Research Article: 2018 Vol: 17 Issue: 2

Innovative Methods of Performance Evaluation of Energy Efficiency Projects

Hilorme Tetiana, Oles Honchar Dnipropetrovsk National University

Lidiia M Karpenko, Odessa National Polytechnic University

Fedoruk V Olesia, National Transport University

Shevchenko Inna Yu, Kharkiv National Automobile and Highway University

Drobyazko Svetlana, Ukrainian State University of Chemical Technology

Keywords

Energy Efficiency, Efficiency, Life Cycle, Target Costing, Cost of Delay.

JEL Classifications: C6, F37, O31, Q4

Introduction

Substantiation of management decisions with regard to the implementation of energy efficiency projects based upon the use of alternative energy sources has a particular topicality in the conditions of survival of the economic entity in circumstances of nationwide energy dependence of industrial enterprises on traditional exhaustible energy sources. In our view, the fundamental issue of renewable energy is the lack of determinacy with regard to the scope of use and attraction of investment, available capacities and number of power stations as well as the connectivity to power networks, scientific and technological development and other issues that require elaboration and adoption of strategy for development of alternative power industry. Heightened interest towards the employment of alternative renewable energy sources in various sectors of economy is evidenced throughout the entire world. The driving force of this process lies within changes in the energy policy of countries, which undergo structural reorganization of fuel and energy industry in view of the ecological situation and transition to energy saving and resource saving technologies in the energy sector, industry, etc.

When forming methods for evaluating the effectiveness of energy saving projects, one must take into account the particularities of the mentality of the managers of a particular country (Crawley, 2008; Pohekar, 2004). So, Lo (2014) highlights the peculiarities of China's energy efficiency policy development. Usage The Green Business Strategies School of Business explores the evaluation of renewable energy projects: Kyriakopoulos (2016); Arabatzis & Chalikias (2018); Kolov & Chalikias (2010); Skordoulis, Galacid & Arabatzis (2017).

Evaluation of energy efficiency projects is possible from two standpoints: Efficiency and investment attractiveness with due consideration of corresponding assumptions. Costs of energy efficiency project depend on the phase of the technology life cycle. Specifically, if the economic entity chooses the way of elaborating its own projects, the preproduction costs would include: Development or purchase of patent for energy efficient equipment, manufacturing of technological tooling, tests and optimization of the equipment for its manufacturability and technological efficiency, equipment start-up and commissioning, purchase of required equipment. In case the economic entity selects the services of the Energy Service Company (ESCO), preproduction costs comprise: Acceptance of services for development and implementation of energy saving and energy efficiency projects, projects for electrical power and heat generation, installation of various power equipment, etc.

In the course of implementation of energy efficiency projects, an economic entity faces the necessity to make a choice from available limited alternative resources: Monetary resources, labour resources, material resources, etc. In such a case, three most effective ways of attracting required resources are possible: Complete or partial use of existing resources or their distribution in accordance with the relation between marginal priority and energy efficiency costs.

Decision-making with regard to the implementation of energy efficiency projects is executed by the company management, which increases the subjectivity of such decision for a number of reasons: Mentality, professional experience and judgment. To decrease the impact of the subjectivity in calculations of profit improvement connected with the implementation of the project it is vital to take into account methodologies of project evaluation from the sphere of social diagnostics.

In the process of evaluating effects that derive from the choice out of several alternative projects, it is imperative to take into consideration not only the economic effect (such as, on the part of the production, an achievement of highest performance results at lowest direct or materialized labour costs or decrease in the total product unit costs), but also social and environmental effects. In such case, it is essential to evaluate such effects from the point of their emergence: Internal and external.

