Research Article: 2021 Vol: 20 Issue: 2S

Impacting Corporate Social Responsibility on Brand Value: A Case Study of Commercial Banks in Ho Chi Minh City

Phan Thanh Tam, Lac Hong University (LHU)

Keywords

Corporate, Social, Responsibility, Brand, Value, LHU

Abstract

Corporate social responsibility is becoming a key trend in connecting sustainable development and core values in business operations to create an expected value for the business and society. Corporate social responsibility (CSR) contributes to improving the business’s quality, brand value, and reputation. CSR can help enterprises to increase brand value and importance significantly. Reputation helps enterprises increase revenue, attracting partners, investors, and employees. Therefore, the authors surveyed 750 customers relating to 15 commercial banks in Ho Chi Minh City (HCMC), and the article explores corporate social responsibility affecting commercial banks’ brand value in HCMC. Corporate social responsibility affected commercial banks’ brand value in HCMC with 1% significance by applying Structural Equation Modeling (SEM). Finally, the authors had policy recommendations to enhance corporate social responsibility contributing to commercial banks’ brand.

Introduction

Pandit, Dhakal & Polyakov (2015) studied that the process of comprehensive national renovation, accelerating economic growth always comes with pressing environmental and social problems. This issue requires economic actors, including the banking sector, to participate in solving. The banking industry has always been considered an important industry of any country, especially in the integration and fierce competition by Pérez & Del Bosque (2012). Banks play a role in connecting actors in the economy and pioneering global trends such as corporate social responsibility. Perform corporate social responsibility related to the long-term success of the business. Commercial banks implement CSR programs aimed at the residential community and organize funding activities that are compatible with current goals and challenges, create energy to innovate, measure performance, and make a competitive advantage.

The banks’ environmental and social policies paid more attention, such as ecological policies in credit activities and community-oriented programs by Pinar, Girard & Eser (2012). The banking industry is increasingly interested in social responsibility. However, there is very little research to measure many aspects relevant to a developing economy like Vietnam. Finally, corporate social responsibility is viewed as one of the company’s top business strategies rather than mandatory charity or regulation by Won-Moo, Hanna, & Woo (2014). Deploying corporate social responsibility help your business does well and help your company solve strategic problems related to business and social issues. Therefore, the article aims to explore corporate social responsibility affecting commercial banks’ brand value in Ho Chi Minh City and apply research results to improve Vietnam’s commercial banks’ brand value.

Methods

Literature Review

Brand Value (BV)

Rhou, Singal, & Koh (2016) showed that brand values are the specific values that brands bring to external audiences such as customers and internal audiences like employees. The brand value is expressed through perceived value - emotions and feelings of consumers towards the brand. In marketing, brands provide the main differentiator between competitors and are a prerequisite for corporate success. Therefore, managing and enhancing brand equity needs to be approached strategically by Saeednia & Sohani (2013). In the business field, branding in the service sector is a much-debated issue among academics and direct marketing activities. It is part of the marketing strategy and a precious corporate asset by Sprinkle & Maines (2010). The brand is a valuable asset of any business in the long term, and brand management should be viewed in multidimensional by Vurro & Perrini (2011). The research paper focuses on looking at brand value based on customers.

Corporate Social Responsibility (CSR)

Wang & Sengupta (2016) argued that CSR is complicated to define; different subjects perceive CSR differently. Each industry, organization, and government see CSR from its perspectives and perspectives. Since then, there are many different definitions of CSR by Soana (2011). Despite the lack of a coherent explanation, all descriptions indicated that a company should meet social expectations when planning environmental management strategies. Wang, Dou & Jia (2016) studied that CSR is the business operator’s obligation to propose and enforce policies that do not prejudice rights and others’ interests. CSR is the relationship between the company and society. Managers must pay attention to foster this relationship with stakeholders in business goals. CSR emphasizes business communication’s critical role in establishing and maintaining a transparent and open dialogue with various stakeholders to promote ethical and socially responsible practices for multiple issues.

