Research Article: 2020 Vol: 19 Issue: 6

Impact the Internal Control of the Credit Operations on the Credit Effectiveness of Commercial Banks: A Case of HCMC and Dong Nai Province

Pham Quoc Thuan, University of Economics and Law, Ho Chi Minh City, Vietnam-Vietnam National University, Ho Chi Minh City, Vietnam

Ho Xuan Thuy, University of Economics and Law, Ho Chi Minh City, Vietnam-Vietnam National University, Ho Chi Minh City, Vietnam

Pham Thi Huyen Quyen, University of Economics and Law, Ho Chi Minh City, Vietnam-Vietnam National University, Ho Chi Minh City, Vietnam

To Thi Thanh Truc, University of Economics and Law, Ho Chi Minh City, Vietnam-Vietnam National University, Ho Chi Minh City, Vietnam

Nguyen Thi Diem Hien, University of Economics and Law, Ho Chi Minh City, Vietnam-Vietnam National University, Ho Chi Minh City, Vietnam

Abstract

The internal control of the credit activities at commercial banks in Vietnam is essential to prevent the risk of asset loss in the bank's credit operations. The objective of this study is to identify and measure the influence of factors on internal control of credit operations at commercial banks in Ho Chi Minh City (HCMC) and Dong Nai province. The study conducted on 600 staff related to credit activities at 10 commercial banks. The Data got from June 2019 to February 2020. Credit staffs answered 29 items, and 568 samples processed. The research method combines qualitative and quantitative with the use of SPSS 20.0 software. Analytical techniques include descriptive statistics, scale reliability testing, exploratory factor analysis (EFA), and Structural Equation Model (SEM). The research results showed that 5 factors are affecting the internal control of the credit operations at 10 commercial banks in Ho Chi Minh City and Dong Nai province, including: (1) Control environment; (2) Risk assessment; (3) Control activities; (4) Information and communication; (5) Supervision activities. Besides, the internal control of the credit operations affecting the credit effectiveness with significance level 0.01.

Keywords

Control, Credit Operations, Credit Effectiveness, Commercial, Bank.

Introduction

Vietnam takes part in international economic integration. Expanding international economic relations has been an indispensable trend for most countries in the world. Vietnam is not outside the inevitable trend, especially in the field of finance - banking. This integration process helps commercial banks have tremendous opportunities, but it is also accompanied by challenges, requiring banks to make efforts to strengthen and improve the risk management system. Risk management needs to meet the development strategy of the bank but still ensure the maintenance of safe and healthy operation (Akwaa-Sekyi, 2016).

Credit management is an essential capital-intensive business because it helps to turn around the mobilized capital. Inputs and accounts have a high proportion of the bank's profits. However, this is also the highest potential risk activity. Besides, credit risk is the likelihood of losses incurred by a bank due to a borrower's failure to pay in due time, to pay, or to repay capital and interest fully. This risk can lead to the bank's loss of payment due to failure to recover credit capital to pay for input deposits, or furthermore, it may adversely affect both the banking system and macro-economy. Credit risk reduces the reputation and competitiveness of banks. When banks are insolvent, they must borrow from different sources. The bank's reputation in the financial market severely reduced. This factor affects the partner’s psychology, leading to more difficult capital mobilization and faces many difficulties in competing with other banks. Therefore, to limit and prevent credit risks, in addition to technical credit measures, proper business orientation, the design of an internal control system of commercial banks. Credit operations are fundamental. This system plays an essential role in preventing and controlling credit risks, limiting the loss of credit capital of banks.

Besides, the objective of this study is to identify and measure the influence of factors on internal control of credit operations at commercial banks in Ho Chi Minh City (HCMC) and Dong Nai province. The research methods are the analysis of scientific literature, collection, comparison, classification and generalization of information, expert evaluation, a questionnaire survey and analytical techniques include descriptive statistics, scale reliability testing, EFA analysis, and SEM model. Therefore, the study of the factors affecting the internal control of credit operations in HCMC banks and Dong Nai province is necessary to improve the credit effectiveness and the management capacity of commercial banks.