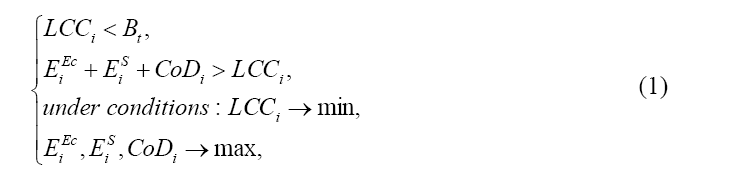

It stands beyond dispute that enterprises experience the scarcity of financial resources to be forwarded towards implementation of energy efficiency projects with the objective of maximizing an economic effect-it thus becomes expedient to perform the selection of projects on the basis of mathematical model:

Where: LCCi -Project life-cycle costs of i-project in energy efficiency, USD; Bi -budget for realization of energy efficiency projects in t-year, USD; EEci -environmental effect associated with the realization of i-project in energy efficiency, USD; ESi -social effect associated with the realization of i-project in energy efficiency, USD; CoDi -cost of delay associated with the realization of i-project in energy efficiency, USD.

In respect of environmental and social effects associated with the realization of i-project in energy efficiency, including the introduction of energy-active fencing, it is possible to single out internal and external effects. Thus wise, internal environmental effects refer to the decrease in amounts of environmental payments, reduction of environmental-related losses of enterprises; social effect-increase in the level of personnel motivation with regard to energy efficiency issues, decrease in occupational injury compensations, etc. External effect is achieved synergistically from constituents of aggregate effects: Social, environmental, economic as the result of increase in capitalization, market value, competitive ability, security of the economic entity on the principle of interaction of stakeholders within the system of energy efficiency systems implementation.

In our viewpoint, it is indispensable to take into account cost of delay and deviations from standard costs. It is necessary to expose the peculiarities of the indicator of time estimation for return on investment into energy efficiency projects-Life-Cycle Costing (of the project) (LCC). Incorporating all costs and savings associated with a purchase for the life of the equipment can be used as a means of judging cost effectiveness of projects (Hansen, 1988).

LCC is a rigorous and time-consuming calculation however all the efforts of the enterprise are justified in the case of large purchases and/or limited capital. Life-Cycle Costing (LCC) aids at evaluating net profit for the duration of the project with the inclusion of all major costs and savings for the life of the equipment discounted to present value.

Review of Previous Studies

Other considerations (calculation of present worth, discounting factors and rates, LCC) require detailed analysis. For instance, these issues have been considered in the ‘Life-Cycle Costing Manual’ for the Federal Energy Management Program elaborated by National Institute of Standards and Technology of the US Department of Commerce (Hansen, 1988).

Cost of delay takes into consideration potential savings, which equal potential losses if the enterprise does not employ energy efficient technologies (Hansen, 1988).

In this view, we deem it viable that success criteria for projects in energy efficiency are as follows: Decrease in the energy consumption of the enterprise (Ce→min), increase in the energy efficiency (En→max) and increase in the energy security of the enterprise (Se→max). The key success criterion of innovative energy efficiency projects is selected according to the expert evaluation, separately for each enterprise, depending on the phase of the life cycle of the economic entity.

Introduction of investment projects into energy efficiency technologies demands changes in the whole sum-total of functions of energy system management at the enterprises. As an instance, management accounting has to form the cost system in accordance with the demands related to activities of the economic entity. It is possible under the condition of using the concept of LCC (life-Cycle Costing) in the management accounting. The suggestion is made to employ the method of target costing which is expedient to be employed at the stage of designing the new energy system or upgrading the existing one with the help of marketing research, which effectively represents the anticipated market price for energy. The objective of this calculation is to provide optimal projection of costs of the future product at the first phase of its life cycle (research, development and design) taking into consideration that the phase of production cycle does not allow demonstrating operating flexibility.

Calculation of the life cycle of electrical energy by the principles of RES (Renewable Energy Sources) implementation expands the confines of traditional approaches towards cost management by means of accounting the costs over the whole life of the power supply system’s project based upon the use of alternative energy sources further allowing to define the target profit. This allows creating the mechanism of sustained and goal-oriented control over the process of shaping the target price of energy.

