Research Article: 2018 Vol: 17 Issue: 1

Impact of Corporate Governance on Sustainability: A Study of the Indian FMCG Industry

Ashok Kumar Sar, KIIT School of Management

Keywords

Corporate Governance, Sustainability, Environment, Economic Performance, Social Equity.

Introduction

In the Indian Companies Act-19561, a company is defined as an "artificial person", invisible, intangible, created by or under law, with a discrete legal entity, perpetual succession and a common seal. Every company needs a set of processes, which may include rules and practices for direction and control. Such processes are often referred to as Corporate Governance (CG). Like any other governance, CG essentially is associated with balancing expectations of stakeholders. Stakeholders in a firm would include community, complementors, suppliers, customers, government and the shareholders. In the U.S., corporate governance has become a pressing issue, which aims to restore confidence in the minds of people regarding companies and markets after accounting fraud leading to bankruptcy of high profile companies such as Enron and WorldCom. The Indian Companies Act, 2013 provides the basic framework for regulation of all companies. Besides, all listed companies need to act in accordance with the provision of the listing agreement as per Section-21 of the Securities Contract Regulation Act, 1956, which has been amended on February 21, 2000 and again on August 26, 2003. Broadly the Indian Corporate Governance framework is in compliance with the corporate governance principles of OECD. These principles of corporate governance are as follows2:

1. Ensuring the basis for an effective corporate governance framework;

2. The rights of shareholders and key ownership functions protected and facilitated;

3. Equitable treatment of shareholders;

4. The role of stakeholders in corporate governance recognized;

5. Disclosure and Transparency;.

6. The responsibility of the board-monitoring management and accountability to shareholders.

Corporate governance discussions have progressively shifted to sustainability, popularly articulated through the three E’s, i.e., Social Equity, Economic Performance and Environmental Performance (Rogers & Hudson, 2011). In 1980s, Gro Harlem Brundtland, the Norwegian Prime Minister defined sustainability as "Meeting the needs of the present without compromising the ability of future generations to meet their own needs” (Porter & Mark, 2007). This definition has been used by the “World Business Council for Sustainable Development”. The associated concerns have resulted in changes in regulation, (e.g., the Indian Environment Protection Act) shift in consumer choices (e.g., towards the so-called green products and services) and increased media attention. In a survey conducted by McKinsey in February 2010, on how companies manage sustainability, it has been reported that companies who are managing sustainability actively are reaping the benefit of superior shared value. However, most companies fail to manage sustainability actively3.

The Indian Fast Moving Consumer Goods (FMCG) industry has been chosen for the study, owing to a trend of significant engagement in sustainability activities, as compared to other industries. During the last five years there is a shift towards naturals in the personal care products aimed at protecting the environment and contributing to the wellbeing of the society. For example Hindustan Unilever Limited has created The Unilever Sustainable Living Plan (USLP) as the blueprint for achieving their vision to grow business, whilst decoupling their environmental footprint from growth and increasing positive social impact. The Plan sets stretching targets, including how they source raw materials and how consumers use their brands. The two fast growing new entrants, Patanjali Ayurveda (promoted by the world famous yoga guru-Baba Ramdev) & Sri Sri Tattva (promoted by another world famous spiritual leader-Sri Sri Ravi Shankar) have similar aspirations. Not to be left out, other leading FMGC companies like Dabur, Himalaya, VLCC, Godrej, Colgate-Palmolive and Dr. Vaidy’s, have realigned their strategies to create shared value.

