Research Article: 2017 Vol: 16 Issue: 2

Import Substitution Strategy and Ways of Marketing, Its Implementation Using the Dairy Industry of the Russian Federation as an Example

Svetlana Victorovna Panasenko, Plekhanov Russian University of Economics

Elena Vasilevna Slepenkova, Plekhanov Russian University of Economics

Timur Alexeevich Tultaev, Plekhanov Russian University of Economics

Boris Ivanovich Pogorilyak, Plekhanov Russian University of Economics

Keywords

Import Substitution, Russian Dairy Industry, Food Sanctions, Import of Dairy Products, Food Industry, Foreign Trade.

Introduction

The current international economic and political situation assumes some profound structural changes in functioning of Russian enterprises including the agrarian ones.

The energized industrialization of the developing countries, demographic increase, growing imbalance between food production and the demand for it, non-food use of agricultural raw materials (increasing biofuel production), transformation of some agricultural products into a financial instrument (wheat, rye, barley), high price volatility-all these factors make food crisis one of the major global challenges of the 21st century against the background of lack of availability of resources and comparatively low efficiency of the agrarian sector.

At a global scale, most countries boost their spending on the pursuance of the basic and applied research concerning agrarian issues. This approach meets the interests of national security, as well as the socio-political stability of the government.

In terms of the world market conjuncture, the country's food dependence entails the risk of internal destabilization. Therefore, the issues of ensuring the sustainable functioning of the national agro-industrial complex and the search for rational ways to meet its domestic needs in this sphere are of great importance. Thus, the sufficient level of food security of the government should be achieved through the independent production of basic food products, because import assumes a large degree of potential vulnerability of food supply.

The urgency of the research is today’s economic conditions for the development of the dairy industry. After the introduction of the food embargo in 2014 (a ban on the import into Russia of "certain types" of agricultural products, raw materials and food products, the country of origin of which is the country that imposed economic sanctions on Russian legal entities and individuals in 2014), the supply pattern of finished products has changed significantly. In addition to meat and fish products, vegetables, fruits and nuts, dairy products were included in the embargo list for the Russian Federation. The countries of the European Union (EU), the USA, Australia, Canada and Norway fell under the embargo. New Zealand, Japan and Switzerland were not included. Russia confirmed that the embargo did not concern Denmark-dependent Faeroes and Greenland (unlike Denmark itself, they are not part of the EU).

Thus, the external economic measures introduced by the Government of the Russian Federation in August 2014 made it possible to reduce import figures and to clear the national market for domestic producers. Nevertheless, the results of marketing research clearly show that domestic producers did not take full advantage of the relatively favorable conditions that had developed in the dairy industry. In many ways, this is justified by the underdeveloped and inefficiently implemented marketing policy by many subjects of this industry. In this regard, practical implications are determined in the development of specific marketing recommendations for the entire marketing complex: Commodity, price, distribution (distribution channels) and communicative policies of Russian dairy producers, with the aim of forming and retaining their competitive advantages in the face of economic sanctions and countermeasures taken by the Russian government.

In this connection, the task of import substitution becomes urgent. It is not impressive for Russia as the great agrarian power to buy abroad almost half of all food. In the context of the drop in export income from the sale of energy, the government simply can not afford to import food for tens of billions of dollars.

Import substitution is replacement of foreign goods with domestic products; it contributes to the creation of additional jobs, the emergence of new market entities in the small and medium business segment. The core of import substitution is to create favorable conditions for domestic producers in order to increase their share in the domestic market of the country.

The main reason for developing the legislation concerning the policy of import substitution in Russia in 2015 was the message of the President of the Russian Federation to the Cabinet of Ministers about the development plan of the industry and agriculture which had been approved way back in 2014. The program itself was approved at the moment when the sanctions of the US and the EU countries (EU) against Russia were introduced. According to the Decree of the President of August 6, 2014 No. 560 "On the Application of Certain Special Economic Measures to Ensure the Security of the Russian Federation" within the framework of import substitution, the Russian Federation Government Regulation "On the Application of Certain Special Economic Measures…" was approved. It contains the list of agricultural products, food and raw materials that were supplied earlier from the United States, the EU countries, Canada, Australia and Norway, but now they are under ban for import into the Russian Federation with the extension till December 31, 2017.

Realization of the potential for import substitution in the milk processing industry turned out to be quite low; just few areas could gain advantages from new opportunities, such as cheese making (an increase of 20% for the period of 2014-2016) (Table 1).

| Table 1: Production Of The Main Types Of Import-Substituting Dairy Products In The Russian Federation, Thousand Tons (Compiled By The Authors According To The Website Of The Federal State Statistics Service, As Of February 2017) | |||||

| Product | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|

| Whole-milk products, million tons | 11.3 | 11.5 | 11.5 | 11.7 | 11.9 |

| Watery and heat-treated milk | 5267 | 5386 | 5348 | 5447 | 5490 |

| Cream | 95.2 | 103 | 115 | 121 | 125 |

| Butter | 214 | 225 | 250 | 256 | 247 |

| Cheese and cheese products | 451 | 435 | 499 | 586 | 600 |

| Condensed milk products, million tins | 873 | 860 | 833 | 828 | 847 |

| Fermented milk product except sour cream and curd cheese | 2430 | 2521 | 2520 | 2445 | 2480 |

| Curd cheese | 396 | 371 | 387 | 416 | 405 |

Despite the fact that the milk processing industry is the third largest recipient of investment in agro-industrial projects after poultry and pork industries, the financing yields poor returns and the industry as a whole does not show a steady growth; it remains a highly dependent sector and self-sufficiency in milk does not exceed 70-78%.

