Research Article: 2021 Vol: 20 Issue: 3

Impact of the Internal Control and Accounting Systems on the Financial Information Usefulness: The Role of the Financial Information Quality

Albertina Paula Monteiro, Polytechnic of Porto

Joana Vale, Polytechnic of Porto

Amélia Silva, Polytechnic of Porto

Cláudia Pereira, Polytechnic of Porto

Abstract

The purpose of this study is to investigate factors that affect Usefulness of Financial Information. In addition, we specifically analyse the effect of both Quality of Internal Control System and Quality of Accounting Information System on the Quality of Financial Reporting and, consequently, on Usefulness of Financial Information. We used a survey design which was applied to 381 Portuguese's managers and they responded to a digital questionnaire. Data was submitted to a structural equations model to obtain the dependent variables and after we performed a multivariate statistical analysis and a linear regression model to determine the factors that affect the Quality of Financial Reporting. The results show a good fit of the model. Main findings show that Quality of Financial Reporting is directly impacted by Quality of the Internal Control System and Quality of the Accounting Information System. Furthermore, Quality of Financial Reporting is a predictive variable of the Usefulness of Financial Information and it mediates the relationship between the information systems and Usefulness of Financial Information. These findings may assist organizations in evaluating and enhancing the quality of their information. However, once the study used a sample for convenience and non-probabilistic, the generalization of its results is limited. This study purposes an original model. These findings highlight the catalyst role of Quality of Internal control and accounting systems on Quality of Financial Reporting and Usefulness of Financial Information.

Keywords

Financial Reporting, Internal Control, Information System, Quality of the Accounting System.

JEL code

M41

Introduction

Accounting is embedded in a social structure and even those that define accounting as a technology, recognize that “it is a technology that is not ideologically sterile” (Dillard, 1991). However, once Accounting Information System (AIS) serve a multiple diversity of purposes (Siqani & Vokshi, 2019), it shall provide information as free bias as possible in order to be useful for decision makers (Solomons, 1991). Therefore, neutrality is a quality parameter of accounting information.

Regardless of the many variations, we can find in the definition of accounting the dominant idea that accounting plays an important role in decision making process of a vast variety of stakeholders (Schwartz, 2016). Indeed, financial information is the core output of financial statements, and it is fundamental for decision making of economic actors in modern capitalist societies, namely decisions in the capital market (Muslim & Setiawan, 2021). Hence, it is reasonable to assume that the Quality of Financial Reporting will impact on economic decisions.

According, Sari et al. (2019), information systems should provide the quantity and quality of information needed by stakeholders to make the best decisions and thus create value for firms. IS integrates the AIS, which enables data to be obtained, recorded, stored, and processed to provide useful information (financial and non-financial) to decision-makers (Nguyen & Nguyen, 2020). Sari et al. (2010) argue that the function of the AIS “is to provide important information to reduce uncertainty, support decision making, and encourage better planning, scheduling, and control of work activities”. However, the AIS require internal control because the accounting system, as an information system, may have either some intentional frauds or unintentional errors (AICPA, 2014).

Literature suggests that both components of information systems - internal control and accounting - are correlated with each other (Frazer, 2020; Gal & Akisik, 2020; Rashedi & Dargahi, 2019; Bozzolan & Miihkinen, 2019; Bauer et al., 2017; Li et al., 2012; Jokipii, 2010). Moreover, there is evidence that they influence financial information quality (e.g. Salehi et al., 2010; Sari & Purwanegara, 2016; Muda et al., 2018 and Phornlaphatrachakorn, 2019). Besides, previous studies indicate that financial information is fundamental in the decision-making process (Cepêda & Monteiro, 2020; Soudani, 2012). Management involves several types of activities and decisions which require accounting information with quality (Soudani, 2012). Based on Accounting Conceptual Framework, accounting information meets the quality characteristic when it is reliable, relevant, comprehensive, and comparable. Furthermore, accounting information is useful for decision-making if it meets those qualitative characteristics. According to Phornlaphatrachakorn (2019), “accounting information usefulness is a capacity of information to make a difference in a decision-making process”, it means that accounting can change the course of action.

Even with theoretical foundations, empirical research on the determinants that influence financial information quality and usefulness is scarce. Therefore, this study aims to analyse whether the quality of the Internal Control System (ICS) impacts the quality of the accounting system and whether both contribute to the quality and Usefulness of Financial Information. This topic is critical for developing literature and practices because information systems efficiency is vital for economic competitiveness in the fourth industrial revolution era. Furthermore, we take into account that in Portugal the business failure was 23.002 in 2019 (INE, 2021) and that 99% refers to small and medium enterprises. Our evidence contributes to show that Quality of the Internal Control System tends to enhance the Quality of Financial Reporting and the Quality of the Accounting Information System. In addition, our results are consistent with the Quality of Financial Reporting being a predictive variable of the Usefulness of Financial Information and mediating the relationship between the information systems and Usefulness of Financial Information. Considering that company's success depends on effective decision-making, it seems reasonable to assume that a better understanding of the factors that contribute to the quality and Usefulness of Financial Information is necessary and positive for economic growth. This issue is as much relevant as we believe “the empowerment of small and medium economic enterprises will drive economic growth” (Surya et al., 2021).

