Research Article: 2021 Vol: 20 Issue: 4

Influence of the Internal Audit Function and Audit Committee on External Audit Fees: Evidence from Jordan

Mohamed Mahmoud Bshayreh, Al-Balqa Applied University

Aiman Mahmoud Abu Hamour, Al-Balqa Applied University

Ziad Jamal Eid Haddad, Al-Balqa Applied University

Abstract

The current study aims to investigate the influence of the internal audit function (IAF) and the audit committee (AC) on the external audit fees, which is extending to a prior study. Despite of the extensive studies on the factors that affect external audit fees, a little empirical studies existing regarding the impact of IAF and (AC) on level of the external audit fees. Through analysing the Secondary Data of the listed non-financial firms in the Amman Stock Exchange using Eviews software, this paper revealed evidence that the internal audit function and audit committee are considered as an important determinants for the external audit fees. The results revealed that the internal audit function and the audit committee activity (measured by AC's meetings) have a significantly positive influence on level of the external audit fees. Such results are important for the policymakers and the regulatory bodies in the Jordanian context, to support and recognize these mechanisms as important mechanisms within the firms' context. The study also provides suggestions for the future studies.

Keywords

Internal Audit Function, Audit Committee Meetings, Audit Fees, Jordan.

Introduction

The monitoring mechanisms such as internal auditing and audit committees have a significant role in helping the organizations to achieve their goals and protection their assets. Thus, as it is explained by the “International Standards for the Professional Practice of Internal Auditing (ISPPIA)”; the existence of effective internal audit can lead to enhance the efficiency of the firm's risk management as well as the monitoring processes (Gustavson & Sundström, 2018; Steinbart et al., 2018; Narayanaswamy et al., 2019). The effective internal audit have a critical function in helping the managers in combat the fraud practices or irregularities (Drogalas et al., 2017; Alias et al., 2019), and it's have a contribution to the accountability (Bananuka et al., 2018). Consequently, the profession of internal audit become an important and essential mechanism to the effective monitoring over the organizations (Behrend & Eulerich, 2019). Felix et al. (2001) argued that quality and contribution of the IAF and the level of the coordination between the internal and the external auditors are considered as key determinants for the external audit fees. A significant and supplementary association is existing between the IAF and the fees paid to the external auditor, since both of them rely on the other. In this regard, Al-Rassas & Kamardin (2015), revealed the firms that invest in their IAF and the outsourcing for the AIF, such as audit fees for the external auditor are associated with high levels of earnings quality.

In addition, the main argument regarding the impact of the audit committee on the external audit fees is that the audit committee can be expected to affect the external audit fees (a two-way pressure) in two aspects. First aspect, audit committee can lead to enhance the level of audit quality through increase audit hours (ensuring that the audit effort is not reduced), and demand additional audit efforts, which result in increasing the audit fees. Second aspect, audit committee can be as a reasonable indicator for the strong and effective internal control. Ceteris paribus, the organizations with effective internal controls are expected to reduce the external audit fees compared to other organizations (Collier & Gregory, 1996).

The general assumption is that the internal auditors and the audit committee’s members have to possess acceptable level of the professionalism and the effectiveness that can minimize the errors level and misstatements in the firm's financial reports, given that the internal auditors and AC’s members have the ability to reduce the scope of the audit process, assist the external auditor, and they have a direct association with the external auditor. Thus, the reduced scope of the external audit process may have a potential impact on the level of audit fees charged by the audit firm (Wea, 2019).

Motivation

The audit committees and the internal audit function are considered important mechanisms within the corporate governance (CG) system (Yassin & Nelson, 2012; Wea, 2019). The function of the internal audit within the CG system is to evaluate the credibility of the financial reports, controlling the compliance with the applicable general standards, as well as provide the adequate consultations regarding the effectiveness of the firms' operating method. In this regard, the quality and the performance of external audits are affected by the effectiveness of the internal audit function, in terms of the knowledge, expertise, quality of the internal auditors, the coordination level between the internal and the external auditors through the AC, and amount of the audit fees paid to the current external auditor. Thus, it can be argued that the IAF have a significant role within the corporate governance system (Zain et al., 2015), and it may influence the quality and scope of the external audit process. More specifically, IAF can significantly affect the determination of the external audit fees (Saputra & Yusuf, 2019).