The dairy industry is a system element of the industrial complex. It represents one of the leading strategic sectors of the agricultural business of Russia, the sector of industry with a huge multiplicative effect and great influence on agriculture, transport, wholesale and retail trade.

Currently, more than 21 thousand enterprises deal with the production of dairy products and other spheres related to it; more than 1.2 million people are employed there; the industry produces up to 15% of the total volume of retail turnover in Russia. In addition, milk and dairy products are included in the list of products of the Food Security Doctrine of the Russian Federation (the Decree of the President of the Russian Federation No. 120, 2010). Consequently, the level of the prolification of the dairy industry is an important indicator of the country’s well-being and the effeciency of the development of the agro-industrial complex.

The reduction in the volume of imports and the insufficient production of milk products inside the country have already led to their shortage in shops. As a result, we estimate the current state of the dairy industry as unsatisfactory; that is why it seems relevant to study the potential and the prospects for the development of the Russian dairy industry under the conditions of economic sanctions.

Methods

Analysis of Recent Research and Publications

This paper has the main results of the study conducted by the teachers of Plekhanov Russian University of Economics based on the internal subsidy concerning Marketing Strategies of Domestic Dairy Enterprises in the Conditions of Western Economic Sanctions topic. It includes the analysis of statistical and primary data of domestic dairy enterprises, research and quantification of the intensity of consumer demand, the state of balance of the market for milk and dairy products; we have used official statistics of the Federal Service of State Statistics of the Russian Federation; Ministry of Economic Development of the Russian Federation; Ministry of Agriculture of the Russian Federation; The Federal Customs Service of the Russian Federation; Federal Tax Service of the Russian Federation; The EurAsEC Customs Union; World Trade Organization, Eurostat data.

Many works of domestic and foreign scientists are devoted to the fundamental issues of ensuring the country's food security: (Anischenko, 2015; Afonina, 2014; Arli, 2017; Becerra, 2002; Dawe et al., 2015; Hemme et al., 2014; Kotler et al., 2010; Malhotra & Birks, 2007; Murtuzalieva & Seifullaeva, 2014; Murtuzalieva et al., 2015; O’Cass, 2002; Piłat, 2014; Pylypiv et al., 2014; Schwartz, 1994; Shklyar et al., 2015; Tultaev et al., 2017; Zerkalov, 2009; Zhiqiang, 2013), etc.

At the same time, scientific achievements and the gathered experience of the research in this field are still debatable. In particular, the impact of food sanctions on the functioning and prospects of development of milk industry as the most important component of the food industry from the point of view of ensuring the food security of the Russian Federation has been little studied.

The aim of the study is to identify the nature of impact of food sanctions on the country's food security using milk products industry as an example, as well as to develop some methodological recommendations for improving the efficiency of domestic dairy industry. This goal predetermined the formulation and consistent solution of a number of conceptual problems of empirical research:

1. Identifying the development features and the current state of the dairy industry in the framework of ensuring the food security of the country;

2. Evaluation of the impact of food sanctions on the functioning of the dairy sector from the point of view of the government policy for supporting the domestic dairy producer;

3. Development and justification of the main promising areas of development of the dairy industry as a component of the agro-industrial complex and the factor of ensuring food security in Russia.

To achieve the goal and objectives, some general scientific and special methods were used in the study.

As a result of the studies using the sampling method by collecting quantitative data about the indicators of foreign trade balance of the dairy industry, the structure and behaviour of import of basic milk products, the average annual prices for buying raw milk and the indicators of the production level in the Russian Federation, an original database was formed for assessing the industry’s current state in terms of sanctions.

The systematization of data about the world volume of raw milk production for the studied period made it possible to assess the competitive positioning of Russia's dairy industry in the world economy. The collection of data about qualitative regularities of the impact of import restrictions became the basis for the attributive evaluation of its impact on the functioning of the dairy industry.

By revealing relatively stable features of the functioning of the food industry, the empirical fact of the destructive influence of food sanctions on the development of the dairy industry of the Russian Federation was established. Based on determining the state of the structure of the foreign trade balance of the dairy industry, the structure of imports of the industry's main products in terms of sanctions, the average annual prices of producers of raw milk and the integral nature of the development of the volume of production of basic dairy products, some practical recommendations have been proposed to improve the efficiency of the dairy industry in Russia.