The remainder of this paper is organized as follows. In section two we review the theoretical foundations for this study, leading to the hypothesis' development and proposed model. Subsequently, we review the literature on IS, quality and Usefulness of Financial Information. Thereafter, we put forward the methodology, research design and measures applied in the empirical study. Then, results are presented and analysed. Finally, we draw conclusions and discuss our study.

Literature Review

Accounting, as a science, is concerned with the preparation, analysis, and disclosure of financial information (Buljubaši? & Ilg?n, 2015). Eierle & Schultze (2013) mention that according to the framework of the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB), the main purpose of financial statements is to provide useful information to existing or potential investors and other stakeholders of the firm. The financial information should be considered of quality so that it is useful to the different stakeholders in decision making (Sari et al., 2019). But, as stated by Beest et al. (2009), “although both the FASB and IASB stress the importance of high-quality financial reports, one of the key problems found in prior literature is how to operationalize and measure this quality”.

Eierle & Schultze (2013) mention that in the mid-1960s, discussions on the qualitative criteria of financial information reached prominence. The quality f financial information is verified when there is evidence that the financial information is accurate, relevant, timely and complete (Sari et al., 2019). According to the same authors, only then is the financial information useful for stakeholders in decision-making. Therefore, in the decision-making process, it is important that the financial information is timely and of quality (Patel, 2015), as well as complete, transparent and not misleading (Jonas & Blanchet, 2000). Due to the difficulty to measure the quality of information as a one-dimensional attribute, various academics evaluate the quality of FI through the elements that are supposed to affect it, such as earnings management, financial restatements, and timeliness (Beest et al., 2009).

Hence, the qualitative characteristics determine the decision usefulness of financial reporting information. Regarding the accounting standards, the Despacho No. 98/2015, of 6th January, identifies four main qualitative characteristics: - Understandability; - Relevance; - Reliability; - Comparability. Nonetheless, the Usefulness of Financial Information is associated with quality the financial reporting (Patel, 2015), which depends on several factors such as board size, ownership of the company (family or non-family), reduction of information asymmetry, state intervention, as well as quality of IS. Indeed, financial reporting quality is a broad concept. It refers not only to financial information, “but also to disclosures, and other non-financial information useful for decision making included in the report” (Beest et al, 2009). On the other hand, the overall architecture of the Information System impacts the quality of information. Consequently, as mentioned by Gorla et al. (2010) IS managers should improve the system quality (through updated hardware and software, graphical user interface and well designed and documented systems), since there is evidence that the IS's poor quality hinders the information quality improvement.

According to Hla & Teru (2015), IS integrates the AIS, which depends on the quality of the Information Control Systems (ICS). Internal control can prevent intentional or unintentional failures in the preparation of financial information. Mirnenko et al. (2020) define ICS as the policies, rules and measures implemented by the manager or the head of the company that ensure the proper functioning of internal control and are aimed at achieving goals, strategic and other specific objectives of the company. Dimitrijevic et al. (2015) mention that according to International Standards on Auditing, an ICS should be the basis of each company's development plan, which should help it to properly organise and control all its activity. In fact, according to Selezneva et al. (2020), the ICS plays an important role in prevention, risk discovery and contributes to quality of financial information. However, the Quality of ICS allows mainly in minimizing the risk of unintentional errors or intentional frauds (AICPA, 2014). Empirical evidence was found by Cioban et al. (2015), when they analysed the impact of internal audit in public sector companies in Romania. Chang et al. (2019) further found that internal auditor competence is positively related to quality of internal control. In the same vein, Afiah & Rahmatika (2014) found a positive influence, although relatively weak, showing that the higher implementation of internal control, the higher the quality of financial reporting.

The literature suggests the existence of a relationship between Quality of ICS and Quality of AIS (Mndzebele, 2012). In this respect, Soudani (2012) argues that managing an organization and implementing an ICS the AIS plays a crucial role. One the other hand, Hla & Teru (2015) refer that what determines Quality of AIS is the quality of the internal control and the existence of a sound ICS. Susanto's (2017) study, applied to the managers and employees of Bandtmg College in Indonesia, show that quality of internal control influences the Quality of AIS of the college under study. In this context, the first research hypothesis is formulated:

