Research Article: 2021 Vol: 20 Issue: 6S

Internal Control Mechanisms and Perceived Occupational Fraud: Evidence of Malaysian Companies

Syaza Nadhira Abd Rahim, Faculty of Accountancy, Universiti Teknologi MARA Selangor

Rina Fadhilah Ismail, Faculty of Accountancy, Universiti Teknologi MARA Selangor

Roshayani Arshad, Accounting Research Institute, Universiti Teknologi MARA

Muzrifah Mohamed, Faculty of Accountancy, Universiti Teknologi MARA Selangor

Abstract

Corporate fraud has impacted all kinds of organisations, regardless of their industry, size, and even profitability. Prior cases that emerged from the literature and the huge cost of fraud provide awareness of corporate dishonesty in the occurrence of these frauds in organisations. The purpose of this study is to examine perceived occupational fraud as to whether the existence of hotlines, ethics and surprise audits infused throughout the organisation will be able to reduce occupational fraud. A structured questionnaire was used to conduct a survey to 274 respondents who are currently working in public listed companies in Malaysia. This study examines the internal control mechanisms in reducing perceived occupational fraud as an attempt to recognise the research gap in prior research and literature besides discovering the extent of future research, specifically in Malaysia. The results imply that the implementation of hotlines, ethics training, and surprise audits has significant impacts on reducing perceived occupational fraud of the publicly listed companies in Malaysia. Consequently, it justifies undertaking this study as well as the basis for generating research questions and developing hypotheses. The results also showed that effective internal control mechanisms could diminish the possible occupational fraud from taking place. Hence, it is significant for the organisation to develop an effective internal control plan to obtain reasonable assurance in achieving its financial reporting objectives.

Keywords

Internal Control, Perceived Occupational Fraud

Introduction

Occupational fraud is widely known as a severe problem that affects the performance of businesses in many countries. The Association of (Certified Fraud Examiners, 2016) defines occupational fraud as "the use of one's occupation for own enhancement through the deliberate misuse or misappropriation of the engaging organisation's resources or assets. As such, occupational fraud causes the organisation to lose an estimated 5 per cent of its annual revenues due to occupational fraud. Occupational fraud in Malaysia has been increasing from year to year. In a survey conducted by KPMG in 2013, most of the respondents (83 per cent), which represented 14 industry segments, believed that fraud is a major problem among Malaysia's organisations. The organisations that were victimised had incurred financial losses of between RM10,000 to RM100,000 during the year. Prior researchers also suggested that companies that experienced fraud usually have a deprived public reputation, declined business dealings and transactions with business associates, and there is a likelihood of being executed in the court of law and eventually suffer liquidation (Rezaee, 2009). According to (Albrecht, Albrecht & Zimbelman, 2012), weak internal controls is the main factor attributable to occupational fraud. It is also reported by (ACFE, 2016) that a deficiency in inadequate internal controls resulted in a more prominent role in occupational fraud cases. These control flaws lead to a massive fraud loss for the investment bank and other investors. Omar, Said & Johari (2016) argued that if the controls by the management are poor, spaces of fraud are opened widely in a much-understated way.

Interestingly, 88.9 per cent of occupational fraud perpetrators have never been charged, as reported by ACFE 2016. As fraud may lead to significant losses, it is crucial to identify the possible internal control mechanisms to reduce occupational fraud's likelihood and impact. Effective internal controls may provide clear communication and oversight from the board and top management, clear guidelines and standards, effective fraud reporting or hotlines, fraud awareness training and improvement of high ethics and honesty culture (Siregar &Tenoyo, 2015).

Thus, this study intends to examine the relationship between internal control mechanisms and perceived occupational fraud among Malaysian public listed companies. The expected findings may allow Malaysian public listed companies to assess the problems that occur in occupational fraud and strengthen the organisation's relevant internal control mechanism. Eventually, improved management and reduced occupational fraud are anticipated to entrust the stakeholders towards quality supervision and beyond legitimation.

