Research Article: 2020 Vol: 19 Issue: 6

Impact of Coronavirus on Small and Medium Enterprises (SMEs): Towards Post-Covid-19 Economic Recovery in Nigeria

Yusuff Jelili Amuda, Prince Sultan University

Abstract

In the recent time, coronavirus (COVID-19) becomes an emerging area of research especially in exploring its effects from multidimensional perspectives such as health, educational and economic perspectives. More importantly, there is an insufficient academic research in connecting the impact of COVID-19 with Small and Medium Enterprises (SMEs) in Nigeria despite the fact different countries of the world such as US, UK, Canada, and China etc. have been making tremendous effort in addressing the economic impact of COVID-19. The primary objective of this paper is to explicitly make a shift by building a comprehensive theoretical basis for the impact of COVID-19 on SMEs in order to chat a forward for post-COVID-19 economy recovery to thrive in the country. This study used secondary data to gather vital information by exploring available materials or literatures in this regard. The findings of this paper indicated that, recent study provides health implication of COVID-19 which has overwhelmingly explained by World Health Organization (WHO). Hence, this paper argues that appropriate measures should be provided especially by giving loan support to SMEs in expanding and strengthening the existing and new business opportunities as response to the impact of post-COVID-19 economy recovery in the country. It is therefore suggested that collaboration between SMEs leaders and the government have vital roles to play especially through the activities of Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) in providing platform for inclusion of digitization into SMEs or business operation in the country.

Keywords

Coronavirus (COVID-19), SMEs, SMEDAN, WHO, Targeted Credit Facility (TCF), Anchor Borrowers’ Programme (ASAP).

Introduction & Literature Review

Nigeria has been playing significant roles in the economy growth and stability in the entire Africa. Several studies have advocated for viable economic and financial policies that can further strengthen the economy (Kozetinac et al., 2010). It is noteworthy to say that, National Economic Emancipation and Development Strategy (NEEDS) is considered as an essential measure for sustainability of economy in the country (McDonald et al., 2014). More importantly, Suberu et al. (2015) advocates for diversification of economy in order to attain sustainable economic growth and development in the country. However, the pandemic of coronavirus or COVID-19 has caused more than enough detriment to all spheres of human endeavours at the international level in general and Nigeria in particular. In the context of Nigeria, COVID-19 pandemic resulting to lockdown in main political and commercial capitals of the country (i.e. Lagos and Abuja). Several efforts have been made to address the health challenge caused by COVID-19. It is not deniable to posit that, there are many other disruptions caused by COVID-19 especially for public and private sectors where there are closures of business activities (Odinaka & Josephine, 2020). It has significantly affected global economy in general and Nigerian economy in particular. The negative impact of COVID-19 manifests on the economic and business activities in the country. Undoubtedly, the health impact of the COVID-19 is an integral part of economic implication of COVID-19 because it is really devastating for trade and business transactions.

More so, it should be reiterated that, the COVID-19 pandemic has affected small and medium enterprises (SMEs) as a result of the lockdown and shutdown of business transactions in the country. As a result of this challenge, this has made many people to advocate for an alternative way of addressing it especially in providing supportive response for survival of small and medium enterprises (SMEs). Nonetheless, there is a gap in the existing literature in examining the impact of coronavirus on the Nigerian Small and Medium Enterprises (SMEs) especially towards strengthening post-COVID-19 economy recovery. Hence, it is paramount to have measures that will address the effects of COVID-19. This paper therefore investigates an overview of coronavirus (COVID-19), Nigerian Small and Medium Enterprises (SMEs) and impact of coronavirus (COVID-19) on Nigerian small and medium enterprises (SMEs), strategies for post-COVID-19 economic recovery are explained. The implications of the paper are highlighted. Conclusion and suggestions are made for improvement of SMEs in order to face the reality of post COVID-19 economy recovery in order to help the potential investors to take relevant decisions in investment plans.