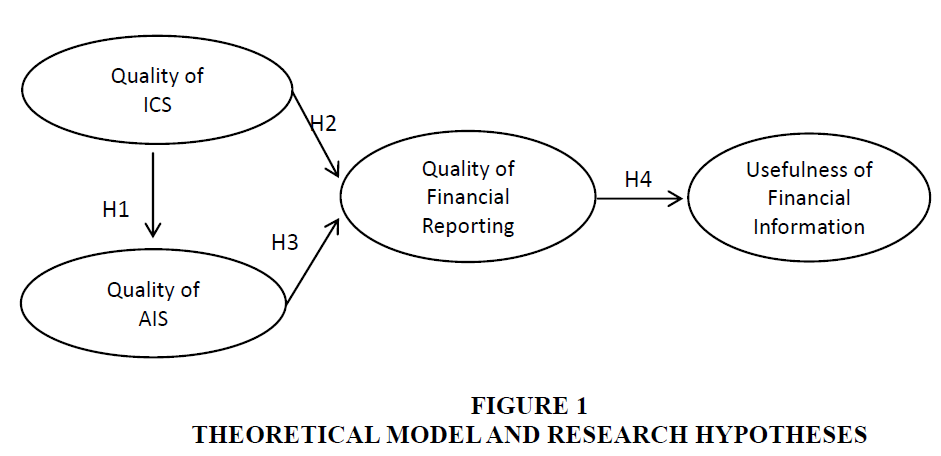

H1 The Quality of the ICS has a positive impact on Quality of AIS

The quality of internal control is important for firms, i.e. for their survival and sustainability of their activities in the long term, as it allows control/analyse the veracity of firms' results (Phornlaphatrachakorn, 2019). Zakaria et al. (2016) study show “that internal control weaknesses can be major contributing factors for fraud to be committed” in an oil and gas company. Furthermore, firms should show sustained improvements of their ICS in order to obtain better quality financial reporting.

Phornlaphatrachakorn (2019), highlights that the reliability of financial reporting is one valuable consequence of internal control quality. Thus, Ji et al. (2017) suggest that the establishment of a high-quality ICS should be seen as an important mechanism to ensure the quality of financial information. Contrary to Muda et al. (2018), this statement is supported by several authors, such as Hendri & Amelia (2019); Dewi et al. (2019); del Rocío Moreno-Enguix et al. (2019); Phornlaphatrachakorn (2019) and Dewi & Hoesada (2020). Based on the above arguments, we posit the third research:

H2 The Quality of ICS has a positive impact on Quality of Financial Reporting.

According to Sari et al. (2019), the quality of AIS “means an integration of several components like: hardware, software, brain ware, telecommunication network and database, quality of work and users' satisfaction” and include as dimensions of quality the “accessible, reliable, complete, timely, under stable and verifiable”. In addition, accounting literature argues that the quality of financial information is considered an outcome of AIS design. Azmi & Azhar (2020) analyse whether AIS contributes to quality of financial information and verify that this variable's improvement depends on the q quality of AIS of the company. For Sari et al. (2019), the “quality of accounting information system has implications for the quality of accounting information”. Other authors highlight identical findings, i.e., that the Quality of AIS influences the quality of financial information reporting, such as Sajady et al. (2008); Salehi et al. (2010); Sari & Purwanegara (2016); Muda et al. (2018). In this context, we formulate the third research hypothesis:

H3 The Quality of AIS has a positive impact on the Quality of Financial Reporting.

We further develop this study by taking into account that management involves several types of activities and decisions which require useful and quality financial information (Soudani, 2012; Phornlaphatrachakorn, 2019). The accounting information is useful when the financial information can make a difference in the decision-making for financial statements' users (Semba, 2017). For Phornlaphatrachakorn (2019) “great usefulness of accounting information can help provide and improve best decision making and enhance and increase firms' competitive advantage, performance and success”. According to the accounting framework, financial information is useful when it meets the qualitative characteristics of information. In this context, we present the last research hypothesis:

H4 The Quality of Financial Reporting has a positive impact on the Usefulness of Financial Information.

In Figure 1, we draw the proposed model, and the analytic hypotheses explained previously. The model tests the relationship between Quality of ICS and Quality of AIS. Furthermore, the model enables us to explore the impact of the attribute “quality” of these two antecedent variables – ICS and AIS – on financial reporting quality. Additionally, we assess if Quality of Financial Reporting has any impact on Usefulness of Financial Information.

As this research is essentially exploratory, we summarize our arguments in the form of four research questions:

1. What is the relation between the Quality of ICS and Quality of AIS?

2. What is the relation between the Quality of ICS and Quality of Financial Reporting?

3. What is the relation between the Quality of AIS and Quality of Financial Reporting?

4. What is the relation between the Quality of Financial Reporting and the Usefulness of Financial Information?

Methodology

Research Setting

To ensure the reliability and validity of data, we followed the procedures advised by Moser & Kalton (2017) the questionnaire was built upon previous research works with similar population. Since we are aware of the serious bias that an error in measuring a construct may have on research findings (Brahma, 2009). We used validated measurement scales or scales adapted from previous studies. We measured Quality of ICS and Quality of AIS using Phornlaphatrachakorn's (2019) and Soudani's (2012) measurement scale, respectively. Measurement scale of the Quality of Financial Reporting and Usefulness of Financial Information dimensions were adapted of the Dornier's (2018) and Cepêda & Monteiro's (2020), respectively. Some adjustments were necessary and in the translation of the questionnaire from English to Portuguese we followed Behling & Law's (2000) recommendations. The resulting measuring instrument was subject to a pre-test with five managers.

