Research Article: 2021 Vol: 20 Issue: 6S

Impacting the Quality of Personal Financial Service on Customers??? Satisfaction: A Case Study of Vietnam Commercial Banks during Covid-19 Pandemic

Nguyen Van Tien, Banking University of Ho Chi Minh City (BUH)

Abstract

The Covid-19 epidemic continues to develop complicatedly across the country, negatively affecting commercial bank service activities in many southern provinces of Vietnam. The reform of financial service quality management policies has been significant. The Covid-19 pandemic has changed the way society works dramatically, with even the most previously least tech-savvy individuals becoming E-commerce enthusiasts. Unlike the global financial crisis, Covid-19 caused the first effects on the real economy on the production of goods and services, and then in the second phase, the impacts on the banking and finance services. In this context, although the global banking and finance industry has not yet witnessed an industry-wide crisis, the prospects are not clear. Although the pandemic has severely impacted the financial services industry, it is still quite limited and includes positive and negative actions. Therefore, the author surveyed 700 customers who are using the financial services of commercial banks in Vietnam. The study results showed that five factors affected the quality of personal financial service at Vietnam commercial banks during the Covid-19 pandemic. The finding of results is crucial scientific evidence for bank managers to improve financial services.

Keywords

Financial, Service, Quality, Commercial, Banks, Covid-19, Pandemic, Buh

Introduction

According to the State Bank of Vietnam, in recent years, total outstanding consumer loans in Vietnam have grown by an average of nearly 20% per year. The average consumer loan balance per capita is approximately 1.5 million VND/person. In addition, there was the participation of 16 financial banks with estimated market size of 1.1 million billion VND (about 48 billion USD) and Fintech companies with the practical support of information technology belief by Nguyen Van Tien & Vo Tan Phong (2021).

According to Barua & Barua (2021), the financial products of the fintech companies are pretty wealthy compared to the needs of consumers. The procedures are carried out online P2P model (directly connecting borrowers and lenders on the internet) of fintech companies with various loan packages and meeting customer needs by Bensley, et al., (2020). With online loans, companies will not have to bear any costs of space, electricity, water, and staff salaries to maintain operations, so the interest rates of online loan services become more attractive. However, these service providers merely consult to help individuals choose their products or other cross-selling products by Baker, et al., (2020). The people who provide personal financial advice are mainly stockbrokers, customer relations officers, or insurance agents.

Thus, the personal financial advisory service in Vietnam only fulfills part of the mission of the personal financial advisory service. The service provision focuses on selling products rather than consulting a plan by Borio (2020a). Overall management of personal finances from consumption to savings, investments commensurate with the risk levels the client accepts or longer-term plans such as retirement and legacy by Borio (2020b). With the nature of personal financial consulting services in Vietnam, customers’ benefits are not much. In some cases, they had consultants to buy products of the Company by Caby, Ziane & Lamarque (2020). Family unit through which consultants will receive commissions by Camous & Claeys (2020). This problem will create many negative consequences for society and unhealthy and sustainable development of the financial market.

Disemadi & Shaleh (2020), the number of independent consultants and planners is very small. In addition, the services provided do not cover the full range of duties of the personal financial advisor profession. The service provider focused on selling financial products rather than taking care of the overall needs by Dahl, Giudici & Kumar (2020). The balance between the client’s risk and return requirements equates to the concept of personal financial advice and banking and insurance services by Deloitte (2020). People who provide personal financial services are mainly stockbrokers, bankers, insurance agents.

The reason is that Vietnam’s financial market is still weak, financial products are not diversified, and conditions to provide a full range of personal financial services. No organization manages ethical standards and professional responsibility for consulting practitioners, so customers’ trust in consultants is not high. On the client’s side, due to the limited awareness of personal finance, the requirements for personal financial advisory services are not increased by Alao, & Gbolagade (2020). Therefore, the author’s research assessed factors that affected the quality of personal financial service at Vietnam commercial banks during the Covid-19 pandemic.

Literature Review

Financial Service Quality (FSQ)

Quality is seen as a competitive factor in the manufacturing sector and has become necessary since World War II. To this day, it is still challenging to define the quality. The service sector had for a few decades by Garman (2021). Recently and also because of its intangible characteristics, it is impossible to measure, and it isn’t easy to control the quality. It is heterogeneous, constantly changing by the customer, over time; inseparable, especially those with high labor content; and cannot be stored, so it is not easy to define and evaluate service quality by Vardsson (2019). There are many controversies, and there is no complete agreement among researchers in determining and assessing the quality of banking and financial services by Wordon & Tougall (2020).

Financial service quality is the difference between the service quality expected by the customer and the service quality that customers feel when the bank provides the service by Wee & Manshor (2019). Thus, although there are many different concepts, in general, we can understand the quality of financial services as the fulfillment of customer needs and expectations, in other words. Financial service quality is the difference between customer expectations and actual service perceptions provided by Kanolis & Chinsor (2020). Therefore, we can understand that financial service quality is the difference between customers’ expectations and perceptions when using the services provided by the bank by Qarbara & Park (2020).

Customer Satisfaction (SAT)

Customer satisfaction is a widely used term in business to measure the extent to which the expected needs of customers had for the types of products and services that the company provides by Sackoy (2020). Parasuraman, Zeithaml & Berry (1988, 1985) describe the satisfaction of customers’ financial-banking service needs as a measure of the degree to which the bank meets the general expectations of customers by Vantos (2018). The factor “Customer satisfaction” is denoted by SAT and is measured by three observed variables. From the preliminary research results, these observed variables had priority from 1 to 3 based on the most frequency of interviewees selected and denoted from SAT1 to SAT3 by Zeithaml (2000).

