable convergent and discriminant validity (Figure 1). On the other hand, in testing the hypothesis, the result from the output of the algorithm and bootstrapping PLS-SEM showed a positive and significant association between direct impact and business recovery (β= 0.001, t= 7.696, p ≤0.05) reported in Table 2. Therefore, Hypothesis 1 is supported.

| Table 1 Fornell Larcker Criterion for Discriminant Validity | ||||

| Variables | 1 | 2 | 3 | 4 |

| Direct impact | 0.723 | |||

| Post-Disaster Recovery | 0.336 | 0.833 | ||

| External Impacts | 0.825 | 0.328 | 0.927 | |

| Physical impacts | 0.755 | 0.194 | 0.252 | 0.900 |

| Table 2 Estimates of Path Coefficients, Effect Sizes, and Hypothesis Testing | ||||||

| Hypothesis 1 | Paths | Path Coeff. (p-level) | BCa Confidence Intervals | t-value | Remarks | |

| 2.5% | 97.5% | |||||

| 1 | Direct Impact à PDR | 0.336(p=0.01) | 0.238 | 0.414 | 7.696 | Yes |

Discussion and Conclusion

This study contributes to the identification of the disaster impacts that enables small business of SMEs in Kelantan to respond with the post-disaster recovery which can be referred to direct impacts. The result shows that the direct impacts influenced the small businesses. Many studies concentrate on business recovery in developed countries. However, there is little evidence available in the literature on small business recovery in developing countries. Thus, it may provide more literature in the research area. The statistically finding of this study supports the previous study on the significance and effect on the relationship between the direct impacts on business recovery. The relationship between direct impacts on the business recovery was has not been analyzed yet using the PLS-SEM by any researcher. However, Brown et al. (2015) carried out a Spearman correlation between disaster impacts and recovery status, which the results show a significant but weak negative correlation. For this study, the findings demonstrate that the direct impacts were significant and affect the business recovery in small businesses in Kelantan.

Limitations and Future Recommendations

Like other research, this study has also some limitations. This study is cross-sectional in nature and the data were gathered in one time. The measurement scale was based on subjective items and may be the response of the respondents not reflecting the constructs truly. The sample size was also limited therefore, the generalizability of the findings of this study are limited in scope. Future studies may be longitudinal in nature with greater sample size. Moreover, this study recommended to the potential researchers to analyze the role of innovation and organizational learning in small business in developing economies.

References

- Asfahani, A. (2021). The impact of covid-19 on the decision making for the customer relation management in the middle east. Journal of Management Information and Decision Sciences, 24(3), 1-11.

- Asgary, A., Anjum, M.I., & Azimi, N. (2012). Disaster recovery and business continuity after the 2010 flood in Pakistan: Case of small businesses. International Journal of Disaster Risk Reduction, 2, 46-56.

- Auzzir, Z., Haigh, R., & Amaratunga, D. (2018). Impacts of disaster to SMEs in Malaysia. Procedia Engineering, 212, 1131-1138.

- Back, E., Cameron, C., & Tanner, T. (2009). Children and disaster risk reduction: Taking stock and moving forward. Children in a Changing Climate Research, UNICEF, p20.

- Brown, C., Stevenson, J., Giovinazzi, S., Seville, E., & Vargo, J. (2015). Factors influencing impacts on and recovery trends of organisations: evidence from the 2010/2011 Canterbury earthquakes. International Journal of Disaster Risk Reduction, 14, 56-72.

- Chan, N.W., Roy, R., Lai, C.H., & Tan, M.L. (2018). Social capital as a vital resource in flood disaster recovery in Malaysia. International Journal of Water Resources Development.

- Chang, S.E., & Rose, A.Z. (2012). Towards a theory of economic recovery from disasters. International Journal of Mass Emergencies & Disasters, 30(2).

- Chong, N.O., Kamarudin, K.H., & Abd Wahid, S.N. (2018). Framework considerations for community resilient towards disaster in Malaysia. Procedia engineering, 212, 165-172.