The first part of questionnaire includes questions that allow characterising the sample. Each of the remaining four components measure a construct of the model, i.e., it includes items that allow assessing the dimensions under study: Quality of ICS; Quality of AIS; Quality of Financial Reporting; and Usefulness of Financial Information. For each item/statement of the variables/dimensions highlighted in the proposed conceptual model, the answers were scored using a 5-point Likert scale, where 1 corresponds to “strongly disagree” and 5 corresponds to “strongly agree”.

Data Collection

To build our variables, we collected data from managers of Portuguese firms. The sample selection process was carried out on the SABI database, applying the following 5 filters: (1) all firms with an e-mail address Portugal; (2) last number of employees: minimum 50; (3) firms with audit; (4) firms, whose legal form is: sole proprietorship, foreign entity, anonymous firms, limited partnership, limited liability firms and sole proprietorship by quotas; and (5) active firms. The SABI database generated a list of 7,812 Portuguese firms. Despite being a substantial number, it was opted to apply the survey to all firms instead of limiting the study to a region or district of the country. This option is because this study is applied to managers and there is the likelihood of obtaining a low response rate.

The survey was applied online. The link to it was sent by email to the companies and addressed to the person who makes the main decisions in the companies (managers). In the period from 2nd to 31st March 2020 emails were sent (total 7799 emails). During the mentioned period, 389 complete observations were obtained. However, there were 8 incomplete questionnaires excluded from the final sample. Given the high number of Portuguese companies, it is opted for a non-probabilistic sample, which is practice in scientific studies that cover a large population (Cepêda & Monteiro, 2020; Montenegro & Rodrigues, 2020; Monteiro et al., 2021). Our final sample presents the following characteristics (Table 1):

| Table 1 Main Characteristics of Sample | |

| Characteristics | Profile |

| Geographic distribution | 111 (29%) from district of Lisbon; 67 (18%) from district Oporto; 41 (118%) from district of Aveiro; 162 (43%) from other 14 districts. |

| Legal form of the company | 197 (52%) are public companies; 121 (32%) are private collective companies; 17 (4%) are individual companies; 46 (12%) belong to other legal form. |

| Main sector of activity | 160 (42%) services activities, 126 (33%) industry activities 53 (14%) commercial activities 42 (11%) other activities. |

| Accounting services | 250 (66%) in-house accounting 69 (18%) outsourced accounting services 62 (16%) both. |

| Internal control services | 267 (70 %) in-house internal control 31 (8%) outsourced accounting services 77 (20%) both. 6 (2%) any. |

Regarding the geographic distribution there is a concentration in three districts (Lisbon, Oporto and Aveiro) which represent 57.5% of the sample. Therefore, 42.5% of the companies are spread across the other 14 districts or autonomous regions. Concerning the legal form of the company, the majority is collective companies, public or private. The prevailing sectors of activity are Service or Industry. Relating the type of bookkeeping and accounting services, the in-house accounting is predominant (65.6%). However, 62 (16.3%) of the companies mention that they have both services, i.e., they have a department in-house, but continue to outsource accounting services. Similarly, regarding the internal control service, 70% of the respondents hold the service in-house and only 6 companies do not have any internal control.

Data Analysis Procedures

Data analysis encompasses three phases: (1) preliminary data analysis, (2) measurement model evaluation, and (3) structural model evaluation. All data "cleaning" procedures were performed in SPSS software, which involve 4 steps: (1) treatment of missing data, (2) analysis of extreme data (outliers), (3) analysis of central tendency and normality and (4) analysis of sample size. After being properly prepared, the data are statistically analysed using the Structural Equation Model in the SPSS Software Amos, since it is a valuable technique in data analysis when the objective is to test the hypotheses formulated in the research (Hoe, 2008) and the theoretical model includes complex relationships and variables/dimensions that are not directly measured, but through their indicators or items (Wang & Wang, 2020).

A preliminary analysis of data was performed (missing values and outliers, the central and dispersion tendencies and the data for normality, the sample size, and the non-responses bias). This previous analysis aims at preparing the data to Structural equation model (SEM) analysis. The data analysis using SEM encompassed two phases, (1) the assessment of the measurement model and (2) the assessment of the structural model.

Results and Discussion

Assessment of the Measurement Model

In the analysis of the measurement model, a confirmatory factor analysis was performed to validate the measurement scales using the maximum likelihood estimation method. This method yields more reliable estimates when using covariance matrices (Byrne, 1998) and is most widely in most statistics packages, as in AMOS (Ainur et al., 2017; Alhija, 2010). According to Diamantopoulos & Siguaw (2000), this method is considered to be robust against moderate of the violations of the assumptions of normality (Marôco, 2010), as is the case in this study.