When assessing the IAF quality in the business organizations, the professional standards and regulatory bodies encourage and support the external auditors in consider and rely -as possible as- on the audit committees and internal audit function due to their role in facilitating conditions of the external audit process and enhance audit quality. In their study, In addition, to improve performance of the internal auditing, the firms need - not only to consider the formal placement to the role of internal auditing - but also they have to take into account the informal roles of the firm’s monitoring functions, such as effectiveness of the firm's audit committee (Abbott et al., 2012). It can use the internal audit function to support the external audit function in audit the firm's financial reports efficiently without reduce or affecting the external auditor's effectiveness, thus, provide accurate audited financial statements (Green, 2003).

Abbott et al. (2012) argued that the external auditors rely on the monitoring function of the AC and the internal audit to perform several tasks. They revealed that both of audit committee and internal audit have a significant role within the firm context and the scope of the external audit. Despite the extensive research in the previous literature which emphasized the important role that can play by the internal audit and audit committees as a monitoring mechanisms within the organizations' context, little is known regarding the impact of the internal auditors and audit committees on the level of the external audit fees. Consequently, this research introduces new evidences regarding the influences of these mechanisms on increase or decreases the external audit fees. Lack of the previous studies concerning the association of the IAF and AC’s meetings with the external audit fees motivated this study to investigate the influence of the IAF and AC meetings on the external audit fees.

The current study provides a preliminary argument regarding the notion that the IAF and the active AC assist in improving quality and performance of the external audit, demonstrated in the level of the audit fees, based on the assumption that the high level of audit fees reflect increasing in the audit tests and efforts, and thus, high-quality-levels of external audit process (Goodwin-Stewart & Kent, 2006; Qawqzeh et al., 2021).

The structure of this research is as follows. In the next section, the association of the internal audit function and the active AC with the fees level of the external audit are presented, this followed by the study framework of the relationship of the independent, control variables and the dependent variable. The findings of the study analysis are also presented, and finally, discussion of the main findings, the conclusions and suggestions for the future studies has been presented.

Literature Review

Internal Audit Function and Audit Fees

Audit function is considered as the cornerstone of the CG (Cadbury, 1992) and corporate governance systems and legislative rules recognize the function of the internal audit as essential internal control tool (Zain et al., 2015). The presence of the internal audit function in the organization can actually help the external auditor to carrying out audit tasks (Wea, 2019). Moreover, the IAF is a significant function within the company to reduce the occurrence of the fraudulent and misleading financial statements or misstatements, to provide reasonable assurances and an independent consultation regarding the decision-making (Dzikrullah et al., 2020).

A few prior studies have been investigating the influence of the IAF on the level of audit fees, and their results were mixed. For instance, Elliott & Korpi (1978) and Felix et al. (2001) revealed that IAF has a negative impact on the audit fees. Several previous studies indicate that the IAF can be considered a significant tool for the external auditor. On the other hand, reduction in level of the audit fees can be as a result of the lower assessment for the audit risks by the internal auditors as internal control tool. In contrast, Stein et al. (1994) and Carey et al. (2000) showed that the IAF has insignificant influence on the audit fees. In their study, Zain et al. (2015) revealed that the high quality of the internal audit function induces the external auditor to rely on the internal audit function and thus lead to reduce external audit fees. Ho & Hutchinson (2010) revealed that the firm's external auditors depend on the IAF, which subsequently lead to reduce the charged audit fees. The low levels of the audit fees that paid to the external auditors reflect the effective role of the internal audit certain important activities, investigations as well as the efforts that achieved by the internal auditors, which have been led to reduce the monitoring costs such as audit fees. In contrary, firms with strong and effective governance, such as adequate internal audit function, require high level of the audit quality, and they are willing to pay additional audit fees to obtain good corporate value (DeFond & Zhang, 2014; AlQadasi & Abidin, 2018).

In this regard, Hay & Knechel (2004) showed that the IAF has positive and significant influence on the audit fees. Goodwin-Stewart & Kent (2006) studied whether the audit committee (AC) meetings and IAF are associated with increase audit fees. They found that the additional meetings of AC and increased reliance on the IAF are related positively with more audit fees paid to the external auditor. Such results are consistent with further demand on the audit efforts by the effective ACs, and by the firms that invest in the internal audit function. Yassin & Nelson (2012) found that IAF has a significantly positive association with the external auditor’s fees. In addition, Wea (2019) revealed that the IAF has a positive and significant effect on audit fees, and the function of the internal audit considered one of the elements of the control process for the external auditor. Dzikrullah et al. (2020) revealed that the firms with a sufficient IAF tend to pay higher level of the external audit fees, choosing one of the big-audit firms to achieve high level of the audit quality, and minimizing the probability of receiving the reports with going-concern opinions in the audit report. Furthermore, Singh & Newby (2010) support the argument that the effective internal audit function (IAF) significantly affects the external audit fees in a positive way, and the firms use the IAF with external audit fees in a complementary manner to enhance their monitoring environment.

