Research Article: 2022 Vol: 21 Issue: 6S

Internal capacity of local enterprises in foreign direct investment linkages: Insights from managers

Nguyen Thanh Hoang, University of Social Sciences and Humanities (USSH)

Citation Information: Hoang, N.T. (2022). Internal capacity of local enterprises in foreign direct investment linkages: Insights from managers. Academy of Strategic Management Journal, 21(S6), 1-15.

Keywords

Local Firm, FDI Linkage, Supply Chain, Benefits of FDI, FDI Absorptive Capacity

JEL

D22, H32, F21, F42

Abstract

This paper aims to assess the internal capacity of local enterprises in their linkages with foreign direct investment enterprises. Through a survey of 308 local business managers and in-depth interviews with 19 managers of FDI enterprises; research shows that most FDI enterprises already have their supply chains; while the capacity of local enterprises is only at the regional and national levels; there is no indication of a strong enough level of competence for cross-national or global linkages. There is evidence of a positive relationship between the internal capacities in terms of “Corporate Governance”, “Technology”, and “Finance” and "Perception & Readiness for Linkage” of the domestic enterprises. This study contributes to the theory of the benefits of FDI and FDI absorptive capacity.

Introduction

In the relationship between Foreign Direct Investment (FDI) and economic growth, domestic enterprises have been identified as a channel to receive the transfer of benefits of FDI including spillover effects on technology, on training the quality of human resources, on management skills, on international business experience. Thus, the absorption processes depend on the skills and capabilities of local firms (Kalotay, 2000).

In another aspect, in this connection, local enterprises not only have more customers who are FDI enterprises but also build or participate in international supply chains, entering a larger market. For a local enterprise to become such a channel, it first requires that local enterprises be able to link to FDI enterprises. Taking an example from Azerbaijan, in an (OECD, 2019) survey in 2018, the sample was enterprises with sufficient capacity to participate in the Global Value Chain (GVC). The results provided evidence of commercial relationships between domestic and foreign firms. Domestic enterprises were suppliers to foreign enterprises abroad and importers from foreign enterprises. However, less than 10% of the companies surveyed had links with multinational companies operating in the country.

If there is no connection, it is not possible to receive FDI benefits directly. In other words, the weakness in the internal capacity of the local enterprises reflects the low absorption of FDI benefits of the host country. In this case, attracting more FDI does not bring practical benefits to the local and national. Indeed, (Chudnovsky et al., 2008); (Kolasa, 2007) find that domestic firms with higher absorption capacities receive positive spillovers from foreign companies, while those with low absorption capacities are more likely to receive negative or lower spillover benefits. And Huy, Linh, Dung, Thuy, Thanh & Hoang (2021) said that Foreign aid also affects the growth of nations (negatively) and, over periods, positively contributes to economic growth, whereas Nguyen Thanh Hoang & Dinh Tran Ngoc Huy (2021) mentioned there are cost-benefits in FDI investment.

How much is low or high? No one says how it is. Up to now, within the limited scope of our knowledge, there have been no scientific studies to assess the capacity of local firms in terms of association with FDI enterprises. From the perspective of local business managers, this study will measure the level of internal capacity of local businesses and provide evidence on whether local companies can link up with FDI enterprises. From here to after the term “linkage between local enterprises and FDI enterprises” shall be abbreviated as LFL.

This article has six parts. Section 2 presents the theoretical foundation; Section 3 is Research Methodology; Section 4 and 5 is for Results and Discussion, and ends with the Conclusions in Section 6.

Theoretical Framework and Hypotheses Development

There are many different theories or approaches to the competence of enterprises.

Approaching along the value chain, (Porter Michael, 1985) points out that the competitiveness of enterprises is reflected in the operation of the total activities from production to consumption of a certain product or service. In the value chain, there is an interaction between the elements necessary and sufficient to create one or a group of products. Whereas, the Market-based approach, typical authors such as (Deshpandé & Farley, 1998); (Baker & Sinkula, 1999) argue that the competitiveness of enterprises is developed and evaluated based on the effectiveness of satisfying customer needs.

The school of Resource-Based View (RBV) considers building a business strategy from the analysis of internal business factors (tangible and intangible resources). (Wernerfelt, 1995) states that even within the same industry, there are differences between firms and that internal attributes play an important role in the success of the business. This difference comes from differences in policies of product quality, distribution channels, competitive positioning, and financial leverage (Foss, 1993). It is these firm-specific factors that allow companies to gain a sustainable competitive advantage, which translates into high performance in the marketplace (Barney, 1991 & 1997; Day, 1994; Wernerfelt, 1984; cited from (Lee & Rugman, 2012).

According to (Barney, 1991), a resource that creates an advantage for an enterprise in competition must satisfy the following four conditions: (1) Valuable, (2) Rare, (3) Inimitable, (4) Non-substitutable, and referred to as VRIN. From the perspective of Rugman (2005), firm-specific advantages are the firm’s unique factors. These factors are built either on products or technological processes, marketing or distribution skills. Therefore, firm-specific advantages include “brand power, corporate culture, technological know-how and innovation capacities” (Lee & Rugman, 2012).

Meanwhile, the school of competence-based view says that the competence of the enterprise is reflected in the ability to recognize the production potential of the enterprise, thereby exploiting and expanding its activities (Carlsson-Eliasson, 1991, quoted from (Kállay, 2012). Furthermore, competence is the ability to identify unexplored market opportunities as well as seize the corresponding opportunities that the market process presents (Freiling & Verlag, 2004). For Sanchez & Heene (1997) the competency perspective is the “systemic, cognitive, holistic and dynamic one” (cited from Freiling & Verlag, 2004); while Pelikan (1988) defines capacity as economic information against which the transferability of other scarce resources cannot be reliably transferred or measured (cited from Kállay, 2012). This capacity is strongly expressed at the management levels of the enterprise; especially the top management level through the so-called “the competence endowment of firms”. These are characteristics such as a sense of direction (intuition), boldness (willingness to take risks), effectiveness in identifying and correcting mistakes, and effectiveness in learning from experience (Eliasson, 1990a cited from Foss, 1993).