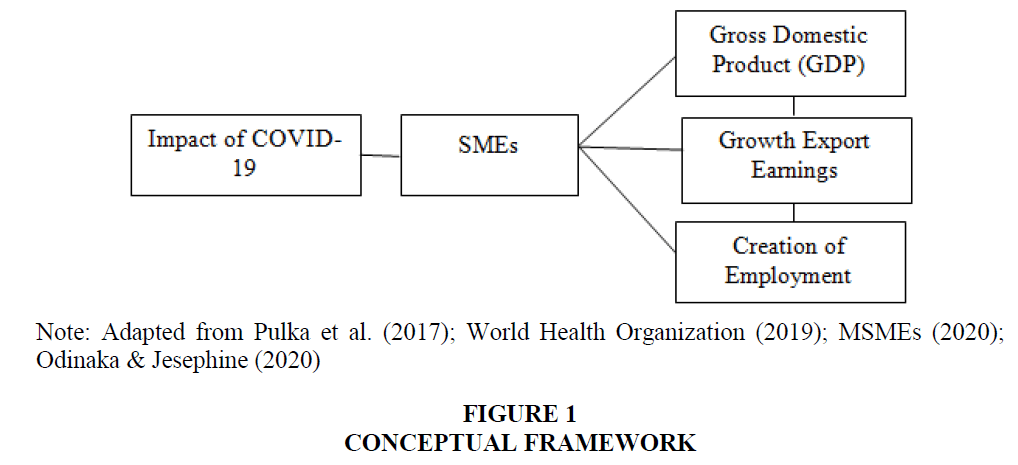

Conceptual Framework

The prime motivating factor of the study is to explore the impact of COVID-19 on small and medium enterprises (SMEs) and strategize for post-COVID-19 economic recovery in the country. The conceptual framework for the performance of SMEs is significant especially as a result of lack of clear framework for exploring the impact of COVID-19 on SMEs in making the economy thrive in the country. It is not arguable to posit that, COVID-19 has drastically contributed to the decline in utilizing SMEs as an important yardstick in reducing the high rate of unemployment and job creation (Ayyagari et al., 2011).

It is not disagreeable to posit that; literature acknowledges that SMEs immensely contribute to the socio-economic growth and development of different countries. For instance, literature establishes that market orientation has significant impact on the relationship between entrepreneurial orientation and SMEs performance (Amin et al., 2016). It is further explained that, SMEs significantly contribute to gross domestic product (GDP), growth of export earnings, and creation of employment opportunities (Pulka et al., 2017). It is vital to reiterate that literature asserts that, strategies for propelling SMEs should be put in place especially considering technological, competitive changes and rapid market. Literature contends that SMEs essentially contribute to the enhancement of export earnings, GDP, growth of local products and new market development (Pulka et al., 2017).

However, literature confirms that despite the fact that, the government has been striving to improve on SMEs, there is still low contributions of SMEs to GDP in developing countries like Nigeria compared to other developed countries like Japan, Germany, Singapore, Rome and many others (Kushnir et al., 2010; ?erban, 2015). In addition, it helps in the development of new entrepreneurs who are expected to create more wealth, employment and immensely add to the overall economy of a particular country (Ayyagari et al., 2011). The aforementioned determinants of SMEs performance are also confirmed in the context of Nigeria as literature expounds (Fida, 2008; Aminu & Shariff, 2015).

As a result of the fact that studies have posited that, at the international level, 95% of the businesses are from SMEs. This inferably means that, it contributes up to 60% of the employment in the sector of the economy especially in private sector. Hence, it is paramount to ensure that, the improvement of SMEs provides sustainable strategies for the responsiveness to the current challenge of COVID-19. Although, literature emphatically stresses that developing country like Nigeria can provide efficiency of SMEs because it is an essential player for improving productivity, competitiveness, innovation and entrepreneurship (Shrivastava, 2016). This position should not be underestimated because Organization for Economic Cooperation and Development-OECD- (2017) submitted that, SMEs are estimated as 63% of the whole employment of the member countries especially an emphasis has been made towards enhancing global and digitalized economy (OECD, 2017).

