Research Article: 2021 Vol: 20 Issue: 6

Integrated Model of Knowledge Management Practice: Survey on the Manufacturing Industry in Indonesia

Sutopoh Sutopoh, Universitas Pendidikan Indonesia

Pajar Machmud, Universitas Pendidikan Indonesia

Agus Rahayu, Universitas Pendidikan Indonesia

Lili Adi Wibowo, Universitas Pendidikan Indonesia

Citation Information: Sutopoh, S., Machmud, P., Rahayu, A., & Wibowo, L.A. (2021). Integrated model of knowledge management practice: survey on the manufacturing industry in Indonesia. Academy of Strategic Management Journal, 20(6), 1-16.

Abstract

The COVID-19 pandemic hit the world in the past year; almost all industries experienced a significant downturn in business. Knowledge Management Practice is considered as one of the important solutions to improve Firm Performance that has experienced a decline due to the pandemic disaster. This study aims to examine the effect of Knowledge Management Practice on organizational performance in the manufacturing industry in Indonesia. The analytical technique used in this research is partial least square (PLS-SEM). The population in this study was 75 Manufacturing Companies in the Karawang Industrial Estate, Indonesia. The intended respondent is the Manager or Supervisor in the company. The results of this study reveal that there is a positive influence of the variables studied on the company's performance.

Keywords

Integrated Mode, Knowledge Management, Manufacturing, Industry.

Introduction

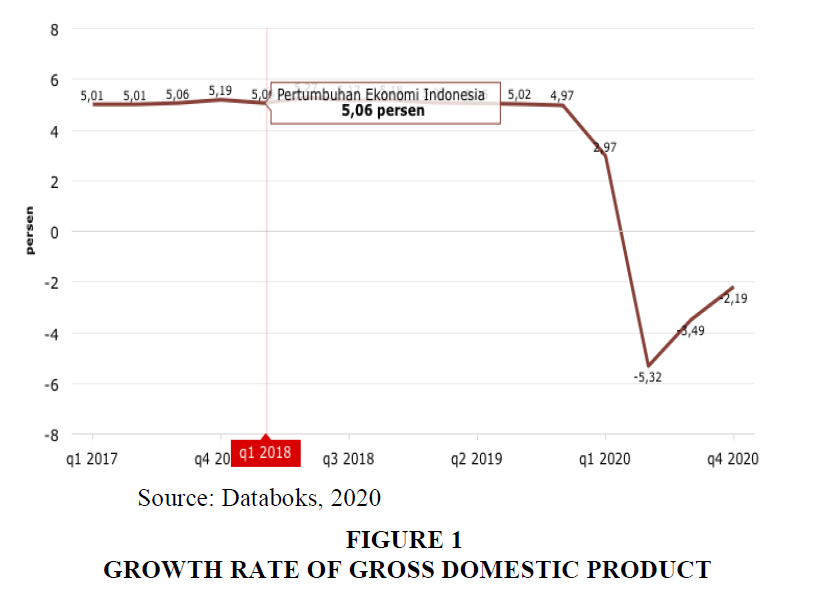

Business competition in the last few decades has continued to increase. The Company continues to compete to seek ways best to be able to survive, improve the performance of enterprise and excellence competitive her. With the catastrophic pandemic COVID-19 that hit the world a year behind it, almost all industries are experiencing the significant impact reduction in business. It the looks of the rate of growth of Product Domestic Gross Indonesia in the year 2020 continued to experience deterioration as seen in Figure 1 below it.

Therefore, companies must be able to read the situation and have knowledge about the changes in people's lifestyles that have occurred as a result of this pandemic to be able to meet the needs and desires of consumers that shift along with the changes that are happening today. Knowledge has been defined as a set of justified beliefs that can be organized and managed to improve organizational performance through effective action (Alavi & Leidner, 2001; Ferraris et al., 2019; Nonaka et al., 1994). Knowledge Management (KM) is a concept widely used in business management discussions and as such has been extensively researched in different contexts (Miozzo et al., 2016), in different industries (Bigliardi et al., 2014), and different countries (Mertins et al., 2001).

Knowledge management (KM) is important for companies because managing their knowledge effectively and efficiently can be of value to the company and can improve its performance. KM refers to the processes and practices that enable companies to manage their intellectual assets and to achieve a knowledge-based competitive advantage (Alavi & Leidner, 2001; Davenport & Prusak, 1998; Nonaka & Takeuchi, 1995; Von Krogh, 1998). There is three main recognized Knowledge Management (KM) processes: knowledge acquisition, conversion, and application (Alavi et al., 2005; Gasik, 2011; Gold et al., 2001). Knowledge acquisition is the process used to develop new knowledge from data and information, whereas knowledge conversion refers to making the acquired knowledge useful to the organization (Gold et al., 2001) by compiling it or turning tacit knowledge into explicit knowledge. The application of knowledge refers to the use of knowledge to perform tasks (Sabherwal & Sabherwal, 2005). KM processes enable companies to capture, store, and transfer knowledge efficiently (Magnier?Watanabe & Senoo, 2010) to improve customer satisfaction, market share, and financial results. Thus, KM includes the company's processes for acquiring new knowledge, transforming knowledge into a form that can be used and accessed easily, and applying this knowledge in the organization (Gasik, 2011), which affects the company's performance (Ferraris et al., 2019).