Conceptual Framework and Hypothesis Development

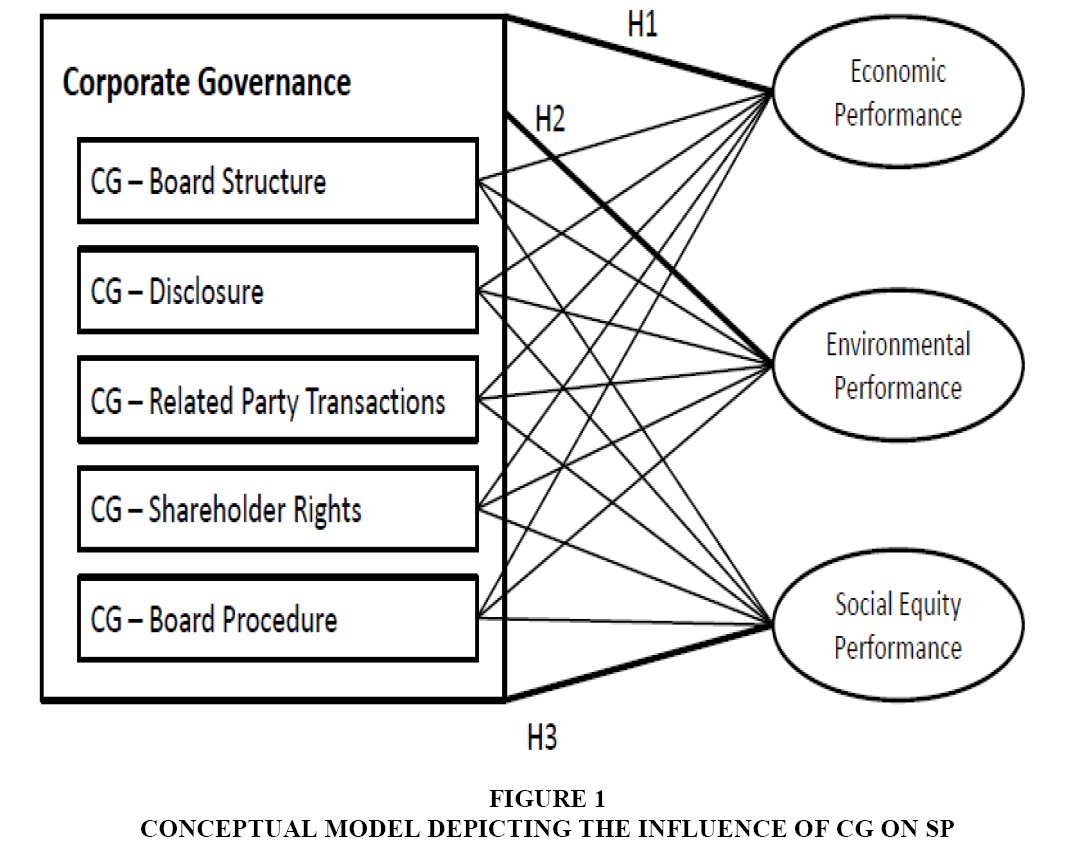

Corporate governance is a key success factor for businesses, as it has been associated with improving sustainability performance and gaining trust of investors (Saltaji & Issam, 2013). The relationship between corporate governance and sustainability has been researched quite extensively separately, i.e. corporate governance and environment performance, corporate governance and social equity and corporate governance and economic value (Figure 1). Huang (2010) studied 1921 U.S. firms on the impact of ownership and management on environment performance. David studied 208 publicly traded firms on the impact of ownership structure on corporate social performance. Balasubramanian, Vikramyadita & Bernard (2008) studied the relationship between corporate governance and firm value, in the Indian context.

Drawing on stakeholder theory, Michelon & Parbonetti (2012) have examined the relationship of board structure, leadership and composition on sustainability. Balasubramanian, Vikramyadita & Bernard (2008) have developed the Indian Corporate Governance Index (ICGI) based on forty nine variables in five groups capturing the aspects concerning corporate governance. Similarly, Robert (2000) has developed the sustainability life cycle analysis tool set to assess the sustainability. The framework refers to the four systems conditions, viz., “concentration of substances extracted from the Earth’s Crust”; “concentration of substances produced by society”; “depletion of physical means”; and “people’s capacity to meet their needs”, through the five stages of product life cycle, viz., design and development, materials (raw and fabricated); production; packaging, distribution and retailing and usage and end of life.

The associated variables have also been captured objectively in the form of dimension wise aspects and aspect wise key indicators, in the GRI guidelines by the Global Reporting Initiative (GRI)4.

The sustainability performance of a firm is greatly influenced by its profile of corporate governance (Lawrence, Collins & Roper, 2013). Corporate governance plays a critical role in sustainability performance, owing to several reasons. First, sustainability aspects have long term strategic significance and require top management commitment and substantial investment (Hart, 1995). Hence, there can be impact on the firm’s capital structure and risk, thereby having impact on firm’s viability. Second, addressing the social dimensions and natural environment, demands extensive coordination at multiple complex levels, that expands the significance of the company across stakeholders (Roome, 1992). Hence, in exploring the corporate governance-sustainability performance (CG-SP) link, I look into three expansive research issues, as follows:

1. The relationship between corporate governance index and economic performance.

2. The relationship between corporate governance index and environmental performance.

3. The relationship between corporate governance index and social equity performance.

Measurement of Corporate Governance

Corporate Governance lays the foundation for performance and is the key driver of strategic activities in a company (Varshney, Kaul & Vasal, 2013). To be able to link corporate governance to sustainability performance, I have captured measures from clause-49 of the SEBI5 listing agreement. To measure the level of corporate governance, I have captured forty-nine aspects in five categories, viz., board structure, disclosure, related party transactions, shareholders rights and procedure, developed by Balasubramanian, Vikramyadita & Bernard (2008).

