Research Article: 2021 Vol: 20 Issue: 6S

Impact of risk-oriented factor and financial capability on saving behavior: An examination of Thai workers and international workers

Narit Kerdvimaluang, Silpakorn University International College (SUIC)

Jantima Banjongprasert, Silpakorn University International College (SUIC)

Abstract

This research aims to analyze the effect of financial capability on saving plan intention and the effect of risk-oriented factor on saving plan intention. In mediating effect, the effect of saving plan intention as the mediator between financial capability and saving behavior. The effect of saving plan intention as the mediator between risk-oriented factor and saving behavior. The research was organized from 400 worker survey data (300 Thais, 100 foreigners) working in Thailand in various occupations. This research analysis method was analyzed by using Structural Equation Modeling (SEM) Amos. The finding indicated that financial capability has a positive effect on saving plan intention (0.560), and the effect of risk-oriented factors has positive effect on saving plan intention (0.700) as well. There is the direct effect from financial capability on saving behavior (0.599). Risk-oriented factors provides the direct effect to saving behavior (0.486). Thereby, employees focus on the knowledge development of financial capability and risk-oriented factors to provide higher ability to develop saving plan intention and saving behavior for successful retirement financial planning. This research helps people to understand the relationship of financial capability, risk-oriented, saving plan intention, saving behavior on retirement financial planning. This study makes a great contribution of comprehensive model to explain about financial behavior on retirement planning.

Keywords

Financial Capability, Risk-Oriented Factors, Saving Plan Intention, Saving Behavior, Retirement Planning

Introduction

Many countries all over the world face the lower government pension fund for elders because of changing in population structure and aging society (OECD, 2015). Declining population in many continents generate the main impact on economic development and less aggregate productivity growth (Carbonaro et al., 2018). The small amount of population growth and the better standard of medical treatment lead to aging society with imbalance financial management. The future retiree cannot rely on government social security fund. Voluntary pension plans, workers should start saving and investing in financial asset to generate the adequate retirement preparation to prevent poverty problem in the retiring period. After retiring period, elders involve less income but the higher expense on health care treatment and elderly care products. Rhee (2013) explained that the main problem for retirement stage is insufficient retirement saving with higher expense. Grace, et al., (2010) pointed out that there is the big effect from public issues like the lower birth rate and the longer life expectancy generating many researches and public debate. Many countries should encourage the importance of national retirement saving and future plan for supporting the retirement planning for people. Lusardi & Mitchell (2011) said that people always fail to have the financial planning for retirement. The small amount of retirement saving or lack of retirement planning could lead to improper or even no plans for retirement stage. People have their own financial investment on retirement planning differing from one another because everyone is totally different in details of employment, earning amount, return on investment, mortality rate, tax incentive and benefit from pension fund system, (Crawford & O’Dea, 2020). From improper decision, people could bring themselves into the insufficient funding in the retiring period that governments should be one of the important parts to defined the saving amount and pension system to help people, (Pereira & Afonso, 2020). There are so many mistakes on retirement planning, such as, wrong retirement financial decisions, no attention on retirement choice, improper knowledge to make decision and other related risks, (Sandbrook & Ravi-Burslem, 2019). Laster, et al., (2016) suggest that financial capability and risk-oriented factors have relationship to saving intention. In addition, saving intention are significantly related to saving behavior (Akhtar & Das, 2019). Also, there is relationship from financial capability and risk-oriented factors to saving behavior (O’Connell, 2012; Lusardi & Mitchell, 2017). Thus, this study aims to examine the impact of financial capability and risk-oriented factors on saving plan intention, and the implication on saving behavior among Thai and International employees in Thailand.

Literature Review

Financial Capability

Financial capability refers to financial education (Xiao & O’Neill, 2016). There are different levels of financial capability involving different abilities to understand, analyze, and evaluate financial packages offered in the market. This research, thus, focuses on financial capability, which is critical ability to understand the financial information and evaluate basic calculation when analyzes the financial products and services (Lusardi, 2011). Furthermore, to manage retirement plan effectively, working people need to have financial abilities regarding financial literacy, financial knowledge, and financial numeracy.

Financial Literacy

Financial literacy, refers to obtaining, understanding, and analyzing all financial information (Caplinska & Ohotina, 2019). In addition, workers with high level of financial literacy tend to have the ability to comprehend and understand financial information. This is likely to result in evaluate the right choice of financial products that has the potential to generate returns from the investment.