- Cochrane, H.C. (1992). Overview of economic research on earthquake consequences. The Economic Consequences of a Catastrophic Earthquake, 100-111.

- Farzad, F.S., Salamzadeh, Y., Amran, A.B., & Hafezalkotob, A. (2020). Social Innovation: Towards a better life after COVID-19 crisis: What to concentrate on. Journal of Entrepreneurship, Business and Economics, 8(1), 89-120.

- Ferris, E. (2010). Earthquakes and floods: comparing Haiti and Pakistan. Brookings Institution, 26.

- Ferris, E., & Petz, D. (2012). The year that shook the rich: A review of natural disasters in 2011. Brookings Institution-London School of Economics Project on Internal Displacement.

- Gold, A.H., Malhotra, A., & Segars, A.H. (2001). Knowledge management: An organizational capabilities perspective. Journal of Management Information Systems, 18(1), 185-214.

- Guha-Sapir, D., Vos, F., Below, R., & Ponserre, S. (2012). Annual disaster statistical review 2011: the numbers and trends.

- Hair Jr, J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2021). A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications.

- Hair, J.F., Ringle, C. M., & Sarstedt, M. (2011a). PLS-SEM: Indeed a silver bullet. Journal of Marketing theory and Practice, 19(2), 139-152.

- Hair, J.F., Ringle, C. M., & Sarstedt, M. (2011b). PLS-SEM: Indeed a silver bullet. Journal of Marketing theory and Practice, 19(2), 139-152.

- Hair, J.F., Ringle, C.M., & Sarstedt, M. (2013). Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long range planning, 46(1-2), 1-12.

- Hair, J., Hollingsworth, C.L., Randolph, A.B., & Chong, A.Y.L. (2017). An updated and expanded assessment of PLS-SEM in information systems research. Industrial Management & Data Systems.

- Jonkman, S.N., Maaskant, B., Boyd, E., & Levitan, M.L. (2009). Loss of life caused by the flooding of New Orleans after Hurricane Katrina: analysis of the relationship between flood characteristics and mortality. Risk Analysis: An International Journal, 29(5), 676-698.

- Kachali, H., Stevenson, J. R., Whitman, Z., Seville, E., Vargo, J., & Wilson, T. (2012). Organisational resilience and recovery for Canterbury organisations after the 4 September 2010 earthquake. Australasian Journal of Disaster and Trauma Studies, 1(1), 11-19.

- Kachali, H., Whitman, Z.R., Stevenson, J.R., Vargo, J., Seville, E., & Wilson, T. (2015). Industry sector recovery following the Canterbury earthquakes. International Journal of Disaster Risk Reduction, 12, 42-52.

- Kawamorita, H., Salamzadeh, A., Demiryurek, K., & Ghajarzadeh, M. (2020). Entrepreneurial universities in times of crisis: Case of COVID-19 pandemic. Journal of Entrepreneurship, Business and Economics, 8(1), 77-88.

- Khalique, M., Hina, K., Ramayah, T., & bin Shaari, J.A.N. (2020). Intellectual capital in tourism SMEs in Azad Jammu and Kashmir, Pakistan. Journal of Intellectual Capital.

- Koks, E.E., Bo?karjova, M., de Moel, H., & Aerts, J.C. (2015). Integrated direct and indirect flood risk modeling: development and sensitivity analysis. Risk Analysis, 35(5), 882-900.

- Kroll, C.A., Landis, J.D., Shen, Q., & Stryker, S. (1991). Economic impacts of the Loma Prieta earthquake: A focus on small business.

- Lee, A.J. (2013). Casting an architectural lens on disaster reconstruction. Disaster Prevention and Management.

- Lindell, M.K., & Perry, R.W. (1998). Earthquake impacts and hazard adjustment by acutely hazardous materials facilities following the Northridge earthquake. Earthquake Spectra, 14(2), 285-299.

