Research Article: 2021 Vol: 20 Issue: 3

Impact of Leverage Ratios on Indicators of Financial Performance: Evidence from Bahrain

Abdul Aziz Abdul Rahman, Kingdom University

Abdelrhman Meero, Kingdom University

Nurul Mohammad Zayed, Daffodil International University

K. M. Anwarul Islam, The Millennium University

Mustafa Raza Rabbani, University of Bahrain

Venus Del Rosario Bunagan, Kingdom University

Abstract

The study aims to explore the effect leverages on the performance of different industrial firm operating in Bahrain. The financial (DFL), operating (DOL) and combined leverages (DCL) were used as independent variables. The financial performance considered as dependent variable is measured by three financial ratios which are: the net income on assets (ROA), return on equity (ROE), and net profit margin (NPM). The sample respondents of this study include three industrial companies, Aluminum Bahrain (ALBA), Bahrain Flour Mills Company (BFM), and Delmon Poltry Company (POLTRY) for the period 2016-2019. The SPSS program was employed to explore the impact of DFL, DOL, and DCL on the three performance variables. The findings indicated no significant impact on for all the independent variables on all the dependent variables. This study recommends the necessity do new studies to examine the impact of different leverage ratios on other financial performance ratios such as economic value-added capital restructuring, and earnings per share.

Keywords

Leverage, Profitability, Ratios, Industrial, Companies, Bahrain.

Introduction

Financial management is primarily aiming to maximize the wealth of owners by maximizing the market value of the organization through making decisions that ensure the enhancement of the competitive position of the organization (Brealey et al., 2012; Ali, 2020). Among the challenges facing organizations is finding the necessary funding to operate the organization, especially in light of the limited financial resources and the various costs of obtaining it. Consequently, financial management must continually align profit maximization with risks (Perinpanathan, 2014). The capital structure clearly affects the profitability of the organization and thus the enterprise has to operate with a capital structure that ensures higher profitability and a higher market value as well.

The capital structure affects not only the profitability of the organization but also the leverage ratios. The operating leverage usually increases with the increase in fixed costs (Brealey et al., 2012; Ali, 2020). Thus, organizations must continuously reduce fixed costs to ensure that more losses are avoided especially in times of crisis. This research aims to measure the effect of leverage indicators on the performance of listed industrial firms in Bahrain Bourse. The study questions are the following:

1. Does the financial leverage have an impact on financial performance indicators?

2. Does the operating leverage have an impact on financial performance indicators?

3. Does the combined leverage have an impact on financial performance indicators?

4. What are the implications on the study “Impact of Leverage Ratios on Indicators of Financial Performance: Evidence from Bahrain”?