Sustainability Performance

To measure sustainability performance, I have used the indicators captured in the sustainability reporting guidelines developed by the “Global Reporting Initiative” (GRI). GRI promotes the use of a system of reporting sustainability performance, with a view to make firms more sensitive to and contribute to sustainable development. Following GRI sustainability reporting framework, companies have set goals in the three dimensions, viz., economic, environment and social equity. Cutting across sectors and geographic territory, the GRI framework has been found to be comprehensive to capture sustainability performance (Milne & Gray, 2013). Accordingly, the measurement of the sustainability performance has been based on the aspects captured in the GRI framework, version 3.1.

Economic Performance

Traditionally, the economic performance of a firm has been measured by “Economic Value Added (EVA)”. However, for a sustainable world, there is a need to look at the impact of a firm’s activity not only on its EVA but also on economic conditions of stakeholders and economic systems at global, national and local levels. The impact of the value activities of a firm on stakeholders’ economy and throughout the society are illustrated in the economic performance indicators. While EVA reflects the true financial state of an organization and reported properly, the company’s involvement to a larger economic system’s sustainability needs to be assessed. The associated aspects are captured in relevant indicators, viz., “economic performance, market presence and indirect economic impacts”. Nine variables in these three aspects are used to measure the economic performance from a sustainability point of view. Mueller (2006) studied the merit of different types of “CG” systems in resolving agency problems and assessment of firm performance. “CG” is understood as a key building block when getting target economic performance and growth and also leading to increase in investors” trust (Kocmanova & Alena, 2011). Hence assess the impact of corporate governance on economic performance, I propose:

H1: A strong corporate governance index will positively impact the firms” “economic performance”.

Environmental Performance

A firm’s value creating activities have impact on non-living as well as living systems, including water, air and land. Accordingly, the indictors of environmental performance are captured in outputs as well as inputs. The outputs cover emissions and waste and the input cover water, energy and basic materials. With a view to make the assessment more comprehensive, additional aspects like impact of product and services; environmental compliance; and bio-diversity are taken. The assessment is done through nine sets of variables, viz., materials, energy, water, biodiversity, emission, effluents and waste, transportation and overall. Thirty variables in these nine aspects are used to measure the environmental performance of a company. Iatridis (2013) found that corporate governance is positively linked to environmental performance in advanced emerging economy like Malaysia. Walls, Berrone & Phan (2012) found a reliable and valid “corporate governance-environment” link through their comprehensive fact-based research. Hence assess the impact of corporate governance on environment performance, I propose:

H2: A strong corporate governance index will positively impact the firms” environmental performance.

Social Equity Performance

Firms” value chain activities have obvious impact on the social system within which firms operate. Social equity aspects relate to all such impacts. The social equity aspect of sustainability has also been captured in the sustainability framework articulated by “The Natural Steps (TNS)” as a key system condition for sustainability. Key aspects surrounding “labor practices, human rights and society and product responsibility” are prescribed in the “GRI social performance indicators” as key assessment attributes.

Labor Practice

Internationally recognized universal standards, viz., “United Nations universal declaration of human rights; international covenant on economic, social and cultural rights; convention on the elimination of all forms of discrimination against women; ILO declaration on fundamental principles and rights at work; and the Vienna declaration and programme action” are the basis for specific aspects for assessment of labor practices. Using the “qualitative comparative analysis” method, Jackson (2005) established linkages between corporate governance and employment pattern in 22 countries. Gilson & Roe (1999) found the Japanese labor practices and related corporate governance aspects as path dependent.