Literature Review

The Internal Control of the Credit Operations (IC)

Internal control is a process implemented by the Board of Directors, the executive board, and all employees. It is not just a procedure or a policy implemented at a time but also continues at all levels of the bank (Ayagre, 2014). Basel II proposed 13 principles to design and evaluate the internal control system of banking system: Executive oversight and control culture (3 principles); Identify and assess risks (1 principle), Control activities and the assignment and assignment (2 principles); Information and communication (3 principles) Monitoring and correcting errors (3 principles), and Assessing the internal control system (Internal Control System) through a banking inspection agency (1 principle). In this study, internal control of credit activity understood as a process influenced by the Board of Directors, and officers, credit officers, established in the credit activities (Bett & Memba, 2017). It intended to provide reasonable assurance on achieving relevant credit objectives such as effectiveness, reporting, and compliance.

The Credit Effectiveness (CEF)

According to Brown (2014) most researchers measure credit effectiveness by paying customers' debt ratios; the higher this ratio is, the more effective credit activity is.

Some other researchers limit credit activity to lending activities only, such as: (Chitan, 2012) argue that loan effectiveness is the ratio of overdue debt to total outstanding loans (Fernando, 2014). Also agreed with this view and stated that the lower the ratio, the higher the loan effectiveness. In this study, credit effectiveness assessed by approaching the following studies: Firstly, a unit activity considered to be useful when the unit has achieved its set goals. Operational goals relate to achieving the unit's primary mission and vision, which is the fundamental reason for the unit to existing (Shun, 2018). Operational goals may be related to an increase in financial results, productivity, quality, environmental effectiveness, innovation, customer, and staff satisfaction. Second, the viewpoint of approach considers the bank as an intermediary to evaluate effectiveness. The bank's output is outstanding credit, and the input is the bank's mobilized capital.

Control Environment (CE)

The control environment is the foundation of the consciousness and culture of the organization, reflecting the general nuance of an organization, affecting the sense of control of all members of the organization (Gené, 2017). The control environment is the foundation for the remaining 4 parts (or components) of the internal control system, to develop appropriate principles and operating structures. The control environment includes the management's perceptions, attitudes, and actions for control and the importance of control. The control environment has an essential influence on the implementation process and the outcome of control procedures (Hunziker, 2017). A pleasant control environment can partly limit the lack of control procedures. Establishing and maintaining a secure control environment help the bank position itself more firmly in the face of internal and external pressures (Jin, 2018). A right control environment creates a positive environment and guides the right behavior of all employees to exercise their internal control and decision-making responsibilities.

H1 The Control environment positively affects the internal control of credit operations of commercial banks in HCMC and Dong Nai province.

Risk Assessment (RA)

Risks are the risks that cause an organization's goals met. All organizations, regardless of size, structure, business lines, face risks at many levels. Risks arise from external and internal sources of the organization (Umar, 2018). Risk assessment is the identification, analysis, and management of risks that can threaten the achievement of an organization's goals, such as production, sales, marketing, finance, and other activities from which risk-managed (Lock, 2014). Every unit, regardless of size, structure, nature, or industry, faces risks at all levels—the risk defined as the likelihood that an event occurs and adversely affect the achievement of the goal. Managers assess risks as part of the design and operation of internal control systems to minimize errors.

H2 Risk assessment positively affects the internal control of credit operations of commercial banks in HCMC and Dong Nai province.

Control Activities (CA)

Control activities are a set of control policies and procedures to ensure that managerial directives implemented to achieve the objectives. These policies and procedures promote the activities necessary to minimize the organization's risks and enable the goals to be implemented thoughtfully and effectively throughout the unit. Control activities take place throughout the organization at all levels and activities (Olana, 2014). Credit control policies are rules about what to do and are the basis for implementing control procedures. Credit control policies are fully documented and systematic. Sometimes policies are communicated verbally rather than in writing because the practice has been around for a long time (Onumah & Kuipo, 2012). The control procedure is the implementation of policies, making them active. The control procedures usually set up in credit operations are authorization and approval, assignment of duties, verification, reconciliation, and physical control (Khen, 2019). Control activities include: Control policies are principles to be done, which are the basis for the implementation of control procedures. Control procedures are specific provisions for enforcing control policies (Rizaldi, 2015). The policies and procedures established by the manager to assist in achieving the unit's objectives of operation and compliance. The manager must determine how to address identified risks and assess whether risk control benefits the entity.