Strategic analysis of operating costs is related to the level of management decision-making-the top-level of management (top management). In such case, the analysis of costs is performed along the chain of creation of value: The cost analysis according to the life cycle of operating activity; competitive and comparative analysis by method of benchmarking; quality-related costs analysis (cost of quality).

Further to this, the methodological platform for the formation of planning and cost forecasting for energy efficiency projects, specifically strategic energy technology planning must be based upon the concept of opportunity costs.

Back in 1817, David Ricardo was close to the development of the concept of opportunity costs in the similar form, however his principle was titled ‘comparative advantage’ (Ricardo, 1817). Ricardo assumed that the efficiency of a certain phenomenon is manifested namely through comparative advantages (Ricardo, 1817). Opportunity costs concept was developed in 19th century by Friedrich von Wieser who established the principle of ‘imputation’ (Der Natürliche, 1889), i.e., attributing the cost and utility of one commodity to another commodity under condition that these commodities are economically bound. Opportunity costs are an economics term, which defines the loss of potential gains due to alternative use of specific resource. In such case, the value of lost potential gains is defined by the largest value among all available alternatives.

Such methodology can be employed at the enterprise when there arises a necessity to construct a logical sequence with all the factors that may form energy efficiency projects costs.

Data and Presentation

The Applied Data and Sources

Along with opportunity costs, there also exist sunk costs (incurred, impossible to be returned or forestalled) and avoidable costs (may be either cancelled or averted). In such perspective, costs of energy efficiency projects are sunk costs, as the enterprise is forced to bear the costs except under conditions of abandoning the production completely.

Furthermore, along with the opportunity cost theory it is necessary to single out prospective (relevant) costs in the process of personnel cost forecasting. Prospective (relevant) costs are the costs that can be altered by means of management decisions, i.e., future costs, hence the costs that differentiate one alternative from another.

Delimitating the levels of cost analysis for operating activity of enterprises on the principles of LCC concept allows taking into account the guidelines of the ‘responsibility accounting’ theory, which is premised on the concept of ‘responsibility centres’ first proposed by John A. Higgins. The Theory of John A. Higgins was based upon the transformation of the organization structure of the enterprise-the enterprise requires allocating the costs to executives of various levels and systematic control over the observance of budget cost estimates by each designated responsible person.

Determining the responsibility centre depends on the organizational structure of the enterprise. Hence, for line and staff structure the responsibility centres are represented by those linked to the profitability of the enterprise (‘cost centre’, ‘revenue centre’, ‘profit centre’), while for divisional structure such centres are represented by ‘revenue centre’ and ‘investment centre’.

Structure Analysis of Operating Costs

Decision-making with regard to the implementation of the project requires carrying out structure analysis of operating costs of the enterprise according to the phases of the product life cycle. For this purpose, operation costs are structured as follows: Preproduction costs (development of tooling, jigs and fixtures for the product, manufacturing of technological tooling, tests and optimization of the equipment for its manufacturability and technological efficiency, equipment start-up and commissioning, purchase of required equipment); production costs (direct production costs, indirect production costs); non-production costs (administrative and commercial marketing costs); post-production costs (waste and production tooling disposal). Based on the results of the given analysis, the information is being drawn up related to the comparability of costs incurred at the production phase of the SKU life cycle and operating costs established at preproduction, non-production and post-production phases of the life cycle of energy efficiency project. We will perform a structure analysis of costs incurred according to life cycle phases of the energy-active fencing system based on the use of alternative energy sources (Table 1).