In other words, customer satisfaction is the overall attitude towards the service bank or emotional response to the difference between what the customer expects and what the customer wants. Received in connection with the fulfillment of some need or want of the customer by Ataur (2011). For banks, long-term customer loyalty had when businesses provide high-quality services, especially in the context of unregulated and volatile financial markets by Gronroos (1984). In summary, the quality of financial services is a factor that significantly affects the satisfaction of customers’ needs by Munusamy, Shankar & Hor (2010). If the bank provides customers with quality products and services, If the customer’s needs are satisfied, the bank has initially made it for the customer satisfied goods by Bassan (2020). Therefore, to improve customer satisfaction, banks need to improve the quality of financial services first. In other words, financial service quality and customer satisfaction had.

Reliability (REL)

Reliability: Measure the ability to perform the exemplary service and on time first time limit. Parasuraman, Zeithaml & Berry (1988, 1985) defined it as the ability to reliably and reliably deliver promised services. The factor “Reliability” had as REL, including four observed variables from REL1 to REL4 is built based on a survey of experts through the adjustment of 5 original SERVQUAL scales of Islam & Borak (2011) to assess the bank’s reliability in the process of providing services to customers. When making transactions, most customers want to ensure safety is complete, accurate, and error-free. And deploying different services or solutions by Tuff & Trair (2021).

According to the customer’s requirements, the bank needs to ensure promptness, timeliness, precisely what it has committed to the customer by Ashraf (2020). If the above issues are not guaranteed, customers will tend to leave the bank. Therefore, to measure the factor “Reliable,” the author adjusts four observed Variables or SERVQUAL scale of Parasuraman. These observed variables had by priority from 1 to 4 based on the highest frequency of interviewees selected. Based on the concept mentioned above and studies, the author gave hypothesis H1 following:

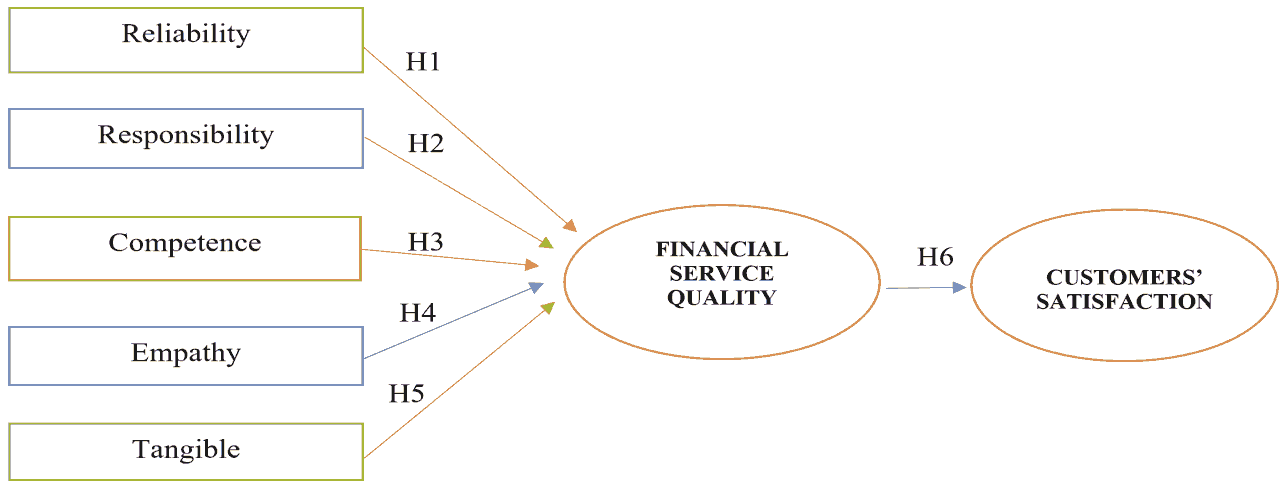

Hypothesis H1: Reliability positively affects the quality of personal financial services at commercial banks.

Responsibility (RES)

The factor “Responsibility” is denoted as RES (RES1 to Res4) and measured by four observed variables. The author had the preliminary research results enhance, support, and boldly apply scientific working methods of officials and employees to work. Encourage and have policies to reward officials and employees for using scientific initiatives and plans to work. Regularly organize periodic and irregular checks on professionalism, expertise, and problem-solving skills arising at work by Barnett (2020). Parasuraman, Zeithaml & Berry (1988, 1985) describes “Responsiveness” as the ability of employees to promptly provide service and respond to customer service requests without having to spend a lot of time waiting in line. Baicu et al. (2020) also argue that if banks keep customers waiting for services. For obvious reasons, it will cause customers to have an unnecessarily negative perception of financial service quality. Therefore, the author proposes to use four observed variables from RES1 to RES4 based on adjusting for four observed variables SERVQUAL by Parasuraman, et al., (1988, 1985) to measure the “Response” factor. Based on the concept as mentioned earlier and studies, the author gave hypothesis H2 following:

Hypothesis H2: Responsibility positively affects the quality of personal financial services at commercial banks.