H3 Control activities positively affect the internal control of credit operations of commercial banks in HCMC and Dong Nai province.

Information and Communication (ICO)

Every department and individual in the business must have the necessary information to help carry out their responsibilities (including control responsibilities). Communication is the exchange and communication of essential information to stakeholders both inside and outside the business (Olana, 2014). Each information system itself has the function of communication because then, the information that has been collected and processed can reach the people in need to help them fulfill their responsibilities. The communication system consists of 2 parts: Internal communication and external communication. Information and communication components support the function of all internal control components (Rizaldi, 2015). Information and communication support the achievement of the bank's goals, the quality of information and communication considered to be the best when the following contents are guaranteed: Easy to access, accurate, full, and timely. The presence of a useful information and communication system is an essential part of an effective internal control structure. Information and exchange systems are activities to identify and assess business risks, thereby determining measures to cope with risks.

H4 Information and communication positively affect the internal control of credit operations of commercial banks in HCMC and Dong Nai province.

Supervision Activities (SA)

The authors proposed the process of evaluating the effectiveness of internal control systems in each period. However, the perfect internal control system can only give the unit a reasonable guarantee to achieve the goals and cannot prevent errors and risks (Saeidi, 2014). Monitoring is the last part of the internal control system, the process of assessing the quality of the internal control system over time. Supervision has an important role; it helps internal control always operate effectively. The monitoring process is carried out by responsible people to evaluate the establishment and implementation of control procedures (Rizaldi, 2015). Monitoring is carried out in all activities of the bank, sometimes applied to external parties in two ways: regular monitoring and periodic monitoring. Regular supervision is the daily monitoring that is closely linked to the credit process and is carried out simultaneously with the credit process activities. Regular monitoring done immediately, dynamically reflecting changing conditions and it deeply embedded in the organization. Frequent monitoring activities are more effective than regular monitoring activities because of pre-inspection and preventive activities.

H5 Supervisory activities positively affects the internal control of credit operations of commercial banks in HCMC and Dong Nai province.

The operation of the internal control system (internal control) is an essential part of the banking system. The internal credit system of well-organized banks has a good impact on credit effectiveness at commercial banks (Umar, 2018).

H6 The internal control of the credit operations positively affecting the credit effectiveness at commercial banks in HCMC and Dong Nai province.