On the other hand, Sarkar et al. (2009) revealed that internal audit is considered as an important determinant of the audit fees paid to the external auditor and the overall audit quality, and the effective IAF in the firms lead to reduce the audit fee paid to the current external auditor. Moreover, Prawitt et al. (2011)revealed that the function of the internal audit can contribute to reduce external audit fees in several ways such as the direct assistance between the external and internal auditors, but not through relying on the internal auditor' work that performed previously. Mohamed et al. (2012) showed that internal audit competency (tenure, training, certifications, qualifications and auditors' expertise) are affect significantly in reducing external audit fees. This study predict that there is significantly and positively association between the internal audit function and the audit quality level, demonstrated through the high level of the audit fees. Consequently, this prediction leads to the next hypothesis:

H1 IAF is significantly and positively affects the external audit fees.

Audit Committee and Audit Fees

The association of the audit committees with the external auditing considered a complex relations, it's arise from the demand on the audit services from the firms (client), or arise from supply and provide the services of the external audit by the audit firm (Collier & Gregory, 1996). The members of the audit committee also may possess incentives to demand high-quality-level of external audit to minimize the litigation risks that may face, or to avoiding the reputation loss in case of the fraudulent financial statements (Goodwin-Stewart & Kent, 2006).

Generally, audit committees should meet regularly with the incumbent auditor in order to assess the firm's financial statements, auditing processes, firm's financial situation, as well as internal control mechanisms such as internal audit. The free information flow between the firm's parties (internal and external) can reduce the agency costs through monitoring and controlling auditing process, thus, minimizes asymmetries of the information. In this context, the AC's function is to provide an environment where the incumbent auditor be able to certify the statements that provided by the managers of the firm. Furthermore, audit committees are responsible in ensuring that the external auditors are performing the auditing process unbiased and independently without any intervention (Rani, 2018).

The relation of the audit committee with external audit fees can be explained in two aspects. First, audit committee can be considered an effective mechanism in ensuring the external audit quality through protect the external auditors from the fees cuts that may affect the level of audit quality. Second, audit committee can be considered as a signal for an effective and stringent internal control mechanism which may help to reduce the audit effort and audit time, and thus audit fees (Collier & Gregory, 1996).

Collier & Gregory (1996) supports the argument that the effective audit committee is a significant mechanism in protect the external current auditor and prevent the reductions in the external audit fees to the levels that the audit quality may be compromised. Stewart & Munro (2007) revealed that the AC's meetings are related with increase the external audit fees level, and the reasonable reasons for increase of the audit fees are related to the additional AC's meetings. They also revealed that the AC's meetings are significantly related with reducing the audit risk. Such results support the argument that the presence of the ACs contributes in preventing the reductions in the external audit fee, with maintaining on the level of audit quality.

The general assumption is that the audit committees considered as a monitoring mechanism on behalf of the stakeholders and shareholders, and it have some of the responsibility in ensuring the trustworthiness and credibility in the financial statements through providing an environment liberated of the management intervening or any other parties, where the external auditor be able to actually certify on the firm's financial statements (Rani, 2018). In this regard, Lee & Mande (2005); Yassin & Nelson (2012) and Januarti et al. (2020) found that frequency of the AC’s meetings have a significantly positive association with external auditor’s fees. Jallow et al. (2012) showed that increasing the monitoring role of the audit committees through their activity (meetings) is associated significantly with increase of the audit fees. While on the other hand, Kikhia (2014) showed that the number of AC's meetings have insignificant association with the audit fees.

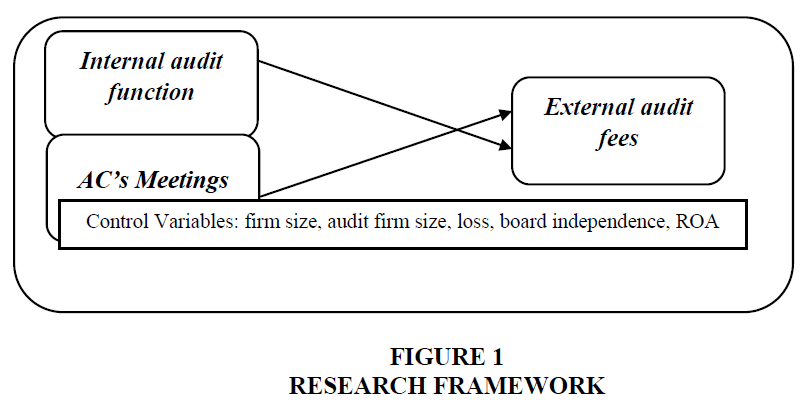

Despite of the conflicting results in the previous literature, this study predict that there is significantly positive influence for the effective audit committee (through frequency its meetings) on the audit quality level, demonstrated through the high level of the audit fees (Figure 1). Consequently, this prediction leads to the following hypothesis:

H2 AC’s Meetings are significantly and positively affect the external audit fees.

