Research Article: 2021 Vol: 20 Issue: 4S

Influence of system design with the support of staff competencies on the quality of local government financial reporting in Indonesia (Study on Local Governments in Java)

Joni Setiawan, Padjadjaran University

Sri Mulyani, Padjadjaran Universit and Universitas Singaperbangsa Karawang

Memed Sueb, Padjadjaran University

Srihadi Winarningsih, Padjadjaran University

Abstract

This study examined the influence of local government accounting information systems and staff competencies on the quality of local government financial statements. The research covered provincial, county and municipal governments on Java Island, except for Jakarta Capital Province (DKI Jakarta), with a total of 102 local governments surveyed. The Structural Equation Modeling (SEM) technique was employed in the research. The study concludes that local government accounting information systems and the competencies of key staff have a significant positive influence on the quality of local government financial statements, and consequently indicates that the better the implementation of local government financial accounting information systems and the more developed the competencies of key staff, the better will be the quality of local government financial statements. This article is expected to be of benefit to local governments, central government, public accounting firms, local legislative assemblies, CSOs concerned with the administration of local government, and local communities with an interest in regional development by helping them to obtain a clear picture of how local government financial management is implemented. The findings of the study should also help to provide input on how to design and implement local government financial management applications, deploy competent staff, and compile high-quality, accountable, and transparent local government financial statements.

Keywords

Accounting Information Systems, Staff Competency, Financial Statement Quality, Local Government

Introduction

Changes in state financial management, the decentralization of local financial management and the implementation of regional autonomy have given rise to various problems at the central and local government levels in Indonesia. These problems are to be found throughout the local government financial cycle, from the initial budget approval stage up to the preparation of financial statements. In general, the problems are due to the complexity of the relevant regulations, lack of adequate human resources in the form of competent local government staff, poor coordination, and inadequate technology (Akbar, 2017).

The quality of local government financial reporting may be categorized as low. This has provided opportunities for corruption, a problem that is particularly acute in a number of local governments. Financial reporting is one of the ways in which local government transparency and accountability to the public is realized. Of the five tiers of financial reporting quality standards, no local government has achieved the highest level to date. Indeed, most local governments have only reached tier three, while many county and municipal governments remain stuck in tier two (Nurafiah, 2018). Consequently, local government financial statements are viewed as being generally unreliable. The principal reason for the unreliability of the financial statements presented by local governments is the problems they face as regards internal control over their accounting systems (Havesi, 2005 as cited in Nurafiah & Azwari, 2015). Accurate records are critical. In the absence of effective control, records may be unreliable. This means that the resulting financial statements may also be unreliable (Harrison et al., 2013, as cited in Nurafiah & Azwari, 2015). Transparency is essential in financial management and planning so as to ensure clean and good governance at the local level. In this regard, the harnessing of technology is essential as a stepping stone to improved performance. The use of information-technology applications should help to achieve greater synchronization in both bottom-up and top-down planning (Sappewali, 2017). Governments need to exhibit accountability in respect of all activities that are undertaken, as reflected in cost calculation and management (Canales, 2012, as cited in Pe?a-Miguel & de la Pe?a, 2017). To encourage this, an effective financial management accounting system is required as a way to improve organizational management (Brusca, 1997, as cited in Pe?a-Miguel & de la Pe?a, 2017). To achieve this aim, Pe?a-Miguel and de la Pe?a (2017) propose the design of new information systems to complement the information provided in the financial statements.

The application of a national local government accounting information system is needed to provide comprehensive information on local government finances to the public and to financial policymakers to inform them when making decisions (Budiriyanto, 2013). The current diversity in local government financial management information systems makes it difficult for stakeholders to obtain consolidated data on central and local government finances. Essentially, robust legislation is needed to facilitate the integration process (Harjowiryono, 2012, as cited in Budiriyanto, 2013). The facts show that of 524 local governments (as of October 2012), 361 (or 68.89%) employed a financial information system. As for the remaining 163 local governments (31.11%), it was unclear what system they used to manage their finances. The data also revealed a lack of uniformity in the accounting information system applications employed by local governments. A total of 223 used SIMDA, 68 used SIPKD, 123 used other systems, and 110 did not use any local government financial management information system (Budiriyanto, 2013). The wide variety of financial management information systems that are employed reveals that local governments in Indonesia continue to face severe problems concerning the designing of accounting systems to support the achievement of high-quality financial reporting.

It is widely agreed that in the public or governmental sector, civil servants play a central role in supporting the successful implementation of governmental duties. The successful provision of public services is primarily influenced by the level of motivation of civil servants in discharging their duties and responsibilities (Palidauskait?, 2007; Palidauskait? & Segalovi?ien?, 2008; Worthley et al., 2009; Anderfuhren-Biget et al., 2010; Merkys & Brazien?, 2010; Palidauskait? & Vaisvalavi?i?t?, 2011; Andersen & Pedersen, 2012; Chen & Bozeman, 2012; Park & Rainey, 2012; Andersen & Kjeldsen, 2013; Jin, 2013; Pedersen, 2013, as cited in Raudeliunienea & Kavaliauskiene, 2014). This shows that the deployment of high-quality and competent staff will result in better quality financial statements. A study of the relationship between staff competencies and financial reporting outcomes showed that the deployment of competent and qualified staff resulted in fewer internal control violations and fewer restatements of financial reporting (Call et al., 2017). Staff competencies are critical as they are synonymous with the values of leadership in the governmental system (Setyabudi, 2017). Many government staff who hold more sector-oriented positions (with responsibility for specific functions) lack an overall understanding of decentralization policies, general governance, and central government relations with local government. They also tend to exhibit a less developed understanding of local government financial management (Setyabudi, 2017)