Despite the particular emphasis on the respective approach, resources can be seen as the root of a company’s survival, competitiveness, and performance in terms of maintaining competitive advantage (Freiling & Verlag, 2004). In some specific cases, the RBV school believes that compared to external resources, the internal resources of the enterprise play a fundamental role in building and developing the competitiveness of enterprises.

Compiled from many studies, (Islami et al., 2018) recorded the basic internal competencies of an enterprise that were the quality of the workforce including knowledge and skills accumulated by company training , experience , ability to work in groups ; the level of technology shown through research and development activities ; and corporate governance capacity . (Ahmedova, 2015) also synthesized from previous studies five groups of factors affecting the competitiveness of enterprises, including finance, innovation activities, intellectual property, national internationalization and implementation with optimal solutions. The World Bank (WB) report written by (Jordaan et al., 2020) listed capacity limitations that make it difficult for local SMEs to become suppliers to FDI including lack of materials, small production scale, product quality and price. Nguyen Thanh Hoang & Dinh Tran Ngoc Huy (2021) also indicated important roles as well as cost-benefit of FDI investment in Vietnam. Besides, several other capacities of local SMEs can forecast the potential of linkages such as international business experience, experience as a supplier to FDI, participation in global value chains, participation in research and development, technology gap with FDI, and firm size. In short, the internal capacity of an enterprise can be summarized by covering the quality of human resources, technology level, corporate governance, supply as well as financial capacity. These are the main theoretical factors included in this study’s framework.

In fact, in Vietnam, the number of domestic enterprises capable of linking with foreign enterprises is still very limited. Due to limitations in technology, corporate governance, human resources and finance, domestic enterprises often face many difficulties in linking with multinational corporations through the supply chain (Nguy?n Minh, 2018). In addition, domestic firms’ lack of information on the capabilities of other domestic and foreign firms causes reluctance to consider vertical and horizontal linkages (Thúy Hi?n, 2016). At the same time, business owners also lack a fair assessment of their firm’s internal resources. Thus, they hesitate and refuse to participate in clusters associated with other enterprises to form a supply chain (Minh Xuân, 2018).

Our propositions are:

1. The internal capacity of local enterprises in terms of human resources, technology level, corporate governance, supply capacity and finance is very low, only at the “regional” level; therefore, they cannot afford to associate with FDI enterprises. However, the perception and readiness of company managers is the decisive factor for this linkage.

2. The internal capacity of domestic enterprises in terms of human resources, technology level, corporate governance, supply capacity and finance has a positive relationship with the ability to link with FDI enterprises. If these capacities are higher, the possibility of linkages is higher.

Research Methodology

Research Context

This article aims to reflect the internal capacity of local enterprises under the assessment of insiders - managers of local enterprises. This study examines enterprises in Ben Tre province. Ben Tre is located in the Southwest region of Vietnam, in the Mekong River delta. Ben Tre is the capital of coconut, industrial crops such as cocoa, sugarcane; fruit trees such as mango, grapefruit; and ornamental plants. Ben Tre also thrives on aquaculture. In terms of Regional Gross Domestic Product (GRDP), Ben Tre is in the bottom 10, ranked 57th out of 63 provinces in Vietnam; but a very high growth rate is estimated at 8.7% in 2020. Ben Tre is an ideal investment destination for FDI enterprises when the Provincial Competitiveness Index (PCI) ranked 7th and foreign investment attraction ranked 35th nationwide in 2019. Only 80 km from Ho Chi Minh City, the largest economic centre of Vietnam, Ben Tre enjoys a lot of benefits from this geographical location.

Sampling and Data Collection

The linkage between local and FDI enterprises can take place horizontally and/or vertically. In this study, selected local enterprises are those that are engaged in industries where they can become suppliers or distributors of FDI enterprises. In addition, all micro-small firms are excluded to minimize linkage noise. According to the Department of Planning and Investment of Ben Tre Province (DPI), 824 enterprises belong to the above-defined sample group. Following (Krejcie & Morgan, 1970)’ suggestion, the sample size should be around 280 at 95% confidence and 5% margin of error.

Data was collected by the Business Management Division of DPI in coordination with the Provincial Business Association from September 2019 to April 2020 (interrupted by the COVID-19 pandemic in early 2020). Finally, 308 copies are eligible for use. The number of 300 is a good guarantee of sample power (Gudgeon et al., 1994).

Accordingly, 30.84% of local firms are in agriculture, forestry and fisheries; 22.40% in processing and manufacturing industries; 7.79% in production and distribution of electricity and water; and 38.96% in other industries such as construction, wholesale and services.

For the company’ size, up to 89.3% and 91.9% of local firms are small and medium-size in terms of capital and number of employees. Meanwhile, FDI of medium to large size in terms of capital and labour were 70.37% and 63.16% respectively.

| Table 1 Means, Standard Deviations and Correlations |

|||||

|---|---|---|---|---|---|

| Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| G1 | 308 | 1 | 4 | 2.81 | 0.749 |