Competence (COM)

Competence: The factor “Competence” is denoted by COM and measured by four variables observed. According to Parasuraman, Zeithaml & Berry (1988, 1985), the composition “Competency” measures the extent to which the customer service staff demonstrates the professional competence of the customer service staff and the name. Ensure that customer information is not misused; Comply with the correct procedure for using customers’ personal information. Officials and employees must know how to improve their own experience and industry knowledge to ensure accurate information and advice to customers. And the reputation of the bank is to be able to convey trust and peace of mind for customers when it comes to banking transactions by Berger, et al., (2020).

Bringing the best benefits to customers must come from the heart of Buehler, et al., (2020). From a banking perspective, service capacity is shown by always considering customers as the focus, improving the sense of responsibility in customer service, making customers feel secure and trust the bank by Demirguc, et al., (2020). Similarly, according to the opinion of customers participating in the interview, the service capacity of the staff is reflected in the enthusiastic service attitude, the ability to consult fluently, answer or answer customers’ questions, shop confidently, fast processing operations of service staff. Besides, this factor also measures how practical communication skills had through attitudes, courteous service, and attitudes. Based on the above and studies, the author gave hypothesis H3 following:

Hypothesis H3: Competence positively affects the quality of personal financial services at commercial banks.

Empathy (EMP)

The factor “Empathy” is denoted by EMP and measured by four important variables close. According to Parasuraman, Zeithaml & Berry (1988, 1985), empathy is the care and concern of service staff towards customers. It makes customers feel welcomed respectfully, and at the same time try to understand the needs and desires of customers. Therefore, from preliminary research results, Vietnamese commercial banks’ managers and customers believe in service work. Staff must always put themselves in customers’ position to understand their needs, wishes, or complicated problems to offer solutions or methods to solve customers’ issues fastest and satisfy customers by Culiberg & Rojsek (2010). When customers come to complete transactions, they expect employees to understand their needs, advise and provide products and services suitable for customers’ needs, considering customers’ interests as a priority top by Bae, et al., (2021). When customers encounter difficulties, customers expect service staff to show sympathy, care for customers, and solve customer problems quickly. Based on the concept mentioned above and studies, the author gave hypothesis H4 following:

Hypothesis H4: Empathy positively affects the quality of personal financial services at commercial banks.

Tangible (TAN)

The factor “tangible means” is denoted by TAN and is measured by four observed variables. Banks regularly renewing their units through activities such as repairing, maintaining, and renovating the workplace. Banks need to periodically inspect, maintain, maintain, or replace equipment and machinery for their work; Invest in replacing old equipment that can no longer meet the bank’s needs. Make financial reserves to prepare financial resources for the purchase of new equipment. The in-depth interviews show that experts, managers, and customers have a common opinion that other issues also determine the quality of financial services by Parasuraman, Zeithaml & Berry (1988, 1985). The problem is related to the service delivery environment, creating a comfortable feeling for customers when they come to the bank. Demonstrated through factors such as facilities quality, documents, display of documents, forms, equipment for service provision, communication materials, promotion of products and services, and the level of appearance of the staff serving customers through the elements of appearance, neat and decent clothes by Berger, et al., (2020). The based analysis above and studies, the author gave hypothesis H5 following:

Hypothesis H5: Tangible positively affects the quality of personal financial services at commercial banks.

Customer satisfaction is a term used to measure customer expectations with the types of services the bank provides. According to experts and managers at commercial banks, customers feel satisfied when their desired needs, including emotional needs and rational needs, are met all expectations by Baker, et al., (2020). When service quality achieves customer satisfaction, it will be a decisive factor in the business’s success. Therefore, banks need to constantly improve service quality to serve customers better and satisfy customers when using the bank’s services. Based on the awareness of the need to enhance the level of customer satisfaction for banks. Many practical studies on the relationship between service quality and customer satisfaction. Barua & Barua (2021) tested this relationship and concluded that perceived service quality leads to customer satisfaction. Studies have concluded that service quality is an antecedent of satisfaction as Bensley, Chheda, Schiff, Stephens & Zhou (2020).

Hypothesis H6: The quality of personal financial services positively affects customer satisfaction of commercial banks in Vietnam.

Figure 1: A Research Model For Factors Affecting The Quality Of Personal Financial Services And Customer Satisfaction

(Source: Researcher discovered)

Methods of Research

Qualitative method: The theoretical basis is scientific to mention and present and analyze the service quality factors affecting customer satisfaction. Data collection applied the convenience sampling method. However, to ensure that the collected data is highly reliable and reflects the overview of financial service quality at Vietnamese commercial banks, the sample collection is carried out according to the following criteria.

Survey subjects are those who are using the service and have accounts at commercial banks in Vietnam. Including both internal and external customers of the bank. The scope or area of the survey mainly focuses on cities and provinces in the Southern, Northern, Central, and Western regions with high population density, developed trading activities, and many banks operating in the area.

Hair, Anderson, Tatham & Black (2010) suggested analyzing the scale in factor analysis Exploratory Factor Analysis (EFA). The sample size must meet the required analytical standards. The sample size must be doubled at least five times the full scale in the measurement model, so a sample size > 160 (32 x 5) is reliable enough for factor analysis. Besides, Confirmatory Factor Analysis (CFA) is reliable enough. The author surveyed 700 customers using services at commercial banks in Vietnam. The questionnaire was tested with a small sample of customers to ensure that the questions were clear and understandable before collecting data on the large model. The customer’s evaluations are expressed on a 5-level scale, corresponding to the rating levels of 5.