The low quality of human resources at the local government level is reflected in the daily lives of local government officials, including low salaries and poor working conditions, and opaque recruitment and promotion patterns. In addition, the work culture continues to be “semi-feudal” in character (an expectation that the public should bow to the civil service rather than the other way around), while professionalism is often lacking (Bappenas, 2004, as cited in Nugroho, 2014). In Trenggalek County, for example, officials suffer from poor working conditions and ineffective organizational communication, which in turn gives rise to low levels of achievement in their work (Soeprapto et al., 2008). In North Aceh County, officials are often not deployed to units that accord with their respective areas of expertise. Thus, many officials in the accounting and reporting section lack a background in accounting or finance. Low competency levels among local government officials tasked with preparing financial statements obviously have implications for the quality of the financial statements they produce (Muzahid, 2014).

Literature Review

Application of Accounting Information Systems

Accounting information presented in the form of financial statements is generated by an accounting information system that is designed and applied by the relevant entity, organization, or company. An accounting information system is a series of interrelated components that comprises the processes of gathering, recording, storing, and processing accounting and other data to generate information that is useful for decision-making (Romney & Steinbart, 2012). An accounting information system can also take the form of a collection of IT-based structures and procedures that work together to produce output in the form of information that meets the needs of its users (Considine et al., 2012; Hurt, 2013; Mulyani, 2014; Simkin et al., 2015).

There are three (3) factors that are very influential in determining the quality of the information generated by an accounting information system: (1) reliability of the software program or application, (2) reliability of the standard operating procedures, and (3) support in the form of infrastructure and facilities (Awad, 1988; Considine et al., 2012; Mulyani, 2014; Hall & Bennet, 2016).

Staff Competencies

Human capital is the principal supporting pillar and driver of an organization in realizing its vision, mission, and goals (Azhar, 2007, as cited in Pradono & Basukianto, 2015). An organization’s personnel is its greatest asset and the key to its success. The way an organization treats its people greatly influences its performance. Nowadays, the value of human capital is widely recognized and appreciated, and staff are seen as assets (Robbin & Coulter, 2016).

Human capital competencies include the capacity of a person or individual, an organization, or a system in discharging its functions or authority in order to effectively and efficiently achieve its goals. The term “competency” may be defined as the ability to achieve a certain level of performance and produce an achievement (Roviyantie, 2011). Human resources management objectives can be used as tools for evaluating or measuring the activities carried out by an organization’s people for the purpose of achieving the organization’s objectives. Overall, human resources management may be said to have the following four objectives (Werther & Davis, 1993):

1) The social objective, including compliance with laws and regulations, and benefit for the public

2) The organizational objective, including staff planning, relations among staff, the selection process, training, and development and placement

3) The function objective includes the assessment of competencies, deployment in accordance with functions, and performance evaluation.

4) The personal objective, including training and development, expectations, placement, compensation, and assessment.

Quality of Local Government Financial Statements

Financial statements contain information that describes an entity’s economic situation, economic resources, third-party claims, the effect of commercial transactions and other events and conditions that can affect the economic resources of the entity. Financial statements also include information on management expectations and strategies and other types of information related to the entity’s plans (Financial Accounting Standards Board [FASB] Chapter 3 on Qualitative Characteristics of Useful Financial Reporting as cited in Higgins, 1998). Local government financial statements are prepared by those staff who are directly involved in the application of the local government’s accounting information system. These staff is responsible for collecting, testing, storing, sorting, and processing of data on financial transactions related to the operations of the organization so that that such data may be employed as useful accounting information for decision-making purposes (Werther & Davis, 1993; Considine et al., 2012; Hurt, 2013).

Local government financial management, in the narrow sense, is limited to matters relating to the local government revenue and expenditure budget, abbreviated as APBD in Bahasa Indonesia (Government Regulation No. 105 of 2000 on Local Government Financial Management and Accountability). Local government financial management can also be interpreted as referring to all the rights and obligations of a local government that are capable of being valued in monetary terms (Mamesah as cited in Halim, 2004 Government Regulation No. 58 of 2005; Law Number 23 of 2014). Local government financial management covers finances that are directly managed by the local government (APBD and local government-owned assets) and local government investments, such as investments in local government-owned companies, foundations, and public service bodies that are managed by the local government. Local government financial management is defined by Government Regulation No. 58 of 2005 as all activities related to planning, implementation, administration, reporting, accountability, and supervision in respect of local government financial management.

The consequence of having the authority of using and managing local government revenue and expenditure budget (APBD) is that local government has the responsibility of reporting all local government financial management in the form of local government financial statements. Local government financial statement consists at least of the balance sheet, statement of budget realization, change-in budget surplus statement, statement of operational, cash flow statement, change-in capital statement, and note to financial statement. These local government financial statements have to be submitted by the Local Government to Local Parliament (DPRD) at the latest six months into the next budget period after being audited by the State Audit Institution (Government Regulation No. 12 of 2017 on local government financial management and accountability; Law No. 1 of 2004 on state finance). The adoption of an accounting and reporting model in Portugal allowed local government the consistent integration of budgetary, financial, and cost accounting in modern public sector accounting. This adoption was believed to be able to support local government management in pursuing good accountability and legal conformity control, as well as providing timely, useful, reliable information to meet the needs of different users for decision-making and internal control (Noguiera & Jorge, 2013).