Human Rights

In the course of transactions of business, incidences of violations of human rights have been widely reported globally. Thus a basic need to respect human rights has come to the forefront for consideration. Over a period of time, a consensus has emerged globally that companies have the responsibility to respect human rights. The associated performance indicators require companies to report on changes in the stakeholders’ ability to enjoy and exercise their human rights and on the extent to which processes have been implemented on prevention of incidence of human rights violations. Issues included are “non-discrimination, gender equality and freedom of association, collective bargaining, child labor, forced or compulsory labor and indigenous rights”. The international legal framework for human rights comprise of a body of law made up of “treaties, conventions, declarations and other instruments”. The corner stone of human rights is the “International Bill of Rights which is formed by three instruments-The Universal Declaration of Human Rights (1948), the International Covenant on Civil and Political Rights (1966); and the International Covenant on Economic, Social and Cultural Rights (1966)”. Eleven indicators in eight aspects are used to assess human rights performance of company. Jackson (2008) found that there is a strong business case for taking human rights seriously. He further articulated that integrating human rights into governance is based in natural law theory.

Society

Business process impact local communities. These impacts and associated risks have been widely reported globally. Particularly for FMCG companies in India, large scale impacts on communities in which the companies operate, have been reported. The indicators relate to these impacts and risks and how they are managed. In particular, information is captured on the risks associated with monopoly practices, undue influence in public policy making, corruption and bribery. Ten indicators in five aspects are used to assess society performance. Chang (2008) developed a unified framework for business-society interface in this globalized environment by synthesizing divergent arguments. Schneider & Scherer (2013) argued that business firms may be able to mitigate the redistribution of individual risk and address the resulting legitimacy deficits even when operating under conditions of regulatory gaps and governance failure, by democratic involvement of various stakeholders.

Product Responsibility

Product Responsibility performance indicators capture a company’s offerings that directly affect consumers, viz., privacy and marketing; labeling and information and safety and health. Performance is assessed by analyzing “customer health and safety; product and service labeling; marketing communication; customer privacy; and compliance”. Nine indicators in these five aspects are used to assess the product responsibility performance. The results of a study by Huang (2010) show that a CG model which includes independent outside directors and which has specific ownership characteristics has a significantly positive impact on both customer health and safety; and product and service labeling. In a study by Johnson & Greening (1999) product quality was found to be positively related to the top management equity. Richard (1999) and others found that product quality dimension was positively related to the top management equity. Hence to assess the impact of corporate governance on social equity performance, I propose:

H3: A strong corporate governance index will positively impact the firms” social performance.

Methods

To test the three hypotheses, respondents from 122 FMCG companies listed the CMIE PROWESS6 database have been used. A self-administered questionnaire has been designed to test the hypothesis in this research. The questionnaire comprise of two sections: the first section captures the corporate governance attributes and the second section captures the sustainability performance attributes.

For computation of corporate governance index, I used the 1st part of the questionnaire, seeking the response on 49 questions that are often believed to correspond to "good" governance. On these 49 firm attributes, there is reasonably complete data; reasonable variation across firms and sufficient difference from another element. For the presence of an attribute code of “1” is given and for absence code of “0” is given. These 49 attributes are grouped as “board structure with sub-indices for disclosure substance and for audit or independence; related party transactions with sub-indices for the volume related party transactions a firm engages in and for approval procedure for these transactions; shareholders rights; and board procedure with sub-indices for overall procedure and for audit committee procedure”.

For sustainability performance, I use the 2nd part of the questionnaire seeking response from the respondents on a five point scale, from low level of performance and reporting to high level of performance and reporting. The response was sought on 84 questions, in the three dimensions of sustainability, viz., “economic performance, environmental performance and social equity performance”.

The attributes on CG have been taken from the work of Balasubramanian, Vikramyadita & Bernard (2008) which is considered as measure with significant reliability and validity. Similarly, the attributes on sustainability have been taken from the GRI index, which very widely used and associated with significant reliability and validity.

Questionnaire to three director level (full time) officials were sent in 122 of the 159 companies mentioned earlier. These 122 companies were chosen based on availability of complete information in CMIE-PROWESS database and records of registrar of companies (ROC), India. For example, there were a few companies, which are listed in the CMIE-PROWESS database but the details of directors are not there in the records of the ROC. Out of the 658 questionnaire sent, 318 responses were received.