The results of the evaluation of the measurement model are illustrated in Table 2. In the first-order models, all items related significantly to factor in terms of loadings, thus confirming the unidimensionality of the single factor. All loadings of the observed variables have values above 0.60, confirming the convergent validity of the constructs (Garver & Mentzer, 1999). The average variance extracted (AVE) is greater than 0.50, which demonstrates the existence of the discriminating validity of the constructs (Fornell & Larcker, 1981). Regarding to composite reliability, we certificate that all latent variables present values greater than 0.60, which proves the reliability of the scales (Bagozzi & Yi, 1988).

| Table 2 Measurement Model Results | |

| Construct | Sc |

| Qualy of ICS (CR = 0.931, AVE = 0.659) | |

| ICS has improved and promoted the company's operational efficiency and effectiveness. | 0.904* |

| ICS has allowed building and creating effective operations, activity, and business practices. | 0.834* |

| ICS has allowed the company to prepare IFs with quality. | 0.824* |

| The company complies with all required regulations, i.e. laws, rules, guidelines, standards, and other issues related to internal control. | 0.667* |

| Quality of AIS (CR = 0.917, AVE = 0.610) | |

| The data processing caused the improvement of the quality of the financial reports. | 0.864* |

| The automated data collection speed up the process to generate financial statements. | 0.758* |

| The automated data collection speed up the process to generate financial statements and overcome human weaknesses in data processing. | 0.744* |

| The automated data collection provides a platform with access to information, which facilitates the use of it. | 0.752* |

| Quality of Financial Reporting (CR = 0.90, AVE = 0.56) | |

| The accuracy of financial information helps decision-making. | 0.724* |

| FI is carefully prepared to ensure its reliability. | 0.831* |

| FI is easily understood by its user. | 0.719* |

| FI represents in a reliable way what you want to portray. | 0.723* |

| Usefulness of Financial Information (CR = 0.92, AVE = 0.62) | |

| I give due importance to financial indicators in the decision-making process. | 0.895* |

| I give value to Financial Information in decision making. | 0.859* |

| The manager of the company requests another type of financial information beyond that of the financial statement | 0.616* |

| I frequently request financial information from the accounting department to make decisions. | 0.758* |

| Notes: Sc, Standardized coefficients; CR, composite reliability; AVE, average variance extracted. *Correlation is significant at the 0.001 level | |

Assessment of the Structural Model

The results show a good fit of the model (χ2=167.55(91), p=0.00, CFI=0.98, GFI=0.95, NFI=0.96, RMSEA=0.048). Table 3 presents the standardized coefficients, the value of t and the significance level for each hypothesis postulated in the model, as well as the coefficient of determination for each construct. Our results show that Quality of ICS has a positive impact in the Quality of AIS (β =0.539; p<0.001). Quality of ICS and AIS positively contribute to the Quality of Financial Reporting (β =0.734; p<0.001 and =0.17; p<0.01, respectively). Finally, Quality of Financial Reporting impacts on Usefulness of Financial Information (β =0.580; p<0.001). In this study, all hypotheses are supported.

| Table 3 Research Findings Model | ||||

| Parameters | H | Cs | p-value | R2 |

| Quality of ICS-Quality of AIS | H1 | 0.539 | *** | 0.20 |

| Quality of ICS-Quality of Financial Reporting | H2 | 0.734 | *** | 0.70 |

| Quality of AIS-Quality of financial reporting | H3 | 0.170 | 0.006* | |

| Quality of Financial Reporting-Usefulness of Financial Information | H4 | 0.580 | *** | 0.34 |

* Correlation is significant at the 0.01

Table 4 presents the standardized effects direct, indirect and total. The results of this study indicate that the quality of the ICS has a greater impact on the quality and Usefulness of Financial Information than the quality of the AIS. However, the quality of the AIS is a variable that mediates the relationship between the quality of the ICS and quality/utility of the financial reporting, adding value to the information that is used in decision making.

| Table 4 Direct, Indirect and Total Effects of the Theoretical Model | |||||

| Effects | Constructs | Quality of ICS | Quality of AIS | Quality of Financial Reporting | Usefulness of Financial Information |

| Direct | Quality of AIS | 0.539 | 0.000 | 0.000 | 0.000 |

| Quality of Financial Reporting | 0.734 | 0.170 | 0.000 | 0.000 | |

| Usefulness of Financial Information | 0.000 | 0.000 | 0.580 | 0.000 | |

| Indirect | Quality of AIS | 0.000 | 0.000 | 0.000 | 0.000 |

| Quality of Financial Reporting | 0.091 | 0.000 | 0.000 | 0.000 | |

| Usefulness of Financial Information | 0.479 | 0.099 | 0.000 | 0.000 | |

| Total | Quality of AIS | 0.539 | 0.000 | 0.000 | 0.000 |

| Quality of Financial Reporting | 0.825 | 0.170 | 0.000 | 0.000 | |

| Usefulness of Financial Information | 0.479 | 0.099 | 0.580 | 0.000 | |

Discussion

Micro, Small, and Medium-Sized Enterprises are very important to Portuguese's economy, given that they represent 99% of the business fabric. Besides the number of new companies is higher than the number of companies entering insolvency, the number of bankruptcies remains significant. In this context, studies contributing to a better understanding of the factors determinants of the decision-making success, with a potential effect on the company's performance, should be performed.

