Research Article: 2021 Vol: 20 Issue: 4S

Intellectual Capital on Cultural Sustainability Practices in Microfinance at Bali

Mirah Ayu Putri Trarintya, Udayana University

Ni Luh Putu Wiagustini, Udayana University

LG Sri Artini, Udayana University

I Wayan Ramantha, Udayana University

Keywords:

Intellectual Capital, Financial Performance, Sustainability Practices

Abstract

This study aims to examine the effect of intellectual capital which consists of structural capital, relationship capital, social capital and reputation capital on business sustainability practices that are mediated by financial performance. Many previous researchers measured business sustainability practices by using the Triple Bottom Line. In this study, it was measured by the Tri Warga concept, which is the concept of Balinese local culture that has been developed and has the same spirit as Profit, People, and Planet. Previous research has examined the effect of sustainability practices on financial performance, but in this study financial performance is used as a mediating variable. By using 100 samples of Village Credit Institutions (Lembaga Perkreditan Desa/LPD) which are Microfinance belonging to Traditional Villages in Bali, the relationship between variables was analyzed by using Structure Equation Modeling through the approach Partial Least Square. The results of the study concluded that capital structural and social capital had a significant positive effect on both performance financial and sustainability practices. Financial performance has a significant effect on sustainability practices. Only capital structural and social capital can be mediated by financial performance against sustainability practices as measured by Tri Warga.

Introduction

One of the well-known microfinance institutions in Indonesia is the Village Credit Institution (LPD) which was founded in 1984. Up to now, there are 1,433 LPD units belonging to each of the Traditional Villages in Bali. In the era of financial inclusion that is developing in Bali, LPDs compete fiercely and freely with commercial banks, people's credit banks and savings and loan cooperatives, both in raising funds and extending credit. Various strategies must be implemented by the LPD in order to maintain the sustainability of its business, including by exploring and utilizing all its intellectual capital. Intellectual capital is the key to a company's competitive advantage (Hejazi, Ghanbari & Alipour, 2016). Intellectual capital can improve financial performance (Meles, Porzio, Sampagnaro & Verdoliva, 2016), so that it can maintain the sustainability of its business. Another study examined the effect of capital structure on financial sustainability in microfinance institutions in developing countries (Nguyen, 2016).

The results found that financial sustainability is negatively and significantly influenced by the capital structure. Research by Farah, Mbebe & Muyoka (2019) on savings and loan institutions in Kenya found that human capital, structural capital, and relational capital have a positive and significant effect on financial sustainability.

Intellectual capital consists of human capital, customer capital, structural capital, social capital, technological capital and spiritual capital (Hashim, Osman & Alhabshi, 2015). All the elements of intellectual capital can improve company performance. Muhmad & Hashim (2017) stated that the measurement of banking financial performance uses Capital, Asset, Earning and Liquidity (CAEL). The three dimensions of sustainability practices by Zyadat (2017) are explained in the form of an economic dimension, environmental dimension, and social dimension. Meanwhile, Arowoshegbe & Emmanuel (2016) explain that the measurement of sustainability uses the triple bottom line which was designed by John Elkington in 1994 and introduced in 1997 in the form of people, planet, and profit.

In this study, the only components of intellectual capital that are selected as independent variable are the specific ones owned by LPDs in Bali, namely structural capital, relationship capital, social capital and reputation capital. The structural capital of the LPD is in the form of a distinctive organizational culture and a unique organizational structure where the Chair of the Supervisory Board is ex officio the Chair of a Traditional Village called Bendesa Adat. The relationship capital of the LPD is very strong because LPD customers, both savers and borrowers, are the owners, because they are residents of the Traditional Village. The social capital of the LPD is very unique, because the social relations between LPD administrators and employees also come from residents of the Traditional Village. In addition, LPD social rules such as sanctions socialfor residents/customers who have bad credit are also regulated in customary rules called Awig-Awig and Perarem. The reputation capital of the LPD is very clear because the depositor community feels safe that their funds are managed by the organization they have, while the borrowers believe that the profit earned by the LPD is also for their benefit.

Measurement of financial performance using indicators capital, Asset, Earning, and Liquidity (CAEL) which are used to measure financial performance by LPD Trustees (LP LPD). The use of CAEL which is part of CAMEL is also based on the consideration that CAMEL can measure financial conditions from various dimensions which are often the concern of parties with an interest in the operations of a bank or financial institution (Saif-Alyousfi, Saha & Md-Rus, 2017). The measurement of sustainability practices adopts a measuring tool developed from Balinese local culture, namely Tri Warga in the same philosophy of Catur Purusa Artha with theconcept Triple Bottom Line. The concept of Tri Warga in Catur Purusa Artha explains that in order to obtain perfection. Artha in this case, the profit earned by the LPD should be divided into 3 (Tri) parts (Warga) into artha for artha (profit/return earning), artha for dharma (planet), and artha for kama (people).

Some researchers conclude that intellectual capital has a significant effect on company performance (Anuonye, 2016; D?enopoljac, Janoševic & Bontis, 2016; Singh, Sidhu, Joshi & Kansal, 2016). Alshehhi, Nobanee & Khare (2018) in their research concluded that there is a positive and significant influence between business sustainability and financial performance.

Several theoretical and empirical studies that have been described in the background, explain that strategic resources in the form of structural capital, relationship capital, social capital and reputation capital will become a competitive basis, which in turn can improve LPD performance. The performance improvement will then be linked to the LPD's ability to apply the theory Triple Bottom Line in implementing Catur Purusa Artha which is used as a proxy to measure the level of business sustainability.

Thus, this study will answer the research question: What is the role of strategic resources in the form of; capital structural, relational capital, social capital and reputation capital as the basis for improving performance to maintain Sustainability Practices in LPDs in Bali Province.

Literature Review

Intellectual capital has been considered as a crucial factor in business by many, and formally valued by practically no one (Bontis, 1998; Yaseen, Dajani & Hasan, 2016). Intellectual capital described by Hashim, et al., (2015) consists of human capital, customer capital, structural capital, social capital, technological capital and spiritual capital. Research by Ulum, Ghozali & Purwanto, (2014) in the banking sector in Indonesia, One of the conclusions is that structural capital is a strong variable which explains the Modified Value Added Intellectual Capital. There are many empirical findings on the effect of structural capital on financial performance, such as (Hashim et al., 2015; Luminta, Artene, Sarca & Draghici, 2016; Sayad & Pourmohammadi, 2014).

Relationship capital has a huge influence on the performance of financial institutions. Borrower relations for financial institutions according to Uchida, Udell & Yamori (2012)is the interaction of borrowers and lenders are recurrent(repeated),so that a close relationship is established between the two parties. Empirical research on financial institutions One of the conclusions explained that relationship capital has a positive effect on financial performance by Meles, et al., (2016) in an American commercial bank. Another research finding that explains the positive effect of relational capital on company performance was carried out by Anuonye (2016). Meanwhile, different research results obtained by previous studies (Mention & Bontis, 2013; Xu & Li, 2019) that found the relational capital has no effect on firm performance.

Social capital is very important for the performance and business sustainability of LPD Bali, because the purpose of its establishment according to (Mantra, 1984) is to assist traditional villages in carrying out their cultural functions. Hossain (2013) in his research describes the success of Grameen Bank in introducing the concept of social capital in the banking system by not spoiling the public with donations, but not forgetting its social function. Banks are still directed to look for profits to maintain their survival. Some researchers explain that there is a positive and significant influence between social capital and microfinance performance (Chmelíková, Krauss & Dvouletý, 2019; Hossain, 2013; Postelnicu & Hermes, 2018). Research by Dar & Mishra (2020) found that social capitalhas a significant impact on increasing company performance.