| Table 1 Structure Analysis of Costs According to Life Cycle Phases of the Energy-Active Fencing System Based on the Use of Alternative Energy Sources [Calculations Provided by Authors] |

|||

| No. | Indicator | Amount, USD | Cost percentage, % |

| 1 | Planned production per month, sq. m | 9600 | - |

| 2 | Planned production per year, sq. m | 75600 | - |

| PREPRODUCTION COSTS | - | - | |

| 3 | TOTAL preproduction costs, USD | 52272 | 1.815 |

| PRODUCTION COSTS | - | - | |

| 4 | Direct costs for materials and parts per 1 unit, USD | 43.4 | - |

| 5 | Direct costs for piece rate pay per 1 unit, USD | 10.85 | - |

| 6 | Direct costs for production of annual plan, USD | 520813 | - |

| 7 | Indirect costs for production per 1 unit, USD | 12.7 | - |

| 8 | Indirect costs for production of annual plan, USD | 122166 | - |

| 9 | Planned period of production, years | 3 | - |

| 10 | TOTAL production costs, USD [(line 6+line 8) × 3 years] | 1928937.6 | 66.977 |

| NON-PRODUCTION COSTS | - | - | |

| 11 | Administrative costs in the accounting period, USD | 80587.2 | - |

| 12 | Planned period of uninterrupted activity, years | 3 | - |

| 13 | TOTAL administrative costs, UAD (?. 12 × 3) | 483523.2 | 16.789 |

| 14 | Marketing costs (commercial) according to annual production plan, USD | 69168 | - |

| 15 | Planned sales period, years | 3 | - |

| 16 | TOTAL marketing costs (commercial), USD (?. 16 × 3 years) | 415008 | 14.41 |

| POST-PRODUCTION COSTS | - | - | |

| 17 | Technological tooling disposal for scrap | 259.2 | - |

| 18 | TOTAL post-production costs | 259.2 | 0.009 |

| 19 | TOTAL LIFE-CYCLE COSTS, USD | 2880000 | 100 |

As demonstrated by the structure analysis of costs according to life cycle phases of the energy-active fencing system based on the use of alternative energy sources, the main percentage of costs is attributed to production costs (66.977%), non-production costs (administrative (16.789%) and distribution-related (14,41%))-31.199%, preproduction costs-1.815%, postproduction costs-0.009%.

Reserves to Reduce Operating Costs

The search for reserves to reduce operating costs is possible to be carried out by means of identifying the sources of competitive advantage in the value chain. To elucidate the sources of competitive advantage it is vital to analyse nine interrelated types of enterprise business activity that, in the framework of strategic management, create the value chain: Five primary activities (inbound logistics, production, outbound logistics, marketing and sales, aftersales service) and four support activities (infrastructure of the enterprise, human resource management, technological development, procurement). Strategic analysis of operating costs by value chain is carried out using comparative analysis of enterprise’s value chain with its direct competitors and within the area of business activity.

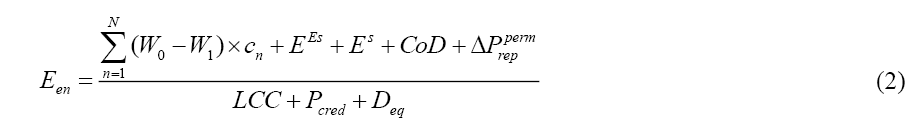

Procedures and methods of analysing investment attractiveness are aimed at defining alternatives and juxtaposing variants of project realization according to the energy efficiency criterion. Executive decision-making related to the choice of energy efficiency projects is based upon the assumption of opportunity costs of projects-we suggest defining complex economic efficiency by means of comparison of project opportunity costs (Hilorme, 2017):

Where: Een -economic effect from implementation of energy efficiency project, part; W0 ,W1 -volume of annual consumption of n-type energy resource before and after energy efficiency project realization accordingly, kWh (Gcal, m3, TFOE); cn -cost of unit of n-type energy resource, USD;  -change in cost of planned permanent repairs, routine inspections and maintenance, USD; Pcred -payment of credit interest, USD; Deq -costs related to production downtime stipulated by energy efficiency project realization, USD.

-change in cost of planned permanent repairs, routine inspections and maintenance, USD; Pcred -payment of credit interest, USD; Deq -costs related to production downtime stipulated by energy efficiency project realization, USD.