The qualitative research author surveyed 15 managers who are working for commercial banks in Vietnam. The author conducted quantitative research through questionnaires with observed variables measured using a 5-point Likert scale: one strongly disagree, and five strongly agree. The study used quantitative methods to assess the quality of the scale, including Exploratory Factor Analysis (EFA) and Alpha Cronbach Cronbach’s Alpha is a measure, not a model used to test, so researchers agree on a value from 0.6 to 0.9.

CFA analysis process to test the fit of the measurement model with the data whether the market. According to the researchers, using the CFA method in Scale testing will have more advantages than analytical methods such as correlation coefficient analysis method, analysis method Exploratory Factor Analysis (EFA). The data collection time is from July 2020 to December 2020. According to the conventional way by Hair, Anderson, Tatham & Black (2010), The author selected samples.

Besides, the author collected data processed through SPSS 20.0 software with descriptive statistical tools, scale testing with Cronbach’s Alpha, discovery factor analysis (EFA), testing Structural Equation Modeling (SEM).

The author applied the method of testing the structural equation model (SEM): This method combined with the techniques of multivariate regression analysis, factor analysis, and analysis of the interrelationships of factors in the research model. research to test the complex relationship and coefficient of estimation of the elements in the research model. The criteria for assessing the suitability of the SEM model (CMIN/df, GFI, CFI, TLI...) are similar to the CFA analysis method by Hair, Anderson, Tatham & Black (2010).

Finally, the author had conclusions and managerial implications for the quality of personal financial services and customer satisfaction at commercial banks in Vietnam.

Research Results

The author tested the scale reliability for factors affecting the quality of personal financial services and customer satisfaction at commercial banks in Vietnam, including five components.

| Table 1 Testing Of Cronbach’s Alpha for Factors Affecting The Quality of Personal Financial Services and Customer Satisfaction |

||

|---|---|---|

| No. | Items | Cronbach’s alpha |

| Reliability (REL) | 0.964 | |

| REL1 | The bank performs the service without errors right from the time of transaction firstly | 0.947 |

| REL2 | The bank continuously records accurate customer information | 0.961 |

| REL3 | The bank provided the service at the right time, as announced | 0.960 |

| REL4 | The bank always fulfills its promises to customers and solves customer complaints | 0.944 |

| Empathy (EMP) | 0.961 | |

| EMP1 | Employees always understand the specific needs of customers | 0.941 |

| EMP2 | The staff is incredibly attentive to the individual customers | 0.951 |

| EMP3 | The staff know how to advise services following the needs of customers | 0.960 |

| EMP4 | Employees always consider the interests of customers as their concern | 0.940 |

| Responsiveness (RES) | 0.963 | |

| RES1 | Notify customers when the service will be launched declare | 0.951 |

| RES2 | Staff respond to customer requests quickly | 0.954 |

| RES3 | Staff are always willing to help customers | 0.959 |

| RES4 | Customers do not spend much time waiting for the transaction | 0.940 |

| Tangibles (TAN) | 0.902 | |

| TAN1 | The bank has modern equipment and technology | 0.887 |

| TAN2 | The bank’s facilities are very spacious | 0.841 |

| TAN3 | The style of the bank staff looks professional | 0.899 |

| TAN4 | The service staff’s uniform is neat and polite và beautifully designed product documents, forms, brochures | 0.866 |

| Competence (COM) | 0.862 | |

| COM1 | Knowledgeable staff to answer customer inquiries | 0.810 |

| COM2 | The behavior of employees always creates trust for customers | 0.819 |

| COM3 | The service attitude of the staff is kind and welcoming | 0.856 |

| COM4 | Customers feel safe when they come to the bank | 0.811 |

(Source: Data processed by SPSS 20.0)

Table 1 showed that the reliability analysis of the scale is done through Cronbach’s Alpha method to find out if the observed variables in the same scale have the same measure for a concept to be measured or not or have the same meaning in the same scale of a group. Cronbach’s alpha analysis results showed that all the financial service quality are more value than 0.7. Thus, the author can conclude that the scales of the elements have sufficient reliability by Hair, Anderson, Tatham & Black (2010). All Cronbach’s alpha values of the research components meet this technique’s requirements, specifically, Cronbach’s alpha values of (1) Reliability, (2) Responsibility, (3) Competence, (4) Empathy, and (5) Tangible. Cronbach’s alpha is higher than 7.0. Therefore, from the above analysis results, all observed variables of 5 the financial service quality measurement factor is suitable for EFA analysis in the next step.

| Table 2 Testing of Cronbach’s Alpha for The Quality of Personal Financial Services and Customer Satisfaction |

||

|---|---|---|

| Personal financial service quality (FSQ) | 0.951 | |

| FSQ1 | The bank performs exemplary service and is on time right the first time | 0.941 |

| FSQ2 | Professional qualifications and polite, welcoming service to customers | 0.891 |

| FSQ3 | Overall, the quality of financial services is excellent and meet the customers’ need | 0.951 |

| Customers’ satisfaction (SAT) | 0.902 | |

| SAT1 | I feel satisfied with the service and attitude of the staff | 0.887 |

| SAT2 | I feel satisfied with the products and services provided by the bank | 0.841 |

| SAT3 | I am satisfied with the design and decoration of the bank’s office | 0.899 |

| SAT4 | The bank ultimately met my expectation/desire | 0.866 |

(Source: Data processed by SPSS 20.0)

Table 2 showed that all Cronbach’s Alpha values of the research components meet this technique’s requirements, specifically, Cronbach’s alpha values of customer satisfaction and loyalty. Cronbach’s coefficient is more than 0.6. Table 2 shows all personal financial service quality (0.951) and customers’ satisfaction (0.902). Cronbach’s alpha is higher than 7.0.