Reputation capital by Hashim, et al., (2015)are grouped into Customer Capital also known as relational capital or external capital consists of relationships with customers and suppliers, the government or related industry associations, brand names, and trademarks. Research that explains the effect of reputation capital on financial performance with the conclusion that several dimensions of reputation capital can be predictors important of financial performance and become valid motivations for business executives to use reputation as a company's business strategy.

The measurement of LPD performance in Bali uses CAMEL and CAEL is used to measure its financial performance Ramantha (2018). CAEL consists of Capital, Asset, Earning, and Liquidity. Capital calculations are based on the percentage comparison between capital and risk-weighted assets. The calculation of assets uses two components, namely the quality of the earning assets and the ratio of reserves for doubtful loans. Earning calculation uses two components, namely the ratio of Return on Assets (ROA) and cost and income savings calculations Liquidity use two ratios, namely the ratio of liquid assets and the ratio of loans to funds received. The use of CAEL is indeed based on the Bali Governor's Regulation on LPD Health. The use of CAMEL was assessed by Saif-Alyousfi, et al., (2017) can measure the financial condition of a bank from various dimensions which are often the attention of parties with an interest in the operations of a bank.

Regarding the efficiency of research by Naz, Salim, Rehman, Ahmad & Ali (2019) entitled Determinants of financial stability of microfinance institutions in Pakistan, one of the conclusions stated that Microfinance Institutions in Pakistan in the use of costs are inefficient and it affects profitability and financial sustainability.

Sustainability practices implemented by LPD Bali are based on regulations in the form of Regional Regulations (Perda) which have undergone several changes, the last 3 of 2017 which divides LPD profits into 60% for retained earnings which in Tri Warga called Artha for Artha or in the Triple Bottom Line the same as Profit. 20% for customary villages and 5% for social funds in Tri Warga called Artha for Dharma or in the Triple Bottom Line the same as Planet. 10% for incentives for supervisors, administrators, employees and 5% for coaching funds which in Tri Warga is called Artha for Kama or in the Triple Bottom Line the same as People.

Based on the theoretical explanation and research results that have been described, hypotheses can be formulated in this study:

H1: Capital Structural has a positive and significant effect on financial performance

H2: Relational capital has a positive and significant effect on financial performance

H3: Social capital has a positive and significant effect on financial performance

H4: Reputational capital has a positive and significant effect on financial performance

H5: Structural capital has a positive and significant effect on sustainability practices

H6: Relational capital has a positive and significant effect on sustainability practices

H7: Social capital has a positive and significant effect on sustainability practices

H8: Reputational capital has a positive effect and significant impact on sustainability practices

H9: Financial performance has a positive and significant effect on sustainability practices

H10: Structural capital has a positive and significant effect on sustainability practices through performance mediation JA finance

H11: Relational capital has a positive and significant effect on sustainability practices through mediation of financial performance

H12: Social capital has a positive and significant effect on sustainability practices through mediation ofperformance financial

H13: Reputation capital has a positive and significant effect on sustainability practices through mediation of financial performance

Method

Location, Variables and Indicators Research

This research was conducted at LPD in Bali Province. The timing of this research is in 2020. The location of this research is determined in all districts/cities in Bali. Structural capital used two indicators: organizational culture and organizational structure (Bontis, 1998). Relational capital used two indicators: relationships with customers and relationships with government (Ulum et al., 2014). Social capital used two indicators: relationship with community and relationship with customary village (Hashim et al., 2015). Reputation capital used two indicators: reputation as a recipient of deposits and reputation as a credit provider (Meles et al., 2016). Financial performance is measured by four indicators of capital, assets, earnings, and liquidity (Saif-Alyousfi et al., 2017). Sustainability practices used three indicators: Artha-Artha, Artha-Dharma, Artha-Kama (Ramantha, 2018).

Population, Sample, and Data Analysis Method

This study is the relationship between intellectual capital and sustainability practices with the mediation of financial performance on microfinance in Bali. The population are 1,433 Village Credit Institutions (Lembaga Perkreditan Desa/LPD) that is spread in nine districts.

Samples were taken from 100 LPDs in proportion to the number of LPDs in each district. This research is a quantitative design by testing the hypotheses using SEM PLS analysis technique.

Result and Discussion

Testing the Validity and Reliability of Constructs

Convergent Validity

The results of the analysis of this study present the latent constructs with each supporting indicator. A complete presentation of each latent construct and its indicators is presented in the following

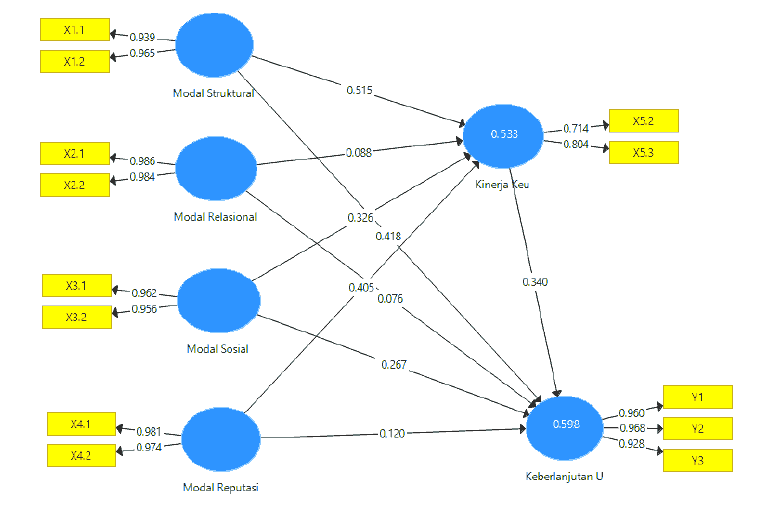

Based on the data presented in Table 1, it turns out that there are indicators whose value outer loading is less than 0.5, namely x5.1 (Capital) of 0.245 and x5.4 (liquidity) of -0.011 so that the two indicators must be eliminated. After the two indicators are eliminated, finally all indicators have an outer loading above 0.5 as shown in Figure: 1

| Table 1 Outer Loading Indicators of Intellectual Capital, Financial Performance and Sustainability Practices of LPD in Bali Province |

|||||

|---|---|---|---|---|---|

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | |

| x1.1<- Structural Capital | 0,939 | 0,939 | 0,019 | 50.01 | 0,000 |

| x1.2<-Structural Capital | 0,965 | 0,964 | 0,011 | 88.291 | 0,000 |

| x2.1<- Relational Capital | 0,986 | 0,985 | 0,004 | 261.558 | 0,000 |

| x2.2<- Relational Capital | 0,984 | 0,984 | 0,004 | 227.985 | 0,000 |

| x3.1<- Social Capital | 0,962 | 0,951 | 0,137 | 7.032 | 0,000 |

| x3.2<- Social Capital | 0,956 | 0,944 | 0,149 | 6.408 | 0,000 |

| x4.1<- Reputation Capital | 0,981 | 0,980 | 0.005 | 191.78 | 0,000 |

| x4.2 <- Reputation Capital | 0,974 | 0,973 | 0,008 | 129.109 | 0,000 |

| x5.1 <- Capital | 0,245 | 0,229 | 0,292 | 0,839 | 0,402 |

| x5.2<- Asset | 0,714 | 0,661 | 0,242 | 2.947 | 0,003 |

| x5.3<- Earning | 0,804 | 0,787 | 0,168 | 4.787 | 0,000 |

| x5.4 <- Liquidity | -0,011 | 0,074 | 0,306 | 0,034 | 0,730 |

| y1<- Artha | 0,960 | 0,961 | 0,012 | 83.494 | 0,000 |

| y2<- Dharma | 0,968 | 0,970 | 0,013 | 76.01 | 0,000 |

| y3<- Kama | 0,928 | 0,925 | 0,024 | 37.996 | 0,000 |

Figure 1: Full Structural Model of Strategic Resources as a Predictor of Financial Performance on the Sustainability of LPD Business in Bali Province