Framework

Research Design

Population, data analyse and collection

Population of the current research includes the all non-financial firms that listed in the Amman Stock Exchange (ASE), and covering the period from 2009 to 2019. Financial firms are excluded due to they usually considered differently for the differences in their business procedures or their regulations. Final sample of the current study comprised only the non-financial firms in the service and industry sectors (89 firms/979 observations), which disclosed their data in the annual financial reports. The data regarding the study's variables were collected manually from the annual financial reports. Further, in order to test the developed hypotheses, this study used Eviews software.

Measurement of the Variables

The dependent variable in the current research the external audit quality, which measured by the LN' audit fees. While the independent variables in this research are IAF and AC’s activity. The existence or absence of the internal audit function was determined through reviewing the annual reports of the firms, which are available on the firms' websites or the Amman Stock Exchange. Following the prior studies, such as Ezzamel et al. (2002) and Willekens & Achmadi (2003) the internal audit function is measured through dummy variable, equal 1 if the firm have internal audit function; and 0 otherwise. Utilizing the dummy variable might be rough measure, but the main purpose to use this measure is to distinguish and classifying the firms which invested their resources in the internal audit and the firms which did not (Axén, 2018). While the AC's meetings are considered as a proxy for the AC's diligence in discharge its duties (Lee & Mande, 2005). In addition, this research employs various control variables - in order to avoid the models misspecification- that may have potential influence on the dependent variable. The control variables in the current study include firm size, audit firm size, loss, board independence and Return on asset (Goodwin-Stewart & Kent, 2006; Rani, 2018; Axén, 2018; Qawqzeh et al., 2021), Table 1 reveals the variables names, symbol, definition and measurement of the variables.

| Table 1 Definition of the Variables | |||

| Type | Variable | Symbol | Measurement |

| Dependent Variable | Audit Fees | AFEES | LN Audit fees |

| Independent Variables |

Internal Audit Function | IAF | 1 if the firm had IAF; 0 otherwise |

| AC activity | ACMeet | Number of AC' meetings | |

| Control Variables |

Audit Firm Size | BIG4 | 1 = Big 4; 0 = Non-Big 4 |

| Board Independence | BDIND | Number of the non-executive directors in the board | |

| Return on asset | ROA | Net profit to total assets (indicator of profitability) | |

| LOSS | LOSS | Dummy variable = 1 if a firm reported loss, 0 otherwise |

|

| FIRMSIZE | FSIZ | LN of total assets | |

Thus, the study's model/equation is as follows:

AFEES = β0 + β1IAF + β2ACMeet + β3BIG4 + β4BDIND + β5ROA + β6LOSS + β7FSIZ + ε

Where:

AFEES: LN’ Audit Fees

IAF: Internal Audit Function

ACMeet: Audit Committee’s Meetings

BIG4: Audit Firm Size

BDIND: Board Independence

ROA: Return on Asset

LOSS: Loss

FSIZ: FIRMSIZE

β0: constant

β1 -β4: coefficients

ε: Error term

Descriptive Statistics

Table 2 shows the descriptive statistics regarding the study’s variables. The mean of the dependent variable (AFEES) is 9.3 in terms of the LN’ of external audit fees, this result is similar to the results that disclosed by Qawqzeh et al. (2019 & 2020) in the Jordanian context. Likewise, the mean of the independent variables were 0.46 (for IAF), and 3.57 (for AC meetings) respectively. The result regarding IAF implies that more than 46% of the sampled firms in this study disclosed their use of the internal audit function in their financial reports. While the result regarding AC Meet implies that most of the audit committees in the Jordanian firms (in this sample) meet 3-4 times yearly, which is acceptable according to the Jordanian Corporate Governance Code? The Median, Maximum (Max), and Minimum (Min) of all variables also have been shown.