CSR Based on Community Awareness (CA)

Wang & Sarkis (2017) studied that businesses forced to change when the public requires and anticipates other behavior. Firms that behave according to the public’s rewarded, while companies that do not satisfy the public faced many difficulties. I predict that in the future, as in the past, changes in public opinion will be an essential factor leading to changes in environmental protection activities of businesses by Raufflet, Cruz & Bres (2014). CSR strategies encourage a company to positively impact the environment and those involved in its operations (stakeholders), including consumers, employees, investors, communities, governments. Compared with the manufacturing sector, the service sector has many advantages in making a difference in customers’ minds. In service marketing, company brands are closely related to each company’s products’ specific brands by Papagiannakis & Lioukas (2012). There are many views on brand equity’s importance; it measures a brand’s strength through logos and trademarks. Strong brands increase community trust, increasing community understanding of the intangible aspect of services provided. Based on the concept mentioned above and studies, the authors gave hypothesis H1 following:

Hypothesis H1: CSR is based on Community Awareness (CA) positively impacting commercial banks’ brand value in HCMC.

CSR Based on Employee Awareness (EA)

Zainab, Anji & Muneer (2019) showed that the brand value is good, including employee loyalty. It will result in the company maintaining its competitive revenue position in the marketplace. According to Tingchi, Anthony, Shi, Chu & Brock (2014) showed that the reputation of businesses operating in the financial sector depends on the CSR programs implemented. It explains why banks strive to achieve high honors in investment charts for CSR. From an employee-centric approach, Scharf & Fernandes (2013) explored CSR’s impact on corporate and internal outcomes. These studies gradually increase brand influence, so the degree of coherence between CSR and brand is increasingly tight. Öberseder, Schlegelmilch & Murphy (2013) demonstrated that the CSR awareness of banking staff in Korea positively impacted potential variables such as job quality, organizational behavior, commitment to engagement. This factor was leading to increased work efficiency and increase brand value. Based on the concept as mentioned earlier and studies, authors gave hypothesis H2 following:

Hypothesis H2: CSR is based on Employee Awareness (EA) positively impacting commercial banks’ brand value in HCMC.

CSR based on legal ethics awareness (LA)

According to Nollet, Filis & Mitrokostas (2016), empirical research on ethical and legal brand value hypothesized that CSR impacts brand value based on ethical value. At the same time, CSR from the employee’s perspective also tested concerning the brand value. According to Al-Samman & Al-Nashmi (2016), employees enjoy working and sticking with companies with good reputations, so there is a positive relationship between CSR and brand equity based on employees. Chung, Yu, Choi & Shin (2015) studied the relationship between employees’ perceptions of CSR affecting job performance, showing that they impact better working conditions, organizational commitment, and organizational behavior. All these components create the brand value based on the employee’s morality. Based on the concept as mentioned above and studies, authors gave hypothesis H3 following:

Hypothesis H3: CSR is based on Legal Ethics Awareness (LA) positively impacting commercial banks’ brand value in HCMC.

CSR Based on Customer Awareness (CUA)

According to Pérez & Rodríguez (2015), brand equity research has three different directions: (1) company based (2) customer-based (3) financial-based. However, in research related to marketing, brand equity is most commonly used by Pérez & del Bosque (2014). The relationship between CSR and brand equity is studied at many different angles and proven through empirical research is positive. In many marketing studies, CSR positively affects customer perception of the brand by Ruiz, Esteban & Gutiérrez (2014). Besides & Cowley (2013) confirmed that CSR is an essential factor in evaluating global brands. The customer- oriented role of CSR towards the brand depends on the credibility of the CSR policies. The research results of Robin, Salim & Bloch (2018) provided evidence of the influence of CSR on the matrix of factors related to brand value from the customer’s perspective. Based on the concept mentioned above and studies, the authors gave hypothesis H4 following:

Hypothesis H4: CSR is based on Customer Awareness (CUA) positively impacting commercial banks’ brand value in HCMC.

CSR Based on Shareholder Awareness (SA)

Pérez & del Bosque (2015) showed that the studies vary, but all conclude about a positive relationship between CSR and brand equity based on public perception. From the theoretical and practical basis of branding and CSR operations of current commercial banks, the study proposes hypotheses that shareholders’ perceptions of CSR aspects positively impact commercial brand value. Shareholders are increasingly concerned with social responsibility, especially corporate tax compliance by Pätäri, Arminen, Tuppura & Jantunen (2014). Raising shareholder awareness of corporate social responsibility in tax payment contributes to promoting business sustainability, healthy competition and continuously contributes to socio-economic development by Wang, Chen, Yu & Hsiao (2015). As education levels increase, shareholders become more aware of their behavior toward businesses that perform well in their social responsibility, especially in tax law compliance by Papagiannakis & Lioukas (2012). Consumers can support the promotion of enterprises’ products that had well-observed tax laws. It is a significant contribution to the state budget. On the contrary, they will not support and call for a boycott of corporate products to evade tax, tax debt and violate the tax law by Tao, Song, Ferguson & Kochhar (2018). Based on the concept mentioned above and studies, the authors gave hypothesis H5 following:

Hypothesis H5: CSR is based on Shareholder Awareness (SA) positively impacting commercial banks’ brand value in HCMC

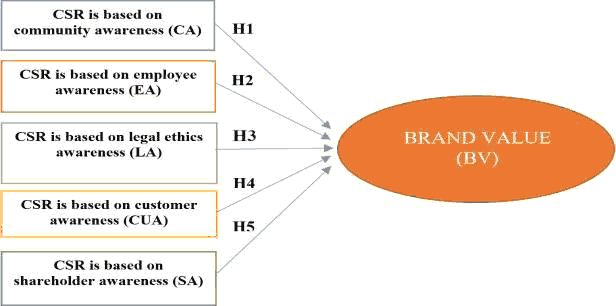

Research on the relationship between commercial banks’ corporate social responsibility and brand value in Ho Chi Minh City. The authors had a research model and the hypothesis following Figure 1 :

Figure 1: A Research Model for The Corporate Social Responsibility Affecting Brand Value of Commercial Banks in Hcmc

(Source: Researchers discovered)

Methods of Research

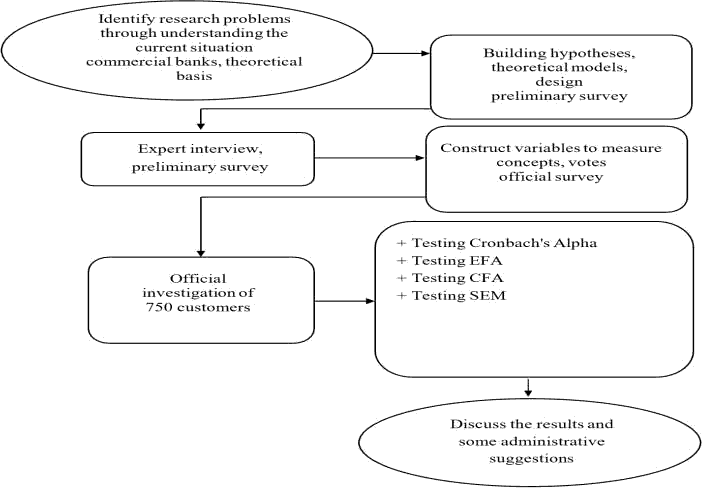

The research method of the topic is a combination of qualitative research methods and quantitative research methods. (Figure 2)

Figure 2: A Research Process for The Corporate Social Responsibility Affecting Brand Value of Commercial Banks in Hcmc

(Source: Researchers proposed)

This research had been combining qualitative and quantitative methods. The quantitative research method is done by collecting, processing, and analyzing data obtained through survey question answer information and secondary data collected from bank managers’ financial statements. Sequential work steps in the research process are summarized as above by Hair, Anderson, Tatham & Black (2010).

Quantitative research: Qualitative research includes interviewing 15 experts in banking management and analyzing the pilot survey content after reviewing the theoretical basis from previous studies. Qualitative research results gave the authors lots of authentic, valuable information about CSR’s actual situation and brand value. The article also combines facts and a theoretical basis to propose research models and hypotheses—the observed variables built on previous studies and corrected contributions by experts.

The quantitative study conducted with an expected sample size of n=750 customers using 15 commercial banks in HCMC from June 2020 to November 2020. The authors used a convenient sampling method to pick a sample, but 725 samples were processed, leaving 25 samples unprocessed. Finally, the authors used SPSS 20.0 tools to measure Cronbach’s Alpha’s trust coefficient, EFA: Explore factor analysis, Confirmation Factor Analysis (CFA), and Structural Equation Modeling (SEM).