Discriminate Validity

Measurement of reflective indicators based on cross loading with latent variables. If the correlation of the variable with the measurement item is greater than the measure of other variables, then the latent variable can predict the size of the block better than the other block sizes (Fornell & Larcker, 1981). Another method is to compare the square root of average variance extracted (√AVE) value of each construct with the correlation between other constructs in the model. The recommended measurement value must be greater than 0.50. The results of the calculation of Discriminant Validity in this study are as follows

Based on calculations Discriminant Validity as in Table 2, all variables reflective value square root of average variance extracted √AVE greater than 0.50.

| Table 2 Results of the Calculation of Discriminant Validity |

|||

|---|---|---|---|

| No | Variable | AVE | vAVE |

| 1 | Structural Capital (X1) | 0,907 | 0,952 |

| 2 | Relational Capital (X2) | 0,970 | 0,823 |

| 3 | Social Capital (X3) | 0,920 | 0,952 |

| 4 | Reputation Capital (X4) | 0,955 | 0,985 |

| 5 | Financial Performance (X5) | 0,678 | 0,960 |

| 6 | Sustainability Practices (Y) | 0,907 | 0,978 |

Composite Reliability and Cronbach Alpha Test

Variables are declared reliable if they have a composite reliability and Cronbach alpha value greater than 0.60. The values of Composite Reliability and Cronbach Alpha are presented in Table 3 below,

| Table 3 Results of the Calculation of Composite Reliability and Cronbach's Alpha |

|||

|---|---|---|---|

| No | Variable | Composite Reliability | Cronbach's Alpha |

| 1 | Structural Capital (X1) | 0,951 | 0,899 |

| 2 | Relational Capital (X2) | 0,985 | 0,969 |

| 3 | Social Capital (X3) | 0,958 | 0,913 |

| 4 | Reputation Capital (X4) | 0,977 | 0,953 |

| 5 | Financial Performance (X5) | 0,732 | 0,732 |

| 6 | Sustainability Practices (Y) | 0,967 | 0,949 |

Based on calculations presented in Table: 3 shows that all reflective constructs have a high reliability rate, all constructs have values Composite Reliability and Cronbach Alpha above 0.60. It can be concluded that based on the validity and reliability calculations carried out through several criteria such as convergent validity, discriminant validity, composite reliability and cronbach alpha, all reflective indicators that form the variables and variables that make up the model in this study are valid and reliable.

Evaluation of Structural Model Test Goodness of Fit InnerModel)

R-Square (R2)

R2 indicates the strength of the effect caused by variations in variables the endogenousto exogenous variables. R-Square (R2) greater than 0.50 is categorized as a strong model. The R-Square (R2) value of each variable is endogenous presented in Table: 4 below:

| Table 4 Results of the Calculation of R Square |

|

|---|---|

| Laten Variable | R Square |

| Financial Performance (X5) | 0,533 |

| Sustainability Practices (Y) | 0,598 |

| Source: Data Analysis Results | |

Based on the table above, R2 values of Financial Performance0.533 and Sustainability Practices0.598 indicate that the model formed by these two variables is classified as strong.

Q2 =1 - (1-0.533) (1-0.598)

=1 - (0.467) (0.402)

=1 - 0.1878

=0.8122

The total determination coefficient of 0.8122 means that 81.22 percent of the variation of Business sustainability can be explained by the model formed (the latent variables of Structure Capital, Relational Capital, Social Capital, Reputation Capital, Financial Performance), while the remaining 18.78 percent is explained by other variables outside the model which are not analyzed in the research model.

Statistical Testing the Relationship between Variables (Path)

Direct Relationship between Variables

Based on Table 5 can be explained that the Structural Capital variable has a positive and significant effect on financial performance with a probability of 0.000 or less than 5 percent.

Structural Capital has a positive and significant effect on Sustainability Practices with a probability of 0,000 or less than 5 percent. The Relational Capital variable has a positive but insignificant effect on financial performance with a probability of 0.845 or more than 5 percent. Relational Capital has a positive and insignificant effect on Sustainability Practices with a probability of 0.733 or more than 5 percent. Social Capital has a positive and significant effect on financial performance with a probability of 0.000 or less than 5 percent. Social Capital has a positive and significant effect on Sustainability Practices with a probability of 0.000 or less than 5 percent. Reputation Capital are positive and insignificant effect on financial performance with a probability of 0.278 or more than 5 percent. Reputation capital are positive but not significant effect on sustainability practices with a probability of 0.881. Variables of financial performance and significant positive effect on the Business Continuity with a probability value of 0.000 or less than 5 percent.

| Table 5 Statistical Test Results Direct Relationship Between Variables |

||||||

|---|---|---|---|---|---|---|

| Original Sample | Sample | Standard | T Statistics | P Values | Hypotesis | |

| Sample (O) | Mean (M) | Deviation (STDEV) | (|O/STDEV|) | Decision | ||

| Structural Capital ->Financial Performance | 0,515 | 0,438 | 0,232 | 4,220 | 0,000 | Accepted |

| Structural Capital-> Sustainability Practices | 0,418 | 0,434 | 0,188 | 4,224 | 0,000 | Accepted |

| Relational Capital ->Financial Performance | 0,088 | 0,097 | 0,153 | 0,574 | 0,845 | Rejected |

| Relational Capital-> Sustainability Practices | 0,076 | 0,071 | 0,113 | 0,675 | 0,733 | Rejected |

| Social Capital ->Financial Performance | 0,326 | 0,349 | 0,138 | 4,369 | 0,000 | Accepted |

| Social Capital-> Sustainability Practices | 0,267 | 0,248 | 0,149 | 4,190 | 0,000 | Accepted |

| Reputation Capital ->Financial Performance | 0,405 | 0,337 | 0,321 | 1,261 | 0,278 | Rejected |

| Reputation Capital-> Sustainability Practices | 0,120 | 0,089 | 0,173 | 0,691 | 0,881 | Rejected |

| Financial Performance -> Sustainability Practices | 0,340 | 0,346 | 0,093 | 3,647 | 0,000 | Accepted |

Indirect Relationship between Variables

Based on Table 6 can be explained that the effect of Sustainability Practices through Financial performance with 0,000 probability or less than 5 percent explained that variable Financial performance afford mediate the influence of Structural Capital on Sustainability Practices.