5. What recommendations can be given from the results of the study?

Literature Review

Chandrakumarmangalam & Govindasamy (2010) aim to examine the impact of the three leverage ratios on the profitability of organizations. This study also examines the impact of capital structure on earnings per share. The results show a statistically significant relationship of leverage ratios on the profitability of the organizations. Liargovas & Skandalis (2009) examined the influence of the financial leverage (DFL) and other variables on the performance of a sample of manufacturing firms operating in Greece. They conclude that there is a significant relationship between the (DFL) and firm’s financial. Similar study has been done by Rehman (2013) applied on a group of chemical companies operating in Pakistan. The result of this research aligns with Liargovas & Skandalis (2009) confirming the existence of a significant relationship between the (DFL) and the studied firms financial performance. Saleem et al. (2013) aim to explore the impact of the leverages on the profitability of a sample of oil and gas companies operating in South Asian countries. The study concludes that that both the financial and operating leverages affect significantly the profitability ratios. Javeda et al. (2015) aims to study the effect of the FL ratio on the financial performance of sample of firms in Pakistan. The findings refer to a negative relationship between the FL and the performance ratios for the leveraged firms. The research of Vijayalakshmi & Manoharan (2015) study the relationship between the financial leverage ratio and the market value-added as well as the economic value added of various sectors. The findings illustrate an evident effect of the financial leverage on the maximization of the shareholders’ value. Another research done by Alipoura & Pejmanb (2015) aimed to study the impact of the financial leverage, operating leverage, and efficiency on the MVA. The results show a clear impact of leverage ratios on the market value-added. Anton (2016) clarifies the impact of financial leverage on company growth for a group of companies listed in Romanian. This study indicates a positive impact on the financial leverage on the company’s growth. Ilyukhin (2015) aims to examine the impact of the financial leverage of the companies’ performance in Russia. This study indicates a negative impact on the financial leverage on the companies’ performance. Megawati (2020) aims to study the relationship between liquidity and leverage ratios on the telecommunication firms’ performance listed in IDX. The results don’t recognize a significant relationship between the independent and the dependent variables except in the case of the relationship liquidity and profitability, a negative relationship has been detected. Samo & Murad (2019) aim to explore the impact of financial leverage and liquidity on profitability for group companies in Pakistani. The results show a negative impact for the financial leverage on profitability and at the same time a positive impact on the liquidity on profitability. Rahman et al. (2020) aim to examine the effect of the financial leverage on the financial performance of a sample of firm operating in Bangladesh. The results show a negative relationship between the two variables. The results also show that there is a negative relationship between the capital structure and profitability. Ali (2020) explores the relationship between leverage ratios and the financial performance of a sample of firms operating in Pakistan. The findings of the study show that there is no significant relationship between the as independent variable and the dependent variable which is the financial performance of studied firm. This relationship is more significant the operating leverage and financial performance. Niaz et al. (2015) explained activity-based costing regarding private universities in Bangladesh. They found that most of the universities were highly leveraged.

The previous studies show different relationships between the three leverage ratios and the financial performance of companies. The previous studies also show that very few studies studied the effect of the three leverage indicators on the financial performance of companies and that most of them were focused on studying the relationship between financial leverage and profitability, and in some cases, between the financial and operational leverage and the financial performance of companies. This study differs from its predecessors in that it studies the relationship between various leverage ratios operational, financial, and combined and the financial performance of companies.

Research Framework

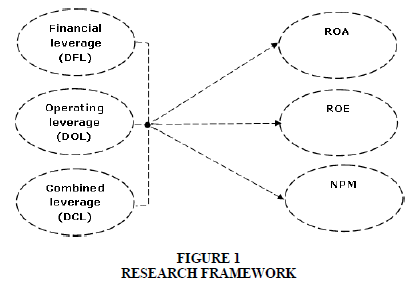

Below Figure 1 shows the framework of the study based on the literature review presented:

The study presented the independent variables explained in detail, such as the financial leverage, operating

Methodology

The study presented the independent variables explained in detail, such as the financial leverage, operating leverage, combined leverage. These are followed by dependent variables such as Returns of Assets (ROA), Return on Equity (ROE), and the Net Profit Margin (NPM). This study depends on the descriptive and analytical methods to achieve the objectives of the study. The researchers rely on collecting the necessary data for the study from the published financial statements in Bahrain Bourse that belong to the companies understudy during the years (2016-2019). The SPSS program was used to analyze the impact of leverage ratios on the financial performance of the companies under study, providing some results and recommendations.

Hypotheses

Financing by borrowing usually affects the financial leverage ratio. When the debt ratio is being high, this means that the financial leverage will affect the company's earnings. Debt ratio can be considered a tool to evaluate the financial position of a company in a particular time. The lower depending on external financial resources, the lower exposure to risk, because loans and their interests usually lead to the waste of the company’s resources including the cash liquidity needed to operate its projects. Based on the above, the first hypothesis of this study examines the impact of financial leverage on the financial performance indicators, ROA, ROE, and NPM. Accordingly, the first hypotheses can be formulated into the following sub-hypothesis:

H1a There is no impact for financial leverage on return on assets.

H1b There is no impact for financial leverage on return on equity.