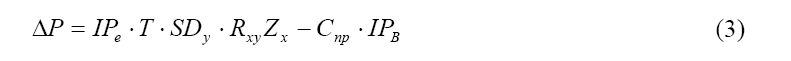

To reduce the subjectivity in decision-making (attributable to human factor) concerning the implementation of energy efficiency projects it is possible to utilize the methods of social diagnostics, particularly Schmidt & Hunter methodology. In the process of evaluating the economic efficiency of proposed approaches, it is essential, in our view, to determine the indicator of validity (characteristic that reflects the capacity to obtain results that meet the stated objective and substantiates the adequacy of decisions made). It is herewith suggested utilizing Cronbach & Gleser methodology (1957) as the basis for calculating the expediency of project implementation, with corrected (taken the peculiarities of the given mechanism) analytic formula being represented as follows (Hilorme, 2015):

Where: ΔP-profit growth as a result of project implementation (USD); IPe-number of projects related to innovative energy efficiency technologies implemented with the help of the given project (units); T-time duration of current projects (yrs.); SDy-standard deviation of success criterion that defines existing distinctions between successful and unsuccessful projects in terms of profits that they yield to the enterprise (USD); Rxy-criterion validity coefficient of the project; Zx-average standardized value of the key success criterion of projects; Cnp-costs for project implementation (USD); IPb-quantity of projects evaluated (units).

Efficiency of management decision-making related to the implementation of energyactive fencing system based upon the use of alternative energy sources will be defined by 4 indicators: Standard deviation of the revenue from energy-active fencing system implementation (USD), amount of revenue per one energy efficiency project (USD), average cost per one energy efficiency project (USD), profit from energy-active fencing system implementation (USD). Standard deviation of the revenue from energy-active fencing system implementation is calculated utilizing Schmidt & Hunter method whereby the research demonstrates that the standard deviation for efficiency of first-time projects in money terms constitutes minimum 40% of expected revenue. With regard to the validity and feasibility of evaluation methods there exist a number of social researches according to which the indicator of validity is considered to equal 0.37. With regard to the average standardized value of the key success criterion for energy-active fencing system project based on the use of alternative energy sources, it equals the average of 0.418. Results of the calculations for energy-active fencing system based on the use of alternative energy sources according to the Cronbach & Gleser (1957) methodology are provided in Table 2.

| Table 2 Performance Evaluation of Energy-Active Fencing System Based on the Use of Alternative Energy Sources According to the Cronbach & Gleser Methodology [Calculations Provided by Authors] |

||

| No. | Indicators | Value, USD |

| 1 | Standard deviation of the revenue from energy-active fencing system implementation | 23276865.38 |

| 2 | Amount of revenue per one energy efficiency project (0,418×0,37×23276865,38) | 3600000 |

| 3 | Average cost per one energy efficiency project (Table 1 p.19) | 2880000 |

| 4 | Profit from energy-active fencing system implementation (3600000-2880000) | 720000 |

Cronbach & Gleser methodology can also be used to assess the energy efficiency of buildings. We agree with the authors of De Boeck, Verbeke, Audenaert & De Mesmaeker (2015); De Wilde (2014), that the results of the forecast and actual data on energy efficiency of buildings in many cases do not coincide. That is why it is necessary to regulate the relationship between stakeholders.

Further to it, to offset the impact of the human factor in decision-making related to the implementation of energy efficiency projects it is possible to use the principles of Contract theory. 2016 Nobel Prize winners Oliver Hart and Bengt Holmström, within the framework of their contract theory, examined the regulations of relationship between contractors: Contracts are capable of significantly relieving the conflict of interest between economic agents, therefore more sophisticated forms of contracts are becoming more widespread (Hart & Moore, 2008). In the process of project implementation, the contractors are being involved: Subcontractors, financial institutions, ESCOs, etc. The better formulated the terms of the contract, the more stimuli and motives for all parties to obtain maximum advantage from cooperation (Holmström, 1999).