With the current scenario of COVID-19, there is need to address the high level of mortality rate as literature canvasses in the country. Onwards, it is significant that, SMEs should be expanded to manufacturing industries in order to magnify the prospect of SMEs. Nonetheless, the reality on ground has demonstrated that, as a result of ineffective strategies and poor performance of SMEs, many businesses have been closed down since the beginning of the pandemic. It is established that youth unemployment rate has proliferated from an approximate of 22% in 2009 to 24% in 2016 as literature contends (Chile, 2016). Nonetheless, the fact is that, the government has initiated different social interventions programmes in the recent such as N-Power in order to drastically reduce the rate of unemployment among the teaming youths. This kind of social interventions programmes is an indication that there is no adequate mechanism for promoting SMEs towards job creation. It is however important to stress that several or multifarious challenges are facing SMEs such as lack of unstable policy, inadequate finance, lack of adequate infrastructure, inadequate transportation, lack of electricity, lack of passion and curiosity for investment, socio-political ambition of entrepreneurs and many others (Adebisi et al., 2015).

All the aforementioned factors are issues that are of concern in the past. More importantly, the study by Pulka et al. (2017) explored the impact of strategic intelligence, competitive intelligence, artificial intelligence, knowledge management, business process management in connection with SMEs and the findings demonstrated significant positive impact. Nonetheless, it should be asserted that the pandemic of COVID-19 has drastically affected the role of SMEs in fostering the economic growth of different countries in general and Nigeria in particular. Reiteratively, the impact of COVID-19 on SMEs in the country remains an ongoing area of research to be explored because, there is less focus of attention on the effect of COVID-19 on SMEs with the main target on post-COVID-19 economic recovery. This research is towards resource diversification for sustainable economy in order to attain to attain post COVID-19 economic recovery. This position is in line with the assertion of Bassey (2012) that advocated for diversification of resources in attaining sustainable economy development in the country. Therefore, this paper attempts to investigate the performance of SMEs as a remedy to economic impact of COVID-19 in the country. Figure 1 depicts conceptual framework of the study which can be empirically investigated in the future research.

An Overview of Coronavirus (COVID-19)

This section explicates on coronavirus or otherwise known as COVID-19 which started in Wuhan in China in the late 2019. The pandemic of COVID-19 has been affecting all spheres of human endeaviour in the recent time. As the coronavirus affects public health services at global level, it also does to global economies. The pandemic of COVID-19 is worrisome because it is inevitable in leading to the global economic recession. World Health Organization (2020) notes that, the victim of COVID-19 will surely experience respiratory illness and older people and more importantly, people with medical or health problems such as diabetes, cancer respiratory disease among others are likely to be infected with COVID-19. It is reiterated that COVID-19 can spread easily through the nose or mucus discharge and droplets of saliva especially through sneezes and coughs (World Health Organization, 2020). Nonetheless, the most common symptoms of the disease are fever, dry cough and tiredness. The severe symptoms are chest pain, loss of speech and difficult breathing. Globally, many lives have been taken as a result of the prevalence of coronavirus. Hence, it is important to adhere to preventive measures especially by washing hands, using sanitizers etc. as directed by the health workers (World Health Organization, 2020). Currently, there is no actual treatment and or vaccine to be taken by someone infected with the virus. Nonetheless, there are several efforts at the international level especially China, US, UK, Japan, Canada, Germany, France etc. pertaining to trail vaccines for treatment of COVID-19.

Nonetheless, the foregoing explanation shows the trends of COVID-19 and it has economic implications in different countries. Reports given by UN analysts show that $80 trillion economy of the world will tremendously decline by $ 1 trillion to $2 trillion. This scenario of the global level will surely affect the economy of Nigeria especially the cases of coronavirus in the country plus direct business contact of the country with China. At the international level, it has caused a lot of disruptions to social and economic activities of citizens. For instance, the United States of America has initially budgeted $350 billion as relief fund for sustaining small businesses in the country. However, recently, the country is seeking for additional amount of $250 billion in order to provide loans for the citizens to be able to cater for the economic sector (Odinaka & Josephine, 2020). With the global trend of COVID-19 which undoubtedly affects various facets of human endeavours, it therefore needs to be addressed especially by looking inwardly in exploring how to strengthen Small and Medium Enterprises (SMEs) in the country as literature advocates (Odinaka & Jesephine, 2020).