Financial Knowledge

Financial knowledge is the understanding of financial products and services offered for retirement plans. Many employees tend to have problems about the retirement planning because of inadequate financial knowledge, and failed plan for retirement planning properly. Robb (2014) pointed out that the financial knowledge is the important variable on the financial decision making on financial products and services. Financial knowledge helps to obtain, understand, evaluate financial information, and make financial decision. Moreover, financial knowledge is positive related to retirement financial planning activity and financial saving behavior (Nguyen et al., 2017).

Financial Numeracy

Financial numeracy creates higher proficiency and expertise in managing financial

products and services. Specifically, it helps investors to comprehend financial concepts, financial information, and basic financial calculation. Lusardi (2012) proposed that the financial numeracy is used for processing, understanding, acquiring and using proficiency from financial information and concepts together with the knowledge background in the financial area. Investors with high level of financial numeracy can manage their investment portfolio successfully, and avoid poor financial outcomes.

Financial capability comprising financial literacy, financial knowledge, and financial numeracy, is vital to understand and evaluate financial products and services, which consequently affect saving plans. There are many studies demonstrate that financial capability shows the positive relationship on saving plan intention (e.g. Lusardi, 2011). With regard to the association mentioned, financial capability is correlated with saving plan intention. Hence, it can be hypothesized that,

H1 Financial Capability has a positive influence on Saving Plan Intention.

Risk-Oriented Factors

Personal risks and market risks for retirement planning are longevity risk, healthcare risk, sequence of return risk, and inflation risk (Laster et al., 2016). The level of personal risks of people, which are longevity risk and healthcare risk, are different due to different personal conditions. Market risks consisting of financial asset sequence of return and inflation risk, involves external factors that are different from country to country (Abraham & Harris, 2016). Thus, all risk-oriented factors should be considered carefully on retirement financial planning and saving because all risks affect significantly the employees’ wealth.

Longevity Risk

Longevity Risk is the risk for each individual associating with the different outcomes between future mortality and life expectancy outcomes (Barrieu et al., 2012). Abraham and Harris (2016) studied the retirees with life span estimation that showed around 40 percent of people underestimated by five years or more about their longevity. Therefore, the life span underestimation, the higher risk on the saving money is not enough for retirees’ spending. Broeders, et al., (2019) explained that the investment of pension funds would face the global trend for the macro-longevity risk and longer mortality rates from the medical development.

Healthcare Risk

Aging population grows rapidly all over the world and increases healthcare service demand Zhou, et al., (2020). Abraham & Harris (2016) explained that around 75 percent of retiring people is highly concerned the skyscraper costs of health care expense. Thus, employees are likely to have higher healthcare expense after the retirement period. From insufficient retirement saving, unaffordable high quality healthcare expenditures could make a lot of retirees suffering from lower quality medical treatment in many countries.

Sequence of Return Risk

Sequence of return risk is improper financial asset allocation portfolio that results in low return on retirement funding. Doran, et al., (2012) said that people near the retirement period are affected by two related forces in the financial retirement planning; the size of investment portfolio and the problem of sequence of return risk. It is very important role to focus on sequence of return risk issue.

Inflation Risk

Inflation rate affects people with low purchasing power especially during the retirement period with no regular income. Inflation risk is the risk for the decreasing value of money on the limited saving money (Bekaert & Wang, 2010). Employees increase salary over the working time that compensate with the higher inflation each year. At the retirement stage, there is no income from salary so that the higher inflation causing the high risk and play the important aspect in the retirement risk.

Risk-oriented factors, which are longevity risk, healthcare risk, sequence of return risk, and inflation risk, are essential factors for retirement planning. Indeed, Laster, et al., (2016) show the positive relationship between risk-oriented factors and saving plan intention. Thereby, risk-oriented factors are proposed to correlate with the saving plan intention in retirement financial planning. Hence, the hypothesis can be set up as,

H2 Risk-Oriented Factor has a positive influence on Saving Plan Intention.

