Research Article: 2020 Vol: 19 Issue: 1

Impact of the Application of IFRS 9 Standards on the Profits and Losses of Insurance Companies Listed on the Amman Stock Exchange

Ola Mohammad Khersiat, Zarqa University

Riham Fathi ALkabbji, Zarqa University

Abstract

This study aims to identify the effect of applying the standard IFRS9 “Financial Instruments” standard on the profits and losses of insurance companies. Insurance companies in Jordan have started applying this standard as of 1/1/2018. The two researchers explored the effect of this standard through receivables on the profits and losses. Tax assets, bank deposits, financial assets at amortized cost and loans holders of life insurance and of life insurance and checks on the collection “Account Receivable: Reinsurers`”. Results show that there is a statistically significant impact for the application of the standard IFRS 9 standard on profits and losses of insurance companies, and that the independent variables have been impacted to varying degrees. By using the factor analysis, variables have been classified from the most influential on the profit and losses of the insurance companies to the least influential, while the most affected and influential of these variables were bank deposits. It has been also found that the FAAC, TA ranked second, and LHLT, PR third in terms of influence. The study mainly recommends that IFRS 9 standard should be applied to address some of the difficulties experienced by insurance companies when processing financial instruments and derivatives, as well as to present financial lists that conform to users of accounting information.

Keywords

IFRS9, Insurance Company, Profits, Losses.

Introduction

On the impact of the fallout of the global financial crisis on the recent economic environment and business environment, efforts have been successfully rewarded by changes in international accounting standards and international financial reporting in addition to changes in generally accepted accounting principles. This was achieved due to the significant impact of these changes on mitigating challenges, difficulties and criticisms directed to applying some accounting standards, including the International Accounting Standard No. 39 due to the difficulties encountered by the users of accounting information regarding its application. As a result, efforts have been made by the Financial Accounting Standards Board FASB, the International Accounting Standards IASB, the Consultative Group for Financial Crisis FCAG to issue the Standard of Financial Reporting, No. IFRS9 in November 2009, till the full application stage in 2010, provided that standards be applied in January 2018, despite the fact that the Board allowed the early application of the standard in 2015. This standard has basically concentrated on setting the principles related to reporting financial assets and financial liabilities which will display the information characterized by its relevance and utility for users of accounting information, in order to increase the quality of financial reports (Barth et al., 2008; Huian, 2013; Onali & Ginesti, 2014; Lachmann et al., 2015; Ramirez, 2015). The standard has adopted a preventive measure in respect to debt losses through preparing allocations for expected losses in order to reduce the risk of realized losses of insurance companies.

Literature Review

Buschhüter & Striegel’s (2011) Financial Instruments was issued to supersede IAS 39 Financial Instruments: Recognition and Measurement and is effective for periods beginning on or after 1 January. This study aims to explain the accounting treatment of financial investments in stocks according to the requirements of IFRS 9 from the theory and practical.

Ionescu’s (2019) IFRS 9 Benchmarking tests: too complicated to worth doing? IFRS 9 presented three models for evaluate financial assets recorded at fair value of money; it is Interest rate, Forward interest rate and Vasicek interest rate model. This study aims to determine the optimal measurement model by comparing the results of application for three models. The study conclude there is no essential differences between results of these models, there is no model better than another model.

Fidan (2018) the purchased or originated credit-impaired financial assets approach as Collected Work under IFRS 9 Financial Instruments. This paper discusses briefly the classification and impairment model under IFRS 9 Financial Instruments. It also examined in the Purchased or originated credit-impaired financial assets approach and the credit-adjusted effective interest rate comparison with IAS 39 Financial Instruments: Recognition and measurement's requirements.

Saqf et al. (2017) the Impact of Applying International Financial Reporting Standard (IFRS 9) on the Quality of the Accounting System Outcomes of the Insurance Companies in Jordan

The results of the study confirm the existence of a statistical significant impact of the applying of IFRS (9) on the appropriateness of accounting information in the financial statements of insurance companies in Jordan, and no significant impact of the applying of IFRS (9) on reliability, timeliness, comparability, symmetry, and measurability of accounting information in the financial statements of insurance companies in Jordan. Finally, The study recommends a constant encouragement of insurance companies in Jordan to apply IFRS (9) and provide the necessary reliability needed of recording the financial transactions and provide the accounting and financial information in the proper time which will lead and support taking the strategic and important decisions from decision makers in Jordanian Insurance Companies.