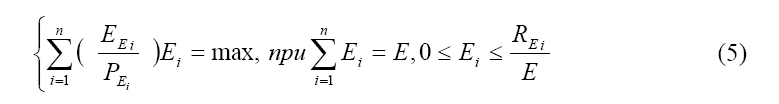

With the economic agent realizing several alternative projects, it is possible to scrutinize forecasting of costs for energy efficiency with the help of Analytic Hierarchy Process (AHP), which makes it feasible to solve three types of problems of energy resources utilization (E): Complete use of existing resources, partial use of existing resources or their distribution in accordance with the relation between marginal priority and energy efficiency costs. Thomas Saaty (1992), when formulating the strategy of the future energy system that represents a reverse process, provides 5 hierarchy levels: Focus, desired scenarios, problems, actors, policies. This testifies to the high topicality of the work, which predetermined the selection of the area of research within its scientific and practical aspects.

Methods

Analytic Hierarchy Process

Analytic Hierarchy Process (AHP) developed by a notable American mathematician Thomas Saaty is successfully used in solving multiple practical problems at various levels of planning (1992). AHP in the forecasting of costs for energy efficiency may be utilized for solving a variety of problems: Comparative analysis of objects and types of costs for energy efficiency (multiple-criteria ranking); multiple-criteria selection of best object (best alternative) for application of energy efficiency costs; distribution of energy resources among the projects of the enterprise; designing the systems of costs evaluation for energy efficiency according to qualitative and quantitative characteristics. For successful implementation, this method requires meeting the following conditions: The procedure involves highly qualified experts that do not make significant errors in evaluation; furthermore, AHP requires the group of experts to be consolidated, i.e., having common positions and striving for uniformity and concordance of their evaluations; for infinitely many compared objects (alternatives) a general system of criteria can be developed; evaluations of ‘negative’ criteria-they are not perilously close to limitations. AHP is a mathematically substantiated approach to obtaining ratio scales in solving complex problems.

The use of the Analytic Hierarchy Process (AHP) (Hierarchy Analysis Method (MAI)) in assessing the effectiveness of energy saving projects has previously been considered in scientific works. Thus, Crawley, Hand, Kummert & Griffith (2008); Pohekar & Ramachandran (2004) suggest the application of multi-criteria decision (application of multi-critical decision-making) at the stage preproduction costs (proprietary). Govindan, Rajendran, Sarkis & Murugesan (2015) uses the AHP toolkit when selecting a green supplier (green suppliers).

Mathematical Model

Using (involving) all energy resources of the enterprise-condition when the new project is initiated (new type of activity). It is possible to perform calculations of energy efficiency ( EE ) and price (energy resources costs- PE ) with projects (n) being identified according to the ratio:

Partial use of energy resources of the enterprise-condition with several projects running and the distribution is affected during specific time frames, formalizing the problem as follows:

Where Ei -required quantity of energy resources of i-type of activity.

In such case, when the lack of own energy resources is evidenced and the limitation for utilizing external resources are present, it becomes necessary to select the project with which the comparative value of cost in relation to the total available resource is the lowest. For projects (types of activities) that are in the execution stage, energy resources are distributed according to the relation between marginal priority and energy resources costs.

Cost effectiveness cannot be determined without taking into consideration auxiliary conditions: Qualifications of service and maintenance personnel, operating conditions of energyintensive equipment, etc. The rate, at which energy savings would provide return on initial investments (investment into energy efficiency), must be observed as the key factor for evaluation of energy modernization in comparison to other investments. When the enterprise decides to involve its own personnel and capital, the first phase of investment project related to energy-efficient technologies is evaluating the cost of delay. Therewith, the evaluation of the delay period for management decision-making must be economically justified-how long the delay lasted (from concept stage to decision taking). The enterprise management must understand the problem of ‘energy efficiency potential’ and the cost of delay.