Saving Plan Intention and Saving Behavior

The retirement saving plan intention can lead to the retirement decision process (Topa & Alcover, 2015). People with different retirement saving intention level can generate different decision. Financial capability and risk-oriented factors can lead to a significant impact on saving plan intention and saving behavior. Saving Behavior is the actual investment by using personal option for the future preparation in the financial aspect (Kimiyagahlam et al., 2019). Saving intention is the behavioral intention that leads to the action on actual saving behavior (Widyastuti et al., 2016). Fishbein & Ajzen (1975) explain that there is the relationship between behavioral intention and actual behavior from consumer behavior study. Moreover, most people think the saving behavior on retirement financial planning is necessary for nearly retirement. Many people start save for retirement too late which it is not enough at the end. Although saving behavior on financial retirement planning is difficult, few people could do it in the right way.

Lursadi (2011) stated that financial capability correlates positively to saving plan intention and saving behavior. Laster, et al., (2016) point out that there is the positive relationship between risk-oriented factor and saving plan intention. They also illustrated that risk-oriented factors also have a positive relationship with saving behavior in the financial retirement planning. Thereby, this study proposes that saving plan intention may have a mediating effect in the following ways.

H3 Saving Plan Intention significantly mediates the relationship between Financial Capability and Saving Behavior.

H4 Saving Plan Intention significantly mediates the relationship between Risk-oriented Factors.

Research Methodology

This research applies quantitative approach by using questionnaire used to analyze data Structural Equation Model (SEM) Amos, modification indices, and good-fitness indices (Hooper, Coughlan & Mullen, 2013; Knekta Runyon & Eddy, 2019). Moreover, the sample of this research 384 round up to 400 is Thai and International workers in Thailand with respondents 400 (300 Thai employees and 100 International employees). Cochran (1977) explained that the calculation of sample size for unknown population portion (p=0.5) by formular at 0.05 significant level (Z=1.96) is 384 samples.

Moreover, questionnaire is composed of two parts. The first part is the questions focusing on the employees’ decision-making factors which are Financial Capabilities, Risk-Oriented Factors, Saving Plan Intention, and Saving Behavior. The answers were rated on 5-point Likert Scale from strongly disagree 1 to strongly agree 5. The second part is demographic data such as gender, age, nationality, marital status, the level of education, and others.

As the level of income is related to Tax incentive program and retirement financial program. Also, The Board of Investment of Thailand showed the average income per capital in Thailand was 7,216.6 USD per year (1 USD=33.42) around 20,098.23 Bath/month The respondents who have income higher than 20,000 Bath/month were asked to participate in the survey.

The measurement of questionnaires is divided into four parts; Financial Capability, Risk-Oriented Factor, Saving Plan Intention, and Saving Behavior. For financial capability, this paper would measure from Financial Literacy (FL) (Caplinska & Ohotina, 2019), Financial Knowledge (FK) (Nguyen et al., 2017) and Financial Numeracy (FN) (Lusardi, 2012). In risk-oriented factor, there are four parts to identify retirement risk; Longevity Risk (LGR) (Barrieu et al., 2012), Healthcare Risk (HCR) (Zhou et al., 2020), Sequence of Return Risk (SRR) (Doran et al., 2012), and Inflation Risk (IFR) (Laster et al., 2016). Also, two more constructs in research about Saving Plan Intention (Topa & Alcover, 2015) and Saving Behavior (Kimiyagahlam et al., 2019).

The construct’s reliability and validity tests were conducted in the measurement model. For reliability statistic, the Cronbach’s Alpha in each construct is shown in Table 1. Moreover, KMO is 0.925 (more than 0.6) and Barlett’s Test sig. 0.000 (less than 0.05). Furthermore, this study has to be normal distribution data from skewness and kurtosis values in every component in the range (-3,3). Thus, all of this information explain that this research is the normal distribution in excellent value for Cronbach’s Alpha, KMO, and Barlett’s Test.

Confirm Factor Analysis (CFA) was studied in first order, second order, and higher order on the structural equation model. The final model was adjusted and constructed from the first initial for good-fit model criteria. The two degree of freedom ratio is 2.732 (CMIN/DF<3), p-value=0.061 indicating moderate good fit, GFI=0.833, AGFI=0.804, and RMSEA=0.062 for absolute fit index. Also, the comparative fit index is moderate good fit as well because of CFI=0.888, NFI=0.835 and TLI=0.868. From all index, this was accepted for higher step analysis to confirm hypothesis from structural equation model.