Nadia & Rosa (2014) the impact of IFRS 9 and IFRS 7 on liquidity in banks: Theoretical aspects this study aims to determine the effect of applying accounting rules according to IFRS9 standard on liquidity in commercial banks. Thus, the study focuses on requirements of IFRS9 standard (concepts and liquidity risks), and then use the disclosure requirements for liquidity risks in IFRS7 standards to find solutions to overcome the limitation of the IFRS9 standards.

The study found that the treatment is not being handled well but it is accepted. Therefore, The International Accounting Standards Board (IASB) should give more attention to develop and adjust standards more.

Methodology

The insurance sector in Jordan has suffered from big losses in recent years due to the delay in recognizing these debts losses until verified. So, insurance companies would recycle some of the losses from a year to another till they accumulate. When recognized, they would cause heavy losses due to the lack of allocations to handle the potential losses. IFRS 9 standard introduced a new application to deal with these losses by envisaging allocations even for the debts, based upon the idea that any financing or debt can falter.

The study problem can be summarized in determining the impact of the IFRS 9 application and its impact on the profits and losses of insurance companies. It shall also answer the following question: What is the effect of applying IFRS 9 standard to the profits and losses of insurance companies?

The Study Hypothesis

There is no significant impact of the application of Financial Reporting Standard No. 9 “financial instruments” on the profits and losses of insurance companies.

The study used the analytical descriptive approach to achieve its objective of answering the following question:

What is the effect of the application of IFRS No. 9 “Financial Instruments” on the accumulated profits and losses of insurance companies listed in the Amman Stock Exchange?

Results and Discussion

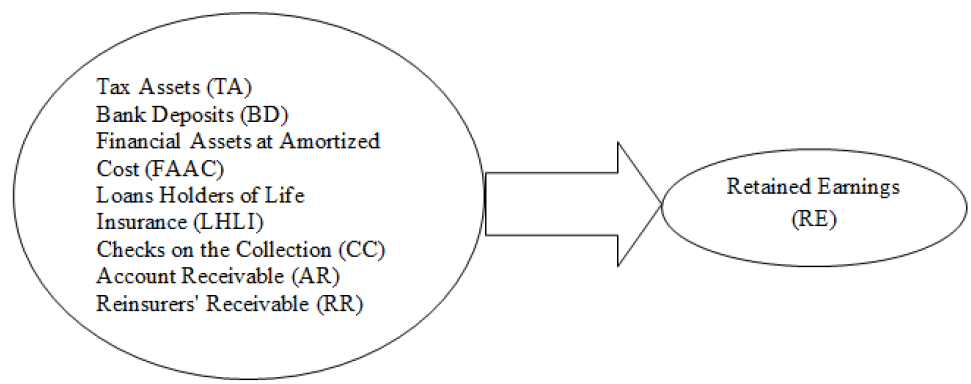

The main difference between IAS 39 and IFRS 9 is in the creation of a potential losses allocation for the funding portfolio. Therefore, the elements affected by the application of the (IFRS9)standard in insurance companies were identified, thus constituting the independent variables of the study, namely, the deferred tax assets, bank deposits, financial assets at amortized cost, loans to life policyholders, net debtors, and re-insurers` receivables. The dependent variable, which shows the changes in cumulative profits and losses is the retained profit account, thus the study hypothesis is manifested as follows:

The main hypothesis: there is no impact for the application of IFRS 9 standard (financial Instruments) (potential losses allocation creation) on the profits and losses of insurance companies listed in Amman Stock Exchange.

To achieve the study objectives annual financial reports of insurance companies issued on 30/3/2019 were observed. These reflect the impact of the application of (IFRS9) for the first time on insurance companies’ financial reports. Through these reports, the affected elements were derived based on the disclosures described in these reports.

Study Sample and Community

The study community is made up of the 23 public joint-stock insurance companies listed on the Amman Stock Exchange.

Result analysis and testing of hypotheses

The statistical methods in the analysis were used through the SPSS program in order to determine the extent of effect of independent variables on dependent ones. Since the data are not subject to normal distribution due to the number of the sample items which is 23 companies, being less than the supposed number to a normal distribution. Therefore, the researcher had to use the non-parametric tests to prove the impact of independent variables on dependent variables.