Results

Details of the correlations among the variables are given in Table 1. From the output, correlation coefficient confirms that corporate governance has positive association with economic performance, with r=0.48 (p<0.01). Hence the results supported the Hypothesis H1. The results also confirm that at a segregate level the five sets of attributes are positively associated with economic performance with r=0.52, 0.56, 0.51, 0.38 and 0.52. The correlation coefficient confirms that corporate governance has positive association with environment performance, with r=0.52 (p<0.01), supporting the Hypothesis H2. The results also confirm that at a segregate level the five sets of attributes are positively associated with environment performance with r=0.47, 0.61, 0.67, 0.41 and 0.63. The correlation coefficient confirms that corporate governance is positively associated with social equity performance, with r=0.56 (p<0.01), supporting the Hypothesis H3. The results also confirm that at a segregate level the five sets of attributes are positively associated with social equity performance with r=0.63, 0.49, 0.55, 0.49 and 0.72. To summarize, both at aggregate and at the segregate level (all five sets of attributes on CG, viz., “board structure, disclosure, related party transactions, shareholder rights and board procedure”) have been found to be strongly associated with the three sets of attributes on sustainability performance, viz., economic performance, environmental performance and social equity performance, supporting hypotheses H1, H2 and H3.

| Table 1 Descriptive Statistics and Correlations for Corporate Governance (Aggregate And Segregate) and Sustainability Performance |

|||||||||

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| CG-Aggregate | 1 | ||||||||

| CG-Board Structure | 0.12* | 1 | |||||||

| CG-Disclosure | 0.55** | 0.03 | 1 | ||||||

| CG-Related Party Transactions | 0.59** | -0.04 | -0.03 | 1 | |||||

| CG-Shareholder Rights | 0.42** | -0.12 | -0.02 | 0.12* | 1 | ||||

| CG-Board Procedure | 0.61** | -0.02 | 0.45 | 0.16** | 0.35** | 1 | |||

| Sustainability-Economic Performance | 0.48** | 0.52** | 0.56** | 0.51** | 0.38** | 0.52** | 1 | ||

| Sustainability-Environmental Performance | 0.52** | 0.47** | 0.61** | 0.67** | 0.41** | 0.63** | 0.74* | 1 | |

| Sustainability-Social Equity Performance | 0.56** | 0.63** | 0.49** | 0.55** | 0.49** | 0.72** | 0.68** | 0.67** | 1 |

| Mean | 42.65 | 5.88 | 10.4 | 8.61 | 4.76 | 13.01 | 4.51 | 4.16 | 4.13 |

| Standard Deviation | 2.39 | 0.34 | 1.33 | 1.25 | 0.55 | 1.03 | 0.29 | 0.54 | 0.31 |

*p<0.05; **p<0.01.

Discussion

My work helped to gain insights into the relationship between five domains of corporate governance-“board structure, disclosure, related party transactions, shareholder rights and board procedure”-and their respective interaction to the three domains of sustainability performance-economic performance, environmental performance and social equity performance. Amidst a lot of talk on sustainability performance, there lies a situation of seemingly irreconcilable academic positions put forward in past studies. This work, essentially, can be seen as a step forward in building knowledge on the CG-SP link that takes a broad view of corporate governance and looks at the interactions among the several factors related to governance in firms. I hope that, the result of this study will stimulate others to examine the governance of firm’s social, environmental and economic practices more closely.

At the beginning, I posed three research issues. In light of the evidence, these research issues can be analyzed now. My broad research was about the relationship between corporate governance and corporate sustainability performance in the Indian FMCG Industry. All five aspects of corporate governance were relevant to the three areas of sustainability performance, based on prior research. However, because of a deeper industry specific study, I have brought out certain new insights for the Indian FMCG industry.

The presence of required aspects for good governance in firms tends to result in better economic performance. Aspects concerning disclosure have been found to be having strongest influence on economic performance. Protecting shareholder rights had least influence on economic performance. An appropriate profile of related party transactions was found to be having strongest influence on environmental performance. The other four domains of CG had also significant influence on environmental performance. Board produce had the strongest influence of social equity performance.

Limitations

My study has been based on the response from 122 companies from the FMCG Industry. I didn’t differentiate between small and large companies. I acknowledge that larger companies are more noticeable and may thus be likely to have higher scores. The “CG-SP link” may be different for small and medium sized companies. Finally, it is likely to some extent that some respondents might have understated the negative aspects and overstated the corresponding positive aspects of their companies, as certain portions of the data on sustainability performance in particular are perceptual in nature.