Composite Reliability (C.R.), Average Variance Extracted (AVE) and discriminant validity and correlation matrix among the research construct were shown in Table 1 and Table 2.

| Table 1 Reliability and Convergent Validity |

|||

|---|---|---|---|

| Variables | Alpha | C.R. | AVE |

| Financial Capability | 0.893 | 0.865 | 0.601 |

| Financial Literacy (FL) | 0.857 | 0.891 | 0.672 |

| Financial Knowledge (FK) | 0.904 | 0.899 | 0.641 |

| Financial Numeracy (FN) | 0.801 | 0.803 | 0.505 |

| Risk-oriented | 0.886 | 0.82 | 0.536 |

| Longevity Risk (LGR) | 0.799 | 0.801 | 0.521 |

| Healthcare Risk (HCR) | 0.892 | 0.888 | 0.618 |

| Sequence of Return Risk (SRR) | 0.83 | 0.827 | 0.501 |

| Inflation Risk (IFR) | 0.814 | 0.802 | 0.504 |

| Saving Plan Intention (SPI) | 0.874 | 0.881 | 0.553 |

| Saving Behavior (SVB) | 0.861 | 0.878 | 0.549 |

| Table 2 Discriminant Validity and Correlation Matrix Among the Research Constructs |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Constructs | FL | FK | FN | LGR | HCR | SRR | IFR | SPI | SVB |

| FL | 0.82 | ||||||||

| FK | 0.668 | 0.801 | |||||||

| FN | 0.483 | 0.575 | 0.711 | ||||||

| LGR | 0.487 | 0.573 | 0.457 | 0.722 | |||||

| HCR | 0.349 | 0.486 | 0.432 | 0.594 | 0.786 | ||||

| SRR | 0.552 | 0.714 | 0.618 | 0.566 | 0.492 | 0.707 | |||

| IFR | 0.416 | 0.481 | 0.482 | 0.541 | 0.354 | 0.648 | 0.71 | ||

| SPI | 0.646 | 0.707 | 0.648 | 0.674 | 0.581 | 0.609 | 0.586 | 0.744 | |

| SVB | 0.592 | 0.725 | 0.548 | 0.588 | 0.521 | 0.687 | 0.479 | 0.707 | 0.741 |

Research Results

Financial Capability, Risk-Oriented Factor, Saving Plan Intention, and Saving Behavior

Employees agree with all factors affecting to retirement financial planning in financial capability, risk-oriented factor, saving plan intention and saving behavior in high level for mean score (3.90, 3.82, 4.07, and 3.85) and the level of standard deviation (0.56, 0.51, 0.56, and 0.66) respectively. Analysis of this study shows that financial capability and saving plan intention have a significant relationship (β=0.560, p-value<0.001). Hence H1 of the study is supported. Next, risk-oriented factor and saving plan intention also show a significant association (β=0.700, p-value<0.001). Hence H2 of the study is supported.

| Table 3 Summary of Standardized Estimate, Standard Error, and Critical Value |

||||||||

|---|---|---|---|---|---|---|---|---|

| Hypothesis | Items | Standardized estimate | S.E. | C.R. | P | Hypothesis Result | ||

| H1 | FC | → | SPI | 0.56 | 0.053 | 10.014 | *** | Accepted |

| H2 | ROF | → | SPI | 0.7 | 0.053 | 9.401 | *** | Accepted |

| Note: Significant level as of 0.001 | ||||||||

From Table 4, the study presents that saving plan intention is not significantly mediated the relationship between financial capability and saving behavior. Hence H3 of the study is not supported. However, there is the direct effect from financial capability to saving behavior (standardized direct effect=0.599, p-value<0.001). Also, saving plan intention is not significantly mediated the relationship between risk-oriented factors and saving behavior. Hence H4 of the study is not supported. The direct effect between risk-oriented factors and saving behavior have significant association (standardized direct effect=0.486, p-value<0.001).