Literature Review and Hypothesis Development

The Fraud Triangle and Fraud Diamond Theory

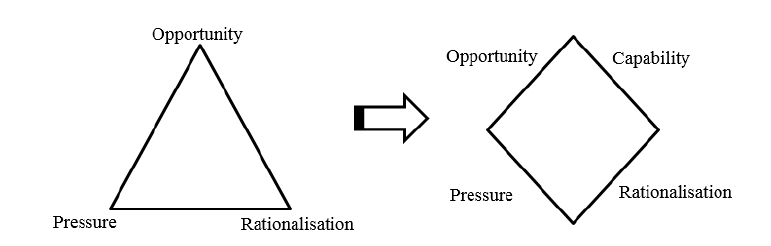

Fraud can be explained from the model of the Fraud Diamond theory, which was extended from the Fraud Triangle by (Wolfe & Hermanson, 2004). The Fraud Triangle by (Cressey, 1973) noted three elements that contribute to committing fraud which emphasised on pressure, opportunity and rationalisation. The main reason for committing fraud may stem from experiences of any forms of pressures such as financial pressure due to low income (Omar, Nawawi & Salin, 2016) or the supervisor having non-financial pressure such as the need to prepare a report that shows better financial result in order to impress shareholders (Albrecht et al., 2012). Zakaria, Nawawi & Salin (2016) defined the first element of pressure as stress and demands that give the person trouble, such as financial trouble. Findings from Omar, et al., (2016) showed that most of the occupational frauds are committed due to personal or financial gain. Pressure might consist of few pressures such as financial pressure, vice pressure and work pressure (Albrecht et al., 2012).

The existence of an opportunity to commit fraud usually caused by poor internal control in the management in which the risk to get caught when committed fraud is low due to the weakness of internal control; thus, the chances to commit fraud is higher since there is low control to prevent or detect such actions (Omar et al., 2016). Lack of supervision indicates a failure to inaugurate adequate standard operating procedures in organisations leads to an increase in the gap of opportunities for frauds to take (Nawawi & Salin, 2018). When there is a chance for the wrong doings, the fraudster will justify it as morally right before they act in an attempt to reduce dissonance (Dorminey, Fleming, Kranacher & Riley, 2012).

Wolfe & Hermanson (2004) extend the earlier theory into the Fraud Diamond theory to include another element which is capability. They argued that fraud might not or cannot commit without the capability to do it, such as understanding the situation, skills to execute it, and confidence level of an employee (Zakaria et al., 2016). Figure 1 below demonstrates the fraud triangle and fraud diamond theory used in this study.

The Occupational Fraud and Internal Control Mechanisms

The term 'fraud' usually concerns on any unethical activities such as theft, corruption, conspiracy, embezzlement, money laundering, bribery and extortion (Doody, 2009). Occupational fraud is fraud gaining advantages from position or occupation for personal gain through the misuse of the organisation's resources (ACFE, 2016). Wells (2004) mentioned that employee fraud could occur from a very basic activity such as pilferage of company supplies to the complex one, including misstating financial statements. Usually, unethical behaviour is caused by poor internal control of the management that gives a bad impression to the organisation in order to attract shareholders due to loss of assets or money (Omar et al., 2016). According to (Sweeney, Arnold & Pierce, 2010), the encouragement by the top management on good ethical culture will increase the making of ethical choices, and this can cut the possibility of committing fraud. These organisations' restrictions have forced the top management to apply a better internal control mechanism. Occupational fraud is a crime that benefits the individual perpetrator and oppresses the employing organisation (Holtfreter, 2005). Occupational fraud consists of three types which are asset misappropriation, corruption and fraudulent statements (ACFE, 2016; Glodstein, 2015).