Nigerian Small and Medium Enterprises (SMEs)

Indeed, there is no generally acceptable definition of SMEs and the definition or explanation depends on the context by which it is given. Hence, there is no perfect wall of defining SMEs in developing countries despite the fact that, it has been playing prime role on the overall economy (Gibson & Van der Vaart, 2008). Notably, small and medium enterprises (SMEs) are the businesses meant for provision of goods and services in the aspect of manufacturing, agriculture, shoe making, computer skill, tailoring and other service sectors (Fatai, 2011; Chile, 2016). The purpose of SMEs can be entrenched with specific emphasis on the investment and employment in order to reduce the rate of unemployment and poverty as literature contends (Kozetinac et al., 2010). Literature further acknowledges that business link, knowledge effectiveness, social context and innovation are important determinants for successful SMEs (Bryson, 1997; Carrillo et al., 2007). Hence, the study by Hayton (2003) contends that, human capital management is important for the success of SMEs especially in improving the entrepreneurial performance in the country.

The government has been making tremendously effort in expanding the sector of economy through the enhancement of small and medium enterprises (SMEs). This assertion is regarded as a response to the advocate of the earlier studies such as Egena et al. (2014) that stress on institutional support for the improvement of SMEs in Nigeria. The government has initiated an Act relating with Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) and the Act explicitly elaborated policy that will foster the growth of Micro, Small and Medium Enterprises MSMEs in the country (MSMEs, 2020). It is specifically mentioned that, SMEDAN is expected to stimulate different programmes and facilitate support services that will accelerate economic development in the country with specific attention on the operations of SMEs. It should be reiterated that, Federal Ministry of Industry, Trade and Investment contends that, there is more than 37.07 million SMEs which provide employment opportunities and contribute to the sector of economy. This assertion is in line with position of previous studies such as Shrivastava (2016) which contend that government plays vital roles in the development of Micro, Small and Medium Enterprise (MSEMs).

As a result of potential of employment opportunities derived from SMEs, the government specifically Central Bank of Nigeria (2010) injected the sum of two hundred billion in order to facilitate the improvement of the sector of the country’s economy through the provision of loan schemes to the citizens for the acceleration of economic growth as literature buttressed that, the government and financial institutions have roles to play in this regard (Oni, 2012). Furthermore, literature also acknowledges the roles of SMEs to the community development (Anigbogu et al., 2014). Despite the fact that, the government has been giving immeasurable attention on the viability and sustainability of SMEs in the country, the sudden outbreak of coronavirus pandemic has cut-short the plans of government in fostering SMEs in the country despite the fact that, SMEs have been creating employment opportunities and playing significant role on poverty reduction (Pulka et al.,, 2017).

Although, there is an existing challenge relating to the funding of SMEs. Nevertheless, the government can still do more in various ways especially through an effective strategy in promoting different investments in areas such as: farming, fishing, well construction, masonry, productive trades, tailoring, and small businesses. Hence, in the recent, there has been negative hindrance or impact of coronavirus on SMEs in the country which subsequent sub-heading explains.

Impact of Coronavirus-COVID-19- on Nigerian SMEs

Indeed, SMEs immensely contribute to the overall economic development of Nigeria but it has not efficiently expanded and strengthened. Nonetheless, literature posits that that are different resources such as oil which significantly have impact on the economic policy formulation in Nigeria and the policy is expected to support the economic condition of the poor citizens in order to achieve sustainable economic growth in the country (Adedipe, 2004; Akinlo, 2012). Notably, the Nigerian government has solely replied on the oil as the source of revenue and overwhelming studies have canvassed for the diversification of the economy (Okonkwo & Madueke, 2016). Nevertheless, COVID-19 has affected the decline in the oil price which is the prime source of revenue to the government. The outbreak of COVID-19 in Nigeria has virtually affected all facets of life such as: education, social activities, political, governance, and economic dealings. Most business transaction since the outbreak of COVID-19 recorded low sales whereby most SMEs reported decline in the source of income. However, prior to the outbreak of COVID-19, literature has shown a concern about the challenges of financing of SMEs towards its effective performance (Adebisi et al., 2015).