H1c There is no impact for financial leverage on net profit margin.

Given that the operating leverage is affected by the volume of fixed costs, this means that a higher proportion of fixed costs mean high operating leverage. Thus, any sales change will cause operating income to change. Also, the high operating leverage could expose the company to risk. The previous studies show a differential effect of operating leverage on financial performance and different profitability indicators. The second hypothesis will study the effect of operating leverage on the financial performance of the companies under study. Based on the foregoing, the second hypothesis can be divided into the following sub-hypotheses:

H2a There in no impact for operating leverage on return on assets.

H2b There in no impact for operating leverage on return on equity.

H2c There in no impact for operating leverage on net profit margin.

Combined leverage explores the impact of both financial and operating leverages on indicators of financial performance. This study will examine also the impact of combined leverage on the financial performance indicators for the mentioned companies. Different previous studies showed different results about the relationship between combined leverage and different financial or profitability indicators. Therefore, the third hypothesis of this study will examine the impact of combined leverage on indicators of financial performance, ROA, ROE, and NPM. To achieve this purpose, the following hypotheses are formulated for the third hypothesis:

H3a There is no impact for combined leverage on return on assets.

H3b There is no impact for combined leverage on return on equity.

H3c There is no impact for combined leverage on net profit margin.

The study community consists of Bahraini industrial listed in Bahrain Bourse. The study sample consists of three huge industrial companies ALBA, BFM, and POLTRY for the period between (2016-2019).

Independent Variables

Financial leverage

The definition of the financial leverage simply leads to explore the extent to which the firms depend on financial institutions to respond to its funding needs, i.e. the degree of dependence of the firms in financing its investment using sources of financial interest fees, whether these resources are bank loans, debt securities or any other debt financial instruments. All these resources have direct impact on the shareholders profit and on increasing the risk exposure of the firm to the default risk. It depends on the use of third part resources to maximize the profit of the firm shareholders. To measure financial leverage that we calculate the ration of long and short-term debts to the total assets. It is directed related to the capital and funding structure of the firm. The Financial leverage is considered effective if the firm can invest the borrowed funds at a rate higher than the cost of the borrowed funds. In case that the firm could not be able to reach this objective, then it is exposed to a high level of risk and potential losses, which forces it to decrease the financial leverage due to the negative impact on firm performance (Zutter & Smart, 2021). Table 1 includes the appropriate formula to compute this ratio.

| Table 1 Leverage Ratios and Indicators of Financial Performance | |||

| Variables | Code | Indicator name | Indicator formula |

| Leverage ratios | DFL | Degree of Financial leverage | total debts/total assets |

| DOL | Degree of operating leverage | % Change in Operating Income/ % Change in Sales | |

| DCL | Degree of combined leverage | financial leverage × operating leverage | |

| Indicators of financial performance | ROA | Return on assets | net income/total assets |

| ROE | Return on equity | net income/shareholders’ equity | |

| NPM | Net profit margin | net income/revenues | |

Operating leverage

Operating leverage is defined as the percentage of fixed costs to variable costs that a company incurs in a specific period. If fixed costs exceed the value of variable costs, then it means that the firm has high operating leverage. It means also that the company is highly sensitive to changes in the volume of sales, and these fluctuations may affect the company's earnings before interest, taxes, and returns on the invested capital. The operating leverage can also be characterized by high values in large-cap companies such as iron, cement, and petroleum manufacturing companies. And low values in companies that are characterized by low capital volumes, such as insurance companies, banks, and wholesale trade companies, as these companies are characterized by high variable costs and low fixed costs. Regardless of the company's sales, it needs to pay fixed costs such as equipment depreciation, manufacturing overheads, and maintenance costs (Gitman & Zutter, 2015). To compute this ratio, Table 1 includes the appropriate formula for this purpose.