Research Results

Testing of Cronbach’s Alpha

Table 1 showed that Cronbach’s alpha for the Brand Value (BV) meets this technique’s requirements. Specifically, Cronbach’s Alpha values of the Brand Value (BV) is 0.953, and Cronbach’s Alpha if Item Deleted (>0.6).

| Table 1 Testing of Cronbach’s Alpha for Brand Value (BV) |

||

|---|---|---|

| Code | Brand Value (BV) | Cronbach’s Alpha if Item Deleted |

| BV1 | There are good financial services products available and clean transaction space | 0.945 |

| BV2 | The brand is different from another bank brand and modern design bank | 0.895 |

| BV3 | The bank is the first choice when it comes to using the service, and the service quality of the bank is good | 0.951 |

| Cronbach’s alpha: 0.953 | ||

Table 2 showed that Cronbach’s alpha for the CSR based on Community Awareness (CA) meets this technique’s requirements. Specifically, Cronbach’s Alpha values of the CSR based on community awareness (CA) is 0.893, and Cronbach’s Alpha if Item Deleted (>0.6).

| Table 2 Testing of Cronbach’s Alpha for Community Awareness (CA) |

||

|---|---|---|

| Code | CSR based on community awareness (CA) | Cronbach’s Alpha if Item Deleted |

| CA1 | Set aside a portion of the budget for charitable and other donations social security work |

0.871 |

| CA2 | There is sponsorship of cultural and sporting events | 0.826 |

| CA3 | Pay attention to issues related to social security | 0.882 |

| CA4 | Contribute to protecting the natural environment | 0.867 |

| Cronbach’s alpha: 0.893 | ||

Table 3 showed that Cronbach’s alpha for the CSR based on Employee Awareness (EA) meets this technique’s requirements. Specifically, Cronbach’s Alpha values of the CSR based on Employee Awareness (EA) is 0.966, and Cronbach’s Alpha if Item Deleted (>0.6).

| Table 3 Testing of Cronbach’s Alpha for Employee Awareness (EA) |

|

|---|---|

| CSR based on Employee Awareness (EA) | Cronbach’s Alpha if Item Deleted |

| Pay employees fairly and create safe working conditions | 0.951 |

| Treat employees fairly – equally and create a friendly working environment | 0.962 |

| Provide adequate professional training and opportunities for learning or advancement | 0.962 |

| Support staff to solve problems of yourself and your family | 0.947 |

| Cronbach’s Alpha: 0.966 | |

Table 4 showed that Cronbach’s alpha for the CSR based on legal ethics awareness (LA) meets this technique’s requirements. Specifically, Cronbach’s Alpha values of the CSR based on legal ethics awareness (LA) is 0.959, and Cronbach’s Alpha if Item Deleted (>0.6).

| Table 4 Testing of Cronbach’s Alpha for Legal Ethics Awareness (LA) |

||

|---|---|---|

| Code | CSR based on Legal Ethics Awareness (LA) | Cronbach’s Alpha if Item Deleted |

| LA1 | Compliance with the laws and regulations of the State Bank | 0.944 |

| LA2 | Fulfill obligations with related parties | 0.947 |

| LA3 | Adhere to ethical standards | 0.956 |

| LA4 | Always be aware of taxes payable to the State | 0.935 |

| Cronbach’s alpha: 0.959 | ||

Table 5 showed that Cronbach’s alpha for the CSR based on customer awareness (CUA) meets this technique’s requirements. Specifically, Cronbach’s Alpha values of the CSR based on Customer Awareness (CUA) is 0.862, and Cronbach’s Alpha if Item Deleted (>0.6).

| Table 5 Testing of Cronbach’s Alpha for Customer Awareness (CUA) |

||

|---|---|---|

| Code | CSR based on Customer Awareness (CUA) | Cronbach’s Alpha if Item Deleted |

| CUA1 | Dedicated to resolving complaints and questions of customers | 0.809 |

| CUA2 | Treat customers honestly and respectfully | 0.820 |

| CUA3 | Provide complete information about the types of products and services to customers and capture customer needs |

0.855 |

| CUA4 | See customer satisfaction as the criterion for product improvement service/ products |

0.811 |

| Cronbach’s alpha: 0.862 | ||

Table 6 showed that Cronbach’s alpha for the CSR based on Shareholder Awareness (SA) meets this technique’s requirements. Specifically, Cronbach’s Alpha values of the CSR based on Shareholder Awareness (SA) is 0.967, and Cronbach’s Alpha if Item Deleted (>0.6).