Academics who discuss the impact of knowledge-based issues on value creation center on the concepts of intellectual capital and knowledge management (Hussinki et al., 2017). Intellectual Capital (IC) refers to the total intellectual assets owned or owned by a company (Roos & Roos, 1997; Stewart, 2010; Sullivan, 1998) whereas KM refers to the processes and practices that enable companies to manage their intellectual assets and to achieve knowledge-based competitive advantage (Alavi & Leidner, 2001; Davenport & Prusak, 1998; Heisig, 2009; Nonaka & Takeuchi, 1995; Von Krogh, 1998). Given that the IC and KM literature discusses the effects of intangible assets on value creation and organizational success, they are expected to be interrelated and synergized (Hussinki et al., 2017). Intellectual capital and knowledge management are closely related, because both are activities that require intellectual effort, starting with knowledge creation and ending with the measurement of knowledge (Huang, Wu 2010). In addition, these two areas influence each other and produce powerful interactive effects on organizational performance and success (Hsu & Sabherwal, 2012). The last few decades have seen the growth of research on this two-dimensional interaction. Many of these studies have focused on the interactive effects of intellectual capital and knowledge management on organizational performance (Atko?i?nien? & Praspaliauskyt?, 2018).

Several previous studies have used the IC and KM approaches; including research Hussinki et al. (2017) on companies that have high IC and KMP characteristics but only low KMP utilization can match the innovation performance of companies with high IC and KMP levels. Another study revealed by Iqbal et al. (2019) finding that KM enablers have a significant effect on the KM process. The results also show that the KM process affects organizational performance (OP) directly and indirectly through innovation and IC. Furthermore, Atko?i?nien? & Praspaliauskyt? (2018) Intellectual capital and knowledge management are very important, intangible assets of various organizations, which, if managed adequately, create value in the long term perspective. This study proves that intellectual capital and knowledge management have a major effect on organizational performance.

Based on the conclusions from several previous studies, we hope that this research will be one of the continued efforts to combine IC and KM disciplines, especially when circumstances occur outside of normal circumstances, especially such as the current COVID-19 pandemic. From the many studies on the influence of Knowledge Management and intellectual capital on company performance, it is proven that Knowledge Management and intellectual capital have an influence on improving company performance (Atko?i?nien? & Praspaliauskyt? 2018; Ferraris et al, 2018; Hsu & Sabherwal, 2012; Hussinki et al., 2017). However, this has not been widely proven in pandemic conditions such as this. Therefore this study wants to add to the updating of the results regarding the influence of Knowledge Management and intellectual capital on company performance in the COVID-19 pandemic conditions. To find new evidence based on the rationale that the authors have mentioned above, this study empirically examines how the company's knowledge base (i.e. IC) and its ability to utilize and develop this base (i.e. KM) are associated with company performance outcomes during a pandemic COVID-19 in Indonesia.

Literature Review

Knowledge Management (KM)

Knowledge management is the process of using conscientious steps to acquire, design, manage and share knowledge within an organization to achieve better performance such as reduced rework costs, faster work, and use of best practices (Abubakar et al., 2019; Nonaka & Takeuchi, 1995; Pfeffer & Jeffrey, 1998). KM also refers to an approach to formalizing knowledge, expertise, and experience that results in new competencies that lead to improved Organizational Performance through innovation and customer satisfaction (Gloet & Terziovski, 2004; Gold et al., 2001). Ramachandran et al. (2013) defines KM as a directed and organized implementation of knowledge practices supported by strategic enablers (Iqbal et al., 2019). Probst et al. (2000) identify it as identification, capture, development, sharing, dissemination, application, and storage. A key characteristic of knowledge management is a “save it, it will be useful” approach to content. The knowledge management process has various classifications by different scholars. According to the literature review Heisig (2009) & Hussinki et al. (2017), KM is usually associated with four groups of critical success factors, consisting of human-oriented factors (culture, people, and leadership), organizational-oriented factors (processes and structures), technology-oriented factors (infrastructure and applications), and process-oriented management (strategy, goals, and measurement). KM deals with processes and practices that enable companies to achieve a knowledge-based competitive advantage (Alavi & Leidner, 2001; Davenport & Prusak, 1998; Heisig, 2009; Nonaka & Takeuchi, 1995; Von Krogh, 1998). The KM literature can be further divided into two categories: knowledge processes and Knowledge Management Practice or KMP (Hussinki et al., 2017). KMP discusses organizational and managerial practices that are used to generate knowledge-based competitive advantage and company performance results (Lerro et al., 2014; Schiuma et al., 2012). The KMP research pathway is characterized by dispersity and a lack of a well-established conceptualization (Hussinki et al., 2017).

Intelectual Capital (IC)

IC is defined as a combination of resources related to knowledge, a wealth of ideas, capabilities, and infrastructure that determine the competitive ability of an organization (Sharabati et al., 2010). IC focuses on all intangible resources that a company can use to achieve a competitive advantage (Roos & Roos, 1997; Stewart, 2010; Sullivan, 1998). In the scientific literature, intellectual capital is often defined as the summation of three interrelated and mutually supporting components: human capital, structural capital (sometimes called organizational capital), and relational capital or customer capital (Atko?i?nien? & Praspaliauskyt? 2018). When analyzing intellectual capital and its components, it should be noted that intellectual capital is intangible and difficult to measure; therefore, no measurement model can be applied without differences in all organizations (Marr et al., 2004). Human capital, as a central component, serves as a driving force for structural and relational aspects (Li & Chang, 2010). According to (Chahal & Bakshi, 2015), human capital is an organization's ability to create value through the use of experience, learning, skills, education, skills, and creativity of its employees (Iqbal et al., 2019). Furthermore, relational capital is concerned with knowledge and learning abilities that are generated not only from the relationships between the employees of an organization and its stakeholders but also from other relational resources such as customer loyalty, brand, and reputation (Agostini et al., 2017).