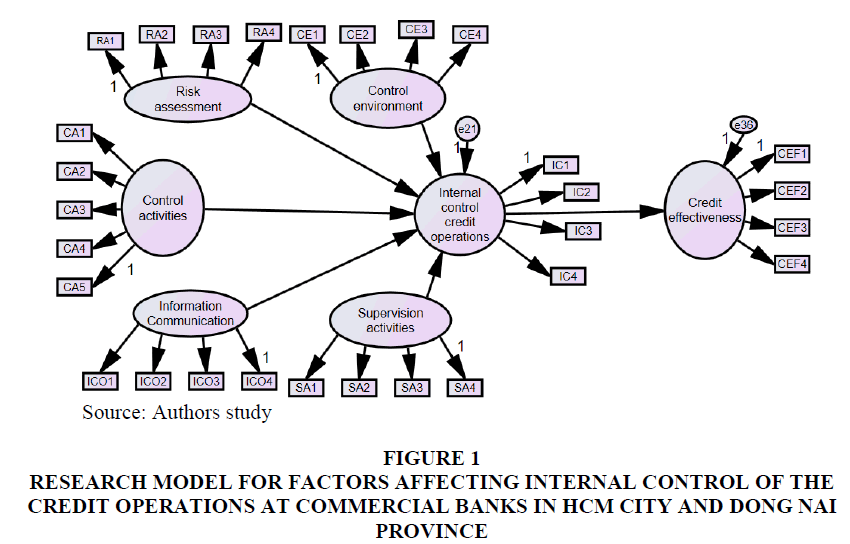

Based on previous studies, the authors propose a model to study factors affecting internal control of the credit operations at 10 commercial banks in HCM City and Dong Nai province including 5 independent variables: (1) Control environment; (2) Risk assessment; (3) Control activities; (4) Information and communication; (5) Supervision activities ((Figure 1). Besides, the internal control of the credit operations affecting the credit effectiveness at commercial banks in HCMC and Dong Nai province.

Figure 1 Research Model for Factors Affecting Internal Control of the Credit Operations at Commercial Banks in HCM city And Dong Nai Province

Methods of Research

The study combines qualitative and quantitative methods. The qualitative research methods used are: Methods of analysis, aggregation based on information from in-depth expert interviews, and annual reports of banks are used to make comments, assess the status of the establishment of internal control of credit operations. There are 50 experts surveyed in 10 commercial banks in HCM City and Dong Nai province. 50 experts are managers at 10 commercial banks above.

The quantitative method used to answer the second question - how the influence of the internal control factors on credit activity affects credit effectiveness (Hair et al., 1998). The study conducted through the following specific steps:

1. Preliminary research: Preliminary study conducted with the survey sample n=100. Purpose of implementation. This study aims to evaluate the reliability of the scale through the Cronbach Alpha coefficient. The assessment results used to remove non-conforming scales before EFA analysis and adjust the draft scale 2 to the official scale.

2. Official research: Official studies conducted to measure factors affecting internal control of the credit operations at commercial banks in HCM City and Dong Nai province. 600 staffs related to credit activities at 10 commercial banks in HCM City and Dong Nai province. The Data got from June 2019 to February 2020. Credit staffs answered 29 items, and 568 samples processed in HCM City and Dong Nai province. The questionnaire uses a 5-point Likert scale, with 1 strongly disagreed and 5 strongly agreement (Hair et al., 1998).

3. The authors tested the reliability and validity of the scale the Cronbach's Alpha, the KMO coefficient is within 0.5 to 1, Sig coefficient ≤ 5%.

4. The authors tested a structure model (SEM). Based on the Chi-square testing is P-value > 5%; CMIN/df ≤ 2, CMIN/df ≤ 3 or ≤ 5 (Hair et al., 1998).

5. The authors had a summary of research results based on model test results.

6. The authors had conclusions and recommendations.

Research Results

Based on 568 samples processed by SPSS 20.0, the authors tested the scale reliability of a model for factors, including five independent variables and two dependent variables: control environment; risk assessment; control activities; information and communication; supervision activities, the internal control of the credit operations, and the credit effectiveness. Cronbach's Alpha has the following: Table 1 showed that Cronbach's Alpha is 0.8, and Cronbach's Alpha is very reliable.

| Table 1 The Scale Reliability Tests for Factors Affecting Internal Control of the Credit Operations | ||

| Items | Contents | Cronbach's Alpha if Item Deleted |

| CE1 | Bank leadership can demonstrate integrity through words | 0.906 |

| CE2 | Management complies with regulations and codes of conduct | 0.930 |

| CE3 | Board of Directors promptly handle violations | 0.913 |

| CE4 | The reporting hierarchy is well established | 0.894 |

| Cronbach's Alpha for control environment (CE) | 0.932 | |

| RA1 | Credit targets explicitly set for each target | 0.913 |

| RA2 | Perform identification of credit risks that may arise when evaluating customer records | 0.946 |

| RA3 | Consider the possibility of fraud when evaluating customer records | 0.939 |

| RA4 | Internal documents on credit risk management to support the work | 0.921 |

| Cronbach's Alpha for risk assessment (RA) | 0.947 | |

| CA1 | Compliance with the regulations provided in the issued documents | 0.883 |

| CA2 | Reconcile information provided by customers with other reference sources | 0.896 |