| Table 6 Testing of Cronbach’s Alpha for Shareholder Awareness (SA) |

||

|---|---|---|

| Code | CSR based on Shareholder Awareness (SA) | Cronbach’s Alpha if Item Deleted |

| SA1 | Credit risks identified through signs arising from customers and banks | 0.951 |

| SA2 | The bank develops a policy of debt classification and timely provisioning for risks | 0.961 |

| SA3 | Credit officers analyze and evaluate customers from contact, during the lending process, and after lending | 0.965 |

| SA4 | Managing customer information by categories and creating reports is very effective | 0.950 |

| Cronbach’s alpha: 0.967 | ||

Table 7 showed that the Kaiser-Meyer-Olkin Measure of Sampling Adequacy (KMO) is 0.834 (>0.5). This result is consistent with the actual data investigated by 750 customers using banking services of 15 commercial banks in Ho Chi Minh City.

| Table 7 Kmo And Bartlett’s Test for The Corporate Social Responsibility Affecting Brand Value of Commercial Banks In Hcmc |

||

|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.834 | |

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 17788.878 |

| df | 253 | |

| Sig. | 0.000 | |

| Extraction Sums of Squared Loadings: Cumulative is 82.481 % | ||

Table 8 showed the corporate social responsibility affecting commercial banks’ brand value in HCMC with a significance level of 0.01. These results are critical information for managerial implications to enhance the corporate social responsibility involving the brand value of commercial banks in HCMC. Besides, the results showed that the research model is consistent with trust data.

| Table 8 Testing Coefficients for The Corporate Social Responsibility Affecting Brand Value of Commercial Banks in Hcmc |

||||||||

|---|---|---|---|---|---|---|---|---|

| Relationships | Unstandardized Estimate | Standardized Estimate | S.E. | C.R. | P | Results | ||

| BV | <--- | EA | 0.534 | 0.550 | 0.033 | 16.345 | *** | Accepted |

| BV | <--- | SA | 0.079 | 0.083 | 0.029 | 2.701 | 0.007 | Accepted |

| BV | <--- | CUA | 0.191 | 0.176 | 0.035 | 5.392 | *** | Accepted |

| BV | <--- | CA | 0.170 | 0.088 | 0.051 | 3.333 | *** | Accepted |

| BV | <--- | LA | 0.097 | 0.106 | 0.029 | 3.369 | *** | Accepted |

Table 9 showed that the bootstrap test results are very good with a sample of 25.000 customers related to 15 commercial banks in HCMC. These results indicated five CSR factors affecting the brand value of 15 commercial banks in HCMC with a significance level of 0.01.

| Table 9 Testing Bootstrap With 25.000 Samples for The Corporate Social Responsibility Affecting Brand Value of Commercial Banks in Hcmc |