| G2 | 308 | 2 | 4 | 2.56 | 0.740 |

| G3 | 308 | 2 | 4 | 2.67 | 0.722 |

| G4 | 308 | 2 | 4 | 2.61 | 0.768 |

| G5 | 308 | 2 | 4 | 2.65 | 0.735 |

| H1 | 308 | 1 | 4 | 2.21 | 1.171 |

| H2 | 308 | 1 | 4 | 2.29 | 0.862 |

| H3 | 308 | 1 | 4 | 1.42 | 0.886 |

| F1 | 308 | 1 | 4 | 2.36 | 0.845 |

| F2 | 308 | 1 | 4 | 2.38 | 0.810 |

| F3 | 308 | 1 | 4 | 2.36 | 0.833 |

| T1 | 308 | 2 | 4 | 2.41 | 0.612 |

| T2 | 308 | 1 | 4 | 2.35 | 0.771 |

| T3 | 308 | 1 | 4 | 2.60 | 0.714 |

| T4 | 308 | 2 | 4 | 2.50 | 0.723 |

| T5 | 308 | 1 | 4 | 2.51 | 0.729 |

| S1 | 308 | 2 | 4 | 2.49 | 0.671 |

| S2 | 308 | 2 | 4 | 2.05 | 0.780 |

| S3 | 308 | 2 | 4 | 2.01 | 0.701 |

| S4 | 308 | 2 | 4 | 1.61 | 0.780 |

| L1 | 308 | 1 | 4 | 2.51 | 0.687 |

| L2 | 308 | 1 | 4 | 2.48 | 0.668 |

| L3 | 308 | 1 | 4 | 2.46 | 0.726 |

| L4 | 308 | 1 | 4 | 2.39 | 0.708 |

| L5 | 308 | 1 | 4 | 2.38 | 0.693 |

| Valid N (listwise) | 308 | ||||

Measures

This study applies the readiness scale developed by (Author, 2021). The scale has been tested for reliability and validity. With the assessment of the theoretical construct validity (Face and Content validity) through a panel of four experts and six business representatives, the Item Content Validity Index (I-CVI) is lowest at 0.9 and the Scale Content Validity Index (S-CVI) is 0.98, higher than the standard value of 0.8 (Davis 1992, cited from (Polit et al., 2007). With the assessment of the Reliability, the Cronbach’s alpha with a value from 0.601 to 0.862 meets the condition that (Hoang & Chu, 2008) classifies a scale as very good if the CA coefficient was from 0.8 to close to 1; good scale: 0.7-0.8; acceptable scale: from 0.6 and up. With the assessment of Validity, the KMO coefficient must be about 0.5 ≤ KMO ≤ 1 and the Bartlett test has Sig. <0.05 (Hoang & Chu, 2008); this scale has a KMO of 0.814; Bartlett's is equal to 0.000; six factors are extracted at eigenvalues 1,061; total variance explained is 62.785%. CFA also give similar results when factor loading estimates (SLE) are from 0.5 to 0.9 are accepted (Hair et al., 2010).

The final questionnaire represented a scale of 5 levels from low to high:

level 1 = very low capacity / very low readiness to linkage to FDI, within Local area

level 2 = low capacity / low readiness to linkage to FDI, within Regional area

level 3 = medium capacity/medium readiness to linkage to FDI, within National area

level 4 = high capacity / high readiness to linkage to FDI, within the International area

level 5 = very high capacity / very high readiness to linkage to FDI, within the Global area

with 25 indicators to measure six domains Corporate Governance (5 items: G1-G5), Human Resources (3 items: H1-H3), Finance (3 items: F1-F3), Technology (5 items: T1-T5), Supply (4 items: S1-S4) and Perception & Readiness for Linkages (5 items: L1-L5).

| Table 2 Constructs and Measures |

||

|---|---|---|

| Factors | Symbol | Indicators |

| Corporate | G1 | Daily executive management |

| Governance | G2 | PR management |

| (mainly focusing on | G3 | Production and service management |

| managerial capacities | G4 | Supply chain management |

| of the management board) | G5 | Strategic management |

| Human Resources | H1 | Quality of labours/staffs: Knowledge, Skills and Experience |

| H2 | Quality of management team: Knowledge, Skills and Experience | |

| H3 | Ability to participate in association activities in terms of HR | |

| Finance | F1 | Ability to accumulate capital and equity capital |

| F2 | Ability to access bank loans and expand business capital | |

| F3 | Capital absorption (deployment and use) | |

| Technology | T1 | Application of information technology to the management and administration of business activities |

| T2 | Application of technology in production / cultivation / animal husbandry / service | |

| T3 | Application of technology in supply chain | |

| T4 | R&D | |

| T5 | Absorption of technology | |

| Supply | S1 | Quality and Price |

| S2 | Quantity | |

| S3 | Diversity of products and services | |

| S4 | Experience | |

| Perception & | L1 | Awareness of the importance of linking with FDI |

| Readiness for | L2 | Potential ability to linkages |

| Linkage | L3 | Current linkages |

| L4 | Readiness to linkages | |

| L5 | Member of professional associations | |

Results

Assessment of Internal Capacity

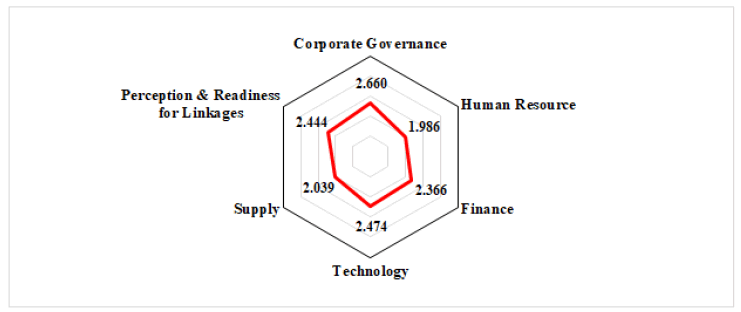

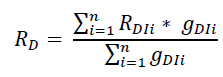

The first purpose of this study is to measure the physical level of the internal capacity of local enterprises as well as the level of readiness to associate with FDI enterprises. We refer to (Schumacher et al., 2016) formula for calculating the readiness level.

R: Readiness, D: Dimension, I: Item, Ii: Item ith, n: number of items within one dimension.

RDIi was the mean or average of Item i based on responses of 308 local firms; while gDit was the mean or average of Item i based on a rating of expert and target panel. The panel was rated the importance of each item with 1=very not important to 4=very important. The calculation of the “Corporate Governance” (RG) as a sample is in Table 3.

| Table 3 Readiness Calculation Example |

||||

|---|---|---|---|---|

| Corporate Governance | RDIi | gDit | RDIi * gDIi | |

| Daily executive management | G1 | 2.81 | 3.9 | 10.953 |

| PR management | G2 | 2.56 | 3.8 | 9.710 |

| Production and service management | G3 | 2.67 | 4.0 | 10.675 |

| Supply chain management | G4 | 2.61 | 3.9 | 10.181 |

| Strategic management | G5 | 2.65 | 4.0 | 10.610 |

| Total | 19.60 | 52.13 | ||

RG = 52.13/19.60 = 2.66.

Similarly, RH=1.99; RF=2.37; RT=2.47; RS=2.04; RL=2.44.