The quality of financial statement presentation is determined by a combination of processes in the system as designed, the infrastructure provided by the entity, and the resources which run it.

The accounting information system is the key to producing good-quality accounting information that can be presented by the entity, organization, or company. The quality of the information presented in financial statements is determined by the extent to which it provides benefit or value to the organization, particularly in the decision-making context. The benefits of high-quality accounting information include reduced uncertainty, better decisions, and enhanced capacity of the organization or company to plan and schedule its activities or operations in the future (Romney & Steinbart, 2012; Hurt, 2013). In order to test the quality of the information presented in the financial statements, five (5) criteria should be employed to prove that the information presented meets expectations. These five criteria are as follows (Hurt, 2013)

1. Authority (or who produced the information)

2. Accuracy (or the level of error that may affect the information presented)

3. Objectivity

4. Currency (time of presentation and production of the information)

5. Information coverage (extent of the benefit derived from the information presented).

Hypotheses Development

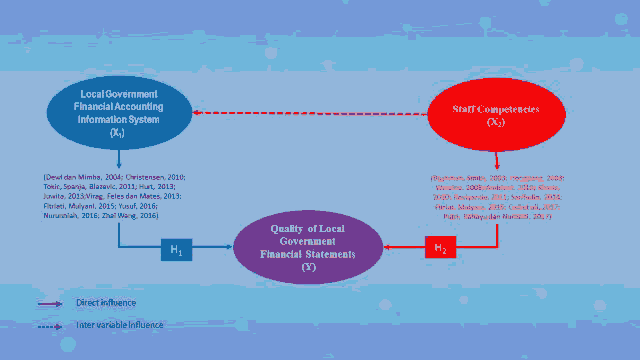

There are strong relationships for developing research hypotheses based on theory and empirical studies of the research variables, as illustrated in the framework shown in Figure 1. Several studies have proven these influences. According to Virag, et al., (2013), if the user of an accounting information system lacks knowledge of accounting, it will be challenging for them to process accounting information into high-quality financial statements. Meanwhile, according to Christensen (2010), an accounting information system can be used as a decision-maker for the purpose of producing high-quality financial statements. A well-designed accounting information system will provide a conceptual framework for deriving and processing data related to the components of the financial statements and convert them into valuable (relevant and reliable) information. The accounting information system itself should be selected based on a cost-effectiveness approach. Taking into consideration cost-benefit constraints, system implementation will involve a comparison between the benefits derived from the processing of the data and the costs incurred (Hurt, 2013). Based on the theories and concepts described above (Christensen, 2010; Tokic et al., 2011; Hurt, 2013; Virag et al., 2013; Fitriati & Mulyani, 2015; Nurunniah, 2016; Zhai & Wang, 2016), together with research that supports these theories, our research hypotheses are as follows:

H-1: Local government financial accounting information systems have a positive influence on the quality of local government financial statements.

The successful application of an accounting information system will improve the quality of accounting information that is produced by helping ensure greater data relevance, and better accuracy of the data itself and its sources, timeliness, and completeness (Fitriati & Mulyani, 2015). The findings of a study on financial management information systems and the quality of local government financial statements revealed that such systems have a positive influence on the accountability of local government financial statements (Juwita, 2013; Dewi & Mimba, 2014; Yusuf, 2016; Nurunniah, 2016)

Call, et al., (2017) found that the utilization of high-quality and competent staff will result in better quality financial statements, fewer internal control violations, and fewer restatements in financial reporting. Furthermore, the facts show that better quality staff will provide advantages to the organization in terms of better management forecasts, improvements in timeliness, frequency, accuracy and precision, and a reduction in bias. Staff competencies influence the quality of financial reports (Kharis, 2010). Kharis (2010) explains that staff competencies refer to the abilities of accounting staff to carry out the tasks and responsibilities assigned to them, armed with adequate knowledge, experience, and skills. Competent staff are able to properly understand accounting logic. The inability of staff in local government to understand and apply accounting logic will have a negative impact in the form of misrepresentations and non-compliance with government standards (Warisno, 2008). +Based on the theories and concepts described above (Bushman & Smith, 2003; Hongjiang et al., 2003; Warisno, 2008; Andriani, 2010; Kharis, 2010; Roviyantie, 2011; Sarifudin, 2014; Fitriati & Mulyani, 2015; Call et al., 2017; Putri et al., 2017), and supporting research findings, our research hypothesis is as follows:

H-2: Staff competencies have a positive influence on the quality of local government financial statements.

Hongjiang, et al., (2003) examined the critical factors that determine the quality of accounting information. The findings of their research show that human resources, systems, organization, and external factors are all critical in determining the quality of accounting information. Conversely, the findings of a study on the influence of staff competencies on the quality of local government financial statements in the Kebumen County Government revealed that the staff competency variable does not affect the quality of local government financial statements (Sarifudin, 2014). However, other studies have found, both partially and simultaneously, that the quality of human resources simultaneously influences the quality of financial reporting (Andriani, 2010; Putri et al., 2017).

Considering this research model, there exists a causality and dependency relationship between exogenous variables of X1 and X2. Nevertheless, this causality relationship between these two exogenous variables is not the object of our research. Awad (1988) stated that the exogenous variable of local government financial accounting information systems (X1) is having two significant parts in designing the application system. Those are logical design and physical design. Logical design describes rational logical flow from the designed process to achieve the system design objectives. The local government financial accounting information system represents the designed process and is symbolized as X1, when the physical design will develop the operational designed process and operate the process to support the designed process. The most significant aspect of the physical design is the human resources aspect from the staff competencies (variable X2). Romney & Steinbart (2012) explained that the most important aspect of the system application is the staff competencies of the human resources. Human resources is the people who operate and run the system to produce the output and achieve the expected results. It describes that the variable X2 has an influence on the effectivity of the system application or variable X1 and together with X1 have an influential effect on the process of making good-quality local government financial statements (variable Y).