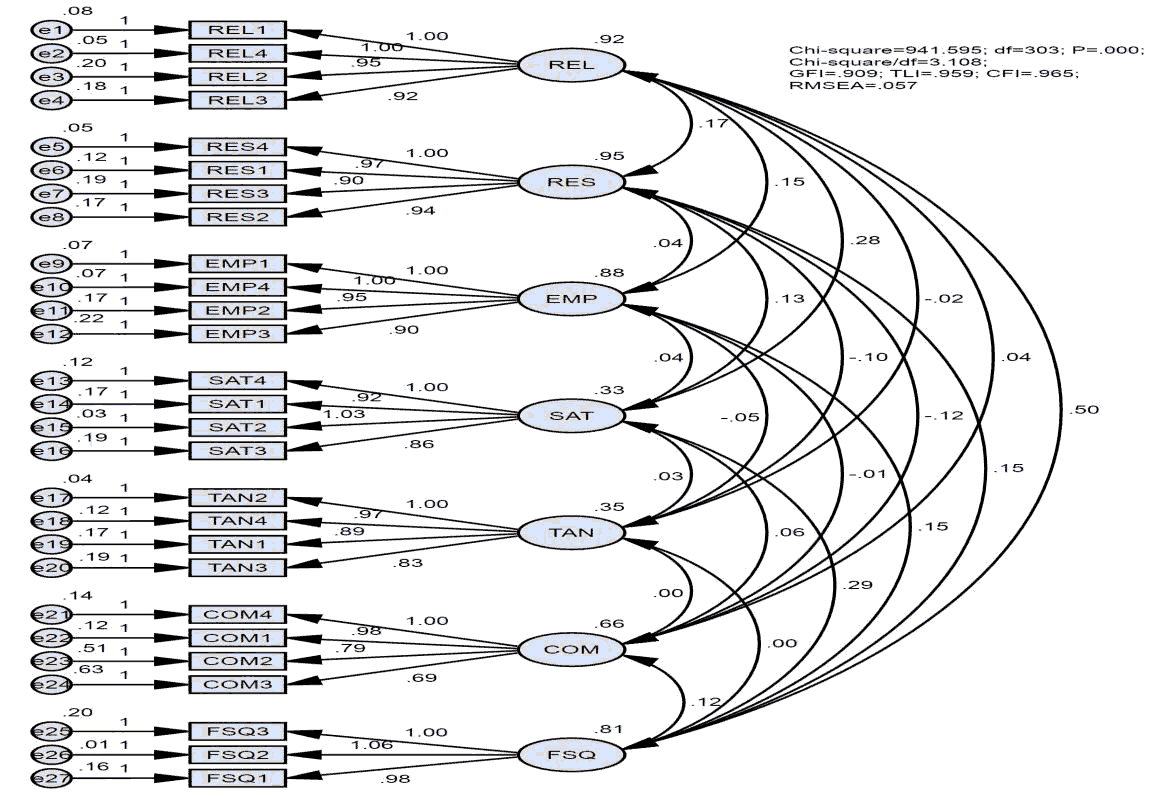

Figure 2: Testing CFA For Factors Affecting The Quality of Personal Financial Services And Customer Satisfaction

(Source: Researcher discovered)

| Table 3 Testing Coefficients for Factors Affecting The Quality of Personal Financial Services and Customer Satisfaction |

||||||||

|---|---|---|---|---|---|---|---|---|

| Relationships | UnstandardizedEstimate | StandardizedEstimate | StandardError | C.R. | P | Hypothesis | ||

| FSQ | <--- | REL | 0.550 | 0.565 | 0.035 | 15.824 | *** | Accepted |

| FSQ | <--- | RES | 0.096 | 0.098 | 0.032 | 2.990 | 0.003 | Accepted |

| FSQ | <--- | EMP | 0.081 | 0.084 | 0.031 | 2.600 | 0.009 | Accepted |

| FSQ | <--- | TAN | 0.162 | 0.077 | 0.059 | 2.729 | 0.006 | Accepted |

| FSQ | <--- | COM | 0.185 | 0.171 | 0.037 | 4.941 | *** | Accepted |

| SAT | <--- | FSQ | 0.365 | 0.571 | 0.024 | 14.977 | *** | Accepted |

(Source: Data processed by SPSS 20.0)

Table 3 showed that the column “P”<0.01 with a significance level of 0.01. These results indicated five factors affecting the quality of personal financial services and customer satisfaction in Vietnam with a significance level of 0.01. These results are science evident for managerial implications to enhance financial service quality and customer satisfaction.