Firm Performance (FP)

Firm performance is a measure of how well a company can meet its goals and objectives compared to its main competitors (Kurniawan, 2021; Cao & Zhang, 2011). In general, superior firm performance is usually characterized by profitability, growth, and market value (Cho & Pucik, 2005). Venkatraman & Ramanujam (1986) argued that organizational performance is a multiple hierarchical constructions that show financial performance and operational performance such as market share and quality (Rajapathirana & Hui, 2018). Organizational performance is the dependent variable or criterion in the field of management and has become one of the most widely researched variables to measure organizational success. As might be expected, much scientific attention has been directed to understanding the causal structure of firm performance and explaining the variation in performance among competing businesses (March & Sutton, 1997).

Hypotheses Development

Strategic KM enables companies to identify key strategic knowledge resources and focus their efforts on leveraging them in building competitive advantage (Barney, 1991; Conner & Prahalad, 1996; Grant, 1996; Zack, 1999). This KM capabilities framework shows that knowledge infrastructure capabilities not only independently influence organizational effectiveness but also provide a supportive environment in facilitating or supporting KM processes which in turn improve company performance (Iqbal et al., 2019). Therefore, in this study the authors expect the following relationship:

H1 There is a positive relationship between Knowledge Management and firm performance

Different types of sources of knowledge are usually required to create value (Grant, 1996; Hussinki et al., 2017; Kogut & Zander, 1992; Spender, 1996). Empirical studies on IC also show that IC affects firm performance mainly through the combination and interaction of different IC dimensions (Jardon & Martos, 2012; Kamukama et al., 2010; Kim et al., 2012; Maditinos et al., 2010; Sharabati et al., 2010). The relationship between IC and company performance can also be explained by increasing innovation capabilities (Mathuramaytha, 2012; Menor et al., 2007) and dynamic capabilities (Hsu & Sabherwal, 2012). Furthermore, a selection of important empirical evidence suggests that IC is associated primarily with innovation performance (Cabello-Medina et al., 2011; Carmona-Lavado et al., 2010; Leitner, 2011; Subramaniam & Youndt, 2005; Wang & Chen, 2013), in particular with unlocking intellectual potential through relational and social capital (Huizingh, 2011; Chesbrough, 2003). Therefore, in this study the authors expect the following relationship:

H2 There is a positive relationship between intellectual capital and firm performance

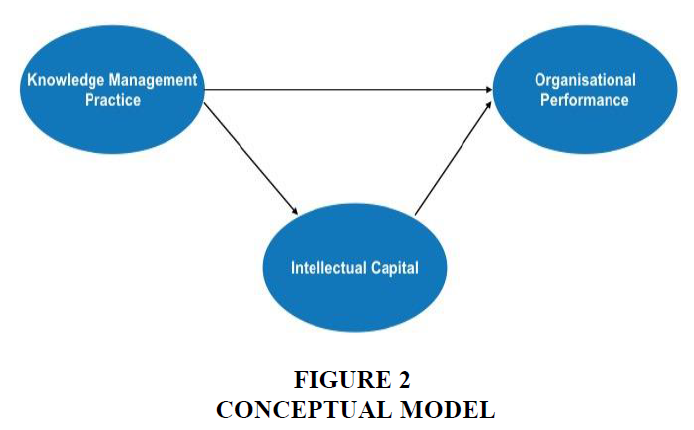

Several previous studies have explained that KM and IC are two important sources of competitive advantage and organizational performance (Lerro et al., 2014; Mills & Smith, 2011; Shih et al., 2010). Much literature has acknowledged the role of KM processes in IC development (Gold et al., 2001; Ramadan et al., 2017; Schiuma et al., 2012). The researchers further confirm that KM and IC are closely linked (Seleim & Khalil, 2011; Serenko et al., 2010; Serenko & Bontis, 2004) and when fitted together in the organizational strategy they can bring about the desired performance results (Cao & Zhang, 2011; Lerro et al., 2014; Wang & Chen, 2013). Further research conducted by Atko?i?nien? & Praspaliauskyt? (2018) support the findings from previous research by explaining that the correlation between Knowledge Management and intellectual capital in improving company performance. Therefore, in this study, the authors expect the following relationships (Figure 2):

H3 There is a positive relationship between Knowledge Management and intellectual capital

Research Method

Population and Sample

The population in this study was 75 manufacturing companies in the Karawang Industrial Estate, Indonesia. The intended respondents are Managers or Supervisors at the company. The data was collected through a survey which was sent via email to the respondent. Data collection was carried out from January to October 2020.

Measurement

To measure knowledge management practices, indicators adapted from Hussinki et al. (2017) consist of 10 dimensions with 27 indicators. Respondents were asked to fill in the level of agreement with 27 statements using a 5 Likert scale.

To measure intellectual capital adapted from Hussinki et al. (2017) which consists of 7 dimensions with 22 indicators. Respondents were asked to fill in the level of agreement with each indicator using a 5 Likert scale.

The company's performance consists of two dimensions, namely market performance and innovation performance which are also adapted from Hussinki et al. (2017). Respondents were asked to compare their company's position with other companies in the same sector, ranging from very bad (1) to very good (5). Market performance is seen from the growth in net sales and profitability. Meanwhile, innovation performance is seen from three indicators, namely product, marketing, and business models.

Analysis

The analysis technique used in this study is partial least square (PLS-SEM) to estimate structural equation models (Chin, 1998; Hair et al., 2017). PLS-SEM has proven to be very useful for analyzing models that are sufficient to very complex with relatively small sample sizes (Reinartz et al., 2009).