Research Methodology

The study population comprised 542 provincial, county, and municipal governments throughout Indonesia, consisting of 34 provincial governments, 415 county governments, and 93 municipal governments (IHPS BPK RI Semester I 2018), while the study sample comprised 118 local governments on Java Island, excluding Jakarta Capital Province (DKI Jakarta).

During the field research, data was collected using the following methods:

1) Questionnaire.

2) Observation.

3) Interview.

Analysis units can consist of individuals, groups, organizations, and countries. The analysis units in this study were local governments (provincial/county/municipal) in Java, except for Jakarta Capital Province (DKI Jakarta), while the observation units comprised local government financial and asset management agencies, local government inspectorates and local government planning, research and development agencies. The number of research samples that satisfied the requirements for data testing and processing (descriptively and inferentially) amounted to 102 local governments. Data was processed using the Covariance Based Structural Equation Modeling (CB-SEM) approach, with Linear Least Square as the alternative method.

Research Findings

Respondents’ Profiles

Of the 118 local governments that were sampled and 590 respondents that were contacted by the researchers, 104 local governments returned the questionnaires (a rate of return of 88.13% out of a total of 118 research samples), while responses were received from 514 respondents (87.12% of 590 respondents). The number of research samples that met the requirements for data testing and processing (descriptively and inferentially) amounted to 102 local governments (86.44% of the total of 118 respondents) and 510 respondents. Two local governments with four respondents returned incomplete questionnaires so that no further analysis could be conducted.

Respondents who participated in this study (see table 1) were system operators (n=102), staff (n=102), and managers in charge of preparing local government financial reports (n=102). In terms of gender, the majority of respondents from those three levels were men (n=177; 57.84%), with 117 women respondents (36.92%), and 16 respondents (5.22%) abstaining. Based on age, most were aged over 40 years (n=151; 49.34%), 117 respondents aged 31–40 (38.23%), and only 15 respondents (4.90%) abstained. In terms of educational background, most respondents held a bachelor’s degree (n=139; 45.42%), the second most held a master’s degree (n=121; 39.54%), and the third most had only an academic degree (n=27; 8.82%). There were 2 respondents with PhD degrees (n=2; 0.65%), and 1 respondent (0.32%) had only a high school degree. Almost half of respondents had worked for 21–30 years (n=135; 44.11%), 74 respondents had worked more than 20 years (24,18%), and 61 respondents had between 5 to 10 years’ experience (19.93%), while there were 16 respondents (4.9%) who did not answer the question.

Analysis of Descriptive Statistic

The descriptive analysis for variables in this study used the average score categorized into eight interval scales. The research variables showed good average scores (see Table 1). For local government financial accounting information systems (X1), the average score is very good (6.47 of a scale of 8), with a standard deviation of 1.70 and there was still a gap of 19.07%. Staff competencies (variable X2) showed a good average score (6.21 from a scale of 8) with a standard deviation of 2.32 and a gap of 22.35%, while quality of local government financial statements (variable Y) also showed a very good average score (6.65 from a scale of 8) with a standard deviation of 2.05 and a gap of 16.88%.

| Table 1 Descriptive Statistic And Variable Scoring |

|||||||

|---|---|---|---|---|---|---|---|

| No. | Variables | Real Score | Max Score | Mean Score | Standard Deviation | % Gap | Criteria |

| 1 | Local government financial accounting information systems (X1) | 14529 | 17952 | 6.47 | 1.7 | 19,07 | Very Good |

| 2 | Staff competencies (X2) | 13940 | 17952 | 6.21 | 2.32 | 22,35 | Good |

| 3 | Local government financial statements (Y) | 21026 | 25296 | 6.65 | 2.05 | 16,88 | Very Good |

| Criteria: (1) 1.00–1.87, Very Worst, (2) 1.88–2.95, Worst, (3) 2.96–3.83, Bad, (4) 3.84–4.71, Fair, (5) 4.72–5.59, Good Enough, (6) 5.60–6.46, Good, (7) 6.47–7.34, Very Good, (8) 7.35–8.00, Best. Source: Data Processed (2020) |