|||||||

|---|---|---|---|---|---|---|---|

| Parameter | SE | SE-SE | Mean | Bias | SE-Bias | ||

| BV | <--- | EA | 0.040 | 0.001 | 0.534 | -0.001 | 0.001 |

| BV | <--- | SA | 0.029 | 0.000 | 0.075 | -0.004 | 0.001 |

| BV | <--- | CUA | 0.038 | 0.001 | 0.185 | -0.006 | 0.001 |

| BV | <--- | CA | 0.047 | 0.001 | 0.164 | -0.006 | 0.001 |

| BV | <--- | LA | 0.027 | 0.000 | 0.094 | -0.002 | 0.001 |

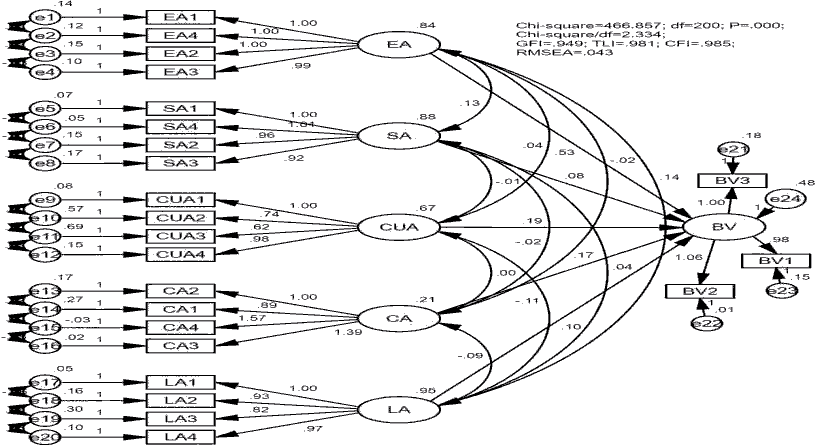

Figure 3 showed that the SEM assessment had five factors of the corporate social responsibility affecting the brand value of commercial banks in HCMC with a significance level of 0.01. Figure 3 showed that the assessment of the scale of the corporate social responsibility affecting brand value of commercial banks in HCMC including: CMIN/DF=2.334 (<5.0), GFI=0.949 (>0.8), TLI=0.981 (>0.9), CFI=0.985 (>0.9) and RMSE=0.043 (<0.08). All model indicators showed that they are perfect and consistent with both theory and practice in Vietnam. This result is significant proof for bank managers to apply research results in improving the corporate social responsibility and brand value of commercial banks in the next years.

Figure 3: Testing Sem for The Corporate Social Responsibility Affecting Brand Value of Commercial Banks in Hcmc

(Source: Data processed by SPSS 20.0 and Amos)

Conclusion & Policy Implications

Conclusion

The research has developed a theoretical model to test the relationship between customer CSR perception and brand equity. Based on stakeholder theory and thorough literature review, and empirical research to measure CSR’s relationship, brand equity. This study’s main findings are as follows: (1) Research results show that all five aspects affect brand equity according to customer perception. Besides, the study found statistical evidence and a positive relationship of customers to CSR. (2) To measure the impact of the R aspects on brand equity. Hypothesis testing results show that all five factors positively impact brand equity based on customers. Based on the analysis results, the bank managers can design CSR activities for each customer. They are continuing to raise awareness of CSR. Besides, the results emphasize the customer, community, legal ethics aspects to improve brand equity based on the customer. Therefore, the bank manager can effectively allocate resources to CSR activities.

Policy Implications

(1) Proposing to build a long-term CSR strategy towards sustainable development with appropriate steps in different stages. The test results show that the customer group’s community and customer aspects and the employee group’s shareholder aspect related to brand value. In other words, the bank invests heavily in the community, customer-aspect. Therefore, commercial banks need to have a long-term strategy in building and implementing CSR towards sustainable development. Implementing CSR in the complete and authentic sense is not a simple problem and is in immediate solvability because of cognitive constraints and resource factors. Finance, technology, human resources. Therefore, commercial banks need to develop a suitable roadmap to implement the community, customers, and shareholders’ aspects for short-term benefits and follow general standards supported by stakeholders, actively contributing to increasing brand value.

(2) All bank branches should strengthen the organization of many quality CSR activities for employees to increase awareness of this aspect, such as creating safe, friendly working conditions, creating learning opportunities, playing, and taking care of your health. When trade unions play an essential role as the representative of workers, they say in the negotiations about setting the employee’s working terms and conditions such as wages, working hours, and other benefits. All bank branches can improve employee-related CSR activities, which is an essential aspect of CSR. The grassroots trade unions should develop and issue schedules and rules to receive workers, open books to track complaints, receive complaints and denunciations, arrange staff to receive and resolve problems from employee recommendations for CSR activities and expertise. From a governance perspective, these research results encourage banks to engage employees in ethical activities, acting as brand ambassadors. Meanwhile, the union organization creates an energetic environment for employees to practice activities that benefit society, the community, as well as meaningful to the employees themselves.

(3) The test results show that the legal ethics aspect positively affects brand value. These results imply that banks should comply with regulations and ethical standards. Banks participate in intensive training and regular training on CSR knowledge through short training courses, agendas, seminars by authorities, specialized agencies. The institutions of the State Bank should pay attention to the selection of suitable subjects. From there, the bank managers will directly guide, implement, and build a CSR strategy towards each customer, following the bank’s current context in each period. For example, they are fostering upcoming legal documents for regulators, leading to full compliance with environmental and financial laws. And staff directly operates to each suitable customer. Commercial banks always consider compliance, responsibility, and standards to be indispensable elements in their operations as the basis for building trust for customers and investors, bringing security, safety, and sustainability for the organization. The bank is determined to get customers the best experience of consistent quality commitment, standards, and spread to each employee.