Internal control is a process that provides a reasonable assurance in terms of achievement of business objectives that translated into policies and procedures in achieving stipulated objectives set by a company or an organisation (Nawawi & Salin, 2018). Internal controls comprise three main objectives: promoting effectiveness and efficiency, ensuring the reliability of financing reporting and maintaining compliance with applicable laws and regulations (McGladrey, 2014). Greater internal control provides better management and allocates good employees with good ethical culture as its main purpose is to upkeep the directions of dealing the organisation's risk to achieve the organisation's objectives and at the same time sustain their performance. Furthermore, the internal control mechanism provides a reasonable guarantee mechanism for the organisation to achieve the best performance and at the same time protect the organisation from any losses due to occupational fraud (Zakaria et al., 2016). To assure effective and efficient organisation, effective internal controls play an important role to prevent and detect fraud or any illegal acts done by employees or managers. ACFE (2016) posits major internal controls contributing to reducing occupational fraud within an organisation, such as hotlines, ethics and surprise audit.

The implementation of hotlines is an essential medium to thwart and deter corporate wrongdoing. Information from hotlines is likely helpful in reducing occupational fraud. Many employees or stakeholders may feel consternation of reporting on the suspicious behaviour caused by a threat from colleagues' superior and negative judgements (Ahmad, Yunos, Ahmad & Sanusi, 2014; ACFE, 2010). More than 40 per cent of all tips came from non-employees such as customers and vendors, thus making the hotlines a medium to determine the effectiveness of internal control in which it is a way detected by tips (ACFE, 2016). Suh, Sim & Button (2018) argued that occupational fraud could be controlled or detected from the earlier stage by applying two forms such as implementation during the pre-employment stage to screen out the applicants and another one is during the course of employment to prevent fraud. These applications may apply towards hotlines whenever there are new applicants or during interview sessions with the candidates by contacting previous employers on the applicant's prior employment history. ACFE (2016) has proven that employees focus on reporting hotlines in an organisation when awarded tips. Formal reporting of hotlines used are mostly by telephone with 39.5 per cent, an email with 34.1 per cent, online form (23.5 %) and fax (1.5 %).

Ethicsis portraying the core values entrenched throughout the organisation in its policies, process, and practices, the formation of a formal ethics program and the constant existence of ethical leadership, which is a proper 'tone at the top' as mirrored by the board of directors and senior managers (Suh et al., 2018). Ethics is more than compliance which focuses on doing the right thing, not just legal (Neff & Gresham, 2016). Ethical rationalisation can be increased among the employees and managers by providing ethical training that focuses on the organisation's ethics policies and internal controls. It plays paramount roles in minimising fraud (Cressey, 1973). Hence, the ethic training program could assist as a pre-emptive control against fraud in many of its forms (Rahman & Anwar, 2014). Awareness among the significant players in implementing internal control applications into the company's operation force is advantageous to the organisation in terms of dealing with fraud perpetrators.

A surprise auditor unannounced audit is a time-tested technique used in order to detect and prevent fraud from occurring. It is a verification mechanism that may increase the efficiency and quality of a certain program (Bravo, Ramírez, Neuendorff & Spiller, 2013). A surprise audit is found to reduce median loss and duration by 51 percent, as compared to an external audit, which only reduces fraud by less than one-third. The method of surprise audit was proven to cut the average detection time in half for fraud cases, as mentioned by the ACFE in 2018. They reported that a surprise audit is the least being used in an organisation as of anti-fraud control, but this method is identified as the most effective method to detect and prevent fraud. There is 73 percent common control that appears in an organisation along with the implementation code of conduct during an external audit. Still, it provides the least effective in terms of preventing or detecting fraud rather than using a surprise audit (Pina, 2016). The element of surprise is crucial because most fraudsters are regularly on guard. By announcing an upcoming audit will give the fraudsters extra time to hide their tracks, such as destroying or creating fabricated documents, modifying actual records or financial statements, or hiding evidence (Pina, 2016).

Hence, based on the above discussion, the following hypothesis is proposed:

H1: There is a significant correlation between internal control mechanisms and perceived occupational fraud.

Research Methodology

Sample of Study

A random sampling method was used to choose the companies for the study. Employees and managers from different fields were selected from Malaysia public listed companies. The sample size consisted of 274 employees and managers in selected Malaysia public listed companies. Nevertheless, the questionnaires were distributed only to those respondents who would yield the information that would meet the purpose of the study.