|||||||

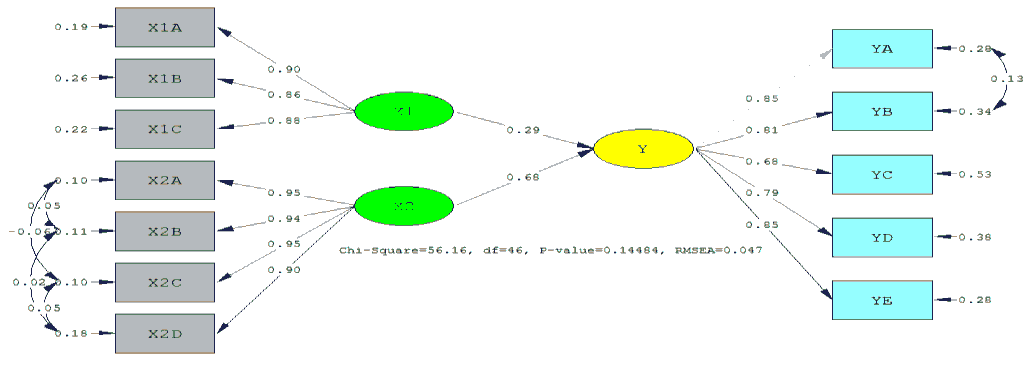

Model Measurement

Model measurement is a technique used to evaluate whether an overall model has a good fit or not (Latan, 2012). Latan (2012) explained that model measurement describes how manifested or observed variables represent latent constructs to measure through validity and reliability testing of latent variables with the Confirmatory Factor Analysis (CFA). There are two kinds of validity testing, external validity testing and internal validity testing. Structural Equation Modelling (SEM) applies internal validity testing to show the ability of the research instrument to measure a concept. The validity test results in this study (see Table 2) show the results of the factor loading values for the indicators. If these values are greater than 0.50, the indicators can be considered good in measuring their latent constructs (Haier et al., 2014; Riadi, 2018). In this case, all three variables indicated that most of indicators were valid and met this criterion of a validity and reliability test.

Reliability testing in the model measurement is to prove accuracy, consistency, and correctness of an instrument to measure the construct. The technique generally used and recommended by experts in using the rule of thumb of testing the reliability of a construct is Composite Reliability (CR), then Cronbach’s alpha (Haier et al., 2014; Latan, 2012). According to Table 2 below, the reliability test result showed the value of Composite Reliability (CR) and Variance Extracted (VE) of all variables respectively are: local government financial accounting information systems (variable X1), 0.98 and 0.69; staff competencies (variable X2), 0.97 and 0.63; and local government financial statements (variable Y): 0.98 and 0.65. CR and VE of all variables have values exceeding the rule of thumb of values 0.70 and 0.50 respectively that show a good reliability (Haier et al., 2014).

Goodness of Fit Model Testing

Once we confirmed the reliability and validity of the construct measures, the next step is to assess the structural model. Haier, et al., (2014) stated that assessment of the structural model results enables the determination of how well empirical data supports the concept and to decide whether the concept has been empirically confirmed. For this purpose, we provide a global Goodness of Fit criteria. Overall model fit is generally used to evaluate Goodness of Fit (GOF) or to evaluate the statistical test of a model. Wiyanto (2008) described that in a model, it is not possible to meet all prescribed criteria, but one of the most important points is that more indicators should meet the criteria than those which do not. Haryono & Wardoyo (2013) stated that apart from the contrary opinion, there is a consensus among the experts that the best lead for evaluating the Goodness of Fit is the strong substantive concept or theory. The Chi-square statistic test (X2) is not the only basic formula for determining the Goodness of Fit of a model. From ten criteria proposed to evaluate the Goodness of Fit of a model, the testing results revealed a good fit, with an RMSEA value of 0.061. Likewise with the GOF indicator, which exhibited marginal fits (close to a good fit) for variables X1 and X2 with a GFI value of 0.81, close to the value specified in the target value, namely, GFI ≥ 0.90. Only the Y variable, which had GOF test results, showed a poor fit with a GFI value of 0.75. Also, seven out of ten indicators for testing the model (majority) exhibited good fits. Based on the testing data, it was concluded that the CFA model variables X1, X2, and Y were fits as RMSEA produced good fit and seven out of ten indicators for testing the model (majority) revealed good fits. The results of structural model suitability testing for the research are as shown in Table 2 below:

| Table 2 Evaluation Of Structural Model Fit Indexes (Respecification) |

||||

|---|---|---|---|---|

| No. | Goodness of Fit | Target Value | Result | Evaluation Model |

| 1 | Chi-square | p-value = 0.05 | 0.1448 (0.00) | Good fit |

| (P-value) | ||||

| 2 | RMSEA | RMSEA = 0.08 | 0.047 | Close fit |

| 3 | NFI | NFI = 0.90 | 0.98 | Good fit |

| 4 | NNFI | NNFI = 0.90 | 0.99 | Good fit |

| 5 | CFI | CFI = 0.90 | 1 | Good fit |

| 6 | IFI | IFI = 0.90 | 1 | Good fit |

| 7 | RFI | RFI = 0.90 | 0.97 | Good fit |

| 8 | SRMR | SRMR = 0.08 | 0.038 | Good fit |

| 9 | GFI | GFI = 0.90 | 0.92 | Good fit |

| 10 | AGFI | AGFI = 0.90 | 0.86 | Marginal fit |

| Source: Research Results (2020) | ||||

Based on the table above, it may be concluded that model testing produced strong confirmation of the indicators and causality relationships between factors. Overall the research model was acceptable.

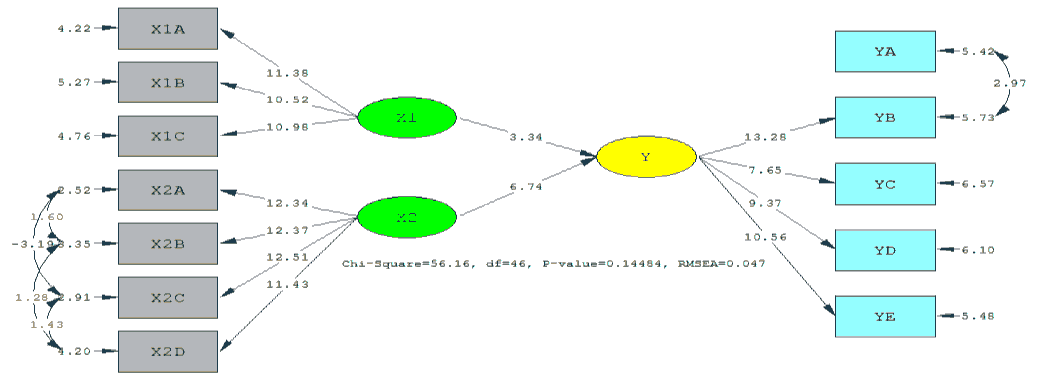

The Result of Hypothesis Testing

After the overall fit of the structural model had been evaluated and it was found to be a fit, the next process was to test the hypothesis and the relationships between research variables. The results of research hypothesis testing are presented in Table 3 below.