Results

Analysis of Research Data

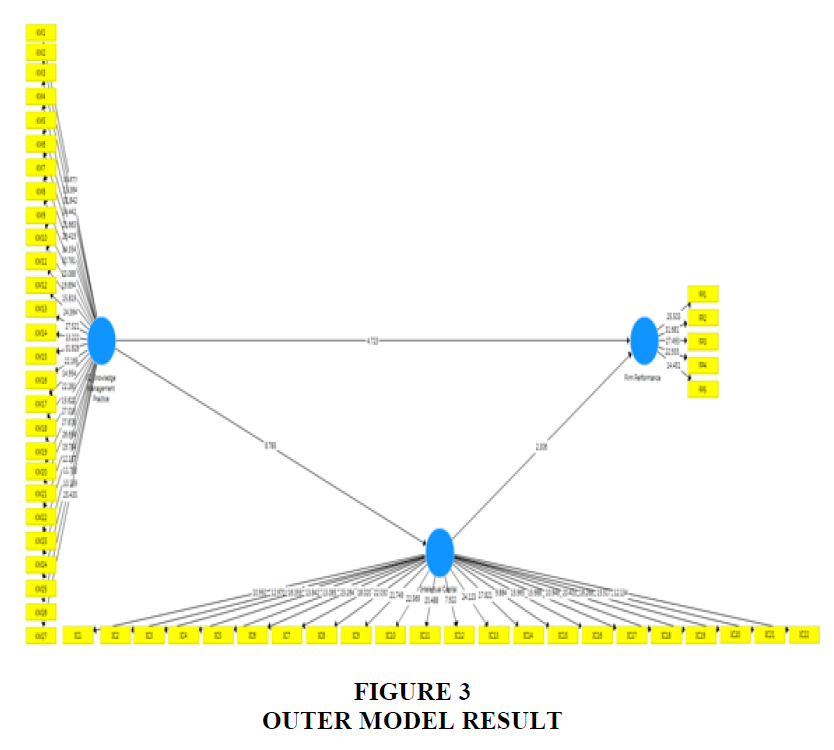

Evaluation of the outer model

At this stage, testing is carried out using the SmartPLS version 3.0 program. And the validity test conducted is constructing validity. Testing construct validity can be done by paying attention to the strength of the correlation between constructs and construct-forming indicators, as well as their weak relationship with other constructs. Construct validity consists of two parts, namely convergent validity and discriminant validity (Figure 3).

Convergent Validity testing of each construct indicator according to Chin in Ghozali & Latan (2015), an indicator is said to be valid if the value is greater> 0.5. Convergent validity can be seen from the loading factor for each construct indicator. The rule of thumb used to assess convergent validity is that the loading factor value must be greater than 0.5. Based on the tests carried out, it can be seen that all the loading factor values are above 0.5, so it can be concluded that all indicators in this study are valid. Based on the results of calculations carried out by the PLS Algorithm for the indicators, the AVE value and the AVE square value are obtained as in Table 1.

| Table 1 Results of Average Variance Extracted (AVE) Value | ||

| Variable | Average Variance Extracted (AVE) | Result |

| Knowledge Management Practice | 0.672 | Valid |

| Intellectual Capital | 0.624 | Valid |

| Firm Performance | 0.741 | Valid |

From Table 1 it can be seen that the AVE value for all variables meets the requirement value, which is above 0.5. The lowest AVE value is in the Intellectual Capital variable with a value of 0.624. By paying attention to the loading factor value and the AVE value in Table 1, the data from this study can be declared to have met the requirements of the convergent validity test.

Another method for assessing discriminant validity is to compare the value of the cross loadings for each construct with the correlation between the construct and the other constructs in the model. The discriminant validity model. The tests carried out, it shows that the cross loading value of each item against its construct is greater than the loading value with other constructs. From these results, it can be concluded that there is no problem with discriminant validity.

After testing the construct validity, the next test is the construct reliability test which is measured by two criteria, namely Composite Reliability (CR) and Cronbach's Alpha (CA) from the indicator block that measures the CR construct used to display good reliability. A construct is declared reliable if the composite value is reliable > 0.7. Based on Table 2, the results of the composite reliability test show a value of> 0.7, which means that the value on each instrument is reliable.

| Table 2 Composite Reliability | ||

| Variable | Composite Reliability | Result |

| Knowledge Management Practice | 0.982 | Reliable |

| Intellectual Capital | 0.973 | Reliable |

| Firm Performance | 0.935 | Reliable |

A construct is declared reliable if the composite value is reliable or Cronbach's Alpha> 0.6. Based on Table 3, the Cronbach alpha test results show a value> 0.7, which means that the value on each instrument is reliable.

| Table 3 Cronbach’s Alpha | ||

| Variable | Cronbach’s Alpha | Result |

| Knowledge Management Practice | 0.981 | Reliable |

| Intellectual Capital | 0.971 | Reliable |

| Firm Performance | 0.913 | Reliable |

Evaluation of the inner model (Structural model)

After evaluating the model and it is found that each construct has met the requirements of Convergent Validity, Discriminant Validity, and Composite Reliability, then what follows is an evaluation of the structural model which includes testing the path coefficient, and R2.

The inner model (inner relation, structural model, and substantive theory) describes the relationship between latent variables based on substantive theory. The structural model is evaluated using the R-square for the dependent construct, the Stone-Geiser Q-square test for the relevant predictive. The value of R2 can be used to assess the effect of certain independent latent variables, whether the dependent latent variable has a substantive effect (Ghozali, 2014). The higher the R2 value, the greater the ability of the independent latent variable to explain the dependent latent variable. R2 results of 0.67, 0.33, and 0.19 indicate that the models are “good”, “moderate”, and “weak” (Ghozali, 2014).

