Research Article: 2022 Vol: 21 Issue: 1

Implementation of Enterprise Risk Management and Determinants of Company Performance

Sidik Ismanu, State Polytechnic of Malang

Anik Kusmintarti, State Polytechnic of Malang

Sugeng Sulistiono, State Polytechnic of Malang

Citation Information: Ismanu, S., Kusmintarti, A., & Sulistiono, S. (2022). Implementation of enterprise risk management and determinants of company performance. Academy of Strategic Management Journal, 21(1), 1-8.

Abstract

Company performance in this study is measured by value of company. This research was conducted before and during the Covid-19 pandemic. The research objective was to examine the influence of implementation of enterprise risk management, firm size, debt ratio, current ratio, and return on assets ratio and price earnings ratio on value of company. The population study is financial service companies and construction services companies that are going public in Indonesia. Determination of the sample by purposive sampling, and selected 25 companies. This study uses quarterly company financial data for a 4-year period from 2017 to 2020. The data analysis model used is the multiple regressions linear. Before the Covid-19 pandemic, firm size, current ratio, return on assets ratio and price earnings ratio have effect on value of company. During the Covid-19 pandemic, firm size and price earnings ratio have effect on value of company. The implementation of enterprise risk management before and during the covid-19 pandemic can minimize the risks.

Keywords

Enterprise Risk Management, Firm Size, Debt Ratio, Current Ratio, Return on Assets, Price Earnings Ratio, Value of Company.

Introduction

Risk management is an integral component of corporate strategy. Implementation of risk management is carried out as an action to prevent and mitigate risk to the smallest level, so that the company can survive in the competition. Efforts to improve the quality of risk management implementation can be carried out through integrated risk management, namely the application of enterprise risk management (Iswajuni et al., 2018). Enterprise Risk Management to manage risks and capture opportunities related to the achievement of corporate goals. The company's risk management in the company requires special attention and is carried out by the manager or risk officer. The application of enterprise risk management can reduce the risks that exist in the company and can produce better company value (Savitri et al., 2020).

One of the important objectives of financial management is the maximization of shareholder wealth which emphasizes maximizing the value of the company. The value of the company is related to the price of the company's shares in the capital market. The higher the stock market price will increase the value of the company, and vice versa (Ejem & Ogbonna, 2019). The main objective of company management is to maximize shareholder wealth by maximizing the company's share price. The higher the value of the company, the higher the return obtained, and the higher the stock return, the more prosperous shareholders will be (Husna & Satria, 2019). The stock market price is a supply and demand mechanism carried out by investors. Investors' perceptions of stock prices are influenced by the company's fundamental factors (Astuty, 2017). To maximize the company's stock price is done by increasing the value of the company (Miles & Covin, 2000). The value of the company is influenced by the company's fundamental factors. Some of the fundamental factors that influence the firm value are firm size, current ratio, debt ratio, return on assets, and price earning ratio (Choudhary, 2012; Shil, 2009; Husna & Satria, 2019; Yinusa et al., 2021).

Currently the world, including the Republic of Indonesia, is under threat from the Covid-19 pandemic. Under these conditions, the economy is an area that gets a fairly severe impact, especially in the capital market. Since January 28, 2020, the National Disaster Management Agency announced that the Unitary State of the Republic of Indonesia was in a state of emergency followed by an international warning from the World Health Organization (Budiarso et al., 2020). A disrupted capital market will cause the financial performance of companies listed on the capital market to decline. This is a research gap that will examine fundamental factors and the role of corporate risk management on company value, before and during the Covid-19 pandemic in Indonesia.

LI\iterature Review

Effect of Firm Size on Value of Company

The large total assets owned by the company indicate the success of the company's management team in achieving company goals. Companies that have large amounts of assets have the opportunity to generate high income. Companies that have a tendency to increase profitability, trigger the company's stock price in the capital market to rise. A reliable management team that has the convenience of controlling the company will increase the value of the company (Rajgopal & Venkatachalam, 2011). This is supported by the results of research conducted by (Nur'ainy et al., 2013) showing that firm size has a significant effect on firm value. Firm size has a relationship with firm value, meaning that the larger the firm size, the more likely it will have an impact on firm value (Husna & Satria, 2019). Based on the description above, the research hypothesis can be formulated:

H1 The size of the company will affect the value of the company.