Measurement of Variables

This study concentrated on three measurements of independent variable and one dependent variable. The questionnaire consists of one section of demographic (Section A) and two sections of variables (Section B and Section C). Bias responses may occur due to uncontrollable aspects of life (Yaveroglu, Donthu & Garcia, 2003). Thus, Si & Cullen (1998) suggested using open-ended questionnaire items to examine the reliability among the multiple method outcomes. Table 1 summarises the items included in the questionnaire.

| Table 1 Summary of Questionnaire Items and Measurements |

||

|---|---|---|

| Section | Items | Measurement |

| A | Demographic information | To assess the demographic information of the respondents. The relevant questions relating to demographics were adapted based on prior literature done by Siregar&Tenoyo (2015). |

| B | Internal control mechanisms | Internal control mechanisms are measured using hotlines, ethics training and surprise audits. A five-point Likert-type rating scale ranging from 1 (strongly agree) to 5 (strongly disagree) was used to Fifteen (15) questions. |

| C | Perceived Occupational Fraud | To explore the awareness of perceived occupational fraud. The items OF 1 to OF 15 were adapted from Siregar&Tenoyo (2015), Stevens (2016) and ACFE (2010). A five-point Likert scale ranging from 1 (strongly agree) to 5 (strongly disagree) was used to measure the items. |

Data Analysis

Descriptive Analysis

The descriptive statistics in Table 2 shows selected demographic information on the respondents, where the majority of the respondents is represented by the age between 21 to 30 years. Hence, this group of respondents has working experience of less than 5 years with the highest position of the executive with a maximum salary is not more than RM5,000.

| Table 2 Demographic Information |

||

|---|---|---|

| Demographic Profile | Frequency (n=274) | Percentage (%) |

| Age | ||

| 21-30 years | 149 | 54.40% |

| 31-40 years | 94 | 34.30% |

| 41-50 years | 26 | 9.50% |

| More than 50 years | 5 | 1.80% |

| Position | ||

| Director | 5 | 1.80% |

| Manager/Supervisor | 50 | 18.30% |

| Executives | 173 | 63.10% |

| Others | 46 | 16.80% |

| Income | ||

| Less than RM 2, 500 | 34 | 12.40% |

| RM 2, 501 - RM 5, 000 | 152 | 55.50% |

| RM 5, 001 - RM 7, 500 | 66 | 24.10% |

| RM 7, 501 - RM 10, 000 | 11 | 4.00% |

| More than RM 10,000 | 11 | 4.00% |

| Years Working in the Company | ||

| Less than 2 years | 75 | 27.40% |

| 2 - 5 Years | 101 | 36.90% |

| 5 - 10 years | 61 | 22.20% |

| More than 10 Years | 37 | 13.50% |

Factor Analysis

Factor analysis is conducted to reduce a data set to a more convenient size while retaining as much of the original information as probable. Factor loadings will be used to identify appropriate measures for internal control mechanisms using Bartlett's Test of Sphericity and Kaiser-Meyer-Olk in measure of sampling adequacy (KMO). The data score is significant when it is less or equal to 0.05 for Bartlett's Test of Sphericity, and the KMO value is equal or more than 0.60. The factor loading must not be less than 0.30 to meet the least level. If the score is greater than 0.50, it will be considered significant and vital (Field, 2009). Hence, any factor that resulted in less than 0.50 is removed to get the most significant value, as indicated in Table 3.

| Table 3 Factor Analysis |

|||

|---|---|---|---|

| Internal Control Mechanisms | Factor loading | Bartlett's Test | KMO |

| Hotlines | 847.433 | .770 | |

| My organisation encourages the staff to come forward if they see or suspect any occupational fraud or corruption occurs. | 0.753 | ||

| Employees have been made clear that reports of suspicious activity will be promptly and thoroughly evaluated. | 0.727 | ||

| There is an anonymous reporting channel available to employees (e.g. third-party hotline) when there are suspicions of fraud, corruption and misconduct. | 0.816 | ||

| There is a fraud hotline in myorganisation,and the internal audit team has access to reported instances | 0.804 | ||