More importantly, the economic experts have noted that, the impact of COVID-19 pandemic has gone beyond what SMEs can cater for in Nigeria. Hence, the government is expected to provide support and assistance in form of palliative measures to the citizens. At the global level, there has been advocacy for collective effort in addressing multifarious challenges emanating from COVID-19. It has been interestingly asserted by the Director-General of International Labour Organization (ILO), Ryder (2020) that: Workers and businesses are facing catastrophe, in both developed and developing economies... We have to move fast, decisively, and together. The right, urgent measures could make the difference between survival and collapse.

The above quotation is true because there is for measure that will serve as response to the contention of the director-General of International Labour Organization (ILO), Ryder (2020) who posits that, if there is no meaningful policy measures during this trying period, many workers are at high risk of falling into abject poverty. Prior to the current scenario of COVID-19 in Nigeria, the country’s economy is still evolving and the evolvement has been affected by the COVID-19 which requires urgent measures to address it. According to the National President, Association of Small Business Owners of Nigeria (ASBON), coronavirus has created negative impact on the overall operations of SMEs in the country. It is due to this negative consequence that, there are a lot of cut downs in the production. It is observed that, many businesses especially Small and Medium Enterprises (SMEs) in Nigeria have collapsed as a result of negative effect of the COVID-19 pandemic. There is vulnerability with regard to the business transactions especially SMEs despite the fact that, priority has been given to protection of life and health conditions of the citizens.

Furthermore, the government has been making tremendous effort in getting support for strengthening production at the manufacturing industries as a way of post-COVID-19 economy recovery strategy. For instance, it has been earlier mentioned that, manufacturers of pure water used to get supply of polyethylene meant for making sachet and bottle water because they used to import most of the materials from China which has stopped since outbreak of COVID-19. Businesses are shutting down as a result of the unavailability of raw materials for production. Currently, there is no ship from China to Nigeria and there are many containers at the seaports in China for shipping them to the country but unfortunately COVID-19 has caused more damage to the business transaction in the country (Odinaka & Josephine, 2020).

More importantly, the production factories have actually stopped as a result of the prevalent coronavirus pandemic. In addition, as a result of lack of supply of raw materials, small and medium businesses cannot triumph and consequently, there is no supply of goods in the market. This situation has two major consequences on the SMEs. First, there are closed down of most manufacturing industries. Second, the factories with available materials for production surely will increase the price of the product whereby inflation is ensured. This situation is worrisome and even becomes unbearable to most citizens because there is no sufficient money to cater for their basic needs.

Further still, it must be reiterated that, priorities should be given to the recovery of economy after COVID-19 specifically through stimulation of economy and creation of more employment opportunities. In addition, significant attention and support should be given to sustainability and viability of SMEs because it plays paramount roles for the growth and development of the country’s economy (Chile, 2016; Pulka et al., 2017; MSEMs, 2020). This position is in line with provision of a framework by the government which will harmonize non-interest window for several intervention programmes of the government such as Targeted Credit Facility (TCF), Anchor Borrowers’ Programme (ASAP) etc. which are meant to support the households and Small and Medium Enterprises (SMEs) that are more specifically affected by COVID-19. Thus, it is essential to explain strategies for post-COVID-19 economic recovery in the country.

Strategies for Post- COVID-19 Economic Recovery in Nigeria

Undeniably, COVID-19 has caused uncertainties in all spheres of human endeavours. Hence, there has been concerted effort in facing the current reality in the world in general and Nigeria in particular. Many countries worldwide have been responsive and supportive to the citizens in the time of difficulties. The current COVID-19 pandemic is the period at which citizens need attention and support of the government (Ryder, 2020). Undoubtedly, the intervention of the government is very significant especially by concretizing it into short- and long-term plans especially towards coming out of the crisis with strong economic viability as literature contends. For instance, in the UK, Canada, Europe, US etc., there are support initiatives especially where the government attempt to pay wages of employees at risk of losing their jobs (Ryder, 2020). Concerted effort and effective response of the government can provide meaningful tranquility to the citizens through the provision of palliative measures. Thus, there is emphasis on three major strategies explored in this paper namely: Government funds support, roles of leaders of SMEs and Emergency Economic Stimulus Bill. Each of these is explained in the subsequent paragraphs.