The Effect of Current Ratio on the Value of Company

Current ratio as a measure of company liquidity. Liquidity demonstrates the ability of the company to meet its current liabilities. The higher the level of company liquidity, the lower the company's risk, and the lower the level of company liquidity, the higher the company's risk (Bringham & Houston, 2014). The liquidity of the company relates to the management of current assets. The efficient and effective use of current assets will increase the profits of the company (Bringham & Houston, 2014). High liquidity makes the company safe in short-term liabilities, but, on the other hand, there is an opportunity cost that should increase the profits of the company and provide positive signals to investors. The greater the liquidity of the company, the smaller the company's revenue will increase and the firm's value will decrease so that there is a relationship between current assets and firm value (Batten & Vo, 2019). Based on above descriptions, the hypotheses of research can be formulated:

H2 Current assets is expected to have a negative impact on value of company.

The Effect of Debt Ratio on Value of Company

Debt ratio as a measure of company leverage. Leverage relates to the company using funds that come from long-term debt, and the company being burdened by interest. The use of these funds by the company has the effect of increasing revenue or vice versa (Bringham & Houston, 2014). There is no public company that has no debt, and the company is burdened with the interest that must be paid for each period. Long-term debt is needed for the company to develop in order to be larger than before. Companies with larger assets, in particular operating assets, will increase the volume of production, which will increase company revenues. Of course, the hope of the company to use the debt has a positive impact, namely an increase in the profits of the company, which has an impact on the increase in firm value (Bringham & Houston, 2014). Often, large corporate debts cast doubt on investors' perceptions of profit at the end of the period, because there is a risk that could arise in the company and disrupt firm value. There is a link between debt ratio and enterprise value (Kouki & Said, 2011). Based on above descriptions, the hypotheses of research can be formulated:

H3 The debt ratio of the company will have a negative impact on value of company.

The Effect of Return on Assets on Value of Company

Return on assets as a measure of company profitability. Profitability always gets the attention of company management, because to be able to carry out the life of a company, every accounting period must make a profit. Without making a profit, it is certainly very difficult for companies to get capital from outside. To measure a company's profitability with return on assets (Bringham & Houston, 2014; Van Horne & Wachowicz, 2005). Profitability is the company's ability to generate profits with efficient and effective company operations (Chen, 2004). Companies that always earn profits will attract investors. Companies that get funds from investors will be used for business expansion, so that the company can increase profits. Profitability in the long term has an important meaning for the company; the company has bright and promising prospects for investors, which in turn will increase the value of the company in the capital market. Based on above descriptions, the hypotheses of research can be formulated:

H4 The return on assets of company will be having a positive impact on value of company.

The Effect of Price Earning Ratio on Value of Company

Brigham & Houston (2010), price earning ratio is the ratio of price per share to earnings per share, indicating the amount investors are willing to pay for every dollar of reported earnings. Indirectly, price earning ratio is one of the gateways for stock investors to gain a lot of profit in the future. Price earning ratio is used by investors to predict the company's ability to generate profits in the future. Investors will be able to consider this ratio to sort out which stocks can provide large profits in the future. Price earning ratio will show the relationship between stock market prices and earnings per share. Companies that have opportunities with high growth rates usually have high price earning ratio, and vice versa companies with low growth values have low or small price earning ratio values. Based on above descriptions, the hypotheses of research can be formulated:

H5 The price earning ratio will be have a positive effect on value of company

The Effect of Enterprise Risk Management on Value of Company

Risk management as a corporate strategy and its implementation is carried out to prevent and mitigate risks to the smallest level of risk. Enterprise risk management is an integrated risk management application. Enterprise risk management provides a framework for risk management, which typically involves identifying specific events or circumstances relevant to the organization's objectives (threats and opportunities), assessing them in terms of likelihood and magnitude of impact, determining response strategies, and monitoring processes. According to a holistic approach, enterprise risk management identifies and assesses various risks, integrates all types of risks, and then coordinates risk management activities across all work units within an organization. This is contrary to traditional practice, where certain risks are assessed separately by each business unit and they decide for themselves how to handle those (Lin et al., 2012). Enterprise risk management can create systems within the organization, so that adverse risks can be anticipated and managed with the aim of increasing company value (Hoyt & Liebenberg, 2011). Investors always see changes in the value of the company as a means to decide whether to invest in the company or not. Enterprise risk management as an important part of the company, if implemented properly, reduces risk, increases efficiency and effectiveness, and has a potential impact on firm value (McShane et al., 2011). Enterprise risk management is a risk management approach in the company by minimizing the impact of losses arising from these risks. Company management that can minimize company losses is expected to gain greater profits than the previous period, and the company's financial performance will increase, and this condition will be seen by stakeholders as an increase in company value (Silva et al., 2019). Hypotheses for this study are formulated as:

H6 The implementation of enterprise risk management will have a positive impact on value of company.

