Research Article: 2019 Vol: 18 Issue: 2

Innovative Approach to the Assessment of the Company's Intellectual Capital

Olekcii Tohochynskyi, Academy of the State Penitentiary Service

Oleksandr Oliinyk, Academy of the State Penitentiary Service

Viktoriya Anishchenko, Academy of the State Penitentiary Service

Olha Rembach, Khmelnytsky University of Management and Law

Olekcii Sheremeta, Academy of the State Penitentiary Service

Abstract

It was determined that the objects of formation of the intellectual capital of an enterprise are human, information, managerial and client capital, without which the existence of an enterprise on the market is impossible. As a result of the study, it was established that there is a relationship between all the components of intellectual capital, the result of their interaction is a synergistic effect, which allows an enterprise with a high level of intellectual capital to receive additional benefits and super-profits. The existing methods of intellectual capital assessment are analyzed and peculiar scientific and methodical approach is proposed, providing for a comprehensive assessment of all components of intellectual capital and the calculation of the integral index.

Keywords

Intellectual Capital, Capitalization, Structural Approach, Integral Index, Potential.

JEL Classifications

M21, Q2.

Introduction

World experience shows that the effectiveness of any process depends on how developed, demanded and implemented intellectual capital are, taking into account its expanded reproduction, since the strategic importance of the latter is to ensure the competitiveness of both the individual and society as a whole. The presence of substantial intellectual capital of a modern enterprise is one of the main and determining competitive advantages that ensure stable development of the enterprise and consolidation of its position in the market by increasing competitiveness, since the effective use of intellectual capital enhances other competitive advantages and contributes to the formation of new ones.

In the paper (Ozkan et al., 2017), the authors note that for the formation and reproduction of intellectual capital from all the intellectual resources of an enterprise, only those are selected that have the potential for development and are able, under certain conditions, to create additional value and competitive advantages. As a result of using motivational tools, intellectual potential is transformed into intellectual capital, which has a dynamic characteristic, that is, resources with potential for development provide additional value and competitive advantages for a certain period of time and can change their form (Dzenopoljac et al., 2017).

On the basis of the selected criteria for innovative development, in the process of study it was revealed that intellectual capital, along with investments, infrastructure and economic structure by type of activity, is one of the key factors of innovative development of the country's economy. It carries out both direct and indirect influence on innovative development in the following areas: transition to a new technological order by creating high-tech innovative competitive products; increase in the efficiency and productivity of workers; reduction of energy and material production; formation of an innovative type of thinking and innovative culture; change in the structure of demand in the labor market-there is a growing demand for highly skilled workers who can quickly adapt to changing conditions; creation of new markets; bankruptcy of noncompetitive enterprises; establishment of a high price monopoly for innovative products etc.

The complexity and limitations of the use of traditional methods in the assessment of intangible assets, the specific nature of individual components of intellectual capital and the lack of a single universal method for its assessment necessitate additional studies and the formation of unified approach to the assessment of intellectual capital.

Review Of Previous Studies

So, depending on how the intellectual capital of the company and its elements are assessed, the following approaches are distinguished (Ramadan et al., 2017):

1. Structural approach, which is based on the use of different units of measure for each element of intellectual capital; does not provide for a total valuation; used in non-financial models.

2. Cost approach is used to determine the total value of the company's intellectual capital, while the value of its individual components is not calculated.

In modern conditions, in the absence of a universal methodology for intellectual capital assessment, it is fully justified to use both of the above approaches.

In determining the value of the intellectual capital of the enterprise as a whole, we use value indexes. At the same time, depending on the particular situation, we use cost, income and market approaches (Nakashydze & Gil'orme, 2015).

According to the income approach, the value of intellectual capital is equal to the discounted stream of income that is expected to receive during the entire period of use of this capital (Tetiana et al., 2018a).

The cost approach assumes that the value of a particular asset is equal to: either the amount of expenses that were previously incurred to create or acquire it, or the amount of expenses required to acquire a similar asset in modern conditions (Tetiana et al., 2018b).