The financial information is increasingly crucial in the decision-making process. The literature suggests that the quality and Usefulness of Financial Information depends on the efficiency of the company's information systems, namely the ICS and the AIS. In this context, the main objective of this study is to analyze the factors (quality of ICS, AIS and financial reporting) have a significant impact on usefulness financial information for decision makers.

Based on a sample of 381 Portuguese firms, results show that the Quality of ICS positively contributes to Quality of AIS, supporting the first hypotheses this investigation (H1). Our findings are in line with the studies of Hendri & Amelia (2019); Dewi et al. (2019); del Rocío Moreno-Enguix et al. (2019); Phornlaphatrachakorn (2019) and Dewi & Hoesada (2020), demonstrating that the ICS is important for AIS. Another important conclusion of this study reflects the importance of the two information systems (ICS and AIS) the Quality of Financial Reporting. This empirical evidence supports H2 and H3, validating the arguments of previous studies (Hendri & Amelia, 2019; Dewi et al., 2019; del Rocío Moreno-Enguix et al., 2019; Phornlaphatrachakorn, 2019; Dewi & Hoesada, 2020). In turn, quality of the financial information impacts on Usefulness of Financial Information, which proves that financial information, is only useful if it is of high quality. This evidence supports the H4 and validates what underpins the objectives of accounting, which is to provide quality information in order to be useful to the company's stakeholders. In addition, we find that the quality of CS is more important than the Quality of AIS for the quality and usefulness of the financial information and that the quality of the information system is more important than the Quality of Financial Reporting enhances the effect of information systems on the Usefulness of Financial Information. In this respect, Phornlaphatrachakorn (2019) argues that Quality of ICS has a potential influence on Usefulness of Financial Information and decision-making success.

The literature review identified two gaps. The first relates to the absence of studies that analyze the influence of the two information systems, simultaneously, on the Quality of Financial Reporting, from the perspective of company manager. Thus, this study covers a literature gap. The second gap relates to the lack of studies in area in European Country, namely on Portugal. So, in practical terms, this research is important for Portuguese companies' managers, as it provides a better understanding of the factors that contribute positively to the quality and Usefulness of Financial Information, from the perspective of key decision-makers.

Conclusions

In this study, we developed and analysed a model that aims analyse the impact of the internal control and accounting systems on the quality and Usefulness of Financial Information. For this purpose, we used primary data, collected in 2020, using a questionnaire applied to managers of Portuguese firms. The survey resulted on a total of 381 valid observations. Data were submitted to a multivariate statistical analysis and a linear regression model. The results show a good fit of the model (χ2=167.55(91), p=0.00, CFI =0.98, GFI=0.95, NFI=0.96, RMSEA = .048). The structural equations model shows that Quality of Financial Reporting is directly impacted by Quality of ICS and Quality of AIS. Financial reporting quality is a predictive variable of the financial information usefulness and it mediates the relationship between the information systems and Usefulness of Financial Information. Our research is expected to contribute to the debate on the importance of quality of information for decision-maker.

Regarding study limitations, the use of a sample for convenience and non-probabilistic is the main limitation and it restricts the generalization of results. Another limitation verified in this study is that there are no guarantees that the managers filled in the questionnaires. However, in the email we requested the forwarding to them, and in the questionnaire, we asked for the indication of the respondent's position in the entity.

In future research, we suggest that the decision-making success variable be added to the model since it is presented in the literature as a determining variable in business performance. Moreover, future research could add to the model the dependent variable organizational performance (in financial and non-financial terms) to evaluate the effects of independent variables. We also suggest that the study be applied to other countries to be able to compare results in similar contexts, despite differences inherent to each country.

Acknowledgement

This work is financed by Portuguese national funds through FCT - Fundação para a Ciência e Tecnologia, under the project UIDB/05422/2020.

References

- Afiah, N.N., & Rahmatika, D.N. (2014). Factors influencing the quality of financial reporting and its implications on good government governance. International Journal of Business, Economics and Law, 5(1), 111-121.

- AICPA. (2014). The importance of internal controls in financial reporting and safeguarding plan assets. American institute of certified public accountant.

- Ainur, A.K., Sayang, M.D., Jannoo, Z., & Yap, B.W. (2017). Sample Size and Non-Normality Effects on Goodness of Fit Measures in Structural Equation Models. Pertanika Journal of Science & Technology, 25(2), 575-586.

- Azmi, F., & Azhar, S. (2020). The accounting information system quality improvement through internal control and top management support effectiveness. Journal of Theoretical and Applied Information Technology 95(19), 5003-5011.

- Bagozzi, R.P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74-94.

- Bauer, A.M., Henderson, D., & Lynch, D.P. (2018). Supplier internal control quality and the duration of customer-supplier relationships. The Accounting Review, 93(3), 59-82.