Combined leverage

Combined leverage is a tool for measuring the operational and financing risks that the company is exposed to, and thus it is the result of the two operational and financial levers. It also measures the ability of the company to maximize its net profits as a result of changes in its net sales, that is, it measures the impact of fixed costs, whether for its sources of funds or for the uses of this money on its net earnings (Gitman & Zutter, 2015).

The increase in the combined leverage of the organization means the increase in the overall risks (operational and financial), then the organization must take all necessary actions that would reduce these risks, such as reducing dependence on fixed-cost funding sources, and thus reducing financial and overall risks. Likewise, the company can work to reduce its fixed costs, and thus reduce operational risks and overall risks as well (Zutter & Smart, 2021; Rahman et al., 2020). Table 1 shows the formula for computing the combined leverage.

The Dependent Variables

Return on assets (ROA)

Return on assets (ROA) is measurement of the firm profitability relative to the resources used by the firm which are the total assets. This ratio reflects the management effectiveness of using the available resources (total assets) to create profits. The ROA informs the company about the profits obtained from the invested capital (assets). The ROA varies from one firm to another and through sectors, using the return on assets as a comparative measure should be done carefully considering the performance history of the company and the compare it with competitors and similar firms in the same industry (Gibson, 2012; Abdul, 2017). The firm’s assets are financed by a mixture of debt and equity which are the source of funds employed to ensure the continuity of the firm’s operations. The ROA reflects to which extent the company effectively transfers the funds invested to net income through the operating process. Generating high ROA indicates better performance of the firm because it reflects the better employment of the available resources (Gibson, 2012).

Return on equity (ROE)

Return on equity is an indicator that assesses the effectiveness of the money invested by corporate shareholders. As a matter of fact, ROE is the company's annual profit after taxes, fees, and other statutory expenses divided by the cost of all money invested by its founders and shareholders without borrowing money (Gibson, 2012).

As a general rule, investors prefer companies that have a higher return on equity. However, profits and incomes in various sectors of the economy differ greatly. For example, the index may differ even within the same sector if the company decides to pay dividends instead of keeping the dividend as available cash assets. Return on equity is usually calculated at the beginning and end of the financial period, and this enables the company to see real changes in profitability. This method provides an opportunity to assess growth dynamics and compare results with the performance of other companies (Gibson, 2012). Ultimately, the stable and increasing ROE attracts investors. The growth of return on equity means that the chosen company is reliable and can generate steady income because it knows how to use its capital wisely to increase performance and profits. On the other hand, a low return on equity may indicate that the company's management is making wrong decisions and is investing money in non-profit assets (Gibson, 2012). To compute this indicator, Table 1 shows its formula.

Net profit margin (NPM)

The net profit margin equals the amount of net income or profit generated as a percentage of revenue. The net profit margin is the ratio of net profits to revenues for a company or business sector. The net profit margin is usually expressed as a percentage. This ratio is calculated by dividing net income by sales (Gibson, 2012; Rahman, 2019). Table 1 shows the formula of this indicator.

Results and Discussion

Table 2 shows the financial, operating, and combined leverage ratios for the three companies and the period between (2016-2016). The results indicate that the financial leverage increases from year to year for all companies. For example, the financial leverage of ALBA reached 0.158 in 2016 and increased to 0.554 in 2019. While the financial leverage of BFM reached 0.185 in 2016 and increased to 0.227 in 2019. As for POLTRY, it reached 0.079 in 2016, and increased to 0.129 in 2019. As for the average financial leverage, it reached 0.045 in 2016, while it reached 0.303 in 2019. As for the average companies for all years, they were 0.422, 0.203, and 0.098 respectively. The standard deviation ranged between 0.045 in 2016 and 0.185 in 2019.