The influence of the Relational Capital variable on Sustainability Practices through Financial Performance with a probability of 0.601 or more than 5 percent. This means that the Financial Performance variable is not able to mediate the effect of Relational Capital on Sustainability Practices. The probability of the positive influence of Social Capital on Sustainability Practices through Financial Performance of 0.000 or less than 5 percent explains that the Financial Performance variable is able to mediate the positive effect of Social Capital on Sustainability Practices. The probability of the influence of Reputation Capital on Sustainability Practices through financial performance is 0.253 or more than 5 percent. This means explaining the Financial Performance variable is not able to mediate the effect of Reputation Capital on Sustainability Practices.

| Table 6 Statistical Test Results of Indirect Relationship Between Variables |

||||||

|---|---|---|---|---|---|---|

| Original Sample | Sample | Standard | T Statistics | P Values | Hypotesis | |

| Sample (O) | Mean (M) | Deviation (STDEV) | (|O/STDEV|) | Decision | ||

| Structural Capital->FP-> SP | 0,175 | 0,168 | 0,092 | 4,029 | 0,000 | Accepted |

| Relational Capital->FP-> SP | 0,030 | 0,035 | 0,057 | 0,524 | 0,601 | Rejected |

| Social Capital->FP-> SP | 0,111 | 0,120 | 0,054 | 4,045 | 0,000 | Accepted |

| Reputation Capital->FP-> SP | 0,138 | 0,119 | 0,120 | 1,145 | 0,253 | Rejected |

Discussion of Research Results

The Effect of Structural Capital on Financial Performance

The results of the study found that Structural Capital has a positive and significant effect on financial performance. These results indicate that if the condition of the Structural Capital is reflected in a strong organizational culture in which all personnel are very much alive to the vision, mission and goals of the LPD which prioritizes the interests of the customary village, it causes them to be enthusiastic and work hard. On the other hand, the existence of Bendesa Adat in the organizational structure which acts as chairman of the supervisory board, is very interested in directing LPD policies to be effective and efficient. This condition will have an impact on the ratio of operating costs to operating income that is efficient, which in turn can increase therate of capital (return on Return on Assets optimal).

High commitment to typical LPD organizational practices and understanding that the purpose of establishing an LPD is to maintain the cultural functions of traditional villages, so LPD administrators and employees will try to approach the community, both as depositors and as debtors in order to use the LPD as a financial intermediary institution will benefit and alleviate the burden on the community is always the customary village residents. The awareness of such management and employees, of course, has obtained the approval of Bendesa Adat because structurally Bendesa Adat is not only a traditional village head but also ex officioas chairman of the LPD supervisory board. These measures will streamline the ratio of Operating Costs to Operating Income (BOPO) and increase the LPD's profit (ROA). These findings support the research results of (Gamayuni, 2015; Khalique, Shaari, Isa & Ageel, 2011; Maditinos, Chatzoudes, Tsairidis & Theriou, 2011; Postelnicu & Hermes, 2018; Sayad & Pourmohammadi, 2014).

Effects of Relational Capital on Financial Performance

The results of the study found that Relational Capital has a positive but insignificant effect on Financial Performance or Relational Capital has no effect on Financial Performance. These results indicate that if the condition of Relational Capital is reflected in customer loyalty in transactions with the LPD and LPD loyalty in carrying out its responsibilities, it will have no impact to LPD profit. The loyalty of customers who save and place deposits in the LPD continues to increase and the high level of public savings causes the interest costs to be borne by the LPD to be even greater.

The success of receiving high funds, unfortunately, cannot be matched by high credit distribution, so that the average Loan to Deposit Ratio (LDRLPD) tends to decline, which then has an impact on increasing financial performance which is not too significant. The insignificant increase in LPD profit is also caused by the fact that excess liquidity has to be placed in asset banks, whose interest rates are lower than the public savings rate (cost of funds) in the LPD.

This finding is in line with Marguerite's (2001) explanation which states that even though it is classified as afully self-sufficient institution and is able to generate profits, a microfinance institution will still carry out social functions and establish good relationships with its customers. The findings of this study are also in line with the previous findings (Mention & Bontis, 2013; Xu & Li, 2019) found that relational capital has no effect on firm performance. The findings of this study are not in line with the previous findings (Anuonye, 2016; Hashim et al., 2015; Singh et al., 2016) which is the initial prediction, which states that Relational Capital has a positive and significant effect on financial performance.

The Influence of Social Capital on Financial Performance

The results found that Social Capital had a positive and significant effect on financial performance. These results indicate that if the condition of social capital, which is reflected in the skills of LPD managers and employees in collaboration with the community, coupled with clear perceptions and commitments about the goals and values of the LPD, increases, the LPD's Financial Performance will also increase.

The skills of LPD administrators and employees working with the community make the community feel close to the LPD. This closeness and trust is then manifested in the loyalty of the community to save funds and seek credit in the LPD, so that the LPD's assets continue to increase and its ability to channel credit also increases. The increase in assets and credit distribution is a potential for increasing LPD profit.

In addition to the fact that the amount of credit disbursement has continued to increase from year to year, the efficiency of the LPD is also influenced by the low risk of bad credit due to the social sanctions imposed by the LPD on debtors with bad credit. These social sanctions are usually contained in the LPD's, known as statutesAwig-Awig and by laws Perarem. These anctions social will encourage debtors to be diligent in carrying out their obligations, which in turn reduces the cost of eliminating bad debts. In this way, LPDs will become more efficient and their financial performance as measured by earning asset quality and profit will increase. The results of this study support the previous findings (Hashim et al., 2015; Khalique et al., 2011; Wang, 2019), namely that there is a positive and significant relationship between social capital and company performance. Social capital has a significant impact on increasing company performance also supports the results of this study (Dar & Mishra, 2020; Yaseen et al., 2016).

The Effect of Reputation Capital on Financial Performance

The results of the study found that Reputation Capital had a positive but not significant effect on Performance Financial or Reputation Capital had no effect on Financial Performance. These results indicate that if the condition of Reputation Capital is reflected in the habit of LPDs that provide high interest on the deposits they receive and easily seek credit without going through complicated procedures, they are unable improve LPD financial performance.

The high deposit interest rate is accompanied by the absence of an obligation to cut interest income tax on customer deposits, indeed causing people to prefer to place their funds in the LPD. High fund accumulation when accompanied by unbalanced lending as previously described causes the Loan to Deposit Ratio (LDR) to be low, which in turn has the potential to reduce LPD efficiency and profitability to increase but not significantly. On the other hand, even though the procedure for disbursing credit by LPDs is not complicated, the high LPD credit interest rates in the midst of competition for cheap bank credit interest rates (such as the People's Business Credit/KUR interest) which are already massive to the countryside, have also caused LPD credit distribution to experience difficulties, which in turn will lead to less than optimal LPD profit.

Thus, although LPD's Reputational Capital can improve its Financial Performance, the increase is not significant. The findings of this study do not support the findings of Hashim et al. (2015)which states that Reputation Capital has a positive and significant effect on financial performance. This finding is also not in line with the findings of Silvija, et al., (2017) in his research entitled The Impact of Reputation on Corporate Financial Performance on companies in Croatia, the results show that several dimensions of reputation capital can be important predictors of financial performance.

The Influence of Structural Capital on Sustainability Practices

The research found that Structural Capital has a positive and significant effect on Sustainability Practices. These results indicate that the condition of Structural Capital which is reflected in a strong organizational culture in which all personnel are very much alive to the vision, mission and goals of the LPD which prioritizes the interests of the customary village continues to increase. On the other hand, the existence of Bendesa Adat in the organizational structure that acts as chairman of the supervisory board is very likely to continuously direct LPD policies towards the interests of the customary village. This condition will have an impact on increasing operational costs incurred by the LPD for the benefit of traditional villages as an indicator of Sustainability Practices which in this study is measured by Artha for Dharma as part of the implementation of Catur Purusa Artha as mandated by Tri Warga in Saracamuscaya Sloka 262.

Understanding the height of the board and employees that the purpose of the establishment of the LPD is to maintain the cultural function of the traditional village, then they will be allocating the costs for routine activities such as subsidies indigenous village implementation costs upakara and the like. Such policies for management and employees are accompanied by the support of Bendesa Adat because structurally Bendesa Adat is not only the head of the customary village but also ex officio as chairman of the LPD supervisory board, so such cost policies are carried out periodically. The greater allocation of costs and profits will increase the LPD's Sustainability Practices as Artha for Artha, Dharma and Kama or for Profit, People and Planet in the theory Triple Bottom Line.