The radar chart in Figure 1 visualized the internal capacity of local firms in six dimensions.

Figure 1 shows that the capacity of local enterprises is quite low, between 2 and 3, showing the intrinsic capacity only at the regional and national levels; there is no indication of a strong enough level of competence for cross-national or global linkages.

Factors affecting Perception & Readiness to Linkages

This study continues to identify the factors affecting the LFL. The linear regression is applied.

The resultsin Table 4 show that this model is significant with Sig. < 0.000, with no multicollinearity (VIF<10). The value of R2, adjusted R2 and F-value are 0.414, 0.405 and 42.749 respectively. This means the variation of the dependent variable is explained by 41.4% of the variation in the independent variable.

| Table 4 Regression Results |

||||

|---|---|---|---|---|

| Model Summary | ||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate |

| 1 | .644a | .414 | .405 | 1.68826 |

| Table 5 Regression Results |

||||||

|---|---|---|---|---|---|---|

| Anovaa | ||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 609.223 | 5 | 121.845 | 42.749 | .000b |

| Residual | 860.764 | 302 | 2.850 | |||

| Total | 1469.987 | 307 | ||||

| a. Dependent Variable: F_LFL | ||||||

| b. Predictors: (Constant), F_H, F_F, F_T, F_G, F_S | ||||||

| Table 6 Regression Results |

||||||||

|---|---|---|---|---|---|---|---|---|

| Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | 1.289 | .919 | 1.404 | .161 | |||

| F_G | .332 | .046 | .370 | 7.272 | .000 | .750 | 1.334 | |

| F_T | .241 | .042 | .269 | 5.766 | .000 | .890 | 1.124 | |

| F_S | .103 | .055 | .099 | 1.895 | .059 | .708 | 1.412 | |

| F_F | .186 | .057 | .161 | 3.275 | .001 | .799 | 1.252 | |

| F_H | .075 | .053 | .063 | 1.420 | .157 | .998 | 1.002 | |

| a. Dependent Variable: F_LFL | ||||||||

In this model, the capacities of “Corporate Governance” (F_G), “Technology” (F_T), and “Finance” (F_F) have a positive relationship to "Perception & Readiness for Linkage” (F_LFL) at sig <0.05; while “Supply” (F_S) has a positive relationship to F_LFL at sig <0.1. The “Human Resources” (F_H) has no statistical relation to F_LFL. The results indicate that if the local firms are more confident in their corporate governance capacity, the possibility of linking to FDI increases by 0.332-unit. Similarly, if the local firms are stronger in their capacity in technology, finance and supply the possibility of linking to FDI increases by 0.269 and 0.24-unit respectively. Based on the value of beta, the F_G (0.370) had the strongest effect on F_LFL. The order of influence is as follows:

F_LFL = .002 + 0.370 F_G + 0.269 F_T + 0.161 F_F + 0.099 F_S + .0919

This result has supported the above internal capacity assessment as well as the current situation of Vietnamese enterprises in general.

Discussion and Implications of the Study

The level of local firm’s internal capabilities is similar to their impact on the ability to link with FDI enterprises. The internal capacity of Corporate Governance with the highest value (2.66) also has the strongest impact (.37) on LFL. Similarly for Technological level (2.47 and .27), Financial capacity (2.36 and .16), and Supply capacity (2.04 and 0.1). Particularly, Human capacity has the lowest level (1.98) and no statistical relationship with LFL.

The quality and quantity of the workforce is a big issue for businesses. The growing industries in Ben Tre in agriculture and fisheries are in great need of a labour force. However, this problem is beyond the control of the local enterprises, becoming a major barrier to the development of the enterprises. According to the results of Vietnam’s 2019 population and housing census (GSO, 2019), the total number of migrants from the Mekong Delta is 1.31 million people, 73% of migrants are in the labour force. In which, Ben Tre is the province with a high net migration rate. High migration reduces population and labour resources. This is also one of the reasons why local companies cannot expand their scale while they are still facing competition to attract scarce labour from FDI enterprises. In addition, the quality of labour is also a problem that makes the human resource capacity of the local enterprises low and not statistically significant with LFL. Also, according to (GSO, 2019) statistics, 80.8% of Vietnam’s population aged 15 and over do not have professional and technical qualifications; the labour force having graduated from high school or higher accounted for 39.1%; trained with degrees and certificates (from elementary level up) accounted for 23.1%; this rate is only 13.6% in the Mekong River Delta, the lowest in the country. According to the World Bank, the quality of human resources in Vietnam is 3.79 points (on a scale of 10), low in quality, lacking in dynamism and creativity, and lacking in industrial style (Minh Ng?c, 2019).

Senior human resources are not better off either.

With 55.63% of small and medium-sized business owners having an intermediate or lower education level (i.e. no university degree), of which 43.3% of business owners have primary, secondary and high education (Minh Ng?c, 2019); as a consequence, the lack of vision and long-term business strategy, and the lack of focus on training to improve management skills are almost inevitable.

In this study, although “corporate governance” is rated highest in the internal competencies of local companies, it is still below level 3 (national level); just slightly above the average of level 2 (regional level). The majority of local companies participating in this study are small (53.9%) and family businesses. The business owner is not subject to much (or even no) pressure from stakeholders other than family members; did not pay attention to the corporate structure but used the management structure proposed by the business owner; as well as not managing the business professionally. The STEP Project 2019 Family Business report (Calabrò Andrea & Valentino Alfredo, 2019) find that family firms prefer to use a family governance structure rather than a corporate governance structure. Family governance tools often use such as external professional advice, working-for-family policies, and formal family meetings. When we asked the target panel about this, the members agreed that they also do the same, but not often. Tools such as planning or developing strategies are usually implemented methodically in large-scale companies. This situation is consistent with the assessment of the Ministry of Planning and Investment about the low level of corporate governance in Vietnam in general. Even enterprises listed on the Stock Exchanges of Hanoi and Ho Chi Minh City only met about 20% of the requirements for corporate governance capacity (Hoàng Y?n, 2019) and is far from an international standard (D??ng Tr?ng Th?y, 2019). This question arises whether corporate governance is appropriate for small family firms operating in an area that is not the economic centre of a developing country. This issue needs to be studied to propose an appropriate governance model for such characteristics firms.