Results and Discussions

In the process of evaluation of energy efficiency projects, it is essential to define all constituents of the notion of efficiency: Economic, environmental and social. Economic efficiency spans over the problem of ‘input-output’, i.e., it characterizes the link between the volumes of economic resources (production factors): Land, workforce [labour, assets (fixed, current, intangible), money, information, etc.] and the volume of products and services obtained as a result of production. With this, products, works, services must meet public demands, real effective demand, which serves as a correlation between the price of the product and its total volume that consumers are willing and capable of buying at the current price. Environmental and social effects connected with the realization of stakeholder interests, specifically alphastakeholders (personnel, society and contractors).

Structure analysis of costs incurred according to life cycle phases of the energy efficiency project is performed using the example of energy-active fencing system based on the use of alternative energy sources. The highest percentage of costs is attributed to the stages of production and service (production and non-production costs), the lowest-to preproduction and postproduction. In particular, it is the structure analysis according to the value chain that allows drawing a comparison between alternative energy efficiency projects with the purpose of selecting the most efficient one.

Management decisions taken at initial stages of implementing energy efficiency projects provide significant impact upon the communicative efficiency of the marketing promotion of energy efficiency technologies, duration and cost of project implementation, cost of delay and, correspondingly, economic efficiency. It has been proved that in the process of implementation of innovative energy efficiency projects, as exemplified by energy-active fencing system based on the use of alternative energy sources, with their economic efficiency evaluations according to Cronbach & Gleser (1957), the standard deviation for efficiency of first-time projects in money terms constitutes minimum 40% of expected revenue. To increase the generation of revenue from implementation of energy efficiency projects it is essential to regulate interrelations between stakeholders, particularly owners and top managers of the company. Company owners and top management are typically not interested in changes to processes and technologies of established energy system. Absence of the system of motivation for increase in expenses dedicated to research and development within energy supply companies ensues in the decrease of their competitive capacity.

Conclusion

Use of the analytic hierarchy process in forecasting of costs for energy efficiency would allow distributing limited energy resources. Depending on the life-cycle phase of energy efficiency projects energy resources of the enterprise are distributed in three possible directions: Complete or partial use of existing resources or their distribution in accordance with the relation between marginal priority and energy efficiency costs.

Taking into account the aforementioned, for the purpose of further development of energy efficiency technologies, it is expedient to conduct researches connected with development and optimization of integrated power supply systems, determining the priorities of renovation and modernization of energy-efficient and environmentally safe technologies, in particular forming methodological platform for implementation of projects related to integrated power supply systems and climatisation, which comprise energy-active fencing and utilize energy from alternative sources.

Acknowledgement

The paper is performed within the framework of the scientific and research project ‘Peculiarities of building and design consideration of energy-active barrier as a means of improving building energy efficiency’, listed under state registration number 0109U000157 and carried out in the scientific research institute of power at Oles Honchar Dnipropetrovsk National University.

Authors of the paper would like to extend their acknowledgment and gratitude to colleagues for providing vital information in the course of calculations for efficiency of energy-active barriers system project on the basis of implementing alternative energy sources-Utility model patent 61489, Ukraine IPC F24G 2/50, E04B 1/76 Energy-active barrier/Habrynets, Zarivniak, Mitrohov, Nakashydze (Ukraine), ? u201014333, Patent applied 30.11.2010, Patent granted 25.07.2011, Patent bulletin No. 14.

References

- Crawley, D.B., Hand, J.W., Kummert, M. & Griffith, B.T. (2008). Contrasting the capabilities of building energy performance simulation programs. Building and Environment, 43(4), 661-673.

- Cronbach, L.J. & Gleser, G.C. (1957). Psychological tests and personnel decisions. Urbana: University of Illinois Press.