Implications and Future Research Directions

Some general conclusions from the study lay the path for future empirical work. One arena of future research can relate to the vital role boards in companies play in the firm’s sustainability. A general idea of independent boards as the most excellent practice to help performance might not be valid for environment and social performance in particular. During the survey, it was found that many of the director level officials lacked rich insights regarding sustainability performance and a feeling emerged like, the attributes are very generic and need refinement to align with industry specific challenges. So the next area of future research can relate to looking at the influence of corporate governance index to industry specific sustainable performance.

Endnotes

1. This being replaced with Indian Companies Act-2013, with effect from 1st April, 2014

2. OECD Principles of Corporate Governance, 2004.

3. McKinsey Global Survey results: How companies manage sustainability.

4. “GRI is a network based organization that has pioneered the development of the world’s most widely used sustainability reporting framework”.

5. Securities and Exchange Board of India.

6. Center for Monitoring Indian Economy’s PROWESS database.

References

- Balasubramanian, N., Vikramyadita, K. & Bernard, B.S. (2008). Firm-level corporate governance in emerging markets: A case study of India. IIM Bangalore Working Paper Series.

- Chang, S.J. (2008). Business-society reciprocity as a guideline for global corporate governance. International Finance Review, 9, 81-96.

- Gilson, R.J. & Roe, M.J. (1999). Lifetime employment: Labor peace and the evolution of Japanese corporate governance. Columbia Law Review, 99(2), 508-540.

- Huang, C.J. (2010). Corporate governance, corporate social responsibility and corporate performance. Journal of Management and Organization, 16(5), 641-655.

- Iatridis, G.E. (2013). Environmental disclosure quality: Evidence on environmental performance, corporate governance and value relevance. Emerging Markets Review, 14(1), 55-75.

- Jackson, G. (2005). Towards a comparative perspective on corporate governance and labor management: Enterprise coalitios and national trajectories. In G.F. Howard & A.P. Gospel (Eds.), Corporate governance and labor management: An international comparison (pp. 284-309). New York: OXFORD University Press.

- Jackson, K. (2008). Natural law, human rights and corporate reputational capital in global governance. Corporate Governance, 8(4), 440-455.

- Johnson, R.A. & Greening, D.W. (1999). The effects of corporate governance and institutional ownership types on corporate social performance. Academy of Management Journal, 42(5), 564-576.

- Kocmanová & Alena (2011). Corporate governance and sustainability. Economics & Management, 16, 543-550.

- Lawrence, S., Collins, E. & Roper, J. (2013). Expanding responsibilities of corporate governance: The incorporation of CSR and sustainability. Indian Journal of Corporate Governance, 6(1), 49-63.

- Michelon, G. & Parbonetti, A. (2012). The effect of corporate governance on sustainability disclosure. Journal of Management and Governance, 16(3), 477-509.

- Milne, M.J. & Gray, R. (2013). W(h)ither ecology? The triple bottom line, the global reporting initiative and corporate sustainability reporting. Journal of Business Ethics, 118(1), 13-29.

- Mueller, D.C. (2006). Corporate governance and economic performance. International Review of Applied Economics, 20(5), 623-643.

- Porter, M.E. & Mark, K.R. (2007). Strategy and society: The link between competitive advantage and corporate social responsibility. Harvard Business Review.

- Richard Johnson, A. & Daniel, G.W. (1999). The effects of corporate governance and institutional ownership types on corporate social performance. Academy of Management Journal, 42(5), 564-576.

- Robert, K.H. (2000). Tool and concepts for sustainable development, how do they relate to a framework for sustainable development and each other? Journal of Clear Production, 8(3), 243-254.

- Rogers, K. & Hudson, B. (2011). The triple bottom line: The synergies of transformative perceptions and practices for sustainability. OD Practitioner, 43(4), 3-9.

- Saltaji & Issam, M. (2013). Corporate governance relation with corporate sustainability. Internal Auditing & Risk Management, 8(2), 137-147.

- Schneider, A. & Scherer, A.G. (2013). Corporate governance in a risk society. Journal of Business Ethics, 1-15.

- Varshney, P., Kaul, V.K. & Vasal, V.K. (2013). Corporate governance mechanisms and firm performance: A study of select Indian firms. Afro-Asian Journal of Finance and Accounting, 3(4), 341-395.

- Walls, J.L., Berrone, P.B. & Phan, P.H. (2012). Corporate governance and environmental performance: Is there really a link? Strategic Management Journal, 33(8), 885-913.