Based on Table 4, it is obtained that the R-Square value for the Intellectual Capital variable is 0.477, which means that 47.7% of the variation or change in Intellectual Capital is influenced by Knowledge Management Practice, while the remaining 52.3% is explained by other reasons.

| Table 4 R-Square Coefficient | |

| R-SQUARE | |

| Intellectual Capital | 0.477 |

| Firm Performance | 0.722 |

Based on this, the results of the calculation of R2 indicate that R2 is moderate. Based on Table 4, the R-Square value for the Firm Performance variable is 0.722, this means that 72.2% of the variation or change in Firm Performance is influenced by Knowledge Management Practice and Intellectual Capital and the remaining 27.8% is explained by other reasons. Based on this, the results of the calculation of R2 show that R2 is good.

Besides looking at the R-square value, the model is also evaluated by looking at the predictive relevance Q-square for the constructive model. The Q-square measures how well the observed values are generated by the model and also the parameter estimates. The magnitude of Q2 has a range value of 0 < Q2 <1, is equivalent to the total coefficient of determination in the path analysis. The value of Q2 > 0 indicates that the model has predictive relevance, on the contrary, if the value of Q2 ≤ 0 indicates that the model has less predictive relevance.

Calculation of Q2 total variable Firm Performance is done with the formula:

Q2 = 1 – [(1- R2 ) * (1- R2 )}

Q2 = 1 – [(1-477) * (1-722)]

Q2 = 1-0.145

Q2 = 0.855

This value shows that the information contained in the data is 85.5% can be explained by the model, while 14.5% is explained by other variables (which are not yet included in the model), as well as the element of error.

Bootstrapping results

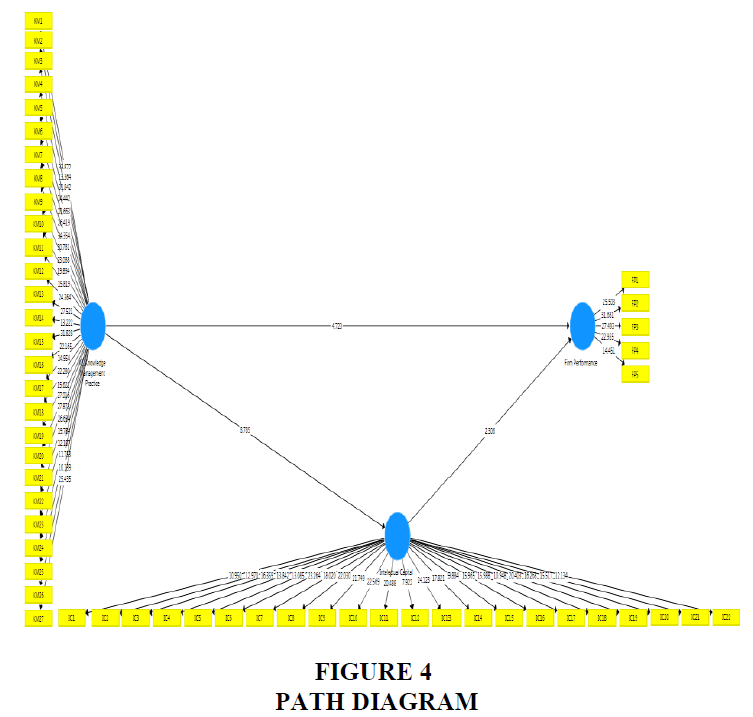

In PLS, testing of each relationship is carried out using a simulation with the bootstrapping method of the sample. This test aims to minimize the problem of abnormalities in research. The test results with the PLS bootstrapping method are as follows (Figure 4):

Meanwhile, the calculation results can be seen based on the direct effect below.

Direct effect analysis

Based on Table 5, it shows the results of PLS calculations which state the direct influence between variables. It is said that there is a direct effect if the T Statistics value is> 1.96 and it is said that there is no effect if the T Statistics <1.96. Based on Table 5, it can be stated as follows:

| Table 5 Direct Effects | ||

| T Statistics (|O/STDEV|) | P Values | |

| Knowledge Management Practice à Firm Performance | 4.723 | 0.000 |

| Knowledge Management Practice à Intellectual Capital | 8.785 | 0.000 |

| Intellectual Capital à Firm Performance | 2.306 | 0.022 |

1. Knowledge Management Practice variable has a significant effect on Firm Performance variable with a T Statistics value of 4.723> 1.96.

2. The Intellectual Capital variable has a significant effect on the Firm Performance variable with a T Statistics value of 2.306> 1.96.

3. Knowledge Management Practice variable has a significant effect on the Intellectual Capital variable with a T Statistics value of 8,785> 1.96.

Hypotheses Testing

Hypothesis testing is done by looking at the probability value and the t-statistic. For the probability value, the t-table value for alpha 5% is 1.96. So that the criterion for acceptance of the Hypothesis is when the t-statistic> t-table. This test is intended to test the hypothesis which consists of the following 3 hypotheses.

First hypotheses “There is a positive relationship between Knowledge Management and firm performance”. Based on Table 5 with a value of T-statistics 4.723 which means> 1.96 then H1 is accepted, which means that Knowledge Management has a positive and significant effect on Firm Performance, meaning that changes in the value of Knowledge Management have a direct effect on changes in Firm Performance or other words if Knowledge Management going well, there will be an increase in Firm Performance and statistically has a significant effect. Based on the results of data processing with SmartPLS version 3.0, it is known that the coefficient value of Knowledge Management to Firm Performance is 0.605, which means Knowledge Management has a positive relationship with Firm Performance with a moderate degree of closeness.