Study model

KOM Data Adequacy Test

The Kaiser-Meyer-Olkin Measure of Sampling Adequacy is a measure of the suitability of data for analysis, where testing measures the adequacy of samples for each variable in the model and for the complete model. KMO values are between (0 and 1) for statistical interpretation of the results, since if the results are greater than 0.8 and less than 1, these two sample indicators are very appropriate, but if they are less than 0.5, then the sample size is insufficient to explain the hypothesis. The following Table 1 shows that the KOM value is 0.513, slightly above 0.50, indicating the adequacy of the study sample size.

| Table 1 KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy | 502 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 389,617. |

| Df | 7 | |

| Sig. | 000 | |

The main component method has been used to define the number of factors from Table 1 the characteristic values of the following Link matrix. Table of derived values of variables contributions

The Table 2 above represents the initial derived values of communalities. It is noted that all values range from 0 to 1, expressing the Square Multiple Correlation. It is also noted that the most commonly variables in the factors are BD by 0.987, followed by CC by 0.973 and RR by 0.24.

| Table 2 Communalities | ||

| Initial | Extraction | |

| TA | 1.000 | 0.922 |

| BD | 1.000 | 0.987 |

| FAAC | 1.000 | 0.902 |

| LHLI | 1.000 | 0.907 |

| CC | 1.000 | 0.973 |

| AR | 1.000 | 0.946 |

| RR | 1.000 | 0.240 |

Friedman Test

Friedman Test was used at level of significance 5%, to test the impact of the application of the (IFRS 9) standard through the variables that were affected by this standard on the retained profits. Results were as shown in Table 3:

| Table 3 Ranks | |||||

| Mean Rank | N | Chi-Square (χ2) | df | Sig | |

| RE | 3.67 | 15 | 25.941 | 7 | 0.002 |

| TA | 4.2 | ||||

| BD | 5.17 | ||||

| FAAC | 4.83 | ||||

| LHLI | 4.7 | ||||

| CC | 3.93 | ||||

| AR | 4.8 | ||||

| RR | 4.7 | ||||

The tabulated value is (20.278) at (df=7) and the level (α = 0.05). It is noted from the Table 3 that the calculated Chi-square at the level of significant (0.05) compared to the value of the tabulated Chi-square, the value of the calculated Chi-square is higher than the tabulated. Thus the nihilism hypothesis will be rejected while the alternative one accepted. The alternative hypothesis states that there a statistically significant impact for the application of (IFRS 9) standard on the profits and losses of insurance companies listed in Amman Stock Exchange.

The following analysis aims to determine the degree of impact of each of the independent variables in the study.

Component Matrix

Table 4 shows the matrix of components where variables are classified into three components. The first key component comprises BD, CC, AR; the second component comprises TA and FAAC, while the third comprises LHLI and RR.

| Table 4 Component Matrix | |||

| Component | |||

| 1 | 2 | 3 | |

| TA | 0.306 | 0.893 | - 0.176 |

| BD | 0.959 | -0.221 | - 0.135 |

| FAAC | 0..255 | 0.896 | - 0.186 |

| LHLI | 0.126 | 0.350 | 0.877 |

| CC | 0.972 | - 0.155 | - 0.060 |

| AR | 0.897 | 0.056. | 0.371 |

| RR | 0.098 | - 0.209 | 0.431 |

Link Matrix Characteristic Values

Depending on the components matrix, Table 5 presents the distinctive values of the matrix of links. It is noted that the first component has the biggest variance, equaling to 3.751 and explains 46.881% of the total data structure.

| Table 5 Total Variance Explained | ||||||

| Component | Initial Eigenvalues | Extraction sum of Squared loads | ||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 3.751 | 46.881 | 46.881 | 3.751 | 46.881 | 46.881 |

| 2 | 1.893 | 23.665 | 70.546 | 1.893 | 23.665 | 70.546 |

| 3 | 1,223 | 15.282 | 85.828 | 1.223 | 15.282 | 85.828 |

| 4 | 0.927 | 11.592 | 97.420 | |||

| 5 | 0.163 | 2.042 | 99.462 | |||

| 6 | 0.037 | 0.469 | 99.931 | |||

| 7 | 0.006 | 0.069 | 100.000 | |||

| 8 | 1.001 E-16 | 1.252 E-15 | 100.000 | |||

The second component equal to 1.893 and explains 23.66% of the data structure, where the first and second components explain 70.546% of the data structure, while the third component with the value of 1.223 explains 15.282 of the data structure, and thus the three previous components interprets 85.828% of the data structure.