| Table 2 Descriptive Statistics for Leverage Ratios | ||||||

| No | Company | Degree of financial leverage | Company Mean | |||

| 2016 | 2017 | 2018 | 2019 | |||

| 1 | ALBA | 0.158 | 0.375 | 0.513 | 0.554 | 0.422 |

| 2 | BFM | 0.185 | 0.168 | 0.230 | 0.227 | 0.203 |

| 3 | POLTRY | 0.079 | 0.084 | 0.099 | 0.129 | 0.098 |

| Yearly Mean | 0.141 | 0.209 | 0.281 | 0.303 | ||

| Std. Deviation | 0.045 | 0.122 | 0.173 | 0.182 | ||

| Degree of operating leverage | ||||||

| 1 | ALBA | 0.072 | 0.234 | -0.610 | -0.461 | -0.191 |

| 2 | BFM | 0.124 | 7.978 | -35.816 | -28.710 | -14.106 |

| 3 | POLTRY | 0.132 | -0.229 | 0.487 | 0.997 | 0.347 |

| Yearly Mean | 0.109 | 2.661 | -11.980 | -9.391 | ||

| Std. Deviation | 0.027 | 3.764 | 16.861 | 13.673 | ||

| Degree of combined leverage | ||||||

| 1 | ALBA | 0.011 | 0.088 | -0.314 | -0.255 | -0.118 |

| 2 | BFM | 0.023 | 1.343 | -8.262 | -6.541 | -3.359 |

| 3 | POLTRY | 0.010 | -0.019 | 0.048 | 0.129 | 0.042 |

| Yearly Mean | 0.015 | 0.471 | -2.843 | -2.222 | ||

| Std. Deviation | 0.006 | 0.618 | 3.835 | 3.058 | ||

The operating leverage of ALBA ranged between 0.072 and -0.461 for the period between (2016-2019). In BFM, it reached 0.124 in 2016 and reached -28.710 in 2019. In POLTRY, it reached 0.132 in 2016 and 0.997 in 2019. Regarding the average operating leverage, the highest value reached 0.347 in POLTRY. As for the average of the years, the highest operating leverage reached 2,661 in 2017. Likewise, the standard deviation reached its highest value in 2018 with a value of 16.861, and the lowest value was 0.027 in 2016.

For combined leverage, the highest average value reached 0.042 in POLTRY. The yearly mean reached 0.471 in 2017 for all companies, while the lowest yearly mean reached -2.843 in 2018. The highest standard deviation reached 3.835 in 2018 and 0.066 in 2016. Table 3 shows that the highest average of return on assets for companies was 0.095 in BFM and the lowest average was 0.018 in POLTRY. For the annual average value of return on assets, it reached 0.086 in 2017 as the highest value and 0.021 as the lowest value in 2019. The standard deviation reached 0.128 in 2017 as the highest value and 0.012 in 2018 as the lowest value. For the return on equity, it reached 0.118 in BFM as the highest value and for years, it ranged between 0.112 in 2017 and 0.017 in 2018. The standard deviation ranged between 0.150 in 2017 and 0.017 in 2018.

| Table 3 Descriptive Statistics for Indications of Financial Performance | ||||||