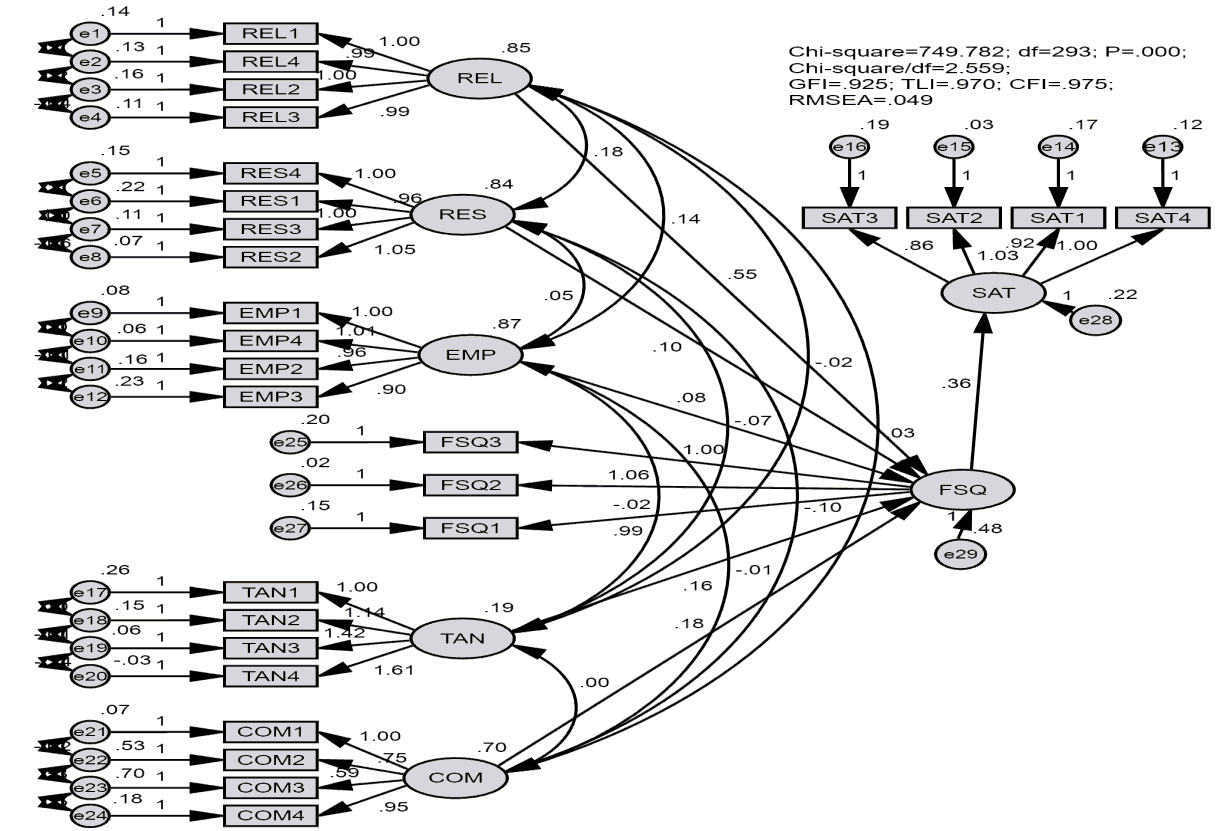

Figure 3: Testing SEM for Factors Affecting The Quality of Personal Financial Services And Customer Satisfaction

(Source: Researcher discovered)

v showed that the assessment factors affecting the quality of personal financial services and customer satisfaction includes the following elements: CMIN/DF=2.559 (<5.0), GFI=0.925 (>0.900), TLI=0.970 (>0.900), CFI=0.975 (> 0.9) and RMSEA=0.049.

Conclusions and Managerial Implications

Conclusions

The study’s objective is to explore the relationship between personal financial service quality and the level of satisfaction of customers at commercial banks in Vietnam during the Covid-19 pandemic. The paper used the SERVQUAL research model, including five components to measure the quality of personal financial service, namely: (1) Reliability, (2) Responsibility, (3) Competence, (4) Empathy, and (5) Tangible.

Based on the results of Structural Equation Modeling (SEM), the author says that all five factors had a positive impact the personal financial service quality and customer satisfaction with the significance level sig<0.01, so we reject the H0 hypothesis, the hypotheses H1, H2, H3, H4, and H5 are accepted. Thus, in assessing personal financial service quality at commercial banks, customers rated the highest in “Reliability” of the service quality, and the “Tangibles” factor is ranked the lowest by customers. The above analysis results are the basis for proposing solutions to improve the satisfaction level of service quality for individual bank customers.

Commercial banks need to develop personal financial service quality is becoming one of the strategic directions of commercial banks. Extending this service, banks often promote consumers using financial services and diversify credit products. However, to improve service quality, Vietnam commercial banks need to implement many managerial implications.

Managerial Implications

1.The author found that, during the customer survey, customer psychology is very interested in banks with many branches, transaction offices, large, beautiful, and eye-catching offices. Therefore, the bank needs to have the right brand development strategy and promote mass media, primarily commercial banks. Commercial banks have a transaction location in the centers, so customers living in the periphery of communes, districts, or towns have little chance to contact and hear about commercial banks. Expanding and perfecting personal financial advisory services in the existing market.

Besides, commercial banks need to expand their business to advise clients on a total solution for personal finance, helping them realize their financial capabilities and their level of risk tolerance from which to make the most suitable options. At the same time, financial consulting packages need to expand links with other fields such as experts in tax, law, risk management, etc., to be able to provide the most comprehensive advice to all customers, related fields. Personal financial services need to be personalized for each customer, thereby offering each investment portfolio according to each customer’s spending requirements and risk tolerance. Promote the application of banking technology in perfecting and improving the quality of SMS banking, Internet banking, and mobile banking services. Commercial banks should provide banking services to customers, quickly providing customer account information, setting up an information security system, providing quick and accurate messages on interest rate/exchange rate fluctuations, etc. At the same time, adding supplements and develop many other services such as recharge phone cards, pay bills, buy air tickets, etc., via the Internet banking system.