- Beest, F.V., Braam, G.J.M., & Boelens, S. (2009). Quality of financial reporting: Measuring qualitative characteristics.

- Behling, O., & Law, K.S. (2000). Translating questionnaires and other research instruments: Problems and solutions (Vol. 133). sage.

- Bozzolan, S., & Miihkinen, A. (2019). The quality of mandatory non-financial (risk) disclosures: The moderating role of audit firm and partner characteristics. Forthcoming, The International Journal of Accounting.

- Brahma, S.S. (2009). Assessment of construct validity in management research. Journal of Management Research (09725814), 9(2), 59-71.

- Buljubaši?, E., & Ilg?n, E. (2015). Impact of accounting information systems on decision making case of Bosnia And Herzegovina. European researcher. Series A, (7), 460-469.

- Byrne, B.M. (1998). Structural equation modeling with LISREL, PRELIS, and SIMPLIS: Basic concepts, applications, and programming.

- Cepêda, C.L.M., & Monteiro, A.P. (2020). Accountants' perception of the usefulness of financial information in decision making: A study in Portugal. RBGN: Brazilian Journal of Business Management, 22 (2), 363-380.

- Chang, Y.T., Chen, H., Cheng, R.K., & Chi, W. (2019). The impact of internal audit attributes on the effectiveness of internal control over operations and compliance. Journal of Contemporary Accounting & Economics, 15(1), 1-19.

- Cioban, A.N., Hlaciuc, E., & Zaiceanu, A.M. (2015). The impact and results of the internal audit activity exercised in the public sector in Romania. Procedia Economics and Finance, 32, 394-399.

- del Rocío Moreno-Enguix, M., Gras-Gil, E., & Henández-Fernández, J. (2019). Relation between internet financial information disclosure and internal control in Spanish local governments. Aslib Journal of Information Management, 71(2), 176-194.

- Despacho 98/2015. (n.d.). Retrieved from https://dre.pt/home/-/dre/66030786/details/maximized

- Dewi, N., Azam, S., & Yusoff, S. (2019). Factors influencing the information quality of local government financial statement and financial accountability. Management Science Letters, 9(9), 1373-1384.

- Dewi, R., & Hoesada, J. (2020). The effect of government accounting standards, internal control systems, competence of human resources, and use of information technology on quality of financial statements. International Journal of Innovative Research and Advanced Studies, 7(1), 4-10.

- Diamantopoulos, A., & Siguaw, J.A. (2000). Introducing LISREL. London: Sage Publications.

- Dillard, J.F. (1991). Accounting as a critical social science. Accounting, Auditing & Accountability Journal, 4(1).

- Dimitrijevic, D., Milovanovic, V., & Stancic, V. (2015). The role of a company’s internal control system in fraud prevention. Finansowy Kwartalnik Internetowy e-Finanse, 11(3), 34-44.

- Dornier, P. (2018). Investigating the Impact of Comprehensive Information Systems on Accounting Information Quality. Electronic Business, 17(12).

- Eierle, B., & Schultze, W. (2013). The role of management as a user of accounting information: implications for standard setting”. SSRN Electronic Journal 12(2), 155-189.

- Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Frazer, L. (2020). Does internal control improve the attestation function and by extension assurance services? a practical approach. Journal of Accounting & Finance (2158-3625), 20(1).

- Gal, G., & Akisik, O. (2020). The impact of internal control, external assurance, and integrated reports on market value. Corporate Social Responsibility and Environmental Management, 27(3), 1227-1240.

- Garver, M.S., & Mentzer, J.T. (1999). Logistics research methods: employing structural equation modeling to test for construct validity. Journal of Business Logistics, 20(1), 33-57.

- Gorla, N., Somers, T.M., & Wong, B. (2010). Organizational impact of system quality, information quality, and service quality. The Journal of Strategic Information Systems, 19(3), 207-228.

- Hendri & Amelia, S. (2019). The influence of human resources, and internal control on the quality of financial statement: Accounting information system as a moderating role. International Journal of Management, Accounting and Economics, 6(10), 761-769.

- Hla, D., & Teru, S.P. (2015). Efficiency of accounting information system and performance measures. International Journal of Multidisciplinary and Current Research, 3, 976-984.

- Hoe, S.L. (2008). Issues and procedures in adopting structural equation modelling technique. Journal of Quantitative Methods, 3(1), 76-83.

- INE. (2021). Empresas em Portugal 2019. Retrieved from https://www.ine.pt/xportal/xmain?xpid=INE&xpgid=ine_publicacoes&PUBLICACOESpub_boui=437546392&PUBLICACOESmodo=2

- Ji, X. D., Lu, W., & Qu, W. (2017). Voluntary disclosure of internal control weakness and earnings quality: Evidence from China. The International Journal of Accounting, 52(1), 27-44.

- Jokipii, A. (2010). Determinants and consequences of internal control in firms: a contingency theory based analysis. Journal of Management & Governance, 14(2), 115-144.