Results

Basic Results of the Research

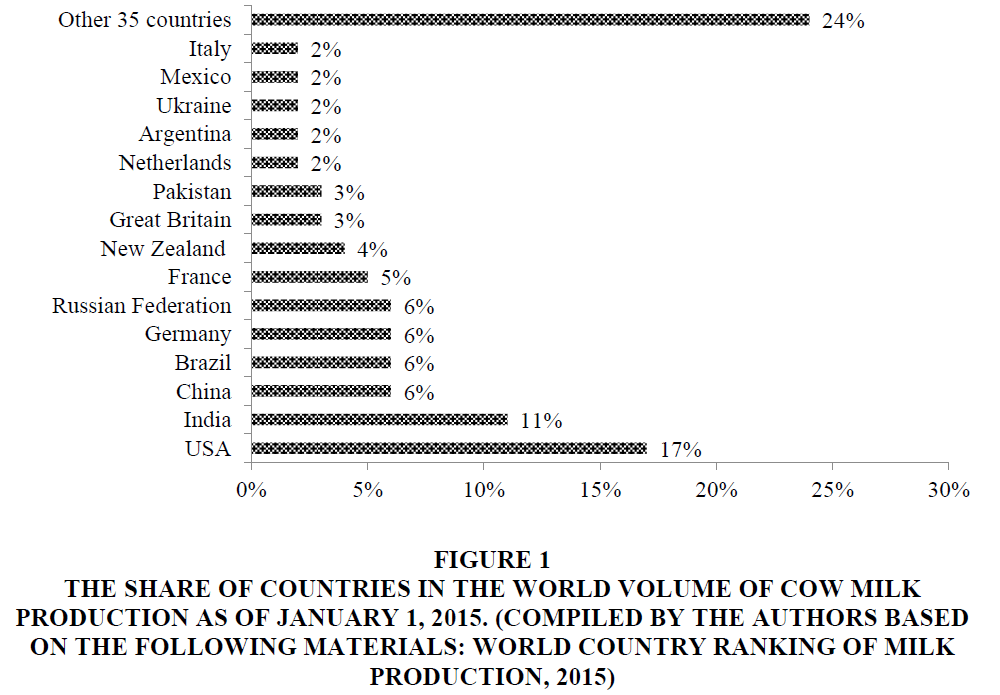

The Russian Federation is one of the largest producers of milk in the world food market. In 2015, Russia, with 6% of the global volume, occupied one of the leading positions the third place-along with China, Brazil and Germany giving place to the USA and India (Figure 1).

Figure 1.The Share Of Countries In The World Volume Of Cow Milk Production As Of January 1, 2015. (Compiled By The Authors Based On The Following Materials: World Country Ranking Of Milk Production, 2015).

Modern Russia has a good potential for agricultural production to ensure in full the import substitution of dairy products, which makes it possible both to meet domestic needs and sell products in the foreign market.

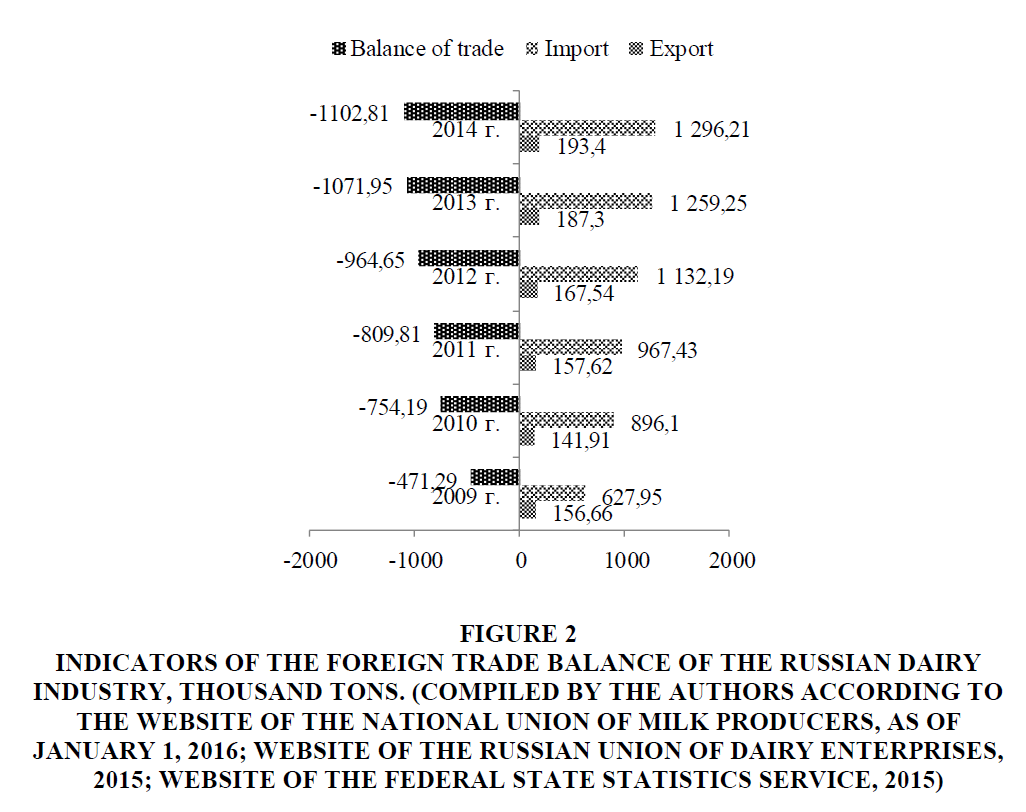

At the same time, the Russian Federation is an importer of dairy products. Thus, the structure of foreign trade in dairy products is characterized by significant import dominance. In addition, there is a dynamics of growth of the disproportionate structure of the foreign trade. During the period of 2009-2014, the increase in imports was 668.26 thousand tons, while the export of dairy products for that period increased by only 36.74 thousand tons (Figure 2).

Figure 2.Indicators Of The Foreign Trade Balance Of The Russian Dairy Industry, Thousand Tons. (Compiled By The Authors According To The Website Of The National Union Of Milk Producers, As Of January 1, 2016; Website Of The Russian Union Of Dairy Enterprises, 2015; Website Of The Federal State Statistics Service, 2015).

According to Rosstat, Russia's own supply of important groups of dairy products amounted to 76.6% in 2013 and 76.8% in 2014, which indicates a possible threat to the country's food security.