Based on the calculation results, the t-statistic value is 4,723 which means > 1.96 and the sig value. 0.000 below 0.05 then H1 is accepted, which means that Knowledge Management Practice has a positive and significant influence on Firm Performance, meaning that changes in the value of Knowledge Management Practice have a direct effect on changes in Firm Performance or other words if Knowledge Management Practice increases, there will be an increase in Firm level. Performance and statistically have a significant effect. Based on the results of data processing with SmartPLS version 3.0, it is known that the path coefficient value of Knowledge Management Practice to Firm Performance is 0.605, which means that Knowledge Management Practice has a positive relationship with Firm Performance.

Second hypotheses “There is a positive relationship between intellectual capital and firm performance”. Based on Table 5 with a value of T-statistics 2.306 which means> 1.96 then H2 is accepted, which means that intellectual capital has a positive and significant effect on firm performance, meaning that changes in the value of intellectual capital have a direct effect on changes in firm performance or other words, if intellectual capital going well, there will be an increase in Firm Performance and statistically has a significant effect. Based on the results of data processing with SmartPLS version 3.0, it is known that the path coefficient value of Intellectual Capital to Firm Performance is 0.311, which means that intellectual capital has a positive relationship with Firm Performance with a strong degree of closeness.

Based on the calculation results, the t-statistic value is 2.305, which means> 1.96, and the sig value. 0.022 below 0.05 then H2 is accepted, which means that intellectual capital has a positive and significant effect on Firm Performance, meaning that changes in the value of intellectual capital have a unidirectional effect on changes in firm performance or in other words, if intellectual capital increases, there will be an increase in the level of firm performance. Statistics have a significant effect. Based on the results of data processing with SmartPLS version 3.0, it is known that the path coefficient value of Intellectual Capital to Firm Performance is 0.311, which means that Intellectual Capital has a positive relationship with Firm Performance.

Third hypotheses “There is a positive relationship between Knowledge Management and Intellectual Capital”. Based on Table 5 with a value of T - statistics 8.785 which means> 1.96 then H3 is accepted, which means that Knowledge Management has a positive and significant influence on Intellectual Capital, meaning that changes in the value of Knowledge Management have a direct effect on changes in Intellectual Capital or other words if Knowledge Management going well, there will be an increase in intellectual capital and statistically significant impact. Based on the results of data processing with SmartPLS version 3.0, it is known that the path coefficient of Knowledge Management to Intellectual Capital is 0.691, which means Knowledge Management has a positive relationship with Intellectual Capital with a strong degree of closeness.

Based on the calculation results, the t-statistic value is 8,785 which means > 1.96, and the sig value. 0.000 below 0.05 then H3 is accepted, which means that Knowledge Management Practice has a positive and significant effect on Intellectual Capital, meaning that changes in the value of Knowledge Management Practice have a unidirectional effect on changes in Intellectual Capital or in other words if Knowledge Management Practice increases, there will be an increase in the intellectual level. Capital and statistically have a significant effect. Based on the results of data processing with SmartPLS version 3.0, it is known that the path coefficient value of Knowledge Management Practice on Intellectual Capital is 0.691, which means that Knowledge Management Practice has a positive relationship with Intellectual Capital.

Discussion

This study aims to understand the relationship between knowledge management practices, intellectual capital, and the performance of manufacturing companies. From the two factors studied, it is evident that both have an influence on company performance. The model in this study proved to be good based on the Q2 value of 85.5%. Knowledge management practices and intellectual capital are proven to have an influence on company performance by 72.2%, meaning that these two variables are substantial in explaining the company's performance or in the case of this study, the performance of manufacturing companies in the Karawang industrial area, West Java, Indonesia. This finding has a significant contribution to improving the performance of manufacturing companies. The results of these findings can be used as a further step for the manufacturing industry in order to improve company performance through the two variables that have been examined in this study.

These findings support research from Hussinki et al. (2017) who found that companies with high IC and KMP rates tended to outperform companies with low overall IC and KMP rates. On a more interesting note, this study also shows that companies that have high IC and KMP characteristics but only low KMP utilization can match the innovation performance of companies with high IC and KMP rates. Likewise with research from Iqbal et al. (2019) shows that the KM process affects organizational performance (OP) directly and indirectly through innovation and IC. So, these findings provide a theoretical contribution to renewal in enriching knowledge about Knowledge Management Practices. This research provides additional knowledge on research on manufacturing companies, especially in Indonesia, which has not studied much about the influence of knowledge management practices and intellectual capital, so this research contributes to the business literature on the manufacturing industry.

Conclusion and Limitation

Knowledge management and intellectual capital are important factors that can improve company performance. These two factors are proven to be able to influence on improving the performance of manufacturing companies in Indonesia so that these two factors are important things that must get more attention from executives and area managers to be applied to the company so that they can make a positive contribution to improving organizational performance. The model used in this research is proven to have good predictability. From the results of the hypothesis testing conducted, it was found that the more dominant factor affecting company performance was intellectual capital. Departing from these findings, the managerial implication that can be improved is that the knowledge management process itself needs to be improved up to the intellectual capital stage to be able to improve company performance optimally, meaning that there are still rooms that can be improved or improved so that in the future it can contribute to the improvement future performance of the company. This research makes an original contribution to prove empirically on knowledge management practices and intellectual capital in the manufacturing industry in Indonesia.

The results of this study provide a practical contribution, namely as a guide for the manufacturing industry in Indonesia to improve its performance, namely by paying attention to the factors of knowledge management and intellectual capital to improve the company's performance.

Some of the limitations of this study are, firstly, the scope of this study only takes samples from manufacturing companies located in the Karawang industrial area in West Java province so that further research is needed to examine this subject so that it can provide a map of the entire manufacturing industry in Indonesia, the second from The phenomenon of knowledge management practices itself has not been widely applied by the manufacturing industry in Indonesia, so further research is needed to examine these topics in the future.