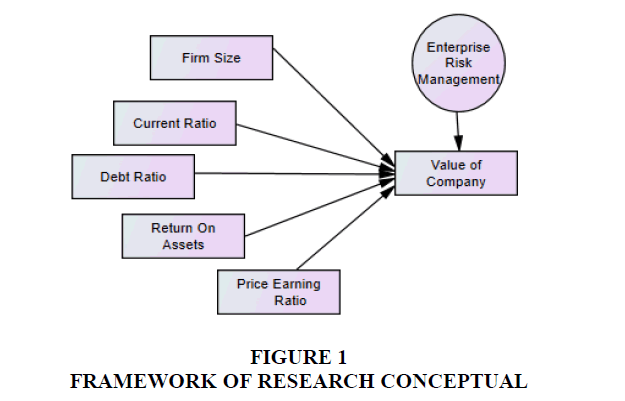

Based on the hypotheses formulated above, Figure 1 shows the conceptual framework of the study.

Methodology

This research was conducted with a quantitative approach. Collecting data by means of documentation, namely by collecting company financial quarterly reports from the Indonesian stock exchange from 2017 to 2020. Time series data are the financial ratios of firm size, current assets, debt ratio, return on assets, and price earning ratio. Inferential statistics are used as a method for testing a sample-based population. In this study, the number of samples selected was 13 the financial service companies, and 12 the construction service companies in Indonesia. Data processing has been carried out using statistical software. The hypothesis will be tested using regression of multiple linear analyses with a significance level of 5%. In this study, model the regression of multiple linear analyses can be formulated as follows: Y=β0+β1ERM+ β2FS+β3DR+β4CR+β5ROA+β6PER, where Y=Value of Company, ERM=Enterprise Risk Management, FS=Size of the firm, DR = Ratio of debt, CR=The Current Ratio, ROA=Return On Assets, PER=Price Earning Ratio. β0, β1, β2, β3, β4, β5, β6=Regression Coefficients. The value of company is measured by the price book value which is formulated as Stock Market Price divided by Stock Book Value. Enterprise risk management measured by 1 or 0 (zero). Firm size which is formulated as Log(total assets). Debt ratio which is formulated as total debt divided by total assets. Current ratio which is formulated as current assets divided by current liabilities. Return on assets which is formulated as net profit after tax divided by total assets. Price earning ratio which is formulated as stock market price divided by earning per share.

Results and Discussion

Firm size, leverage, liquidity and profitability in this study is fundamental factors that affect value of company. Fundamental factors are factors from within the company that affect firm value. Firm size is measured by logarithmic total assets, leverage is measured by debt ratio, liquidity is measured by current ratio, and profitability is measured by return on assets and price earning ratio. Value of company is measured by price book value. Enterprise risk management is rated 1 for companies that implement risk management, and is rated 0 for companies that do not implement risk management. The results of data processing before covid-19 pandemic for the correlation between the independent variable and the dependent variable do not show a relationship that is not too strong, so it can be continued to perform regression analysis (Sekaran & Bougie, 2019). The correlation between these variables is shown in Table 1.

| Table 1 Correlation Matrix Before Covid-19 Pandemic |

|||||||

|---|---|---|---|---|---|---|---|

| Variables | Y | ERM | FS | DR | CR | ROA | PER |

| Y | 1 | ||||||

| ERM | -0.05 | 1 | |||||

| FS | 0.118 | -0.736 | 1 | ||||

| DR | -0.008 | 0.069 | -0.093 | 1 | |||

| CR | -0.244 | -0.469 | 0.417 | -0.22 | 1 | ||

| ROA | 0.015 | -0.25 | 0.008 | 0.308 | -0.062 | 1 | |

| PER | 0.439 | 0.169 | -0.286 | 0.02 | -0.041 | -0.093 | 1 |

The results of the regression analysis found the influence of enterprise risk management and several fundamental factors on value of company, before the Covid-19 pandemic occurred in Indonesia. Beta as a regression coefficient and the significance of each independent variable are shown in Table 2.