The conclusion of his research is that a thorough understanding and efficient management of structural capital provides valuable opportunities and tools for companies to achieve sustainable competitiveness in today's dynamic and competitive market. This study also supports the results which found that human capital, structural capital, and relational capital have a positive and significant effect on financial sustainability (Farah et al., 2019).

The Effect of Relational Capital on Sustainability Practices

The results of the study found that Relational Capital has a positive but not significant effect on Sustainability Practices or Relational has no effect. Towards Sustainability Practices. These results indicate that if the condition of Relational Capital is reflected in customer loyalty in transactions with the LPD and LPD loyalty in carrying out its social responsibility, it is not will have impact on LPD Business Sustainability. The loyalty of customers who save and place deposits in the LPD continues to increase and the high level of public savings causes the interest costs to be borne by the LPD to be even greater.

The high cost of saving interest as a cost of funds will reduce the interest margin, LPD's which in turn will reduce the LPD's ability to allocate costs for the benefit of customary villages so that the LPD will still earn a profit. This condition causes the cost allocation for traditional villages which is an indicator of Artha for Dharma to increase. Likewise, the result of the profit that is not too large causes the LPD profit sharing policy of 20 percent for customary villages and 5 percent for social funds will be insignificant for Artha for Dharma.

The findings of this study do not support the findings of Maria, et al., (2018) who conducted a study entitled Managing Relational Capital for the Sustainability of the Energy Sector in the Social Media. Whose research results show that with the use of relational capital variables, companies can connect the company's intangible assets with strategy and business within the company for Sustainability Practices.

The Influence of Social Capital on Sustainability Practices

The results of the study found that Social Capital has a positive and significant effect on Sustainability Practices. These results indicate that if the condition of social capital, which is reflected in the skills of LPD management and employees in collaboration with the community, coupled with clear perceptions and commitments about the goals and values of the LPD, increases, and then LPD Sustainability Practices will increase.

The skills of LPD administrators and employees working with the community make the community feel close to the LPD. This closeness and trust is then manifested in the loyalty of the community to save funds and seek credit in the LPD, so that the LPD's assets continue to increase and its ability to channel credit also increases. The increase in assets and lending certainly has the potential to increase LPD profit.

High assets caused by good social relationships with customers will support the smooth quality of earning assets. The high current productive assets will increase the LPD's opportunity to allocate costs to support traditional villages that are classified as Artha for Dharma. The high LPD profit due to smooth productive assets can also increase the amount of 20 percent distributed to traditional villages and 5 percent for social funds which are also components of Artha for Dharma. The high profit due to smooth productive assets also causes an increase in capital reserves which is Artha for Artha and an increase in the manager's bonus which is Artha for Kama, which is an indicator of Sustainability Practices.

The findings of this study support the research of Kusaka be (2012) in his research entitled Social capital networks for achieving sustainable development in Japan, whose conclusion explains that the accumulation of social capital can make a difference in achieving Sustainability Practices.

The Influence of Reputation Capital on Sustainability Practices

The results of the study found that reputation capital had a positive but insignificant effect on business sustainability or reputation capital did not affect business sustainability. These results indicate that if the condition of Reputation Capital is reflected in the habit of LPDs that provide high interest on deposits received and easily provide credit without going through complicated procedures but the analysis is not in-depth, it will make the LPD inefficient.

The high deposit interest rate is accompanied by the absence of an obligation to cut interest income tax on customer deposits, indeed causing people to prefer to place their funds in the LPD. High accumulation of funds with unbalanced lending causes the Loan to Deposit Ratio (LDR) to be low, which in turn has the potential to reduce the efficiency and profitability of the LPD to not optimal. On the other hand, even though the procedure for disbursing credit by LPDs is not complicated, the high LPD credit interest rates in the midst of competition for cheap bank credit interest rates (such as the People's Business Credit/KUR interest) which are already massive to the country side, have also caused LPD credit distribution to experience difficulties. which in the end causes the LPD's profit to be not optimal. The reduced efficiency on the one hand and the obligation to keep the LPD profitable, on the other hand, resulted in a reduced opportunity for the LPD to allocate costs to support the traditional village which is Artha for Dharma. Such conditions make it clear that the increase in Reputation Capital can indeed increase Business Sustainability but not too significantly.

The findings of this study are not in line with the findings of Naz, et al., (2019) which states that inefficient use of costs will affect financial sustainability.

The Effect of Financial Performance on Business Sustainability

The research found that financial performance has a positive and significant effect on business sustainability. These results indicate that if the condition of the Financial Performance which is reflected in the quality of the productive assets, efficiency and profitability of the LPD increases, it will have the potential to increase the LPD's Business Sustainability.

If the LPD can increase its efficiency and profitability, it will increase the opportunity for the LPD to allocate costs for routine needs in supporting customary villages. These routine expenses are the manifestation of Artha for Dharma (planet in the triple bottom line) which is an indicator of the LPD's Business Sustainability. The achievement of high profits will also increase the LPD allocation to provide various allowances and incentives for LPD employees which is the manifestation of Artha for Kama (people in the triple bottom line) which is also an indicator of Business Sustainability.

The findings of this study support the research findings of Alshehhi, et al., (2018) entitled: The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential, which. The conclusion explains that from 132 articles from popular journals, 78% concluded that there was a positive and significant influence between business sustainability and financial performance. This finding is not in line with Nguyen (2016) findings on Microfinance Institutions (MFIs) in developing countries which found that the financial sustainability of MFIs in developing countries is negatively and significantly influenced by the capital structure which is one of the indicators of financial performance.

The Influence of Structural Capital on Business Sustainability through Financial Performance Mediation

The results of the study found that Structural Capital has a positive and significant effect on Business Sustainability through Financial Performance mediation. These results indicate that the condition of the Structural Capital is reflected in a strong organizational culture in which all personnel are deeply involved in the vision, mission and objectives of the LPD which prioritizes the interests of the customary village. On the other hand, the existence of Bendesa Adat in the organizational structure which acts as chairman of the supervisory board has a very important role in directing LPD policies towards the interests of the customary village. Meanwhile, on the other hand, there is an obligation for the LPD to maintain its earning asset quality and profitability. This condition will have an impact on the alignment of the LPD's financial performance targets with efforts to maintain its Business Sustainability.

With a high commitment to typical LPD organizational practices and an understanding that the purpose of establishing an LPD is to maintain the cultural functions of traditional villages, LPD administrators and employees will allocate a lot of costs for routine customary village activities such as subsidizing costs for carrying out ceremonies and the like. Such policies of management and employees certainly get the approval of Bendesa Adat because structurally Bendesa Adat is not only the head of a traditional village but also ex officio. As chairman of the LPD supervisory board. Allocation of these costs will increase Artha for Dharma which is an indicator of business sustainability, but on the other hand the LPD must maintain its financial performance. This finding is consistent with the results of research by Cabrita, et al., (2008) entitled Intellectual Capital and Business Performance in the Portuguese Banking Industries, which states that all components of intellectual capital have a significant effect on the performance and sustainability of banking in Portugal.

Effects of Relational Capital on Sustainability Practices through Mediation of Financial Performance.

The results of the study found that Relational Capital has a positive and insignificant effect on Sustainability or Relational Capital has no effect on Financial Performance. Efforts through mediation of Financial Performance. These results indicate that if the condition of Relational Capital is reflected in customer loyalty in transactions with the LPD and LPD loyalty in carrying out its social responsibility, it will not have an impact on Sustainability Practices.

The loyalty of customers who save and place deposits in the LPD continues to increase and the high level of public savings causes the interest costs to be borne by the LPD to be even greater. The success of receiving high funds, unfortunately, cannot be matched by high credit distribution, so that the average Loan to Deposit Ratio (LDRLPD) tends to decline, which then impacts on suboptimal financial performance.