2.Commercial banks need to ensure that all information about new products and services is continually updated timely and accurately to customers via press channels, television, website, phone, message, etc. And at the same time, ensure that all activities had promised or committed to customers. In addition, banks need to take appropriate and appropriate handling measures in case the service units or staff do not comply with what the bank has committed to customers. Besides, commercial banks continue raising people’s awareness about the role of personal finance in managing assets and achieving the spending goals of themselves and their families. Personal financial services are not only for the “rich” but for everyone. Accordingly, it is necessary to strengthen propaganda and create forums on personal finance to access information and learn about personal finance. Therefore, banks need to create conditions for employees to participate in professional classes to gain more professional knowledge.

In addition, commercial banks continue to update information regularly, handle business professionally, quickly, and accurately, organize professional exchange activities, test sessions to improve learning, and increase mutual support and teamwork between new and longtime employees. The service staff needs to understand the regulations and policies related to the business to answer questions and advise customers accurately and clearly. Avoid the case when risks, incidents arise unintentionally, customers blame the bank for not having advice or not having information for customers to know. Specifically, in the case of customers, account maintenance fees will be deducted when the customer no longer conducts transactions with the bank. Besides, the savings book is lost change to the form of receiving interest without term upon maturity without the customer’s knowledge.

3.Commercial banks have service packages offered to customers that diversify according to each customer’s spending goals. At the same time, financial instruments had many markets, including stocks, bonds, currencies, insurance, and other alternative mechanisms. Diversifying financial instruments will make it easier to achieve profit and risk goals for clients. Commercial banks need to complete the capacity standards and functions and tasks for each position related to customer service. Moreover, commercial banks focus on reviewing all employees’ efforts in serving current customers to re-arrange. And reassigning human resources to suitable job positions according to the development needs of the bank; At the same time, it creates conditions for employees to have the opportunity to promote their strengths and abilities properly. To improve morale and motivation at work, banks need to research and develop reasonable remuneration policies. Commercial banks have studying patterns and salary payment policy, welfare policy is being applied at major financial institutions in the world to create appropriate and competitive salary payment policies. Thereby, it can contribute to employees’ long-term commitment and attract more employee’s talent for contributing to the bank.

4.Bank staff is demonstrated through customer serviceability, enthusiasm, friendliness, attentive customer care, and all customers receive the same attention. However, some bank employees are not skillful in prioritizing VIP customers or have too much imitation of relatives and friends when they come to the bank to transact, accidentally losing money. Sympathy for customers who are waiting for their turn to transact. This issue is very delicate, so it requires bank staff to be peaceful and behave with standards in each case. Regulatory agencies or associations need to offer courses and training programs that apply advanced world standards, provide personal financial advice practice certificates to minimize risks. Commercial banks continue contributing to promoting the development of personal financial consulting services sustainably. Invest in building a contact center system for customer care in the direction of a professional model. This policy is the bridge between the bank and the customer. The focus is on handling all customer requirements through modern communication channels such as phone systems, email, and other online media to guide, provide and respond to information on time, bringing satisfaction to customers. This recommendation not only diversifies the form of communication with customers but also increases service quality.

5.Commercial banks continue improving brand recognition from customers. In terms of signs, banks need to invest in designing and synchronizing highly interactive interfaces at all transaction points in the same banking system. Create a clear difference as well as show the overall brand personality of the bank. For transaction locations, when building, expanding, or relocating, banks should choose sites with convenient locations, spacious campus areas, and open parking spaces for customers to create favorable conditions for customers to come and transact and match the trend of customers’ shopping behavior.

Regarding transaction rooms, banks should consider investing in the design or rearrangement of transaction spaces in a customer-oriented way to attract customers. Goods to transact with the bank. Moreover, arranging more space for customers at each transaction point impacts the customer-customer relationship. Customers influence the enjoyment and experience of other customers while using a service with a larger, more comfortable space will facilitate other customers. Each other exchange their experiences about products and services or what they are satisfied with about the bank. Commercial banks continue increasing the length for customers at each delivery point. The bank’s services also increase the comfort and convenience factor for customers.

References

- Alao, B.B., & Gbolagade, O.L. (2020). Coronavirus pandemic and business disruption: The consideration of accounting roles in business revival. International Journal of Academic Multidisciplinary Research, 4(5), 108-115.

- Ashraf, B.N. (2020). The economic impact of government interventions during the Covid-19 pandemic: International evidence from financial markets. Journal of behavioral and experimental finance, 27(1), 1-9.

- Ataur, R.D. (2011). Measuring service quality using servqual model: A study on private commercial banks in Bangladesh. Business Management Dynamics, 1(1), 1-11.

- Bae, K.H., & Sadok E.G., & Gong, Z.J., & Guedhami, O. (2021). Does CSR matter in times of crisis? Evidence from the Covid-19 pandemic. Journal of Corporate Finance, 67(1), 1-18.

- Baicu, C.G., & Gârdan, I.P., & Gârdan, D.A., & Jiroveanu, D.C. (2020). Responsible banking practices during the covid-19 pandemic: Findings from Romania. Annales Universitatis Apulensis: Series Oeconomica, 22(2), 146-157.

- Baker, S.R., Bloom, N., Davis, S.J., Kost, K., Sammon, M., & Viratyosin, T. (2020). The unusual stock market reaction to Covid-19. Covid Economics, 33-42.