References

- Abubakar, A.M., Elrehail, H., Alatailat, M.A., & Elçi, A. (2019). Knowledge management, decision-making style and organizational performance. Journal of Innovation and Knowledge, 4(2), 104-114.

- Agostini, L., Nosella, A., & Filippini, R. (2017). Does intellectual capital allow improving innovation performance? A quantitative analysis in the SME context. Journal of Intellectual Capital.

- Alavi, M., Kayworth, T.R., & Leidner, D.E. (2005). An empirical examination of the influence of organizational culture on knowledge management practices. Journal of Management Information Systems, 22(3), 191-224.

- Alavi, M., & Leidner, D.E. (2001). Knowledge management and knowledge management systems: Conceptual foundations and research issues. MIS Quarterly, 107-136.

- Atko?i?nien?, Z., & Praspaliauskyt?, G. (2018). The influence of intellectual capital and knowledge management on organizational performance in Lithuanian software companies. Ekonomika, 97(2), 106-120.

- Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management.

- Bigliardi, B., Galati, F., & Petroni, A. (2014). How to effectively manage knowledge in the construction industry. Measuring Business Excellence.

- Cabello-Medina, C., López-Cabrales, A., & Valle-Cabrera, R. (2011). Leveraging the innovative performance of human capital through HRM and social capital in Spanish firms. The International Journal of Human Resource Management, 22(4), 807-828.

- Cao, M., & Zhang, Q. (2011). Supply chain collaboration: Impact on collaborative advantage and firm performance. Journal of Operations Management.

- Carmona-Lavado, A., Cuevas-Rodríguez, G., & Cabello-Medina, C. (2010). Social and organizational capital: Building the context for innovation. Industrial Marketing Management, 39(4), 681-690.

- Chahal, H., & Bakshi, P. (2015). Examining intellectual capital and competitive advantage relationship. International Journal of Bank Marketing.

- Chin, W.W. (1998). The partial least squares approach for structural equation modeling. In Modern methods for business research.

- Cho, H. J., & Pucik, V. (2005). Relationship between innovativeness, quality, growth, profitability, and market value. Strategic Management Journal.

- Conner, K.R., & Prahalad, C.K. (1996). A resource-based theory of the firm: Knowledge versus opportunism. Organization Science, 7(5), 477-501.

- Davenport, T.H., & Prusak, L. (1998). Working knowledge: How organizations manage what they know. Harvard Business Press.

- Databoks. (n.d.). RI's economy is increasingly recovering, but still growing negatively as of the fourth quarter of 2020

- Ferraris, A., Mazzoleni, A., Devalle, A., & Couturier, J. (2019). Big data analytics capabilities and knowledge management: impact on firm performance. Management Decision, 57(8), 1923-1936.

- Gasik, S. (2011). A model of project knowledge management. Project Management Journal, 42(3), 23-44.

- Ghozali, I. (2014). SEM Metode Alternatif dengan menggunakan Partial Least Squares (PLS). Badan Penerbit Universitas Diponegoro.

- Ghozali, I., & Latan, H. (2015). Partial least squares concepts, techniques and applications using the smartpls 3.0 program for empirical research. UNDIP Publishing Agency.

- Gloet, M., & Terziovski, M. (2004). Exploring the relationship between knowledge management practices and innovation performance. Journal of Manufacturing Technology Management.

- Gold, A.H., Malhotra, A., & Segars, A.H. (2001). Knowledge management: An organizational capabilities perspective. Journal of Management Information Systems, 18(1), 185-214.

- Grant, R.M. (1996). Toward a knowledge?based theory of the firm. Strategic Management Journal, 17(S2), 109-122.

- Hair, J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2017). A primer on partial least squares structural equation modeling (PLS-SEM). Second Edition. In California: Sage.

- Heisig, P. (2009). Harmonisation of knowledge management–comparing 160 KM frameworks around the globe. Journal of Knowledge Management.

- Hsu, I., & Sabherwal, R. (2012). Relationship between intellectual capital and knowledge management: An empirical investigation. Decision Sciences, 43(3), 489-524.

- Huizingh, E. K. R. E. (2011). Open innovation: State of the art and future perspectives. Technovation, 31(1), 2-9.

- Hussinki, H., Ritala, P., Vanhala, M., & Kianto, A. (2017). Intellectual capital, knowledge management practices and firm performance. Journal of Intellectual Capital, 18(4), 904-922.

- Iqbal, A., Latif, F., Marimon, F., Sahibzada, U.F., & Hussain, S. (2019). From knowledge management to organizational performance: Modelling the mediating role of innovation and intellectual capital in higher education. Journal of Enterprise Information Management, 32(1), 36-59.

- Jardon, C.M., & Martos, M.S. (2012). Intellectual capital as competitive advantage in emerging clusters in Latin America. Journal of Intellectual Capital.

- Kamukama, N., Ahiauzu, A., & Ntayi, J.M. (2010). Intellectual capital and performance: Testing interaction effects. Journal of Intellectual Capital.

- Kim, T., Kim, W.G., Park, S.S., Lee, G., & Jee, B. (2012). Intellectual capital and business performance: What structural relationships do they have in upper?upscale hotels? International Journal of Tourism Research, 14(4), 391-408.

- Kogut, B., & Zander, U. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383-397.

- Leitner, K.H. (2011). The effect of intellectual capital on product innovativeness in SMEs. International Journal of Technology Management, 53(1), 1-18.

- Lerro, A., Linzalone, R., Schiuma, G., Kianto, A., Ritala, P., Spender, J.C., & Vanhala, M. (2014). The interaction of intellectual capital assets and knowledge management practices in organizational value creation. Journal of Intellectual Capital.