First, as a response to this, the federal government of Nigeria is seeking for assistance of $3.4 billion from the International Monetary Fund; $2.5 billion from the World Bank and $1 billion from the African Development Bank in order to bridge the vacuum created by COVID-19 pandemic (Odinaka & Josephine, 2020). It is not disagreeable to contend that, there is need to diversify various aspects of small and medium enterprises (SMEs) especially manufacturing, agriculture etc. as an attempt to respond to the impact of COVID-19 on the country’s economy.

Second, the role of leaders of SMEs is significant for an expansion of businesses despite the fact that, the government has been trying to foster health sector in order to respond to the challenge of COVID-19. It should be reiterated that digitization of business operations is also significant for further exploration of business opportunities in the SMEs. In so doing, the support for local production because COVID-19 affected the raw materials importation from China as being incessantly mentioned. Thus, the government in the recent time especially through Central Bank of Nigeria is giving support for business loans in order to strengthen the existing and new businesses especially towards addressing post COVID-19 economy. This can be considered as a great innovation in making national economy thrive after the scenario of COVID-19.

Third, since the current hardship of COVD-19 has potential of losing jobs by some employees, thus, in order to safeguard people’s job, the government has taken proactive step through an Emergency Economic Stimulus Bill 2020 before the House of Assembly in order incentivize businesses to protect the employees. It is specifically mentioned that, company should not retrench staff between the 31st March 2020 and 31st December, 2020 with an exception of rationale to a breach of Labour Act. This initiative undeniably is in right direction especially in encouraging the employers to retain their employees and consequently save the loose of jobs. Nonetheless, there is no explicit way through which the government attempts to finance the tax refund and pay its workers. It has been practically demonstrated that the government is interested in ensuring that the employees are safeguarded from losing their jobs. For instance, the Central Bank of Nigeria (CBN) has suspended banks that layoff of their staff without substantial justification or reason (MSMEs, 2020). It is not disagreeable to posit that, the governmental policies should be directed towards giving priority to survival of citizens through effective strategies for economic viabilities. Hence, implication of the study is explained.

Implication of the Study

This paper used secondary sources of data. Theoretically, the paper immensely contributes to the exploration and expansion of SMEs by addressing issues relating to economic activities after COVID-19 pandemic especially by strengthening SMEs performance. More specifically, this paper provides insightful strategies to the government which has been trying to strategize for addressing socio-economic conditions of the citizens in the post-COVID-19. Enhancing social intervention programmes of the government can serve as meaningful and valuable way of fostering SMEs performance which is an important mechanism for improving socio-economic situation of the citizens. The study will be helpful to various agencies such as SMEDAN, NGOs etc. who are concerned with improvement of SMEs performance. However, the limitation of this paper is that, it is still a theoretical in nature which needs further empirical investigation in order to establish a better understanding of the framework for SMEs performance as part of strategy for rejuvenating post-COVID-19 economic recovery in the country. Nonetheless, in overall, this study has provided a basis for building on the conceptual framework of this research in order to further explore the SMEs performance as an important aspect of economy in the country.

Conclusion

This paper elucidates on the historical background of coronavirus from global level then narrows it down to the basis of its widespread in the context of Nigeria. The paper further explores the roles of small and medium enterprises (SMEs) prior to the outbreak of COVID-19 and it is argued that the government has been supportive to the SMEs in the country. It has been demonstrated that SMEs greatly contribute 48% of GDP in the country and it largely contributes to 84% of employment and 96% of the business according to National Bureau of Statistics. It is not doubtful that the paramount contribution of SMEs to the Nigerian economy cannot be underestimated. Nonetheless, the paper argues that, the leaders of SMEs are worried about negative impact of COVID-19 on small and medium enterprises (SMEs) especially when there is no necessary financial support. Nevertheless, some people are optimistic that with fervent support of the government, the country will come out stronger after the pandemic of COVID-19. It is specifically mentioned that, the health implication of COVID-19 is a subset of the financial or commercial implication of the COVID-19 in the country. The conceptual framework of the paper provides substantial direction for an empirical exploration of the identified variables especially towards investigating correlation or relationship between COVID-19 and small and medium enterprises (SMEs) in the country. If the conceptual framework can be empirically investigated, it will enable the government and leaders of SMEs to provide measures for addressing multifarious issues emerging from COVID-19 in the country.