(4) Commercial banks increase CSR spending, mainly through community development and social security expenditures to build image and brand. Banks should have a plan to disclose their CSR activities to raise awareness among managers, employees, and the community about CSR. Commercial banks need to design CSR activities for customers. Bank managers will be the ones to directly guide and organize CSR activities towards each customer, following the current context in each period. And staff now operates to each suitable customer. When designing CSR activities, managers should pay attention to updating information on different types of customers. Managers should reference perceptions of male and female clients to increase these activities’ effectiveness. Banks that need to raise CSR awareness must start with the business’s head because their vision and decisions extensively influence its business strategy. Besides, managers must be adequately aware of the nature of CSR and each aspect of CSR. Because CSR’s implementation is not simply a matter of business ethics or charitable activities in the traditional sense, but economic benefits, brand benefits, benefits both the bank and related parties.

(5) Commercial banks should promote CSR activities towards each specific aspect. Managers will see these CSR efforts increase customer-based brand value. The five CSR elements all have positive effects on brand value, so focusing on each specific aspect to raise awareness about CSR is essential in managing the banking industry. Next, the research results show that banks make customers aware of the legal, ethical aspects and increase brand value. Simultaneously, according to the bank’s inside, the positive impact of the brand value’s legal, ethical aspect. These results demonstrate the importance of the ethical and legal aspects of CSR. Banks provide complete information on products and services to customers as part of CSR. Banks should consider customer satisfaction an important criterion. The voluntary mechanism should be encouraged as it is the interaction between the bank and its stakeholders. The State should only indirectly influence through tools such as non-governmental organizations, associations, community networks, and education. Implementing the ethical and legal aspect of CSR is to contribute to sustainable development. The State builds gratitude ceremonies for the banks that contribute the most to society (participating banks need to disclose specific information about CSR activities, contributions during the year) and create particular scales to evaluate CSR’s banking sector. Propagating, creating advantages, and creating a framework for banks to implement CSR are the core things to encourage banks to fulfill their obligations to stakeholders, thereby creating a competitive advantage and creating brand values.

Finally, this paper’s limitations had data collected from 15 commercial banks in HCMC. Besides, the data of 750 customers are too few compared to the number of commercial banks. Therefore, the results had not reflected the appropriateness of the research model. Thus, it is necessary to further serve customers from other banks in many big cities in Vietnam to increase data reliability.

References

- Al-Samman, E., & Al-Nashmi, M.M. (2016). Effect of corporate social responsibility on non-financial organizational performance: Evidence from Yemeni for-profit public and private enterprises. Social Responsibility Journal, 12(2), 247-262.

- Chung, K., Yu, J., Choi, M., & Shin, J. (2015). The effects of CSR on customer satisfaction and loyalty in China: the moderating role of corporate image. Journal of Economics, Business, and Management, 3(5), 542-547.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (2010). Multivariate data analysis with readings. U.S: Prentice- Hall: Upper Saddle River, NJ, USA.

- Nollet, J., Filis, G., & Mitrokostas, E. (2016). Corporate social responsibility and financial performance: A non- linear and disaggregated approach. Economic Modelling, 5(2), 400-407.

- Öberseder, M., Schlegelmilch, B.B., & Murphy, P.E. (2013). CSR practices and consumer perceptions. Journal of Business Research, 66(10), 1839-1851.

- Oyewumi, O.R., Ogunmeru, O.A., & Oboh, C.S. (2018). Investment in corporate social responsibility, disclosure practices, and financial performance of banks in Nigeria. Future Business Journal, 4(2), 195-205.

- Pandit, R., Dhakal, M., & Polyakov, M. (2015). Valuing access to protected areas in Nepal: The case of Chitwan National Park. Tourism Management, 50(1), 1-12.

- Papagiannakis, G., & Lioukas, S. (2012). Values, attitudes, and perceptions of managers as predictors of corporate environmental responsiveness. Journal of environmental management, 100(3), 41-51.

- Pätäri, S., Arminen, H., Tuppura, A., & Jantunen, A. (2014). Competitive and responsible? The relationship between corporate social and financial performance in the energy sector. Renewable and Sustainable Energy Reviews, 3(7), 142-154.

- Pérez, A., & del Bosque, I.R. (2015). Corporate social responsibility and customer loyalty: Exploring the role of identification, satisfaction, and type of company. Journal of Service Marketing, 29(1), 15-25.