| Employees have been taught how to communicate concerns about known or potential wrongdoing. | 0.754 | ||

| Ethics | 761.492 | .851 | |

| Myorganisation offers training in business ethics. | 0.655 | ||

| The top managers in myorganisation demonstrate high ethical standards. | 0.877 | ||

| The top managers in myorganisation appropriately balance the needs of the business with ethical issues. | 0.890 | ||

| Myorganisation culture supports ethical behaviour in the workplace as well as in dealings with customers and vendors. | 0.811 | ||

| Unethical behaviourswill be punished in myorganisation. | 0.621 | ||

| Surprise Audit | 595.092 | 0.809 | |

| Surprise fraud audits are being performed in addition to regularly scheduled fraud audits. | 0.699 | ||

| Employees believe that a surprise audit is the best way to reveal the truth about operations in the organisation. | 0.730 | ||

| The internal auditor has taken necessary procedures to detect fraud. | 0.617 | ||

| A surprise audit gives a more accurate reflection of myorganisation than an announced audit. | 0.836 | ||

| Surprise audits will be beneficial to myorganisation. | 0.756 | ||

Reliability Analysis

Table 4 indicates the Cronbach's alpha coefficient for Hotlines was 0.875 for 5 items, 0.872 for 5 items of the Ethics variable, and 0.843 was obtained for another 5 items of Surprise audits. Perceived Occupational Fraud resulted in a Cronbach's alpha coefficient of 0.964 for 15 items. The Cronbach's alpha coefficient obtained for all the three variables, i.e., Hotlines (0.875), Ethics (0.872), and Surprise Audit (0.843), suggested a very good internal consistency reliability for the scale of this sample as the value of above 0.8 is preferable, and the value of 0.7 is considered acceptable. Hence, all the variables in this study which are Hotlines, Ethics and Surprise Audit, have strong relationships and good internal consistency since Cronbach's alpha coefficient values were reported to be in the range values of 0.843 to 0.875.

| Table 4 Reliability Test |

|||

|---|---|---|---|

| Reliability Coefficients | Cronbach Alpha | Cronbach Alpha Based on Standardised Items | N |

| Perceived Occupational Fraud | 0.964 | 0.965 | 15 |

| Hotlines | 0.875 | 0.88 | 5 |

| Ethics | 0.872 | 0.879 | 5 |

| Surprise Audit | 0.843 | 0.848 | 5 |

Correlation Analysis

Table 5 provides the inter-correlations of the study variables. Cohen’s guidelines was adopted as stated above (r=below 0.29 is measured as small; 0.30 to 0.49 as medium; above 0.50 as large). Cohen (1988) recommended the following guidelines (1) r =0.10 to 0.29 specifies small effect; (2) r=0.30 to 0.49 suggests medium effect; and (3) r=0.50 to 1 denotes a relatively strong positive effect between two variables. Cooper and Schindler (2006) further highlighted that correlation which reaches 0.80, is measured as a high level; thus, it shows the existence of multi collinearity. Multi collinearity exists when there is a strong correlation between two or more predictors (Field, 2009).

| Table 5 TIM |

|||||

|---|---|---|---|---|---|

| Mean | Hotlines | Ethics | Surprise Audits | Occupational Fraud | |

| Hotlines | Pearson Correlation | 1 | 0.750** | 0.604** | 0.742** |

| Sig. (2-tailed) | 0 | 0 | 0 | ||

| VIF=2.403 | |||||

| Tolerance=0.416 | |||||

| Ethics | Pearson Correlation | 0.750** | 1 | 0.658** | 0.763** |

| Sig. (2-tailed) | 0 | 0 | 0 | ||

| VIF=2.693 | |||||

| Tolerance=0.371 | |||||

| Surprise Audits | Pearson Correlation | 0.604** | 0.658** | 1 | 0.759** |

| Sig. (2-tailed) | 0 | 0 | 0 | ||

| VIF=1.856 | |||||

| Tolerance=0.539 | |||||

| Occupational Fraud | Pearson Correlation | 0.742** | 0.763** | 0.759** | 1 |

| Sig. (2-tailed) | 0 | 0 | 0 | ||

| **. Correlation is significant at the 0.01 level (2-tailed). | |||||

| b. List wise N=274 | |||||

From the analysis above, there is no serious multicollinearity problem as the values of the variance inflation factor (VIF) were less than 10. The values of VIF for Hotlines (2.403), Ethics (2.693) and Surprise Audits (1.856) were less than 10. Furthermore, the values of tolerance for Hotlines (0.416), Ethics (0.371), and Surprise Audits (0.539) were also acceptable.