When it comes to the financial capacity of enterprises, both state agencies and enterprises have a common voice: weak in the capital, insufficient capital to expand the business, difficult to access bank loans. Many small firms, family firms do not fully and transparently record financial information, production and business situation, collateral, so it is difficult for banks to accept loans. This situation is also recorded in 24 SMEs around the world in the report (World Bank Group, 2018) on investigating the financial capabilities of SMEs. When faced with constraints in accessing finance for the same above reasons, business owners tend to rely on internal funds.

However, there is another situation that needs to be studied to have a suitable policy. It is a fact that “money in the people” in Vietnam is very high. An expert from the World Bank said that the Vietnamese economy has an accumulation rate of about 60 billion USD held by the people (Phuong Dung, 2018). This statement of the World Bank does not come with a calculation method to ensure accuracy, but according to Mr. Vo Tri Thanh, Deputy Director of the Central Institute for Economic Management, the total gross domestic savings % of GDP is greater than total annual investment in terms of GDP. This shows that a large amount of money is being stored among the people in many forms, but not put into production and business to create added value (BBC, 2018). This partly reflects that not all local firms lack financial capacity; not all companies need to access the loans. In our interview, when we asked a female CEO: if the government offers a support package including financing, do you want to expand the status quo? She told us the value of her existing properties and replied firmly that she did not need financial support. The reason is she has more than enough capital, but she does not want to expand her business.

Technology level will go hand in hand with capital capacity. Raising the level of technology requires capital. Local company managers have recognized that improving technological capabilities is enhancing the competitiveness of enterprises. However, the pace of technological innovation is quite slow, only concentrated in a few large enterprises with capital and resources to invest. Evaluation of technology level in food production and processing industries by the Department of Science and Technology of Ben Tre province (DOST) in 2019 gave the results: 96.9% (31/32) of enterprises reached the medium low-technology, there is only 01 enterprise with medium high-technology, no enterprises with outdated technology1. Previously, in 2015 DOST also assessed the technology level of several key industries, there were 06 industries with medium low-technology and 01 industry with medium high-technology. With this level of technology, it is difficult to have a connection with FDI enterprises. This linkage is only favourable when the gap between the labour productivity of domestic and foreign firms narrows (Falk, 2015) as well as the product innovation of domestic firms (Görg & Seric, 2016).

However, capital is not the only determinant of technological innovation. The Ministry of Industry and Trade (B? Công th??ng, 2020) in collaboration with the United Nations Development Program (UNDP) surveyed the readiness to approach Industry 4.0 of 2,659 enterprises in 18 industry groups; The results determined that up to 82% of firms are “beginners” and 61% are “outsiders”. Companies often have a waiting mentality, do not want to change technology right away; Only when enterprises face the challenge of gradually losing market share, production costs gradually increase due to outdated technology, then enterprises are "forced" to change. This shows that technology capacity is limited not only due to lack of capital but also because of decisions of business heads. According to Mr. Mike Dickinson, General Director of Industrial Forum of the Society of Motor Manufacturers and Traders (SMMT, UK), Senior Advisor of Supplier Development Program in Vietnam, many Vietnamese enterprises have systems of machinery and technology that meet the requirements of Japanese and Korean businesses due to new investment, but not promoted due to lack of governance capacity, from long-term strategy development to implementation plan (Quynh Chi, 2018). Again, it can be seen that even with modern technology, the lack of governance capacity is still weak in terms of supply chain participation.

The second-lowest internal capacity of the local firms is supply capacity (2.039), which shows that the supply capacity, in general, can only meet a limited scope within the region and inter-region. For example, in coconuts (Ben Tre is called the land of coconuts, it is enough to see that this product is abundant in the province), most of the fresh coconuts are supplied around the province and surrounding areas. There is a factory processing canned coconut water that also sells in the domestic market.

To study the possibility of “linkage between local enterprises and FDI enterprises” (LFL), we posed two questions to the managers of FDI enterprises:

1). Does your business affiliate with a local business/ Is a local firm your supplier or distributor?

2). If yes, what is the activity? At what scale? If no, the reasons?

The most common answer is “almost not”. Most FDI enterprises have their supply and distribution chains. For example, the chain of Korean companies in the garment industry includes fabric and yarn suppliers; dyeing company, garment company, and packaging company. Similarly, C.P group from Thailand also has a supply chain from seed, breeding, processing and product distribution channel to the market. For FDI enterprises that process products for other enterprises, they import raw materials at the request of the client enterprises. Domestic enterprises can only squeeze in as an alternative supplier if and only if they are more capable than the existing suppliers.

However, FDI enterprises doing business in the field of processing local products such as coconut and cocoa are very much in need of cooperation with suppliers who are local firms. But this partnership is more like a “retail purchase” than a long-term contract. There are many reasons such as price changes according to market supply and demand, unstable output and product quality. Above all, local companies do not want to be tied to a fixed contract that makes them lose flexibility in pricing and a high risk of contracting when they do not supply enough volume and quality. Again, this shows that short-term thinking, weak corporate governance capacity and unwillingness to scale up have created limitations in the possibilities of cooperation with FDI enterprises.

This situation is not only in Ben Tre. Mr. Tomaso Andreatta - Vice President of Eurocham said that Vietnamese enterprises are too small in scale and lack the knowledge and experience in producing top quality products at reasonable prices and selling them to the global market; Therefore, FDI enterprises must find foreign partners with sufficient capacity to meet the requirements (Qu?nh Trung - Lê Thanh, 2018). The World Bank 2020 report also identifies the characteristics of domestic enterprises that affect the linkage of MNEs as lack of availability of inputs; quality of inputs; cost competitiveness; reliability of supply; the limited scale of production processes (Jordaan et al., 2020).