| Table 2 Coefficients Of Regression |

|||||||

|---|---|---|---|---|---|---|---|

| Before Covid-19 Pandemic | Variables | ERM | FS | DR | CR | ROA | PER |

| Beta | 0.303* | 0.382* | 0.007 | 0.260* | 0.152* | 0.522* | |

Based on Table 1, enterprise risk management, firm size, current ratio, return on assets, and price earning ratio have a positive influence on value of company (Sekaran & Bougie, 2019). In normal economic conditions, prior to the Covid-19 pandemic in Indonesia, several companies that implemented risk management would increase the value of company. Mitigation of risks that occur in the company as a strategy to strengthen competitiveness by managing the company more efficiently. The higher the size of the company, liquidity, the ratio of earnings to assets, and the ratio of stock market prices to earnings per share, will increase the value of company. A large company size will produce products with high sales volume and increase company profits. A high level of liquidity can benefit the company by utilizing excess funds for short-term investments. The ratio of earnings to assets is a measure of the company's return, the higher it will attract investors to invest their funds in the company. The ratio of stock market prices to earnings per share as a reference for investors to predict the value of shares in the future can be profitable or detrimental. Based on Table 3 presents the results of multiple regression analysis for the relationship between variables in the study. It can be seen in Table 3 that there is a weak relationship between the variables. Therefore, it can be continued to determine the regression coefficient (Sekaran & Bougie, 2019). The correlation between the variables during the covid-19 pandemic is presented in the table below.

| Table 3 Correlation Matrix During Covid-19 Pandemic |

|||||||

|---|---|---|---|---|---|---|---|

| Variables | Y | ERM | FS | DR | CR | ROA | PER |

| Y | 1 | ||||||

| ERM | 0.281 | 1 | |||||

| FS | -0.167 | -0.616 | 1 | ||||

| DR | 0.132 | 0.572 | -0.449 | 1 | |||

| CR | 0.061 | -0.269 | 0.085 | -0.647 | 1 | ||

| ROA | 0.055 | -0.234 | 0.043 | -0.241 | 0.401 | 1 | |

| PER | 0.354 | 0.003 | -0.041 | 0.21 | -0.094 | -0.087 | 1 |

Based on Table 4 below shows the findings of the influence of enterprise risk management and several fundamental factors on value of company. These results are an analysis during the Covid-19 pandemic that occurred in Indonesia. The significant independent variables and the amount of beta as a regression coefficient are presented in the table below.

| Table 4 Coefficients Of Regression |

|||||||

|---|---|---|---|---|---|---|---|

| During Covid-19 Pandemic | Variables | ERM | FS | DR | CR | ROA | PER |

| Beta | 0.682* | 0.372* | -0.028 | 0.168 | 0.160 | 0.402* | |

Based on tables above and based on the level of significance, enterprise risk management, firm size, and price earning ratio have a positive effect on value of company. These results show that the Covid-19 pandemic is a risk that can be reduced by mitigation, and this risk does not reduce the company's financial performance, even though it shows the composite stock price index has decreased, as a result of several companies experiencing losses. An increase in company assets will make investors' perceptions more positive and in line with improved financial performance, as indicated by an increase in corporate profits and an increase in the composite stock price index on the stock market. During the Covid-19 pandemic, the company's sales decreased due to a decline in consumer purchasing power. The company's current assets cannot be used optimally to increase profits. Excess current assets can of course be used to invest in financial assets that can lead to a good opinion for the company. Indeed, the Covid-19 pandemic has weakened the national economy. Investors prefer to hold their funds and wait for conditions to return to normal. The findings in the study indicate that the use of debt by the company cannot increase sales, and the company still pays interest on long-term debt. This condition will result in losses for the company, and potentially cause financial distress and bankruptcy. The results of hypothesis testing indicate that the most dominant factor influencing firm value is profitability. Prospective investors or old investors will invest their funds in the company, as a consideration is the development of the company's profitability. The increase in profitability in recent periods will make investors' perceptions of the company stronger, so that an increase in the level of investor confidence will lead to positive sentiment towards the company's stock price. The results of this hypothesis test indicate that specifically the price earning ratio is the most important in increasing value of company. The better the value of the company, the company's share price will rise, because many investors will buy shares in the capital market.