Based on the table above, the results of hypothesis testing may be summarized as follows:

| Table 3 Research Hypothesis Testing Results |

|||||

|---|---|---|---|---|---|

| Hypothesis | Correlation | Standardized (Path Coefficient) | T-value | Critical Value | Conclusion |

| H1 | X1 --> Y | 0.29 | 3.34 | 1.66 | Ho Rejected |

| H2 | X2 --> Y | 0.68 | 6.74 | Ho Rejected | |

| Source: Research Results of 2020 | |||||

a. As regards the results of testing of the hypothesis and causal relationships between variables X1 to Y, the above table shows that the t-value was 3.34. Because the value of the t-count (3.34) is higher than t-critical (1.66), then, at a margin of error of 5%, it was decided to accept H1 and reject H0 so that the first hypothesis was accepted. Based on the results of the tests, it concluded that the local government financial accounting information systems has a significantly positive influence on the quality of local government financial statements.

b. As regards the results of testing of the hypothesis and causal relationships between variables X2 to Y, the above table shows that the t-value was 6.74. Because the value of the t-count (6.74) is higher than t-critical (1.66), then, at a margin of error of 5%, it was decided to accept H1 and reject H0 so that the first hypothesis was accepted. Based on the results of these tests, it concluded that staff competencies have a significantly positive influence on the quality of local government financial statements.

After the model was declared good, the researchers then conducted tests to determine the values of the causal relationships between the variables, with the results of this testing on the research being as shown in the following Figure 2:

The above diagram shows that all of the variables in the indicators positively support the indicators and all dimensions so that each indicator has a positive relationship variable for variables X1, X2, and Y. The results of testing the relationships among the variables are as shown in the following Figure 3:

According to the model shown in Figure 3 above, the construct coefficient values, loading factors, and t-values all satisfy the requirements. In addition, all indicators that require a model fit showed good fits. The t-table value used in the study was 1.66 at a level of confidence (significance) of 95%. In addition to looking at the model’s t-value, the researchers also conducted a standard estimate of the resulting model to identify the magnitude of influence between latent variables.

Discussion

The Influence of Local Government Financial Accounting Information Systems on the Quality of Local Government Financial Statements

The design and implementation of a local government financial reporting system should be logical and reflect the local government’s needs as regards its financial statements. If the design and implementation of the system cannot describe the procedures and steps involved in compiling local government financial statements, then the application of the system will be unable to produce the quality of financial reporting products that are expected and required. In this regard, the relationship between system implementation and the quality of local government financial statements is strong and interrelated. This finding supports research conducted by Hurt (2013); Zhai & Wang (2016) which found that accounting information presented in the form of financial statements is the product of an accounting information system that is designed and implemented by an entity, organization, or a company. The findings of this study also support the findings of previous studies (Mulyani et al., 2019), which show that an effective accounting information system, plus better internal government supervision and organizational culture, will improve the quality of financial statement presentation by reducing the level of irregularities and fraud.

From the responses provided by respondents, most of whom are educated to a relatively high level and have adequate work experience, it was found that that an application for the preparation of financial statements must be designed by a reliable supplier and be supported by experts and competent staff. The reason for this is understandable, given that a system application design must satisfy the expectations and needs of the organization, be able to keep pace with developments in information technology, be capable of being adjusted to take account of new information needs, and be able to cope with all problems and obstacles that may arise at theoperational level. The results of the path coefficient estimation and statistical tests show that the path coefficient between the implementation of a local government financial accounting information system and the quality of local government financial statements is 29% with a positive direction. This shows that improved implementation of local government financial accounting information systems will improve the quality of local government financial statements by 29%. The research findings support previous research (Christensen, 2010; Tokic et al., 2011; Hurt, 2013; Virag at al., 2013; Fitriati & Mulyani, 2015; Nurunniah, 2016; Zhai & Wang, 2016), which found that the better the implementation of local government financial accounting information systems, the better the quality of local government financial statements.

The Influence of Staff Competencies to the Quality of Local Government Financial Statements

Testing results for Hypothesis 2 revealed that staff competencies significantly influence the quality of local government financial statements. Competent staff will encourage a healthy organizational culture and better performance, enhanced productivity, and greater efficiency in the achievement of the organization’s goals. If those responsible for compiling local government financial statements are competent, this will help to create a more comfortable work environment, characterized by strategic thinking and planning, so that the financial statements that are produced can be relied upon. If those responsible for compiling local government financial statements lack the necessary competencies or lack an understanding of the business processes and procedures for preparing financial statements, then the financial statements that are produced will likely be unreliable. Given this, the relationship between staff competencies and the quality of local government financial statements is stable and interrelated. Consequently, the findings of this study support those of previous research (Bushman & Smith, 2003; Hongjiang et al., 2003; Warisno, 2008; Andriani, 2010; Kharis, 2010; Sarifudin, 2014; Fitriati & Mulyani, 2015; Call et al., 2017; Putri et al., 2017), which postulate that the better staff competencies are, the better the quality of local government financial statements will be. The findings of this study also show that staff competencies have an influence on endeavors to improve the quality of local government financial statements.