The Ministry of Industry & Trade (2016) assessed the three biggest obstacles for Vietnamese businesses when participating in the global value chain: capital, quality of human resources and technology level. Besides, awareness of integration is still incomplete and not systematic (Ha Linh, 2016). The value of 2.44 indicates that local firms do not aware of the need to link up with other businesses and are not ready for linkages. “Perception” or “Readiness” are factors that require almost no material conditions, seeming to be most readily available, but very low. Diyamett & Mutambla (2019) pointed out that the linkages between domestic enterprises and FDI enterprises do not happen automatically, but depend on the economic size of the host country, the technological capacity of domestic enterprises and the quality of quantity of local inputs. Our research adds another factor that is the will of the leaders of the local companies. Indeed, when researching on barriers to setting up foreign enterprise linkages in Vietnam, (Bilici et al., 2017) find that about one-third of companies have no thought and are not interested in building this relationship. Although companies leaders know that these partnerships will help companies build networks from which to get external benefits such as information, experience exchange, human resource introduction and even the ability to borrow capital (St-Jean & Tremblay, 2020) as well as financial and non-financial benefits that will appeal to business owners (Holland & Garrett, 2015); however, not all of them prefer to make linkages.

The low level of perception and readiness for linking with FDI enterprises of local companies is the result of the status quo: low management capacity; the knowledge and business experience of the company's managers are not high, many people do not know foreign languages; meanwhile, human and labour resources are low in quality and quantity; an average level of technology. As a result, business leaders do not confidently improvise to unpredictable changes in the market, do not confidently enter the world through linkage and market expansion.

We discussed this issue with the target panel. More than half of them said that their businesses do not need to cooperate with other businesses (including domestic ones) because there is no need. We recognize that if the mind is not “open” or still wants to close, there can be no further actions.

In addition, it is also due to the personality characteristics of people in the Southwest region of Vietnam. They tend to choose safety, do not want to be pressured or bound by supply contracts, do not need to earn too much money and prefer a quiet lifestyle like the rice fields and the gentle river of the plains. We surprise that the STEP Project 2019 also show the same things: Millennial family CEOs plan to retire before their 50th birthday; More than 1/3 of global family CEOs don’t plan to spend time in business activities after retirement.

The numbers reflect each inner capacity, although discrete, but in harmony with each other. They reflect quite honestly about the current state of the internal capacity of local firms. If leaders/owners/managers did not want to expand their business for many reasons, they certainly would not want to cooperate with outsiders.

Conclusion

This study has provided scientific and empirical evidence on the extent of the internal capacity of local firms to FDI linkages. Most of the internal capacity of local enterprises is at the domestic level. First of all, it must be highlighted that local enterprises have not yet appreciated the need to cooperate with FDI enterprises, so the level of willingness to cooperate is not high. This is a consequence of the low level of capacity in corporate governance, technology, finance, human resources and, of course, the capacity of local businesses to provide products and services.

Local enterprises are one of the main channels to convey the benefits of FDI in terms of technology transfer, management skills and experience, and labour training; but if local enterprises have the weak capacity or do not want to open the door for cooperation, it is local enterprises that have contributed to closing the valve to transfer benefits from FDI. In other words, benefits from FDI do not fully absorb to contribute to the local economic development.

What makes local firms aware that they need to develop, need to cooperate with FDI enterprises to become a channel to transfer the benefits of FDI to the locality, contributing to local development, etc. is not possible with spiritual appeals. Now, this requires the presence of government in a constructive role: to create a business environment in which companies can trust to put their efforts and wealth into business to create added value. This environment cannot be different from the properties of transparency, stability and competitive openness. Besides, the real weakness of local companies is not in the capital or technology level (because money can buy technology), but in corporate governance. The government needs to “compulsory universalization” of management knowledge and skills to local companies managers. It is necessary to have strong measures, even administrative regulations to “lever” local firms, especially small ones, out of their inherent inertia. At the same time, help them realise that corporate governance will be more effective when applying technology and artificial intelligence. Once they can analyse the situation, forecast, and manage risks, they have the confidence to enter the business, as well as increase their competitiveness.

For the problem of scarce human resources in the delta. This scarcity comes from many reasons such as labour movement to industrial centres, climate change causing people to lose their jobs from agriculture, and the competition to attract workers from FDI enterprises with better wages. Local companies lose their advantage in recruiting workers. In a way, attracting FDI enterprises to use labour is not bringing real benefits to the locality. Instead, local governments should focus on attracting investment in clean agriculture, building the locality into a “hub" of some special productions (such as seafood, fruit trees, coconuts, and cocoa in Ben Tre). The convergence advantage of a “centre” will help local businesses be competitive enough to lead the domestic and international markets. This means not sacrificing the delta ecosystem for industrial development.

At this point, we all realise that calling for a lot of FDI but the ability to absorb FDI benefits is absent or weak, the receiving country does not receive as many benefits as expected. The issue of improving absorptive capacity needs to be given great attention. Try to attract FDI where in that ecosystem local companies can fulfil the role of the host, can play equally with FDI enterprises.

Although the sample size of this study is representative enough, it is representative of only one locality. This study needs to be replicated in other localities.

Acknowledgement

This project which is to assess the internal capacity of local companies is funded by the state budget of Ben Tre province, Vi?t Nam.

References

Ahmedova, S. (2015). Factors for increasing the competitiveness of Small and Medium-Sized Enterprises (SMEs) in Bulgaria. Procedia - Social and Behavioral Sciences, 195, 1104–1112.

Crossref, GoogleScholar, Indexed

Baker, W., & Sinkula, J. (1999). Learning orientation, market orientation, and innovation: Integrating and extending models of organizational performance. Journal of Market - Focused Management, 4(4).

Crossref, GoogleScholar, Indexed

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1).

Crossref, GoogleScholar, Indexed

BBC. (2018). Quanh vi?c “60 t? dô ti?n nhàn r?i trong dân.” BBC (Around "60 billion dollars of idle money in the people." BBC).

Bilici, H., Ta, L., & Carcamo, B. (2017). Impact of foreign direct investment and barriers to MNC Supply Chain Integration in Vietnam. Zagreb International Review of Economics and Business, 20(s1).

Crossref, GoogleScholar, Indexed

B? Công thuong. (2020). Ð?i m?i công ngh?: V?n không ph?i là y?u t? quy?t d?nh. B? Công Thuong (Technological innovation: Capital is not the deciding factor. Ministry of Industry and Trade).