But this method has very limited use in intellectual capital assessment, since the results of expenses in the research and development field are unpredictable and do not have a direct connection with investment volumes: sometimes substantial expenses remain futile, and sometimes a little effort is enough to make a brilliant discovery, which will significantly improve the position of the organization in the market and increase profits.

The market approach provides for an assessment of the value of a certain asset at the cost of similar assets, bought and sold on the market (taking into account possible differences). This approach gives quite accurate results, but has limited use. It can be applicable only to those elements of intellectual capital that have analogues. In practice, it is sometimes possible to use these approaches in combination (Bontis et al., 2018).

Methodology

Methods for calculating the return on assets are based on the calculation of the difference between the ratio of the income of a business entity for a certain period of time (net of taxes) to the value of its tangible assets and that of the industry as a whole (Obeidat et al., 2017). The product of the difference obtained by the value of the tangible assets of an estimated business entity is the average income from intellectual capital. Then, by direct capitalization or discounting of the received cash flow, the value of its intellectual capital is determined.

Methods for measuring intellectual capital are developed to better understand the nature of all types of intangible assets, as well as to create a logical theory that explains how such assets should be identified and measured in order to accurately assess the value of an organization (Zambon, 2017; Kita & Šimberová, 2018). It is assumed that the refinement of market estimates of their value will lead to the optimization of capital flows and, as a result, will increase the efficiency of a market economy.

Results and Discussion

We determined to assess the intellectual capital using a structural approach, which includes an assessment of each individual component (human, organizational, client and information capital) and the calculation of the integral index of the level of intellectual capital of an enterprise. Based on study, we have formed a system of indexes for each of the components of intellectual capital.

In the opinion of the author, intellectual capital should be considered as a set of human, organizational, client and information capital, which interact with each other.

We proposed to consider human capital as a combination of such personnel characteristics as knowledge, skills, experience in a particular industry, level of education, health care, quality of life, moral values, work culture (responsibility, integrity, and focus on results, mutual support, and mutual substitutions) involved in the production and commercial activities of the enterprise for the purpose of profit. Table 1 presents indexes for the assessment of human capital (ICc) as a component of intellectual capital.

| ??ble 1: Indexes For The Assessment Of Human Capital (Icc) As A Component Of Intellectual Capital | |||

| No. in sequence | Index name | Symbol | Characteristics |

|---|---|---|---|

| 1 | Index of the educational level of the enterprise personnel | ???1 | Educational level of the enterprise personnel. |

| 2 | Coefficient of personnel constancy | ???2 | Degree of stability (wear) of a team of highly skilled workers. |

| 3 | Engineering and Scientific Support Index | ???3 | Potential ability of enterprise personnel to solve engineering and scientific and applied problems. |

| 4 | Inventive Activity Index | ???4 | Ability to generate new knowledge (technical and technological solutions), which can be the basis of innovation. |

| 5 | Knowledge Update Index | ???5 | Compliance of the level of knowledge of worker employees with modern requirements (retraining and advanced training of workers). |

| 6 | Share of employees with experience in the company for more than 5 years | ???6 | Degree of fixation of employees in the enterprise. |

Information capital is a combination of intellectual property rights; documents certifying intellectual property rights; hardware and software; scientific and methodological materials; access to special databases of scientific developments and inventions; research and development works that allow the company to create competitive products and get a profit. Table 2 presents the indexes for the assessment of information capital (???) as a component of intellectual capital.

| ??ble 2: Indexes For The Assessment Of Information Capital (??i) As A Component Of Intellectual Capital | |||

| No. in sequence | Index name | Symbol | Characteristics |

|---|---|---|---|

| 1 | Share of manufactured products based on intellectual property, the rights to which are enshrined in the relevant documents belonging to the company. | ???1 | Degree of implementation of research and development results in the production process. |

| 2 | Index of security objects of intellectual property | ???2 | Number of developments and discoveries made by employees of the enterprise during the year, as well as patents acquired and sold (transferred copyright, etc.). |

| 3 | Licensed program coverage index | ???3 | Provision of computers with licensed programs necessary for uninterrupted and effective work of employees. |

| 4 | Information Accessibility Index | ???4 | Level of enterprise access to databases of scientific developments, innovations, etc.. |

| 5 | Share of investment in research and development | ???5 | Ability of the enterprise and its financial soundness to be engages in research activities. |

| 6 | Index of work site computerization | ???6 | Availability of computers at employees’ work sites. |