- Barnett, M. (2020). Covid-19 and the Sacrificial International Order. International Organization, 74(1), 128-147.

- Barua, B., & Barua, S. (2021). Covid-19 implications for banks: Evidence from an emerging economy. SN Business & Economics, 1(1), 1-28.

- Bassan, A.T. (2020). Measuring perceived service quality at UAE commercial banks. International Journal of Quality & Reliability Management, 20(4), 58-72.

- Bensley, E., & Chheda, S., & Schiff, R., Stephens, D., & Zhou, N. (2020). Remaking banking customer experience in response to coronavirus. McKinsey & Company, 3(3), 19-27.

- Berger, A.N., & Molyneux, P., & Wilson, J.O.S. (2020). Banks and the real economy: An assessment of the research. Journal of Corporate Finance, 62(1), 45-56.

- Borio, C. (2020a). The Covid-19 economic crisis: dangerously unique. Business Economics, 5(5), 181-190.

- Borio, C. (2020b). The prudential response to the Covid-19 crisis. Bank of International Settlements, 4(5), 1-6.

- Buehler, K., Conjeaud, O., Giudici, V., & Samandari, H. (2020). Leadership in the time of coronavirus: Covid-19 response and implications for banks. McKinsey Quarterly, 6(7), 23-35.

- Caby, J., Ziane, Y., & Lamarque, E. (2020). The determinants of voluntary climate change disclosure commitment and quality in the banking industry. Technological Forecasting and Social Change, 161(1), 56-67.

- Camous, A., & Claeys, G. (2020). The evolution of European economic institutions during the Covid?19 crisis. European Policy Analysis, 6(2), 328-341.

- Culiberg, B., & Rojsek, I. (2010). Identifying service quality dimensions as antecedents to customer satisfaction in retail banking. Economic and Business Review, 12(3), 151-166.

- Dahl, J., Giudici, V., & Kumar, S. (2020). Lessons from Asian banks on their coronavirus response. McKinsey & Company, 19(5), 124-135.

- Deloitte (2020). Navigating financial services sector performance post-Covid-19. International journal of business management, 4(5), 18-27.

- Demirguc-Kunt, A., & Pedraza, A. and Ruiz-Ortega, C. (2020). Banking sector performance during the covid-19 crisis. Policy Research Working Paper, 9(3), 1-19.

- Disemadi, H.S., & Shaleh, A.I. (2020). Banking credit restructured policy amid Covid-19 pandemic in Indonesia. Journal of Economic Innovation, 5(02), 63-70.

- Garman, J.K. (2021). Consumer perceptions of service quality. Journal of Retailing, 6(6), 33-55.

- Gronroos, C.A. (1984). Service quality model and its marketing implications. EuropeanJournal of Marketing, 18(4), 36-44.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (2010). Multivariate data analysis with readings. US: Prentice-Hall: Upper Saddle River, NJ, USA.

- Islam, N.F., & Borak, A.K. (2011). Measuring service quality of banks: An empirical study. Research Journal of Finance and Accounting, 2(4), 74-85.

- Kanolis, C.A. & Chinsor, R.D. (2020). Service quality perspectives and satisfaction in private banking. Journal of Services Marketing, 14(3), 244-271.

- Munusamy, J., Shankar C., & Hor W.M. (2010). Service quality delivery and its impact on customer satisfaction in the banking sector in Malaysia. International Journal Innovation, Management, and Technology, 1(4), 398-404.

- Nguyen, V.T., & Phong, V.T. (2021). Advanced strategic management. Finance publishing house, The Ministry of Finance, Hanoi.

- Parasuraman A., Zeithaml V., & Berry L. (1988). SERVQUAL: A multiple item scale for measuring consumer perceptions of service quality. Journal of Retailing, 64(1), 12-40.

- Parasuraman, V., Zeilthaml, A., & Leonard, L.B. (1985). A conceptual model of service quality and its implications for future research. Journal of Marketing, 49(1), 41-50.

- Qarbara, R.T., & Park, H.G. (2020). Service quality measurement in the banking sector in South Korea. International Journal of Bank Marketing, 21(4), 191-201.

- Sackoy, R.T. (2020). An empirical examination of a model of perceived service quality and satisfaction. Journal of retailing, 7(22), 201-214.

- Tajendran, C.S., & Anatharaman, F.N. (2019). The relationship between service quality and customer satisfaction: A factor-specific approach. Journal of Services Marketing, 16(4), 363-379.

- Tuff, A.S., & Trair, M.J. (2021). Service quality measurement in the Chinese corporate banking market. International Journal of Bank Marketing, 2(4), 305-327.

- Vantos, J.F. (2018). E-service quality: A model of virtual service quality dimensions. Managing Service Quality, 13(3), 233-246.

- Vardsson, B.T. (2019). Service quality improvement. Managing Service Quality, 8(2), 142-149.

- Wee, F.S., & Manshor, A.H. (2019). Determining the relative importance of critical factors in delivering service quality of banks: An application of dominance analysis in SERVQUAL model. Managing Service Quality, 19(2), 211-228.

- Wordon, H.G., & Tougall, H.S. (2020). Determinants of customer satisfaction in retail banking. International Journal Bank Marketing, 14(7), 12-20.

- Zeithaml, V.A. (2000). Service quality, profitability, and the economic worth of customers: What we know and what we need to learn. Journal of the Academy of Marketing Science, 28(1), 67-85.