| No | Company | Return on assets | Company Mean | |||

| 2016 | 2017 | 2018 | 2019 | |||

| 1 | ALBA | 0.041 | 0.055 | 0.027 | 0.002 | 0.031 |

| 2 | BFM | 0.035 | 0.227 | 0.048 | 0.071 | 0.095 |

| 3 | POLTRY | 0.075 | -0.023 | 0.027 | -0.009 | 0.018 |

| Yearly Mean | 0.050 | 0.086 | 0.034 | 0.021 | ||

| Std. Deviation | 0.022 | 0.128 | 0.012 | 0.043 | ||

| No | Company | Return on equity | Company Mean | |||

| 2016 | 2017 | 2018 | 2019 | |||

| 1 | ALBA | 0.049 | 0.088 | 0.056 | 0.005 | 0.050 |

| 2 | BFM | 0.043 | 0.273 | 0.063 | 0.092 | 0.118 |

| 3 | POLTRY | 0.082 | -0.025 | 0.030 | -0.011 | 0.019 |

| Yearly Mean | 0.058 | 0.112 | 0.050 | 0.029 | ||

| Std. Deviation | 0.021 | 0.150 | 0.017 | 0.055 | ||

| No | Company | Net profit margin | Company Mean | |||

| 2016 | 2017 | 2018 | 2019 | |||

| 1 | ALBA | 0.072 | 0.108 | 0.066 | 0.005 | 0.063 |

| 2 | BFM | 0.075 | -0.023 | 0.027 | -0.009 | 0.018 |

| 3 | POLTRY | 0.132 | -0.022 | 0.025 | -0.009 | 0.032 |

| Yearly Mean | 0.093 | 0.021 | 0.039 | -0.004 | ||

| Std. Deviation | 0.034 | 0.075 | 0.023 | 0.008 | ||

Table 3 also shows that the highest average of net profit margin was for ALBA with 0.063 and as the lowest average was for BFM with 0.018. The highest yearly mean reached 0.093 in 2016 and -0.004 in 2019. The standard deviation ranged between 0.008 and 0.075. Testing the hypotheses of this study requires conducting the necessary financial and statistical analysis, and arranging them in tables to facilitate the process of observing data and commenting on them in the framework of determining the relationship between the study variables. This study is mainly concerned with studying the impact of leverage ratios, financial, operating, and combined leverages, and the financial performance indicators for a group of industrial companies in Bahrain. Using the financial statements of the companies under study, all independent and dependent variables of this study have computed for the period between (2016-2019). To achieve the study objectives, the impact of leverage ratios on indicators of financial performance has examined. Pearson correlation has used to examine the relationship between the independent variables and the dependent variables as shown in Tables 4, 5, and 6.

| Table 4 Pearson Correlation between Financial Leverage and Indicators of Financial Performance | ||||

| Financial leverage | ROA | ROE | NPM | |

| R | 0.133 | 0.049 | 0.125 | |

| Significant | 0.680 | 0.880 | 0.698 | |

| Table 5 Pearson Correlation between Operating Leverage and Indicators of Financial Performance | ||||

| Operating leverage | ROA | ROE | NPM | |

| R | 0.080 | 0.069 | 0.005 | |

| Significant | 0.804 | 0.832 | 0.987 | |

| Table 6 Pearson Correlation Between Combined Leverage and Indicators of Financial Performance | ||||

| Combined leverage | ROA | ROE | NPM | |

| R | 0.048 | 0.036 | 0.040 | |

| Significant | 0.883 | 0.912 | 0.901 | |

The first hypothesis examines the impact of financial leverage on indicators of financial performance, which has been formulated into three sub-hypotheses. Table (4) shows the absence of any significant impact for the financial leverage on the three indicators of financial performance, ROA, ROE, and NPM, where the correlation coefficient reached 0.133, 0.049, and 0.125 respectively. Also, the significant value for the impact of the financial leverage on all the dependent variables is more than 0.05. this proves that the financial leverage has no impact on all the indicators of financial performance. Based on the above, we accept the first main hypothesis with its three sub-hypotheses which state that financial leverage has no impact on ROA, ROE, and NPM.

This result is supported by Megawati (2020) and Ali (2020), but at the same time, it differs from many other studies, such as Ilyukhin (2015) and Javeda et al. (2015) whose indicate a negative impact between financial leverage and corporate financial performance. Another study such as Saleem et al. (2013) indicates a significant relationship between financial leverage and profitability. These differences in results among studies can be explained by the fact that the economic conditions of each country are different. Also, many companies have benefited from some support and encouragement by the Bahraini government, which reduces the effectiveness and efficiency of financial leverage in affecting the financial performance of the companies.