In the context of the sanctions, the government has already used some various instruments to support Russian producers by limiting imports and policies for full or partial import substitution. Currently, the State Program for the Development of Agriculture and Regulation of Markets for Agricultural Products, Raw Materials and Food for the period of 2013-2020 are in use.

The Food Security Doctrine was approved in 2010; the Strategy for the Development of Food and Processing Industry-2020 was approved in 2012, etc. (On the Approval of the Strategy for the Development of Food and Processing Industry of the Russian Federation (Decree of the Government of the Russian Federation No. 559-r. of April 17, 2012)).

The analysis of the current situation shows that Russia will not be able to cope with the complete substitution of imports of embargoed products in the near future, due to the limited possibilities of Russian agrarian sector. There can be some serious problems with certain types of dairy products.

41% of production capacity of whole milk products remain unloaded, while the share of milk imports have reached 60% for the period until 2013. It will be difficult to unload available capacities, since raw materials are used in the production of a number of products and embargo is also imposed on them.

According to the Ministry of Economy of the Russian Federation, milk production in Russia will hardly grow in the near future and its import will decrease by 10%, which will lead to higher prices and a reduction in the consumption of dairy products.

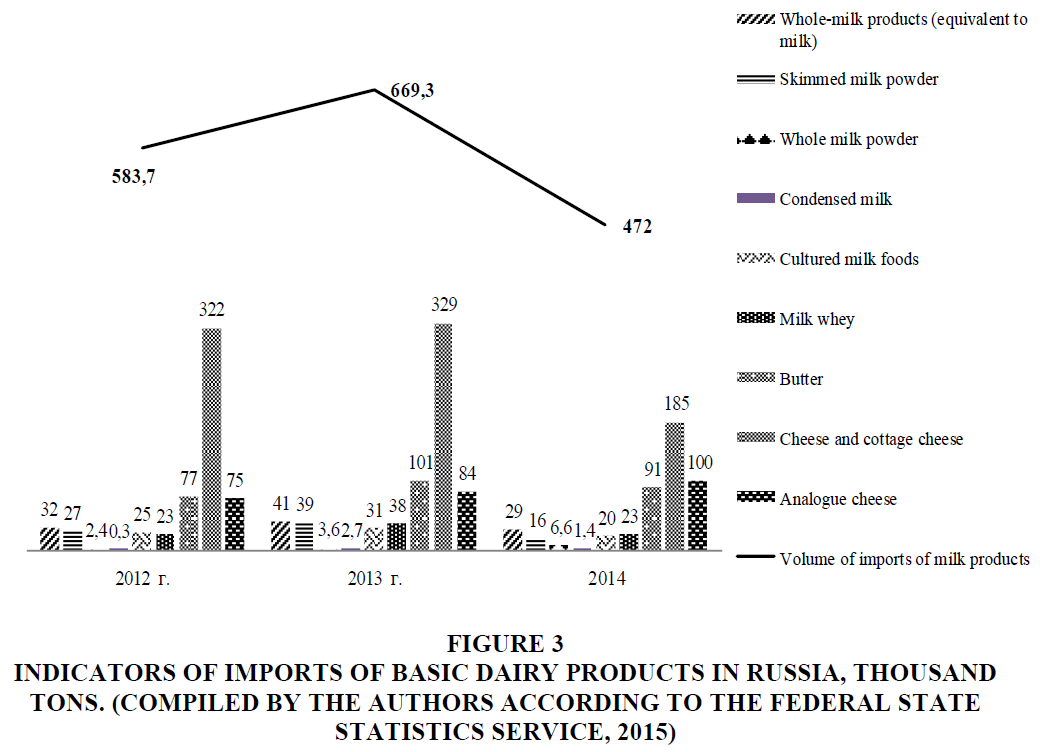

According to the Federal State Statistics Service (Rosstat), the dairy industry of the Russian Federation is characterized by a significant decrease in imports of basic dairy products in 2014-2015 in the context of the sanctions: By 23% in 2012 and by 42% in 2013, with a sharp decline in imports of basic dairy products to 472 thousand tons in five months of 2014 instead of 669.3 thousand tons in 2013; in addition, the import of butter, cheese and cottage cheese has also decreased (Figure 3).

Figure 3.Indicators Of Imports Of Basic Dairy Products In Russia, Thousand Tons. (Compiled By The Authors According To The Federal State Statistics Service, 2015).