Improving financial performance that is not too optimal then requires the LPD to reduce its operational cost allocations aimed at Business Sustainability, especially for the benefit of traditional villages which are the embodiment of Artha for Dharma. Resources are less able to explain benefits to stakeholders partially, but must be mediated by financial performance.

The Influence of Social Capital on Sustainability Practices through Financial Performance Mediation

The results of the study found that social capital has a positive and significant effect on business sustainability through financial performance mediation. These results indicate that if the condition of social capital, which is reflected in the skills of LPD management and employees in collaboration with the community, coupled with clear perceptions and commitments about the goals and values of the LPD, increases, and then LPD Sustainability Practices will increase through mediation of Financial Performance.

The LPD's personal skills in dealing with the community make the community feel close. This closeness and trust is then manifested in the loyalty of the community to save funds and seek credit in the LPD, so that the LPD's assets continue to increase and its ability to channel credit also increases. The increase in assets and lending has the potential to increase profits and reduce the percentage of bad loans.

High assets caused by good social relationships with customers, supported by the quality of current earning assets, will result in a lower cost of bad credit risk which must be recorded by the LPD as a reserve for deletion of bad debts. The low cost of eliminating doubtful accounts will increase the LPD's opportunity to allocate costs to support customary villages and the amount of profit is allocated to the routine part of the traditional village which is classified as Artha for Dharma as an indicator of Sustainability Practices.

The findings of this study support the results of the research by (Cabrita & Bontis, 2008) entitled Intellectual Capital and Business Performance in the Portuguese Banking Industries which states that all components of intellectual capital have a significant effect on the performance and sustainability of banking in Portugal. But it is not in line with the findings of (Nguyen, 2016) who examined the effect of capital structure on financial sustainability in Microfinance Institutions (MFIs) in developing countries. The results of his research found that the financial sustainability of MFIs in developing countries was negatively and significantly influenced by the capital structure, which is one indicator of financial performance.

Influence of Reputation Capital on Sustainability Practices through Mediation of Financial Performance

Finance Financial performance is not able to mediate the effect of Reputation Capital on Business Sustainability. These results indicate that if the condition of Reputational Capital is reflected in the habits of LPDs that give high interest on their savings and easily seek credit without going through complicated procedures, it will be able to make LPDs profit. but it will not be optimal if it does not implement the prudential principle in lending.

The high interest rate on deposits without the obligation to cut interest income tax has indeed caused people to prefer to place their funds in the LPD. High fundraising without optimal credit distribution causes efficiency to decline. The reduced efficiency on the one hand and the obligation to keep the LPD profitable on the other hand, have resulted in LPD management having to be wise in allocating costs to support traditional villages which are Artha for Dharma. The findings of this study support the research findings of Naz et al.(2019)which states that inefficient use of costs will have a direct or indirect effect on sustainability.

Research Findings

1) Non-financial strategic resources in this study are proxies by intellectual capital influencing the performance and Sustainability Practices of LPD Bali is Structural Capital and Social Capital. Structural Capital which is characterized by an organizational culture, in which all personalities deeply animate the vision, mission and goals of the LPD which is supported by the existence of Bendesa Adat as Chair of the Supervisory Board, plus social relations based on awig-awig and perarem, are the main determinants of Financial Performance and Sustainability LPD Business.

2) Structural Capital and Social Capital which requires LPD to be wise in making decisions on financial performance and Sustainability Practices based on the opinion of Marguerite (2001) from the World Bank which explains that even though microfinance institutions must be independent (Fully self-sufficient Institution), they must be able to cover everything. costs include risk costs and can create profits, on the other hand, he must maintain its sustainability while still carrying out social functions. In keeping with Sustainability Practices, besides allocating 20 percent profit sharing for indigenous village and 5 percent for charity, it turns LPD also spend a lot of costs(expense)for the benefit of indigenous villages.

3) The concept of Catur Purusa Artha, which is a proxy for measuring the sustainability of LPD business according to John Elkington's (1994) theory of the Triple Bottom Line, has actually been implemented by the LPD ten years earlier, namely since 1984. Implementation of Catur Purusa Artha described in Sarasamuccaya Sloka 262 reads : Ekenamcana dharmathah kartavyo bhutimicchata, Ekanamcana kamartha ekanamcam vivirddhayet, Translation: That is the essence, then the results of the work are divided into three. One part is for attaining the Dharma, the second part is for fulfilling Kama, the third part is used for putting effort into thefield Artha to develop again. Then the income obtained by its use is divided by three people who want to obtain.

Conclusions

Based on the research results that have been discussed, it can be concluded that the Catur Purusa Artha concept which is a proxy for measuring Business Sustainability such as Jhon Elkington's (1994) theory on Sustainability has actually been applied by LPD ten years earlier, namely since 1984. Described in Sarasamuccaya Sloka 262 which divides Artha for Artha, Artha for Dharma and Artha for Kama is the same as the Triple Bottom Line concept. Related to the hypothesis, it can be concluded as follows.

1. Structural Capital has a positive and significant effect on Financial Performance. LPD Structural Capital which is reflected in the organizational culture and organizational structure where Bendesa Adat acts as chairman of the supervisory board has a very large role in directing LPD policies so that they run efficiently so that they can further increase profitability which is an important indicator of LPD Financial Performance.

2. Relational Capital has a positive but not significant effect on financial performance. Relational Capital, which is reflected in customer loyalty in transactions with the LPD, if it is not accompanied by prudent and sound lending, can lead to sub-optimal LPD Financial Performance.

3. Social Capital has a positive and significant effect on financial performance. These findings indicate that the increase in LPD Social Capital, which is reflected in the skills of LPD managers and employees working with the community as well as a clear commitment to LPD goals and values, is able to improve LPD Financial Performance. Improved LPD Financial Performance is also driven by customers' fear of Sanctions Socialfor those withnon-performing loans (NPL).

4. Reputation Capital has a positive but not significant effect on financial performance. Reputation capital which is reflected in the habit of LPDs that provide high interest rates on their savings and easily seek credit without going through complicated procedures cannot improve LPD Financial Performance in Bali. This is becausehigh fundraising is not accompanied by quality credit distribution.

5. Structural Capital has a positive and significant effect on Sustainability Practices. Structural Capital is like an organizational culture withBendesa Adat as the supervisory board, often directs LPD policies to the interests of traditional villages, this has an impact on the sustainability of LPD businesses in Bali which is reflected in the implementation of Catur Purusa Artha.

6. Relational Capital has a positive but not significant effect on Sustainability Practices. Relational capital, which is reflected in customer loyalty in transactions with the LPD and loyalty of the LPD in carrying out its responsibility social to customary villages, has not been able to increase LPD Sustainability Practices in Bali.

7. Social Capital has a positive and significant effect on Sustainability Practices. The condition of social capital, which is reflected in the skills of LPD managers and employees in collaboration with the community, coupled with clear perceptions and commitments about the goals and values of the LPD have an impact on the increase in LPD Sustainability Practices in Bali Province.

8. Reputation capital has a positive and insignificant effect on Sustainability Practices. This finding indicates that Reputation Capital, which is reflected in the habit of LPDs giving high interest on people's savings and easily seeking credit without going through complicated procedures, makes LPDs less efficient, because they bear the burden of risk. This inefficiency narrowed the LPD's opportunity to allocate costs for the benefit of customary villages.

9. Financial Performance has a positive and significant effect on Sustainability Practices. Improved financial performance, which is reflected in the quality of productive assets, efficiency and profitability of the LPD, has the potential to increase LPD Business Sustainability. High profitability also provides an opportunity for LPD management to allocate costs for the benefit of customary villages in order to maintain Sustainability Practices.