It is clear from the previous analysis that the first component consisting of bank and cash deposits under collection and accounts receivables the most affecting variables on the interpretation of the impact of the application of IFRS 9 standard on the retained profits, followed by the second component which contains deferred tax assets and financial assets at amortized cost. The third least affecting component in the interpretation of the study hypothesis comprises re-insurance companies s’ receivables and policyholder’s loans.

Conclusions

1. There is a statistically significant impact for the application of IFRS 9 standard on profits and losses of insurance companies, and that the independent variables were affected by this standard to varying degrees. By using a factor analysis, variables were classified from the most influential on the profits and losses of insurance companies to the least influential, while the most affected and affecting variables were bank deposits. This is due to changes in interest rates as a result of the changes in the country`s policies (fiscal and monetary) depending on the economic situation. Accounts receivables and collection tax were the variables mostly affected by the potential losses allocation creation, being the variables mostly prone to losses because of the Jordanian economic situation, which is heading towards a recession and the lack of liquidity investors and citizens suffer from in Jordan.

2. It was also found that the FAAC, TA ranked second because the bonds are refunded at the end of the period and their price in the financial market does not change dramatically. These have the priority in case the company is liquidated.

3. It was also found that LHLT, PR comes second in terms of the impact, because insurance companies pay part of the insurance premiums obtained from the insured to the re-insurance company guaranteeing in exchange part of the losses.

Recommendations

1. Applying IFRS 9 standard to address some of the difficulties experienced by insurance companies when processing financial instruments and related derivatives is of pivotal importance, and dealing with changes in the country`s policies (fiscal and monetary) depending on the economic situation.

2. Applying IFRS 9 to financial assets and liabilities (specially according with FAAC, TA) to present appropriate financial statements characterized by accounting information users has become necessary.

3. Applying IFRS 9 has become very important since changes in recognizing the depreciation in the financial assets value that require recognition of the loans portfolio value depreciation allocation of the expected and realized losses has been noted.

4. Applying IFRS 9 standard is of great necessity to reduce the volume of losses accumulated from previous years that emerge as a result of non-recognition of their existence only when these are realized.

References

- Buschhüter, M., & Striegel, A. (2011). IAS 39–Financial Instruments: Recognition and Measurement.

- Fidan, M.M. (2018). Credit-impaired financial asset approach when purchased or created in accordance with IFRS 9 financial instruments standard. Finance and Finance Articles, 1 (109), 233-258.

- Huian, M.C. (2013). Stakeholders’ participation in the development of the new accounting rules regarding the impairment of financial assets. Business Management Dynamics, 2(9), 23.

- Ionescu, B.S. (2019). IFRS 9 benchmarking test: Too complicated to worth doing it?. Economic Computation & Economic Cybernetics Studies & Research, 53(1).

- Lachmann, M., Stefani, U., & Wöhrmann, A. (2015). Fair value accounting for liabilities: Presentation format of credit risk changes and individual information processing. Accounting, Organizations and Society, 41, 21-38.

- Nadia, C., & Rosa, V. (2014). The impact of IFRS 9 and IFRS 7 on liquidity in banks: Theoretical aspects. Procedia-Social and Behavioral Sciences, 164, 91-97.

- Onali, E., & Ginesti, G. (2014). Pre-adoption market reaction to IFRS 9: A cross-country event-study. Journal of Accounting and Public Policy, 33(6), 628-637.

- Saqf, A., Firas I.M., & Shabita, Muhammad F.S. (2017). The impact of applying international financial reporting standard (IFRS 9) on the quality of the accounting system outcomes of the insurance companies in Jordan. Zarqa Journal for Research and Studies in Humanities, 341 (5693), 1-20.

- Ramirez, J. (2015). Accounting for derivatives: Advanced hedging under IFRS 9. John Wiley & Sons.

- Barth, M. E., Hodder, L. D., & Stubben, S. R. (2008). Fair value accounting for liabilities and own credit risk. The accounting review, 83(3), 629-664.