Suggestions

The following suggestions are therefore provided:

1. The Nigerian government is expected to drastically reduce the costs of governance and operation and provide strategies for accessing grants and loans from international community in order to enhance SMEs in the country.

2. That the government should provide financial supports for the diversification of various aspects of small and medium enterprises (SMEs) such as: agriculture, manufacturing, beauty/cosmetics etc. in order to be responsive to the impact of COVID-19 in the country.

3. Alternative support of getting raw materials should be given to the expansion of SMEs in the country in order to create alternative sources of income to the manufacturers.

4. The government should collaborate with the leaders and promoters of SMEs in order to explore possible way of rendering the needed assistance for the maximization of production in SMEs.

5. That as the government has been trying to enhance health system in the country, there is need improve post-COVID-19 economy especially strengthening and bringing desired changes for operations of SMEs.

6. The government should provide technological equipment for effectiveness and efficiency of small and medium enterprises (SMEs) especially by promoting digital economy through delivery and payment system. More importantly, the focus should be on integration of the digitization into business operations in order to explore the emerging business opportunities in the country.

7. That the government should strengthen its support for local provision of raw materials for production because COVID-19 has greatly affected the importation of raw materials necessary for production from China in particular and other countries in general.

8. There is need for new strategy especially by providing financial support for existing business transaction and loans for new businesses in order to make most of SMEs survive after the plague of COVID-19.

9. That the government at both state and federal levels should involve private sectors and investors in providing necessary support for an expansion of SMEs in order to achieve economic recovery after COVID-19 in the country.

10. Monitoring mechanism in an innovative way should be put in place by the government in order ensure that financial support of business loans is used judiciously towards making the businesses thrive in particular and to make the national economy evolve after COVID-19 in general.

Acknowledgement

The authors are hereby acknowledged the Prince Sultan University higher management for their financial, academic, and moral support throughout this research.

References

- Adebisi, S.A., Alaneme, G.C., & Ofuani, A.B. (2015). Challenges of finance and the performance of small and medium enterprises (SMEs) in Lagos state. Developing Country Studies, 5(8), 46-58.

- Adedipe, B. (2004). The impact of oil on Nigeria’s economic policy formulation. In Proceedings of Overseas Development Institute Conference in Collaboration with the Nigerian Economic Summit Group.

- Akinlo, A.E. (2012). How important is oil in Nigeria’s economic growth?. Journal of Sustainable Development, 5(4), 68-84.

- Amin, M., Thurasamy, R., Aldakhil, A.M., & Kaswuri, A.H.B. (2016). The effect of market orientation as a mediating variable in the relationship between entrepreneurial orientation and SMEs performance. Nankai Business Review International, 7(1), 39-59.

- Aminu, I.M., & Shariff, M.N.M. (2015). Determinants of SMEs performance in Nigeria: A pilot study. Mediterranean Journal of Social Sciences, 6(1), 156-164.

- Anigbogu, T.U., Onwuteaka, C.I., Edoko, T.D., & Okoli, M.I. (2014). Roles of small and medium scale enterprises in community development: Evidence from Anambra south senatorial zone, Anambra State. International Journal of Academic Research in Business and Social Sciences, 4(8), 302-315.

- Ayyagari, M., Demirguc-Kunt, A., & Maksimovic, V. (2011). Small vs. young firms across the world: contribution to employment, job creation, and growth. The World Bank.

- Bassey, C.O. (2012). Resource Diversification for Sustainable Economic Development in Nigeria. British Journal of Humanities and Social Sciences, 5(1), 33-46.