The responses of respondents, most of whom were college graduates, showed that what is most urgently needed is the establishment of a performance appraisal mechanism. The results of the path coefficient estimation and statistical test results revealed that the path coefficient between staff competencies and the quality of local government financial statements was 68% with a positive direction. This means that improved staff competencies will enhance the quality of local government financial statements by 68%. However, in the absence of a performance appraisal mechanism, it will be impossible to ascertain the extent to which individual officials have successfully performed their work and contributed to the achievement of the organization’s vision and mission. Supported by a performance appraisal mechanism, improved staff competencies will contribute to a healthier work culture. This finding supports those of previous research (Warisno, 2008; Fitriati & Mulyani, 2015; Call et al., 2017), which postulate that the deployment of high-quality staff leads to fewer internal control violations and fewer restatements in financial reporting as they understand accounting logic and are able to adjust as required to changes in accounting systems and technology.

Conclusion

The design and implementation of a good local government financial accounting information system will have a positive influence on the quality of local government financial statements, meaning that the better the implementation of the local government financial accounting information system, the better the quality of local government financial statements will be. Conversely, a local government that does not properly implement and operate an accounting information system will be likely to produce less reliable financial statements. The study findings reveal that the implementation of a local government financial accounting information system has an influence on improving the quality of local government financial statements. From the responses provided by respondents, most of whom are educated to a relatively high level and have adequate work experience, it was found that that an application for the preparation of financial statements must be designed by a reliable supplier and be supported by experts and competent staff. A system application design must satisfy the expectations and needs of the organization, be able to keep pace with developments in information technology, be capable of being adjusted to take account of new information needs, and be able to cope with all problems and obstacles that may arise at the operational level.

Staff competencies significantly influence the quality of local government financial statements. Competent staff will encourage a healthy organizational culture and better performance, enhanced productivity, and greater efficiency in the achievement of the organization’s goals. If those responsible for compiling local government financial statements are competent, this will help to create a more comfortable work environment, characterized by strategic thinking and planning, so that the local government financial statements can be relied upon. This reveals that the better staff competencies are, the higher the quality of local government financial statements will be. The findings of the study indicate that staff competencies have a substantial influence on improving the quality of local government financial statements. The responses of respondents, most of whom were college graduates, showed that what is most urgently needed is the establishment of a performance appraisal mechanism. In the absence of a performance appraisal mechanism, it will be impossible to ascertain the extent to which individual officials have successfully performed their work and contributed to the achievement of the organization’s vision and mission. Supported by a performance appraisal mechanism, improved staff competencies will contribute to a healthier work culture.

References

- Akbar, B. (2017). Local government financial management reform still faces problems. Centre for Study and Information for Local Government Financial Management (Pekik Daerah). http://pekikdaerah.wordpress.com/artikel

- Andriani. (2010). The influence of human resources capacity and the use of information technology towards the reliablity and timelines of local government financial reports (Study on the county government of South Pesisir). Journal of Accounting and Management, 5(1), 69–80.

- Badan Pemeriksa Keuangan RI. (2018). Audit Report Resume Semester (IHPS) I of 2018. BPK RI Jakarta.

- Budiriyanto, E. (2013). Legal study on the information system of local government financial management (SIPKD), Ministry of Finance of the Republic of Indonesia, Preface Word from Director General of Fiscal Balance, Marwanto Harjowiryono.

- Bushman, R.M., & Smith, A.J. (2003). Transparency, financial accounting information, and corporate governance, Federal Reserve Bank of New York (FRBNY) Economic Policy Review. FRBNY Economic Policy Review.

- Call, A.C., Campbell, J.L., Dhaliwal, D.S., & Moon, J.J.R. (2017). Employee quality and financial reporting outcomes. Journal of Accounting and Economics, 64, 123–149.

- Christensen, J. (2010). Conceptual frameworks of accounting from an information perspective. Accounting and Business Research, 40(3), 287–299.

- Considine, B., Parkes, A., Olesen, K., Speer, D., & Blount, Y. (2012). Accounting information systems: Understanding business process (4th edition). Wiley.

- Dewi, P.A.R., & Mimba, N.P.S.H. (2014). The influence of application effectivity of local government financial management information system towards the quality of financial statements. E-Journal of Accounting in University of Udayana, 8(3), 442–457.

- Financial Accounting Standard Boards. (1980). Statement of Financial Accounting Concept No. 2: Qualitative Characteristics of Accounting information. FASB, Connecticut.

- Fitriati, A., & Mulyani, Sri. (2015) Factors that affects accounting information system success and its implication on accounting information quality. Asian Journal of Information Technology, 14(5), 154–161. Hall, J.A., & Bennett, P.E. (2016), Accounting Information System (9th edition). Cengage Learning.

- Haryono, S., & Wardoyo, P. (2013). Structural equation modelling: Using Amos 18.00 for management research. Bekasi, PT Intermedia Personalia Utama Publishing Company.

- Higgins, R.C. (1998). Analysis for financial management (5th edition). McGraw-Hill Book Co.

- Xu, H., Horn Nord, J., Daryl Nord, G., & Lin, B. (2003). Key issues of accounting information quality management: Australian case studies. Industrial Management & Data Systems, 103(7), 461–470. https://doi.org/10.1108/02635570310489160

- Hurt, R.L. (2013). Accounting Information Systems: Basic concepts and current issues (3rd edition). McGraw Hill.