Conclusion

A company under normal conditions all the plans that have been set will be carried out properly. Financial service companies that have implemented enterprise risk management will be able to mitigate the risks that occur, and the company will operate efficiently. Investors will be interested in investing their funds in companies that implement enterprise risk management in accordance with the company's risk management principles, processes and frameworks. Risk management is an integral part of organizational governance, leadership, and interaction with stakeholders. Company management has an interest in the implementation of enterprise risk management, because it can protect and increase the value of the company and the company's goals can be achieved. Indeed, companies cannot avoid internal and external influences that can create uncertainty and risk. To anticipate these conditions, company management must be able to make the right strategy to avoid financial losses. The Covid-19 pandemic that caused the global financial crisis, several companies began to implement enterprise risk management. Company management is increasingly aware that the implementation of serious enterprise risk management can prevent companies from going bankrupt. To keep the company surviving in this pandemic era, the level of profitability must always be increased by changing the sales strategy in a more modern way. Investors do not always use economic, political, security or social issues, but also use fundamental factors as a reference to keep their shares or sell shares in the capital market.

References

Astuty, P. (2017). The influence of fundamental factors and systematic risk to stock prices on companies listed in the Indonesian Stock Exchange.European Research Studies,20(4A), 230-240.

Batten, J., & Vo, X.V. (2019). Liquidity and firm value in an emerging market.The Singapore Economic Review,64(02), 365-376.

Brigham, E.F., & Houston, J.F. (2021).Fundamentals of financial management. Cengage Learning.

Budiarso, N.S., Hasyim, A.W., Soleman, R., Zam, I.Z., & Pontoh, W. (2020). Investor behavior under the Covid-19 Pandemic: The case of Indonesia.Innovations,17(3), 308-318.

Chen, C.K. (2004). Research on impacts of team leadership on team effenctiveness.The Journal of American Academy Of Business, Cambridge, 266-278.

Choudhary, V. (2012). Financial leverage and firm?s value: A study of transport equipment sector firms.

Ejem, C.A., & Ogbonna, U.G. (2019). Modelling dividend policy and firms? value relations in Nigeria.International Journal of Economics and Financial Issues,9(6), 171-176.

Husna, A., & Satria, I. (2019). Effects of return on asset, debt to asset ratio, current ratio, firm size, and dividend payout ratio on firm value.International Journal of Economics and Financial Issues,9(5), 50.

Hoyt, R.E., & Liebenberg, A.P. (2011). The value of enterprise risk management.Journal of Risk and Insurance,78(4), 795-822.

Iswajuni, I., Manasikana, A., & Soetedjo, S. (2018). The effect of enterprise risk management (ERM) on firm value in manufacturing companies listed on Indonesian Stock Exchange year 2010-2013.Asian Journal of Accounting Research, 3(2), 224-235

Kouki, M., & Said, H.B. (2011). Does management ownership explain the effect of leverage on firm value? An analysis of French listed firms. Journal of Business Studies Quarterly,3(1), 169.

Lin, Y., Wen, M.M., & Yu, J. (2012). Enterprise risk management: Strategic antecedents, risk integration, and performance.North American Actuarial Journal,16(1), 1-28.

McShane, M.K., Nair, A., & Rustambekov, E. (2011). Does enterprise risk management increase firm value?.Journal of Accounting, Auditing & Finance,26(4), 641-658.

Miles, M.P., & Covin, J.G. (2000). Environmental marketing: A source of reputational, competitive, and financial advantage.Journal of Business Ethics,23(3), 299-311.

Nur'ainy, R., Nurcahyo, B., Sri Kurniasih, A., & Sugiharti, B. (2013). Implementation of good corporate governance and its impact on corporate performance: the mediation role of firm size (Empirical Study from Indonesia).Global Business & Management Research,5.

Rajgopal, S., & Venkatachalam, M. (2011). Financial reporting quality and idiosyncratic return volatility.Journal of Accounting and Economics,51(1-2), 1-20.

Savitri, E., Gumanti, T.A., & Yulinda, N. (2021). Enterprise risk-based management disclosures and firm value of Indonesian finance companies.Problems and Perspectives in Management,18(4), 414.

Sekaran, U., & Bougie, R. (2019).Research methods for business: A skill building approach. john wiley & sons.

Shil, N.C. (2009). Performance measures: An application of economic value added.International Journal of Business and Management,4(3), 169-177.

Silva, J.R., Silva, A.F.D., & Chan, B.L. (2019). Enterprise risk management and firm value: evidence from Brazil.Emerging Markets Finance and Trade,55(3), 687-703.

Van Horne, J.C., & Wachowicz, J.M. (2005).Fundamentals of financial management. Pearson Education.

Yinusa, O.G., Ariyibi, M.E., Yunusa, L.A., & Olaiya, K.I. (2021). Operating leverage and firm value of manufacturing firms in Nigeria. International Journal of Commerce and Finance, 7(1), 77-91.