The second hypothesis examines the impact of operating leverage on indicators of financial performance. This hypothesis has distrusted into three sub-hypotheses to examine the impact of operating leverage on ROA, ROE, and NPM. (Table 5) indicates no significant relationship between the operating leverage and ROA, ROE, and NPM, where the correlation coefficient reached 0.080, 0.069, and 0.005 respectively. Also, the significant value for the impact of the operating leverage on all the dependent variables is more than 0.05, which emphasizes the same result. Accordingly, we accept the second main hypothesis and its sub-hypotheses. The absence of any relationship between the operating leverage and the three financial performance indicators can be explained by the fact that the industrial companies listed in Bahrain Bourse cannot influence the cost structure including variable and fixed costs through the period between (2016-2019), and this might be because of the absence of new investments made by those companies through the same period. This result is supported by studies of Megawati (2020) and Ali (2020), which showed that there is no statistically significant relationship between operating leverage and profitability indicators, while the study of Chandrakumarmangalam & Govindasamy (2010) proved a clear statistically significant effect between the operating leverage and profitability.

The third hypothesis examines the impact of combined leverage on indicators of financial performance. This hypothesis has also distrusted into three sub-hypotheses to examine the impact of combined leverage on ROA, ROE, and NPM. Table (6) indicates that there is no significant relationship between the combined leverage and t ROA, ROE, and NPM, where the correlation coefficient reached 0.048, 0.036, and 0.040 respectively. Also, the significant value for the impact of the combined leverage on all the dependent variables is more than 0.05, which emphasizes the same result. Accordingly, we accept the third main hypothesis and its sub-hypotheses. This result is supported by studies of Megawati (2020) and Ali (2020).

Table 7 summarizes the results of all sub-hypotheses to show which hypothesis either accepted or rejected accordingly:

| Table 7 Results of Hypotheses | ||

| Hypothesis | Impact | Result |

| H1a | Financial leverage → Return on assets | Accepted |

| H1b | Financial leverage → Return on equity | Accepted |

| H1c | Financial leverage → Net profit margin | Accepted |

| H2a | Operating leverage → Return on assets | Accepted |

| H2b | Operating leverage → Return on equity | Accepted |

| H2c | Operating leverage → Net profit margin | Accepted |

| H3a | Combined leverage → Return on assets | Accepted |

| H3b | Combined leverage → Return on equity | Accepted |

| H3c | Combined leverage → Net profit margin | Accepted |

Based on the previous table we notice that all the nine sub-hypotheses and therefore the main hypotheses are accepted. This means that all leverage ratios based on the results of this study have no impact on any indicator of financial performance.

Conclusions

The following conclusions are based on the results of the study:

1- Financial leverage does not affect all the three financial performance indicators profit margin ratios, return on equity and return on assets in the companies under study.

2- There is no relationship between operating leverage and all the indicators of financial performance, return on assets, return on equity, and net profit margin ratios in the companies under study.

3- There is no impact for the combined leverage on indicators of financial performance, return on assets, return on equity, and net profit margin ratios in the companies under study.

Recommendations

Based on the above and the conclusions of this study, the following recommendations can be addressed:

1. The necessity to study and evaluate the financing structure of the companies under study to achieve an optimum rate of leverage within the financing structure.

2. The need for alternative financing sources to ensure obtaining the necessary loans for financing operations at the lowest costs thus, achieving optimum leverage.

3. Employing the borrowed money in a reasonable way that will best achieve a high return and reduces liquidity risk.

4. Conduct more studies that cover other dependent variables such as earnings per share, economic value-added and other variables.

5. Conduct more studies to understand the real impact of the leverage ratios on the financial performance of companies.

6. Conduct other studies to rule out results from this study and previous studies and come out with more timely relevant results for improvements of the issues.

References

- Abdul, A.A.A. (2017). The relationship between solvency ratios and profitability ratios: Analytical study in food industrial companies listed in Amman Bursa. International Journal of Economics and Financial Issues, 7(2), 86.

- Ali, M. (2020). Impact of leverage on financial performance (evidence from Pakistan food and fertilizer sector). Journal of Critical Reviews, 7(13), 447-456.