| CA3 | The credit information system is regularly maintained | 0.908 |

| CA4 | Access to clearly decentralized credit information systems | 0.883 |

| CA5 | Assets serving credit activities are carefully protected | 0.899 |

| Cronbach's Alpha for control activities (CA) | 0.913 | |

| ICO1 | The database of credit operations is accurate | 0.807 |

| ICO2 | The database of credit activities is updated promptly | 0.804 |

| ICO3 | The internal bank information exchange is convenient | 0.839 |

| ICO4 | Easy to access credit operation database system | 0.801 |

| Cronbach's Alpha for information and communication (ICO) | 0.853 | |

| SA1 | Bank leaders regularly monitor the progress of employees' work | 0.917 |

| SA2 | The audit record of credit activity reflects the exact status of credit activity | 0.934 |

| SA3 | The minutes of inspection and control of credit activities strictly reflect the actual situation of credit activities | 0.929 |

| SA4 | Cases of violations in credit activities handled promptly | 0.911 |

| Cronbach's Alpha for supervision activities (SA) | 0.941 | |

| IC1 | Control environment positively impact on the internal control of the credit activities | 0.821 |

| IC2 | Risk assessment positively impact on the internal control of the credit activities | 0.788 |

| IC3 | Control activities positively impact on the internal control of the credit activities | 0.843 |

| IC4 | Information communication and supervisory activities positively impact on the internal control of the credit activities | 0.790 |

| Cronbach's Alpha for the internal control of the credit operations (IC) | 0.852 | |

| CEF1 | The target loan balance of the branch reached the plan | 0.931 |

| CEF2 | The wrong debt target of the branch reached the plan | 0.919 |

| CEF3 | Profit of the branch reached the plan | 0.927 |

| CEF4 | Creditworthiness reports prepared with confidence | 0.910 |

| Cronbach's Alpha for credit effectiveness (CEF) | 0.940 | |

Cronbach's Alpha for control environment (CE) is 0.932; risk assessment (RA) is 0.947; control activities (CA) is 0.913; information and communication (ICO) is 0.853; supervision activities (SA) is 0.941; the internal control of the credit operations (IC) is 0.852; the credit effectiveness (CEF) is 0.940.

Table 2 showed that the KMO coefficient is 0.827, and the level of significance (Sig) is 0.000. The result showed that there are five components. Extraction sums of squared loadings are % of the Variance coefficient is 79.685%, with the level of significance (Sig) is 0.000. These results show that Data is very reliable for researching structural equation modeling (SEM).

| Table 2 KMO and Bartlett's Test for Factors Affecting the Internal Control of the Credit Operations | |||||||

| Code | Component | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| CA5 | 0.901 | ||||||

| CA4 | 0.863 | ||||||

| CA3 | 0.845 | ||||||

| CA2 | 0.828 | ||||||

| CA1 | 0.818 | ||||||

| RA1 | 0.953 | ||||||

| RA4 | 0.949 | ||||||

| RA3 | 0.914 | ||||||

| RA2 | 0.899 | ||||||

| CEF4 | 0.946 | ||||||

| CEF2 | 0.939 | ||||||

| CEF3 | 0.912 | ||||||

| CEF1 | 0.888 | ||||||

| SA4 | 0.936 | ||||||

| SA1 | 0.922 | ||||||

| SA2 | 0.914 | ||||||

| SA3 | 0.914 | ||||||

| CE1 | 0.940 | ||||||

| CE4 | 0.912 | ||||||

| CE2 | 0.890 | ||||||

| CE3 | 0.870 | ||||||

| ICO4 | 0.857 | ||||||

| ICO1 | 0.836 | ||||||

| ICO2 | 0.832 | ||||||

| ICO3 | 0.804 | ||||||

| IC4 | 0.876 | ||||||

| IC1 | 0.819 | ||||||

| IC2 | 0.814 | ||||||

| IC3 | 0.782 | ||||||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy is 0.828 | |||||||