| Table 2 Descriptive Statistics | ||||||||

| AFEES | IAF | ACMeet | BIG4 | BDIND | ROA | LOSS | FSIZ | |

| Mean | 9.3 | 0.46 | 3.57 | 0.49 | 0.61 | 2.95 | 0.33 | 10.25 |

| Median | 9.2 | 0 | 3 | 0 | 0.64 | 3.34 | 0 | 10.21 |

| Max | 11.6 | 1 | 13 | 1 | 0.86 | 31.35 | 1 | 14.4 |

| Min | 6.6 | 0 | 0 | 0 | 0 | -46.07 | 0 | 5.98 |

| Obs | 979 | 979 | 979 | 979 | 979 | 979 | 979 | 979 |

Correlation Matrix

Table 3 reveals the Correlation Matrix between all of the independent variables and the control variables with dependent variable, as well as the significance of these correlations of each two variables. In this regard, the threshold value of a harmful Multicollinearity assumption is (± 0.80), if the Correlation was at this threshold, the analysis of the regression model may be influenced in an adversely way (Gujarati, 2003). There is high correlation between the firm sizes (FSIZ) with the dependent variable (AFEES), which is (0.699); such result is expected given that the firm size is considered as one of dominant determinants for the external audit feesc (Simunic, 1980). The correlations between of all other variables are low correlation (less than 0.8), and such results do not cause any problem.

| Table 3 Correlation Matrix | ||||||||

| AFEES | IAF | ACMeet | BIG4 | BDIND | ROA | LOSS | FSIZ | |

| AFEES | 1 | |||||||

| IAF | 0.638 | 1 | ||||||

| 0.000 | --- | |||||||

| ACMeet | 0.611 | 0.508 | 1 | |||||

| 0.000 | 0.000 | --- | ||||||

| BIG4 | 0.538 | 0.549 | 0.406 | 1 | ||||

| 0.000 | 0.000 | 0.000 | --- | |||||

| BDIND | 0.223 | 0.067 | 0.189 | 0.146 | 1 | |||

| 0.000 | 0.035 | 0.000 | 0.000 | --- | ||||

| ROA | 0.134 | 0.159 | 0.083 | 0.086 | 0.030 | 1 | ||

| 0.000 | 0.000 | 0.010 | 0.007 | 0.342 | --- | |||

| LOSS | -0.072 | -0.063 | -0.015 | 0.022 | 0.028 | -0.579 | 1 | |

| 0.025 | 0.051 | 0.641 | 0.486 | 0.374 | 0.000 | --- | ||

| FSIZ | 0.699 | 0.439 | 0.442 | 0.345 | 0.182 | 0.199 | -0.172 | 1 |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | --- | |

Relaxing of the General Assumptions

Multicollinearity

The current research utilized Variance Inflation Factors (VIF) test in order to examine the Multicollinearity assumption. The VIF is considered as a popular way to test if the collinearity is existing between the variables (Gujarati & Porter, 2009). As shown in Table 4, the results revealed that VIF values for all the independent variables were less than 2, which is a clear indicator that there is no Multicollinearity issue in this research.

| Table4 Variance Inflation Factors | |

| Variable | Centered VIF |

| IAF | 1.775 |

| ACMeet | 1.524 |

| BIG4 | 1.514 |

| BDIND | 1.068 |

| ROA | 1.551 |

| LOSS | 1.544 |

| FSIZ | 1.431 |

Heteroskedasticity and Serial Correlation

This research investigated if the Serial Correlation and Heteroskedasticity issues exists or not through the Breusch-Pagan-Godfrey test. As showed in the Table 5, the result shows that there are no problems regarding the Serial Correlation or Heteroskedasticity issues in this research, since the P-value of the Breusch-Pagan-Godfrey was insignificant. The P-Values of the BP-Godfrey were 0.253 and 0.172 for the Heteroskedasticity and the Serial Correlation issues respectively.

| Table 5 Prob. Chi-square | |

| Heteroskedasticity | Serial Correlation |

| 0.253 | 0.172 |

Results

Table 6 shows the outcomes of the regression analysis of the study model, its shows the influence of the independent variables (IAF and AC's meetings), and the control variables (firm size, audit firm size, loss, board independence and ROA), on the external audit fees (LN' Audit Fees). As shown in the Table 6, the R-squared of the research model is (0.69), and the P-Value (F-statistic) is (0.000) significant. Thus, according to these findings, all of the explanatory variables under investigation explain 69% of the variance in dependent variable (audit fees), then, it is statistically significant.