As shown in Table 4, the Pearson correlation coefficients are all positive, which indicate positive correlations between all variables. The correlations between the dependent variable and independent variables are less than 0.80. Hence, there is no multicollinearity detected in this study. There were strong relationships between Perceived Occupational Fraud and all independent variables as the Pearson correlations were more than 0.50. Hotlines recorded a correlation result of 0.742 (significant at p= 0.000), Ethics recorded a correlation result of 0.763 (significant at p=0.00) and Surprise Audits stood at 0.759 (significant at p=0.00).

Meanwhile, there were also correlations between the independent variables. These independent variables were found to be positive and significantly correlated to each other. For the relationship between Hotlines and Ethics, it was significant (r =0.750 p<0.01) while Hotlines and Surprise Audits had a strong correlation (r=0.604, p<0.01). Ethics and Surprise Audits also showed a strong correlation between each other (r=0.658, p<0.01). In a nutshell, the findings of correlation coefficient among variables in the study indicated that statistically, interdependence relationship existed between dimensions of Hotlines, Ethics and Surprise Audits. Hence, hypothesis H1 is accepted.

Multivariate Analysis

The multiple regression analysis is carried out to examine the influence of internal control mechanisms in reducing perceived occupational fraud. Table 6 shows the the significant value at 5% where F (3, 270) =247.14, p=0.000). Adjusted R² is reported at 0.730, indicating the variability of perceived occupational fraud is explained by the predictors of Hotlines, Ethics and Surprise audit. All independent variables of Hotlines, Ethics and Surprise audit, were statistically significant. The highest recording Beta value was Surprise Audits (β=0.476, p<0.005) followed by Ethics (β=0.316, p<0.05) and Hotlines (β=0.279, p<0.05).

Hotlines showed a significant positive relationship with perceived occupational fraud when the value of coefficient was 0.279, t=5.895, p=0.000 where p<0.05. The beta coefficient for hotlines (0.279) indicated that every 1 increase in hotlines could contribute to reducing occupational fraud by 0.279. Ethics was also found to be significant in reducing Occupational Fraud as p=0.000. The coefficient value for ethics was 0.316, t=5.564. This means that every increase in ethics could contribute to reducing occupational fraud by 0.316.

The Surprise Audit also was indicated as significant since the coefficient value was 0.476, t=9.250 p=0.000 where p<0.05. This showed that conducting surprise audits could contribute to reducing occupational fraud by 0.476. Therefore, the hypothesis is supported.

| Table 6 Multiple Regression Analysis |

|||||

|---|---|---|---|---|---|

| R² | 0.733 | ||||

| Adjusted R² | 0.730 | ||||

| Durbin Watson statistic | 1.831 | ||||

| F Sig. | 0.000 | ||||

| Variable | Unstandardized Coefficients | Standardized Coefficients | Std. Error | t-stat | p-value |