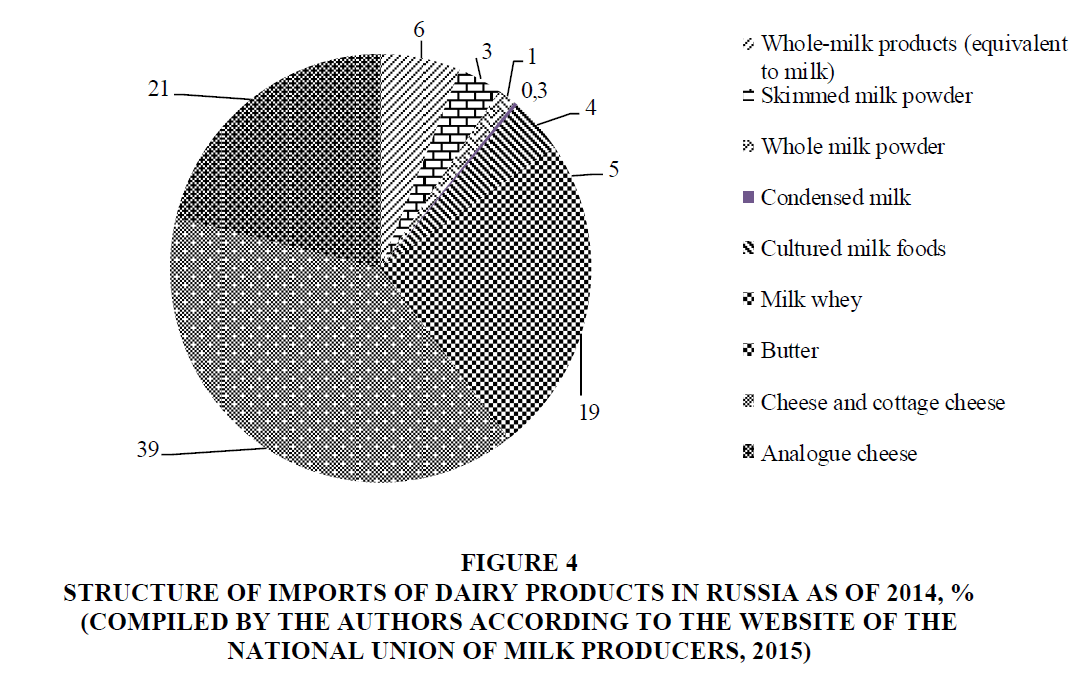

Since the structure of imports of dairy products for Russia is represented by a rather small range of products (cheese and cottage cheese (39%), analogue cheese (21%) and butter (19%) have the largest share of imported products in the country up to 79%), it was the reduction in the import of these products that became the object of food sanctions in the Russian dairy industry (Figure 4).

Figure 4.Structure Of Imports Of Dairy Products In Russia As Of 2014, % (Compiled By The Authors According To The Website Of The National Union Of Milk Producers, 2015).

After the imposition of limitations on imports, a significant increase in prices of raw milk as a raw material basis for dairy products of the Russian Federation is shown. Thus, in March 2015, the price for basic dairy products grew by about 70% as compared to 2014.

Such a trend will show over the long term the prospects of increasing the investment attractiveness of the Russian dairy industry. But as of March 2015, due to surplus production of dairy products, purchasing prices have collapsed to a critical level in the international dairy market.

For example, in the European Union, the volume of dairy production increased by 5.5% at the end of 2014 -the beginning of 2015. In Germany, the price of milk was fixed at about 33- 35 cents per 1 kg, in Lithuania-24 cents per 1 kg of milk, in Estonia-22-25 cents. In Latvia, the purchasing price of milk has decreased by 25% since August 2014; then there was a gradual decrease in prices by 10% at the beginning of 2015.

With a steady decline in prices for that period, there is an active growth in dairy production. For example, the production increased by 7% in 2014 in Poland; by 5-10%-in the Netherlands.

This reflected the current state of the Russian dairy industry: In May 2015, the price of 1 kg of milk amounted to 17.57 rubles. The purchasing price of raw milk decreased by 47.2% just in two month without control of the government over the level of prices in the dairy industry.

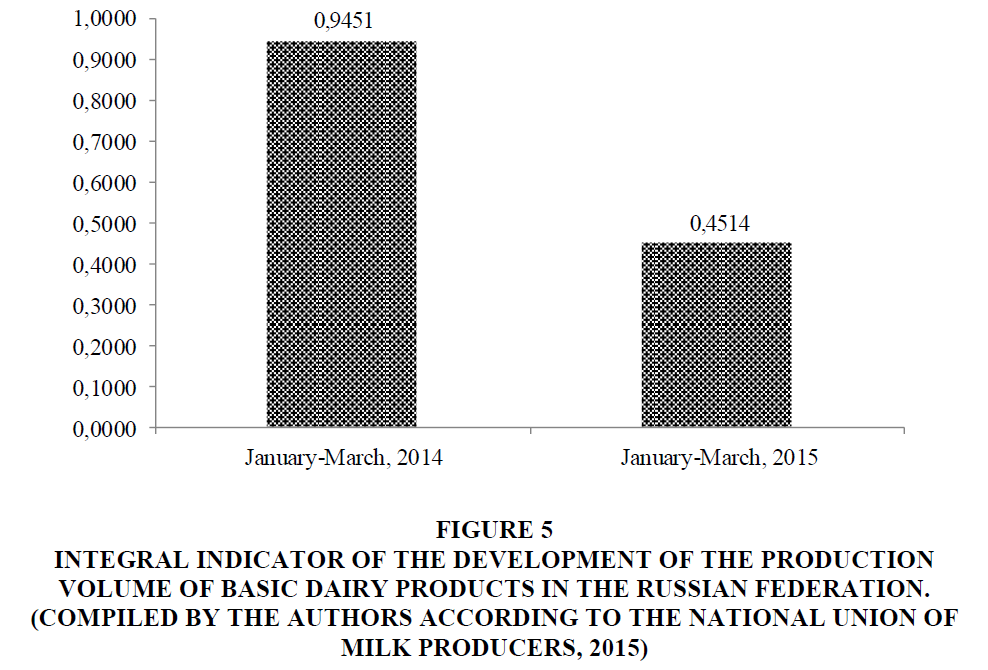

The fall in prices in the food industry against the backdrop of weak government financial support, the high cost of the borrowed capital and the lack of potential for attracting investments have led to a sharp decline in the production of dairy products in Russia. The integral indicator of the volume of production of basic dairy products, such as whole milk products, cheeses, analogue cheese, butter, skimmed milk powder, whole milk powder, whey powder and cottage cheese as of January-March 2015 decreased by 52.24% as compared to the same period in 2014 (Figure 5).