- Pereira, J.J., Tiong, T.C., & Komoo, I. (2010). Mainstreaming climate change adaptation and disaster risk reduction: A Malaysian approach. In Climate change adaptation and disaster risk reduction: An Asian perspective. Emerald Group Publishing Limited.

- Perwaiz, A. (2015). Thailand floods and impact on private sector. In Disaster Management and Private Sectors (pp. 231-245). Springer, Tokyo.

- Pratt, J. (2000). Homebased business: The hidden economy (No. 194). Dallas, Texas: United States Small Business Administration.

- Rahman, B.A. (2012). Issues of disaster management preparedness: A case study of directive 20 of National Security Council Malaysia. International Journal of Business and Social Science, 3(5).

- Ringle, C.M., Wende, S., & Becker, J.M. (2015). SmartPLS 3. SmartPLS GmbH, Boenningstedt. Journal of Service Science and Management, 10(3).

- Rose, A. (2004). Economic principles, issues, and research priorities in hazard loss estimation. In Modeling spatial and economic impacts of disasters (pp. 13-36). Springer, Berlin, Heidelberg.

- Rose, A., & Lim, D. (2002). Business interruption losses from natural hazards: Conceptual and methodological issues in the case of the Northridge earthquake. Global Environmental Change Part B: Environmental Hazards, 4(1), 1-14.

- Rose, A.Z. (2009). A framework for analyzing the total economic impacts of terrorist attacks and natural disasters. Journal of Homeland Security and Emergency Management, 6(1).

- Runyan, R.C. (2006). Small business in the face of crisis: Identifying barriers to recovery from a natural disaster 1. Journal of Contingencies and Crisis Management, 14(1), 12-26.

- Samsuddin, N.M., Takim, R., Nawawi, A.H., & Alwee, S.N.A.S. (2018). Disaster preparedness attributes and hospital’s resilience in Malaysia. Procedia Engineering, 212, 371-378.

- Schrank, H.L., Marshall, M.I., Hall-Phillips, A., Wiatt, R.F., & Jones, N.E. (2013). Small-business demise and recovery after Katrina: rate of survival and demise. Natural hazards, 65(3), 2353-2374.

- Smawfield, D., & Brock, C. (2013). Education and natural disasters. Bloomsbury Publishing.

- Tajpour, M., & Hosseini, E. (2021), Entrepreneurial intention and the performance of digital startups: The mediating role of social media. Journal of Content, Community & Communication, 13, 2-15.

- Tanveer, M., Hassan, S., & Bhaumik, A. (2020). Covid-19 quarantine and consumer behavior that change the trends of business sustainability & development. Academy of Strategic Management Journal, 19(4).

- Teo, T.S., Srivastava, S.C., & Jiang, L.I. (2008). Trust and electronic government success: An empirical study. Journal of Management Information Systems, 25(3), 99-132.

- Tierney, K.J. (1997). Business impacts of the Northridge earthquake. Journal of Contingencies and Crisis Management, 5(2), 87-97.

- Tierney, K.J. (2007). Businesses and disasters: Vulnerability, impacts, and recovery. In Handbook of disaster research (pp. 275-296). Springer, New York, NY.

- Webb, G.R., Tierney, K.J., & Dahlhamer, J.M. (2000). Businesses and disasters: Empirical patterns and unanswered questions. Natural Hazards Review, 1(2), 83-90.

- Webb, G.R., Tierney, K.J., & Dahlhamer, J.M. (2002). Predicting long-term business recovery from disaster: A comparison of the Loma Prieta earthquake and Hurricane Andrew. Global Environmental Change Part B: Environmental Hazards, 4(2), 45-58.

- Whitney, D.J., Dickerson, A., & Lindell, M.K. (2001). Nonstructural seismic preparedness of Southern California hospitals. Earthquake Spectra, 17(1), 153-171.

- Zhang, Y., Lindell, M.K., & Prater, C.S. (2009). Vulnerability of community businesses to environmental disasters. Disasters, 33(1), 38-57.