| Table 6 Regression Analysis of the Effect of IAF and AC Meetings on Audit Fees | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| IAF | 0.354 | 0.034 | 10.551 | 0.000 |

| ACMeet | 0.085 | 0.009 | 9.943 | 0.000 |

| BIG4 | 0.218 | 0.031 | 7.044 | 0.000 |

| BDIND | 0.235 | 0.068 | 3.455 | 0.001 |

| ROA | -0.002 | 0.002 | -1.086 | 0.278 |

| LOSS | 0.003 | 0.033 | 0.098 | 0.922 |

| FSIZ | 0.212 | 0.011 | 20.193 | 0.000 |

| C | 6.422 | 0.103 | 62.384 | 0.000 |

| R-squared | 0.690 | Mean dependent var | 9.308 | |

| Adjusted R-squared | 0.688 | Durbin-Watson stat | 0.389 | |

| Prob(F-statistic) | 0.000 | DV | AFEES | |

The findings of the research analysis in the Table 6 reveal that IAF affect the level of external audit fees in a significantly and positively way. This result reflect that the organizations with effective internal audit function, require additional audit efforts, and they are willing to pay additional fees to the external auditor, thus, high level of the external audit quality. This result support the argument that the function of the internal audit considered one of the elements of the control process for the external auditor, and the IAF in the Jordanian organizations can actually help the external auditor to carrying out audit tasks, which will reflect - at the end - in the level of external audit quality. Further, the firms use the IAF and the external audit fees in a complementary manner to enhance their overall monitoring environment. The findings related to the positive association between the internal audit function and external audit fees has been supported by several prior studies such as Goodwin-Stewart & Kent (2006); Singh & Newby (2010); Yassin & Nelson (2012); Wea (2019); Dzikrullah et al. (2020).

In addition, the findings in the Table VI reveal that the association between the audit committee’s meetings (AC Meet) and the external audit fees is significantly and positively association. Moreover, result reflects that frequency of the AC’s meetings is related significantly and positively with the level of external audit quality, which is demonstrated in the increasing of the audit fees. This result support the argument that the AC’s meetings is considered as an effective mechanism within the firm context, and it have an important role in protect the external auditor from the fees reduction in the Jordanian organizations which may influence negatively on the level of the audit quality. The increase of the monitoring function of the AC by its activity (meetings) is associated positively with the increasing in the audit fees, which will be reflected in the audit quality. The positive influence of the audit committee activity (meetings) on the external audit fees also was supported by several previous studies, such as Lee & Mande (2005); Goodwin-Stewart & Kent (2006); Stewart & Munro (2007); Jallow et al. (2012); Januarti et al. (2020).

Regarding the findings of the control variables, the findings showed that the audit firm size, board independence, and firm size have a significantly positive association with level of the audit fees. Such results can be considered as an indicators that the large of audit firms (one of the Big4 audit firms), the independent members in the board, and large companies are associated positively with the audit fees. On the other hand, the other control variables, namely, the return on asset and the loss, the results revealed that they have insignificant relationship with the audit fees. In this regard, it's acceptable that the external auditor will charge higher audit fees when he provide high level of the audit quality. Several previous studies also support this argument.

Discussion

Generally, the IAF and the effective audit committees have an important role in ensuring the trustworthiness of the financial information as well as the credibility of financial statements if there is an environment that liberated from the management intervention. In addition, the effective IAF and audit committee have a significant role to assist the external auditor to perform his work in auditing the firm's financial statements, and thus issuing the suitable audit report without any intervention from any part.

This research has contribution to the current literature by expansion the examination the association of the IAF and the AC's activity with the level of the external audit fees in the Middle East context (Jordan). Therefore, this study investigates whether the IAF and AC's meetings affect the level of the audit fees. The main findings of the current study were that the reliance on the IAF and the additional AC's meetings has a significant and positive impact on the audit fees for the external auditor in the Jordanian context. The most important outcomes are that the IAF and AC possess a significant role in protect the external auditors from the cuts of the audit fees which may influence the audit quality. The results of this study are consistent with the further demand on the audit efforts by the firms that invest in their IAF and audit committees.

Furthermore, these results can be explained in several ways, the ACs' members and the internal auditors have incentives in ensuring high-quality-level of the external audit to minimize the litigation risks or to avoid loss of their reputation. Such results have implications for the policymakers in the Jordanian context, to support and recognize these mechanisms as important mechanisms within the firms' context. Thus, this study encourages the regulatory bodies to emphasise on participation of these mechanisms in the decisions making.