Figure 5.Integral Indicator Of The Development Of The Production Volume Of Basic Dairy Products In The Russian Federation. (Compiled By The Authors According To The National Union Of Milk Producers, 2015).

Thus, in the current conditions of the functioning of the national dairy industry, with the further extension of food sanctions, the potential for extrapolation of the trend of the decline in the production of dairy products is formed as part of the process of accelerating the reduction of the price of dairy products, which creates a threat of a crisis in Russian dairy industry as a factor in the destabilization of the country's food security.

We could see the same situation at the end of 2016; there was a small increase in the consumption of dairy products in the first half of the year. It was due to an increase in cheap imports and domestic production. However, then the rise in world dairy products prices took place and imports decreased. Domestic production volumes had also declined and internal prices began to rise.

These events have led to a slowdown in the recovery of demand. The decline in consumption (butter, cottage cheese) continued and reorientation of demand took place-towards cheaper traditional whole-milk products instead of expensive products.

The production of the most essential types of dairy products in Russia in 2016 remains higher than last year's levels, but the growth is not significant. The rate of the increase in production has decreased significantly. This is due to the lack of raw materials and an increase in the volume of imports of dairy products in the first half of the year. The production of whole milk products remains higher by 1.7%, cheese-by 2.2%, analogue cheese-by 1.0%, whole milk powder-by 12.9%. At the same time, the production of butter and skimmed milk remains lower by 5.6% and 4.8% than in 2015, cottage cheese and curd products-by 1.8%, margarine productsby 6.4%.

According to the estimates of the National Union of Milk Producers "Soyuzmoloko", in 2016 the production of the most popular types of dairy products will increase: Whole milk products (+1.2% to 11.9 million tons in milk equivalent), cheeses (2.4% to 463.6 thousand tons) and cheese products (+0.1% to 136.1 thousand tons).

The gross output of raw milk by the end of 2016 was 0.6% lower than in 2015. If in the first quarter there was an insignificant increase in the monthly volumes of raw milk production, then in April-September the growth rates turned out to be negative. According to the Federal State Statistics Service, 26,414 thousand tons of raw milk were produced in farms of all categories (-0.6% compared to 2015). In January-October 2015, the volume of raw milk production corresponded to the level of 2014-26,579 thousand tons.

There is a shortage of raw milk suitable for cheese production, due to price competition with foreign (usually Belarusian) producers, as well as a relatively small effective consumer demand for relatively expensive dairy products, including cheeses. As a result, the current assets of industrial cheesemakers are reduced, which is unacceptable in conditions of sufficiently long terms of cheese ripening and leads to a significant decrease in the profitability of production.

In this regard, in order to increase the efficiency of the domestic dairy industry, in parallel with the optimization of the import substitution process, it is expedient to maximally resolve the systemic problems of its functioning that accompany the development of the industry throughout its functioning.

One of such problems, as we pointed out earlier in our work, is the depreciation of fixed assets (Murtuzalieva & Seyfullaeva, 2014). Most of the processing plants in the industry were built and equipped even under the Soviet system-30 years ago and at the same time have never been upgraded. For example, typical factories for the production of cheese products were built in the 1970s and equipped with the equipment from the Hungarian enterprise "Elgep" (Ermakova & Atabaeva, 2014). According to experts, the estimated wear level of the basic funds of the national dairy industry amounted to 40-80%.

Along with the physical wear and tear of fixed assets for the dairy industry in Russia, there is also a significant moral wear, which leads to low competitiveness of products, their inability to meet the taste requirements of the modern consumer in terms of the quality characteristics and assortment (Afonina, 2014).

Discussion

During the study, the authors identified the main problems of the Russian dairy industry that hindered its development:

1. Low operational performance of the industry, high infrastructure costs and the high cost of investment resources necessary for development;

2. Low efficiency of interaction between the industry and the state in the sphere of decision-making regarding directions and volumes of support including measures of customs and tariff regulation;

3. High production cost;

4. Low production assets;

5. Low investment attractiveness of dairy farming;

6. The excessive volatility of domestic prices for raw milk as a result of the high seasonality of its production;

7. The irregularity of state support, leading to a shortage of working capital and the inability to strictly comply with the technology of production;

8. Low level of information equipment of dairy enterprises;

9. Low level of competence among all groups of workers in the dairy industry as a result of the non-competitive level of wages; low level of modernization of the industry, the lack of adequate infrastructure in most regions of the country.

A necessary condition for the successful economic growth of the Russian dairy industry, in our opinion, is the existence of a long-term development strategy that requires a systematic scientific, technical and structural policy for the formation of scientific and production complexes.

If the technical base of the dairy industry is worn out, it is not possible to efficiently generate financial resources for the industry in the form of cheap borrowed capital and to accumulate a sufficient financial base by subsidizing the state. So, in 2015, state funding for the food processing industry was only 0.3% of GDP, which does not cover even 5% of the food industry's need for additional capital.

Despite a number of measures that the government took in the dairy market, problems related to the limited consumer demand for dairy products, the seasonality of raw milk production and the lack of opportunities for market participants to attract long-term loans on preferential terms, remain unresolved.