- Pérez, A., & Del Bosque, I.R. (2012). The role of CSR in the corporate identity of banking service providers. Journal of Business Ethics, 108(2), 145-166.

- Pérez, A., & del Bosque, I.R. (2014). Customer CSR expectations in the banking industry. International Journal of Bank Marketing, 32(3), 223-244.

- Pérez, A., & del Bosque, I.R. (2015). Customer values and CSR image in the banking industry. Journal of Financial Services Marketing, 20(1), 46-61.

- Pinar, M., Girard, T., & Eser, Z. (2012). Consumer-based brand equity in the banking industry: A comparison of local and global banks in Turkey. International Journal of Bank Marketing, 30(5), 359-375.

- Raufflet, E., Cruz, L.B., & Bres, L. (2014). An assessment of corporate social responsibility practices in the mining and oil and gas industries. Journal of Cleaner Production, 84(2), 256-270.

- Rhou, Y., Singal, M., & Koh, Y. (2016). CSR and financial performance: The role of CSR awareness in the restaurant industry. International Journal of Hospitality Management, 57(5), 30-39.

- Robin, I., Salim, R., & Bloch, H. (2018). Financial performance of commercial banks in the post-reform era: Further evidence from Bangladesh. Economic Analysis and Policy, 5(8), 43-54.

- Ruiz, B., Esteban, A., & Gutiérrez, S. (2014). Banking reputation during the economic downturn. Comparison among the leading Spanish financial institutions from the customer’s perspective. Universia Business Review, 4(3), 16-35.

- Saeednia, H., & Sohani, Z. (2013). An investigation on the effect of advertising corporate social responsibility on building corporate reputation and brand equity. Management science letters, 3(4), 1139-1144.

- Scharf, R.E., & Fernandes, J. (2013). The advertising of corporate social responsibility in a Brazilian bank. International Journal of Bank Marketing, 31(1), 24-37.

- Sen, S., & Cowley, J. (2013). The relevance of stakeholder theory and social capital theory in CSR in SMEs: An Australian perspective. Journal of Business Ethics, 118(2), 413-427.

- Soana, M.G. (2011). The relationship between corporate social performance and corporate financial performance in the banking sector. Journal of Business Ethics, 104(1), 133-148.

- Sprinkle, G.B., & Maines, L.A. (2010). The benefits and costs of corporate social responsibility. Business Horizons, 53(5), 445-453.

- Tao, W., Song, B., Ferguson, M.A., & Kochhar, S. (2018). Employees’ prosocial behavioral intentions through empowerment in CSR decision-making. Public Relations Review, 44(5), 667-680.

- Liu, M.T., Wong, I.A, Shi, G., Chu, R., & Brock, J.L. (2014). The impact of Corporate Social Responsibility (CSR) performance and perceived brand quality on customer-based brand preference. Journal of Services Marketing, 28(3), 181-194.

- Vurro, C., & Perrini, F. (2011). Making the most of corporate social responsibility reporting: disclosure structure and its impact on performance. Corporate Governance: The international journal of business in society, 11(4), 459-474.

- Wang, D.H.M., Chen, P.H., Yu, T.H.K., & Hsiao, C.Y. (2015). The effects of corporate social responsibility on brand equity and firm performance. Journal of business research, 68(11), 2232-2236.

- Wang, H.M.D., & Sengupta, S. (2016). Stakeholder relationships, brand equity, firm performance: A resource- based perspective. Journal of Business Research, 69(12), 5561-5568.

- Wang, Q., Dou, J., & Jia, S. (2016). A meta-analytic review of corporate social responsibility and corporate financial performance: The moderating effect of contextual factors. Business and Society, 55(8), 1083-1121.

- Wang, Z., & Sarkis, J., (2017). Corporate social responsibility governance, outcomes, and financial performance. Journal of Cleaner Production, 16(2), 1607-1616.

- Won-Moo, H., Hanna, K. & Woo, J. (2014). How CSR Leads to Corporate Brand Equity: Mediating Mechanisms of Corporate Brand Credibility and Reputation. Journal of Business Ethics, 125(1), 75-86.

- Zainab, A. M., Anji, B. H., & Muneer, A.M. (2019). Impact of corporate social responsibility on bank’s corporate image. Social responsibility journal, 15(5), 710-722.