| Constant | -0.562 | 0.162 | -3.467 | 0.001* | |

| Hotlines | 0.279 | 0.287 | 0.047 | 5.895 | 0.000* |

| Ethics | 0.316 | 0.287 | 0.057 | 5.564 | 0.000* |

| Surprise Audits | 0.476 | 0.396 | 0.052 | 9.250 | 0.000* |

Discussion of Findings

This study is conducted to examine whether the internal control mechanisms, i.e., Hotlines, Ethics and Surprise Audits, could influence the reduction in perceived occupational fraud. Based on the finding, the use of Hotlines is correlated in reducing occupational fraud as tips or hotlines have constantly been the most effective method to detect fraud, with 40 to 46 percent of all cases are able to be discovered. It also helps to detect fraud at the earlier stage, which shows a positive impact to reduce the amounts stolen from an organisation (Rivest & Lanoue, 2015). The ability to report fraud anonymously is critical because many employees and other stakeholders may be afraid to report any suspicious behaviour due to the threat of revenge from their colleagues' superior and negative judgments. As such, a well-communicated whistle-blower system or hotlines is one of the best tools that an organisation can adopt to help lessen the risk of fraud and other reputational damage (Price water house Coopers, 2016).

Ethics may influence reduced occupational fraud. The implementation of ethics programs or training in the organisation could reduce the cases of fraud as regular training could offer better communication among all employees and managers in mitigating fraud, besides safeguarding the assets and resources and ensuring the business is conducted in an efficient and orderly manner (Zuckweiler, Rosacker & Hayes, 2016). The ethics training program conducted by the organisations could serve as an important precautionary control against fraud from occurring in the company (Rahman & Anwar, 2014). Regular ethics training and program, which are offered and communicated to all employees and managers, play an important role in mitigating fraud, besides safeguarding the assets and resources and ensuring the business is conducted in an efficient and orderly manner. Nowadays, ethics training is in demand due to the consequence of various types of frauds that affect organisations worldwide. The ethic training program conducted by the organisations could serve as an important precautionary control against fraud from occurring in the company (Rahman & Anwar, 2014).

Surprise audits are also found to correlate the reduced occupational fraud. Surprise audits could deter fraud as the employees and managers are not informed in advance of these random verifications (e.g. cash counts, document reviews) to avoid covering their tricks (Wells, 2011). Random and impromptu audits upsurge the perpetrators' awareness of detection and their fear of being caught. In order to ensure the success of a surprise audit, it has to be well-planned as compared to any other audit (Lowers & Associates, 2018). This could include recognising the key risk in the system that is being evaluated during the audit and understanding the internal control design in the organisation. Hence, these factors could be used in creating an effective surprise audit approach.

This study is conducted to gain insights into perceived occupational fraud that might take place in an organisation. Future research may conduct in specific industries in Malaysia by using other mechanisms in evaluating the methods to reduce perceived occupational fraud.

References

- Rahman, A.R., & Anwar, K.I. (2014). Effectiveness of fraud prevention and detection techniques in Malaysian Islamic Banks.Procedia - Social and Behavioral Sciences,145, 97-102.

- Ahmad, S., Yunos, R., Ahmad, R., & Sanusi, Z. (2014). Whistle blowing behaviour: The influence of ethical climates theory.Procedia - Social AndBehavioral Sciences,164, 445-450.

- Albrecht, W., Albrecht, C., Albrecht, C., & Zimbelman, M. (2012).Fraud examination(4th edition). 36-52, Ohio: South-Western Cengage Learning.

- Association of Certified Fraud Examiners (ACFE). (2018). "Report to the Nations on Occupational Fraud and Abuse", ACFE.

- Association of Certified Fraud Examiners (ACFE). (2016). "Report to the Nations on Occupational Fraud and Abuse", ACFE, Austin.

- Association of Certified Fraud Examiners (ACFE). (2010). Report to the Nations on Occupational Fraud and Abuse, ACFE, Austin.

- Bravo, C., Ramírez, V.I., Neuendorff, J., & Spiller, A. (2013). Assessing the impact of unannounced audits on the effectiveness and reliability of organic certification.Organic Agriculture,3(2), 95-109.

- Cressey, D.R. (1973). Other people's money. Patterson Smith, Montclair.

- Doody, H. (2009). Fraud risk management: A guide to good practice. Retrieved from https://www.cimaglobal.com/Documents/ImportedDocuments/cid_techguide_fraud_risk_management_feb09.pdf.pdf

- Dorminey, J., Fleming, A.S., Kranacher, M.J., & Riley, R.A. (2012). The evolution of fraud theory. Issues in Accounting Education,27(2), 555–579. https://doi.org/10.2308/iace-50131

- Field, A. (2009). Discovering statistics using SPSS(3rd Edition). SAGE Publication Ltd.