In conditions of the low profitability of the industry and insufficient volume of circulating assets, dairy enterprises are forced to resort to raising additional capital through loans. Russian commercial banks after the introduction of Western sanctions and retaliatory embargo reoriented to lending to import substituting industries, but the dairy industry recognized them as a crisis area of activity and taking into account this, it is limited by the possibilities of attracting credit bank resources.

The effective functioning of the dairy industry in the Russian Federation is also hindered by the imperfection of the system of state and customs-tariff regulation of the dairy market. For the major part of food products imported to Russia, the threshold value of their customs value significantly exceeds its average value, which, other things being equal, determines the imposition of a specific duty on most imported dairy products.

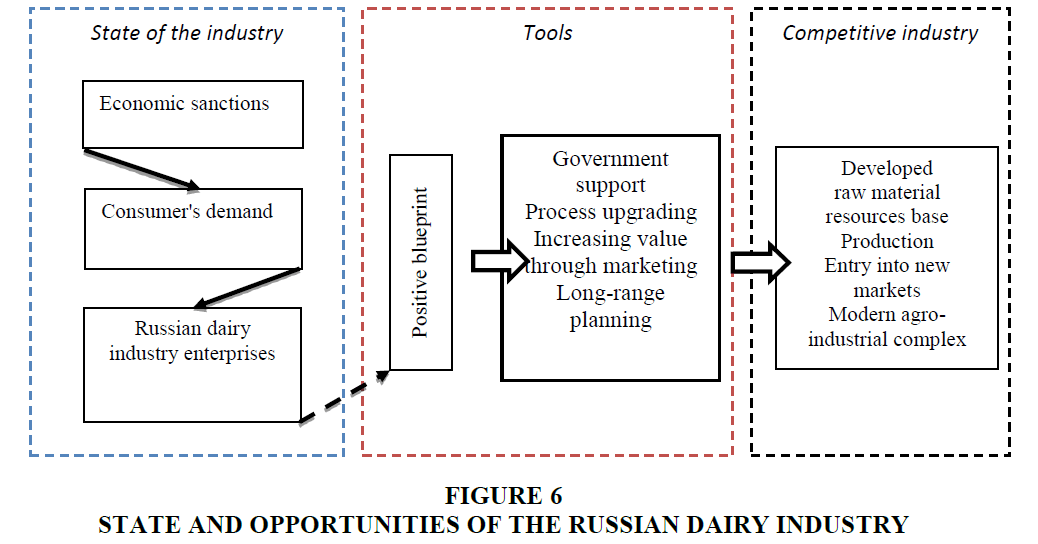

In the context of growing competition in the modern market economy, the process of formulating an enterprise strategy should include identifying potential opportunities and threats from the external environment of an organization, assessing risks and possible alternatives. In addition, before making any strategic decision, one should evaluate all the strengths and weaknesses of the organization, as well as available and available resources. These issues remain relevant for the dairy industry. The scheme described above for the sector under investigation can be as follows (Figure 6).

If these trends in the functioning and development of the Russian dairy industry are maintained, the process of the deindustrialization of the industry and the preservation of the current potential for its development will be inevitable. The dairy industry of the Russian Federation, both in general and for the country's agro-industrial complex, needs structural reforms and financial and legal support of the state.

Food sanctions, used as a tool for the protection of the domestic producer and import substitution, are a destructive factor in the functioning of the Russian dairy industry.

The unfavorable impact of the conditions of food sanctions is multiplied by systemic problems of the dairy industry. The impact of food sanctions in conditions of unresolved systemic problems in the development of the dairy industry led to a crisis in the industry as a factor in destabilizing the food security of the Russian Federation.

In connection with the foregoing, in order to ensure stabilization and increase the efficiency of the dairy industry in the Russian Federation, as part of the study conducted by the authors of the article, it is proposed to do the following:

1. To strengthen the role and function of state intervention and control by creating industrial parks in the regions economically favorable for the production of milk and dairy products.

2. To ensure the maximum permissible level of protective measures and state support for the dairy industry, taking into account the special risks for such milk-intensive subsectors as the production of milk powder, butter and cheese.

3. Rosstat and the Ministry of Agriculture of Russia should improve the methodology for obtaining operational and reliable data on monitoring livestock, productivity, gross milk production, the volume of marketable milk in dairy farming in Russia, especially in the public sector.

4. To consider the possibility of strengthening the interaction between Rospotrebnadzor and the Rosselkhoznadzor of Russia with respectable producers through specialized unions and associations in identifying the facts of unfair competition. To increase the responsibility for the production of products that do not comply with the "Technical Regulations for Milk and Dairy Products", especially with regard to the unauthorized use of vegetable fats of tropical origin. Significantly limit the import of vegetable fats of tropical origin to the territory of the Russian Federation, using the quota mechanism.

5. To implement the Program to Stimulate the Consumption of Milk and Dairy Products until 2020 through social advertising and increased consumption in the public sector (children's, medical, military and other institutions).

6. For an objective assessment of the financial state of dairy farming, the profitability of raw milk production, pay special attention to the formation of the cost of milk production, since the existing practice distorts the real picture, not allowing making the right decisions aimed at the development of dairy farming.

7. Given the significant impact of credit obligations on the cost of milk production, we believe that the crediting period in the dairy industry for construction and modernization should be at least 15 years, for equipment-at least 10 years and for the purchase of livestock-at least 5 years. We also consider it necessary to introduce a delay on the beginning of the repayment of the body of the loan for 3 years, until the enterprise reaches full production capacity.