- Jonas, G.J., & Blanchet, J. (2000). Assessing quality of financial reporting. Accounting Horizons, 14(3), 353.

- Li, C., Peters, G.F., Richardson, V.J., & Watson, M.W. (2012). The consequences of information technology control weaknesses on management information systems: The case of Sarbanes-Oxley internal control reports. Mis Quarterly, 179-203.

- Marôco, J. (2010). Analysis of structural equations: Theoretical foundations, software & applications . ReportNumber, Lda.

- Mirnenko, V.I., Tkach, I.M., Potetiuieva, M.V., Mechetenko, M.Y., & Tkach, M.Y. (2020). Analysis of approaches to assessing effectiveness of the system of internal control of the military organization as the element of Public Internal Financial Control of Ukraine. Revista Espacios, 41(08).

- Mndzebele, N. (2013). The usage of accounting information systems for effective internal controls in the hotels. International Journal Advanced Computer Technology, 2(5), 1-3.

- Monteiro, A., Cepêda, C., & Silva, A. (2021). Linking decision and utility theories to financial information usefulness and company performance: A study applied to Portuguese's certified accountants. Accounting, 7(6), 1395-1406.

- Montenegro, T.M., & Rodrigues, L.L. (2020). Determinants of the attitudes of Portuguese accounting students and professionals towards earnings management. Journal of Academic Ethics, 18(3), 301-332.

- Moser, C. A., & Kalton, G. (2017). Survey methods in social investigation. Routledge.

- Muda, I., Haris Harahap, A., Erlina, E., Ginting, S., Maksum, A. and Abubakar, E. 2018. “Factors of quality of financial report of local government in Indonesia”. IOP Conference Series: Earth and Environmental Science 126(1): 012067. https://doi.org/10.1088/1755-1315/126/1/012067

- Muslim, A.I., & Setiawan, D. (2021). Information asymmetry, ownership structure and cost of equity capital: the formation for open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 48.

- Nguyen, H., & Nguyen, A. (2020). Determinants of accounting information systems quality: Empirical evidence from Vietnam. Accounting, 6(2), 185-198.

- Patel, F. (2015). Effects of accounting information system on organizational profitability. International Journal of Research and Analytical Reviews, 2(1), 168-174.

- Phornlaphatrachakorn, K. (2019). Internal control quality, accounting information usefulness, regulation compliance, and decision-making success: Evidence from canned and processed foods businesses in Thailand. International Journal of Business, 24(2), 198-215.

- Rashedi, H., & Dargahi, T. (2019). How influence the accounting information systems quality of internal control on financial reporting quality. JMDMA, 2(5), 33-45.

- Sajady, H., Dastgir, M., & Nejad, H.H. (2012). Evaluation of the effectiveness of accounting information systems. International Journal of Information Science and Management (IJISM), 6(2), 49-59.

- Salehi, M., Rostami, V., & Mogadam, A. (2010). Usefulness of accounting information system in emerging economy: Empirical evidence of Iran. International Journal of Economics and Finance, 2(2), 186-195.

- Sari, N.Z.M., Afifah, N.N., Susanto, A., & Sueb, M. (2019). Quality Accounting Information Systems with 3 Important Factors in BUMN Bandung Indonesia. In First International Conference on Administration Science (ICAS 2019) (pp. 93-96). Atlantis Press.

- Sari, N.Z.M., Se, M., & Purwanegara, H.D. (2016). The effect of quality accounting information system in Indonesian government (BUMD at Bandung area). Research Journal of Finance and Accounting, 7(2).

- Schwartz, M.S. (2016). Ethical decision-making theory: An integrated approach. Journal of Business Ethics, 139(4), 755-776.

- Selezneva, E.Y., Rakutko, S.Y., & Temchenko, O.S. (2020). Optimize the choice of counteragent based on the application of the coso internal control model. In International Scientific Conference" Far East Con"(ISCFEC 2020) (pp. 2291-2296). Atlantis Press.

- Semba, H.D. (2017). Does recycling improve information usefulness of income? The case of Japan. Asian Review of Accounting.

- Siqani, S., & Vokshi, N. (2019). The impact of accounting information system on the effectiveness of public enterprises: The case of Kosovo. International Journal of Economics and Business Administration, 7(3), 106-115.

- Solomons, D. (1991). Accounting and social change: a neutralist view. Accounting, Organizations and Society, 16(3), 287-295.

- Soudani, S.N. (2012). The usefulness of an accounting information system for effective organizational performance. International Journal of Economics and Finance, 4(5), 136-145.

- Surya, B., Menne, F., Sabhan, H., Suriani, S., Abubakar, H., & Idris, M. (2021). Economic Growth, Increasing Productivity of SMEs, and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 20.

- Wang, J., & Wang, X. (2019). Structural equation modeling: Applications using Mplus. John Wiley & Sons.

- Zakaria, K.M., Nawawi, A., & Salin, A.S.A.P. (2016). Internal controls and fraud–empirical evidence from oil and gas company. Journal of Financial Crime, 23 (4), 1154-1168.