| Bartlett's Test of Sphericity; Sig. is 0.000 | |||||||

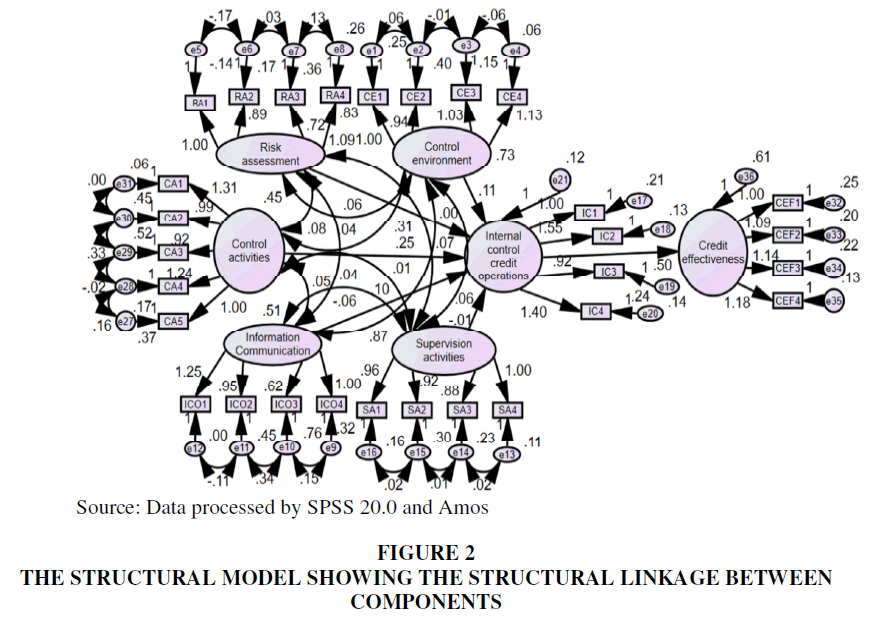

Table 3 & Figure 2 showed that column P<0.01 with significance level 0.01 and column “Conclusion” H1: supported; H2: supported; H3: supported H4: supported; H5: supported; H6: supported. These results showed that five factors are affecting the internal control of the credit operations and the internal control of the credit operations affecting the credit effectiveness with a significance level of 0.01. These results are science evident for managerial implications to enhance credit effectiveness. Chi-square =1254.401; df =345; p=0.000; Chi-square/df =3.636; GFI=0.869; TLI=0.926; CFI=0.938; RMSEA=0.068.

| Table 3 Coefficients from Structural Equation Modeling (SEM) | ||||||||

| Relationships | Coefficient | Standardized Coefficient | S.E. | C.R. | P | Conclusion | ||

| Internal control credit operations | <--- | Control environment | 0.109 | 0.213 | 0.024 | 4.584 | *** | H1: Supported |

| Internal control credit operations | <--- | Risk assessment | 0.058 | 0.138 | 0.019 | 2.989 | .003 | H2: Supported |

| Internal control credit operations | <--- | Control activities | 0.251 | 0.384 | 0.035 | 7.219 | *** | H3: Supported |

| Internal control credit operations | <--- | Information Communication | 0.099 | 0.161 | 0.023 | 4.265 | *** | H4: Supported |

| Internal control credit operations | <--- | Supervision activities | 0.063 | 0.134 | 0.018 | 3.458 | *** | H5: Supported |

| Credit effectiveness | <--- | Internal control credit operations | 0.497 | 0.267 | 0.087 | 5.738 | *** | H6: Supported |

Source: Data processed by SPSS 20.0, and Amos

Conclusions

The authors proposed the internal control of the credit operations built to carry out supervision of senior management, internal control, risk management, internal assessment of sufficient capital, and internal audit. Based on the implementation function and role, the internal control operation is the core activity of this system. Besides, the study conducted on 600 staff related to credit activities at 10 commercial banks. The Data got from June 2019 to February 2020. Credit staffs answered 29 items, and 568 samples processed. The research method combines qualitative and quantitative with the use of SPSS 20.0 software. Analytical techniques include descriptive statistics, scale reliability testing, EFA analysis, and SEM model. The research results showed that five factors are affecting the internal control of the credit operations at 10 commercial banks in Ho Chi Minh City and Dong Nai province, including: (1) Control environment; (2) Risk assessment; (3) Control activities; (4) Information and communication; (5) Supervision activities. Besides, the internal control of the credit operations affecting the credit effectiveness with significance level 0.01. The researchers had managerial implications for commercial banks to continue improving the management policies of the internal control of credit operations in the future.