Calabrò Andrea, & Valentino Alfredo. (2019). STEP 2019 global family business survey—The impact of changing demographics on family business succession planning and governance.

Chudnovsky, D., Lopez, A., & Rossi, G. (2008). Foreign direct investment spillovers and the absorptive capabilities of domestic firms in the Argentine manufacturing sector (1992-2001). Journal of Development Studies, 44(5).

Crossref, GoogleScholar, Indexed

Deshpandé, R., & Farley, J. (1998). Measuring market orientation: Generalization and synthesis. Journal of Market-Focused Management, 2(3).

Crossref, GoogleScholar, Indexed

Duong Tr?ng Th?y. (2019). Nâng cao nang l?c qu?n tr? DNNN dáp ?ng chu?n m?c qu?c t?. Tapchidoanhnghiep (Improve SOE governance capacity to meet international standards. Tapchidoanhnghiep).

Falk, M. (2015). The relationship between FDI through backward linkages and technological innovations of local firms: Evidence for emerging economies. Eastern European Economics, 53(5).

Crossref, GoogleScholar, Indexed

Foss, N.J. (1993). Theories of the firm: Contractual and competence perspectives. Journal of Evolutionary Economics, 3(2), 127–144.

Crossref, GoogleScholar, Indexed

Freiling, J., & Verlag, R.H. (2004). A competence-based theory of the firm. Management Revue, 15(1), 27–52.

Crossref, GoogleScholar, Indexed

Görg, H., & Seric, A. (2016). Linkages with multinationals and domestic firm performance: The role of assistance for local firms. European Journal of Development Research, 28(4).

Crossref, GoogleScholar, Indexed

GSO. (2019). K?t qu? toàn b? T?ng di?u tra dân s? và nhà ? nam 2019 (Results of the entire population and housing census 2019).

Gudgeon, A.C., Comrey, A.L., & Lee, H.B. (1994). A first course in factor analysis. The Statistician, 43(2).

Crossref, GoogleScholar, Indexed

Ha Linh. (2016). Tham gia chu?i cung ?ng toàn c?u: Doanh nghi?p c?n thêm s? h? tr?. B? Tài Chính (Join the global supply chain: Businesses need more support. The financial). https://mof.gov.vn/webcenter/portal/tttc/r/m/cochechinhsach/cochechinhsach_chitiet?dID=99721&dDocName=MOFUCM096317&_adf.ctrl-state=1aqcjdcox2_4&_afrLoop=560555260796625

Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2010). Multivariate Data Analysis. In Vectors.

Hanh, H.T., Huy, D.T.N., Phung, N.T.T., Nga, L.T.V., & Anh, P.T. (2020). Impact of macro economic factors and financial development on energy projects - Case in Asean countries. Management, 24(2).

Crossref, GoogleScholar, Indexed

Hac, L.D., Huy, D.T.N., Thach, N.N., Chuyen, B.M., Nhung, P.T.H., Thang, T.D., & Anh, T.T. (2021). Enhancing risk management culture for sustainable growth of Asia commercial bank -ACB in Vietnam under mixed effects of macro factors. Entrepreneurship and Sustainability Issues, 8(3), 291-307.

Crossref, GoogleScholar, Indexed

Hang, T.T.B., Nhung, D.T.H., Hung, N.M., Huy, D.T.N., & Dat, P.M. (2020). Where Beta is going–case of Viet Nam hotel, airlines and tourism company groups after the low inflation period. Entrepreneurship and Sustainability Issues, 7(3), 2282-2298.

Crossref, GoogleScholar, Indexed

Hang, N.T., Tinh, D.T., Huy, D.T.N., & Nhung, P.T.H. (2021). Educating and training labor force Under Covid 19; Impacts to meet market demand in Vietnam during globalization and integration era. Journal for Educators, Teachers and Trainers, 12(1), 179–184.

Crossref, GoogleScholar, Indexed

Hien, D.T., Huy, D.T.N., & Hoa, N.T. (2021). Ho Chi Minh viewpoints about marxism moral human resource for state management level in Vietnam. Psychology and education, 58(5), 2908-2914.

Hoa, N.T., Hang, N.T., Giang, N.T., & Huy, D.T.N. (2021). Human resource for schools of politics and for international relation during globalization and EVFTA. Elementary education online, 20(4), 2448-2452.

Huy, D.T.N. (2021). Banking sustainability for economic growth and socio-economic development–case in Vietnam. Turkish Journal of computer and mathematics education, 12(2).

Crossref, GoogleScholar, Indexed

Huy, D.T.N., & Hien, D.T.N. (2010). The backbone of European corporate governance standards after financial crisis, corporate scandals and manipulation. Economic and business review, 12(4).

Crossref, GoogleScholar, Indexed

Huy, D.T.N. (2015). The critical analysis of limited South Asian Corporate Governance standards after financial crisis. International Journal for Quality Research, 9(4), 741-764.

Huy, D.T.N. (2012). Estimating Beta of Viet Nam listed construction companies groups during the crisis. Journal of Integration and Development, 15(1).

Huong, L.T.T., Huong, D.T., Huy, D.T.N., & Thuy, N.T. (2021). Education for students to enhance research skills and meet demand from workplace-case in Vietnam. Elementary education online, 20(4).

Huy, D.T.N., Loan, B.T., & Anh, P.T. (2020). Impact of selected factors on stock price: A case study of Vietcombank in Vietnam. Entrepreneurship and Sustainability Issues, 7(4), 2715-2730.

Crossref, GoogleScholar, Indexed

Huy, D.T.N., Dat, P.M., và Anh, P.T. (2020). 'Building and econometric model of selected factors’ impact on stock price: a case study'. Journal of Security and Sustainability Issues, 9(M), 77-93.

Crossref, GoogleScholar, Indexed

Hoang, T., & Chu, N.M.N. (2008). Analyzing research data with SPSS, Part 1 and Part 2. Hong Duc.

Hoàng Y?n. (2019). Nâng cao nang l?c qu?n tr? d? tang s?c d? kháng cho doanh nghi?p. ThoibaoTaichinhVietnam (Improve management capacity to increase business resistance. ThoibaoTaichinhVietnam).