Finally, because the Jordanian environment is similar to the developing markets in the MENA region, the results of the current study can be generalized to such developing countries that have similar contextual characteristics. The analysis of this study used the Panel Data path, thus, for the future studies; the questionnaires approach may provide further results in this regard. Future studies also can examine the effect of the IAF and ACs' activity on other different measures of the audit quality such as industry specialization, auditor size, and auditor tenure or auditor rotation.

References

- Abbott, L.J., Parker, S., & Peters, G.F. (2012). Audit fee reductions from internal audit-provided assistance: The incremental impact of internal audit characteristics. Contemporary Accounting Research, 29(1).

- Al-Rassas, A.H., & Kamardin, H. (2015). Internal and external audit attributes, audit committee characteristics, ownership concentration and earnings quality: Evidence from Malaysia. Mediterranean Journal of Social Sciences, 6(3), 458-470.

- Alias, N.F., Nawawi, A., & Salin, A.S.A.P. (2019). Internal auditor’s compliance to code of ethics. Journal of Financial Crime, 26(1), 179-194.

- AlQadasi, A., & Abidin, S. (2018). The effectiveness of internal corporate governance and audit quality: The role of ownership concentration–Malaysian evidence. Corporate Governance, 18(2), 233-253.

- Axén, L. (2018). Exploring the association between the content of internal audit disclosures and external audit fees: Evidence from Sweden. International Journal of Auditing, 22(2), 285-297.

- Bananuka, J., Nkundabanyanga, S.K., Nalukenge, I., & Kaawaase, T. (2018). Internal audit function, audit committee effectiveness and accountability in the Ugandan statutory corporations. Journal of Financial Reporting and Accounting, 16(1), 138-157.

- Behrend, J., & Eulerich, M. (2019). The evolution of internal audit research: A bibliometric analysis of published documents (1926-2016). Accounting History Review, 29(1), 103-139.

- Cadbury, A. (1992). Cadbury report: The financial aspects of corporate governance. In Tech reprt, HMG, London.

- Carey, P., Craswell, A., & Simnett, R. (2000). The association between the external audit fee and external auditors reliance on the work of internal audit. AAANZ Conference, Hamilton Island, Australia, July.

- Collier, P., & Gregory, A. (1996). Audit committee effectiveness and the audit fee. European Accounting Review, 5(2), 177-198.

- DeFond, M., & Zhang, J. (2014). A review of archival auditing research. Journal of Accounting and Economics, 58(2-3), 275-326.

- Drogalas, G., Pazarskis, M., Anagnostopoulou, E., & Papachristou, A. (2017). The effect of internal audit effectiveness, auditor responsibility and training in fraud detection. Accounting and Management Information Systems, 16(4), 434-454.

- Dzikrullah, A.D., Harymawan, I., & Ratri, M.C. (2020). Internal audit functions and audit outcomes: Evidence from Indonesia. Cogent Business & Management, 7(1), 1-21.

- Elliott, R.K., & Korpi, A.R. (1978). Factors affecting audit fees, Appendix Commission on auditors’ responsibilities. Cost-Benefit Analysis of Auditing, Research Study, 3(AICPA, New York).

- Ezzamel, M., Gwilliam, D.R., & Holland, K.M. (2002). The relationship between categories of non audit services and audit fees: Evidence from UK companies. International Journal of Auditing, 6(1), 13-35.

- Felix, W.J., Gramling, A.A., & Maletta, M.J. (2001). The contribution of internal audit as a determinant of external audit fees and factors influencing this contribution. Journal of Accounting Research, 39(3), 513-534.

- Goodwin-Stewart, J., & Kent, P. (2006). Relation between external audit fees, audit committee characteristics and internal audit. Accounting & Finance, 46(3), 387-404.

- Green, S. (2003). Fighting financial reporting fraud. Internal Auditor, 60(6), 58-65.

- Gujarati, D.N. (2003). Basic econometrics (Forth Edit). McGraw-Hill Higher Ed.

- Gujarati, D.N., & Porter, D. (2009). Basic econometrics (Fifth Edit). McGraw-Hill/Irwin.

- Gustavson, M., & Sundström, A. (2018). Organizing the audit society: Does good auditing generate less public sector corruption? Administration & Society, 50(10), 1508-1532.

- Hay, D., & Knechel, W.R. (2004). Evidence on the associations among elements of control and external assurance. Unpublished doctoral dissertation, The University of Auckland.

- Ho, S., & Hutchinson, M. (2010). Internal audit department characteristics/activities and audit fees: Some evidence from Hong Kong firms. Journal of International Accounting, Auditing and Taxation, 19(2), 121-136.