- Li, Q., & Chang, C. (2010). The customer lifetime value in Taiwanese credit card market. African Journal of Business Management, 4(5), 702-709.

- Maditinos, D., Sevic, Z., & Tsairidis, C. (2010). Intellectual capital and business performance: an empirical study for the Greek listed companies.

- Magnier?Watanabe, R., & Senoo, D. (2010). Shaping knowledge management: Organization and national culture. Journal of Knowledge Management.

- March, J.G., & Sutton, R.I. (1997). Organizational performance as a dependent variable. Organization Science.

- Marr, B., Schiuma, G., & Neely, A. (2004). Intellectual capital–defining key performance indicators for organizational knowledge assets. Business Process Management Journal.

- Mathuramaytha, C. (2012). The impacts of intellectual capital on innovative capability: Building the sustain competitive advantage on a resource-based perspective of Thailand industrials. International Business Management, 6(4), 451-457.

- Menor, L.J., Kristal, M.M., & Rosenzweig, E.D. (2007). Examining the influence of operational intellectual capital on capabilities and performance. Manufacturing & Service Operations Management, 9(4), 559-578.

- Mertins, K., Heisig, P., Vorbeck, J., Mertins, K., Heisig, P., & Vorbeck, J. (2001). Knowledge management: Best practices in Europe.

- Mills, A.M., & Smith, T.A. (2011). Knowledge management and organizational performance: a decomposed view. Journal of Knowledge Management, 15(1), 156–171.

- Miozzo, M., Desyllas, P., Lee, H., & Miles, I. (2016). Innovation collaboration and appropriability by knowledge-intensive business services firms. Research Policy, 45(7), 1337-1351.

- Nonaka, I., Byosiere, P., Borucki, C.C., & Konno, N. (1994). Organizational knowledge creation theory: A first comprehensive test. International Business Review, 3(4), 337-351.

- Nonaka, I., & Takeuchi, H. (1995). The knowledge-creating company: How Japanese companies create the dynamics of innovation. Oxford university press.

- Pfeffer, J., & Jeffrey, P. (1998). The human equation: Building profits by putting people first. Harvard Business Press.

- Probst, G., Raub, S., & Romhardt, K. (2000). Managing knowledge: Building blocks for success (Vol. 360). John Wiley & Sons Chichester.

- Rajapathirana, R.P.J., & Hui, Y. (2018). Relationship between innovation capability, innovation type, and firm performance. Journal of Innovation & Knowledge, 3(1), 44-55.

- Ramachandran, S.D., Chong, S., & Wong, K. (2013). Knowledge management practices and enablers in public universities: A gap analysis. Campus-Wide Information Systems.

- Ramadan, B.M., Dahiyat, S.E., Bontis, N., & Al-dalahmeh, M.A. (2017). Intellectual capital, knowledge management and social capital within the ICT sector in Jordan. Journal of Intellectual Capital, 18(2), 437-462.

- Reinartz, W., Haenlein, M., & Henseler, J. (2009). An empirical comparison of the efficacy of covariance-based and variance-based SEM. International Journal of Research in Marketing.

- Roos, G., & Roos, J. (1997). Measuring your company’s intellectual performance. Long Range Planning, 30(3), 413-426.

- Sabherwal, R., & Sabherwal, S. (2005). Knowledge management using information technology: Determinants of short?term impact on firm value. Decision Sciences, 36(4), 531-567.

- Schiuma, G., Andreeva, T., & Kianto, A. (2012). Does knowledge management really matter? Linking knowledge management practices, competitiveness and economic performance. Journal of Knowledge Management.

- Seleim, A.A.S., & Khalil, O.E.M. (2011). Understanding the knowledge management?intellectual capital relationship: a two?way analysis. Journal of Intellectual Capital, 12(4), 586-614.

- Serenko, A., & Bontis, N. (2004). Meta-review of knowledge management and intellectual capital literature: Citation impact and research productivity rankings. Knowledge and Process Management, 11(3), 185-198.

- Serenko, A., Bontis, N., Booker, L., Sadeddin, K., & Hardie, T. (2010). A scientometric analysis of knowledge management and intellectual capital academic literature (1994?2008). Journal of Knowledge Management, 14(1), 3-23.

- Sharabati, A.A., Jawad, S.N., & Bontis, N. (2010). Intellectual capital and business performance in the pharmaceutical sector of Jordan. Management Decision.

- Shih, K., Chang, C., & Lin, B. (2010). Assessing knowledge creation and intellectual capital in banking industry. Journal of Intellectual Capital, 11(1), 74-89.

- Spender, J. (1996). Making knowledge the basis of a dynamic theory of the firm. Strategic Management Journal, 17(S2), 45-62.

- Stewart, T.A. (2010). Intellectual Capital: The new wealth of organization. Currency.

- Subramaniam, M., & Youndt, M.A. (2005). The influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal, 48(3), 450-463.

- Sullivan, P.H. (1998). Profiting from intellectual capital: Extracting value from innovation. John Wiley & Sons.

- Venkatraman, N., & Ramanujam, V. (1986). Measurement of business performance in strategy research: A comparison of approaches. Academy of Management Review, 11(4), 801-814.

- Von Krogh, G. (1998). Care in knowledge creation. California Management Review, 40(3), 133-153.

- Wang, D., & Chen, S. (2013). Does intellectual capital matter? High-performance work systems and bilateral innovative capabilities. International Journal of Manpower, 34(8), 861-879.

- Zack, M.H. (1999). Developing a knowledge strategy. California Management Review, 41(3), 125-145.