- Juwita, R. (2013). The influence of implementation the government accounting standard and accounting information system towards the quality of financial reports, 12(2),

- Kharis, A. (2010). The influence of Human Resources Competences towards the application of Internal Control System in PT Avia Avian. Script of UPN Veteran, East Java.

- Tokic, M., Spanja, M., Tokic, I., & Blazevic, I. (2011). Functional structure of entrepreneurial accounting information systems. Annals of the Faculty of Engineering Hunedoara, 9(2), 165–168.

- Mulyani, S. (2014). Accounting information system. Terbuka University, Ministry of Education and Cultural.

- Mulyani, S., Kasim, E., Yadiaty, W., & Umar, H. (2019). Influence of accounting information systems and internal audit on fraudulent financial reporting. Scientific publications of the experimental faculty of sciences, Universidad del Zulia. Maracaibo Venezuela. Opción, 35(21), 323–338.

- Muzahid, M. (2014). The influence of education level, training quality and working experience duration towards the quality of local government working unit financial reports. Journal of Accounting, 2(2), 179–196.

- Nugroho, P.S.P. (2014). The settlement of human resource personnel as a basis for bureaucracy reform. Article of Human Resources Management Bureau (BPSDM) in Law and Human Rights, Public Relation Division of the Ministry of Law and Human Rights.

- Nurafiah, N., & Azwari, P.C. (2015). The effect of implementation of Government Internal Control System (GICS) on the quality of financial reporting of the local government and its impact on the principles of good governance: A research in district, city and provincial government in South Sumatera. Procedia - Social and Behavioral Sciences, 211, 811–818.

- Nurafiah, N. (2018). IAI (Indonesian Accounting Association) encourage the mitigation from corruption based on the financial reports quality improvement. Contributor in Malang, Andi Hartik. Kompas. https://ekonomi.kompas.com/read/2018/05/03/211942826/iai-dorong-mitigasi-korupsi-dari-peningkatan-kualitas-pelaporan-keuangan

- Nurunniah, S. (2016). The influence of local government financial management information system toward the accountability of local government financial statements (Study on the local government working units in municipal government of Bandung City). University of Widyatama.

- Pradono, F.C., & Basukianto. (2015). The quality of local government financial statements: Influencing factors and policy implification (Study on the local government working units in provincial government of central Java), University of StikuBank Semarang. Journal of Business and Economy.

- Pe?a-Miguel, N., & I?aki de la Pe?a, J. (2017). New accounting information system: An application for a basic social benefit in Spain. Revista de contabilidad-Spanish Accounting Review, 21(1), 28–37.

- Putri, I.D., Rahayu S., & Nurbaiti, A. (2017). The influence of human resources competences, the understanding of accrual basis of government accounting regulation, the internal control system and local financial management system towards the quality of financial reports. e-Proceeding of Management, 4(2).

- Raudeliuniene, J., & Kavaliauskiene, L.M. (2014). Analysis of factors motivating human resources in public sector. Social and Behavioral Sciences, 110, 719–726.

- Robbin, S.P., & Coulter, M., (2016). Management (13th edition). Pearson.

- Romney, M.B., & Steinbart, P.J. (2012). Accounting Information Systems: Global edition (13th edition). Pearson.

- Roviyantie, D. (2011). The influence of human resources competences and the application of local government accounting system rowards the quality of local government financial reports. University Journal of Siliwangi.

- Sappewali, A.M.S. (2017). Preventing from corruption, the county government uses SIMDA on planning process. Makasar update. https://plus.google.com/share?url=https://makassar.terkini.id/cegah-korupsi-pemkab-manfaatkan-simda-perencanaan/

- Setyabudi, T. (2017, November 16). Government employees have to meet the government competences. Ministry of Internal Affairs News.

- Simkin, M.G., Rose, J.M., & Norman, C.S. (2015). Core concepts of Accounting Information Systems (13th edition). Wiley.

- Soeprapto, R., Ribawanto, H., & Hanafi, I. (2008). Human resources employees development in the reform era. Pustaka Online. https://pustakaonline.wordpress.com/2008/03/22/pengembangan-sumber-daya-aparatur-daerah-di-era-reformasi/

- Syarifudin, A. (2014). The influence of human resources competences and the role of internal audit towards the quality of local government financial reports with the intervening variable of local government internal control sytem (empirical study on the county government of Kebumen). Journal of Business Focus, 14(2).

- Toki , M., pan a, M., Toki , I., & Bla Evi , I. (2011). Functional structure of entrepreneurial accounting information systems. Annals of Faculty Engineering Hunedoara – International Journal Of Engineering, 9(2).

- Virag, N.P., Feies, G.C., & Mates, D. (2013). Accounting information - basic support for decision making. Economics Series, 23.

- Warisno. (2008). Influencing factors on the local government working units in the provincial government of Jambi. [Unpublished doctoral dissertation]. University of North Sumatera.

- Werther, W.B.Jr., & Davis, K. (1993). Human resources and staff management (4th edition). McGraw Hill.

- Wiyanto, S.H. (2008). Structural Equation Modelling for Lisrel: Concept and tutorial. Graha Ilmu, 3(1), 40–45.

- Yusup, M. (2016). The influence of local government financial management information system toward the quality of local government financial reports. Journal of Economy, Business & Enterpreneurship, 10(2).

- Zhai, J., & Wang, Y. (2016). Accounting information quality, governance efficiency and capital investment choices. China Journal of Accounting Research, 9, 251–266.