Managerial Implications

The commercial banks continue improving the quality of credit activities in particular and the operation of the banking system in general, the direction to complete the internal control system in the next time should focus on the following groups of managerial implications:

The managerial implications for control activities are (β = 0.384): The commercial banks need to build a centralized data warehouse, containing all credit information such as all the internal regulations on credit activities, the bank's regulations. State goods and related laws. Besides, there should be a department in charge of synthesizing, screening, and analyzing information on credit activities necessary to support the work, thereby proactively sending to professional credit staff according to the permission. Besides, commercial banks need to increase the use of modern software technology, which can detect immediately and issue alerts to the leaders of pre-formatted data editing cases. The commercial banks continue completing the legal basis, creating a corridor for improving the efficiency of the internal control system. Banks should issue operational safety regulations for the system based on the regulations of the State Bank, generally accepted accounting standards, accounting and auditing standards, and the application of principles. On Basel bank supervision.

The managerial implications for the control environment are (β=0.213): The commercial banks should promulgate a full range of policies and guidelines on credit activities to ensure that all officers and employees comply with the issued documents to limit the risks arising, achieving goals set. Commercial banks need to regulate and separate business functions, risk management, operations, accounting, asset protection, and approval. A business process must have at least two participants, one performing, one controlling, not letting an individual perform, and deciding a business process. The commercial banks continue to perfect the environment of personal credit control as the basis for building the rest of the internal control system. Correctly, raising the awareness of compliance with individual credit regulations, processes, respect the integrity and ethical values of not only employees but also senior managers of the system; Clearly define the responsibilities of individuals and departments when participating in the personal credit process to prevent and promptly detect violations.

The managerial implications for information and communication are (β=0.161): The annual report is one of the tools for the bank to communicate information to investors who are interested in learning about the bank's effectiveness. Therefore, the content of the annual report should clearly show the significant indicators of the bank's credit operations, such as outstanding loans, outstanding loan structure, bad debts, and interest income. And safety indicators according to State Bank regulations. Besides, banks need to attach the statement of income and financial statements to demonstrate the transparency of the information that the bank has provided. Besides, commercial banks need to build a centralized data warehouse containing all credit information such as all internal regulations on credit operations, regulations of the State Bank, and laws. The commercial banks continue to perfect the information and communication system. Banks need to invest in modernizing their information technology systems, developing internal management systems to upgrading their core banking systems to suit the size and complexity of individual credit operations, as well as requiring system administrator administration.

The authors proposed that the managerial implications for risk assessment (β = 0.138). Commercial banks periodically tested risk assessment, at the units in the bank, it is necessary to organize knowledge and dissemination sessions actively, update new points, changes that significantly affect officials and employees to ensure that all employees Ministry and staff have understood and can correctly apply the contents of the credit risk management document issued. Besides, the bank needs to improve its compliance with the standards set out in the Code of Conduct/Ethics and the handling of violations of established regulations. The bank should establish a compliance department, which is responsible for overseeing compliance with the bank's standards. Compliance checks and supervises compliance with the standards specified in the Code of Conduct and professional ethics. The violations punished by the bank. The commercial banks continue to complete the credit risk assessment process. Banks should quickly strengthen the research department, evaluate the factors affecting internal control of personal credit activities to identify risks, and advise the management.