10. Structural Capital has a positive and significant effect on Sustainability Practices through mediation of Financial Performance. The condition of Structural Capital, which is reflected in a strong organizational culture in which all personalities deeply animate the vision, mission and goals of the LPD, plus the presence of Bendesa Adat as chairman of the supervisory board plays a very important role in directing LPD policies to improve its financial performance while maintaining the sustainability of its business

11. Relational Capital has a positive effect. And not significant to Sustainability Practices through Financial Performance mediation. Relational Capital, which is reflected in customer loyalty in transactions with the LPD and loyalty of the LPD in carrying out its responsibility, social results in less than optimal LPD efficiency. Less than optimal efficiency has limited the LPD's ability to maintain Sustainability Practices in the form of financing traditional village activities.

12. Social Capital has a positive and significant effect on Sustainability Practices through mediation of Financial Performance. Social capital, which is reflected in the skills of LPD administrators and employees in collaboration with the community, coupled with clear perceptions and commitments about the goals and values of the LPD and the existence of social ties through awig-awig and perarem can improve the Financial Performance as well as the Sustainability Practices of the LPD in Bali Province.

13. Reputation Capital has a positive but insignificant effect on Sustainability Practices through mediation of Financial Performance. Reputation Capital, which is reflected in the habit of LPDs giving high interest on deposits and easily seeking credit without going through complicated procedures, creates a risk burden that can increase LPD's Financial Performance but is not optimal, so that the impact on Sustainability Practices is also insignificant.

Suggestions

Based on the descriptions in the previous chapters and conclusions, some suggestions can be made as follows.

1. For LPDs in Bali in improving their financial performance and Sustainability Practices, it can be done through increasing capital structural with a better understanding of the organizational structure where the importance of internal control structures and social capital is in the form of understanding the common goals of customary villages.

2. For the Government, LPD and BKS LPD need to immediately compile a performance measurement tool for LPD management in maintaining its Sustainability Practices. From the purpose of its establishment, it is clear that one of the main functions of the LPD is to protect traditional villages in order to carry out their cultural functions. This management measurement tool needs to be quantified so that it can be compared as a financial performance measurement tool.

3. For further researchers, they can add components of Intellectual Capital such as Human Capital, Technological Capital and Spiritual Capital. To measure LPD performance, both financial and business sustainability. Explores the theories of local knowledge is highly recommended in order to increase their repertoire of knowledge. Further researchers are also advised to conduct qualitative research on LPDs.

References

- Alshehhi, A., Nobanee, H., & Khare, N. (2018). The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability, 10(2), 494.

- Anuonye, N.B. (2016). Effect of intellectual capital on return on assets of insurance firms in Nigeria. Global Journal of Management And Business Research, 16(1–C), 1–13.

- Arowoshegbe, A.O., & Emmanuel, U. (2016). Sustainability and triple bottom line: An overview of two interrelated concepts. Igbinedion University Journal of Accounting, 2(16), 88–126.

- Bontis, N. (1998). Intellectual capital: An exploratory study that develops measures and models. Management Decision, 36(2), 63–76.

- Cabrita, M.D.R., & Bontis, N. (2008). Intellectual capital and business performance in the Portuguese banking industry. International Journal of Technology Management, 43(1–3).

- Chmelíková, G., Krauss, A., & Dvouletý, O. (2019). Performance of microfinance institutions in Europe—Does social capital matter? Socio-Economic Planning Sciences, 68(December), 1–27.

- Dar, I.A., & Mishra, M. (2020). Dimensional impact of social capital on financial performance of SMEs. The Journal of Entrepreneurship, 29(1), 38–52.

- D?enopoljac, V., Janoševic, S., & Bontis, N. (2016). Intellectual capital and financial performance in the Serbian ICT industry. Journal of Intellectual Capital, 17(2), 373–396.

- Farah, A.A., Mbebe, J.N., & Muyoka, B. (2019). Effect of intellectual capital on financial sustainability of savings and credit cooperative societies in Kenya. International Academic Journal of Economics and Finance, 3(3), 427–453.

- Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50.

- Gamayuni, R.R. (2015). The effect of intangible asset, financial performance and financial policies on the firm value. International Journal of Scientific and Technology Research, 4(1), 202–212.

- Hashim, M.J., Osman, I., & Alhabshi, S.M. (2015). Effect of intellectual capital on organizational performance. Procedia-Social and Behavioral Sciences, 211(November), 207–214.

- Hejazi, R., Ghanbari, M., & Alipour, M. (2016). Intellectual, human and structural capital effects on firm performance as measured by Tobin’s Q. Knowledge and Process Management, 23(4), 259–273.

- Hossain, D.M. (2013). Social capital and microfinance: The case of Grameen Bank, Bangladesh. Middle East Journal of Business, 8(4), 1–9.

- Khalique, M., Shaari, J.A.N., Isa, A.H.B.M., & Ageel, A., Khalique, M., Nassir S.J.A., Isa, A.H.B.M., & Ageel, A. (2011). Relationship of intellectual capital with the organizational performance of pharmaceutical companies in Pakistan. Australian Journal of Basic and Applied Sciences, 5(12), 1964–1969.

- Luminta, M.G., Artene, A., Sarca, I., & Draghici, A. (2016). The impact of intellectual capital on organizational performance. In Procedia-Social and Behavioral Sciences, 194–202.

- Maditinos, D., Chatzoudes, D., Tsairidis, C., & Theriou, G. (2011). The impact of intellectual capital on firms’ market value and financial performance. Journal of Intellectual Capital, 12(1), 132–151.

- Mantra, I.B. (1984). Bali's potential in supporting village development. Denpasar: Balinese script.

- Meles, A., Porzio, C., Sampagnaro, G., & Verdoliva, V. (2016). The impact of the intellectual capital efficiency on commercial banks performance: Evidence from the US. Journal of Multinational Financial Management, 36(September), 64–74.

- Mention, A., & Bontis, N. (2013). Intellectual capital and performance within the banking sector of Luxembourg and Belgium. Journal of Intellectual Capital, 14(2), 286–309.

- Muhmad, S.N., & Hashim, H.A. (2017). The interaction effect of corporate governance and CAMEL framework on bank performance in Malaysia. Afro-Asian Journal of Finance and Accounting, 7(4), 317–336.

- Naz, F., Salim, S., Rehman, R.U., Ahmad, M.I., & Ali, R. (2019). Determinants of financial sustainability of microfinance institutions in Pakistan. Manager, 10(4), 51–64.

- Nguyen, B.N. (2016). The effect of capital structure and legal status on financial sustainability of MFIs in developing countries. Review of Business and Economics Studies, 4(2), 53–64.

- Postelnicu, L., & Hermes, N. (2018). Microfinance performance and social capital: A Cross-country analysis. Journal of Business Ethics, 153(2), 427–445.

- Ramantha, I.W. (2018). LPD Sehat Desa Adat Kuat (Mandiri Secara Ekonomi Berkepribadian Secara Budaya). Denpasar: Udayana University Press.

- Saif-Alyousfi, A.Y., Saha, A., & Md-Rus, R. (2017). Shareholders’ value of Saudi commercial banks: A comparative evaluation between Islamic and conventional banks using CAMEL parameters. International Journal of Economics and Financial Issues, 7(1), 97–105.

- Sayad, A., & Pourmohammadi, R. (2014). Evaluating the relationship between intellectual capital and financial performance in Iranian biotechnological production companies. European Journal of Experimental Biology,1, 168–173.