- Bryson, J.R. (1997). Small and medium?sized enterprises, business link and the new knowledge workers. Policy Studies, 18(1), 67-80.

- Carrillo, F.J., Brachos, D., Kostopoulos, K., Soderquist, K.E., & Prastacos, G. (2007). Knowledge effectiveness, social context and innovation. Journal of Knowledge Management, 11(5), 31-44.

- Chile, H., (2016). Financing smes and entrepreneurs 2016, financing smes and entrepreneurs. OECD Publishing.

- Egena, O., Wombo, D.N., Theresa, E.E., & Bridget, M.N. (2014). Institutional support for small and medium enterprises in Nigeria: An empirical investigation. International Journal of Economy, Management and Social Sciences, 3(9), 481-489.

- Fatai, A. (2011). Small and medium scale enterprises in Nigeria: The problems and prospects.

- Fida, B.A. (2008). The Role of Small and Medium Enterprises (SMEs) in Economic Development. Enterprise Development, Free Online Library.

- Gibson, T., & Van der Vaart, H.J. (2008). Defining SMEs: A less imperfect way of defining small and medium enterprises in developing countries.

- Hayton, J.C. (2003). Strategic human capital management in SMEs: An empirical study of entrepreneurial performance. Human Resource Management: Published in Cooperation with the School of Business Administration, the University of Michigan and in alliance with the Society of Human Resources Management, 42(4), 375-391.

- Kozetinac, G., Vukovic, V., & Kostic, D. (2010). Corporate finance and monetary policy: The role of small and medium-sized enterprises.

- Kushnir, K., Mirmulstein, M. L., & Ramalho, R. (2010). Micro, small, and medium enterprises around the world: how many are there, and what affects the count. Washington: World Bank/IFC MSME Country Indicators Analysis Note, 1-9.

- McDonald, U.U., Iloanya, K.O., & Okoye-Nebo, C. (2014). National Economic Emancipation and Development Strategy (NEEDS): A SpringBoard for Nigerian Sustainable Development. Arabian Journal of Business and Management Review (Oman Chapter), 4(5), 23-32.

- MSMEs. (2020). Micro, small, and medium enterprises (msmes) in Nigeria-an overview. Retrieved May 18, 2020 from https://invoice.ng/blog/msmes-in-nigeria-overview/

- Odinaka, A. & Josephine, O. (2020). SMEs closures seen after covid-19 pandemic. Retrieved May 28, 2020, from https://businessday.ng/enterpreneur/article/smes-closures-seen-after-covid-19-pandemic/

- OECD. (2017). Enhancing the contributions of smes in a global and digitalised economy. Retrieved from https://www.oecd.org/industry/C-MIN-2017-8-EN.pdf

- Okonkwo, I.V., & Madueke, N.M.F. (2016). Petroleum revenue and economic development of Nigeria.

- Oni, E.O. (2012). Development of small and medium scale enterprises: The role of government and other financial institutions. Oman Chapter of Arabian Journal of Business and Management Review, 34(962), 1-14.

- Pulka, B.M., Ramli, B.A., & Bakar, S.M. (2017). Conceptual framework on Small and medium enterprises performance in a turbulent environment. Sahel Analyst: Journal of Management Sciences, 15(8), 26-48.

- Ryder, G. (2020). The economic impact of COVID-19 on the labour market. Retrieved May 08, 2020 from https://www.stearsng.com/article/the-economic-impact-of-covid-19-on-the-labour-market

- ?erban, A.I. (2015). Business process reengineering on sme’s: Evidence from Romanian sme’s. In Proceedings of the 9th International Management.

- Shrivastava, A.K. (2016). Role of government in the development of msmes. South Asia Journal of Multidisciplinary Studies, 2(1), 34-44.

- Suberu, O.J., Ajala, O.A., Akande, M.O., & Olure-Bank, A. (2015). Diversification of the Nigerian economy towards a sustainable growth and economic development. International journal of Economics, finance and Management sciences, 3(2), 107-114.

- World Health Organization. (2019). Coronavirus disease (COVID-19) pandemic. Retrieved June 16, 2020, from https://www.who.int/