Agreeing with the opinion (67), we will consider “client capital” as a system of capital, reliable, long-term trusting and mutually beneficial relations of an enterprise with its customers, buyers of the goods that have developed during its work in the market. Table 3 presents the indexes for the assessment of client capital (??k) as a component of intellectual capital.

| ??ble 3: Indexes For The Assessment Of Client Capital (??k) As A Component Of Intellectual Capital | |||

| No. in sequence | Index name | Symbol | Characteristics |

|---|---|---|---|

| 1 | Cost-effectiveness on the formation of a positive image of the company (brand) | ??k1 | Return on investment in the formation of a positive image of the company in order to consolidate the position of the enterprise in the market. |

| 2 | Share of loyal customers | ??k2 | Degree of commitment and customer confidence to the company. |

| 3 | Share of manufactured products using trademarks | ??k3 | Availability and degree of use of the brand to recognize the company on the market. |

| 4 | Percentage of clients that form the image of the company | ??k4 | Relationships with customers who have a good reputation (or have well-known brands) and form an image. |

| 5 | Cost-effectiveness of marketing activities to attract new and retain old customers | ??k5 | Profitability from measures in order to build a customer base (customers attracting and retaining). |

| 6 | Customer retention index | ??k6 | Degree of customer satisfaction with the implementation of the first order and stability of relations with customers. |

The most accurate definition of organizational capital is presented in (Nielsen et al., 2017)-these are organizational capabilities of a company that must meet market needs-forms, methods, and structures that allow you to effectively select, create and distribute knowledge, organize them into a system accessible to all employees, make it possible to achieve synergies from joint activities. Table 4 presents the indexes for the assessment of organizational capital (???) as a component of intellectual capital.

| ??ble 4: Indices Of Organizational Capital Assessment (Ico) As A Component Of Intellectual Capital | |||

| No. in sequence | Index name | Symbol | Characteristics |

|---|---|---|---|

| 1 | Percentage of personnel participating in festive, sports, creative and other events held by the company during the year to strengthen team spirit | ???1 | Initiative and activity of employees in the formation of the corporate culture of the enterprise. |

| 2 | Management profitability index | ???2 | Management efficiency of enterprise managers. |

| 3 | Index of profitability of the enterprise from the use of trademarks | ???3 | Level of profitability of the enterprise from the products sold using trademarks. |

| 4 | Share of investment in management improvement | ???4 | Level of investment in the improvement of the enterprise management system. |

| 5 | Index of deviations in the enterprise | ???5 | Negative influence on the general state of corporate culture of the enterprise and takes into account the following factors: absenteeism (evasion from participation in elections, meetings); complaints of consumers; complaints of employees of the enterprise; other complaints (for example, violation of obligations by the authorities); lack of manufactured products; mistakenness in making managerial decisions; inefficient functioning of the enterprise; violation of production and trade rules. |

| 6 | Percentage of man-hours lost due to insufficiently management actions or a poor climate in the team: downtime, strikes, industrial conflicts | ???6 | Problems in the work of the enterprise and negative trends in management. |

As a result of the study, it was established that there is a relationship between all the components of intellectual capital, the result of their interaction is a synergistic effect. We believe that in general, in the management of intellectual capital, a synergistic effect arises on the basis of a combination of all its components and their elements with a certain influence of factors of the marketing environment of the enterprise.

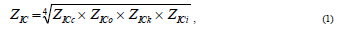

We propose to determine the valuation of intellectual capital at the company level (micro level) using a multidimensional average, which, given the non-aggressiveness of intellectual capital, can be calculated using the following formula:

ZIK -integral index for assessment the value of intellectual capital at company level (micro level).

ZICC -general index of human capital.

ZICo -general index of organizational capital.

ZICk -general index of client capital.

ZICi -general index of information capital.