- Jallow, K., Adelopo, I., & Scott, P. (2012). Multiple large ownership structure, audit committee activity and audit fees. Journal of Applied Accounting Research, 13(2), 100-121.

- Januarti, I., Darsono, D., & Chariri, A. (2020). The relationship between audit committee effectiveness and audit fees: Insights from Indonesia. The Journal of Asian Finance, Economics, and Business, 7(7), 179-185.

- Kikhia, H.Y. (2014). Board characteristics, audit committee characteristics, and audit fees: Evidence from Jordan. International Business Research, 7(12), 98-110.

- Lee, H.Y., & Mande, V. (2005). The relationship of audit committee characteristics with endogenously determined audit and non-audit fees. Quarterly Journal of Business and Economics, 44(3/4), 93-112.

- Mohamed, Z., Zain, M.M., Subramaniam, N., & Yusoff, W.F.W. (2012). Internal audit attributes and external audit’s reliance on internal audit: Implications for audit fees. International Journal of Auditing, 16(3), 268-285.

- Narayanaswamy, R., Raghunandan, K., & Rama, D.V. (2019). Internal auditing in India and China: some empirical evidence and issues for research. Journal of Accounting, Auditing & Finance, 34(4), 511-523.

- Prawitt, D.F., Sharp, N.Y., & Wood, D.A. (2011). Reconciling archival and experimental research: Does internal audit contribution affect the external audit fee? Behavioral Research in Accounting, 23(2), 187-206.

- Qawqzeh, H.K., Endut, W.A.N.A., & Rashid, N. (2021). Board Components and Quality of Financial Reporting: Mediating Effect of Audit Quality. Journal of Contemporary Issues in Business and Government, 27(2), 178-190.

- Qawqzeh, H.K., Endut, W.A., Rashid, N., & Dakhlallh, M.M. (2020). Impact of the external auditor’s effectiveness on the financial reporting quality: The mediating effect of audit quality. Journal of Critical Reviews, 7(6), 1197-1208.

- Qawqzeh, H.K., Endut, W.A., Rashid, N., & Mustafa, M. (2019). Ownership structure and financial reporting quality?: Influence of audit quality evidence from Jordan. International Journal of Recent Technology and Engineering (IJRTE), 8(4), 2212-2220.

- Rani, A. (2018). Audit committee effectiveness: Relationship between audit committee characteristics and audit fees and non-audit service fees. Journal of Commerce and Accounting Research, 7(3), 35-44.

- Saputra, I.G., & Yusuf, A. (2019). The role of internal audit in corporate governance and contribution to determine audit fees for external audits. Journal of Finance and Accounting, 7(1), 1-5.

- Sarkar, J.B., Hossain, S.M., & Islam, M.S. (2009). Impact of internal audit and audit committee characteristics on external audit fees: A case study of banks in Bangladesh. ASA University Review, 3(2), 171-185.

- Simunic, D.A. (1980). The pricing of audit services: Theory and evidence. Journal of Accounting Research, 18(1), 161-190.

- Singh, H., & Newby, R. (2010). Internal audit and audit fees: further evidence. Managerial Auditing Journal, 25(4), 309-327.

- Stein, M.T., Simunic, D.A., & Keefe, T.B.O. (1994). Industry differences in the production of audit services. Auditing: A Journal of Practice and Theory, 13, 128-142.

- Steinbart, P.J., Raschke, R.L., Gal, G., & Dilla, W.N. (2018). The influence of a good relationship between the internal audit and information security functions on information security outcomes. Accounting, Organizations and Society, 71, 15-29.

- Stewart, J., & Munro, L. (2007). The impact of audit committee existence and audit committee meeting frequency on the external audit: Perceptions of Australian auditors. International Journal of Auditing, 11(1), 51-69.

- Wea, A.N.S. (2019). Political Connection, CEO Gender, Internal Audit, Corporate Complexity and Audit Fee in Go Public Companies in Indonesia. Research Journal of Finance and Accounting, 10(12), 10-18.

- Willekens, M., & Achmadi, C. (2003). Pricing and supplier concentration in the private client segment of the audit market: Market power or competition? The International Journal of Accounting, 38(4), 431-455.

- Yassin, F.M., & Nelson, S.P. (2012). Audit committee and internal audit: Implications on audit quality. International Journal of Economics, Management and Accounting, 20(2).

- Zain, M.M., Zaman, M., & Mohamed, Z. (2015). The effect of internal audit function quality and internal audit contribution to external audit on audit fees. International Journal of Auditing, 19(3), 134-147.