| Table 4 Summary Of Testing Mediator Models |

|||||

|---|---|---|---|---|---|

| IV-DV | IV-M-DV | Mediation Type | |||

| Direct | Direct | Indirect | |||

| H3 | FC -> SPI -> SVB | 0.599(***) | 0.282(0.016) | 0.147 (ns) | NS, No mediation |

| H4 | ROF -> SPI -> SVB | 0.486(***) | 0.092(0.511) | 0.174 (ns) | NS, No mediation |

| Note: Significant level as of 0.001 | |||||

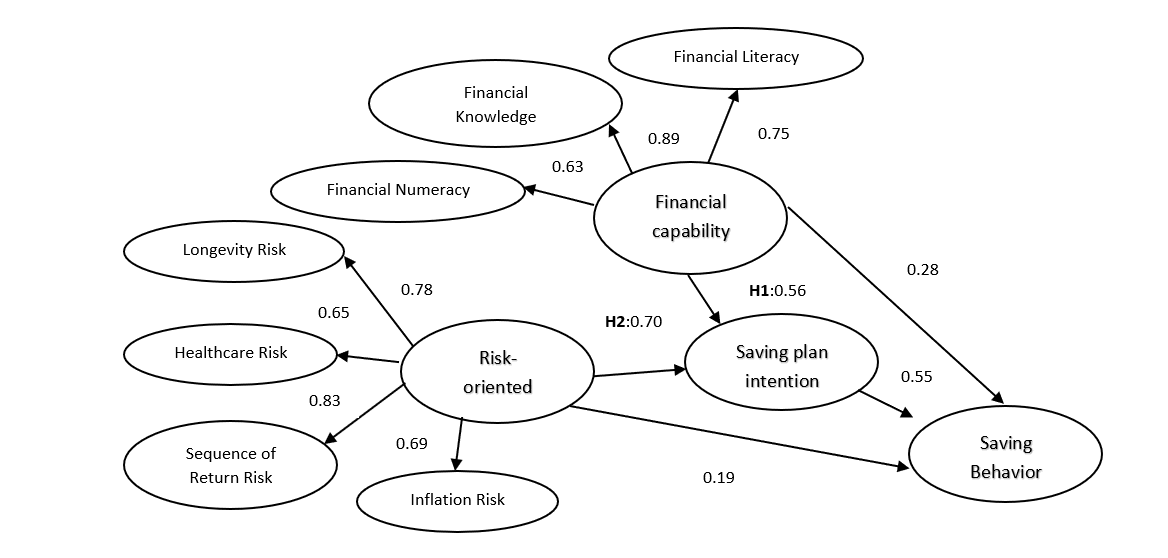

All variables were accepted at significant level of 0.001 and absolute value of t-test or C.R. higher than 1.96 for all testing hypothesis, so all hypotheses were accepted. From the standardized estimate (β), the standardized estimate of financial capability had the positive effect on saving plan intention with (β=0.560), the standardized estimate of risk-oriented on saving plan intention with (β=0.700), and the standardized estimate of saving plan intention (β=0.550) on saving behavior, the standardized estimate of financial capability (β=0.28) on saving behavior and the standardized estimate of risk-oriented (β=0.019) on saving behavior. The factor loading of all model would be described in the Figure 1.

Figure 1: The Model of Financial Capability, Risk-Oriented Factors, Saving Plan Intention, and Saving Behavior

Path Analysis Results

Path analysis is developed to test hypothesis. The result of study has been shown in Table 6. The regression weight and critical ratio test that financial capability (0.560, p-value<0.001) risk-oriented factors (0.700, p-value<0.001) have a strong relationship with saving plan intention. Moreover, the regression weight and critical ratio show that financial capability (0.285, p-value<0.05) and risk-oriented factors (0.191, p-value<0.05) have a relationship with saving behavior.