To calculate the indexes and the integral index, it is determined to use a modified geometric mean formula, since this approach allows for calculations in cases where at least one of the partial coefficients is zero, because otherwise the integral coefficient will also have a zero value.

It was proposed to identify three levels of intellectual capital of an enterprise: high (sufficient for accelerated growth of the enterprise), medium and low (insufficient, one that can cause damage) (Table 5).

| Table 5: Range Of Values Of The Integral Indicator Of The Intellectual Capital Of The Enterprise | ||

| Z-index value | Level of intellectual capital | Characteristics |

|---|---|---|

| 0.67 = Z = 1 | High | Sufficient for accelerated growth of the company. |

| 0.33 = Z<0.67 | Medium | Sufficient to ensure the stability of the company. |

| 0 = Z<0.33 | Low | Insufficient, one that can cause damage. |

Conclusion

According to the results of the assessment, a complex of measures aimed at increasing the level of intellectual capital is being formed. After their implementation, the assessment of the intellectual capital of the enterprise is recommended to be repeated.

Thus, the use of this method of intellectual capital assessment will allow to reveal the current state of intangible assets, to track the dynamics of their development or aging, identify strong and weak points, to choose the most appropriate strategy for intellectual capital management, and as a result, to respond to changes in the internal and external marketing environment of enterprise in a timely manner.

References

- Bontis, N., Ciambotti, M., Palazzi, F., & Sgro, F. (2018). Intellectual capital and financial performance in social cooperative enterprises. Journal of Intellectual Capital, 19(4), 712-731.

- Dzenopoljac, V., Yaacoub, C., Elkanj, N., & Bontis, N. (2017). Impact of intellectual capital on corporate performance: Evidence from the Arab region. Journal of Intellectual Capital, 18(4), 884-903.

- Kita, P., & ?imberová, I. (2018). An overview of business models in the Czech chemical industry: A sustainable multiple value creation perspective. Entrepreneurship and Sustainability Issues, 6(2), 662-676.

- Nakashydze, L., & Gil'orme, T. (2015). Energy security assessment when introducing renewable energy technologies. Eastern-European Journal of Enterprise Technologies, 4/8(76), 54-59.

- Nielsen, C., Ricceri, F., Guthrie, J., & Dumay, J. (2017). The past, present, and future for intellectual capital research: an overview. In The Routledge Companion to Intellectual Capital,(pp.1-17). Routledge.

- Obeidat, B.Y., Tarhini, A., Masa'deh, R.E., & Aqqad, N.O. (2017). The impact of intellectual capital on innovation via the mediating role of knowledge management: A structural equation modelling approach. International Journal of Knowledge Management Studies, 8(3-4), 273-298.

- Ozkan, N., Cakan, S., & Kayacan, M. (2017). Intellectual capital and financial performance: A study of the Turkish banking sector. Borsa Istanbul Review, 17(3), 190-198.

- Ramadan, B.M., Dahiyat, S.E., Bontis, N., & Al-Dalahmeh, M.A. (2017). Intellectual capital, knowledge management and social capital within the ICT sector in Jordan. Journal of Intellectual Capital, 18(2), 437-462.

- Tetiana, H., & Shachanina, Y. (2017). Staff development as an object of accounting of a social activity of the entity. Economics and Finance, 6, 14-20.

- Tetiana, H., Chorna, M., Karpenko, L., Milyavskiy, M., & Svetlana, D. (2018a). Innovative model of enterprises personnel incentives evaluation. Academy of Strategic Management Journal17(3).

- Tetiana, H., Inna, N., Okulicz-Kozaryn, W., Getman, O., & Svetlana, D. (2018). Innovative model of economic behavior of agents in the sphere of energy conservation. Academy of Entrepreneurship Journal, 24(3).

- Tetiana, H., Karpenko, L., Fedoruk, O., Shevchenko, I., & Svetlana, D. (2018b). Innovative methods of performance evaluation of energy efficiency project. Academy of Strategic Management Journal, 17(2), 112-110.

- Zambon, S. (2017). Intangibles and intellectual capital: An overview of the reporting issues and some measurement models. In The Economic Importance of Intangible Assets, (pp.165-196). Routledge.