- Alipour, M., & Pejman, M.E. (2015). The impact of performance measures, leverage and efficiency on market value added: Evidence from Iran. Global Economics and Management Review, 20(1), 6-14.

- Anton, S.G. (2016). The impact of leverage on firm growth. Empirical evidence from Romanian listed firms. Review of Economic and Business Studies, 9(2), 147-158.

- Brealey, R.A., Myers, S.C., Allen, F., & Mohanty, P. (2012). Principles of corporate finance. Tata McGraw-Hill Education.

- Brewer, P., Garrison, R., & Noreen, E. (2021). Management Accounting, USA: McGraw Hill.

- Chandrakumarmangalam, S., & Govindasamy, P. (2010). Leverage: An analysis and its impact on profitability with reference to selected cement companies in India. European Journal of Economics, Finance and Administrative Sciences, 27(1), 53-65.

- Durrah, O., Rahman, A.A.A., Jamil, S.A., & Ghafeer, N.A. (2016). Exploring the relationship between liquidity ratios and indicators of financial performance: An analytical study on food industrial companies listed in Amman Bursa. International Journal of Economics and Financial Issues, 6(2).

- Gibson, C.H. (2012). Financial reporting and analysis. Cengage Learning.

- Gitman, L.J., Juchau, R., & Flanagan, J. (2015). Principles of managerial finance. Pearson Higher Education AU.

- Ilyukhin, E. (2015). The impact of financial leverage on firm performance: Evidence from Russia. Corporate Finance, 9 (2).

- Javed, Z.H., Rao, H.H., Akram, B., & Nazir, M.F. (2015). Effect of financial leverage on performance of the firms: Empirical evidence from Pakistan. SPOUDAI-Journal of Economics and Business, 65(1-2), 87-95.

- Liargovas, P., & Skandalis, K. (2009). The impact of leverage and other key variables on firm’s performance: evidence from Greece (No. 00040).

- Megawati, L.R. (2020). The analysis of effects of operating leverage, financial leverage, and liquidity on profitability in the telecommunications industry listed in indonesia stock exchange. In First ASEAN Business, Environment, and Technology Symposium (ABEATS 2019) (pp. 110-115). Atlantis Press.

- Niaz, A.Z.M., Rahman, M.M. & Zayed, N.M. (2015). Implementing Activity Based Costing in Private Universities of Bangladesh: An Exigency. MTC Global Journal of Management & Entrepreneurship, 3(6), 95-104.

- Perinpanathan, R. (2014). Impact of financial leverage on financial performance special reference to John Keels Holdings PLC Sri Lanka. Scientific Research Journal (SCIRJ), 2.

- Rahman, A.A.A.A. (2019). The impact of strategic planning on enhancing the strategic performance of banks: evidence from Bahrain. Banks and Bank Systems, 14(2), 140.

- Rahman, M.M., Saima, F.N., & Jahan, K. (2020). The impact of financial leverage on firm's profitability: An empirical evidence from listed textile firms of Bangladesh. The Journal of Business Economics and Environmental Studies, 10(2), 23-31.

- Rehman, S.S.F.U. (2013). Relationship between financial leverage and financial performance: Empirical evidence of listed sugar companies of Pakistan. Global Journal of Management and Business Research.

- Saleem, Q., Rahman, R.U., & Sultana, N. (2013). Leverage (Financial and Operating) Impact on profitability of oil and gas sector of SAARC Countries. American Based Research Journal, 1(3), 29-56.

- Samo, A.H., & Murad, H. (2019). Impact of liquidity and financial leverage on firm’s profitability–an empirical analysis of the textile industry of Pakistan. Research Journal of Textile and Apparel.

- Vijayalakshmi, D., & Manoharan, P. (2015). Corporate leverage and its impact on EVA and MVA. International Journal of Multidisciplinary Research and Development, 2(2), 22-25.

- Zutter, C.J., & Smart, S. (2021). Principles of managerial finance (What's New in Finance) (15th ed.). USA: Person.