| Table 6 Result of Structural Model |

||||

|---|---|---|---|---|

| Paths | Standardized estimate | S.E. | C.R. | P |

| SPI FC | 0.56 | 0.053 | 10.014 | *** |

| SPI ROF | 0.7 | 0.053 | 9.401 | *** |

| SVB FC | 0.285 | 0.118 | 2.406 | * |

| SVB ROF | 0.191 | 0.264 | 2.888 | * |

| Note: Significant level as of ***(0.001) and *(0.05) | ||||

Discussion and Recommendation

This study explained that Financial Capability and Risk-Oriented from workers showed the positive relationship on the Saving Plan Intention. From financial capability, there are three important parts for creating workers financial capability; Financial Knowledge, Financial Literacy, and Financial Numeracy. For retirement risk, there were four parts for Risk-oriented factors on retirement stage, such as, Longevity Risk, Healthcare Risk, Sequence of Return Risk and Inflation Risk. In addition, workers concerned more about sequence of return risk comparing to longevity risk, inflation risk, and healthcare risk respectively. Financial capability has positive relationship on saving plan intention so financial literacy, financial knowledge, and financial numeracy have the relationship on saving plan intention. Perhaps part of the explanation in this relationship is about debt knowledge that people do not have much knowledge to manage debt with overspending during working lives (Lusardi, 2011). Risk-oriented factors have positive relationship on saving plan intention that longevity risk, healthcare risk, sequence of return risk, and inflation risk have influenced on saving plan intention. Laster, et al., (2016) indicate that people understand and concern about all related risk for retirement to be more risk tolerant than no risk idea people. For higher risk tolerant, people tend to invest more in some riskier asset to generate higher return for retirement saving. Also, financial capability (financial literacy, financial knowledge, and financial numeracy) has positive relationship on saving behavior. Risk-oriented factors (longevity risk, healthcare risk, sequence of return risk, and inflation risk) have positive relationship on saving behavior. So, all of these results relate to the previous academic research, academic theory, and academic journal.

The implication of this research should be divided into two different aspects between employees and policy makers. First, this implication on all workers showed that people should pay more intention on the financial capability and retirement risk-oriented factors because both of them could lead definitely to saving plan intention and saving behavior for employees. In terms of financial capability, people should find and learn more about financial literacy, financial knowledge, and financial numeracy from financial institution and other places. From technology advancement, there are so many financial capabilities provided on many channels; television program, internet program, book, and other forms. In cases of risk-oriented factor, employees should concern more on the retirement risk (longevity risk, healthcare risk, sequence of return risk, and inflation risk) which retirement period would affect to employees with higher level of risk at non regular income period. Thereby, people should concern more on financial capability and risk-oriented factors that could lead to saving plan intention and saving behavior. After having saving plan intention, workers would implement and develop until coming up with the actual saving behavior. Workers’ saving behavior save more money on the retirement plan budget that could lead to the proper retirement life in the resting period of time. For policy makers, there are two level at the organization level and country level which the management level of the company and government should try to encourage people to have their own retirement saving budget more. More saving money on retirement budget, more stable and less problem produce on the retirement period.

Conclusion

Employees in every part of the world should focus more on their own retirement saving fund. Moreover, the employees in the well-organized retirement budget from government policy might not get any effect on their retirement life unless government’s policy provide some money on pension fund. However, the aging society and small birth rate could create effect on every country in the future. Therefore, workers should rely on their retirement financial saving plan coming from saving plan intention and saving behavior. There are two different parts on saving plan intention and saving behavior from financial capability and risk-oriented factors. So, people pay a lot of attention on both financial capability and risk-oriented factors. For financial capability, this ability should be divided into 3 parts; financial knowledge, financial literacy, and financial numeracy. Thus, people should increase their financial ability that has a strong positive relationship on saving plan intention and saving behavior. In addition, risk-oriented factors could provide the significant impact on retirement plan intention and saving behavior as well consisting of sequence of return risk, longevity risk, inflation risk, and healthcare risk. So, all workers should have proper saving amount on the retirement period which should focus more on creating financial capability and reducing risk-oriented factors.

Acknowledgement

Narit Kerdvimaluang,Silpakorn University International College (SUIC), Silpakorn University, Thailand,Email: KERDVIMALUANG_N@silpakorn.edu, Jantima Banjongprasert Silpakorn University International College (SUIC), Silpakorn University, Thailand,Email: BANJONGPRASERT_J@silpakorn.edu

References

- Abraham, K.G., & Harris, B.H. (2016). The market for longevity annuities. The Journal of Retirement, 3(4), 12-27.

- Akhtar, F., & Das, N. (2019). Predictors of investment intention in Indian stock markets: Extending the theory of planned behaviour. International Journal of Bank Marketing, 37(1), 97-119.

- Barrieu, P., Bensusan, H., El Karoui, N., Hillairet, C., Loisel, S., … & Salhi, Y. (2012). Understanding, modelling and managing longevity risk: Key issues and main challenges. Scandinavian Actuarial Journal, 2012(3), 203-231.

- Bekaert, G., & Wang, X. (2010). Inflation risk and the inflation risk premium. Economic Policy, 25(64), 755-806.