- Singh, S., Sidhu, J., Joshi, M., & Kansal, M. (2016). Measuring intellectual capital performance of Indian banks: A public and private sector comparison. Managerial Finance, 42(7), 635–655.

- Uchida, H., Udell, G.F., & Yamori, N. (2012). Loan officers and relationship lending to SMEs. Journal of Financial Intermediation, 21(1), 97–122.

- Ulum, I., Ghozali, I., & Purwanto, A. (2014). Intellectual capital performance of indonesian banking sector: A modified VAIC (M-VAIC) Perspective. Asian Journal of Finance & Accounting, 6(2), 103.

- Wang, C.H. (2019). How organizational green culture influences green performance and competitive advantage: The mediating role of green innovation. Journal of Manufacturing Technology Management, 30(4), 666–683.

- Xu, J., & Li, J. (2019). The impact of intellectual capital on SMEs’ performance in China: Empirical evidence from non-high-tech vs. high-tech SMEs. Journal of Intellectual Capital, 20(4), 488–509.

- Yaseen, S.G., Dajani, D., & Hasan, Y. (2016). The impact of intellectual capital on the competitive advantage: Applied study in Jordanian telecommunication companies. Computers in Human Behavior, 62(September), 168–175.

- Zyadat, A.A.H. (2017). The impact of sustainability on the financial performance of Jordanian Islamic banks. International Journal of Economics and Finance, 9(1), 55–63.

- Abdulazeez, Y.H.S.A., Asish, S., Rohani, M.R. (2017). Shareholders value of saudi commercial bank: A comparative evaluation between islamic and conventional banks using CAMEL Parameters. International Journal of Economics and Financial Issues, 7(1), 97-105.

- Zyadat, A.A.H. (2017). The impact of sustainability on the financial performance of jordanian islamic banks. International Journal of Economics and Finance, 9(1).

- Alshehhi, A., Nobanee, H., & Khare, N. (2018). The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability Journal, 10, 494

- Amos, O., Arowoshegbe., & Emmanuel, U. (2016). Sustainability and triple bottom line: An overview of two interrelated concepts. Igbinedion University Journal of Accounting, 2.

- Anuonye, N.B. (2016). Effect of intellectual capital on return on asset of insurance firms in Nigeria. Journal of Intellectual Capital, 8(1). 212-240.

- Bontis, N. (1998). Intellectual capital: An exploratory study that develops measures and models. Management Decision, 36(2), 63-76.

- Dar, I.A., & Mishra. (2020). Dimensional impact of social capital on financial performance of SMEs. The Journal of Entrepreneurship, 29(1) 38-52.

- Hossain, D.M. (2013). Social capital and microfinance: The case of Grameen Bank, Bangladesh,. Middle East Journal of Business, 8(4).

- Farah, A.A., James, N.M., & Berbara, M. (2019). Effect of intellectual capital on financial sustainability of savings and credit cooperative societies in Kenya. Journal of International Economic and Finance, 3(3), 427-453.

- Chmelikova, G., Krauss, A., & Dvaulety, O. (2018). Performance of microfinance institutions in Europe – Does social capital matter ? Socio-Economic Planning Science, 07 Dec.

- Hasan., Iftekhar., Chun-Keung, H., Qiang, Wu., & Zhaang. (2020). Is social capital associated with corporate innovation? Evidence from publicly listed firms in the US. Journal of Corporate Finance.

- Hashim, M.J., Osman, I., & Alhasbshi, S.M. (2015). Effect of intellectual capital on organizational performance. Social and Behavioral Sciences.

- Hejazi, R., Ghanbari, M., & Alipour, M. (2016). Intellectual, human and structural capital effect on firm performance as measured by Tubin' Q. Knowledge and Process Management. 23, 259-273.

- Hossain, M.D. (2013). Social capital and microfinance: The Case of Grameen Bank. Department of Accounting & Information Systems, University of Dhaka, Dhaka, Bangladesh.

- Ito, S. (2003). Microfinance and social capital: Doses social capital help create good practice and performance? Development and Practice, 13 (4).

- Kusakabe, E. (2012). Social capital networks for achieving sustainable development. Local Environment, 17(10), 1043–1062.

- Khalique, M., Shaari, N.B.J.A., Hassan, A.I.M., Ageel, A., & Sarawak, M. (2011). Relationship of intellectual capital with the organizational performance of pharmaceutical companies in pakistan. Australian Journal of Basic and Applied Sciences, 5(12); 1964-1969

- Luminitas., Gogan, M., Artene, A., & Draghici, A., (2016). The impact of intellectual on organizational performance. Procedia-Social and Behavioral Sciences, 221: 194-202.

- Luminita, P., & Hermes, N. (2016). Microfinance performance and social capital: A cross-country analysis. J Bus Ethics, 153. 427-445.

- Mantra, I.B. (1984). Bali's potential in supporting village development. Balinese Script.

- Mantion, A.L., & Bontis, N. (2013). Intellectual capital and performance with in the banking sector of Luxembourg and Belgium. Journal of Intellectual Capital, 14(2), 286-309.

- Maryam, J.H., Idris, O., & Syed, M.A. (2015). Effect of intellectual capital on organization performance. 2nd Global Conference on Business and Social Science.

- Marguerite, S., & Robinson. (2001). The microfinance revolution: Sustainable finance for the poor, lessons from indonesia. The World Bank, Washington, DC USA.

- Meles, A., Claudio, P., Gabriele, S., & Vincenzo, V. (2016). The impact of intellectual capital efficiency on commercial bank performance: Evidence from the US. Journal of Multinational Financial Management, 36, 64-74.

- Muhmad, S.N., & Hashim, H.A. (2017). The Interaction effect of corporate governance and CAMEL framework on bank performance in Malaysia. Afro-Asian J. of Finance and Accounting, 7(4), 317

- Naz, F., Salim, S., Rehman, R., Ahmad, M.I., & Ali, R. (2019). Determinants of financial stability of microfinance institutions in Pakistan. Upravlenets – The Manager, 10(4), 51–64.

- Nguyen, B.N. (2016). The effect of capital structure and legal status on financial sustainability of MFIs in developing countries. Review of Business and Economics Studies, 4(2), 53-64.

- Ramantha, I.W. (2018). Healthy LPDs in strong traditional villages (Economically Independent, Culturally Personal), Anthology of LPD strengthening strategies in Bali, Udayana University Press.

- Saad, G., Yaseen, D.D., & Yasmeen, H. (2016). The impact of intellectual capital on the competitive advantage: Applied study in Jordanian telecommunication companies. Computers in Human Behavior, 62. 168e175.

- Sayad, A., & Pournomohammadi, R. (2014). Evaluating the relationship between intellectual and financial performance in Iranian biotechnological production companies, 4(1), 168-173.

- Sukhdev, S., Javinder, S.M., & Joshi, M.K. (2016). Measuring intellectual capital performance of Indian banks: A public and private sector comparison. Managerial Finance, 42(7).

- Uchida, H., Udell, G., & Yamori, N. (2012). Loan officer and relationship lending to SME's. Journal of Financial Intermediation, 21(1), 97-122.

- Ulum, I., Ghozali, I., & Purwanto, A. (2014). Intellectual capital performance of indonesian banking sector: A modified VAIC (M-VAIC) Perspective. Asian Journal of Finance & Accounting, 6(2), 103.

- Vladimir, D.S., & Nick, B. (2016). Intellectual capital and financial performance in the Serbian ICT industry, Journal of Intellectual Capital, 17(2).

- Xu, J., & Jingsouy, Li. (2019). The impact of intellectual capital on SMEs, performance in China. Empirical Evidence from non-hiht-tech vs. high-tech SMEs. Journal of Intellectual Capital, 488-509.