- De Boeck, L., Verbeke, S., Audenaert, A. & De Mesmaeker, L. (2015). Improving the energy performance of residential buildings: A literature review. Renewable and Sustainable Energy Reviews, 52, 960-975.

- De Wilde, P. (2014). The gap between predicted and measured energy performance of buildings: A framework for investigation. Automation in Construction, 41, 40-49.

- Der Natürliche, W. (1889). Natural value, 1893, translated into English by Christian A. Malloch. Edited with an introduction by William Smart.

- Govindan, K., Rajendran, S., Sarkis, J. & Murugesan, P. (2015). Multi criteria decision making approaches for green supplier evaluation and selection: A literature review. Journal of Cleaner Production, 98, 66-83.

- Hart, O.S. & Moore, J.H. (2008). Contracts as reference points. Quarterly Journal of Economics, 1-48.

- Hilorme, T.V. (2015). Mekhanizm marketynhovoho prosuvannia innovatsiinykh enerhozberihaiuchykh tekhnolohii na zasadakh investytsiinoho audytu [Mechanism of marketing promotion of innovative energy-efficient technologies on the principles of investment audit] [Elektronnyi resurs] [Electronic resource]. Hlobalni ta Natsionalni Problemy Ekonomiky [Global and National Problems of Economics], 6, 299-306.

- Hilorme, T.V. (2017). Methodological principles of efficient activity of the enterprise in the energy efficiency sphere. Management of energy efficiency technologies in Ukraine and around the world: Methodology and practical aspects: Collective monograph/Development of economic entities in Ukraine: Modern regalia and prospects: Collective monograph.

- Holmström, B.R. (1999). Managerial incentive problems: A dynamic perspective. Review of Economic Studies, 66(1), 169-182.

- Kyriakopoulos, G., Kolovos, K.G. & Chalikias, M.S. (2010). Environmental sustainability and financial feasibility evaluation of wood fuel biomass used for a potential replacement of conventional space heating sources. Part II: A combined Greek and the nearby Balkan countries case study. Operational Research, 10(1), 57-69.

- Kyriakopoulos, G.L., Arabatzis, G. & Chalikias, M. (2016). Renewables exploitation for energy production and biomass use for electricity generation. A multi-parametric literature-based review.

- Lo, K. (2014). A critical review of China's rapidly developing renewable energy and energy efficiency policies. Renewable and Sustainable Energy Reviews, 29, 508-516.

- Ntanos, S., Kyriakopoulos, G., Chalikias, M., Arabatzis, G. & Skordoulis, M. (2018). Public perceptions and willingness to pay for renewable energy: A case study from Greece. Sustainability, 10(3), 687.

- Papageorgiou, A., Skordoulis, M., Trichias, C., Georgakellos, D. & Koniordos, M. (2015). Emissions trading scheme: Evidence from the European Union countries. In Kravets et al. (Eds.), Communications in Computer and Information Science (pp. 222-233). Switzerland: Springer International Publishing.

- Pohekar, S.D. & Ramachandran, M. (2004). Application of multi-criteria decision making to sustainable energy planning-a review. Renewable and Sustainable Energy Reviews, 8(4), 365-381.

- Ricardo, D. (1817). On the principles of political economy and taxation. In P. Sraffa (Eds.), Works and Correspondence of David Ricardo (pp. 1-10). Cambridge University Press.

- Saaty T.L. (1992). The hierarchon: A dictionary of hierarchies. Pittsburgh, Pennsylvania: RWS Publications.

- Shirley, J. Hansen, P.D. & Jeannie, C.W. (1988). Performance contracting: Expanding horizons. Published by the Fairmont Press, INC. 700 Indian Trail Lilburn, GA 30047.

- Skordoulis, M., Galatsidas, S. & Arabatzis, G. (2017). Business strategies and competitive advantage through green entrepreneurship and sustainable environmental management. Proceedings of the 8th International Conference on ICT in Agriculture, Food and Environment (HAICTA 2017), 205-213.