Holland, D.V., & Garrett, R.P. (2015). Entrepreneur start-up versus persistence decisions: A critical evaluation of expectancy and value. International Small Business Journal: Researching Entrepreneurship, 33(2).

Crossref, GoogleScholar, Indexed

Huy, D.T.N., Linh, T.T.N., Dung, N.T., Thuy, P.T., Thanh, T.V. ., & Hoang, N.T. (2021). Investment attraction for digital economy, digital technology sector in digital transformation era from ODA investment - and comparison to FDI investment in Vietnam. Laplage in Journal, 7(3A), 427-439.

Crossref, GoogleScholar, Indexed

Islami, X., Mulolli, E., & Skenderi, N. (2018). The effect of factors industrial and internal to the firm’s performance. Danubius University Economic problems, 14(5).

Jordaan, J., Douw, W., & Qiang, C.Z. (2020). Foreign direct investment, backward linkages, and productivity spillovers: What governments can do to strengthen linkages and their impact. In Focus: Finance, Competitiveness & Innovation: Investment Climate, 1–16.

Kállay, B. (2012). Evolutionary and competence-based theory. Journal of International Studies, 5(1), 38–45. Indexed http://www.geoffrey-hodgson.info/user/image/evcomp.pdf

Kalotay, K. (2000). Is the sky the limit? The absorptive capacity of Central Europe for FDI. Transnational Corporations, 9(3).

Kolasa, M. (2007). How does FDI inflow affect the productivity of domestic firms? The role of horizontal and vertical spillovers, absorptive capacity and competition (No. 42).

Crossref, GoogleScholar, Indexed

Krejcie, R.V., & Morgan, D.W. (1970). Determining sample size for research activities. Educational and Psychological Measurement, 30(3), 607–610.

Crossref, GoogleScholar, Indexed

Lee, I.H., & Rugman, A.M. (2012). Firm-specific advantages, inward FDI origins, and performance of multinational enterprises. Journal of International Management, 18(2).

Crossref, GoogleScholar, Indexed

Minh Ng?c. (2019). Ch?t lu?ng ngu?n nhân l?c Vi?t Nam x?p h?ng th? 11/12 qu?c gia t?i châu Á. VNMedia (The quality of human resources in Vietnam ranks 11th out of 12 countries in Asia. VNMedia).

Minh Xuân. (2018). Doanh nghi?p khó ti?p c?n chu?i cung ?ng di?n t? toàn c?u. SGGP (It is difficult for businesses to access the global electronic supply chain. SGGP).

Nguy?n Minh. (2018). Doanh nghi?p Vi?t Nam tham gia chu?i cung ?ng toàn c?u. Báo Giáo D?c (Vietnamese enterprises join the global supply chain. Education Newspaper).

Nguyen Thanh Hoang, Dinh Tran Ngoc Huy (2021). Determining factors for educating students for choosing to work for foreign units: Absence of Self-Efficacy. Journal for Educators, Teachers and Trainers, 12(2), 11 – 19.

Crossref, GoogleScholar, Indexed

Nguyen Thanh Hoang, Dinh Tran Ngoc Huy. (2021). Cost-benefit analysis of FDI: FDI Barriers and Firm Internal Capabilities, Resta Geintec-Gestao Inovacao E Tecnologias, 11(3).

Crossref, GoogleScholar, Indexed

OECD. (2019). Azerbaijan linking domestic suppliers with foreign investors.

Phuong Dung. (2018). Chuyên gia World Bank: Vi?t Nam có 60 t? USD ti?n nhàn r?i trong dân. Dantri (World Bank expert: Vietnam has 60 billion USD of idle money in the people. Dantri).

Polit, D.F., Beck, C.T., & Owen, S.V. (2007). Focus on research methods: Is the CVI an acceptable indicator of content validity? Appraisal and recommendations. Research in Nursing and Health, 30(4).

Crossref, GoogleScholar, Indexed

Porter Michael, E. (1985). Competitive Advantage: Creating and sustaining superior performance. The Free.

Quynh Chi. (2018). Doanh nghi?p Vi?t khó vào du?c chu?i cung ?ng toàn c?u do thi?u nang l?c qu?n tr?. The Leader (It is difficult for Vietnamese enterprises to enter the global supply chain due to lack of management capacity. The Leader). https://theleader.vn/doanh-nghiep-viet-kho-vao-duoc-chuoi-cung-ung-toan-cau-do-thieu-nang-luc-quan-tri-1539576698881.htm

Qu?nh Trung - Lê Thanh. (2018). Samsung ph?i dùng nhi?u nhà cung ?ng ngo?i vì doanh nghi?p Vi?t y?u. TuoiTreonline (Samsung has to use many foreign suppliers because Vietnamese enterprises are weak. TuoiTreonline).

Schumacher, A., Erol, S., & Sihn, W. (2016). A Maturity Model for Assessing Industry 4.0 Readiness and Maturity of Manufacturing Enterprises. Procedia CIRP, 52, 161–166.

Crossref, GoogleScholar, Indexed

St-Jean, É., & Tremblay, M. (2020). Mentoring for entrepreneurs: A boost or a crutch? Long-term effect of mentoring on self-efficacy. International Small Business Journal: Researching Entrepreneurship, 38(5), 424–448.

Crossref, GoogleScholar, Indexed

Thúy Hi?n. (2016). Kh? nang tham gia vào chu?i giá tr? toàn c?u c?a Vi?t Nam còn y?u. Bnews. Vietnam's ability to participate in global value chains is still weak. News.

Wernerfelt, B. (1995). The resource-based view of the firm: Ten years after. Strategic Management Journal, 16(3).

Crossref, GoogleScholar, Indexed

World Bank Group. (2018). Investigating the financial capabilities of SMEs : Lessons from a 24-Country Survey.

Received: 26-Apr-2022, Manuscript No. ASMJ-21-8380; Editor assigned: 29- Apr -2022, PreQC No. ASMJ-21-8380 (PQ); Reviewed: 13-May-2022, QC No. ASMJ-21-8380; Revised: 20-May-2022, Manuscript No. ASMJ-21-8380 (R); Published: 26-May-2022