The authors proposed that the managerial implications for supervision activities (β = 0.134). Manager of commercial banks should take the initiative in regularly opening self-training classes for auditors to improve their professional skills as well as financial analysis skills to improve the quality of the audit, reflecting the right situation. The branch, restricting the cases of multiple explanations, wasting working time on both sides. At the same time, detect, prevent, and promptly handle violations in credit activities. The audit committee/committee of the department needs detailed planning and should work together. Avoid the audits, control too close to each other, affecting the quality of work of the banks. The commercial banks continue to improve the supervision of credit controls to ensure transparency and enhance the supervision of the Board of Directors; Banks need to separate the supervisory and business administration functions of the Board of Directors. Also, banks need to perfect the internal control system according to the 17 expansion principles. Accordingly, it is necessary to evaluate the internal control system based on 3 defensive lines: Directly dealing with customers; Approval Block; System of supervisory and disbursement departments.

The research limitations only surveyed 10 commercial banks in Ho Chi Minh City and Dong Nai province. The sample used 600 staffs related to credit activities. This sample is very little significant and exactly. Therefore, the next research-tested another sample in other provinces and cities. The next study needs to improve the variables for the model.

Acknowledgement

This research is funded by University of Economics and Law, Vietnam National University Ho Chi Minh City, Vietnam.

References

- Akwaa-Sekyi. (2016). ‘Effect of internal controls on credit risk among listed spanish banks. Intangible Capital, 12(1), 357-389.

- Ayagre, P. (2014). The effectiveness of internal control systems of banks: The case of Ghanaian Banks. International Journal of Accounting and Financial Reporting, 4(2), 377-183.

- Bett, J.C., & Memba, F.S. (2017). Effects of internal control on the financial performance of processing firms in Kenya: A case of menengai company. International Journal of Recent Research in Commerce Economics and Management, 4(1), 105-115.

- Brown, N.C. (2014). The effect of internal control and risk management regulation on earnings quality: Evidence from Germany. Journal of Accounting and Public Policy, 33(1), 1-31.

- Chitan, G. (2012). Corporate governance and bank performance in the Romanian banking sector. Procedia Economics and Finance, 13(1), 549-554.

- Fernando, A. (2014). A proposed reaserch framework?: Effectiveness of internal control system in state. International Journal of Scientific Research and Innovative Technology, 1(5), 25-44.

- Gené, J.M. (2017). Internal controls and credit risk relationship among banks in Europe. Intangible Capital, 13(1), 25-50.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (1998). Multivariate data analysis with readings. US: Prentice-Hall: Upper Saddle River, NJ, USA.

- Hunziker, S. (2017). Efficiency of internal control: evidence from Swiss non financial companies. Journal of Management and Governance, 21(2), 399-433.

- Jin, H.K. (2018). Analysis of the internal control audit model of commercial banks from the perspective of comprehensive risk management. Internal Auditing in China, 1(2), 15-21.

- Khen, Q. (2019). Discussion on the internal control of chinese commercial banks from the perspective of risk management. Journal of Socialist Theory Guide, 5(1), 230-238.

- Lock, K.L. (2014). A proposed reaserch framework?: Effectiveness of internal control system in state commercial banks in Sri Lanka. International Journal of Scientific Research and Innovative Technology, 5(1), 25-44.

- Olana, D.R. (2014). Bank-specific determinants of credit risk: Empirical evidence from Ethiopian bank. Research Journal of finance and accounting, 5(7), 80-85.

- Onumah, J.M., & Kuipo, R. (2012). Effectiveness of Internal Control Systems of Listed Firms in Ghana. Accounting in Emerging Economies, 12(1), 31-49.

- Rizaldi, A. (2015). Control environment analysis at government internal control system: Indonesia case. Procedia - Social and Behavioral Sciences, 211(9), 844-850.

- Saeidi, P. (2014). A proposed model of the relationship between enterprise risk management and firm performance. International Journal of Information Processing and Management, 5(2), 70-80.

- Shun, L. (2018). Analysis and reflection on the internal control of commercial banks. Science & Technology Association Forum, 2(1), 132-143.

- Umar, H. (2018). The effect of internal control systems on the performance of commercial banks in Nigeria. Journal of Management Sciences, 16(3), 86-105.