8. To restructure loans granted to milk producers from regions affected by the 2010-2012 drought, the consequences of which prevented them from accumulating funds to repay the loan body. And also, to allocate funds for the purchase of feed to preserve the breeding stock in the regions affected by the drought, which will help keep the livestock and keep the prices of finished dairy products on the rise.

9. To introduce amendments to the Tax Code of the Russian Federation taking into account the VAT charge when agricultural producers use the preferential taxation system and apply processing systems to the general taxation system. We also propose to extend the zero income tax rate for agricultural producers until 2020.

10. To tighten the control of the Federal Antimonopoly Service for the intra-industry distribution of income from the sale of milk and dairy products between milk producers, milk processors and trade.

Some special economic measures with respect to goods from a number of countries, as an instrument of protection of the domestic producer, are more likely to be destructive in the current situation in the dairy industry. Their adverse effects are multiplied due to systemic problems in the activity of milk processing enterprises. The impact of food sanctions in the context of the unsolved problems in the development of the milk processing industry has spectra of crisis in the industry as a factor in the destabilization of national food.

The practical implications include the possibility of using recommendations for developing strategies for dairy enterprises in Russia, in particular, the algorithm for its implementation proposed by the authors. It is for Russian producers of other spheres of the economy that have fallen under the economic sanctions of the West.

Only a comprehensive solution of the problems presented in this paper will allow ensuring the development of the milk processing industry, improve the quality of products and lay the foundations for the revival of the competitiveness of the domestic industry as the basis for ensuring the state's food security.

References

- Afonina, E.V. (2014). Prodovolstvennaya bezopasnost i investitsii v kontekste vyzovov sovremennosti [Food security and investment in the context of modern challenges]. Naukovedenie, 4(23).

- Anischenko, A.N. (2015). Importozameshchenie kak faktor obespecheniya prodovolstvennoi bezopasnosti [Import substitution as a factor of ensuring food security]. Ekonomika i sotsium, 2(15).

- Arli, D. (2017). “Does ethics need religion? Evaluating the importance of religiosity in consumer ethics”. Marketing Intelligence & Planning, 35(2), 205-221.

- Dawe, D., Morales-Opazo, C., Balie, J. & Pierre, G. (2015). How much have domestic food prices increased in the new era of higher food prices? Global Food Security, 5, 1-10.

- Becerra, E.P. (2002). “The impact of felt ethnicity on purchasing behavior: Hispanic influence on other cultures”. Proceedings from Decision Sciences Institute Annual Meeting.

- Ermakova, E.E. & Atabaeva, S.A. (2014). Sovremennoe sostoyanie i perspektivy razvitiya molochnoi promyshlennosti RF [Current state and prospects for the development of Russian dairy industry]. Molodoi uchenyi, 7, 338-340.

- Hemme, T., Mohi Uddin, M. & Ndambi, O. (2014). Benchmarking cost of milk production in 46 countries. Journal of Reviews on Global Economics, 3, 254-270.

- Kotler, P., Kartajaya, H. & Setiawan, I. (2010). “Marketing 3.0: From products to customers to the human spirit”. John Wiley & Sons: Hoboken, New Jerscey, USA.

- Malhotra, N.K. & Birks, D.F. (2007). “Marketing research: An applied orientation”. Pearson Education: NY, USA.

- Murtuzalieva, T.V. & Seyfullaeva, M.E. (2014). Sostoyanie i perspektivy razvitiya molochnoi promyshlennosti Rossii v usloviyakh ekonomicheskikh sanktsii Zapada [State and prospects for the development of Russia's dairy industry in the context of western economic sanctions]. Vestnik Rossiiskogo ekonomicheskogo universiteta im. G.V. Plekhanova, 12(78), 59-73.

- Murtuzalieva, T.V., Seifullaeva, M.E. & Shirochenskaya, I.P. (2015). Peculiarities of RF dairy industry development under food embargo. Mediterranean Journal of Social Sciences, 6(5-4).

- O’Cass A. & Frost H., (2002). “Status brands: Examining the effects of non-product-related brand associations on status and conspicuous consumption”. Journal of Product & Brand Management, 21(2), 67-88.

- Piłat, R. (2014). Russian Embargo-History and Impact. Retrieved July 10, 2017, from http://www.kig.pl/files/BWZ/Russian%20embargo_history%20and%20impact_2014_pdfx.pdf

- Pylypiv, A.M., Panchenko, V.V. & Grazhdanova, P.I. (2014). Sanktsii kak instrument povysheniya prodovolstvennoi bezopasnosti [Sanctions as an instrument for improving food security]. Naukovedenie, 5(23).

- Schwartz, S.H. (1994). “Are there universal aspects in the structure and contents of human values?” Journal of Social Issues, 50, 19-46.

- Shklyar, T.L., Mkhitaryan, S.V. & Tultaev, T.A. (2015). Analysis of dependence of the emotional perception of colors on the type of personality of the Russian consumers of advertising information. Social Sciences, 10(6), 1223-1231.

- Tultaev, T.A., Shklyar, T.L. & Mkhitaryan, S.V. (2017). Russian citizen personality typology and their belonging to the generations X, Y and Z impact on the perception of colors during demand and consumer preferences development. International Journal of Economic Perspectives, 11(2).

- Zerkalov, D.V. (2009). Prodovolstvennaya bezopasnost. Monografiya [Food security. Monograph]. Kiev: Osnova.

- Zhiqiang, F. (2013). The national food security research. Advances in Applied Economics and Finance, 4(1), 646-651.