- Glodstein, D. (2015). Occupational fraud: Misappropriation of assets by an employee.Journal of the International Academy for Case Studies,21(5).

- Holtfreter, K. (2005). Is occupational fraud "typical" white-collar crime? A comparison of individual and organisational characteristics.Journal of Criminal Justice,33(4), 353-365.

- KPMG. (2013). KPMG Malaysia fraud, Bribery and corruption survey,1–72. Retrieved from http://doi.org/10.1007/s13398-014-0173-7.2

- Lowers and Associates. (2018). The element of surprise: How to cut fraud detection time in half. Retrieved from https://blog.lowersrisk.com/surprise-audits-cut-fraud-detection-time-in-half/

- McGladrey. (2014). Internal control. Retrieved from https://audit.mercer.edu/internal-control/

- Nawawi, A., & Salin, A.S.A.P. (2018). Internal control and employees' occupational fraud on expenditure claims. Journal of Financial Crime, 25(3), 891–906. https://doi.org/10.1108/JFC-07-2017-0067

- Neff, C., & Gresham, J. (2016). The difference between ethics and compliance. Journal of Practical Business Ethics, 30(1), 1-5

- Omar, M., Nawawi, A., & PutehSalin, A. (2016). The causes, impact and prevention of employee fraud.Journal of Financial Crime,23(4)

- Omar, N., Said, R., & Johari, Z. (2016). Corporate crimes in Malaysia: A profile analysis.Journal of Financial Crime,23(2), 257-272.

- Rivest, P.D., & Lanoue, N. (2015). Cutting fraud losses in Canadian organisations.Journal of Financial Crime,22(3), 295-304.

- Pina,F.(2016). Surprise audits can stop fraud in its tracks. Retrieved from https://www.mercadien.com/resource/surprise-audits-can-stop-fraud-in-its-tracks/

- Price water house Coopers. (2016). Global economic crime survey 2016: Adjusting the lens on economic crime.Retrievedfromhttps://www.pwc.com/gx/en/economic-crime-survey/pdf/globaleconomiccrimesurvey 2016.pdf

- Rezaee, Z. (2009). Corporate governance and ethics. Wiley, Hoboken, NJ.

- Yaveroglu, S.I.,Donthu, N.,&Garcia, A.(2003). "Antecedents of survey response bias in business?to?business services".Journal of Business & Industrial Marketing, 18(4/5), 366-375.

- Si, S., & Cullen, J. (1998). Response categories and potential cultural bias: Effects of an explicit middle point in cross-cultural surveys. International Journal of Organizational Analysis, 6, 218-230.

- Siregar, S.V., & Tenoyo, B. (2015). Fraud awareness survey of private sector in Indonesia. Journal of Financial Crime, 22(3), 329–346.

- Suh, J., Shim, H., & Button, M. (2018). Exploring the impact of organisational investment on occupational fraud: Mediating effects of ethical culture and monitoring control.International Journal of Law, Crime and Justice,53, 46-55.

- Sweeney, B., Arnold, D., & Pierce, B. (2010). The impact of perceived ethical culture of the firm and demographic variables on auditors' ethical evaluation and intention to act decisions. Journal of Business Ethics, 93, 531-551

- Wells, J.T. (2004). "Small business big losses". Journal of Accountancy, 198(6), 42-7.

- Wolfe, D.T., & Hermanson, D.R. (2004). The fraud diamond: Considering the four elements of fraud. The CPA Journal, 74(12), 38-42.

- Zakaria, K., Nawawi, A., & Salin, A. (2016). Internal controls and fraud – empirical evidence from oil and gas company.Journal of Financial Crime,23(4), 1154-1168.

- Zuckweiler, K.M., Rosacker, K.M., & Hayes, S.K. (2016). Business students' perceptions of corporate governance best practices. Corporate Governance: The International Journal of Business in Society, 16(2), 361–376.