- Broeders, D., Mehlkopf, R., & Van Ool, A. (2019). Managing macro-longevity risk. IPE Magazine, 54-56.

- Caplinska, A., & Ohotina, A. (2019). Analysis of financial literacy tendencies with young people. Entrepreneurship and Sustainability Issues, 6(4), 1736.

- Carbonaro, G., Leanza, E., McCann, P., & Medda, F. (2018). Demographic decline, population aging and modern financial approaches to urban policy. International Regional Science Review, 41(2), 210-232.

- Cochran, W.G. (1977). Sampling techniques, (3rd Edition). Wiley.

- Crawford, R., & O'Dea, C. (2020). Household portfolios and financial preparedness for retirement. Quantitative Economics, 11(2), 637-670.

- Doran, B., Drew, M.E., & Walk, A.N. (2012). The retirement risk zone: A baseline study. JASSA.

- Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behavior: An introduction to theory and research.

- Grace, D., Weaven, S., & Ross, M. (2010). Consumer retirement planning: An exploratory study of gender differences. Qualitative Market Research: An International Journal, 13(2), 174-188.

- Hooper, D., Coughlan, J., & Mullen, M.R. (2013). The services cape as an antecedent to service quality and behavioral intentions. Journal of services marketing, 27(4), 1-27.

- Kimiyagahlam, F., Safari, M., & Mansori, S. (2019). Influential behavioral factors on retirement planning behavior: The case of Malaysia. Journal of Financial Counseling and Planning, 30(2), 244-261.

- Knekta, E., Runyon, C., & Eddy, S. (2019). One size doesn’t fit all: Using factor analysis together validity evidence when using surveys in your research. CBE-Life Sciences Education, 18(1), rm1.

- Laster, D., Vrdoljak, N., & Suri, A. (2016). Strategies for managing retirement risks. The Journal of Retirement, 4(1), 11-18.

- Lusardi, A. (2011). Americans' financial capability (No. w17103). National Bureau of Economic Research.

- Lusardi, A., & Mitchell, O.S. (2011). Financial literacy and planning: Implications for retirement wellbeing (No. w17078). National Bureau of Economic Research.

- Lusardi, A. (2012). Numeracy, financial literacy, and financial decision-making (No. w17821). National Bureau of Economic Research.

- Lusardi, A., & Mitchell, O.S. (2017). How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness. Quarterly Journal of Finance, 7(03), 1750008.

- Nguyen, T.A.N., Rózsa, Z., Belás, J., & Belásová, ?. (2017). The effects of perceived and actual financial knowledge on regular personal savings: Case of Vietnam. Journal of International Studies, 10(2), 278-291.

- O'Connell, A. (2012). Underestimating lifespans? Why longevity risk exists in retirement planning and superannuation policy. Te Herenga Waka-Victoria University of Wellington.

- OECD. (2015). Organization for economic cooperation and development. Ageing in cities: Paris.

- Pereira, A.G., & Afonso, L.E. (2020). Automatic enrollment and employer match: An experiment with the choice of pension plans. Revista de Gestão, 27(3), 281-299.

- Rhee, N. (2013). The retirement savings crisis. Washington DC: National Institute on Retirement Security.

- Robb, C.A. (2014). The personal financial knowledge conundrum. Journal of Financial Service Professionals, 68(4).

- Sandbrook, W., & Ravi-Burslem, R. (2019). Communicating NEST pensions for 'New' DC savers in the United Kingdom.

- Topa, G., & Alcover, C.M. (2015). Psychosocial factors in retirement intentions and adjustment: A multi-sample study. Career Development International.

- Widyastuti, U., Suhud, U., & Sumiati, A. (2016). The impact of financial literacy on student teachers’ saving intention and saving behaviour. Mediterranean Journal of Social Sciences, 7(6), 41.

- Xiao, J.J., & O'Neill, B. (2016). Consumer financial education and financial capability. International Journal of Consumer Studies, 40(6), 712-721.

- Zhou, Y., Wushouer, H., Vuillermin, D., Ni, B., Guan, X., & Shi, L. (2020). Medical insurance and healthcare utilization among the middle-aged and elderly in China: Evidence from the China health and retirement longitudinal study 2011, 2013 and 2015. BMC Health Services. Research, 20(1), 1-9.